Explore what is fund finance and how tools like NAV and subscription lines can optimize your fund's performance. Unlock strategic liquidity and boost returns.

At its core, fund finance is all about providing liquidity and credit solutions tailored specifically for investment funds, like private equity or venture capital. It's important to understand this isn't a loan for the companies a fund invests in. Instead, it’s a strategic tool for the fund manager to manage cash flow better and jump on investment opportunities faster.

Think of a fund manager as a general contractor building a house. The contractor has solid commitments from various subcontractors (the investors, or Limited Partners) to show up with labor and materials when called upon. But then, a fantastic opportunity pops up—a chance to buy premium lumber at a huge discount, but the supplier needs payment now, and the subs won't pay their share for a few more weeks.

Rather than letting the deal slip away, the contractor gets a line of credit, secured by the binding agreements from the subcontractors. That's a perfect parallel for fund finance. It gives fund managers the capital they need to act decisively, closing the time gap between finding a great investment and actually receiving the committed cash from investors.

This financial toolkit really stands on two main pillars, each designed for a different stage in a fund’s life:

Fund finance has become an essential component of modern fund management. It transforms a fund's operational efficiency, moving from a reactive "wait-for-cash" model to a proactive, strategic approach to capital deployment that can significantly improve performance.

The use of fund finance has exploded in recent years, which makes sense when you see that global assets under management in private markets have hit €13.2 trillion in 2024. This massive growth underscores the demand for more sophisticated financial tools. These strategies can even help offset the impact of asset management fees by boosting overall returns.

Ultimately, fund finance gives managers a real competitive advantage. It helps streamline complex capital calls and treasury functions, working hand-in-glove with a well-organized back office that handles critical fund administration. For a deeper look at that side of the equation, you can explore our guide on what is fund administration to see how these pieces fit together.

By speeding up deal execution and optimizing cash management, these financial instruments help funds enhance investor returns and operate with the efficiency of a large-scale institution.

Subscription finance, which you’ll often hear called a capital call line or subscription credit facility, is essentially a powerful financial shortcut for fund managers. It’s a line of credit a fund can tap into, with the lender using the legally-binding capital commitments from its Limited Partners (LPs) as the ultimate security.

This completely changes the game for how a fund gets and uses its cash. Instead of kicking off a traditional capital call—a clunky process that can stretch out for weeks—a manager can just draw down on this credit line. This gives them almost instant access to capital, letting the fund pounce on opportunities with speed and confidence.

Think of it like a business credit card backed by guaranteed future revenue. The fund has a contractual right to the LPs' money, and the bank knows it. The subscription line just lets the fund use that capital now, long before it actually hits the bank account, smoothing out the entire operational workflow.

Picture this: a private equity fund has found the perfect company to acquire. It's a family-owned business, and they're ready to sell. But there’s a catch. The sellers have other offers on the table and are demanding a firm commitment with funds wired in just five business days.

Without a subscription line, the fund manager is in a tough spot. They'd have to scramble to issue an urgent capital call to every single LP. That means drafting notices, sending them out, and then anxiously waiting for dozens of investors to wire their money. The whole affair could easily take two or three weeks, and the deal would be long gone.

Now, let's see how it plays out with a subscription line in place.

This approach doesn't just save the deal; it makes life easier for everyone. For a closer look at the mechanics behind this, our guide on understanding the capital call definition breaks it down even further.

The perks of using a subscription line go well beyond simple speed. It creates a cascade of benefits that make a real difference for both the fund manager and the investors.

By bridging the gap between an investment decision and its funding, subscription finance removes operational friction. This allows managers to focus on executing strategy rather than managing administrative timelines, which directly contributes to better fund performance and stronger investor relationships.

Here are the key benefits you'll see:

As a private equity fund grows up, its financial playbook needs to evolve. The early days are all about calling capital from investors and deploying it into new deals. But once the portfolio is built, the focus shifts to managing those assets and creating value. This is precisely where Net Asset Value (NAV) finance comes into its own.

Think of it like this: a subscription line is a loan against the money your investors have promised to give you. A NAV loan, on the other hand, is a loan secured by the value of the assets you already own in the portfolio. It's a fundamental shift from borrowing against future promises to borrowing against present value.

This change in collateral opens up a whole new world of strategic options. It gives a General Partner (GP) the power to tap into the value they've painstakingly built, all without having to sell a star portfolio company or go back to their Limited Partners (LPs) for more cash.

For a fund that’s a few years into its life, the portfolio isn't just a collection of companies—it's a significant financial asset. A NAV facility lets the fund manager access a portion of this unrealized value, generating fresh capital for a host of strategic moves. It’s a tool that allows GPs to be nimble and opportunistic.

The market for these loans has grown up, too. Over the last year, interest margins on NAV facilities have tightened by roughly 40 basis points, now typically landing in the 4%-7% range. Managers also have more choice, with a surprisingly small price difference between standard secured loans (around 5.2%) and more flexible, recourse-light structures (around 6.6%). You can dive deeper into these trends in this 2025 market report.

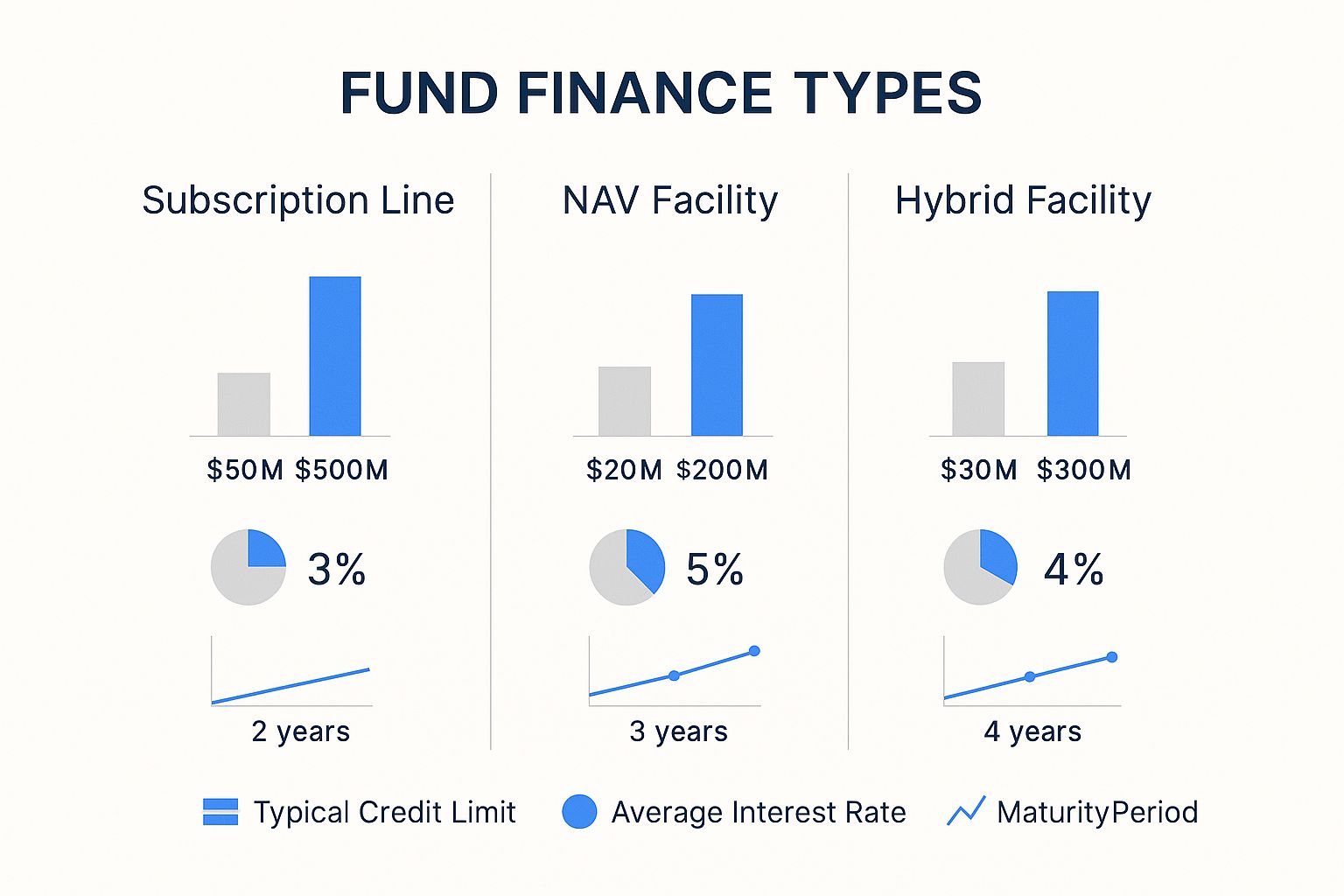

This chart gives you a bird's-eye view of how different fund finance tools stack up in terms of credit limits, rates, and loan terms.

As the data shows, subscription lines are great for short-term liquidity at a lower cost. NAV facilities, however, are built for bigger, longer-term strategic plays, offering more substantial credit lines that reflect their role in driving serious value.

To make the distinction crystal clear, let's compare these two financing workhorses side-by-side.

The following table breaks down the core differences between NAV and subscription facilities, helping you see which tool is right for the job at different points in your fund's life.

| Feature | Subscription Finance (Capital Call Line) | NAV Finance (Net Asset Value Line) |

|---|---|---|

| Stage of Fund Life | Primarily used in the early stages (investment period). | Best suited for mature funds (post-investment period). |

| Primary Collateral | Unfunded capital commitments from Limited Partners (LPs). | The fund's existing portfolio of investments (e.g., company equity). |

| Loan-to-Value (LTV) | High LTV against LP commitments (often 80-90%). | Lower LTV against portfolio value (typically 10-30%). |

| Typical Loan Term | Short-term, often 1-3 years with annual renewals. | Longer-term, often 3-5+ years, aligned with holding periods. |

| Primary Use Case | Bridging capital calls, managing cash flow, speeding up deal execution. | Funding follow-on investments, add-on acquisitions, providing LP liquidity. |

| Underwriting Focus | Creditworthiness of the LP base. | Quality, diversity, and valuation of the underlying portfolio assets. |

In short, think of subscription finance as your fund's operational cash flow tool and NAV finance as its strategic growth engine.

So, what are the real-world situations where a NAV loan is the perfect solution? It’s for those moments when you need a significant amount of capital for a game-changing move but don't want to disrupt your investors or your core strategy.

Here are a few classic examples:

NAV financing transforms a static portfolio into a dynamic source of capital. It allows managers to act opportunistically, solve liquidity challenges, and drive portfolio growth—all while maintaining alignment with their LPs and maximizing long-term fund performance.

By tapping into the fund's net asset value, GPs can pull off sophisticated maneuvers that were once much harder to finance. In today's competitive private markets, that kind of flexibility can be the difference-maker in achieving top-quartile returns.

Fund finance has come a long way from its early days as a niche banking service. What started as a simple way to bridge capital calls has exploded into a standard, indispensable part of a private fund's financial toolkit. It's a completely different world now.

This isn't just about the market getting bigger; it's about a massive leap in sophistication. We've moved far beyond basic subscription lines. Today, managers have access to a whole menu of advanced products, each designed to solve specific challenges at different points in a fund's life.

The modern fund finance market is a hotbed of innovation. As funds have gotten more complex, lenders have had to get more creative, rolling out flexible solutions that are now standard practice.

At its heart, this evolution is a shift away from cookie-cutter products toward true financial engineering. Lenders are no longer just order-takers; they're becoming strategic partners, working with GPs to build financing that fits their exact value creation strategy.

These advanced tools give General Partners (GPs) an incredible amount of leeway. They can now fund growth, juggle liquidity, and fine-tune returns in ways that were unimaginable just a decade ago. It changes the entire conversation around what fund finance is—it’s not just an operational tool anymore, but a strategic weapon.

Another huge shift shaping the future of fund finance is who's doing the lending. For years, this was the exclusive playground of a few big, global banks. While those giants are still major players, they’re now sharing the field with a whole new roster of capital providers.

Specialized private credit funds have jumped in, often proving more agile and willing to take on complex or unusual risks. We're also seeing large insurance companies and other institutional investors enter the market, drawn in by the steady, attractive returns these facilities offer.

The industry’s growth has been nothing short of remarkable. A core part of this is the sheer variety of products now available, which managers see as essential tools for using capital wisely and boosting returns for their LPs. With private credit and insurance firms joining the traditional banks, the market has become far more competitive. For a deeper dive into this transformation, the insights from the Fund Finance Symposium are a great resource.

For fund managers, more competition among lenders is fantastic news. It’s created a borrower’s market, leading to better terms, more creative structures, and sharper pricing. GPs are no longer stuck with just a few choices; they can now find a financing partner who really gets their strategy and risk tolerance.

Looking down the road, this trend isn't slowing down. Technology will inevitably play a bigger part, making things like underwriting and monitoring much smoother. And as private markets keep expanding, the appetite for even more specialized fund finance solutions will only grow, pushing the limits of what these powerful tools can do for funds and their investors.

Pulling off a fund finance deal isn't a one-person show. Think of it more like a well-oiled machine, where every part has a specific job to do. For a fund manager, knowing who these players are and how they fit together is the key to a smooth process. The entire transaction really hangs on their ability to work in concert.

At the heart of the deal, you have the General Partner (GP), which is the fund manager. The GP is the one borrowing the money, looking for a credit facility to jump on investments faster, smooth out cash flow, or just run the fund more efficiently. They get the ball rolling, hammer out the terms, and manage the lender relationship for the fund.

Of course, the GP's ability to get that financing rests squarely on the shoulders of the Limited Partners (LPs). While the LPs aren't sitting at the negotiating table, their uncalled capital commitments are the star of the show—they’re the main collateral, especially for subscription lines. A strong, diverse group of LPs is what gives a lender the confidence to write the check.

On the other side of the transaction, you’ll find the Lenders. This isn't just a world of big, global banks anymore. The lender landscape has opened up considerably.

Having these different types of lenders gives GPs more choices than ever before. For all these financial institutions, maintaining strong cybersecurity best practices for financial institutions is non-negotiable to protect everyone's assets and keep trust intact.

A fund finance transaction is a complex web of legal and financial obligations. The success of the deal depends not just on the borrower and lender, but on the entire ecosystem of advisors ensuring every detail is meticulously structured and compliant.

Finally, you can't forget the Legal Counsel. Both the fund and the lender will have their own law firms specializing in this space. These legal experts are absolutely essential. They structure the deal, draft and negotiate the fine print in the credit agreements, and make sure everything is compliant and enforceable. Their job is to protect their client's interests, dotting every 'i' and crossing every 't'.

This entire process happens alongside the critical work of managing investor relationships, where clear communication is everything. You can learn more by checking out our guide on what is investor relations.

The fund finance world isn't a one-size-fits-all market. Far from it. What’s considered standard practice in New York or London might be just gaining traction in Singapore or Paris. For any fund manager plotting a course, understanding these regional differences is absolutely critical.

North America and Europe are the traditional heartlands of fund finance. They're mature, deeply liquid markets with a massive bench of experienced lenders and lawyers. Fund managers there have been using these tools for years, weaving them into the very fabric of their operations. This is where you’ll see the most sophisticated and innovative deals, especially for complex NAV and hybrid facilities.

But the real action—the most exciting growth—is happening elsewhere. The Asia-Pacific region, in particular, is where the market is exploding.

As private capital goes global, so does fund finance. We’re seeing new hubs pop up and gain serious momentum. Places like Singapore and Hong Kong are becoming major players, fueled by a boom in regional private equity and venture capital. Lenders are scrambling to build out their teams on the ground to serve this growing hunger for everything from basic subscription lines to more complex NAV loans.

What does this mean for fund managers? More options. Better terms. A more competitive global landscape where international and local banks are all fighting for your business. It’s also a clear sign that these financing tools are no longer a niche product but a global standard for running a fund efficiently.

The global spread of fund finance isn't just a trend; it's a fundamental change in how private funds work. What started in a few key markets is now a best practice everywhere, essential for staying competitive no matter where your fund is based.

Often, this global growth gets a major boost from local regulators who are modernizing their rules to welcome more sophisticated financial products.

If you want a perfect example of how a market can evolve quickly, just look at France. For a long time, the French fund finance market was relatively simple. But in the last few years, it has taken off.

We're now seeing more complex structures, like NAV financing and hybrid facilities, being put to work. This signals a real shift toward using fund-level debt for more strategic purposes, like funding follow-on investments or shoring up portfolio company valuations. This growth was supercharged by regulatory updates that introduced new partnership structures and gave French funds the power to issue their own debt securities. You can dive deeper into these French market developments on Goodwinlaw.com.

The lesson here is simple but powerful: keep a close eye on the regulatory environment in your fund’s home country. A rule change can suddenly open up financing avenues that weren't there yesterday. The global fund finance map is always changing, and the managers who are paying attention to both the big picture and the local details are the ones who will win.

Stepping into fund finance can feel like learning a new language, and it's natural to have questions. Whether you're a first-time manager weighing your options or a seasoned pro looking to refine your approach, getting straight answers is key.

Let's cut through the complexity and tackle some of the most common things managers ask. Think of this as your practical guide to timelines, risks, and keeping your investors happy.

This is usually the first question on everyone's mind. For a standard subscription credit line, you should typically budget between four to eight weeks from your first conversation with a lender to closing the deal.

Of course, that’s not a hard and fast rule. A number of things can speed up or slow down the process. The complexity of your fund's legal structure, how quickly everyone (including lawyers) gets back to each other, and the back-and-forth on legal documents all play a part. A well-organized fund with a simple structure can often get it done on the quicker side of that range.

No financial tool is without risk, and it’s critical to go in with your eyes open. The risks really depend on which type of facility you're using, as they look to different sources for repayment.

On top of these, both types of loans are exposed to general interest rate risk. If rates go up, so will your cost of borrowing.

Knowing the specific risks tied to each fund finance product is the foundation of using them responsibly. A smartly structured facility, paired with clear communication, lets you tap into the benefits of these tools while safeguarding the fund and your LPs.

When handled with transparency, most LPs view fund finance as a smart, operational tool. They especially appreciate subscription lines because it means they aren't getting hit with constant capital calls for small amounts, which simplifies their own internal treasury operations. It's just more efficient for everyone.

The absolute key, however, is communication. You have to be upfront about how you're using leverage and be prepared to discuss its effect on performance metrics like the Internal Rate of Return (IRR). Taking the time to explain what is fund finance and how it fits into your strategy from the get-go builds trust. That kind of transparency is what turns a good LP relationship into a great one.

Ready to move beyond spreadsheets and manage your fund with institutional-grade tools? Fundpilot provides the reporting, administration, and compliance solutions you need to scale effectively. Schedule your personalized demo today.