What is a capital call? This guide breaks down the capital call definition, explaining how it works for investors in private equity and venture capital.

Think of a capital call as the moment a fund manager "calls in" the money that investors have already promised to contribute. It’s the formal request from a private equity or venture capital firm to its investors to send in their cash so the fund can make a new investment.

Let's use a simple analogy. Imagine you agree to help a friend start a new bakery. You promise them a certain amount of money, but you don't just hand over a big check on day one. Instead, you agree to give them the funds as they need them—first for the new oven, then for the initial batch of ingredients, and later to hire the first employee.

A capital call works exactly the same way, just in the more structured world of private funds. It’s a "just-in-time" funding model that is incredibly efficient. Why? Because it prevents massive amounts of investor money from sitting around in a bank account, earning next to nothing. This idle cash would be a major drag on returns. Instead, the money is put to work precisely when a great investment opportunity pops up.

To really get what a capital call is, you need to know who's involved. It comes down to two main groups:

When a GP issues a capital call (sometimes called a drawdown), they are simply asking LPs to provide a portion of the total capital they already pledged. This all happens under the rules laid out in the Limited Partnership Agreement (LPA), the core legal document of the fund. If you're looking for a more detailed look at the paperwork involved, you can check out this helpful capital call template and guide.

This whole process is governed by a few fundamental concepts that dictate how money moves from an investor's pocket into an investment.

Key Takeaway: A capital call isn't some unexpected plea for more money. It's the scheduled, legally-binding collection of funds that investors already agreed to contribute when they joined the fund.

To make sense of the mechanics, you have to speak the language. The terms below are the building blocks of every capital call notice and investor report, so getting familiar with them is crucial for both fund managers and their investors.

Here's a quick reference table to help you understand the core language used in the capital call process.

| Term | Simple Definition |

|---|---|

| Limited Partnership Agreement (LPA) | The legal contract between the GPs and LPs that outlines the fund's rules, including how and when capital calls can be made. |

| Capital Commitment | The total amount of money an LP agrees to invest in the fund over its lifetime. Think of it as their total pledge. |

| Drawdown (or Takedown) | Another name for a capital call. It’s the act of "drawing down" a portion of an LP's total commitment. |

| Capital Call Notice | The official document sent by the GP to the LPs requesting the funds. It specifies the amount due and the deadline. |

| Unfunded Commitment | The portion of an LP's total capital commitment that has not yet been called by the GP. It’s the money still "on the sidelines." |

Knowing these terms makes the entire process much clearer. It helps you understand exactly what’s being asked, why it’s being asked, and how it fits into the fund’s broader strategy.

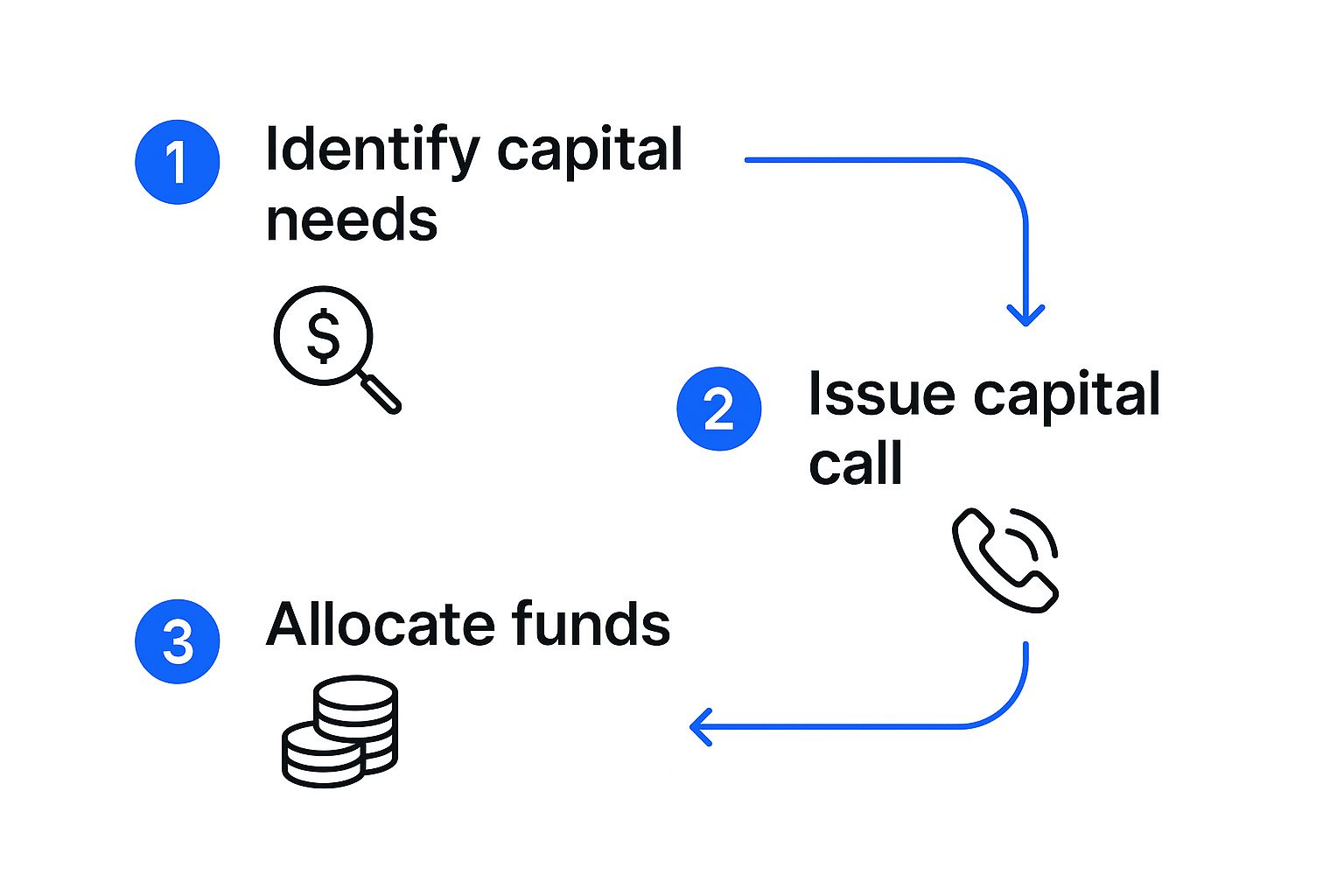

A capital call isn't just a single action; it's a deliberate and well-oiled process. Think of it as a sequence of events, starting with a fund manager zeroing in on an opportunity and ending with investor money being put to work. Seeing this flow from start to finish really brings the concept to life.

It all starts when a General Partner (GP) spots a promising investment. This could be a hot new startup, an undervalued piece of real estate, or a chance to double down on a company already in their portfolio. After the GP's team does their homework—digging through financials, vetting the opportunity, and negotiating the terms—they know exactly how much cash they need to make the deal happen. This is the trigger.

With the investment details locked in, the GP formally kicks things off by sending out a capital call notice to all the Limited Partners (LPs). This isn't just a friendly heads-up; it's a formal, legally binding document that clearly outlines the funding request.

A proper capital call notice will always include:

This simple graphic breaks down the essential workflow, from identifying the need to putting the capital to work.

As you can see, it’s a direct, three-stage sequence designed to pool capital efficiently right when it's needed.

Once the notice goes out, the clock starts ticking. LPs are legally required by the Limited Partnership Agreement (LPA) to wire their share of the funds by the due date. This is the moment where the investors' "committed capital" on paper transforms into actual paid-in capital.

For example, if a fund needs $10 million to close an acquisition and one LP holds a 5% stake, that LP will get a notice to wire $500,000.

As soon as the money lands in the fund’s bank account, the GP gets the green light. They immediately use the capital to close the deal, fund a portfolio company's growth, or cover critical fund expenses. The cycle is complete—a paper commitment has become a real, active investment.

In the high-stakes world of private equity, speed is everything. When a compelling investment opportunity surfaces, fund managers can't afford to hesitate. This is where a subscription line of credit, sometimes called capital call financing, becomes a fund’s secret weapon. It’s designed for one simple reason: to help funds move much faster than a traditional capital call allows.

Think of it as the fund's short-term bridge loan. Instead of issuing a capital call notice and waiting the standard 10 business days for investor capital to land, the General Partner (GP) can tap this credit line. This gives them immediate cash to close a deal on the spot. It's a crucial advantage that ensures a great opportunity isn't lost simply because the money is still on its way.

This powerful financing tool has become standard practice for a good reason. It lets GPs pounce on time-sensitive deals without the usual lag time. If you want to dive deeper, you can learn more about how these facilities function and their growing importance in private equity.

So, how does it all work? A bank provides the credit line, and it’s secured against the legally binding, uncalled capital commitments from the fund's Limited Partners (LPs). The loan is made possible by the strength and creditworthiness of the fund's investor base.

Key Insight: A subscription line doesn't replace a capital call—it just gets you there faster. After the GP uses the credit line to acquire an asset, they still issue a capital call. The cash from the LPs is then used to pay back the bank, typically within 30 to 90 days.

This approach delivers a few major advantages for the fund:

At the end of the day, a subscription line is a strategic tool. It gives funds the agility to stay competitive without changing the fundamental capital call definition.

A capital call isn't just a casual request for cash. It’s a formal process governed by a serious legal framework designed to protect everyone involved—both the fund manager and the investors. The absolute cornerstone of this relationship is the Limited Partnership Agreement (LPA).

Think of the LPA as the fund's constitution. It's a comprehensive legal document that every investor signs, and it spells out the rights and responsibilities of all parties in painstaking detail. This agreement establishes clear rules for the capital call process before any money is committed, which brings a welcome layer of predictability for investors.

A well-constructed LPA provides critical protections for Limited Partners (LPs). For example, it will specify the minimum notice period a General Partner (GP) must give before your money is due, which is often 7 to 14 days. This isn't just a courtesy; it's a contractual obligation that prevents last-minute fire drills and gives you time to get your own liquidity in order.

The agreement also builds in other important guardrails. These aren't just suggestions; they are legally binding terms that dictate how the fund manager can operate. A solid LPA will almost always define:

A strong LPA creates a two-way street built on mutual obligation. The investor is legally bound to fund valid capital calls, and the fund manager is legally bound to operate within the agreed-upon rules.

Of course, this legal commitment cuts both ways. Failing to meet a capital call is a serious breach of contract with significant consequences. You could face steep financial penalties or, in a worst-case scenario, even forfeit your entire stake in the fund. This really drives home how important it is to review everything upfront, which is where a thorough due diligence checklist template becomes an indispensable tool for any serious investor.

Successfully navigating capital calls really comes down to having a smart game plan. As an investor, or Limited Partner (LP), one of your biggest challenges is keeping enough cash on hand to meet a funding request that might land in your inbox with as little as 10 to 14 days' notice. This isn't a situation where you can just wing it; proactive planning is absolutely essential.

Experienced investors have a few key strategies up their sleeves to stay prepared. One of the most effective tactics is to diversify commitments across different funds, managers, and even vintage years. By staggering your investments, you make it far less likely that several large capital calls will hit you all at once, effectively smoothing out your cash flow demands over time.

It’s also crucial to maintain a healthy level of liquidity. This means setting aside a specific portion of your portfolio in cash or other easily accessible, short-term investments. Think of it as a dedicated fund for your future capital calls, ensuring you never have to scramble and sell other assets at a bad time.

At the end of the day, a strong, transparent relationship between the LP and the General Partner (GP) is the bedrock of a smooth process. It's about much more than just the money—it's about building trust through clear communication.

A healthy GP-LP dynamic is built on proactive communication and transparent reporting. When LPs understand the fund’s pipeline and strategy, capital calls become predictable checkpoints in a shared journey, not surprise demands.

The best GPs earn this trust by sending out regular, detailed updates on their deal pipeline and portfolio performance. This gives you, the investor, a valuable heads-up on when future calls might be coming.

On your end, it's just as important to do your homework upfront. Truly understanding what the due diligence process is and applying it thoroughly helps you partner with reputable managers who prioritize transparency from the start. When both sides are committed to working together, it creates a healthy, long-term partnership that sets everyone up for success.

When you're looking at investing in private funds, the idea of capital calls can bring up a lot of questions. That’s completely normal. Let's walk through some of the most common concerns to give you a clear picture of how it all works.

Missing a capital call is a big deal. It's a serious violation of the legal agreement you signed—the Limited Partnership Agreement (LPA)—and the consequences are designed to be tough.

Why? Because the fund manager (the GP) relies on that money to close deals, and when one investor doesn't pay, it puts the entire fund and the other investors in a bind. The penalties can be steep, ranging from high-interest penalty fees on the amount you owe all the way to forfeiting your entire investment in the fund. In some cases, the GP can even force you to sell your stake at a massive discount.

There's no set schedule. The timing is driven entirely by the fund's deal flow.

If the fund manager finds a lot of great investment opportunities in a short period, you might see several capital calls in one year. On the flip side, if the market is slow, you could go a year or more without a single one. Most of the action happens during the fund's "investment period," which is usually the first 3 to 5 years of its life.

Is Your Capital at Risk Before It Is Called? No, it isn't. Until the fund manager formally issues a capital call notice and you wire the money, your committed capital stays in your own bank account, under your control. Your commitment is a binding promise to invest, but the actual investment risk doesn't start until the fund has your cash and puts it to work.

It's highly unlikely. While the legal documents could theoretically allow it, that's not how things work in practice.

Most partnership agreements have specific limits on how much capital can be called at once or within a single year. This is done to protect investors from sudden, massive cash demands. The whole point is to draw down capital gradually as the fund finds and pays for new investments. These rules are part of a larger regulatory framework, often overseen by exempt reporting advisers who follow key compliance guides to ensure everything is handled properly and fairly.

Managing capital calls, distributions, and investor reporting can be complex. Fundpilot empowers emerging managers by automating these critical fund administration tasks, allowing you to focus on sourcing deals and raising capital, not manual Excel work. Learn how Fundpilot can professionalize your back office.