Discover what is fund administration, its key functions, and why it’s vital for investors. Learn how it drives successful asset management today.

Fund administration is the engine room of the investment world. It’s the collection of essential back-office services that keeps a fund running smoothly, compliantly, and efficiently. Think of it as the central nervous system for a fund, handling all the critical operational tasks so that the fund manager can do what they do best: focus on investing.

When you watch a blockbuster movie, you’re focused on the actors and the story. You don't see the massive crew handling logistics, finance, and scheduling behind the scenes. Without them, the movie simply wouldn't get made. Fund administration is that essential backstage crew for any investment fund. It covers all the non-investment activities that are absolutely fundamental to a fund's success and integrity.

These tasks might be invisible to the average investor, but they form the bedrock of trust and operational stability in asset management. Without precise administration, a fund couldn't accurately calculate its performance, report to investors, or satisfy its legal and regulatory duties. It's the operational backbone supporting every investment strategy, whether it’s a straightforward mutual fund or a complex private equity venture.

To really get a feel for what fund administration entails, it helps to see where the administrator fits into the bigger picture. Every fund has a few key players, each with a specific job. The administrator often acts as a central hub, making sure all the different parts are working in concert.

A fund administrator provides the independent, third-party verification that investors and regulators rely on. Their role is to ensure the fund's financial records are accurate, transparent, and compliant, serving as a crucial check and balance on the fund manager's activities.

Demand for these specialized services often follows the money. For instance, a recent survey of over 100 U.S. asset management professionals found that private debt and private equity are expected to deliver the highest returns over the next three years. As investors pour capital into these alternative assets, the need for administrators who can navigate their complex valuation and reporting requirements grows right alongside it. You can dive deeper into these trends with asset management industry outlooks from KPMG to see how market shifts directly influence operational needs.

To put it all in perspective, here’s a quick look at the main players in a typical fund ecosystem. This table clearly shows how the fund administrator is a distinct and vital part of the whole machine.

| Entity | Primary Role |

|---|---|

| Fund Manager | Makes investment decisions and manages the portfolio to generate returns. |

| Investors (LPs) | Provide the capital for the fund to invest. |

| Fund Administrator | Manages all back-office operations, including accounting, reporting, and compliance. |

| Custodian | Holds the fund’s assets securely for safekeeping. |

| Auditor | Independently reviews and verifies the fund’s financial statements annually. |

As you can see, while the fund manager is in the driver's seat making investment decisions, the administrator is the one making sure the vehicle is sound, the gauges are accurate, and the journey is compliant from start to finish.

To really understand what fund administration is, you have to look past a simple job description and dive into the day-to-day work that holds the entire investment structure together. These aren’t just checklist items; they are the critical actions that build investor confidence, ensure fairness, and keep the fund running smoothly. At its core, the administrator's job is to provide a single, undisputed source of truth for everyone involved.

Think of a fund as a complex financial engine. The fund administrator is the chief engineer, the one responsible for keeping an eye on all the gauges, maintaining the moving parts, and producing precise performance reports. Their work ensures the machine runs reliably day in and day out, and that every investor’s slice of the pie is calculated with absolute precision. This role isn't just helpful—it's essential.

Fund administration is a cornerstone of the asset management world, covering a whole host of back-office functions like valuation, accounting, compliance, and reporting. With global assets under management ballooning, largely thanks to a surge in alternative investments and new platforms opening access for more retail investors, the pressure on administrators is mounting. This growth is also pushing the industry to adopt new technologies faster than ever. You can learn more about how AI-driven trends are shaping financial services to get a sense of where things are headed.

If there's one responsibility that stands above all others, it's calculating the Net Asset Value (NAV). The NAV is the fund's per-share market value, and it's the price at which investors buy shares or cash them out. Getting this number right, and on time, is the foundation of treating every single investor fairly.

Think of the NAV as the official, non-negotiable price tag on a fund's shares at a specific moment. If that price is wrong, some investors could end up paying too little to get in or getting paid too much when they leave—directly harming the other investors who remain. To prevent this, the administrator meticulously adds up all the asset values, subtracts every liability, and divides the result by the number of outstanding shares to arrive at this all-important figure.

This isn't a simple calculation. The process involves several key steps:

Beyond just the NAV, the administrator handles all the fund's bookkeeping and accounting. This is a whole different ballgame from standard business accounting because of how investment funds operate. It means maintaining a complete general ledger that tracks every single transaction, from buying an investment to calling capital from investors.

A fund administrator’s ledger is the definitive financial record of the fund's life. It provides a complete, auditable trail of every dollar that moves in and out, creating the transparency that both investors and regulators demand.

This function becomes even more crucial for funds with complex structures, like a fund of funds, where the administrator has to track investments spread across many underlying funds. If you're managing that kind of portfolio, our guide to fund of fund accounting offers a much deeper look into those specific challenges. Ultimately, this detailed record-keeping is what makes it possible to prepare official, audit-ready financial statements.

The fund administrator is also the main point of contact for investors when it comes to their holdings. They manage the entire investor journey from start to finish, ensuring the experience is professional and seamless.

This involves a wide range of essential services:

Finally, the administrator is the fund’s navigator through the dense fog of financial regulations. They make sure the fund sticks to all legal requirements, protecting the fund manager from liability and the investors from unnecessary risk. This involves preparing and filing a mountain of reports with regulatory bodies and ensuring all financial statements meet the right accounting standards. From tax reporting to ongoing compliance monitoring, they provide the specialized expertise needed to stay on the right side of the law.

It might seem strange for a fund manager, someone whose job is all about being in control, to hand over the operational keys to their firm. But in reality, outsourcing fund administration is one of the smartest, most strategic moves a manager can make. This isn't about losing control. It's about focusing control where it counts: generating returns for investors.

Think about an elite chef. Their genius is in creating phenomenal dishes, not in filing payroll, scrubbing floors, or dealing with health inspectors. Those tasks are vital, but they’re distractions from the chef’s true purpose. By hiring a great restaurant manager and staff, the chef is free to innovate in the kitchen.

Outsourcing fund administration is the exact same principle. It lets fund managers offload the heavy, time-consuming back-office work so they can pour all their energy into what they do best—research, portfolio management, and strategy.

The world of fund operations is a labyrinth of complex accounting standards, ever-changing regulations, and niche technology. Trying to build an in-house team that has mastered all of this isn't just expensive; it’s a massive time sink. A good third-party administrator, on the other hand, lives and breathes this stuff every single day.

When you outsource, you're not just hiring a service provider. You’re tapping directly into a deep well of institutional knowledge. This expertise covers critical ground:

This immediate access to top-tier expertise allows even emerging managers to operate with the polish and professionalism of a multi-billion-dollar institution.

Running an in-house administration team comes with a hefty price tag. You have salaries, benefits, office space, software licenses, and ongoing training. These are significant fixed costs that you have to pay whether the market is booming or busting.

Outsourcing changes that financial equation. It converts those large, fixed overheads into a much more manageable and predictable variable expense. The fee is typically tied to the fund’s assets under management (AUM) or a flat annual rate, providing some much-needed clarity.

By outsourcing, a fund manager can avoid the massive capital outlay for internal infrastructure. This approach preserves capital, allowing it to be deployed for investment activities rather than being tied up in operational overhead.

This structure doesn't just save money; it creates a clear path to better financial performance. For managers serious about optimizing their firm's bottom line, exploring operational efficiency improvement for fund managers can unlock significant savings and smoother workflows.

In the investment world, perception is often reality. When potential investors see that a fund uses a reputable, independent administrator, it sends a powerful message about good governance and transparency.

An external administrator provides an objective, third-party calculation of the fund’s performance and Net Asset Value (NAV). This separation of duties—where one firm makes the investments and another reports on them—is a cornerstone of investor protection. It gives limited partners confidence that the numbers are accurate and free from any conflict of interest. For institutional investors conducting due diligence, this is often a non-negotiable requirement.

This model also offers another huge advantage: scalability. As your fund grows, a good administrator can easily handle the increased complexity and transaction volume. You won’t have to worry about frantically hiring more back-office staff or overhauling your internal systems. The fund can scale its operations smoothly, ensuring that growth remains an opportunity, not an operational nightmare.

Not all investment funds are created equal. You wouldn't expect a simple, daily-traded mutual fund and a complex, ten-year private equity fund to run on the same operational engine, and their administrative needs are just as different. To truly understand what is fund administration, you have to see it as a bespoke service, not a one-size-fits-all solution. The processes, complexity, and day-to-day focus have to adapt precisely to the fund's specific structure and strategy.

Think of it like car maintenance. The service plan for a reliable family sedan is worlds apart from the one for a Formula 1 race car. Sure, both need their fluids checked and tires rotated, but the F1 car demands a dedicated team of specialists to manage its intricate engine, advanced aerodynamics, and extreme performance requirements. In the same way, every type of fund has a unique operational engine that requires specialized care.

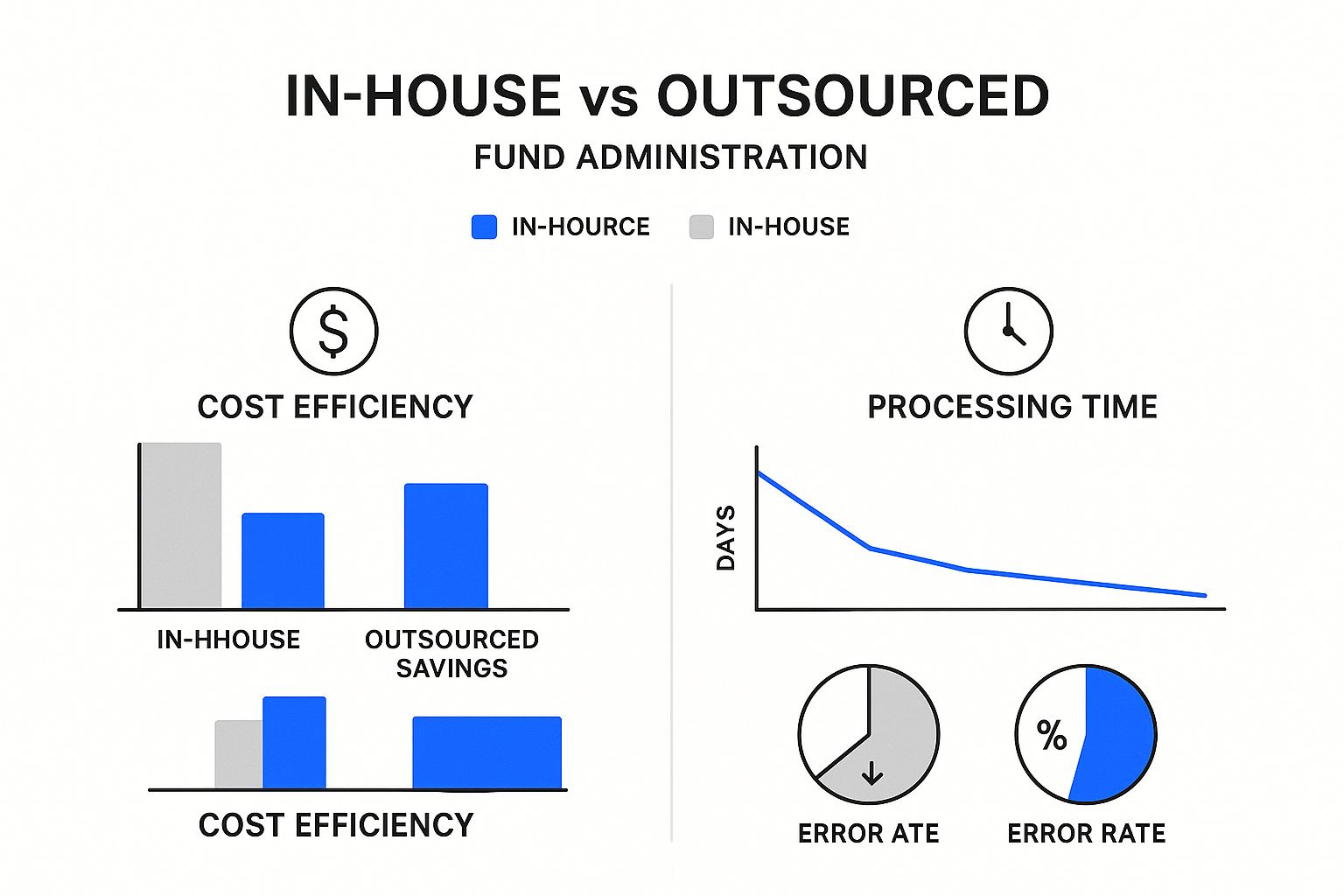

This is a key reason why many fund managers choose to outsource these tasks. A quick look at the data shows a clear pattern when comparing in-house administration to using a specialized provider.

As you can see, outsourcing often leads to major cost savings, quicker processing, and far fewer errors. This frees up fund managers to do what they do best: focus on their investment strategies.

When it comes to funds offering daily liquidity, like mutual funds and Exchange-Traded Funds (ETFs), the name of the game is speed, volume, and precision. These funds see a constant flow of investors buying and selling shares, which means the Net Asset Value (NAV) has to be calculated with absolute accuracy every single day. An error of just a fraction of a cent could ripple out to affect thousands of investors.

The core administrative challenges here are all about scale:

In this environment, the administrator acts like the operator of a massive, high-precision assembly line. The goal is flawless execution at high speed, ensuring every transaction is processed correctly and the NAV is struck on time, every time.

Shift gears into the world of private capital—think private equity, venture capital, and private credit—and the administrative landscape changes completely. These funds are illiquid, long-term investments, and their assets aren't conveniently priced on a public exchange. Here, the focus moves from high-volume daily tasks to managing deep complexity over a long fund life.

A private equity administrator, for example, must be a master of valuing assets that have no ready market price. This isn't simple math; it requires sophisticated valuation models and a genuine understanding of the underlying private businesses.

This complexity is only growing as the investment landscape evolves. For instance, the rise of direct indexing and separately managed accounts (SMAs)—projected to hit $825 billion and $2.5 trillion in assets, respectively—demands new administrative capabilities. Likewise, the massive capital shift from mutual funds to ETFs, with over $60 billion converted since early 2021, forces administrators to master entirely new operational workflows. These are just some of the trends highlighted in recent Deloitte findings on the investment management industry that are reshaping administrative needs.

The best way to grasp these differences is to see them side-by-side. The specific expertise needed to administer a hedge fund is quite different from what's required for a real estate fund. The following table breaks down how the key challenges shift across different fund types.

| Fund Type | Valuation Complexity | Regulatory Reporting | Investor Servicing Needs |

|---|---|---|---|

| Mutual Fund/ETF | Low: Based on daily public market prices. | High & Frequent: Strict daily and quarterly public filings. | High Volume: Managing thousands of retail investor transactions. |

| Hedge Fund | Medium to High: Involves complex derivatives, short positions, and intricate fee structures (e.g., high-water marks). | Moderate: Varies by strategy and jurisdiction, but often less public than mutual funds. | Specialized: Servicing sophisticated investors with complex reporting needs. |

| Private Equity/VC | High: Valuing illiquid, private company shares requires deep expertise and financial modeling. | Lower Frequency: Primarily annual audited financials and specific investor disclosures. | Long-Term & Relational: Managing capital calls and distributions over a 10+ year fund life. |

Ultimately, one of the most important decisions a fund manager can make is choosing an administrator with proven, hands-on experience in their specific corner of the market. This specialized knowledge isn’t just a nice-to-have feature—it’s absolutely fundamental to the fund’s operational integrity, investor confidence, and long-term success.

The back office is finally getting its high-tech makeover. For what felt like an eternity, fund administration was a world of endless spreadsheets, mind-numbing manual data entry, and entire teams of analysts just trying to keep up. That old story is being replaced by powerful new technology, turning a once tedious, labor-heavy field into a hub of data-driven strategy.

The future here isn’t just about doing the old tasks faster; it’s about unlocking entirely new ways of operating. Imagine manual reconciliations that used to take days now being wrapped up in minutes with near-perfect accuracy. This isn't some far-off dream—it's happening right now, fundamentally changing fund administration from a reactive reporting chore into a proactive, strategic tool for fund managers. The focus is now on eliminating human error, boosting efficiency, and letting talented professionals focus on high-level analysis instead of clerical work.

Artificial intelligence (AI) and machine learning (ML) are leading the charge. These aren't just simple automation tools anymore; they are now sophisticated enough to handle complex, judgment-based tasks that were always the domain of human experts. Think of AI as a tireless digital analyst that can read, understand, and classify thousands of documents in the time it takes a person to get through a single one.

Here’s where AI is making a real difference on the ground:

The true magic of AI in fund administration is its ability to learn. The more data it processes, the smarter and more accurate it gets, creating a virtuous cycle of improvement that manual processes could never hope to achieve.

This level of automation results in faster NAV calculations, quicker investor reports, and a much more solid compliance framework. It gives fund managers access to deeper insights pulled directly from their own data, helping them make smarter, more informed decisions.

While AI is tackling the efficiency problem, blockchain technology is zeroing in on one of finance's most foundational elements: trust. At its core, a blockchain is a shared, unchangeable digital ledger. Once a transaction is recorded, it's there for good—it can't be altered or deleted. This creates a permanent and completely transparent audit trail for everyone involved.

The implications for fund administration are massive. Picture a single, "golden source of truth" for every fund activity, from investor commitments to portfolio trades. This ledger is shared securely between the manager, the administrator, and the custodian. Suddenly, the endless, time-sucking need to reconcile different sets of books disappears because everyone is working from the exact same, unchangeable record.

Blockchain's potential goes beyond just record-keeping. It also enables tokenization—the process of converting rights to an asset into a digital token that lives on a blockchain. This could completely change the game for private markets by making traditionally illiquid assets, like a stake in a private equity fund or a piece of real estate, much easier to trade.

While still in its early days, tokenization points to a future where investors could find liquidity without having to wait for a fund's entire lifecycle to end. For administrators, this means a whole new world of work: developing capabilities to manage tokenized assets, track ownership on a blockchain, and ensure compliance in a new digital-first environment. Technology is paving the way for a future that's not just faster and more accurate, but also more secure and accessible for investors than ever before.

Once you've wrapped your head around the core functions of fund administration, the practical questions usually start bubbling up. It’s one thing to understand what it is, but it's another to know how it actually affects your costs, your key relationships, and the very structure of your fund.

This is where the rubber meets the road. Let’s tackle the most common questions we hear from both fund managers and their investors. Think of this as the final piece of the puzzle, designed to give you the confidence to move forward.

There's no simple, one-size-fits-all price tag for fund administration. The cost is tied directly to the complexity of your fund—the more moving parts, the more work is involved. Factors like your total assets under management (AUM), how intricate your investment strategy is, the number of investors you have, and how often you need reporting all play a big role.

Typically, you'll see fees structured in one of two ways:

Here’s a good analogy: servicing a standard family car is always going to be cheaper than the specialized maintenance for a high-performance racing engine. The race car has more intricate parts, requires deeper expertise, and involves greater risk—all of which gets baked into the price. The same logic holds true for funds. A private credit fund with hard-to-value assets and complicated loan structures is simply more intensive work than a long-only equity fund.

Bottom line? Always get a detailed quote tailored to your fund’s specific needs to understand the true cost.

Picking a fund administrator is one of the most important decisions you'll make. This isn't just about hiring a service provider; it’s about bringing on a partner whose reliability and technology will be woven into the fabric of your operations. The right choice boosts your credibility. The wrong one can drown you in operational headaches.

Think of your administrator as a co-pilot for your firm. You need someone with the right flight hours for your specific aircraft, who you trust completely to handle the controls, and who can navigate a storm without panicking. Their performance has a direct impact on your ability to fly safely.

When you're vetting potential partners, zero in on these areas:

Absolutely not. They are two distinct roles, and this separation is a cornerstone of good fund governance. It’s a common point of confusion for newcomers, but their different responsibilities create a crucial system of checks and balances.

Let’s use a film production analogy.

The fund manager is the director. They are the creative force making all the strategic decisions—what to buy, when to sell, and how to steer the portfolio to generate returns.

The fund administrator is the entire production crew. They handle the budget (accounting), manage contracts with the talent (investor onboarding), and make sure all the permits are in order (regulatory compliance). They aren't telling the director what scenes to shoot, but they make sure the whole production runs smoothly, on budget, and by the rules.

This separation ensures an independent third party is verifying the fund’s assets and financial records, which prevents conflicts of interest and gives investors confidence that the numbers are real.

Technically, yes, a fund can manage its administration internally. But in reality, it has become incredibly impractical and rare, especially for small to mid-sized funds.

First, there’s the cost. Building an in-house team requires a huge investment in specialized talent, expensive software licenses, and continuous training to keep up with ever-changing regulations. For an emerging fund, that’s capital that would be far better spent on actual investing.

More importantly, going in-house means you lose the independent oversight that institutional investors and regulators demand. Outsourcing to a reputable third-party administrator gives your fund an immediate stamp of credibility. It signals to the market that you're committed to transparency and best practices. For the vast majority of funds today, the choice is clear: outsourcing is more cost-effective, more credible, and lets the investment team focus on what they do best—managing money.

Ready to move beyond spreadsheets and operate like an institutional-grade firm? Fundpilot empowers emerging managers to automate back-office tasks, deliver professional LP reports, and secure larger commitments with audit-ready data. Discover how our platform can streamline your operations and accelerate your growth. Schedule your personalized demo with Fundpilot today.