Understand what is investor relations (IR) and why it's crucial for fund managers. Learn to build strong investor relationships with our expert guide.

At its core, Investor Relations (IR) is the strategic art and science of managing the conversation between a company's leadership and the financial world. It’s the essential bridge connecting a firm to its investors, analysts, and other key players in the market.

Think of it this way: a solid IR function is both a financial storyteller and a keen listener. This isn't just about pushing out quarterly earnings reports. It’s about creating and maintaining a continuous, two-way dialogue.

On one hand, IR gives investors the data and the narrative they need to make informed decisions about a company’s performance and where it's headed. On the other, it acts as a crucial feedback loop, gathering market sentiment and relaying it back to management. This helps leaders understand exactly how their strategies are being perceived on the street.

A strong IR program is fundamental to a company's financial stability and health. It works to ensure the company's stock is valued fairly, helps smooth out market volatility, and builds a dedicated base of long-term shareholders. In the end, it all comes down to cultivating trust—the most valuable currency in the capital markets.

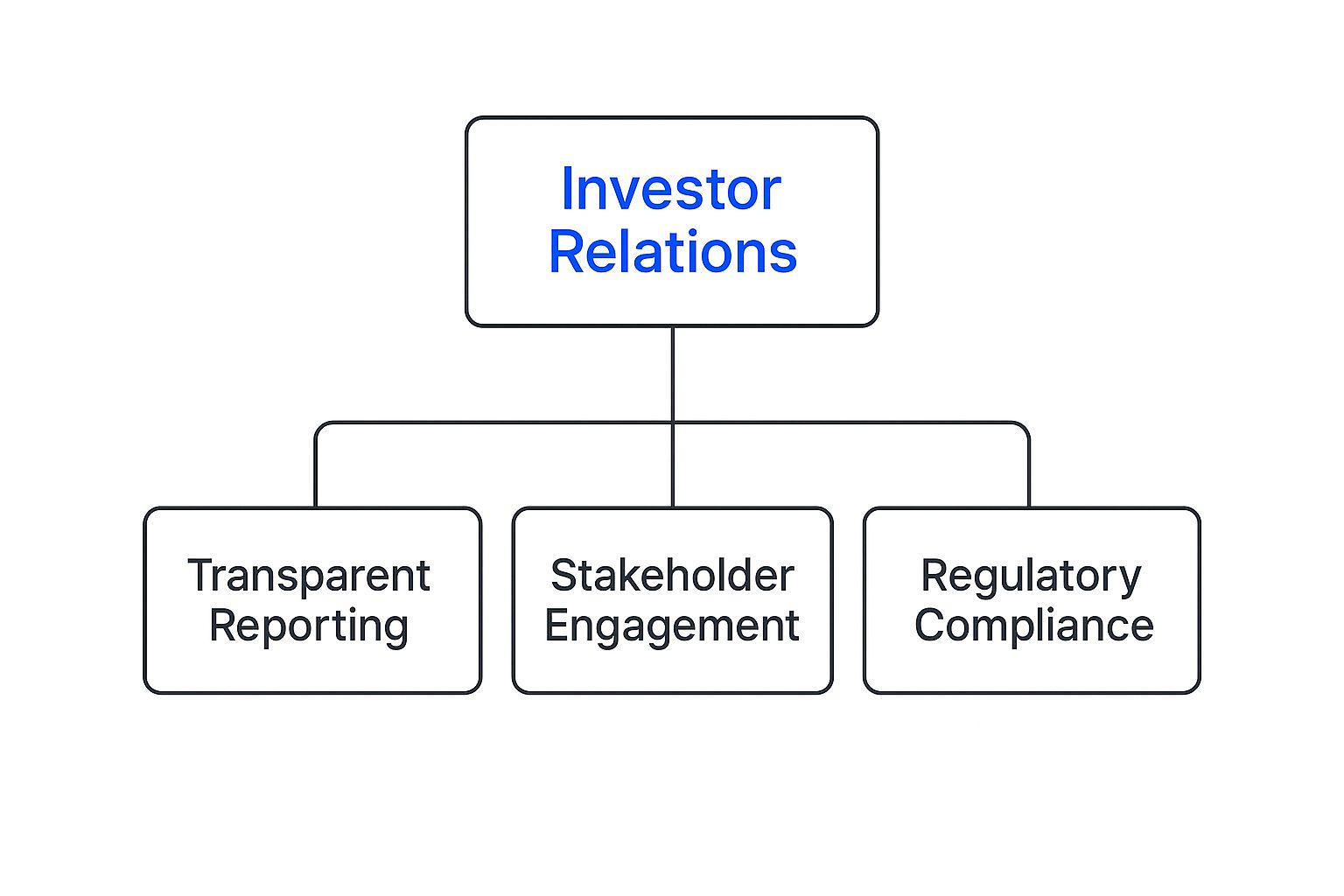

To be truly effective, a modern investor relations strategy needs to be built on three core pillars that work together seamlessly.

This infographic breaks down how transparent reporting, proactive stakeholder engagement, and strict regulatory compliance create the foundation for a successful IR strategy.

As the visual shows, every significant IR activity flows from these foundational responsibilities. They are absolutely vital for building and sustaining investor confidence over the long haul.

This kind of strategic communication is even more critical when you look at the bigger picture. The global debt market, for example, swelled to a record $318 trillion by the end of 2024. In such a massive and complex environment, clear and transparent communication was the key for organizations to maintain access to capital. For a deeper dive into these trends, the IIF's latest reports offer some incredible insights.

A well-structured IR function is a complex machine with several moving parts. The table below breaks down the main components and what they aim to achieve.

| Component | Primary Objective - | | Financial Reporting | To deliver clear, accurate, and timely financial disclosures (e.g., quarterly/annual reports) that help investors understand the company's performance and financial health. | | Strategic Messaging | To craft and communicate a compelling narrative about the company's long-term strategy, competitive advantages, and market opportunities. - | | Investor Engagement | To build and maintain strong relationships with current and potential investors through meetings, roadshows, and consistent communication. - | | Market Intelligence | To monitor market trends, competitor activities, and analyst perceptions to provide strategic feedback to the company’s leadership. - | | Regulatory Compliance | To ensure all communications and disclosures adhere to securities laws and regulations (like those from the SEC) to avoid legal and financial penalties. - |

Each of these components is crucial for a well-rounded and effective IR program that builds credibility and supports the company’s long-term success.

At its heart, investor relations is about managing expectations. It ensures there are no surprises by creating a predictable and transparent narrative about the company's financial journey and strategic direction.

Ultimately, IR is directly tied to a fund's ability to operate smoothly. While IR focuses on the critical communication with those who provide the capital, other functions handle the essential back-office tasks. To see how these roles fit together, take a look at our guide on what is fund administration.

To really get what investor relations is all about, we have to look past the formal definition and dive into what an IR team actually does every day. These aren't just isolated tasks on a checklist; they're a series of interconnected efforts that keep communication flowing, the company’s story straight, and investors in the loop.

At its core, IR is all about financial reporting. This means putting together and sending out crucial documents like quarterly earnings releases and annual reports. The whole point is to give a clear, accurate, and on-time picture of the company’s financial health.

But it’s so much more than just dropping numbers into a spreadsheet. A great IR professional weaves a story around that data, explaining what drove the results and what the future might hold.

An IR team's role is not just to report history but to shape the market's understanding of the future. They translate complex financial data into a compelling, forward-looking narrative that investors can believe in.

This storytelling duty comes with a huge responsibility: making sure every single communication complies with strict regulations from bodies like the Securities and Exchange Commission (SEC). This isn't optional—it's the bedrock that protects both the company and its investors from serious legal trouble.

Beyond the official reports, a huge part of the job is strategic messaging and direct engagement. This is the proactive side of IR, where the team actively manages how the company is perceived in the financial world.

These day-to-day activities are where the real relationship-building happens:

Think about what happens when a company makes a major move, like acquiring a competitor. The IR team is in the driver's seat. They craft the announcement, prepare the leadership team for interviews, and host investor calls to walk everyone through the strategic thinking behind the deal. Every step is carefully planned to build and maintain market confidence.

When the economy is humming along, investor relations can feel like a routine, almost background, function. But the moment markets get choppy or a geopolitical crisis hits, its role changes completely. It goes from a support function to a strategic necessity.

During times of high uncertainty, a proactive IR program becomes a powerful stabilizing force. Instead of just pushing out performance numbers, strategic IR is all about shaping the company’s narrative. It’s about getting ahead of investor concerns and tackling them head-on with clear, consistent communication. This kind of transparency manages expectations, prevents panic-selling fueled by rumors, and builds the kind of long-term shareholder trust that is absolutely critical for weathering any storm.

Think of IR as the ship's rudder in turbulent seas. The executive team is at the helm steering, but it's the IR function that provides the crucial market intelligence—the map and compass—needed to navigate safely. They gather insights on investor sentiment and analyst worries, feeding that vital information back to leadership so they can make smarter, more grounded decisions.

In a downturn, the best IR programs don’t just play defense. They go on a strategic offense. This means you’re not just reacting to bad news; you’re actively guiding the conversation around your fund’s resilience and long-term value proposition.

This shift is more important than ever. With rising geopolitical tensions and economic volatility, the role of IR has become far more strategic. Recent data highlights a renewed focus on strengthening shareholder relationships as a core survival tactic. Factors like trade tariffs and unpredictable global policies have fundamentally changed the game, forcing IR pros to rethink how they communicate value and manage expectations. For a deeper look at this trend, you can explore how top firms are adapting over at getirwin.com.

In volatile markets, silence is interpreted as bad news. A well-run IR function fills the information vacuum with a clear, credible, and consistent message, reinforcing stability when investors need it most.

Of course, this proactive communication must always be compliant with regulatory guidelines, especially as new rules come into play. For private fund managers, this is non-negotiable. You can learn more about mastering the SEC private fund rules to ensure your investor communications are both effective and fully compliant.

https://www.youtube.com/embed/kPDQl43xQP8

Running a top-tier investor relations program is about much more than just ticking regulatory boxes. It’s a strategic discipline. To truly excel, you need to build your IR function on a bedrock of consistency, transparency, and accessibility.

Think of it this way: consistency is about telling the same core story everywhere, whether it's on a quarterly call or in a face-to-face meeting. Investors hate being caught off guard. Transparency means you’re just as forthcoming with bad news as you are with good news, which is how you build unshakable credibility. And accessibility makes investors feel like they have a real connection to management, turning them into genuine partners.

The real goal of any great IR strategy is simple: no surprises. A predictable, honest, and open dialogue builds an investor base that will stick with you through the inevitable market ups and downs.

These aren't just buzzwords; they should be the guiding principles for every report you write, every meeting you take, and every strategic decision you make. They are the foundation of trust.

With those principles as your guide, you can start building out the tactical side of your IR plan. The first step is to nail down your investment narrative. This is your company's story—what's your mission, where have you been, and what's the vision for the future? It needs to be clear, compelling, and backed up by hard data.

Next, create a predictable IR calendar. This calendar should map out all your key dates: earnings releases, investor conferences, annual meetings, you name it. Publishing this calendar manages expectations and signals to the market that you're committed to a regular rhythm of communication.

Finally, remember that IR is a two-way street. It's as much about listening as it is about talking. Make a point to actively seek feedback from analysts and investors. This dialogue is gold—it gives you priceless market intelligence and helps you spot potential concerns before they blow up. Staying on top of market reactions and broader shifts is crucial, which is why it's so important to track the latest venture capital industry trends for 2025.

Ready to put this into practice? Here are a few habits that separate the best IR programs from the rest.

Investor relations isn't what it used to be. The entire field is in the middle of a massive shift, and technology is firmly in the driver's seat. The old ways of communicating and analyzing performance are giving way to powerful digital tools that bring incredible efficiency and much deeper insights. This change is allowing IR teams to move from being reactive to truly strategic.

Take data collection, for example. What was once a tedious, manual chore of tracking sentiment is now largely automated. Modern IR platforms can sift through market chatter, news mentions, and analyst reports in real time. This gives you an immediate sense of how your fund's story is landing, so you can adjust your messaging on the fly.

And what about investor roadshows? The days of depending entirely on expensive, cross-country flights are numbered. While face-to-face meetings still have their place, virtual roadshows and interactive digital annual reports are now common. This not only slashes costs but also opens the door to a wider, more global investor base that might have been out of reach otherwise.

Perhaps the biggest change is the pivot to data-driven decision-making. Gut feelings are being replaced by hard data. Advanced platforms can now help IR teams pinpoint and target potential investors who are a perfect match for a fund's profile. These tools dig into trading patterns and ownership data to find funds that have a track record of investing in similar opportunities.

This wave of new technology is changing daily workflows from the ground up. Artificial intelligence and digital communication tools are now essential. As these key 2025 trends show, integrated platforms help professionals manage communications, analyze sentiment, and even anticipate market reactions. This frees up the IR team to focus on high-value strategic work instead of getting bogged down in logistics.

Technology isn’t just making investor relations more efficient; it's making it smarter. By automating routine tasks and delivering powerful analytics, it allows IR professionals to shift their focus from administrative duties to strategic counsel.

This is precisely where tools like Fundpilot come in, especially for emerging managers. By offering an integrated investor portal and institutional-grade reporting, these platforms give smaller funds the polish and professionalism needed to stand out. They help level the playing field, making it easier to streamline communications and compete with the big guys.

Even after you've got the basics down, you’ll inevitably run into some practical questions when you start building out your investor relations function. Let’s tackle a few of the most common ones that fund managers and company leaders ask.

It’s easy to get these two mixed up, but they serve very different masters. Here’s a simple way to think about it: Public Relations (PR) talks to the general public, while Investor Relations (IR) talks to the people with the money.

A great public reputation built by PR is definitely helpful, but it's the IR team’s job to connect that positive buzz to a solid financial story that investors can believe in.

You don't need a huge budget or a sprawling team to do IR well. For smaller and emerging funds, the secret isn't size—it's consistency and transparency.

First, nail down your investment story. Make it crystal clear what you do and why you do it. Then, make sure your firm's leaders are actually available to talk to your most important investors. A simple but professional IR section on your website is a must-have, giving LPs a single place to find essentials like quarterly reports or capital call notices. Tools designed for fund managers can also help you punch above your weight, managing communications like a pro without needing a big team.

For an emerging manager, the most powerful IR tool isn't a large budget; it's an unwavering commitment to transparency. A clear, consistent, and honest communication strategy builds the trust needed to attract and retain capital.

Figuring out if your IR efforts are working requires looking at both hard numbers and the softer, more subjective feedback you get from the market. It’s never just one or the other.

On the quantitative side, you can track things like your fund's valuation compared to your peers, how accurate analyst reports are, and the stability of your investor base (low turnover is a good sign). Successfully raising a new round of capital on good terms is another massive win.

But qualitative feedback is just as crucial. This is what you learn from investor perception studies or simply by having candid conversations with analysts. It tells you whether your strategic message is actually hitting home.

Timing is everything. Bringing in a dedicated IR person or hiring a specialized firm usually makes sense at a few distinct trigger points:

Making that first IR hire sends a powerful signal to the market. It says your firm is growing up and getting serious about managing its relationship with the people who fund its growth.

Ready to elevate your investor communications and streamline your operations? Fundpilot empowers emerging fund managers with institutional-grade reporting, a professional investor portal, and automated workflows. See how you can compete with top-tier firms by booking a demo.