Learn key strategies for fundraising for private equity. Discover how to pitch LPs, navigate due diligence, and secure capital effectively.

Successful fundraising doesn’t start with the first pitch meeting. Far from it. The real work begins months, sometimes years, earlier by laying a rock-solid foundation of strategy, legal structure, and team alignment.

This is the phase where you prove your fund is an institutional-quality operation—one that’s truly worthy of an LP's trust and, ultimately, their capital.

Before you can even think about asking for a single dollar, you need a powerful story backed by an undeniable structure. Let's be honest, Limited Partners are drowning in opportunities. What makes your fund any different?

The answer is in the groundwork. This isn't just about having a great idea; it's about building a professional, durable, and compliant investment vehicle from scratch. It all starts with a crystal-clear fund strategy. The process is a lot like defining your fund's scope—you need absolute clarity before you move forward.

Your investment thesis is the heart of your fund's narrative. It has to be specific, defensible, and genuinely different. Saying "we invest in good companies" is a surefire way to get ignored. You have to carve out a niche where your team has a clear, demonstrable edge.

For instance, a strong thesis sounds more like this: "We acquire B2B SaaS companies with $5M to $15M in ARR, focusing on vertical markets like logistics and supply chain. Our operational partners will then implement proprietary efficiency playbooks to drive growth."

That single statement tells an LP everything they need to know—your focus, deal size, and unique value proposition.

Your thesis must answer three critical questions for LPs:

- Where will you invest? (Be specific about the sector, geography, and company stage.)

- Why you? (What gives your team an unfair advantage? Is it your network, expertise, or proprietary deal flow?)

- How will you create value? (What happens after the check is signed? Lay out your plan for operational improvements, M&A, or strategic guidance.)

Getting this right gives potential investors a clear roadmap, showing them you’ve thought through every step of deploying their capital and making it grow.

At the end of the day, investors bet on people first and strategy second. Your team’s collective experience, track record, and how well you work together will be put under a microscope. A truly well-rounded team brings complementary skills to the table.

You'll want to have all your bases covered:

Even if you have a killer track record, a perceived gap in your team can be a major red flag for LPs. For a first-time fund manager, bringing on a board of advisors with deep industry experience can add a massive layer of credibility. The goal is to project a team that can not only execute the strategy but also manage the immense complexities of running a fund.

We dive deeper into this in our guide to https://www.fundpilot.app/blog/forming-a-private-equity-fund-essential-guide-to-success and building your team.

The legal structure is the operational backbone of your fund. It’s what protects both you and your investors. For most U.S.-based funds, the go-to structure is a Delaware Limited Partnership (LP). It provides liability protection for the LPs and operational flexibility for you, the General Partner (GP).

Your most important legal document is the Private Placement Memorandum (PPM). Think of it as a formal disclosure document that lays out everything about your fund: the strategy, the team, the risks, and the terms. It’s part marketing document, part legal shield.

Working with experienced legal counsel on this is absolutely non-negotiable. One mistake here can have serious regulatory consequences down the road. This initial setup is what establishes the institutional credibility that sophisticated LPs demand, ensuring your operation is built to last.

Let's be blunt: your pitch deck is everything. It's your fund's story, your team's credibility, and your entire strategy, all packaged into one document. In a world where Limited Partners (LPs) see hundreds of these, a generic, cookie-cutter deck is a one-way ticket to the recycling bin. A truly great deck doesn’t just lay out the facts; it builds conviction.

The real goal here is to anticipate and answer every question an LP might have before they even think to ask it. Your value proposition needs to be so compelling and your logic so sound that scheduling a follow-up meeting feels like the obvious next step for them.

Before you even think about opening PowerPoint, you need to map out your story. A winning deck has a natural, logical flow. It’s a journey that takes the investor from understanding the market opportunity, to believing in your unique ability to seize it, and finally, to seeing the tangible returns you can generate.

This narrative arc is what separates the good from the great. Each section has to build on the last, reinforcing your core message and proving you have an expert-level grasp of your market. A big part of hooking them early on involves crafting compelling executive summaries that get right to the point and make them want to learn more.

Your pitch deck isn't a data dump. It's a strategic argument designed to persuade a highly sophisticated audience. Every slide, every chart, and every word should serve that single purpose.

Once you have that story straight, you can flesh out the individual components that will bring it to life and withstand the tough scrutiny all LPs will apply.

While the specific order can be tweaked, any powerful pitch deck will cover a core set of topics. The key is to keep each section tight, data-driven, and visually clean. Too much text is the enemy.

Here’s a look at the essential components every pitch deck needs to include. Think of each one as answering a critical question in the LP’s mind.

Table: Key Sections of a Winning Private Equity Pitch Deck

| Section | Core Purpose and Key Question to Answer |

|---|---|

| Executive Summary | A one-page snapshot of the entire fund. Why should I keep reading? |

| Market Opportunity | Defines the landscape and problem you solve. Where is the inefficiency or growth? |

| Investment Thesis & Strategy | Your unique approach to the market. How will you specifically generate returns? |

| Team Background | Highlights the team's relevant experience. Why are you the right people to execute this? |

| Deal Sourcing & Pipeline | Shows how you find proprietary opportunities. Where do your deals come from? |

| Track Record (Attributed) | Demonstrates past performance. What have you accomplished before? |

| Fund Structure & Terms | Outlines the legal and financial details. What are the fund's economics? |

| Case Studies | Provides concrete examples of your strategy in action. Show me how it works. |

Each of these sections demands serious attention to detail. For first-time fund managers who don't have an established firm track record, the Team Background and Case Studies (even from previous jobs) are absolutely crucial for building trust and credibility.

Don't forget the market context. While the first half of 2025 showed fundraising rebounding with $424.58 billion secured globally, that's still a far cry from the peak of over $1 trillion raised in 2021. Competition for LP capital is fierce.

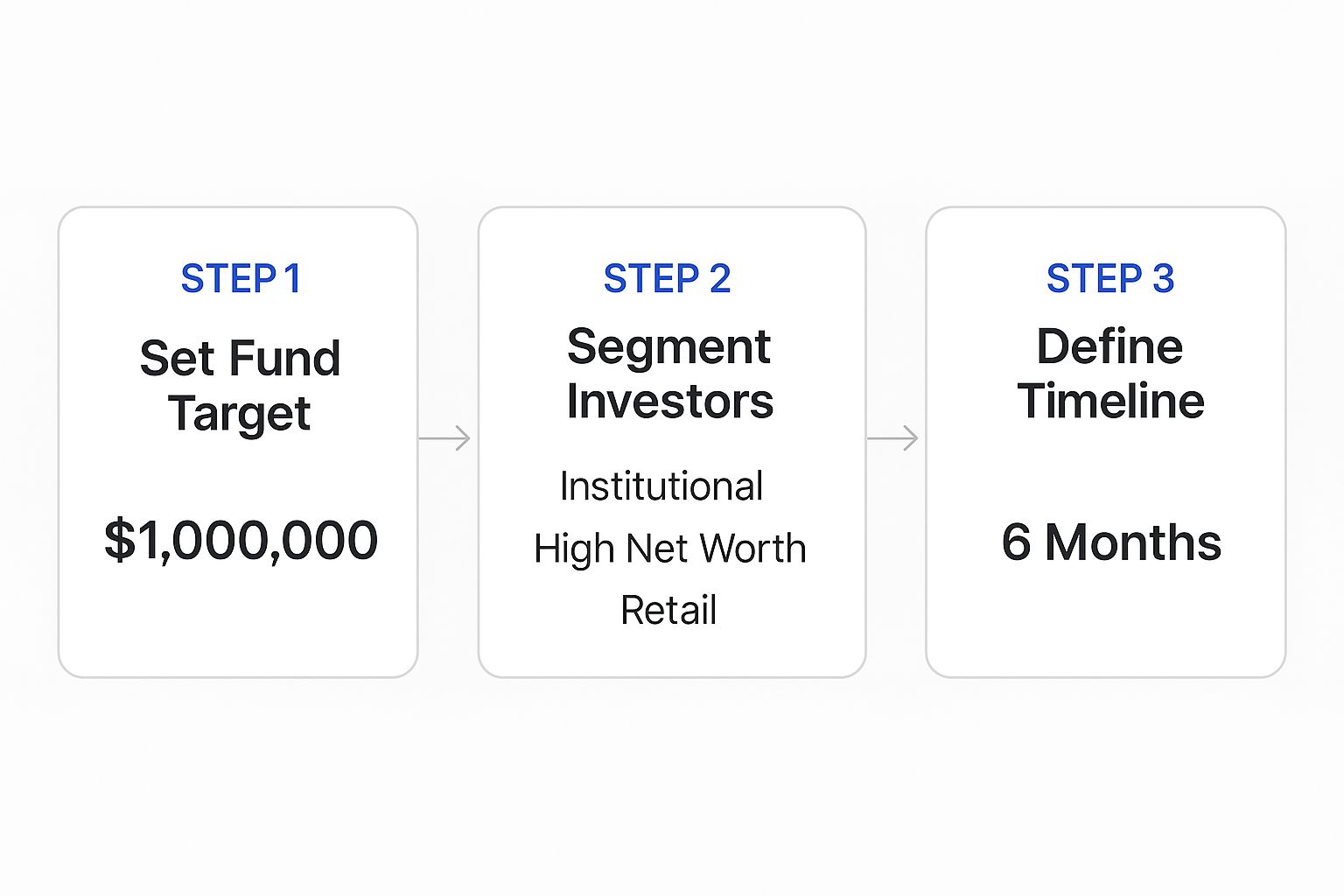

This image lays out the foundational work required before you even think about outreach. It’s all about setting the stage for a targeted and effective fundraise.

As you can see, a successful campaign is built on a bedrock of strategy—from setting clear targets to identifying the right investors and mapping out a realistic timeline.

When it comes to your track record, how you present the data is just as important as the data itself. LPs are busy. They need to see your performance and grasp it instantly. A dense table of raw numbers just won't do the job. You need visuals.

Here are a few ways to make your numbers pop:

For emerging managers, attributing your track record is non-negotiable. You have to transparently showcase the deals you led or had a major hand in at your old shop. This is the hard evidence LPs need to see to believe you can replicate that success. Your deck must connect the dots from past wins to future potential.

Successful private equity fundraising isn't a numbers game; it's a targeting exercise. I’ve seen too many GPs make the rookie mistake of blasting their pitch deck across the institutional landscape. That’s a surefire way to waste time and burn credibility before you even get started.

The real pros know that success comes from meticulously identifying and building relationships with the right Limited Partners.

This means looking beyond the obvious mega-funds and endowments. A truly well-constructed fundraise involves a carefully balanced mix of investor types, each bringing something different to the table. Your goal isn't just to collect checks—it's to build a stable, long-term investor base that believes in your vision.

Before you send a single email, you need an almost photorealistic picture of your ideal investor. This isn't just about finding people with deep pockets. It’s about finding capital that is truly aligned with your fund’s strategy, size, and timeline. Think of it as creating your ideal "LP persona."

Start by asking yourself some tough, practical questions:

Getting clear on these answers will help you build a laser-focused list, which makes your entire fundraising for private equity effort dramatically more efficient.

Once you know who you're looking for, you can start mapping the landscape. Smart fund managers diversify their LP base for stability, because different types of investors operate on different timelines and with different motivations.

Here’s a quick breakdown of the usual suspects:

| LP Type | Key Characteristics | Why You Should Target Them |

|---|---|---|

| Family Offices | Often more flexible and relationship-driven. Can make decisions faster than large institutions. | Fantastic for securing an anchor commitment and building momentum early on. |

| Funds of Funds | They act as intermediaries, investing for smaller LPs and conducting heavy-duty diligence. | A commitment from a respected fund of funds is a powerful stamp of approval for other LPs. |

| Endowments & Foundations | Long-term investors with established processes and specific allocation targets. | Provide stable, patient capital, but be prepared for a long, meticulous diligence cycle. |

| High-Net-Worth Individuals | Typically accessed through personal networks and wealth managers. Decisions are often personal. | They can move quickly and are often more willing to back an emerging manager they believe in. |

Building relationships across these categories will create a far more resilient investor base for your fund.

Let's be blunt: cold emails rarely work in private equity. This industry runs on trust and established networks. A warm introduction is the gold standard for getting a meeting because it bypasses gatekeepers and lends you instant credibility.

A warm intro isn't just a name-drop. It's a strategic endorsement from someone the potential LP knows and respects, signaling that you are worth their valuable time.

To get these introductions, you need to meticulously map your existing network. Use tools like LinkedIn to find the connections between you and your target LPs. You'd be surprised how often your lawyers, accountants, or even personal contacts can open the right doors.

When you ask for that intro, make it ridiculously easy for the person helping you. Give them a short, forwardable email that clearly explains who you are, what your fund does, and—most importantly—why it's a specific fit for that particular LP.

This level of preparation shows professionalism and respect for everyone's time. And remember, these connections need to be maintained. You can learn more about managing these critical relationships in our guide on what investor relations is for fund managers. Proactive engagement is essential not just for this fundraise, but for your long-term success.

Getting an LP to lean in is a huge win, but it’s just the start of the marathon. Now comes the real acid test for your firm: the due diligence process. This is where your story, your pitch deck, and your track record get put under the microscope.

A smooth, professional, and transparent diligence process does more than just tick boxes. It builds incredible confidence in your operational backbone, proving you’re a reliable steward of capital. On the other hand, a messy, slow, or disorganized process can absolutely kill a deal that felt like it was on the one-yard line.

Think of your Virtual Data Room (VDR) as the central nervous system for your entire due diligence effort. It’s the secure online space where you'll house every single document a potential LP will want to see. This isn't something you can just throw together last minute; it demands careful preparation long before you even have your first LP meeting.

Essentially, it's an open-book exam where you get to prepare all the answers ahead of time. The goal is to anticipate every possible request and have the documentation ready, neatly organized, and easy to find. A well-structured VDR sends a powerful signal that you run a tight ship.

Common VDR sections typically include:

Having this ready to go means you can grant access the moment an LP asks, keeping the momentum going.

The quality of your data room is a direct reflection of the quality of your firm. An investor will assume that how you manage your documents is how you'll manage their money.

This level of preparation is especially vital in today's more cautious market. The fundraising environment has tightened up significantly since its peak. Global private equity fundraising hit roughly $1.15 trillion in 2021, but by 2024, that number fell to $680.04 billion—a staggering 30% drop from the previous year. This climate makes a flawless diligence process more critical than ever.

Investors will come at your firm from two distinct but connected angles. You have to be ready to defend your strategy and your operations with equal intensity.

This is the forensic deep-dive into your past performance and your future strategy. LPs and their consultants will pick apart every single deal in your track record. They aren't just glancing at the final IRR or MOIC; they’re trying to understand how you actually generated those returns.

Get ready for questions like:

Your ability to answer these with data, honesty, and thoughtful analysis is what will win them over. For a complete rundown of what to expect, take a look at our guide for building out your expert due diligence checklist template, which can help you get fully prepared.

While your deal team is getting grilled on investments, your operations team will face an equally intense review known as Operational Due Diligence (ODD). This is how LPs assess the non-investment risks of your firm. They need to know you have the right people, processes, and systems in place to manage their capital safely.

The ODD team will zero in on areas like:

Passing ODD is a non-negotiable. You could have the best track record on the street, but if an LP senses operational risk, they will walk away. This is where having institutional-grade systems for reporting and administration gives you a massive leg up, demonstrating a level of professionalism that gives LPs the comfort they need to sign on the dotted line.

Getting that verbal commitment from a Limited Partner (LP) is a huge moment. It's the point where you can finally feel the momentum shift. But don't start celebrating just yet. The deal isn't truly done until the ink is dry on the Limited Partner Agreement (LPA).

This final stretch is all about the nitty-gritty legal and operational details. You're moving from the big-picture pitch to the fine print of the partnership, and getting this part right requires patience, precision, and an eye toward the long-term health of your firm.

The LPA is the legal bedrock of your fund. It’s the document that will govern your relationship with investors for the next ten years or more. While much of it is standard, savvy LPs and their lawyers will zero in on a few key areas. You need to be ready.

Expect to have detailed conversations around these points:

An LPA isn't just a legal hoop to jump through; it’s the blueprint for your partnership. A fair, transparent agreement builds a foundation of trust that will be invaluable when you're out raising your next fund.

Once you've hammered out the LPA terms, the process shifts to the final mechanics. This is where LPs execute their subscription documents to formally commit their capital, followed by your first capital call to start funding deals.

This administrative phase has to be flawless. It's the very first impression your investors will have of your back-office capabilities. A smooth, organized closing process tells them you're as professional as you claimed to be during due diligence. A sloppy one, on the other hand, can plant seeds of doubt right from the get-go.

The work doesn’t stop when the money hits the bank—it’s actually just beginning. The second your fund closes, your job shifts from fundraiser to steward of capital. The reputation you build with your first LPs is the single most important asset you have for raising Fund II.

This new phase is about execution and communication. LPs don't just expect returns; they expect regular, insightful reporting that tells the story behind the numbers.

Here’s what great post-close communication looks like:

The amount of capital in private equity is staggering. The top 300 firms have raised $3.29 trillion in the last five years, with giants like KKR reportedly targeting $117.9 billion in 2025 alone. You can explore more data on private equity fundraising giants to see just how competitive this world is. While you may not be playing in that stratosphere yet, adopting their discipline in investor relations is exactly how you earn the right to grow.

Even the most seasoned fund managers run into roadblocks during a capital raise. The private equity world is always shifting, and what worked last year might not work today, thanks to new market conditions and changing investor appetites.

Let's cut through the noise and get straight to the answers for the most common questions we hear from both emerging and established managers.

There's no single answer here, but you should realistically budget for a 12 to 24-month marathon from the moment you start prepping to your final close. This timeline can stretch or shrink depending on your firm's track record, the size of your fund, and the economic climate you're raising in.

First-time funds, be prepared for a journey on the longer end of that spectrum. This isn't just about sending emails and taking meetings. The process really breaks down into a few distinct stages:

Don't get ahead of yourself. A few great meetings early on don't mean you're weeks away from a close. Fundraising is a test of endurance and professionalism that plays out over many months, not a quick sprint.

I've seen three critical mistakes sink an otherwise solid fundraise time and time again. Avoiding them is all about preparation and a disciplined approach.

First, a vague or undifferentiated strategy is a deal-killer. LPs hear hundreds of pitches. Yours has to tell a sharp, compelling story about how you'll generate alpha in a way no one else can. If you just sound like another "lower middle-market buyout fund," you'll get glossed over.

Second is being unprepared for due diligence. Nothing screams "operational risk" louder than a disorganized data room, slow answers to questions, or inconsistent numbers. Investors will see that and immediately question your ability to manage their money. This is a totally unforced error and completely within your control.

Finally, treating LPs like walking checkbooks instead of long-term partners is a fatal flaw. Fundraising isn't a transaction; it's the start of a relationship that will hopefully last a decade or more. If you're not genuinely engaged, it’s a massive red flag for investors looking for a real partner.

Placement agents are specialized third-party marketers who can connect your fund with institutional investors. For a first-time fund or a team trying to break into a new region, their network and stamp of approval can be a game-changer, opening doors that would otherwise be firmly shut.

Of course, that access comes at a price. Placement agents typically charge a fee based on the capital they help bring in, which can be a significant slice of your raise. The decision really comes down to an honest look at your own team's strengths and weaknesses.

Ask yourself these questions:

A placement agent is only worth the cost if they fill a critical gap in your network and expertise that you simply can't bridge on your own.

For emerging managers, trying to navigate these challenges while also managing an active portfolio can feel overwhelming. Fundpilot gives you the institutional-grade reporting and operational tools you need to impress LPs, fly through due diligence, and build the trust required for a successful fundraise. See how you can compete with larger funds.