Download a battle-tested due diligence checklist template. Move beyond generic lists and uncover real risks with our actionable, expert-driven guide.

A due diligence checklist template gives you a starting point for investigating a potential deal, but its real power is unlocked through careful customization. If you just grab a generic, one-size-fits-all list and start checking boxes, you're taking a huge risk. A truly effective process means molding that checklist to fit the specific financial, legal, and operational realities of the deal in front of you.

Starting with a generic due diligence checklist can feel like you're setting yourself up for failure. It’s a common crutch for investors and fund managers, but it's a flawed one. Real due diligence isn't about ticking off items on a list; it’s about asking the right questions—the ones that expose hidden risks and opportunities unique to that specific business.

A basic template might tell you to verify financial statements, but it won’t prompt you to ask why a SaaS company’s customer acquisition cost suddenly shot up last quarter. It’ll remind you to check for lawsuits, sure, but it won’t push you to investigate the high employee turnover in the engineering department, which could signal a toxic culture or a failing product.

These are the kinds of details that turn into disastrous surprises after the deal closes. The goal isn't just to collect data, but to gather actual intelligence. That means you have to move beyond a static list and adopt a more dynamic, investigative mindset.

Let's imagine you're looking to acquire a direct-to-consumer brand because its revenue growth looks fantastic on paper. A generic checklist would simply confirm the top-line numbers. Done.

But a customized, dynamic checklist would push you to dig deeper. It would have you ask for a breakdown of revenue by marketing channel. This simple, specific question might reveal that 90% of sales are driven by a single social media influencer whose contract is up for renewal next month—with no guarantee it will be extended. All of a sudden, that "impressive" revenue stream looks incredibly fragile.

A due diligence checklist should be a starting point for inquiry, not an endpoint for confirmation. Its purpose is to guide your curiosity, not limit it.

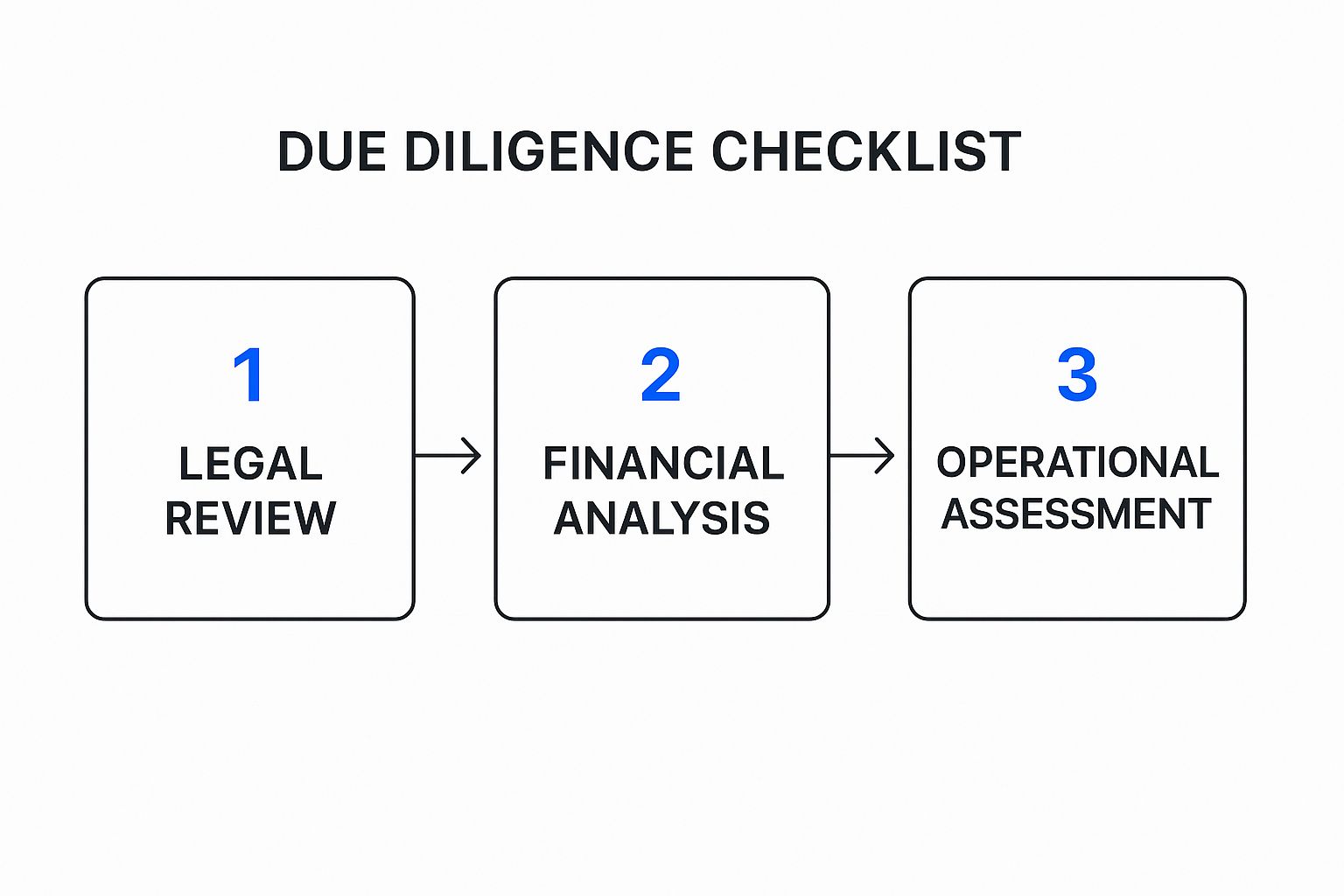

Every deal has the same core pillars—financial, legal, and operational—but how you examine them has to change every single time. You have to adapt your questions to the industry, company size, and specific structure of the deal.

There’s a reason global advisory firms stress this. Adopting a dynamic, expert-informed checklist has been shown to reduce post-deal integration headaches by up to 30% in M&A transactions. You can find more insights on the importance of tailored checklists on datarooms.org. The difference in approach isn't just academic; it has a real impact on outcomes.

This table really breaks down the two mindsets.

| Aspect | Generic Checklist Approach | Dynamic Checklist Approach |

|---|---|---|

| Focus | Document collection and box-ticking. | Risk identification and strategic insight. |

| Questions | Asks "Do you have...?" | Asks "Why is it this way?" and "What if...?" |

| Scope | Covers broad, universal categories only. | Drills down into industry-specific nuances. |

| Outcome | Creates a false sense of security. | Uncovers hidden liabilities and opportunities. |

| Example | "Review customer contracts." | "Analyze change-of-control clauses in top 5 customer contracts." |

As you can see, the dynamic approach isn't just a longer list—it's a fundamentally different way of thinking that protects your investment and sets the stage for a successful acquisition.

When it's time to build out your due diligence checklist, the financial section is where you'll find the company's real story. Numbers don't lie, but they can be framed to mask weaknesses. Your job isn't just to gather statements; it's to ask the right questions—the kind that probe revenue quality, uncover hidden debts, and truly get to the heart of what drives profitability.

Forget just asking for the last three years of P&L statements. A proper financial deep-dive is about understanding the health and sustainability of the company's economic engine. This is how you shift from simply checking boxes to conducting a genuine investigation, revealing the financial truths that aren't always printed in black and white.

This chart shows how financial analysis slots into the wider due diligence workflow, usually coming after a legal review and before you dig into operations.

As you can see, there's a logical flow here. Each phase of diligence builds on the last, helping you construct a complete, well-rounded picture of the target company.

Let’s be clear: not all revenue is created equal. The very first pillar of your financial checklist needs to be about understanding where the money is coming from and, just as importantly, how reliable it is. Recurring revenue from long-term contracts is worlds apart from one-off project fees or sales propped up by temporary discounts.

Your checklist items must be designed to get at this truth. For instance, instead of a vague "Review revenue," a far more pointed item is, "Analyze revenue concentration from the top 10 customers over the last three fiscal years." This simple tweak can immediately expose a dangerous over-reliance on a single client—a huge risk if that relationship ever goes south.

Here are a few specific items I always include on my checklist:

The balance sheet shows what a company owns and what it owes, but it rarely tells the whole story without some prodding. Your checklist needs to be your guide to finding the financial landmines that could go off after the deal closes. This means looking beyond the stated debt and digging into commitments, guarantees, and contingent liabilities.

A classic mistake is getting tunnel vision on the income statement. A company can post impressive profits while its balance sheet is quietly falling apart from mounting debt or receivables that are never going to get paid.

Accounts receivable is a perfect example. Seeing the total amount customers owe is one thing; understanding the odds of actually collecting that cash is another thing entirely.

A must-have checklist item is: "Analyze the aging schedule of accounts receivable against historical bad debt write-offs." If you spot a trend where the percentage of invoices over 90 days past due is climbing, it could signal serious cash flow issues or a deteriorating customer base.

This kind of rigor is standard practice in high-stakes situations. Globally, financial institutions use enhanced due diligence (EDD) checklists to methodically verify critical client information like source of wealth, transaction histories, and beneficial ownership. This meticulous approach, which involves reviewing a host of documentation required in due diligence on dealroom.net, is all about managing risk in complex scenarios.

Finally, your checklist needs to connect the dots between past performance and future potential. Let's face it—business plans and financial projections tend to be optimistic. Your checklist items should be designed to stress-test the assumptions behind those rosy numbers.

You need to validate the key drivers of their projected growth. If the company forecasts a 50% revenue jump, your checklist should prompt you to ask how. What specific sales activities, market shifts, or new initiatives are supposed to make that happen? Do they have a plan to hire more salespeople? Is a new product launch fully funded and on track?

Here’s how I structure this part of the checklist:

When you build your financial diligence checklist with this level of detail, it becomes more than a simple to-do list. It transforms into a strategic tool for uncovering the true financial health and hidden risks of any potential acquisition.

While a bad balance sheet can hurt, legal skeletons have a nasty habit of killing a deal dead in its tracks. A single misunderstood contract, a lawsuit lurking in the shadows, or a regulatory misstep can unleash liabilities that completely dwarf any potential upside.

This is exactly why the legal and compliance section of your due diligence checklist needs to be a fortress. You have to build it with a healthy dose of professional skepticism and a true investigator's eye. Your job isn’t just to find today's problems but to sniff out tomorrow's as well. This means moving past simple questions like "Are there any lawsuits?" and digging much, much deeper.

Before you even think about contracts or litigation, you have to confirm the company's very existence is legally sound. Is it a properly formed entity? Is the ownership clear? Messy corporate structures are a recipe for headaches later on, complicating everything from major decisions to profit distributions.

Your checklist should zero in on the fundamentals:

These steps aren't just box-checking; they confirm the company is what it claims to be and that the people you're dealing with actually have the authority to sell it.

Every single business is built on a foundation of contracts—customer agreements, vendor deals, office leases, you name it. Each one is a bundle of promises and potential liabilities. A thorough review isn't just recommended; it's absolutely critical.

I’ve seen deals fall apart because the acquiring team only collected contracts instead of actually analyzing them. The real danger is almost always buried in the fine print of a change-of-control clause or an automatic renewal term.

Imagine buying a SaaS company only to discover its biggest client can walk away, penalty-free, simply because the company was sold. That’s a deal-killer. Your checklist has to be designed to find these landmines before you step on them. For a closer look at these kinds of issues, our guide on navigating complex legal fund structures can be a real asset.

Frame your checklist to force a deep dive:

For many businesses, especially in tech, their intellectual property (IP) is their crown jewel. You absolutely have to verify that they own it, free and clear. A weak IP position means a competitor could swoop in, copy their "secret sauce," and make your acquisition worthless.

Here's a classic nightmare scenario: a buyer pays a premium for a software company's groundbreaking algorithm. Months later, they find out a founder developed it before joining the company and never formally signed it over. When that founder leaves, the IP walks out the door with them. That’s a catastrophic failure of due diligence.

Make your IP checklist airtight:

By approaching your legal review with this level of detail, your checklist becomes more than a to-do list—it's your primary defense against costly surprises.

A company can look absolutely perfect on paper but be an operational dumpster fire. I’ve seen it happen. While financial statements tell one story and legal contracts another, the real story is in the company's day-to-day operations and its position in the market.

A pristine balance sheet means very little if the core business is a house of cards waiting for a stiff breeze. This is where your due diligence checklist needs to get its hands dirty. You have to ask the practical, nitty-gritty questions that uncover how the business actually works. We're talking about its core processes, the strength of its customer relationships, and whether the leadership team truly has a handle on things. Without this, you’re flying blind.

First things first: you need to lift the hood and see how the engine runs. An operational review is all about spotting the inefficiencies, dependencies, and ticking time bombs that will never appear on a P&L statement.

A company might boast great margins, but what if you discover it relies entirely on a single, ancient piece of custom machinery with no spare parts available? You’re not just buying a business; you’re buying a future crisis.

Your checklist should be armed with pointed questions to uncover these hidden vulnerabilities:

A classic mistake is assuming profitability equals efficiency. In my experience, some companies succeed in spite of themselves—for a while. Your job is to figure out if that success is sustainable or if you're about to inherit an operational mess.

Beyond the internal gears, you have to assess the company’s place in the wider world. A business doesn’t operate in a vacuum. Its long-term health is directly tied to customer loyalty, its standing among competitors, and the actual integrity of its sales process.

Analyzing the sales pipeline is a great example. A pipeline stuffed with low-quality leads or deals that haven't moved in six months is a massive red flag. It suggests future revenue projections are built on wishful thinking, not solid ground.

To get a clear picture, your checklist needs to force an investigation into these commercial fundamentals:

Putting all of this together gives you a truly holistic view of the business. The table below gives a great snapshot of how you can structure these questions within your own due diligence template to make sure you're covering all your bases.

| Diligence Category | Key Questions for Your Checklist | Potential Red Flag Example |

|---|---|---|

| Technology | Are core systems scalable or will they require a major overhaul? Is there a clear technology roadmap for the next 3 years? | The entire business runs on a custom-built software platform that only one semi-retired developer understands. |

| Supply Chain | What percentage of raw materials comes from a single supplier? Are there backup suppliers for all critical components? | 85% of a key manufacturing component comes from one supplier with no formal long-term contract in place. |

| Customer Base | What is the annual customer churn rate? What is the revenue concentration of the top five customers? | The top two customers, making up 50% of revenue, have contracts that are up for renewal within six months. |

| Management Team | What is the average tenure of the senior leadership team? Are there clear succession plans for key roles? | The founder/CEO handles all major client relationships and makes every strategic decision single-handedly. |

By methodically building these operational and commercial questions into your checklist, you shift from being a passive reviewer to an active investigator. This is how you ensure the business you’re buying is as strong in reality as it looks on a spreadsheet.

Due diligence today goes way beyond just crunching numbers and reviewing legal documents. If you want a complete picture of a company, your checklist has to dig into its Environmental, Social, and Governance (ESG) and Diversity, Equity, and Inclusion (DEI) practices.

These aren't just buzzwords. They're real-world indicators of a company's culture, its long-term viability, and its exposure to risks that can sink a brand. Ignoring them means you're flying blind to operational threats and opportunities that traditional checklists simply don't cover.

Smart investors have figured it out: a company's stance on environmental impact, how it treats its people, and the diversity of its leadership are directly tied to its long-term health. Think about it. A business that cuts corners on environmental compliance is a ticking time bomb of regulatory fines and public backlash. A company with a toxic, non-inclusive culture will bleed talent and struggle to innovate.

These aren't "soft" metrics; they are hard, financial risks. Building them into your checklist is a strategic imperative. It's how you future-proof your investments and spot the businesses built for sustainable growth, not just a quick profit.

It's about shifting your mindset from asking "Is this business profitable?" to "Is this business sustainable?" ESG and DEI criteria give you the tools to answer that second, crucial question, uncovering strengths and weaknesses that never show up on a balance sheet.

Adding ESG to your diligence process means asking pointed, evidence-based questions. The goal is to get past the corporate jargon and collect actual data on what the company is doing.

Environmental: Don't just ask if they're compliant. Demand proof. Ask for copies of environmental permits, details on their waste management policies, and energy consumption data from the last three years. For a manufacturer, I'd insist on seeing a summary of all hazardous materials used and exactly how they are disposed of.

Social: This bucket is broad, covering everything from labor relations to data privacy. A big piece of this is employee treatment. Your checklist should request employee turnover rates (broken down by department), summaries of any workplace safety incidents, and a copy of the employee handbook to scrutinize their policies. You also have to assess how they handle data—our guide to GDPR compliance is a great resource for framing questions on customer data protection.

Governance: Good governance is the foundation of any well-run company. Your checklist needs to probe the board’s composition, executive compensation structures, and shareholder rights. A question I find very revealing is: "Provide the minutes from the last three board meetings." This gives you a raw look at their oversight and strategic decision-making process.

This shift isn't just happening in theory; major industry bodies are formalizing it. The Institutional Limited Partners Association (ILPA), for example, has been updating its guidance for years. By 2023, it officially integrated a DEI Monitoring Questionnaire, creating a structured template for investors. Reports now show over 75% of institutional investors actively consider ESG metrics. You can see how the industry is moving by checking out the latest ILPA DDQ resources.

The ILPA framework is a fantastic model for structuring these questions in your own templates.

This screenshot gives you a sense of the detailed, standardized templates that are becoming the new normal for serious, institutional-grade due diligence. It's proof that DEI has moved from a talking point to a quantifiable metric.

Even the most seasoned teams run into questions during due diligence. It's a complex, high-stakes process, and there's no substitute for clarity. Let's tackle some of the most common questions I hear from teams on the ground, offering straightforward answers to help you navigate your next deal with more confidence.

Your due diligence checklist template should be a living document. It's not a static file you dust off once a year. The best approach is to review it at least annually, but more importantly, you should refine it after every single significant transaction.

Why so often? Because the world doesn't stand still. Regulations change, markets shift, and best practices evolve. A few years ago, things like ESG or deep-dive cybersecurity reviews might have been minor points. Now, they're often headline risks that demand their own dedicated sections.

After each deal closes, do a post-mortem. Get the team together and ask the tough questions: What did the checklist help us catch? What did we miss? Where were the blind spots that forced us to scramble? This feedback loop is what turns a good template into a great one.

The most dangerous mistake is treating your checklist as a finished product. Think of it as version 1.0. Every deal you do is an opportunity to gather data and build a smarter, more insightful version 2.0.

Hands down, the single biggest mistake is using the checklist as a simple task list instead of a framework for genuine investigation. Rushing to get a "yes" or a document for every line item isn't due diligence—it's just glorified paper-pushing.

The real work begins after the box is checked. It's about critically analyzing what you've received, asking sharp follow-up questions, and connecting seemingly unrelated data points to see the bigger picture.

For example, checking off "Received all customer contracts" is useless if you don't actually read them. You might miss unfavorable change-of-control clauses or a massive concentration risk with just one or two clients. The checklist's job is to trigger critical thinking, not just provide the relief of getting another item done.

Absolutely not. Trying to use the same due diligence checklist template for a local business and a multinational corporation is a recipe for disaster. While the core categories—financial, legal, operational—are consistent, the scale and focus have to be completely different.

For a Small Business: Your focus will be much tighter. You’ll dig into things like owner dependency (what happens if the founder walks away?), the stability of a few key customer relationships, and the quality of their bookkeeping, which might be less formal.

For a Large Corporation: The checklist needs to be far more extensive. You'll be dealing with divisional performance breakdowns, compliance with international regulations, complex IT system integrations, pension liabilities, and a tangled web of sophisticated legal agreements.

Using a corporate-level checklist for a small deal is overkill and wastes precious time. Even worse, using a startup-level checklist for a major acquisition is just plain negligent. Your template must be modular, allowing you to add or remove sections based on the specific context of the deal. For more insights on tailoring your investment analysis, the Fundpilot blog is a great resource that covers various facets of fund management.

Ready to move beyond messy spreadsheets and generic checklists? Fundpilot empowers emerging fund managers with an institutional-grade toolkit for due diligence, reporting, and operations. Streamline your entire workflow, from pipeline management to audit-ready records, and present your findings with the professionalism that secures larger commitments. Schedule a demo with Fundpilot today.