Learn how to form a private equity fund with our expert guide. From legal structures to raising capital, start building your firm today.

Launching a private equity fund really comes down to three things: a bulletproof investment thesis, a management team that LPs can trust, and a legal and operational backbone that’s built to last. Honestly, the real work starts long before you ever see a dollar of committed capital. It all begins with a clear, compelling vision that convinces investors your team is the one to deliver standout returns in a specific corner of the market. This is where you lay the groundwork and craft the narrative that will bring your first Limited Partners (LPs) to the table.

Before you even dream of writing a pitch deck, you need a story that sells. That story is your investment thesis—the "why" behind your entire fund. It’s simply not enough to say you're going to invest in "tech startups." A truly powerful thesis is specific, defensible, and immediately demonstrates your edge.

For instance, a rock-solid thesis might be: “We invest in Series B, B2B SaaS companies in the Midwest that are automating legacy industrial processes.” See the difference? That level of detail shows you have deep domain expertise and a concrete plan for sourcing deals that others will miss.

Your fund's strategy is the roadmap that turns your thesis into reality. It gets into the nitty-gritty of the types of deals you'll do, your geographical focus, and the company stage you're targeting. Are you a growth equity player, a buyout specialist, or something in between?

This strategic focus has to be a natural extension of your team’s background. If your partners have a combined 50 years of experience in renewable energy, a fund dedicated to that sector is instantly credible. A pivot to biotech? Not so much. When you’re zeroing in on a geographic focus, deep research is non-negotiable. For example, understanding the venture capital landscape in Turkey could uncover unique, overlooked opportunities that align perfectly with your team's expertise.

A well-defined investment thesis acts as a filter for every decision you make. It not only guides your investment choices but also signals your expertise to potential Limited Partners, making your fundraising efforts more effective.

Let’s be clear: your team is your single most important asset. LPs aren’t just backing a strategy; they are backing the people who will execute it. The General Partner (GP) team must have a proven track record that makes the promises in your thesis feel like a sure thing.

This credibility is built on a few key pillars:

Without a team that inspires absolute confidence, even the most brilliant thesis will fall on deaf ears. This is exactly why so many successful first-time funds are spin-outs from established firms—the partners can point to a shared history of winning together. At the end of the day, launching a private equity fund is all about building a foundation of trust from day one.

To put it all together, think of these elements as the essential building blocks for getting your fund off the ground.

| Pillar | Key Considerations | Example Action Item |

|---|---|---|

| Investment Thesis | Is it specific, defensible, and aligned with market opportunities? Does it leverage your team's unique insights? | Draft a one-page summary stating your focus on "post-revenue, pre-profitability med-tech devices in the DACH region." |

| Management Team | Does the team have a proven track record, relevant operational experience, and complementary skills? | Create detailed biographies for each GP, highlighting specific deals, IRR, and their roles in previous portfolio companies. |

| Fund Structure | Have you determined the optimal legal entity, jurisdiction, and fee structure (e.g., 2 and 20)? | Consult with legal counsel to draft a term sheet outlining a Delaware LP structure with a 2% management fee and a 20% carry. |

| Deal Sourcing | How will you find unique, off-market opportunities? What is your proprietary network or angle? | Map out a target list of 50 potential companies and identify key industry conferences for networking over the next six months. |

Each of these pillars is interconnected. A strong team makes the thesis believable, and a clear thesis makes it easier to structure the fund and source the right deals. Getting these fundamentals right is the only way to build a fund with a real shot at success.

The legal and structural choices you make aren’t just paperwork—they're the very foundation of your private equity fund. These decisions will govern your relationships with investors, dictate how your team gets paid, and shape your fund’s operational life for the next decade. Getting this blueprint right from the start is non-negotiable.

The most common, battle-tested structure for a private equity fund is the Limited Partnership (LP). This model works because it creates a clear, functional separation between the two key groups involved.

This setup aligns everyone's interests while shielding investors from the operational risks of the underlying portfolio companies. It’s a clean and effective way to run things.

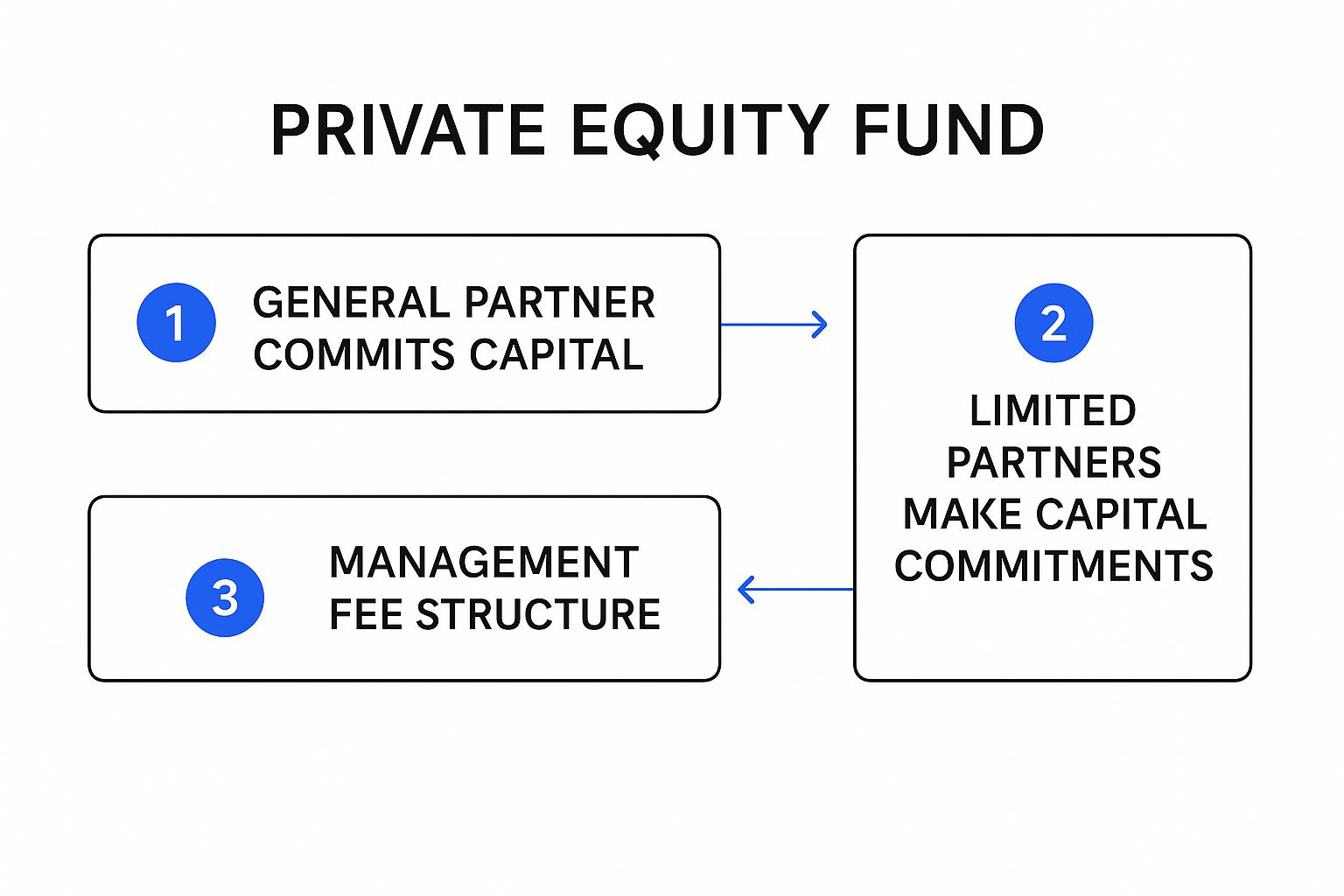

This diagram shows the fundamental flow of capital and fees within this typical fund structure.

As you can see, capital flows from both GPs and LPs into the fund, which then generates management fees to support the firm's operations.

Think of the Limited Partnership Agreement (LPA) as the constitution for your fund. It's a dense legal document that meticulously outlines the rights and responsibilities of both the GPs and the LPs. This is where every critical detail gets hammered out, and it's absolutely vital to get it right.

Key terms you’ll find in every LPA include:

These terms aren't set in stone; they can be a point of negotiation, especially for emerging managers. Still, the "2-and-20" model remains the industry benchmark for a reason. A well-drafted LPA provides clarity and heads off potential disputes down the road.

The LPA is more than a legal requirement; it's a testament to your professionalism and foresight. A thorough, investor-friendly agreement shows LPs you’ve considered every contingency and are committed to running a transparent, well-governed fund.

While the LPA is the legal backbone, the Private Placement Memorandum (PPM) is your fund’s story. It's the primary marketing and disclosure document you'll hand to prospective LPs. It needs to articulate your investment thesis, detail the bios of your team, and summarize the key terms from the LPA in a digestible way.

Your PPM has to walk a fine line. It must be compelling enough to attract capital but also comprehensive enough to satisfy legal disclosure requirements, which means clearly stating all the risks involved. For a deep dive into the rules governing private offerings, like Regulation D Rule 506, you'll need expert legal advice.

I’m going to be blunt: attempting to form a private equity fund without specialized legal counsel is a recipe for disaster. The regulatory landscape is a minefield, and a single misstep can be incredibly costly. You need a law firm that lives and breathes fund formation and understands the nuances of securities laws, especially the Investment Advisers Act of 1940.

Your legal team won't just draft your LPA and PPM. They’ll guide you through crucial decisions, like choosing the right jurisdiction (Delaware is the go-to for U.S. funds for good reason) and handling SEC registration.

Ultimately, your legal and structural choices send a powerful signal to the market. A robust, well-advised structure tells LPs you are serious, professional, and ready to manage their capital responsibly. For more on the legal documents and frameworks involved, you can find a solid overview here: https://www.fundpilot.app/legal.

With your legal framework locked in, you’re now facing what many consider the toughest part of launching a fund: raising the capital. This is where the rubber meets the road. Your investment thesis, track record, and professional structure are all about to be put under a microscope.

Let’s be honest—fundraising is a marathon, not a sprint. It requires relentless persistence, a highly strategic approach, and a story that absolutely commands attention.

The current climate for raising capital is undeniably challenging. The private equity fundraising world has cooled off, and we've seen a real shift in how Limited Partners (LPs) are deploying their money. In fact, global fundraising for traditional private equity funds recently dropped by 24%, part of a multi-year slide as cautious LPs grapple with muted returns and a shaky economy.

But there's a glimmer of hope. For the first time since 2015, distributions back to LPs have outpaced capital contributions. This could signal that the tide is starting to turn. This market reality means your pitch has to be sharper and more targeted than ever. You can't just send a generic deck to a long list of investors and hope for the best.

First things first, you need to build a curated list of potential LPs whose investment mandates genuinely align with your fund's strategy. All capital is not created equal. An LP focused on late-stage North American tech buyouts isn't going to give your early-stage European healthcare fund a second look.

Your target list needs to be thoughtfully segmented:

Once you have your list, it's all about the approach. Cold emails almost never work. You have to leverage your network—former colleagues, alumni contacts, and industry connections—to get warm introductions. Nothing beats direct engagement, so make it a point to attend industry gatherings and specialized VC and LP networking events. These are invaluable opportunities to build real rapport long before you ever ask for a check.

Your pitch is much more than a slide deck; it’s the narrative that brings your vision to life. It needs to answer the single most important question on every LP's mind: “Why should I invest with you, and why now?”

A compelling pitch deck should tell a clear and logical story:

Keep it sharp. LPs see hundreds of pitches a year. Yours has to stand out by being incredibly clear, credible, and concise. To stay current on what's resonating with investors, it’s smart to keep up with resources like the https://www.fundpilot.app/blog, which often shares great insights on LP communication.

The moment an LP shows serious interest, they’ll want to dive into due diligence. This is where your virtual data room (VDR) becomes critical. A well-organized, comprehensive data room is a direct reflection of your professionalism and transparency. Your goal is to anticipate every question an investor might have and have the answer waiting for them.

A disorganized or incomplete data room is a massive red flag for LPs. It screams "lack of attention to detail" and can kill a potential commitment before you even get a chance to defend your strategy.

Your data room needs to be meticulously organized. Think clean, intuitive folders containing all the key documents:

The due diligence process is intense, and it should be. LPs will pick apart your track record, stress-test your financial models, and make reference calls. Being prepared for this level of scrutiny isn't just a good idea; it's absolutely essential. This is how you build the long-term trust that will be the bedrock of your fund's success.

Once you have those first few capital commitments in the bank, the game changes. The hustle of fundraising takes a backseat to the very real, and often daunting, task of building a private equity firm that can stand the test of time. Now, you have to prove to your LPs that their trust—and their capital—was well-placed.

This is where you build your firm's engine room. A truly professional operational infrastructure doesn't just manage the basics; it supports your deal flow, streamlines investor relations, and keeps you on the right side of regulators. It's not glamorous, but it's what separates a flash-in-the-pan fund from a lasting franchise.

Getting your external team right is one of the most critical decisions you'll make, period. These partners are far more than just vendors; they’re an extension of your own team, handling the specialized work that lets you focus on what you do best: finding and closing deals. I’ve seen new managers make the mistake of choosing purely on cost, and it almost always comes back to bite them later.

You absolutely need these key players in your corner:

When you're vetting these firms, dig deep. Don't just look for a big name; find one with a proven track record working with funds of your size and strategy. The best piece of advice I can give is to ask for references from other emerging managers. They’ll give you the unvarnished truth about a provider's responsiveness and actual expertise.

With your A-team of external partners lined up, it’s time to look inward. Your internal systems are what turn your investment thesis from a good idea on paper into a repeatable, scalable machine for generating returns. Sloppy internal processes lead to missed deals and poor execution, and believe me, your LPs will notice.

You need to sit down and document a clear, step-by-step process for every stage of your investment lifecycle.

Deal Sourcing and Pipeline Management How are you actually going to find deals that no one else sees? A systematic approach is everything. This is more than just going to conferences; it means having a real process for tracking leads, nurturing relationships, and making sure your pipeline is always full of opportunities that perfectly fit your thesis. A simple but effective CRM or pipeline tool like Affinity or DealCloud is a must-have here.

Due Diligence Checklist Every single potential deal needs to go through the same rigorous, standardized due diligence gauntlet. Create a checklist that covers all your bases—financial, operational, legal, and commercial. This ensures you're disciplined and leave no stone unturned before putting LP capital at risk.

Portfolio Company Monitoring You've made the investment. Now what? You need a formal process for tracking performance and actually adding the value you promised. This means setting up regular check-ins, defining the key performance indicators (KPIs) you'll track, and establishing a clear board governance model. It shows LPs you're an active, hands-on partner, not just a passenger.

Your internal processes are the operational expression of your investment strategy. They provide the discipline and consistency needed to execute your thesis effectively and build a track record that will attract capital for future funds.

These days, you can't run a serious private equity firm on a jumble of spreadsheets. It’s inefficient, risky, and frankly, looks amateur. Investing in a smart technology stack from day one will make you look and feel institutional, which goes a long way with investors.

Look for tools that can handle:

This operational framework is the engine room of your firm. By locking in the right partners, building disciplined internal processes, and using modern technology, you create a solid foundation that can support your growth and deliver the professional-grade experience your investors rightly expect.

When you're forming a private equity fund, the old fundraising playbook just doesn't cut it anymore. Relying solely on the traditional pools of capital isn't enough. For emerging managers, looking beyond the usual institutional investors isn't just a backup plan—it's a massive competitive advantage.

The smartest fundraising strategies today actively court vast, underserved markets. Tapping into these groups can get your fund off the ground faster and build a more resilient foundation for the long haul. The entire investor landscape is shifting, and two of the biggest forces are private wealth and sovereign wealth funds (SWFs). They think differently and have different needs than a pension fund, and knowing how to speak their language is key.

The private wealth space is a huge, relatively untapped ocean of capital for private equity. Think about it: private individuals hold about half of all global wealth, yet that capital only makes up roughly 16% of assets in alternatives. That gap is a flashing green light for growth, and smart fund managers are already building out teams to go after it. For a deeper dive, Ocorian published some great insights on how private wealth is reshaping the industry.

Historically, high-net-worth individuals and family offices were kept out of the best PE funds by sky-high minimums—often $5 million or more—and decade-long lockups. That's all changing.

To get this capital on board, you have to get creative with your fund's design:

Catering to the private wealth market means you need to think more like a wealth manager than an old-school institutional fundraiser. It's all about clear communication, transparent reporting, and offering a product that actually fits their needs for liquidity and access.

But an innovative structure isn't enough. You have to deliver an institutional-grade experience from day one. That means a polished, professional investor portal and the kind of high-quality reporting that builds immediate trust. If you're figuring out how to set up that kind of infrastructure, our team can help you explore the right solutions.

On the other end of the spectrum, you have Sovereign Wealth Funds (SWFs). These are massive, state-owned investment giants with unbelievably deep pockets. They’ve always been big players in private equity, but their strategy is evolving, which is creating new openings for sharp emerging managers.

SWFs are no longer content to just be a standard LP. They want to be partners. They're showing a huge appetite for direct co-investment opportunities right alongside your fund's main investments. This lets them put more money to work in deals they really like, often at a lower fee basis.

To even get a meeting, you need to be ready for a different kind of conversation.

By strategically pursuing these non-traditional sources of capital, you're not just fundraising—you're building a more diverse and resilient investor base. A forward-thinking approach that caters to the unique demands of private wealth and the strategic goals of SWFs can give you the critical momentum you need to succeed in today's market.

Even with the best-laid plans, launching a private equity fund is a journey filled with tough questions. Getting straightforward answers to the most common ones can make a huge difference, helping you anticipate the real-world challenges ahead.

Let’s dive into some of the questions that come up time and time again.

Be prepared for some serious upfront investment. For a first-time private equity fund, startup costs typically land somewhere between $500,000 and $2 million, sometimes even more. And remember, you're footing this bill long before you see a single dollar in management fees.

So, where does all that money go?

Typically, the General Partners (GPs) cover these expenses personally. The entire game is about getting to that first close, because that’s when the management fees finally kick in and can start sustaining the firm's day-to-day operations.

The honest answer? Longer than you think. Raising a first-time fund is a marathon, not a sprint, especially compared to established firms with a proven track record. You should realistically budget for a 12 to 24-month process, from the day you start planning to your final close.

Think of the fundraising journey in two main phases. The first six to nine months are usually dedicated to laying the groundwork—refining your pitch deck, finalizing the legal structure, and building a highly targeted list of LPs who might actually invest. The next six to 15 months are all about execution: hitting the road for pitch meetings, grinding through due diligence with interested LPs, and holding a series of 'closes' as you secure capital commitments.

In today's tough fundraising environment, that timeline can easily stretch even further. A strong personal network and a genuinely unique investment strategy aren't just nice-to-haves; they're critical for getting you across the finish line.

This is a common point of confusion for new managers, but getting it right is crucial for your fund’s integrity. While both are key partners, a fund administrator and a custodian have completely different jobs.

A fund administrator is essentially your outsourced back office. They handle the nitty-gritty operational work that keeps the fund running smoothly. Their job includes:

A custodian, on the other hand, is a financial institution that holds your fund's assets for safekeeping. They are the vault. They hold the stocks, cash, and other securities in a secure, separate account, which provides a critical layer of protection for your investors by preventing any potential misuse of their capital.

You absolutely need both to run a professional and credible private equity firm.

Ready to move beyond spreadsheets and build an institutional-grade operational backbone for your fund? Fundpilot empowers emerging managers with automated LP reporting, a professional investor portal, and streamlined fund administration. See how Fundpilot can help you compete and grow.