Master KYC AML compliance with this guide for fund managers. Learn to build a robust framework, navigate regulations, and leverage tech to protect your fund.

For any emerging fund manager, KYC and AML compliance isn't just a regulatory hurdle—it's the very foundation of your firm's credibility and security. Think of Know Your Customer (KYC) as your firm's front-door security, meticulously checking IDs to make sure your investors are exactly who they say they are. Anti-Money Laundering (AML), then, is your 24/7 surveillance system, constantly scanning for anything that looks out of place financially.

For fund managers, getting a handle on KYC and AML is about much more than just ticking a box. It's about protecting your fund's integrity and your hard-earned reputation. These two concepts are often mentioned together, and for good reason—they're two sides of the same coin, working in tandem to shield your fund from illicit activities.

It’s a common mistake to treat them as separate to-do list items. Instead, see them as one integrated system designed to protect everyone involved: your fund, your limited partners (LPs), and the financial system as a whole.

KYC is where it all starts. It's the proactive, get-to-know-you phase of every new investor relationship. Before you let anyone in the door, you need to do your homework to build a clear, verified picture of who they are.

AML is the long game. It kicks in right after KYC and runs for the entire life of your relationship with an investor. It’s the ongoing monitoring that flags unusual patterns that don’t quite match the investor profile you so carefully built during the KYC checks.

To build a compliance program that actually works, you need to be crystal clear on the specific roles KYC and AML play.

Know Your Customer (KYC): This is all about identity verification and risk assessment. You're collecting and confirming crucial details like government-issued IDs, proof of address, and getting a clear understanding of the investor's source of wealth. The end goal is to assign a risk score—low, medium, or high—to every single LP.

Anti-Money Laundering (AML): This is the bigger picture. It's the entire set of policies and procedures you have in place to spot and report suspicious activity. This includes everything from monitoring transactions to filing official Suspicious Activity Reports (SARs) with agencies like the Financial Crimes Enforcement Network (FinCEN).

Adopting a strong compliance mindset isn’t about being defensive; it’s a strategic move. It sends a powerful signal to institutional investors that your fund is professional and operates with integrity, immediately making you a more attractive and trustworthy partner.

If you're a smaller, growing fund, putting a solid KYC and AML compliance framework in place from day one is absolutely critical. This isn't just about avoiding fines or legal headaches; it's about building a firm that's ready to scale.

As you start attracting bigger LPs and find yourself under a brighter spotlight, having these processes already ironed out gives you a serious competitive edge.

Many prime brokers, fund administrators, and institutional LPs won't even entertain a conversation with a fund that doesn't have a formal AML program. They see it as a basic sign of operational competence and sound risk management. To truly integrate this into your fund's DNA, you also need to grasp the broader essential compliance requirements that all businesses face.

Ultimately, being proactive about compliance is a powerful tool for building credibility and fast-tracking your fund to an institutional-grade operation.

When you run a fund, you're not just managing assets; you're also navigating a tangled web of national and international regulations. Think of yourself as the captain of a ship sailing through different countries' waters—each territory has its own set of rules you have to follow to stay out of trouble. Getting a handle on these key legal frameworks isn't optional. It's flat-out essential for survival and growth.

For fund managers, especially those with investors scattered across the globe, KYC and AML compliance is a multi-jurisdictional headache. What satisfies the regulators in one country might not even come close in another. This reality means a solid, internationally-aware compliance program isn't just a back-office task; it's a core strategic necessity.

On the world stage, the Financial Action Task Force (FATF) is the big standard-setter. While it can’t directly enforce laws, its recommendations are the blueprint for the AML and counter-terrorist financing (CTF) laws in over 200 countries. Following FATF guidelines is really the baseline for being taken seriously as an international player.

Here in the United States, the cornerstone of AML regulation is the Bank Secrecy Act (BSA). At its heart, this law requires financial institutions to help the government sniff out and stop money laundering. The BSA lays the groundwork for most of what you'll be required to do, from reporting large cash transactions to keeping meticulous records.

These rules have a direct impact on your day-to-day work in a few critical ways:

Let's be blunt: ignoring these rules can cripple an emerging fund. The penalties aren't just a slap on the wrist. They're financial, reputational, and can even land you in legal trouble with criminal charges. For a smaller fund, a major compliance failure can be a death sentence, destroying the trust of your LPs and making it almost impossible to raise another dollar.

The penalties for non-compliance are designed to hurt. Regulators hand out massive fines, sanctions, and even prison sentences to protect the integrity of the financial system. For a fund manager, the reputational damage from a public enforcement action is often far more costly than the fine itself.

Recent shifts in the U.S., driven by the Anti-Money Laundering Act of 2020, are cranking up the compliance pressure into 2025 and beyond. We’re seeing stricter reporting on beneficial ownership and new AML program requirements for groups that were previously exempt, like registered investment advisers. The penalties for BSA violations are no joke—individuals can face fines up to $250,000 and jail time, while firms can be hit with fines of $1 million or more. This just underscores how critical a rock-solid compliance framework is.

Understanding the law is one thing, but actually putting it into practice is a whole different ballgame. Your goal is to translate dense legal jargon into a clear, actionable set of internal policies and procedures. You need to build a system that not only checks the compliance boxes but also works for your fund's specific operations.

This isn't just about creating a checklist. It's about developing a deep understanding of your fund’s unique risk profile, which is shaped by your investor base, investment strategy, and where you operate. For a wider view on how to tackle these varied requirements, check out this guide on Navigating Regulatory Compliance with Salesforce. Building this kind of operational resilience is what will allow you to manage your duties with confidence and secure your fund's future.

Putting together a solid KYC AML compliance program can seem like a mountain to climb, but it’s really just a structure built on four key pillars. Each one supports the others, creating a framework that's not just robust but also defensible when regulators come knocking. If you approach it systematically, what feels like a complex legal burden becomes a manageable, step-by-step process.

Think of it like building a house. You wouldn't dream of putting up the walls before you've laid a solid foundation. In the world of compliance, that foundation is your Customer Identification Program (CIP).

The Customer Identification Program is your first, non-negotiable step with any new investor. Its job is simple but absolutely critical: to make sure your investors are who they say they are. This is where you gather the basic, verifiable facts that everything else in your compliance process will hinge on.

For an individual investor, you’re looking for the basics:

When you’re dealing with an entity like a trust or a corporation, you have to dig a bit deeper to identify the beneficial owners—the real people who own or control at least 25% of that entity. A lot of firms get into hot water by failing to look behind complex corporate structures. Verification is the name of the game here; you have to use reliable, independent documents or electronic methods to confirm everything.

Once you know who your investor is, you move on to Customer Due Diligence (CDD). This is where you figure out the level of risk each investor brings to your fund. You’re trying to understand the nature of their business, where their money comes from, and what their typical transaction patterns should look like. All this context helps you build a unique risk profile for every single client.

A low-risk investor might be a well-known domestic pension fund. On the other hand, a high-risk investor could be a complex offshore entity with a murky source of funds. Based on that risk assessment, you can then apply the right level of scrutiny.

For clients or transactions you flag as high-risk, you need to apply Enhanced Due Diligence (EDD). This isn't a totally separate program—it's just a more intensive, deeper version of your standard CDD. It means more rigorous identity checks and much more detailed documentation on the source of their wealth.

Getting this right requires a clear, repeatable process. For a structured approach to gathering and assessing this information, take a look at our expert due diligence checklist template for some practical tools.

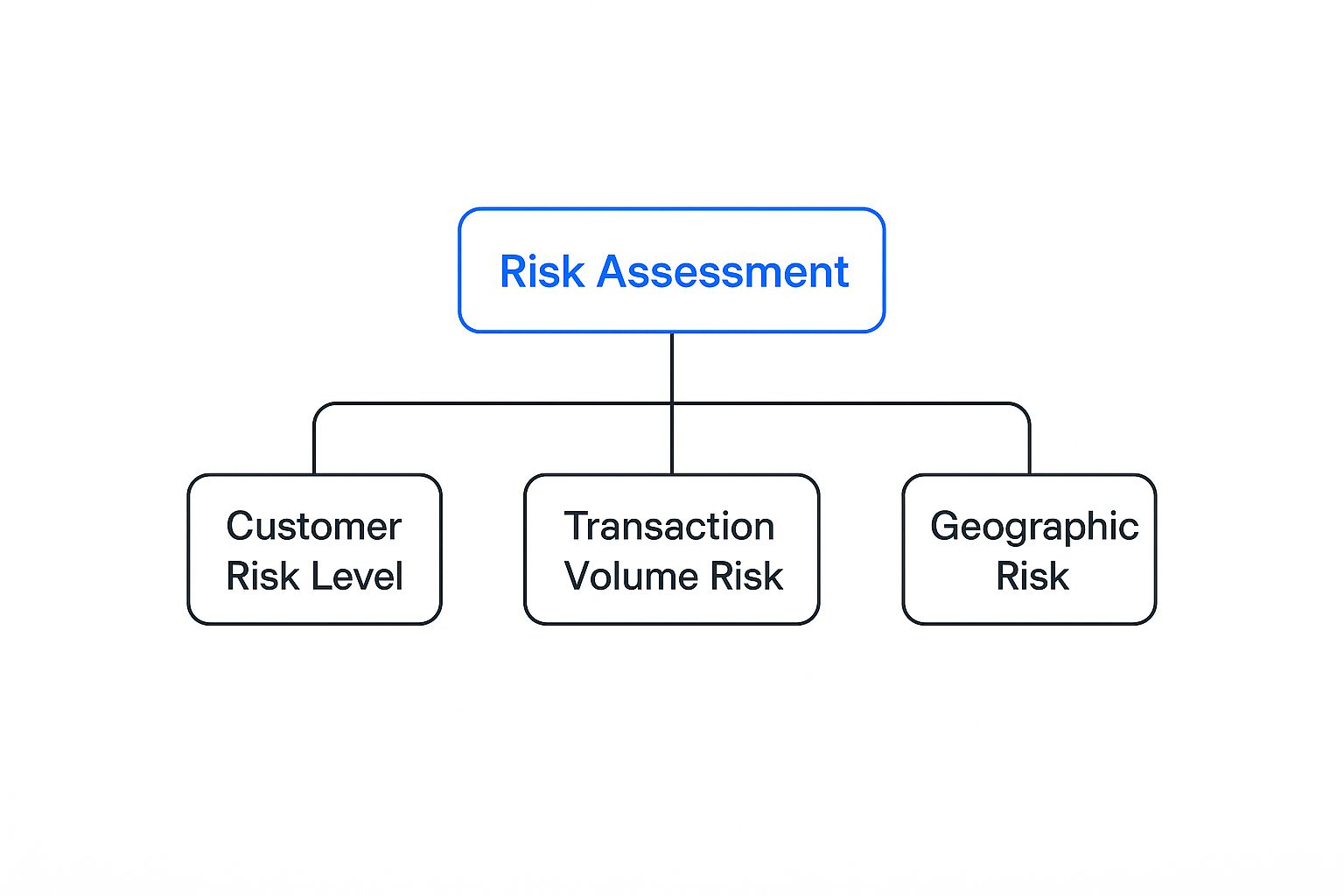

This is where you bring everything together to form a clear picture of risk.

As you can see, a solid risk rating isn't based on one single piece of information. It's a conclusion you draw from looking at multiple, interconnected factors.

Your compliance work doesn’t just stop once an investor is onboarded. Ongoing monitoring is the pillar that keeps your program effective and relevant over time. It’s all about keeping a close eye on transactions and investor behavior to catch anything that doesn't line up with their established profile.

Think of it as the security camera system for your fund. You’re constantly scanning for red flags that could point to money laundering or other shady activities.

What to look for:

This constant vigilance is what makes a kyc aml compliance strategy dynamic and allows you to catch potential problems as they happen, not after the fact.

The last pillar is your legal duty to report suspicious activity to the government. When your ongoing monitoring flags something that you can’t logically explain—and you have a gut feeling it might be tied to illegal activity—you are required to file a Suspicious Activity Report (SAR) with the Financial Crimes Enforcement Network (FinCEN).

Filing a SAR isn't you playing judge and jury; it's simply a notification to law enforcement that something warrants a closer look. It’s a critical responsibility that protects not just your firm, but the integrity of the entire financial system. And remember, confidentiality is everything—it is illegal to let the subject of a SAR know that a report has been filed about them.

To bring all this together, let's look at how these four pillars form a complete, functioning compliance system.

This table breaks down the essential pillars for building a robust KYC AML program. It details the purpose and key activities for each to guide fund managers in creating a defensible framework.

| Compliance Pillar | Core Purpose | Essential Activities |

|---|---|---|

| Customer Identification (CIP) | To verify the true identity of every investor and beneficial owner. | Collect and verify names, addresses, dates of birth, and government ID numbers. For entities, identify individuals with 25% or more ownership. |

| Customer Due Diligence (CDD) | To assess an investor's risk profile based on their background, business, and expected transaction patterns. | Analyze the source of wealth, understand the purpose of the investment, and assign a risk rating (low, medium, high). Apply Enhanced Due Diligence (EDD) for high-risk clients. |

| Ongoing Monitoring | To detect and scrutinize unusual or suspicious transactions in real-time. | Continuously review account activity against the investor's established profile. Investigate transactions that deviate from norms, such as unusual sizes, frequencies, or geographic locations. |

| Suspicious Activity Reporting (SAR) | To formally report potential illicit activities to the appropriate regulatory authorities. | When suspicious activity is detected and cannot be explained, document findings and file a SAR with FinCEN within the legally required timeframe. Maintain strict confidentiality throughout the process. |

With these four pillars firmly in place, you create a complete, functioning system that effectively manages your compliance duties from start to finish.

A one-size-fits-all compliance strategy isn't just inefficient—it’s a genuine liability. For new fund managers, putting every investor through the exact same level of scrutiny is a classic mistake. You’ll burn through resources, frustrate LPs during onboarding, and, worst of all, you might miss the real threats hiding in plain sight.

This is exactly why the risk-based approach (RBA) is now the gold standard in KYC/AML compliance.

The whole idea behind an RBA is simple but powerful: not all risks are created equal. Instead of blindly following a rigid checklist, you build a dynamic defense system. It intelligently focuses your time, money, and energy on the areas that pose the biggest threat to your fund. This means you can keep things smooth and straightforward for low-risk investors while saving your deep-dive investigations for higher-risk profiles.

The bedrock of any solid RBA is a comprehensive AML risk assessment. Think of this not as a one-and-done task, but as a living, breathing analysis of your fund's unique vulnerabilities. The goal is to pinpoint exactly where and how your fund could be exposed to illicit money.

To get there, you need to dig into a few key factors:

Systematically working through these areas will give you a clear map of your risk landscape. This process is the foundation for a logical, defensible compliance program. For a structured way to get started, our guide on how to build your compliance risk management framework is a great resource.

Once your assessment is done, the next step is to translate those findings into practical action. You need to sort your investors into risk tiers. This is where the RBA really comes to life, letting you apply the right level of due diligence to the right people.

It usually boils down to three main categories:

This proactive assessment isn't just about ticking a regulatory box; it's a critical business decision. The sheer scale of global financial crime means a reactive, "wait and see" approach is a recipe for disaster.

The numbers here are staggering. Estimates suggest that between USD 800 billion and 2 trillion is laundered globally every single year—that’s 2-5% of global GDP. Without a serious step-up in AML efforts, that figure could balloon to between USD 4.5 trillion and 6 trillion by 2030. You can find more insights on the future of AML compliance on shuftipro.com, and you'll quickly see why a robust, risk-based defense is the only way forward.

In today's world of sophisticated financial crime, trying to manage KYC and AML compliance with manual spreadsheets is like bringing a pocketknife to a digital gunfight. It’s painfully slow, riddled with potential for human error, and simply can't keep up with the bad guys. Technology isn't a "nice-to-have" anymore; it's the core of any modern, resilient compliance defense.

For an emerging fund manager, the right tech stack is a massive force multiplier. It allows a small, lean team to build an institutional-grade compliance function without needing a huge budget or headcount. The whole point is to shift from a reactive, box-ticking exercise to an intelligent system that spots real threats, fast.

The biggest leap forward in compliance has been the adoption of Artificial Intelligence (AI) and Machine Learning (ML). These aren't just buzzwords. Think of these systems as super-analysts that can sift through enormous piles of data, spotting subtle patterns of illegal activity that would be completely invisible to the human eye. They don't just follow a set of rules; they learn and adapt over time.

This is especially powerful when it comes to monitoring transactions. Instead of just flagging an obvious red flag like a huge cash deposit, an AI-powered system can connect the dots between seemingly random transactions across different accounts and timeframes to reveal a hidden money laundering scheme. This isn't science fiction—it's quickly becoming the industry standard.

A 2023 PwC survey really drives this home. It found that 62% of financial institutions are already using AI/ML for AML, and that number is expected to jump to 90% by 2025. These tools have been shown to slash false positives by up to 40%, which means your team can stop chasing ghosts and focus on genuine risks. You can get more data on 2025 trends in financial crime compliance at Silenteight.com.

Another pillar of any modern compliance setup is automated identity verification. Let's be honest, manually reviewing investor documents during onboarding is a huge bottleneck. It's a drag for your team and a frustrating first impression for your new Limited Partners (LPs).

Automated platforms completely change the game.

This kind of automation doesn't just make you more efficient. It creates a professional, smooth experience for your investors, setting a positive tone right from the start.

Putting technology in place is about more than just buying a piece of software. It’s about building an integrated system that actually fits your fund's unique needs. When you're looking at different options, focus on tools that give you a centralized view of everything. A single dashboard where you can see investor risk scores, manage transaction alerts, and keep a clean audit trail is worth its weight in gold.

The market is full of great choices, but finding the right one is what matters. To get you started, you can explore our breakdown of the 12 best compliance management software solutions on the market today. Adopting the right tech is what turns KYC AML compliance from a costly headache into a smart, effective function that protects your fund and helps it grow.

Think of KYC/AML compliance as more than just a box-ticking exercise. It's not a cost center; it's a strategic asset that protects your fund's reputation and future. When institutional investors look at your firm, they're looking for this kind of operational maturity. It all comes down to creating a culture where compliance is everyone's job, from the junior analyst to the managing partners.

This kind of resilience doesn't happen by accident. It's built on a foundation of four key pillars: a rock-solid understanding of the rules, a repeatable framework for every process, a proactive mindset that focuses on real risks, and the smart use of technology to support—not replace—your team's judgment.

Ready to put this into practice? You can start making meaningful improvements right away by focusing on a few critical actions. The first step is to conduct a thorough, firm-wide AML risk assessment. This isn't just about regulations; it's about honestly identifying where your fund is most vulnerable.

With that insight, you can immediately begin sharpening your Customer Identification Program (CIP) to make sure every piece of data you collect is verified and accurate.

In the end, a strong compliance culture is your best defense. It's what protects your investors, builds your reputation, and secures your fund's long-term viability in a financial world that demands nothing less than total accountability.

When you make this a firm-wide commitment, compliance stops being a reactive headache. It becomes a proactive advantage, positioning your fund for the kind of sustainable growth and institutional trust that truly matters.

Even with the best policies in place, the day-to-day reality of running a KYC and AML compliance program brings up a lot of questions. This is especially true if you're an emerging fund manager trying to get everything right from the start.

Let's clear up some of the most common queries we hear. Think of this as the practical advice you need to bridge the gap between regulatory theory and real-world action.

This is a big one, and it's easy to get them mixed up.

Think of Customer Due Diligence (CDD) as your standard security check. It's the baseline process you run for every single investor without exception. You're verifying their identity, getting a feel for their risk profile, and making sure they are who they say they are. This is your foundation.

Enhanced Due Diligence (EDD), on the other hand, is like calling in the forensic team. It’s a much deeper, more intensive investigation reserved only for investors you've flagged as high-risk.

So, what triggers this "enhanced" review? It's usually one of these:

With EDD, you have to dig much deeper. You'll scrutinize the investor's source of wealth and funds far more closely and monitor their activity with a magnifying glass to make sure you’re managing that elevated risk.

Before you even think about onboarding your first LP, your single most important step is to conduct a formal, documented AML risk assessment. Seriously. Don't skip this. A generic, off-the-shelf compliance plan just won't cut it and leaves you exposed.

You need to sit down and analyze your fund's unique vulnerabilities. Get specific.

This assessment is the blueprint for your entire KYC and AML compliance program. It dictates how you'll design your Customer Identification Program (CIP), how you'll rate investor risk, and how you'll monitor activity. It ensures your efforts are actually focused on the real threats your fund faces.

Yes, you can—and many funds do. Outsourcing operational tasks like identity verification, background screening, or even transaction monitoring to a specialized provider can be a smart, cost-effective move. This is especially true for smaller teams that don't have a dedicated compliance officer.

But here’s the crucial part: You can outsource the work, but you can never outsource the responsibility. The ultimate legal accountability for compliance always, always stays with you, the fund manager.

If you decide to partner with a vendor, you need to do your homework. That means performing rigorous due diligence on them, setting up a rock-solid contract with clear expectations, and constantly overseeing their work to make sure they're doing the job right. It’s a classic case of "trust, but verify."

Ready to move beyond manual compliance and reporting? Fundpilot provides an institutional-grade platform to automate fund administration, streamline LP communications, and maintain audit-ready records, empowering you to focus on growth. See how over 500 funds are scaling their operations by booking a demo at fundpilot.app.