Discover how to build a robust compliance risk management framework. Our guide provides actionable steps and expert insights to protect your organization.

Think of a compliance risk management framework not as a dusty rulebook, but as your company's strategic playbook. It’s the navigation system a ship's captain uses—a combination of charts, radar, and experience—to steer clear of regulatory icebergs, financial penalties, and a damaged reputation.

Essentially, a compliance risk management framework is the formal system of processes, policies, and controls a company puts in place. Its job is to spot, evaluate, manage, and keep an eye on risks tied to non-compliance. This isn't about just reacting; it’s a forward-thinking approach that helps you navigate the tangled web of laws, regulations, and internal standards in your industry.

Without this kind of structure, compliance efforts tend to be chaotic. You end up putting out fires—frantically responding to audits, incidents, or new regulations as they pop up. This reactive mode is not only inefficient and expensive but also leaves your business exposed.

A well-designed framework turns compliance from a necessary evil into a genuine business advantage. It creates a clear, documented system so everyone, from the C-suite to the front lines, understands their role in maintaining compliance. This builds a culture of integrity and foresight, making accountability a core part of how you operate.

The payoff for making this shift is huge and directly impacts your bottom line:

The ever-increasing complexity of global regulations makes a proactive stance more important than ever. In fact, the compliance data management market is on track to hit $16.6 billion in 2025, a surge driven by new cybersecurity rules, ESG standards, and data privacy laws. This shows just how much businesses are investing to get their compliance systems right.

A compliance framework is more than just a defensive play; it’s the bedrock for sustainable growth. It lets your business scale with confidence, knowing its operations are built on a solid, ethical, and legally sound foundation.

Before you start building, it's crucial to take a step back. The first move is carefully Choosing Your Compliance Framework to make sure it aligns with your specific industry and operational risks. This decision shapes everything that follows, setting you up for a resilient and effective program. In the end, this framework is your company's compass, guiding you safely through choppy regulatory waters toward lasting success.

A truly effective compliance risk management framework isn't some monolithic, off-the-shelf product. It’s a living, breathing structure built on five interlocking pillars, each serving a critical function. When these components are working in sync, they create a resilient system that can handle regulatory pressure and adapt to new business risks as they emerge.

Think of it like building a fortress. You need scouts on the perimeter, analysts to interpret their reports, engineers to build defenses, guards on the walls, and a command center coordinating everything. If any one of those roles fails, the entire defense is weakened. Your compliance framework operates on the same principle, relying on a set of core functions to protect your fund.

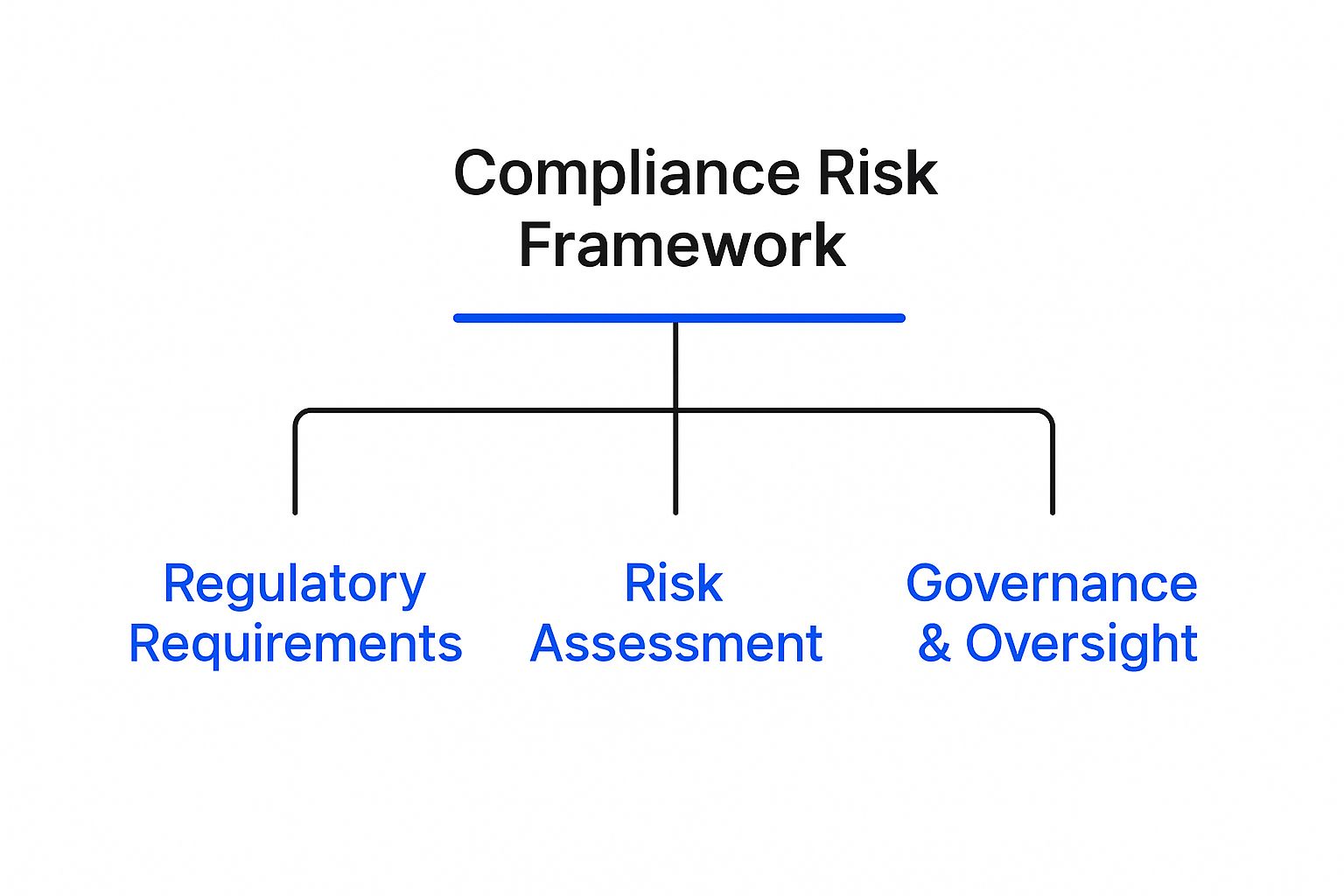

This diagram shows how foundational elements like regulatory awareness, risk assessment, and solid governance create the bedrock of a strong framework.

As you can see, it all starts with understanding the external rules and your internal weak spots, with clear leadership guiding the entire process.

The first pillar, Risk Identification, is your framework’s early warning system. This isn't a one-time task; it's a proactive, ongoing process of scanning the horizon for potential compliance threats before they can cause real damage. It means staying on top of new legislation, regulatory guidance, and even industry enforcement trends that could affect your operations.

For an emerging fund manager, this could be as simple as spotting risks in marketing materials that might not pass the SEC’s new advertising rules, or recognizing a potential conflict of interest in a novel investment strategy. The entire point is to see trouble coming long before it arrives at your doorstep.

Once you’ve spotted a potential risk, the next step is Risk Assessment. This is where you dig in and analyze the threat to truly understand its potential impact and how likely it is to happen. It’s not enough to just know a risk exists; you have to quantify it so you can prioritize your response.

This stage is all about asking the tough questions:

This analysis is absolutely crucial for putting your limited resources where they’ll have the biggest impact, separating the minor headaches from the mission-critical threats that need immediate attention.

With a clear picture of your key risks, it’s time for Risk Mitigation. This is the active defense phase, where you implement the controls and procedures designed to reduce the likelihood or impact of a compliance failure. Think of these as the firewalls, locks, and security protocols for your fund.

Mitigation strategies can take many forms, including:

The goal of mitigation isn't to eliminate all risk—that's impossible. It's about reducing it to an acceptable level that aligns with your fund's specific risk appetite.

A framework is useless if you just set it and forget it. The Monitoring and Reporting pillar is your watchtower, providing continuous oversight to make sure your controls are actually working as intended. This involves regular testing, internal audits, and keeping a close eye on key risk indicators (KRIs).

For instance, a fund might monitor the frequency of trade errors or track completion rates for mandatory compliance training. This kind of data gives you real-time intelligence on the health of your compliance program. Reporting these findings up to leadership ensures that the people making decisions have an accurate view of the fund's compliance posture at all times.

Finally, we have Governance and Oversight—the command center that directs the whole operation. This pillar establishes clear lines of authority, responsibility, and accountability for compliance across the entire firm. It ensures you have strong buy-in from the top and that the compliance function is empowered to do its job.

The table below breaks down these five pillars, showing how each contributes to a cohesive and effective compliance framework.

| Component Pillar | Objective | Key Activities Example |

|---|---|---|

| Risk Identification | To proactively identify potential compliance threats before they cause harm. | Monitoring regulatory updates, analyzing new business initiatives for compliance risks. |

| Risk Assessment | To analyze the likelihood and potential impact of identified risks. | Conducting scenario analysis, scoring risks based on severity and probability. |

| Risk Mitigation | To design and implement controls to reduce risks to an acceptable level. | Developing policies and procedures, implementing compliance software, training staff. |

| Monitoring & Reporting | To continuously track the effectiveness of controls and inform stakeholders. | Performing periodic compliance audits, tracking key risk indicators (KRIs), reporting to the board. |

| Governance & Oversight | To establish clear accountability and a strong compliance culture. | Defining roles and responsibilities, forming a compliance committee, getting leadership buy-in. |

Ultimately, effective governance is what separates a mature compliance program from one that's just going through the motions. A recent survey revealed that only 50% of risk and compliance professionals see their programs as mature, while the other half are still in development. This 50/50 split highlights the ongoing journey many firms are on to build truly robust governance structures that can stand the test of time.

Knowing the theory is one thing, but putting a compliance framework into practice is where the real work begins. It’s where abstract concepts become the day-to-day guardrails that protect your fund. Let’s walk through how an emerging fund manager can build this structure from the ground up, turning ideas into tangible, protective measures.

This whole process starts not with a hefty policy document, but with a simple conversation. Without genuine, vocal support from the fund's leadership, any compliance effort is dead on arrival. This buy-in has to be more than just a nod of approval; it’s an active commitment to provide the resources, authority, and cultural backing needed to make compliance a real priority.

Once you have leadership’s support, the next step is to define a realistic scope. A small fund can't boil the ocean. Instead of trying to tackle every conceivable risk at once, start by focusing on the regulations that pose the biggest threats, like the SEC’s marketing rules or anti-money laundering (AML) statutes.

With a clear scope, you can move to the cornerstone of implementation: the comprehensive risk assessment. This isn't just a brainstorming session. It's a structured process to pinpoint specific vulnerabilities, analyze their potential fallout, and check what controls you already have in place. Think of it as a diagnostic scan of your fund’s entire operation.

This means asking some tough, targeted questions:

This initial assessment gives you a data-driven foundation for your entire compliance framework. It takes you from guessing what your risks are to knowing exactly where to focus your defenses. The findings should be documented and prioritized, creating a clear roadmap for what to do next.

A framework without clear owners is just a pile of good intentions. The next critical step is assigning clear roles and responsibilities so nothing gets missed. A Responsibility Assignment Matrix, better known as a RACI chart, is an incredibly useful tool for this. It spells out who is Responsible, Accountable, Consulted, and Informed for every compliance task.

For an emerging fund, this could be as simple as:

This simple exercise cuts through the confusion and ensures critical tasks don't fall through the cracks. It builds a culture of ownership where everyone knows exactly how they contribute to the fund's integrity.

With roles defined, it's time to write the policies and procedures that will guide everyone’s behavior. The key here is to be clear and practical. A 50-page policy document stuffed with legal jargon is worse than useless if no one reads or understands it. Good policies are concise, written in plain English, and tied directly to your team's daily work.

The best compliance policies aren't the most complex ones. They're the ones that are understood, respected, and consistently used by every single person on the team, from the top down.

Focus on creating practical guides for the high-risk areas you found in your assessment. For example, a simple, one-page checklist for pre-clearing personal trades or a straightforward protocol for reporting a potential conflict of interest will be far more effective than an intimidating manual. For more ideas on building strong operational habits, check out the resources on the Fundpilot blog.

Finally, implementation is an ongoing conversation. You have to train your team not just on what the rules are, but why they matter. Good training connects your compliance policies back to the fund's reputation, investor trust, and its ability to succeed long-term.

This isn't a one-and-done event. Regular, engaging training sessions and clear, consistent communication are what truly embed compliance into your fund's DNA. Celebrate the wins and use any near-misses as teachable moments. By following these steps, an emerging fund can build a compliance framework that isn't just a shield against regulators, but a real asset for sustainable growth.

Trying to run a modern compliance program with a jumble of spreadsheets, shared drives, and manual checklists is like navigating a city with a tattered, old paper map. It might have gotten you by years ago, but in today's fast-moving regulatory world, it's a recipe for getting lost. These manual systems aren't just slow—they’re full of holes, creating dangerous blind spots that can lead to costly penalties.

The fundamental problem with a disconnected system is that there’s no single source of truth. Information is scattered everywhere. A risk assessment lives in one spreadsheet, an incident report is buried in an email chain, and policy documents are tucked away on some server. This setup makes it nearly impossible to get a clear, real-time snapshot of your fund's actual compliance health.

This is where centralized technology, often in the form of a Governance, Risk, and Compliance (GRC) platform, completely changes the picture. Think of this tech as the central nervous system for your entire framework. It connects every part—risk identification, policy management, monitoring, and reporting—into one cohesive, living system.

Instead of your team hunting for information across a dozen different places, they have one spot to go for everything. This isn't just about convenience; it creates real efficiency and ensures decisions are based on data that's actually current and correct. For an emerging fund manager, this isn't a luxury item. It's a critical tool for scaling your operations without having to exponentially grow your headcount or your risk exposure.

This move toward integration isn't just a small trend; it's a massive shift across the market. A recent study found that a staggering 91% of organizations have now centralized their GRC teams—the highest rate seen in six years. The message is clear: an integrated approach is now the standard for effective risk management. You can dig into more of these insights in the IT Risk and Compliance Benchmark Report.

Bringing everything onto one platform delivers real, tangible benefits that directly strengthen a fund's resilience and efficiency. It pulls compliance out of the chaotic, manual weeds and turns it into a streamlined, strategic part of your business.

The key benefits are straightforward:

Centralized technology doesn't just make compliance easier; it makes it smarter. By connecting all the dots, you can finally spot trends, identify new risks before they blow up, and make proactive decisions.

For emerging managers, building this kind of institutional-grade infrastructure from scratch can feel completely out of reach. That’s exactly the problem Fundpilot was designed to solve. Our platform acts as that central nervous system, pulling your key operational and compliance functions under one roof.

Fundpilot creates a single source of truth for your fund by:

By integrating these core functions, Fundpilot helps emerging funds build a rock-solid compliance foundation right from day one. It lets smaller teams operate with the discipline and control of a much larger institution, turning what was once a headache into a genuine competitive edge.

Getting your compliance framework off the ground is only the first chapter. If you tuck it away and forget it, it becomes a relic—blind to fresh risks and shifting rules. Treat it like a living guide: update it as regulations change, your strategy evolves, and lessons emerge from real decisions.

Embedding maintenance into your day-to-day turns compliance from a tick-box chore into a genuine safeguard. When everyone sees compliance as part of the routine, the framework weaves itself into your operations instead of standing off to the side.

Building a resilient framework starts with people. Leadership must model the behavior, then reinforce it with clear practices and ongoing support.

These steps make compliance an everyday conversation, not a quarterly checkbox.

Think of your framework as the engine in a performance car. Without regular tune-ups, heat builds, parts wear, and breakdowns happen. The same logic applies in compliance.

Your framework’s strength comes from its responsiveness. If it can’t shift when the industry shifts, weak spots will appear.

1. Periodic Audits and Testing

Bring in internal teams or outside experts to push on your controls. The aim is to spot gaps before they become problems.

2. Incident Response Analysis

After any slip-up or near-miss, dive into the what and why—then adjust the playbook so it doesn’t recur.

3. Proactive Regulatory Scanning

Keep an eye on announcements and draft laws. Updating your system ahead of formal rules saves time and shows foresight.

Regular upkeep does more than dodge headaches—it builds trust. Limited partners notice when you can show a detailed, up-to-the-minute compliance record.

As you refine workflows, head over to the Fundpilot legal resources page for a deeper dive into regulations. A well-oiled compliance framework not only protects you—it becomes proof of your discipline and reliability to investors.

Even with a good plan in place, building a compliance risk management framework can feel like you're putting together a complex puzzle. Questions always pop up when you start applying the theory to your own fund. Let's tackle some of the most common ones head-on to clear up any confusion and sharpen your strategy.

Think of this section as your practical field guide. Just like a pilot runs through a pre-flight checklist, these answers will help you make sure your approach is solid before you take off.

It helps to imagine you're the captain of a ship.

General risk management is your total responsibility for the entire vessel. You're constantly scanning for every possible threat—a competitor launching a faster ship (strategic risk), an engine failing mid-voyage (operational risk), or fuel prices suddenly doubling (financial risk). It’s the big-picture strategy to keep the ship, its crew, and its mission safe from all harm.

Compliance risk management, on the other hand, is a very specific part of that job. Think of it as the navigator's sole duty: making sure the ship follows every single maritime law and international rule. This means steering clear of restricted waters, meeting all safety equipment standards, and having the right permits for every port of call. The focus is squarely on avoiding legal fines, regulatory penalties, or getting banned from a port. It's a critical specialty within the much broader world of risk management.

Your framework needs to be a living, breathing system—not a dusty document sitting on a shelf. At a minimum, you should conduct a complete, top-to-bottom review at least once a year. This annual check-up ensures your controls and assessments are still in lockstep with your business goals and the current risk landscape.

But here’s the thing: waiting a full year between updates is a rookie mistake. You have to be ready to make changes the moment certain events happen.

Being proactive and making these event-driven updates is just as important as the annual review. That kind of agility is what keeps your framework relevant and effective.

A compliance framework that only gets updated once a year is already out of date. Continuous, event-driven refinement is the hallmark of a resilient and mature compliance program.

For an emerging fund or a smaller shop, the secret is to start small and build from there. Trying to roll out a massive, enterprise-grade framework on day one will just lead to burnout and frustration.

Here’s a practical, four-step game plan to get you started:

The goal here is to pour a solid foundation that you can build on as your firm grows. This targeted approach makes sure your limited resources are aimed where they'll have the biggest protective impact.

Technology is a massive force multiplier for any compliance program, but it's a game-changer for lean teams. It puts all the repetitive, data-heavy tasks on autopilot, freeing up your people to focus on what humans do best: strategic thinking and judgment.

For example, AI and automation can scan thousands of global regulatory updates in real time, flagging only the specific changes that affect your business. Sophisticated tools can churn through complex transaction data to spot subtle patterns of potential money laundering that would be virtually impossible for a person to find. This is especially true for data-heavy regulations like GDPR; our guide on GDPR for fund managers dives deeper into these kinds of requirements.

At the end of the day, these tools do the heavy lifting of gathering and watching the data. This empowers your team to do the work that requires human nuance—making tough judgment calls, fostering a strong compliance culture, and giving smart advice to leadership.

A robust platform like Fundpilot gives emerging managers the centralized technology to build and maintain an institutional-grade compliance framework from the get-go. By automating fund administration, creating audit-ready records, and providing a secure investor portal, Fundpilot replaces manual risk with streamlined control. Schedule your personalized demo of Fundpilot today.