Discover the top 12 best compliance management software strategies and tips. Complete guide with actionable insights.

Navigating the complex web of regulatory requirements is a critical, non-negotiable function for any modern business, especially for fund managers, operations teams, and compliance officers. The manual tracking of policies, risk assessments, and audit trails across spreadsheets and disparate documents is no longer a viable strategy. It's inefficient, prone to human error, and creates significant risk exposure. The right technology doesn't just mitigate these risks; it transforms compliance from a reactive burden into a strategic advantage.

This guide provides a comprehensive breakdown of the best compliance management software available today. We move beyond marketing claims to deliver a practical analysis of each platform's core strengths, ideal use cases, and potential limitations. Whether you are an emerging fund manager overseeing a growing portfolio or an investor relations team needing to produce audit-ready reports, this resource is designed to help you pinpoint the solution that aligns with your specific operational needs and regulatory landscape.

We will analyze everything from comprehensive GRC (Governance, Risk, and Compliance) suites to specialized tools for specific regulations. To begin establishing a robust compliance framework, you may find our 9-point GDPR compliance checklist a helpful starting point for understanding foundational requirements.

Each review in this listicle includes:

Our goal is straightforward: to equip you with the detailed information needed to make a confident, informed decision and select the compliance management platform that will best serve your organization.

Fundpilot stands out as a premier choice for emerging fund managers, offering a specialized, all-in-one platform that masterfully combines institutional-grade operations with robust compliance management tools. It is specifically engineered to help funds managing between $10M and $100M AUM transition away from inefficient manual processes, such as Excel spreadsheets, and adopt a more sophisticated, scalable operational framework.

What makes Fundpilot one of the best compliance management software solutions for this niche is its holistic approach. It embeds compliance directly into the fund administration workflow, creating built-in audit trails for every critical action, from capital calls and distributions to LP communications. This integrated system ensures that regulatory and due diligence requirements are met consistently, minimizing risk and preparing the fund for scrutiny at any moment.

Fundpilot offers a clear, transparent pricing model at $2,500 per month. This flat-rate fee provides access to the full suite of features without the prohibitive costs of enterprise solutions that can exceed $100,000 annually. The platform offers a 14-day free trial and a demo-driven onboarding process, allowing fund managers to experience its capabilities firsthand before committing.

Website: Fundpilot

G2 is not a compliance management software solution itself but rather an indispensable meta-resource for discovering and vetting them. As a peer-to-peer review marketplace, its Governance, Risk & Compliance (GRC) and Security Compliance categories function as a comprehensive starting point for your research. It aggregates hundreds of tools, allowing you to filter by company size, specific features, and user satisfaction ratings, making it one of the most efficient ways to build an initial shortlist of vendors.

The platform’s strength lies in its verified user reviews and its "G2 Grid" reports, which map out market leaders based on satisfaction and market presence. This provides invaluable social proof, helping you understand how a tool performs in real-world scenarios for organizations similar to yours. For fund managers and compliance officers, this is crucial for quickly identifying solutions trusted by peers in the financial sector.

G2 is best used as a first step in your vendor discovery process. You can create side-by-side comparisons of up to four products, which is a powerful feature for contrasting specific functionalities like audit trail capabilities or policy management workflows.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Verified User Reviews | Gaining authentic insights into user experience and customer support quality. | Reviews can be skewed by vendors with strong customer outreach programs. |

| Side-by-Side Comparison | Directly comparing specific features of shortlisted vendors before scheduling demos. | Relies on vendor-supplied feature data, which may not be fully up-to-date. |

| G2 Grid Reports | Identifying established market leaders and high-performing niche solutions. | Popularity can sometimes overshadow innovation from newer, less-reviewed tools. |

While access is free, remember that G2 is a lead-generation platform for vendors. Pricing information is often hidden behind "request a quote" buttons, so you'll still need to engage directly with sales teams.

Website: https://www.g2.com/software/compliance

Similar to G2, Capterra is a comprehensive software directory, not a standalone tool, but it serves as an excellent resource for market research. It lists over 1,600 compliance management solutions, making it one of the largest aggregators available. Its primary value for fund managers and compliance officers lies in its user-friendly interface that allows for quick filtering by industry, company size, and specific compliance features.

Capterra distinguishes itself by often providing more transparent pricing guidance and snapshots of low-entry options, which is particularly useful for emerging funds benchmarking initial budget requirements. The platform's strong review verification process helps ensure the authenticity of user feedback, giving you a reliable sense of how different tools perform in real-world scenarios. This makes it a great starting point for finding the best compliance management software for your specific needs.

Capterra is most effective for building a broad list of potential vendors and understanding the general pricing landscape. Its detailed buyer guides and feature matrices help educate teams on what to look for before engaging with sales representatives, saving valuable time during the procurement process.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Pricing Guidance Ranges | Estimating initial budget needs and identifying cost-effective solutions for smaller funds. | Many enterprise-level tools still require a direct quote; advertised prices may not include all fees. |

| 1600+ Listed Tools | Conducting broad market research to discover both popular and niche compliance software. | The sheer volume can be overwhelming; some listings are sponsored, affecting their visibility. |

| Verified Review Standards | Gaining trustworthy feedback on usability, implementation, and customer support. | Enterprise-grade GRC tools sometimes have less review depth compared to SMB-focused software. |

While Capterra is free to use, remember that its business model is based on lead generation. Sponsored listings often appear at the top of search results, so be sure to look beyond the initial recommendations.

Website: https://www.capterra.com/compliance-software/

For organizations deeply integrated into the Amazon Web Services ecosystem, the AWS Marketplace serves as a streamlined procurement hub for compliance management software. It’s not a single solution but a digital catalog where you can find, purchase, and deploy third-party Governance, Risk, and Compliance (GRC) tools directly through your existing AWS account. This significantly simplifies the procurement process by consolidating billing and leveraging familiar enterprise agreements.

The platform’s key advantage is its integration with AWS infrastructure and billing, allowing fund managers and operations teams to bypass lengthy new vendor onboarding processes. Many listings offer transparent, click-to-subscribe pricing and easy trial access, making it one of the best ways to test new compliance management software. Additionally, the AWS Vendor Insights feature provides security and compliance evidence for many listed products, helping you perform due diligence on potential vendors more efficiently.

The AWS Marketplace is ideal for teams who want to manage their software stack within a single environment. Use it to discover and deploy tools that can be managed alongside your cloud infrastructure, often with pre-configured integrations. The ability to negotiate private offers directly through the marketplace is also a significant benefit for larger organizations seeking customized pricing.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Consolidated AWS Billing | Streamlining procurement and budget management for teams already using AWS. | Requires an active AWS account and knowledge of IAM for proper governance. |

| Private Offers | Negotiating custom pricing and terms directly with software vendors. | The negotiation process and terms are still managed by the individual seller. |

| Vendor Insights | Accessing real-time security and compliance data for vendor risk assessment. | Not all vendors have completed the Vendor Insights evaluation, limiting its coverage. |

While many products have clear pricing, some still require you to contact the seller for a quote, similar to other marketplaces. Effective use requires a foundational understanding of AWS account management to ensure deployments are secure and cost-effective.

Website: https://aws.amazon.com/marketplace

For organizations deeply embedded in the Microsoft ecosystem, Purview Compliance Manager is a native and powerful solution that simplifies complex regulatory requirements. It moves beyond a simple checklist by providing a risk-based approach, offering a compliance score that gives a clear, quantifiable measure of your organization's posture against specific regulations like GDPR, HIPAA, and ISO 27001. It translates intricate controls into concrete improvement actions, directly linking them to Microsoft 365 and Azure services.

The platform’s key advantage is its seamless integration. It automatically assesses your existing Microsoft configurations and provides continuous monitoring, reducing the manual effort required for evidence collection and control validation. For fund managers already using Microsoft 365 for operations, this native tooling represents one of the best compliance management software options for consolidating their tech stack and centralizing governance without adding another third-party vendor.

Purview is best utilized as the central hub for managing compliance within a Microsoft-centric IT environment. The platform comes with a vast library of pre-built assessment templates that can be customized, allowing teams to quickly stand up a framework for a new regulation and assign ownership for specific controls and action items.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Pre-built Assessment Templates | Rapidly deploying frameworks for common regulations like GDPR, SOX, and NIST. | Customizing templates for highly specific or niche industry rules can be complex. |

| Compliance Score & Actions | Prioritizing security and compliance efforts based on risk and impact. | The score heavily reflects the use of Microsoft's own security and data governance tools. |

| Control & Evidence Mapping | Automating evidence collection and centralizing audit-ready documentation. | Less effective for tracking controls and evidence from non-Microsoft applications. |

Full functionality is typically included with Microsoft 365 E5 or the E5 Compliance add-on SKU, making it a cost-effective choice for organizations already licensed at this level. However, for those on lower-tier plans, the cost of upgrading can be a significant consideration.

For organizations deeply embedded in the Salesforce ecosystem, the AppExchange is not just a marketplace but a critical extension of their operational infrastructure. It serves as a specialized app store offering a wide array of compliance, policy, and privacy management applications designed to integrate natively with Salesforce. This eliminates complex integration projects, allowing compliance data and workflows to live alongside customer and operational data, making it a powerful choice for teams standardizing on the platform.

The primary advantage of sourcing compliance management software here is the seamless integration with existing Salesforce objects, dashboards, and permission sets. Fund managers and compliance officers can leverage their current Salesforce investment to manage everything from investor due diligence to regulatory reporting without leaving their primary CRM. Every application listed must pass a rigorous Salesforce security review, providing an essential layer of trust and vetting.

The AppExchange is best leveraged when your core compliance activities are directly tied to customer or investor data already managed within Salesforce. Many apps offer "test drive" or trial options, allowing you to evaluate functionality in a sandbox environment before committing.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Native Salesforce Integration | Automating compliance workflows that are triggered by CRM data, like investor onboarding or communications. | Utility is minimal if your organization does not heavily rely on the Salesforce platform. |

| Salesforce Security Review | Ensuring any third-party app meets baseline security and data handling standards. | The review focuses on technical security, not necessarily the app's overall quality or usability. |

| Try-Out/Test-Drive Options | Evaluating how an app interacts with your specific Salesforce configuration before purchasing. | Licensing and pricing models vary significantly between vendors, creating complexity. |

While the AppExchange simplifies integration, it's crucial to note that you are still dealing with individual third-party vendors. Pricing, support, and feature roadmaps are determined by each app developer, not by Salesforce itself, requiring careful due diligence on each potential solution.

Website: https://appexchange.salesforce.com

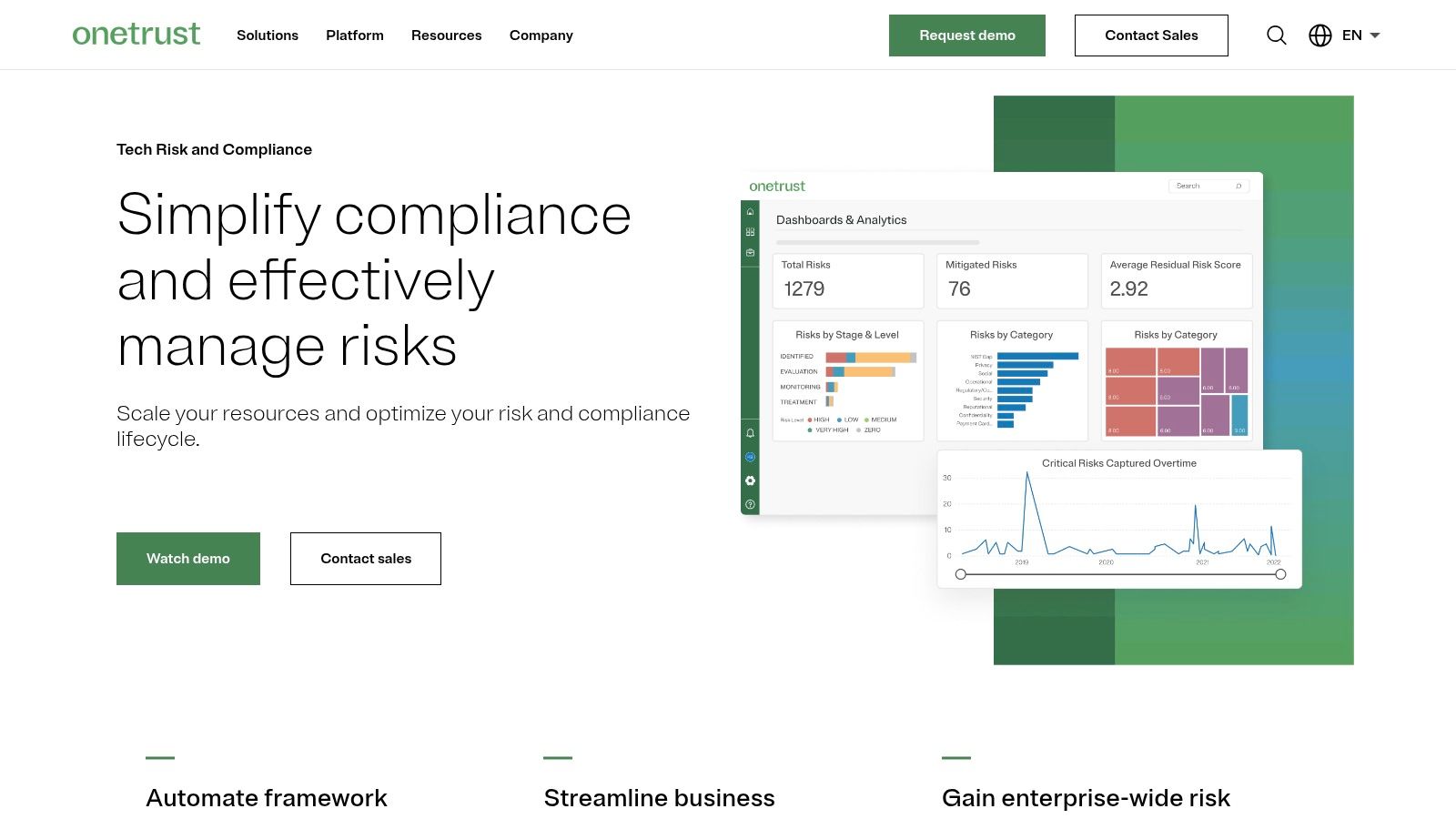

OneTrust is an enterprise-grade platform designed for organizations managing complex, multi-framework compliance obligations. It excels at automating evidence collection and control mapping across standards like SOC 2, ISO 27001, NIST, and PCI DSS. The platform’s key strength is its ability to centralize compliance efforts, allowing teams to use a "collect once, use many" approach for evidence, significantly reducing redundant work for overlapping controls.

For organizations scaling their operations, OneTrust offers robust modules that extend beyond core compliance into areas like third-party risk management and AI governance. This makes it a comprehensive solution for maturing programs that require integrated risk, privacy, and security functions. Its powerful reporting dashboards and extensive library of over 200 integrations provide deep visibility and connect compliance activities directly to your existing tech stack, making it a powerful contender for the best compliance management software for large-scale needs.

OneTrust is best suited for established compliance teams that need to orchestrate and automate controls across numerous business units and regulatory frameworks. The initial setup requires dedicated implementation effort to map controls and configure integrations, but this investment yields significant long-term efficiency gains.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| 50+ Ready-to-Action Frameworks | Managing compliance across multiple, overlapping regulations (e.g., SOC 2 and ISO 27001). | Can be overly complex for organizations focused on just one or two simple frameworks. |

| Shared Evidence Model | Reducing audit fatigue by linking a single piece of evidence to multiple controls. | Requires a well-defined internal control structure to be used effectively. |

| Continuous Monitoring & Integrations | Automating control testing and evidence gathering from cloud and security tools. | Enterprise-oriented pricing is metered and may be prohibitive for smaller teams. |

Pricing is customized and typically metered by the number of administrative users and assets inventoried, reflecting its enterprise focus. You will need to contact their sales team for a specific quote.

Website: https://www.onetrust.com/solutions/tech-risk-and-compliance/

NAVEX One offers a unified governance, risk, and compliance (GRC) platform that excels in managing the people-centric aspects of compliance. Its strength lies in integrating policy management, ethics training, and whistleblowing into a single system, making it a comprehensive choice for firms aiming to build a strong ethical culture alongside procedural adherence. The platform is modular, allowing organizations to select specific tools or opt for pre-packaged "Compliance Essentials" bundles for quicker implementation.

This people-first approach makes it one of the best compliance management software solutions for organizations focused on mitigating behavioral risks. For fund managers, this is particularly valuable for managing conflicts of interest, gifts and entertainment disclosures, and ensuring employees complete mandatory ethics training. The platform’s analytics provide clear visibility into program effectiveness, highlighting potential risk areas before they escalate.

NAVEX One is best utilized by compliance teams who need to manage both policies and the human element of their program. The AI-assisted employee portal can significantly reduce the compliance team's administrative burden by answering common questions automatically.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Integrated GRC Modules | Organizations seeking a holistic solution for policy, training, and incident management. | Pricing requires a custom quote and can become complex depending on the modules selected. |

| Compliance Essentials Bundles | SMBs or firms needing a fast, pre-configured way to launch a foundational compliance program. | Less flexibility for customization compared to building a solution from individual modules. |

| Program Analytics & Dashboards | Gaining high-level visibility into compliance program health and employee engagement. | Accessing the most advanced analytics may require adopting a broader suite of platform features. |

While powerful, the platform’s extensive capabilities mean that pricing is not transparent and requires direct engagement with their sales team. To maximize value, firms should have a clear idea of which compliance areas (e.g., policy, training, disclosures) are their highest priority before requesting a quote.

Website: https://www.navex.com/en-us/platform/compliance-software/

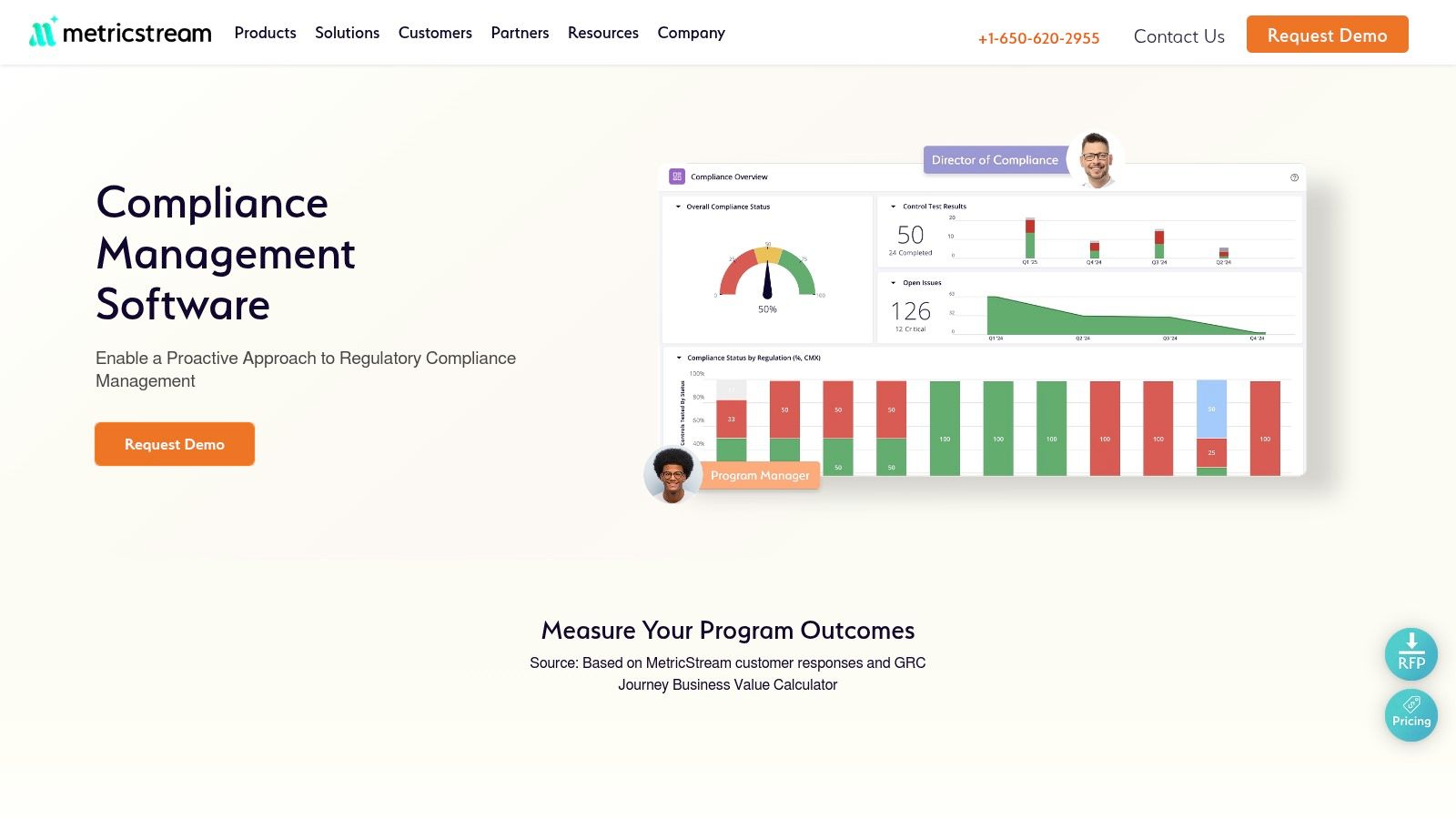

MetricStream is a well-established GRC vendor offering a powerful platform for large, highly regulated enterprises. Its strength lies in centralizing and managing complex compliance obligations across multiple jurisdictions and business units. The software excels at ingesting regulatory content, mapping it to internal policies and controls, and automating the entire compliance lifecycle from assessment to remediation. This makes it a formidable option for organizations needing a single source of truth for their compliance posture.

The platform is designed for deep integration, featuring modules for IT and cyber compliance that connect with authoritative sources like the Unified Compliance Framework (UCF). This allows for control harmonization, reducing redundant testing and reporting efforts. For compliance officers in global financial firms, this capability is essential for creating a cohesive and efficient compliance risk management framework.

MetricStream is best suited for mature compliance programs that require robust workflow automation and detailed reporting. The platform's dashboarding provides executives with a real-time, aggregated view of compliance risks and issue resolution status, which is critical for strategic oversight.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Centralized Regulatory Library | Managing compliance across multiple complex regulatory frameworks (e.g., SOX, GDPR, HIPAA). | The platform’s complexity can lead to a steep learning curve and long implementation times. |

| UCF Integration | Harmonizing and de-duplicating controls across numerous IT security standards. | May be overkill and too costly for smaller organizations with a limited compliance scope. |

| Automated Issue Remediation | Tracking and managing the lifecycle of compliance issues from detection to closure. | The sales-led process means pricing is not transparent and requires direct engagement. |

While MetricStream provides one of the most comprehensive solutions, its enterprise focus means it is often too heavyweight for smaller teams. The system's complexity requires significant resources to implement and maintain effectively.

Website: https://www.metricstream.com/products/compliance-management.htm

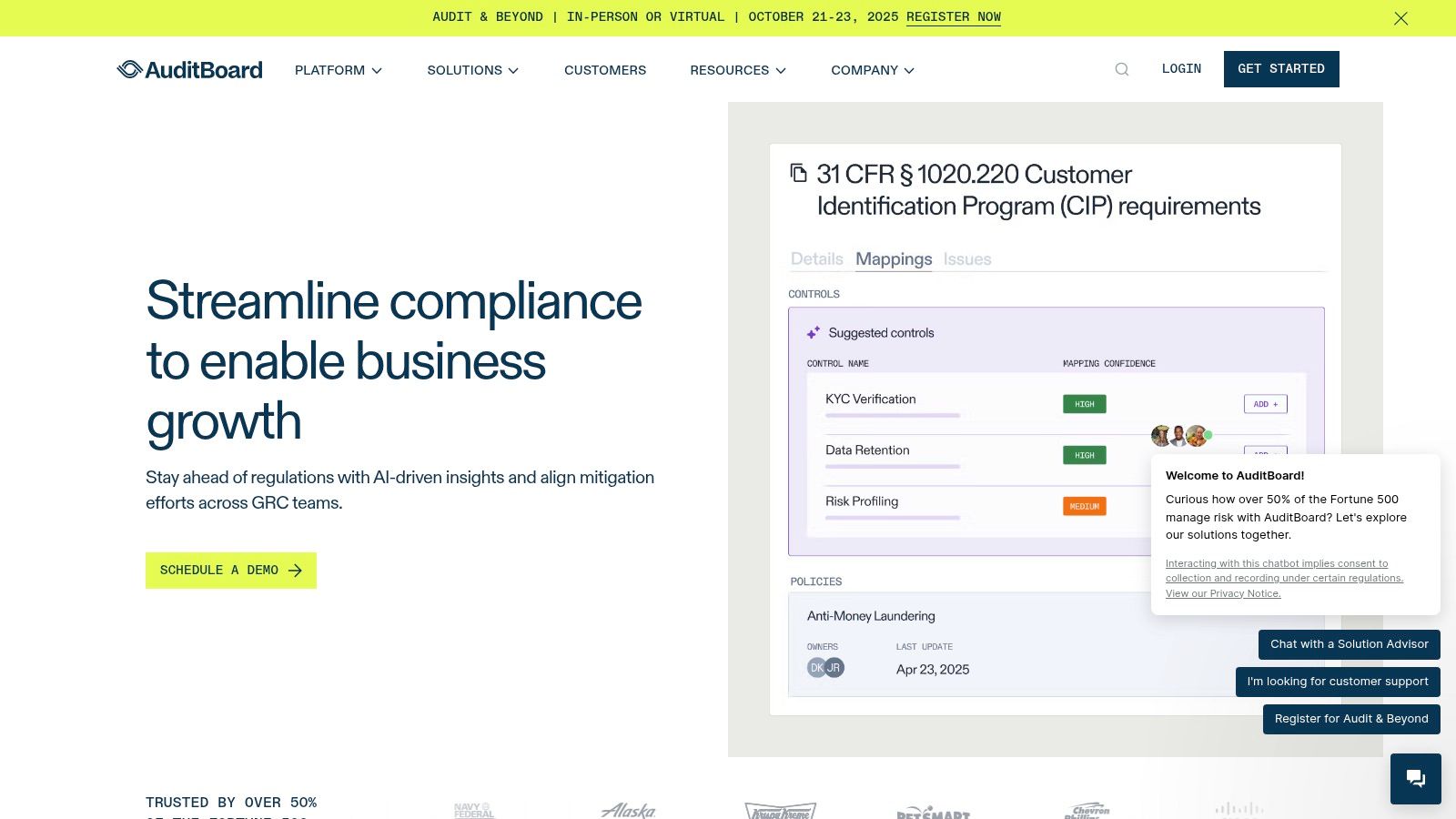

AuditBoard’s CrossComply module emerges from a strong audit-centric background, offering a GRC platform that excels at connecting risk, controls, and compliance frameworks. It is designed to help teams move beyond manual, spreadsheet-based processes by providing a centralized system for managing evidence, mapping controls across multiple standards (like SOC 2, ISO 27001, and SOX), and automating reporting. Its user-friendly interface is frequently praised, making it a strong contender for organizations prioritizing stakeholder engagement and ease of use.

The platform’s key differentiator is its seamless integration between its audit, risk, and compliance modules, creating a single source of truth that reduces redundant work. For fund managers and compliance officers, this means evidence collected for one audit can be easily repurposed for another, streamlining the entire GRC lifecycle. This makes it one of the best compliance management software choices for teams that manage multiple, overlapping regulatory requirements.

AuditBoard is most effective for organizations looking to unify their internal audit, IT compliance, and risk management functions. The platform’s continuous monitoring capabilities and automated evidence requests help ensure that compliance is an ongoing activity, not just a periodic fire drill. This proactive approach is ideal for maintaining an audit-ready posture at all times.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Multi-Framework Control Mapping | Managing compliance across several standards (SOX, SOC 2, etc.) simultaneously. | The extensive feature set can have a steeper learning curve for smaller teams. |

| Integrated Audit & Risk Modules | Creating a holistic view of the GRC landscape and leveraging work across functions. | Pricing is enterprise-focused and may be a significant investment for smaller funds. |

| Continuous Monitoring | Proactively identifying and remediating compliance gaps in real-time. | Advanced automation and integrations often come at an additional cost. |

Pricing is tailored to each organization's needs and is not publicly listed, requiring direct engagement with their sales team for a quote. Its focus on the enterprise market means the platform is robust but may be more than what a very small fund requires.

Website: https://www.auditboard.com/solutions/compliance/

Hyperproof is a compliance operations platform designed to automate and streamline the management of multiple security and privacy frameworks. It excels at cross-framework mapping, allowing US-based tech and SaaS companies to manage standards like SOC 2, ISO 27001, NIST, and PCI simultaneously without duplicating efforts. The platform's core strength is its ability to centralize controls and reuse evidence across different audits, dramatically reducing the manual workload associated with scaling compliance programs.

With support for over 100 frameworks and 70 integrations with tools like Jira, AWS, and ServiceNow, Hyperproof stands out as one of the best compliance management software options for teams embedded in complex tech ecosystems. This deep integration automates evidence collection and task orchestration, ensuring that compliance activities are continuously monitored and audit-ready. For firms with growing compliance needs, such as those navigating the rules for exempt reporting advisers, this level of automation is invaluable.

Hyperproof is ideal for organizations preparing for multiple audits in a single year. Its automated evidence collection pulls data directly from integrated systems, saving countless hours. Many of its quotes include unlimited-user licensing, making it a cost-effective solution for growing teams that need to collaborate on compliance tasks without worrying about per-seat costs.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Automated Evidence Collection | Continuously gathering compliance proof from integrated cloud services and dev tools. | Initial setup and integration mapping require significant upfront configuration. |

| Centralized, Mapped Controls | Managing compliance for multiple frameworks (e.g., SOC 2, ISO 27001) from one control set. | Some advanced capabilities and premium integrations are locked behind higher-tier plans. |

| Unlimited-User Licensing | Providing platform access to entire security, GRC, and engineering teams cost-effectively. | Public pricing is not available; quotes increase with the scope of frameworks and integrations needed. |

While powerful, be aware that pricing is quote-based and depends heavily on your specific needs. The most advanced features often require investing in their higher-tier subscriptions, so a detailed discussion with their sales team is necessary to understand the total cost.

Website: https://hyperproof.io/

Diligent offers a suite of enterprise-grade GRC solutions designed for large, highly regulated organizations that require robust governance and board-level reporting. Its platform extends beyond typical compliance management software, incorporating modules for entity management, IT risk, ERM, and ESG. This integrated approach allows compliance and legal teams to manage regulatory obligations, corporate filings, and risk assessments from a single, unified environment.

The platform’s key differentiator is its focus on connecting operational compliance data directly to board and leadership reporting. This makes it particularly valuable for organizations where the board of directors has direct oversight of compliance and risk functions. Furthermore, for government contractors or entities handling sensitive data, Diligent offers FedRAMP and DoD IL5-authorized modules, providing a level of security assurance that few competitors can match.

Diligent is best suited for mature organizations looking to consolidate multiple GRC functions into one system. The platform’s strength in entity management helps automate the tracking of legal entities, director/officer information, and filing deadlines, which is a critical compliance function for complex corporate structures.

| Feature Highlights | Best Use Case | Limitations |

|---|---|---|

| Integrated GRC Modules | Consolidating compliance, risk, audit, and entity governance into one platform. | Significant implementation effort and change management are required. |

| Board-Level Reporting | Creating executive dashboards and reports for board oversight and strategic decision-making. | May be overly complex for organizations without direct board involvement in compliance. |

| FedRAMP/DoD Authorization | US government contractors and agencies needing high-security compliance hosting. | Enterprise pricing is only available via quote and can be substantial. |

Given its enterprise focus, pricing is not publicly available, and prospective users must engage with a sales team. While some products are available on the AWS Marketplace, full implementation typically requires a direct partnership with Diligent's professional services team.

Website: https://www.diligent.com/

| Product | Core Features / Capabilities | User Experience / Quality ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points ✨ |

|---|---|---|---|---|---|

| 🏆 Fundpilot | Institutional-grade LP reporting, automated fund ops | ★★★★☆ High credibility, demo-driven | Transparent $2,500/month, 14-day trial | Emerging fund managers $10M-$100M | White-labeled investor portal, deal pipeline, automated admin |

| G2 – Compliance Software category | Vendor discovery, peer reviews | ★★★☆☆ Efficient discovery | Free, but requires buying separately | SMBs to Enterprise buyers | Side-by-side comparisons, verified reviews |

| Capterra – Compliance Software directory | 1600+ tools, pricing snapshots, feature matrices | ★★★☆☆ Broad market overview | Free access with sponsored listings | Budget-conscious buyers | Extensive filtering, pricing guidance |

| AWS Marketplace – Compliance/GRC storefront | Purchase/deploy via AWS, Vendor Insights | ★★★★☆ Seamless AWS integration | Pricing varies, often clear listings | AWS users and enterprises | Consolidated billing, private offers |

| Microsoft Purview Compliance Manager | Assessment templates, compliance scoring | ★★★★☆ Best within Microsoft ecosystem | Included in Microsoft 365 E5 | Microsoft 365 organizations | Deep Azure & M365 integrations |

| Salesforce AppExchange – Compliance Apps | Salesforce native apps, security-reviewed | ★★★☆☆ Salesforce-centric user experience | Varies by vendor and app | Salesforce users | Native Salesforce integration |

| OneTrust – Tech Risk & Compliance | Multi-framework automation, policy & risk mgmt | ★★★★☆ Enterprise-grade complexity | Custom pricing, admin-user based | Large, complex compliance programs | 200+ integrations, AI governance |

| NAVEX One – Compliance Software | Policy mgmt, training, reporting | ★★★☆☆ Wide compliance coverage | Custom quotes, modular pricing | SMBs to large orgs | AI-assisted employee portal, modular bundles |

| MetricStream – Compliance Management | Regulatory content, automated assessments | ★★★★☆ Mature enterprise workflows | Sales-led quotes, generally high-cost | Large enterprises | Unified Compliance Framework integration |

| AuditBoard – Compliance Management | Controls, evidence, AI alerts | ★★★★☆ Usability & engagement focused | Enterprise pricing by quote | Audit, SOX, IT compliance teams | AI-assisted change alerts, audit-focused |

| Hyperproof – Compliance Operations Platform | Automation, cross-framework, integrations | ★★★★☆ Automation reduces manual workload | Pricing varies by scope | US tech & SaaS scaling companies | 100+ frameworks, 70+ integrations |

| Diligent – GRC/Compliance Suite | Compliance, entity mgmt, board reporting | ★★★★☆ Robust board & legal governance | Enterprise quotes only | Regulated US organizations | FedRAMP/DoD IL5 authorization, board-grade reporting |

Navigating the complex landscape of regulatory requirements is a non-negotiable aspect of modern fund management. As we've explored, the journey to find the best compliance management software is not about locating a single, universally perfect solution. Instead, it’s about identifying the platform that aligns precisely with your firm's unique operational framework, scale, and strategic objectives.

The solutions detailed in this guide, from comprehensive GRC powerhouses like MetricStream and NAVEX One to more specialized platforms like AuditBoard and Hyperproof, showcase the diversity of tools available. We also examined marketplaces like the AWS Marketplace and Salesforce AppExchange, which offer a modular approach for firms wanting to integrate compliance functions directly into their existing tech stacks. This variety underscores a critical takeaway: your selection process must be as rigorous and tailored as your compliance strategy itself.

Reflecting on the dozen options we've analyzed, several core themes emerge for fund managers, compliance officers, and operations teams. First, the distinction between a point solution and a platform is crucial. A tool like Microsoft Purview might be an excellent fit for firms deeply embedded in the Microsoft 365 ecosystem, while a dedicated GRC platform like Diligent One is built for organizations managing multifaceted risk and entity structures on a global scale.

Second, implementation is just as important as the software itself. The most feature-rich tool will fail to deliver value if it's poorly integrated or if your team isn't properly trained to use it. Consider the resources required for onboarding, the availability of customer support, and the platform’s user interface. A solution that promises comprehensive features but requires a team of consultants to operate may not be practical for an emerging fund manager.

To make a confident decision, start by mapping your specific compliance obligations. Are you primarily concerned with SEC regulations, GDPR, or a combination of industry-specific frameworks? Your answer will immediately help narrow the field.

From there, consider these practical steps:

Ultimately, investing in the right compliance management software is an investment in your firm's reputation, operational efficiency, and long-term viability. By moving beyond manual spreadsheets and disconnected processes, you empower your team to focus on strategic growth, confident that your regulatory foundation is secure, auditable, and built for the future.

Ready to streamline your fund's operations and compliance with a single, intuitive platform? See how Fundpilot integrates portfolio management, LP reporting, and compliance workflows to provide a unified source of truth for emerging fund managers. Discover Fundpilot and simplify your back office today.