Learn about exempt reporting advisers, SEC requirements, duties, and pitfalls. Essential guidance for fund managers to ensure compliance and success.

So, what exactly is an exempt reporting adviser, or ERA? Think of it as a special classification within the world of investment advisory. It's for firms that don't need to go through the full, exhaustive registration process with the SEC, but still have to file certain key reports.

It’s like an express lane on the regulatory highway. This lane isn't open to everyone; it's specifically for advisers who meet very particular criteria, such as those managing venture capital funds or handling private funds with less than $150 million in assets.

In the intricate landscape of SEC regulation, you can picture most investment advisers as large commercial trucks. They have to stop at every weigh station, undergo regular inspections, and follow a comprehensive set of traffic laws. These are the fully registered investment advisers (RIAs). Exempt Reporting Advisers, on the other hand, get to travel in a less congested lane, with a more streamlined set of rules.

But here’s a common point of confusion: "exempt" absolutely does not mean invisible or unregulated. That couldn't be further from the truth. An ERA isn't free from oversight; they're simply exempt from the most strenuous parts of the registration process laid out in the Investment Advisers Act of 1940. They must still honor their fiduciary duty to clients and follow crucial anti-fraud provisions.

There are really only two main gateways, or on-ramps, that a firm can take to qualify for ERA status. Each route is tailored to a specific kind of fund manager, so figuring out which one fits is the very first step.

These advisers are a unique regulatory class, created for managers running these particular fund types. Starting in 2025, ERAs file their reports through the Investment Adviser Registration Depository (IARD) system, but the disclosure requirements are much less comprehensive than for fully registered advisers. You can learn more about the specifics of Exempt Reporting Adviser filings from Qapita.

Ultimately, deciding to operate as an ERA is a major strategic choice for a fund manager—one that balances the goal of operational efficiency with the non-negotiable need for compliance.

To operate as an Exempt Reporting Adviser, you can't just decide you want to be one. You have to fit squarely into one of two specific categories laid out by the SEC. These qualification paths aren't suggestions; they're hard and fast rules.

Getting this right from the start is absolutely crucial. Misinterpreting the requirements or choosing the wrong path can set you up for serious compliance headaches down the road.

Think of these two exemptions as different doors leading to the same status. One door opens with a key based on how much money you manage, while the other is unlocked by the specific type of fund you run. Let's walk through both.

The first and more common route is the Private Fund Adviser Exemption. This path is built for advisers who work exclusively with private funds and keep their total assets under management (AUM) in the United States below a specific ceiling.

The magic number here is $150 million. If you advise only private funds and your U.S.-based AUM is less than this amount, you're generally in the clear for this exemption. A "private fund" is simply an investment pool that isn't offered to the general public and is sold only to a select group of accredited investors or qualified purchasers—think smaller hedge funds or private real estate funds.

The growth in Exempt Reporting Advisers, particularly under this asset threshold, has been remarkable. This regulatory classification has spurred a significant increase in ERAs, as many emerging managers naturally fall into this category. You can learn more about the expansion of ERAs and private fund RIAs to see just how much this corner of the industry is growing.

The second door is the Venture Capital Fund Adviser Exemption. Unlike the first path, this one isn’t really about your AUM. Qualification here depends entirely on the character of the funds you advise. To use this exemption, you must only advise venture capital funds.

So, what exactly does the SEC consider a venture capital fund? The definition is pretty specific.

A venture capital fund is generally defined as a private fund that represents itself as a venture capital fund to investors, is not leveraged, and invests at least 80% of its assets in qualifying investments, which are typically equity securities of private operating companies.

This means you can’t just slap a "VC fund" label on your product and call it a day. The fund’s actual strategy, its portfolio holdings, and how you talk about it to investors must all align with the SEC's definition. If an adviser manages even a single fund that doesn't meet this test—like a fund of funds or a hedge fund alongside their VC fund—they won't be eligible for this exemption.

To help clarify these distinctions, let's compare the two primary paths to becoming an ERA side-by-side.

| Qualification Factor | Private Fund Adviser Exemption | Venture Capital Fund Adviser Exemption |

|---|---|---|

| Primary Requirement | Exclusively advise private funds. | Exclusively advise venture capital funds. |

| AUM Threshold | Total U.S. AUM must be less than $150 million. | No AUM limit is imposed. |

| Fund Type Focus | Based on the private nature of the fund. | Based on the fund's strategy and holdings. |

| Key Limitation | Crossing the $150 million AUM mark triggers full SEC registration. | Managing even one non-VC fund disqualifies you. |

As the table shows, your choice depends entirely on your business model. Are you a smaller manager with various private fund strategies, or are you a dedicated venture capital specialist? The answer will point you to the correct exemption.

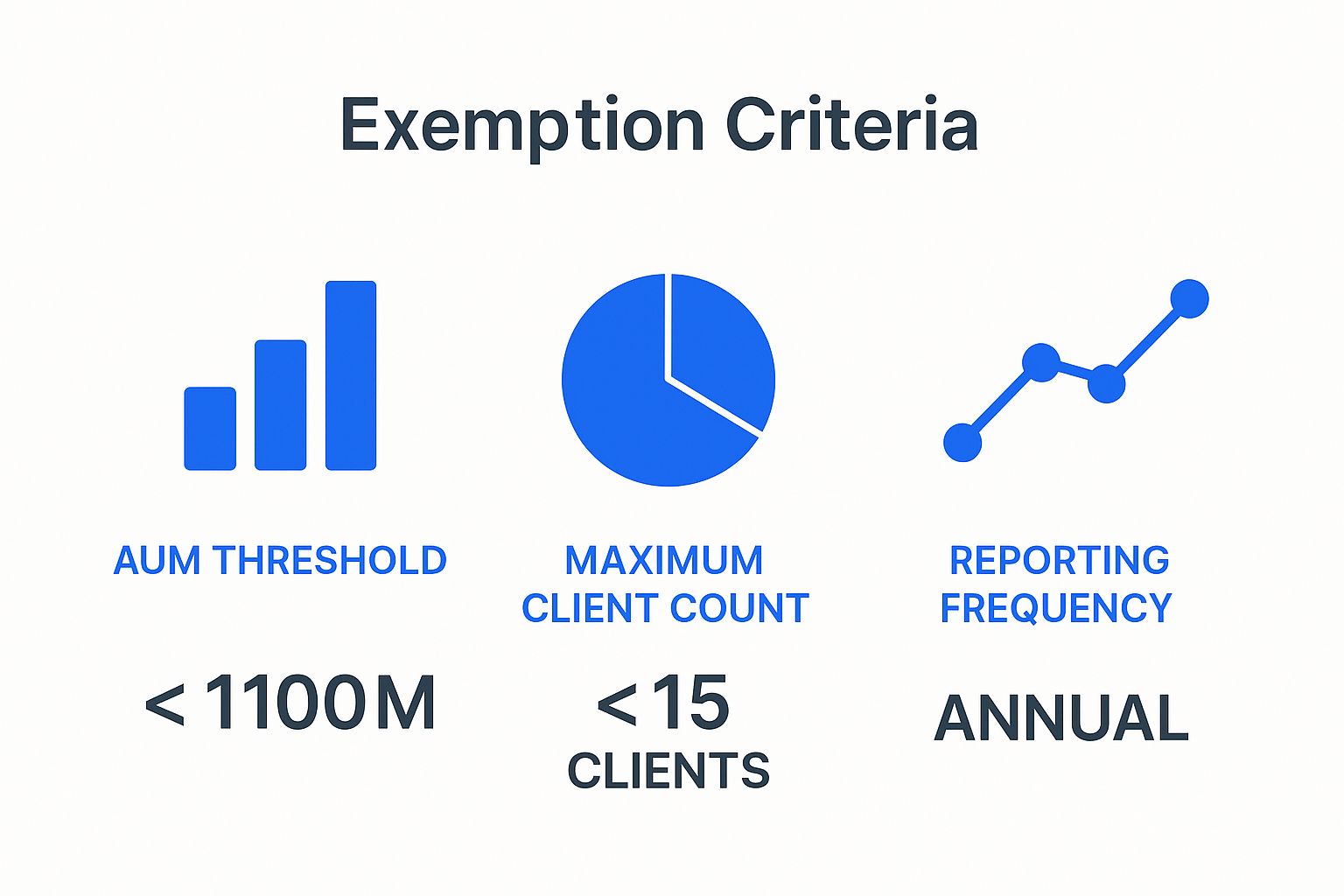

The infographic below offers a broader look at how different exemption types compare.

This visual helps illustrate how thresholds for AUM and client numbers, along with reporting duties, create distinct regulatory lanes for investment advisers. Figuring out which lane you belong in is the foundational step in building your firm's compliance program.

It’s one of the biggest misconceptions in the industry. People hear the word "exempt" and think it means "no rules." That couldn't be further from the truth.

Operating as an Exempt Reporting Adviser (ERA) isn't about getting a free pass from oversight. It’s about following a different, more focused set of regulations. You might be off the main highway of full SEC registration, but you are still very much on the regulator's map.

The central compliance duty for every ERA is filing Form ADV, Part 1A every single year. This isn't just a simple checkbox exercise; it's a critical disclosure document you’ll submit through the Investment Adviser Registration Depository (IARD) system.

This form gives regulators a clear snapshot of your firm. You'll need to provide details on your ownership structure, who controls the firm, the private funds you manage, and any disciplinary history. Think of it as the SEC’s primary tool for keeping tabs on the private fund world.

Beyond the annual filing, a much bigger responsibility hangs over every ERA: the unwavering duty to act as a fiduciary. Exempt reporting advisers are fully subject to the anti-fraud provisions of the Investment Advisers Act. This is the bedrock of your responsibilities, and it's not negotiable.

What does this mean in practice? You must always act in your clients' best interests, avoid making misleading statements, and be completely transparent about any potential conflicts of interest. The SEC can, and does, conduct examinations of ERAs to make sure these rules are being followed, especially if they get a tip or spot a red flag.

A strong compliance program isn't just a shield to protect you from trouble; it's a proactive strategy. It shows investors and regulators that you're committed to doing things the right way, which is ultimately your firm's best defense against scrutiny.

Having a solid compliance program is essential for your firm's survival and growth. While it doesn't need to be as massive as what a fully registered adviser requires, an ERA's framework still needs to be strong.

Here are a few key areas that demand your attention:

The regulatory environment is also getting stricter. The SEC’s 2025 updates, for example, point to increased scrutiny on private funds, requiring larger funds to quickly report major events like extraordinary investment losses. While ERAs face lighter burdens, the trend toward greater transparency is unmistakable.

You can check out the SEC’s heightened requirements for fund advisers to get a feel for these evolving expectations. For a closer look at the specific legal frameworks affecting fund managers, review our guide to Fundpilot's legal and compliance features.

Deciding whether to operate as an Exempt Reporting Adviser (ERA) or to become a fully registered investment adviser (RIA) with the SEC is one of the most significant choices a fund manager will make. This isn't just about paperwork; it's a strategic decision that directly impacts your firm's operating costs, day-to-day compliance obligations, and even your potential for growth. The right answer really boils down to your specific business model, the investors you serve, and where you see your firm heading in the long run.

A good way to think about it is comparing a food truck to a full-service restaurant.

As an ERA, you're essentially running a nimble food truck. Your overhead is lower, operations are simpler, and you have more flexibility to adapt. A fully registered RIA, on the other hand, is like running a large, sit-down restaurant. It demands a bigger staff, a more complex kitchen (your compliance program), and adherence to a long list of health codes (SEC rules). The upside? You can serve a much wider, and often more demanding, clientele.

For many new and emerging managers, that food truck model is the perfect way to get started. The lighter compliance load is easily the biggest perk of being an ERA. You get to skip the much more intensive disclosure requirements of Form ADV Part 2, you'll find the custody rules less burdensome, and you are far less likely to see SEC examiners show up for a routine check-in. All of this adds up to real savings in legal and administrative costs.

Of course, that operational simplicity comes with a few trade-offs. While being one of the many exempt reporting advisers is incredibly efficient, some investors—particularly large institutions—might view it as a less established or less serious setup.

Full SEC registration, while a much heavier lift, carries a certain gravitas. It’s a clear signal to the market that your firm has invested in a robust compliance infrastructure and can meet the highest regulatory hurdles. This can be a huge marketing advantage, boosting your credibility and opening doors to pension funds, endowments, and other institutional players who often have strict mandates to only invest with RIAs.

Choosing between ERA and RIA status is a strategic calculation. You're balancing the immediate cost and time savings of the ERA path against the potential for greater market access and institutional credibility that comes with full SEC registration.

Ultimately, there's no single right answer. It all comes back to your firm's unique situation. Let's put the two side-by-side to make the differences crystal clear.

To help you weigh the pros and cons, the table below breaks down the key operational and compliance differences between being an Exempt Reporting Adviser and a fully Registered Investment Adviser.

| Feature | Exempt Reporting Adviser (ERA) | Registered Investment Adviser (RIA) |

|---|---|---|

| Primary Duty | Subject to anti-fraud rules and fiduciary duty. | Subject to the full scope of the Investment Advisers Act. |

| SEC Filings | Files an abbreviated Form ADV Part 1A annually. | Files a comprehensive Form ADV Part 1A and Part 2 annually. |

| Compliance Program | Requires a basic, risk-based compliance program. | Requires a detailed, comprehensive, and tested compliance program. |

| SEC Exams | Examined less frequently, often on a for-cause basis. | Subject to regular, routine SEC examinations. |

| Investor Appeal | Ideal for accredited investors and smaller funds. | Often preferred by large institutional investors. |

As you review these points, think hard about your growth plans. If your strategy is to stay nimble, serve a select group of sophisticated investors, and remain under the $150 million AUM threshold, the ERA path offers fantastic efficiency. But if your five-year plan involves scaling up quickly and courting major institutional capital, it’s smart to start thinking about the transition to full RIA status from day one.

Being an exempt reporting adviser certainly means dealing with fewer regulatory hoops, but don't let that fool you. This lighter-touch status can sometimes create a false sense of security, leading firms into some surprisingly common—and totally avoidable—compliance traps. A little bit of vigilance goes a long way.

One of the biggest tripwires we see is miscalculating assets under management (AUM). It sounds simple, but it can get complicated fast. If you're relying on the Private Fund Adviser Exemption, that sub-$150 million AUM threshold is a hard ceiling, not a friendly suggestion. One great fundraising round is all it takes to push you over the limit, often when you least expect it. When that happens, the clock starts ticking on a 90-day window to get fully registered with the SEC. Miss that deadline, and you've got a serious problem.

Another classic mistake is misinterpreting the Venture Capital Fund Adviser Exemption. It’s easy to assume that any fund investing in startups automatically qualifies, but the SEC has a very specific and narrow definition of a "venture capital fund."

To qualify, your fund can't use leverage and must have at least 80% of its assets tied up in qualifying private company securities. If you manage just one fund that steps outside these tight boundaries, it can blow up the exemption for your entire firm.

On a similar note, don't get sloppy with disclosing conflicts of interest. Just because ERAs don't have to file the exhaustive Form ADV Part 2 doesn't mean you're off the hook. You still have a fiduciary duty to your investors, which means being completely transparent whenever the firm's interests might not perfectly align with theirs.

"Many of the new rules and requirements have specific nuances. For covered investment advisers that have not voluntarily implemented AML/CFT programs... these new compliance obligations will require significant time and attention."

This quote really drives home the point that the compliance goalposts are always moving. For example, new FinCEN rules are coming into effect in 2026 that will require ERAs to stand up full anti-money laundering (AML) programs. That's a significant new responsibility you need to prepare for now.

Finally, and this one is a real self-inflicted wound, is just plain bad record-keeping. It's an easy thing to get right, but it can turn a small headache into a massive migraine during a regulatory exam.

Think about it: meticulous records of investor communications, trading activity, and compliance decisions are your proof. They show regulators you have a culture of compliance. Messy, incomplete, or missing files? That just screams chaos and invites them to dig deeper.

Staying on top of these duties is a constant effort. For more practical advice on fund operations and compliance, feel free to check out the articles on the Fundpilot blog. Ultimately, being proactive about compliance is the single best way for an ERA to protect the firm, its reputation, and its investors.

Becoming a federal exempt reporting adviser feels like a huge win, but it’s really just crossing the halfway point. You've cleared the federal hurdle, but now you have to navigate the often-tricky landscape of state-level regulations, commonly known as "blue sky" laws.

A common and costly mistake is assuming your federal exemption gives you a free pass everywhere. It doesn't. Each state has its own playbook; some will mirror the SEC's exemption, but others will require you to complete a notice filing, pay a fee, or even go through a full state registration process. You have to check the rules for every single state where you do business.

Looking down the road, it's clear the regulatory climate for all private fund advisers is getting warmer. The SEC has been very open about its plans to ramp up scrutiny of the private fund world, all in the name of boosting transparency and protecting investors.

What does this mean for ERAs? It means you should prepare for a future with more oversight. Even though you're exempt from full registration now, the compliance bar is constantly being raised. A perfect example of this is a major new rule coming from the Financial Crimes Enforcement Network (FinCEN).

Starting January 1, 2026, both RIAs and ERAs will officially be classified as "financial institutions" under the Bank Secrecy Act. This isn't just a change in title; it means you'll be required to build and maintain a full anti-money laundering (AML) and countering the financing of terrorism (CFT) program.

This is a game-changer, especially for smaller firms that likely don't have these kinds of robust programs in place. It will demand serious resources to create internal policies, implement risk-based testing, and ensure your team gets ongoing training. You can find more information about these kinds of legal responsibilities in our service terms and legal conditions.

Staying ahead of these changes is key to your firm's survival and success. By understanding the nuances of state laws and keeping a close eye on upcoming regulatory shifts, you can build a strong, flexible compliance foundation that will support your growth for years to come.

Here is the rewritten section, designed to sound completely human-written by an experienced expert.

Even after you've got the rules down, the real world always throws a few curveballs. Let's walk through some of the most frequent "what-if" scenarios we see fund managers grapple with when they're operating as an exempt reporting adviser.

This is a big one, and it's a moment every successful fund manager should anticipate. Crossing the $150 million AUM threshold is a major milestone, but it also means you've officially outgrown the Private Fund Adviser Exemption.

The good news is the SEC doesn't expect you to flip a switch overnight. You get a 90-day grace period, starting from the day your AUM officially crosses that line. Within those 90 days, you need to get your full application for registration as a Registered Investment Adviser (RIA) filed. Don't drag your feet on this—missing that deadline is a serious compliance issue, which is why keeping a close, constant eye on your AUM is so critical.

The answer here is a hard no. The rules are incredibly strict on this point. Whether you're relying on the Private Fund or the Venture Capital Fund exemption, your advisory services can only be provided to qualifying private funds.

Think of it this way: the moment you take on even one client who isn't a private fund—say, an individual with a separately managed account—you've immediately lost your ERA status. That single action triggers the requirement for full SEC registration.

This isn't a minor detail; it's a fundamental part of the exemption's design. The SEC wants to keep this category tightly defined.

Not even close. This is probably one of the most common traps for new managers. Your federal ERA status doesn't give you a free pass at the state level. Each state has its own unique regulations, often called "blue sky" laws, and they can vary dramatically.

For example, while some states might mirror the federal exemption, many others will require you to take additional steps. You might have to:

The key takeaway is to never make assumptions. You absolutely have to do your homework and check the specific rules for every single state where you have clients or are actively doing business.

Ready to move past spreadsheets and operate like a top-tier firm? Fundpilot provides the institutional-grade reporting, automated fund administration, and audit-ready compliance tools that empower emerging managers. Schedule your demo of Fundpilot today and see how we help funds scale with confidence.