Download our comprehensive document retention policy template. Designed for fund managers to ensure compliance and streamline critical record-keeping.

A good document retention policy template is more than just a starting point; it's the foundation for managing your fund's records. It provides a crucial framework for deciding what to keep for legal and business reasons, and what to get rid of responsibly. Think of it less like housekeeping and more like a fundamental risk management tool.

In the high-stakes world of fund management, you’re navigating a sea of sensitive data under intense regulatory pressure. A clear document retention policy isn't just a box to check—it's your shield. Without one, you’re leaving your firm exposed to regulatory fines, litigation headaches, and pure operational chaos.

Let’s walk through a real-world scenario I’ve seen play out. A mid-sized hedge fund gets hit with a surprise SEC audit. They don't have a formal policy, so their unofficial rule was "keep everything." This backfired, spectacularly.

Their legal team was suddenly buried under a mountain of data, which sent discovery costs through the roof and dragged out the audit for months. Even worse, an old, irrelevant email was pulled out of context, sparking a lengthy investigation. This entire mess could have been avoided if that document had been properly disposed of, following a consistent, legally defensible schedule.

We're all drowning in data. The sheer volume of digital information makes managing it by hand a fool's errand. By 2025, the total amount of data worldwide is projected to hit 175 zettabytes—a tenfold jump from 2016.

Here’s the kicker: about a third of all stored data hasn't been touched in three years, and a staggering 75% of over-retained data contains personal or sensitive information. That's a massive liability, especially with laws like the US CPRA that require firms to set maximum retention periods. You can find more insights on the risks of data over-retention and governance over at bigid.com.

A well-structured policy helps you get a handle on this risk by defining clear, easy-to-follow rules.

A policy isn't about hoarding records; it's about intelligent governance. It establishes a rhythm for how information flows through your firm, from creation to secure destruction, protecting you from both regulatory penalties and the operational drag of digital clutter.

Aside from keeping regulators happy, a solid policy delivers some very real operational wins. It creates a single source of truth for how documents are handled, which gets rid of the guesswork and inconsistency that can creep into any team's workflow. That clarity is invaluable.

Here’s what else you get:

Putting together a document retention policy isn't just about downloading a template and calling it a day. It's about building a living framework that genuinely organizes, protects, and simplifies how your fund handles data. Each piece of the policy has a specific job, and they all need to work together to create a strategy that will hold up under scrutiny.

I like to think of it like building a house. You need a solid foundation, clear blueprints for every room, and rules for who gets a key. A sloppy policy is like a house with a leaky roof—it might look okay for a while, but eventually, you're going to have a serious mess on your hands.

First things first, your policy needs to state its purpose and who it applies to, plain and simple. This isn’t just bureaucratic box-ticking; it sets the tone for everything else. The purpose statement should be direct, explaining that the policy is in place to keep the fund compliant, manage operational records efficiently, and cut down on legal risks.

The scope then defines the policy's reach. Make it crystal clear that it covers everyone—employees, contractors, and any third-party vendors who touch your fund's data. You'll want to be specific about the types of records included, such as:

A critical part of this is clearly defining what records you need to keep for your limited company and for how long. Getting this right from the start avoids confusion and ensures everyone knows exactly what's expected of them.

Let's be honest: a policy without an owner is a policy that's going to gather dust. You have to assign specific responsibilities to make sure someone is accountable. This doesn't need to be overly complicated, especially for smaller funds, but it absolutely must be spelled out.

For instance, you might name a Compliance Officer or a designated partner as the "Policy Administrator." This person owns the policy—they keep it updated, field questions, and schedule regular reviews. Your IT team would then handle the technical side, like setting up automated deletion rules in your systems.

Every single person on your team plays a part in managing data. Your policy should drive home the point that compliance is a shared responsibility, not just a job for the back office. It helps build a culture where everyone feels accountable.

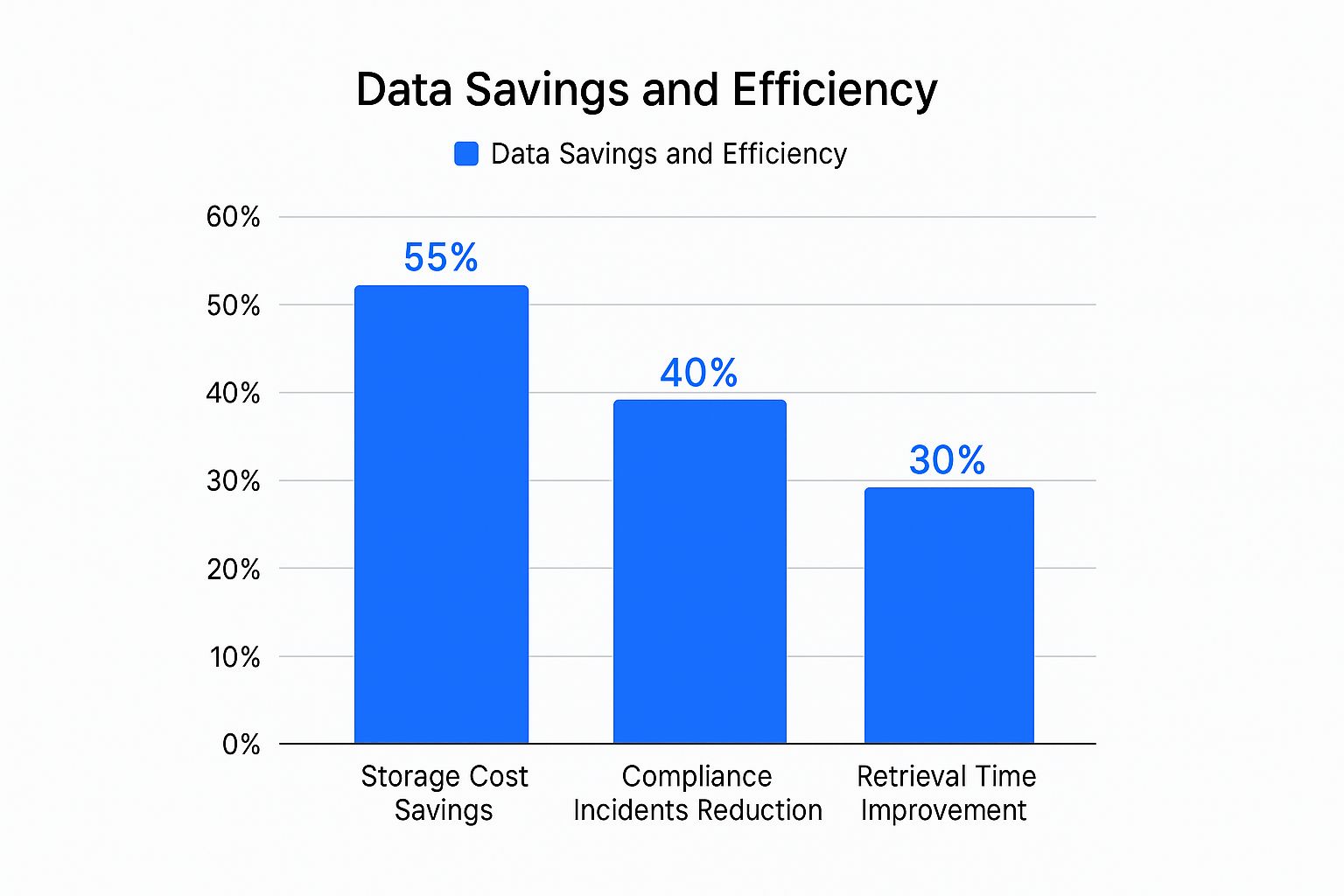

As this chart shows, a well-structured policy isn't just about avoiding fines. It leads to real-world benefits like major cost savings and fewer compliance headaches.

The numbers don't lie. A disciplined approach to data management directly boosts operational efficiency and strengthens your overall compliance posture.

The retention schedule is the heart and soul of your policy. It's essentially a detailed cheat sheet that organizes your records by category and assigns a specific retention period to each one. During an audit, this schedule is your best friend because it proves you have a logical, systematic approach to record-keeping.

As you build this out, you have to factor in regulations like the Investment Advisers Act of 1940, which sets strict timelines for things like trade confirmations and client communications. But it’s not just about regulators; your schedule also has to accommodate your own internal business needs.

Here's a sample to give you a feel for how to structure your retention schedule.

This table provides a snapshot of common document types and their typical retention periods based on key U.S. regulations. It’s a great starting point for building your own comprehensive schedule.

| Document Category | Specific Examples | Governing Regulation | Minimum Retention Period |

|---|---|---|---|

| Investor Communications | LP Reports, Capital Call Notices | Investment Advisers Act, Rule 204-2 | 5 years after the end of the fiscal year |

| Trade Records | Confirmations, Order Tickets | Investment Advisers Act, Rule 204-2 | 5 years from the end of the fiscal year in which the transaction occurred |

| Financial Statements | Audited Fund Financials, Balance Sheets | Sarbanes-Oxley (SOX) | 7 years |

| Marketing Materials | Pitch Decks, Due Diligence Questionnaires | SEC Rules | 5 years from last use |

This kind of structured approach ensures your decisions are backed by legal requirements, not just guesswork. It's a much more defensible position to be in.

Finally, your policy must outline exactly how documents will be securely destroyed once their time is up. This process needs to cover everything, both digital and physical. For digital files, this could mean using secure deletion software that overwrites the data. For paper, it means hiring a professional shredding service.

Just as important is defining the process for a legal hold. If you have a reasonable expectation of litigation, you are legally obligated to suspend the destruction of any relevant documents. Your policy needs to specify who can issue a hold, how that notice is sent out, and how the hold is eventually lifted. This is non-negotiable for demonstrating good faith and is one of the https://www.fundpilot.app/blog/8-crucial-audit-trail-best-practices-for-2025 every fund manager should have locked down.

The moment your fund takes on capital from international investors or begins operating across borders, things get complicated. Fast. Your document retention policy is no longer a simple matter of following one set of rules. Suddenly, you're juggling a complex web of global regulations that often overlap and sometimes directly conflict.

A policy built solely around U.S. laws just won't cut it. It leaves your firm dangerously exposed.

For most fund managers, the biggest headache comes from the clash between the SEC's rigorous record-keeping rules and the EU's privacy-centric General Data Protection Regulation (GDPR). These two regulations are built on fundamentally different philosophies. The SEC wants you to keep just about everything for accountability, while GDPR is all about data minimization—holding onto the least amount of personal data for the shortest possible time.

This isn't just a theoretical problem. It creates very real dilemmas.

Let's walk through a common scenario. You have an investor based in Germany. They contact you and invoke their "right to be forgotten" under GDPR, demanding you delete all their personal data. Simple enough, right?

Not so fast. SEC Rule 204-2 requires you to keep detailed investor records—including communications and transaction histories—for a minimum of five years.

So, what’s the right move? If you delete the data, you could be in hot water with the SEC. If you keep it, you could be facing a hefty GDPR fine.

This is exactly where a nuanced, well-drafted policy becomes your best defense. The key is to understand that a specific legal obligation usually trumps a general right like erasure. Your policy needs to clearly state that data will be retained to meet binding legal and regulatory requirements, even when a deletion request is made. This gives your team a clear, defensible position.

When regulations clash, the principle of legal obligation typically takes precedence. Your policy should explicitly state that retention periods will align with the strictest applicable legal or regulatory mandate, providing a clear, defensible framework for your team.

To manage these moving parts, your document retention policy template must be built with a global mindset from the very beginning. It's not about just listing out different regulations. You need a practical system for resolving conflicts and ensuring your actions are consistent, no matter where your investors call home.

This kind of forward-thinking is a critical part of a strong operational backbone. To dig deeper into this, check out our guide on how to build your compliance risk management framework.

And make no mistake, the global landscape is always changing. Between February 2021 and May 2023 alone, 17 new countries rolled out data privacy laws. That brought the total to 162 jurisdictions, all with rules that could affect your retention schedules. These laws can vary dramatically—Switzerland, for instance, mandates a 10-year retention for business records. For a closer look at the differences, you can find a detailed comparison of data retention laws by country.

So, how do you create a policy that can stand up to this complexity? Here’s a practical approach:

By taking this "highest standard" approach, you can create a single, unified policy that satisfies multiple international requirements at once. It makes training your team simpler and dramatically reduces the risk of an accidental—and costly—compliance breach.

A good document retention policy template is a fantastic starting point, but it's not the finish line. Every fund is unique, with its own investment strategy, team structure, and operational quirks. Simply adopting a generic policy without careful customization is a recipe for a document that looks good on paper but fails spectacularly in practice.

A good document retention policy template is a fantastic starting point, but it's not the finish line. Every fund is unique, with its own investment strategy, team structure, and operational quirks. Simply adopting a generic policy without careful customization is a recipe for a document that looks good on paper but fails spectacularly in practice.

The real goal here is to transform that template into a living, breathing guide that reflects how your firm actually works. This means getting specific and moving well beyond broad categories. It’s the difference between a policy that just says "store investment records" and one that clearly distinguishes between high-frequency trading logs and illiquid real estate due diligence files—each with its own distinct lifecycle and regulatory nuances.

As you start digging in, a structured framework can keep you from getting lost in the weeds. A solid Process Documentation Template can provide a methodical starting point, helping you outline your specific retention procedures and ensuring no detail is overlooked.

Your first task is to define document categories that truly align with your fund’s specific activities. A venture capital fund generates a completely different paper trail than a quant fund. One is swimming in term sheets and shareholder agreements, while the other is producing terabytes of algorithmic back-testing data.

Think about the real-world documents your team creates and receives every single day. Instead of using generic labels, create specific subcategories that leave no room for ambiguity.

This level of detail makes it far easier for your team to classify documents correctly from the get-go, which is the absolute foundation of a successful policy. It removes the guesswork that so often leads to inconsistent filing and retention errors down the line.

Next, you have to adapt the roles and responsibilities in the template to fit your team's actual size and structure. A large institution probably has a dedicated Chief Compliance Officer (CCO) and an IT department to manage automated workflows. But in a smaller family office, the managing partner might be wearing all those hats.

Critical Customization Question: Who is actually responsible for making sure this policy is followed? If our primary record-keeper leaves tomorrow, who takes over? Defining this clearly prevents the entire policy from falling through the cracks during personnel changes.

Be realistic about your team's bandwidth. Assigning complex review tasks to someone who is already stretched thin is just setting them up for failure. The key is to name specific individuals or roles responsible for:

By carefully tailoring these elements, you create a document retention policy template that is not just compliant, but practical and perfectly suited to your fund's unique operational reality.

A beautifully drafted document retention policy is worthless if it just sits on a server. The real test is making it a living, breathing part of your firm’s daily rhythm. Without a solid rollout, you’ve just created more shelfware, leaving your fund just as exposed as before. The goal here is to embed this policy so deeply into your operations that compliance becomes second nature.

This all comes down to two things: clear communication and practical training. Everyone, from your senior partners to your newest analyst, needs to understand not just what the rules are, but why they exist. When you can clearly explain how this policy protects the firm, simplifies everyone’s workflow, and even reduces their personal liability, you’ll get buy-in instead of eye-rolls.

Don't just email a PDF of the policy and call it a day. That's a recipe for failure. You need to get everyone in a room (or on a video call) and walk them through it. Make it real by focusing on how the policy impacts each person's specific role.

For example, show your investment team the exact steps for tagging and archiving due diligence files in your data room. Walk the operations team through the new, standardized process for saving capital call notices. This kind of hands-on, practical demonstration clears up confusion and gives people the confidence to actually follow the new procedures.

Your policy’s success is directly tied to your team’s buy-in. When people understand that the policy makes their jobs easier and the firm safer, compliance becomes a shared goal rather than a top-down mandate.

And it's not a one-and-done event. Make a point to touch on the policy during your annual compliance refresher training to keep it top of mind.

Relying on people to manually enforce retention rules is asking for trouble. We're all human, and mistakes will happen. The most robust approach is to let technology do the heavy lifting. This means configuring your existing systems to automatically manage the lifecycle of a document—from creation to archival and, eventually, secure destruction.

I saw one fund do this brilliantly. They simply set up a rule in their CRM to automatically apply a seven-year retention tag to every new investor email. It was a simple tweak, but it instantly eliminated the risk of someone accidentally deleting a critical communication and built a perfect, defensible audit trail.

Finally, you need to build in a regular review cycle. Tying this into your firm's annual operational review is a smart move. If you need a framework for that, check out our guide on building a better internal audit checklist template.

Don't underestimate the complexity and cost of getting this right, especially as regulations tighten globally. For instance, back in 2015, Australia's mandatory data retention law forced ISPs to store metadata for two years, a move that cost the industry an estimated AU$400 million per year. It's a constant balancing act between security, privacy, and cost, as you can see from the global evolution of data retention policies.

Even with the best template in hand, you’re going to get questions when it's time to put your new retention policy into action. Getting ahead of these common hurdles is the key to creating a policy that’s not just compliant, but genuinely practical for your team.

Let's walk through some of the most frequent questions I hear from fund managers.

Without a doubt, the single most dangerous mistake is falling into the "keep everything forever" trap. It feels like the safest option, but in reality, it’s a ticking time bomb of liability.

Hoarding data doesn't just increase storage costs; it multiplies your risk. Under privacy laws like the GDPR and CCPA, you're required to practice data minimization—only keeping what's necessary for as long as it's necessary. Every extra document you hold onto is another potential landmine during a regulatory audit or legal discovery.

And it’s a financial drain, too. Imagine the costs during litigation when your legal team has to sift through terabytes of irrelevant files. Systematically disposing of records according to your policy isn't about hiding information. It's just good, proactive governance.

A legal hold is essentially a "pause button" on your document destruction schedule. It's a formal directive that gets triggered the moment you can reasonably anticipate litigation, and it legally obligates you to preserve any information that could be relevant to the case.

When a hold is triggered, it immediately overrides your standard retention periods for the specific data involved.

Putting a hold in place involves a few critical steps:

A legal hold isn’t a suggestion; it's a non-negotiable legal obligation. Botching this process can lead to devastating penalties, including sanctions for spoliation of evidence, which can cripple your case before it even starts.

You can—and absolutely should—automate large chunks of your policy. But relying on 100% automation with zero human oversight is a recipe for trouble.

Software is a game-changer for enforcing retention schedules, flagging documents for review, and managing secure deletion. Automation is fantastic for reducing human error and ensuring the policy is applied consistently across your entire firm.

But human judgment is still irreplaceable. An automated system can’t know when to initiate a legal hold, for example. It also can't grasp the nuances of a particularly sensitive or complex record. The smart play here is a hybrid approach.

Let technology do the heavy lifting: applying retention tags, tracking timelines, and carrying out routine destructions. But always keep a human in the loop for the big decisions, like triggering a legal hold, giving the final sign-off on documents flagged for destruction, and updating the policy itself. This balance delivers the efficiency of automation with the critical context and sound judgment only a person can provide.