Stop using generic templates. Learn to build a dynamic internal audit checklist template that targets key risks and boosts audit value. Free guide included.

Let's be honest, that standard internal audit checklist template you grabbed off the internet is probably doing more harm than good. In the real world, where risks are complex and constantly shifting, a generic, one-size-fits-all approach is a recipe for missing what truly matters. The most effective template isn't something you find; it's a living tool you build and constantly refine yourself. This ensures every audit you conduct is sharp, relevant, and genuinely insightful.

The days of treating an internal audit checklist as a static, box-ticking exercise are long gone. A generic template simply can't keep up with the specific, evolving risks your organization is grappling with right now. It doesn't understand your industry's regulations, your operational quirks, or your strategic goals. And that disconnect is precisely where the biggest risks love to hide.

Relying on an off-the-shelf checklist often creates a dangerous false sense of security. Your team might diligently check every box, but the checklist itself could be completely blind to your most significant threats—a new cybersecurity loophole, a subtle flaw in your supply chain, or a breakdown in governance. The result? An audit that looks complete on paper but offers zero strategic value, leaving your organization wide open.

One of the biggest traps of a generic template is how it kills critical thinking. Instead of pushing auditors to dig deeper and adapt their approach, it encourages a paint-by-numbers mentality. This can muzzle an auditor's professional judgment and natural curiosity—the very skills needed to uncover systemic problems.

Think about it. A financial services firm uses a generic template for an IT audit. The checklist has a vague item like "Review user access controls." An auditor, following the script, might just confirm that a written policy exists and call it a day.

A custom-built checklist, however, would force them to ask the right questions:

This is where you find real assurance. It's that level of specific detail that generic templates will always miss.

The entire profession is shifting gears, moving away from rigid, compliance-based audits toward a more dynamic, risk-focused model. This change is being cemented by the upcoming update to the Global Internal Audit Standards from The Institute of Internal Auditors (IIA), which takes effect in January 2025. This new framework demands agility, strategic alignment, and a much sharper focus on areas like cybersecurity. It's a good idea to learn more about how to prepare for these new global audit standards to make sure your practices aren't left behind.

A truly effective internal audit checklist isn't a finished product you download. It's a foundational framework that you build and continuously refine. It has to be a direct reflection of your organization's unique risk appetite, strategic goals, and operational realities.

To build a checklist that delivers genuine value, you have to start with a solid foundation. A modern template should be structured to guide the audit process, not put it in a straitjacket.

The table below breaks down the core elements you absolutely need to include. These components ensure your checklist is comprehensive and aligned with what's expected from a high-performing audit function today.

| Component | Description | Why It's Critical |

|---|---|---|

| Audit Objectives | A clear statement defining what the audit aims to achieve (e.g., "To verify the effectiveness of vendor onboarding controls"). | Aligns the audit with strategic risks and prevents scope creep. |

| Risk Identification | The specific risks the audit procedures are designed to address (e.g., "Risk of fraudulent vendor payments"). | Ensures audit efforts are focused on what matters most. |

| Control Descriptions | A brief explanation of the key controls in place to mitigate the identified risks. | Provides context for the auditor and stakeholders. |

| Test Procedures | Specific, actionable steps the auditor will perform to test the effectiveness of each control. | Creates a consistent, repeatable, and thorough audit process. |

| Evidence & Notes | A section to document the evidence reviewed, observations made, and auditor conclusions. | Forms the basis for the audit report and supports findings. |

By building these essential components into your template from the ground up, you move away from simple compliance and start conducting audits that provide true assurance and strategic foresight. This is the foundation for turning your internal audit function into a valued strategic partner.

Alright, let's get practical. It's time to build the foundational framework for your master internal audit checklist template. A solid template isn't just a laundry list of questions; it's a structured guide that steers an auditor's thinking from big-picture goals right down to the nitty-gritty test procedures. Getting this right ensures you bring consistency and thoroughness to every audit, no matter what you're looking at.

The first move is to map out your "audit universe"—basically, every process, department, and system that could possibly be audited. Don't hold back here. Think core functions like finance and operations, but also extend your map to IT, HR, legal, and compliance. The idea is to create a complete inventory of what's auditable in your organization. Once you have that bird's-eye view, you can start building a template that's both rigid enough to be consistent and flexible enough to be useful.

Before you write a single checklist item, you have to know why you're doing the audit. What are you actually trying to achieve? An audit objective is a short, sharp statement that spells this out. Without it, audits tend to wander, lose focus, and deliver wishy-washy results.

Your template needs a dedicated spot for these objectives. This simple step forces the team to think strategically before they get lost in the weeds. Good objectives are specific, measurable, and tie directly back to real business risks.

There's a huge difference between:

See the difference? The second one gives you a clear target. It immediately tells you which risks you need to go after.

With your objective locked in, you can now pinpoint the key controls management has put in place to hit that objective. A control is just an action, policy, or procedure meant to knock down a specific risk. In our procure-to-pay scenario, the risks might be things like setting up fake vendors or paying for goods you never actually got.

Your checklist has to connect these dots. For every area you're auditing, create columns for the risk, the control that's supposed to handle it, and who owns that control. This structure guarantees that every test you run is tied to a business risk that matters. It’s a crucial detail that a lot of generic, off-the-shelf templates completely miss.

The best internal audit checklists are designed to test for control, not just to test controls. This means you're not just checking if a task was done, but also looking at the entire system—the control environment, risk assessment, and monitoring—that supports it.

This shift in thinking is what elevates a basic audit to a strategic one. You move from just asking, "Did they do it?" to answering, "Is the whole system actually working as it should?"

This is where the rubber meets the road. Test procedures are the specific, step-by-step instructions the auditor will use to gather evidence and figure out if a control is working. The single biggest mistake I see people make here is writing simple "yes/no" questions. That tells you almost nothing.

Good test procedures are open-ended; they push the auditor to dig deeper. They should clarify how to test something, not just what to test. This means specifying the method—are you asking, watching, inspecting, or re-doing the work?—and what kind of evidence you need to collect. For businesses juggling complex finances, like fund administration, having meticulously detailed and auditable records is non-negotiable. You can see how modern platforms help with this by exploring the resources on the Fundpilot blog.

Let's bring this home with our "Procure-to-Pay" example. Instead of a flimsy question, we'll create a robust test.

Example Audit Area: Procure-to-Pay

A detailed procedure like this leaves no room for guesswork. It gives the auditor a clear roadmap, keeps the work consistent, and generates solid evidence to back up the final conclusion. When you build your core internal audit checklist template with this level of care, you’re creating a powerful tool that will drive high-quality audits for years to come.

A solid internal audit checklist template is a fantastic starting point, but its real power comes alive when you customize it. A generic framework ensures you cover the basics, but it won’t sniff out the unique, high-impact risks that could truly damage your business. The real value is in sharpening that template into a precision tool aimed squarely at your biggest vulnerabilities.

This means getting specific. You need to move beyond general questions and add targeted lines of inquiry that address today’s most significant threats—think cybersecurity, complex regulations, and business disruptions. When you tailor your checklist, you transform it from a simple document into a strategic asset, focusing your team’s effort where it matters most.

The risk landscape is always shifting. Your audit plan, and the checklists that guide it, have to keep up. Fortunately, global data gives us a clear picture of where organizations are most concerned, which is an excellent guide for where to sharpen your own focus.

For example, survey after survey confirms that cybersecurity is the number one audit priority around the world. Internal audit functions, on average, now dedicate a massive 69% of their time to this critical area. That number is even more striking in some regions, with North American teams devoting a staggering 87% of their resources to cyber threats. You can see more on these trends in the full Risk in Focus 2025 summary.

Other major areas demanding attention include:

Your internal audit checklist template absolutely must be adapted to dig into these high-stakes areas with the depth they deserve.

Given its top-dog status, let’s break down how to properly tailor your checklist for a cybersecurity audit. Vague questions like, "Are IT security controls in place?" are basically useless. You need to get your hands dirty with specific, evidence-based tests that probe for genuine resilience.

Instead of a single checkbox, your template should prompt the auditor to investigate the nuts and bolts of your cyber defenses.

Cybersecurity Customization Example

| Audit Area | Specific Checklist Items to Add |

|---|---|

| Access Control | - Pull a sample of 15 terminated employees from the last 6 months and verify all system access was revoked within 24 hours of departure. - Review system logs for the past 90 days to identify and question any after-hours access to critical financial systems. |

| Incident Response | - Ask the IT security lead for the post-mortem report from the most recent security incident. - Verify that all recommended corrective actions from that report have been implemented and tested. |

| Vulnerability Management | - Inspect the latest vulnerability scan reports. - Select 5 critical-rated vulnerabilities and trace them to confirm they were patched within the 30-day window defined by internal policy. |

This level of detail forces a much more rigorous audit. It shifts the focus from a theoretical review of policies to a practical test of how things actually work—and that’s where you find real assurance.

A failure in governance or compliance can trigger severe financial and reputational crises. Your checklist needs to be sharp enough to spot these weaknesses before they blow up. This is particularly true for data privacy rules.

When auditing for compliance with regulations like GDPR, for instance, your checklist should include very specific lines of questioning. To get a better handle on this, you might want to check out our guide on GDPR for a deeper dive into these requirements.

A customized checklist doesn't just ask if a control exists; it asks for proof of its effectiveness. It pushes auditors to validate, verify, and test the controls that are supposed to be protecting the organization’s most valuable assets and its reputation.

Let's say you're auditing your corporate governance framework. A generic template might ask if a code of conduct exists. A tailored one, however, would add:

This approach transforms your internal audit checklist template from a simple guide into a dynamic tool. It helps you directly address and mitigate your company’s most critical risks, adding real strategic value with every single audit.

Technology is no longer just another line item on an audit plan; it's the engine that should be driving the audit itself. I’ve seen firsthand how sophisticated tools and AI are changing the game for top-tier audit teams. They're moving away from tedious manual spot-checks and toward comprehensive, data-driven analysis.

This means your internal audit checklist template has a dual role now. First, it must help you assess the risks your company takes on when adopting new technologies. Second, and just as importantly, it needs to push your auditors to use that same technology to make their own work more insightful and efficient.

This isn't just about tweaking your IT controls. We're talking about adding specific prompts to evaluate your company’s AI governance, the privacy implications of machine learning models, and the fundamental reliability of AI-generated information. This goes way beyond simple compliance—it's about providing real assurance over the very tools reshaping your business.

As your organization starts deploying artificial intelligence, internal audit has a huge responsibility to provide independent assurance that it’s being done thoughtfully and safely. A generic IT audit checklist just won’t get the job done anymore. You have to add pointed, specific questions to your template that tackle AI risks head-on.

Your checklist should guide auditors through the entire AI lifecycle. Think about including prompts like these:

Adding these items turns your checklist from a simple to-do list into a strategic risk assessment tool, making sure your team is focused on the modern risks that keep stakeholders up at night.

The other side of this coin is using tech to make your own audits more powerful. A modern internal audit checklist should act as a catalyst, nudging your team to move beyond small, manual samples and embrace what's possible with data analytics. Why just "test" a process when you can analyze 100% of the transactions?

Imagine turning a mind-numbing manual test into an automated script. Instead of painstakingly checking a sample of 25 invoices for duplicates, a data analytics tool can scan every single invoice paid last year in just a few minutes. This delivers a much higher level of assurance and, more importantly, frees up your auditors to investigate the why behind anomalies instead of just looking for them.

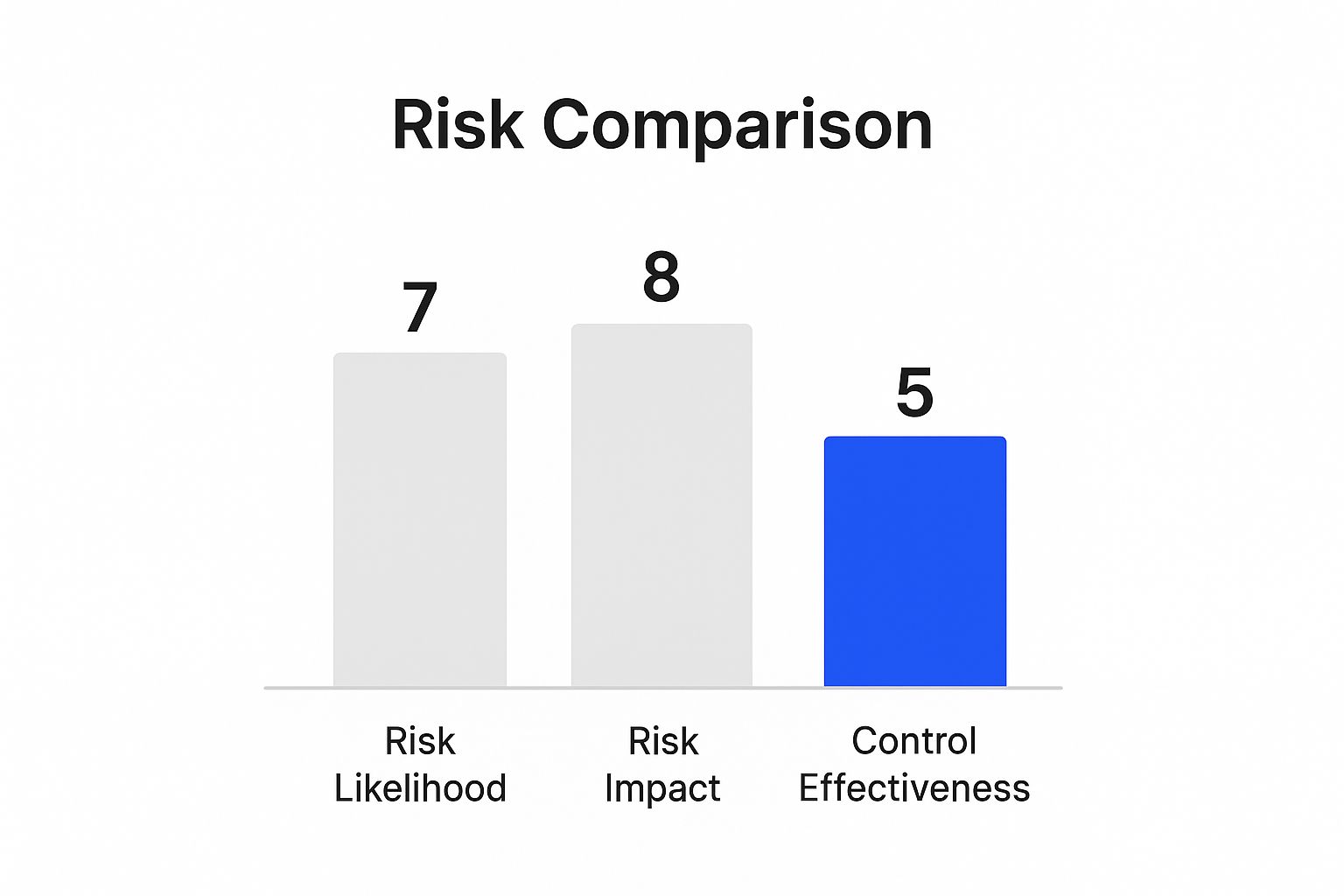

The image below gives a great visual of how this works in practice. Technology helps you get a clearer view of risk likelihood, impact, and control effectiveness so you can prioritize your efforts.

This data-driven approach means you can aim your limited audit resources at the highest-risk areas where controls are weakest, which is how you maximize your team's value and impact.

To put this into practice, you have to update your checklist with specific, tech-focused procedures. It involves rethinking traditional audit steps to bake in data analysis and automation from the start. This is a fundamental shift in mindset, not just a change in tools.

The table below shows some practical examples of how you can reframe classic checklist items to reflect a more modern, tech-enabled approach. This is the kind of thinking that moves an audit function from reactive to proactive.

| Audit Area | Traditional Checklist Item (Manual) | Tech-Enabled Checklist Item (Automated/Data-Driven) |

|---|---|---|

| Procure-to-Pay | "Select a sample of 25 invoices and check for duplicates." | "Run a script to analyze 100% of invoices for duplicate payments, vendor numbers, or amounts." |

| Payroll | "Manually verify a sample of 15 employees for ghost employees or abnormal overtime." | "Cross-reference the entire employee master file against the payroll register to identify terminated employees who were still paid." |

| Access Controls | "Review access logs for a sample of 5 privileged users to check for inappropriate access." | "Analyze all system access logs to identify users with conflicting permissions (e.g., ability to create and approve vendors)." |

| Expense Reporting | "Examine 30 expense reports for policy violations like weekend or holiday spending." | "Filter all expense reports from the past year to flag keywords ('gift,' 'spouse') or expenses submitted on weekends." |

As you can see, the tech-enabled items provide far greater assurance and open the door for deeper analysis. This is where audit adds real strategic value.

Internal audit teams are quickly adopting AI, especially generative AI, to work more efficiently and get a better handle on complex risks. This forces us as auditors to look at things like cybersecurity, fraud, and even workforce motivation through a new lens. To keep up, your checklist needs updated controls and tests for AI usage, emerging cyber threats, and modern fraud indicators. You can read more about topical risk areas internal audit must consider to see how the profession is evolving.

A checklist that encourages data analytics is a hallmark of a mature internal audit function. It proves the team has moved beyond simple compliance and is actively using technology to provide deeper, more valuable insights to the organization.

By weaving these technological prompts and AI-specific risk assessments into your master internal audit checklist template, you're setting your team up for the future. You ensure they can confidently audit new technologies and use modern tools to do their jobs with more depth and efficiency than ever before.

You’ve done the hard work and built a fantastic internal audit checklist template. That's a huge win. But I’ve seen it happen time and again: a great template is created, then gets buried on a server somewhere, collecting digital dust. The moment you finalize version 1.0, its real life—and the need to maintain it—begins.

If you let it stagnate, your template quickly becomes obsolete. Audits start missing new risks and ignoring updated regulations. To stop this from happening, you have to treat your template as a living document, not a static file. This means setting up a clear review schedule, managing updates properly, and making sure the entire team can access it and help it evolve.

The relevance of your template is directly tied to the current risk landscape. So, its review cycle can't just be a random date on the calendar; it should be integrated with your company's core risk management activities. The whole point is to keep your checklist sharp and focused on what matters right now.

At a minimum, plan for a comprehensive review once a year. The perfect time for this is during your annual risk assessment and audit planning. As new strategic risks are identified for the coming year, you can immediately build them into your master template as concrete audit steps.

But an annual check-in isn't always enough. You need to be ready to move faster. Your checklist should be updated any time there's a significant trigger event, like:

This proactive mindset is what keeps your audits relevant and prevents them from falling behind the pace of the business.

Key Takeaway: The real power of an audit template isn't just in creating it, but in constantly refining it. When you treat it like a living document, you elevate it from a simple checklist to a dynamic tool that improves audit quality every single time.

As your template changes, version control can get messy fast. I’ve seen teams waste time and effort auditing with outdated checklists, which leads to inconsistent work and missed findings. The good news is that this chaos is completely avoidable with a few simple rules.

First, establish a single source of truth. Your master template needs one—and only one—central home. This could be a shared drive, a SharePoint site, or, even better, a dedicated audit management platform. Whatever you do, don't let it live on individual laptops. That’s a recipe for disaster.

Next, get serious about a naming convention. A simple format like IA_Checklist_Master_v2.1_2024-Q4 works wonders. It tells everyone at a glance which version it is and when it was updated. When you release a new version, make sure you archive the old one. This stops people from using it by mistake while giving you a historical record of how your audit approach has matured.

A perfect template is useless if your team can’t find it or doesn't know how to use it properly. Simply attaching the file to an email and hitting "send" won't cut it. Effective sharing and training are what turn your template into a true organizational asset.

Start by hosting the template in a collaborative, cloud-based environment. This ensures everyone is always working from the most current version. For any organization, especially those handling sensitive investor data, secure systems with robust audit trails are non-negotiable. It's a foundational principle, and you can see how we apply it by reviewing our privacy policy for more on our data management practices.

Finally, training needs to be more than a quick walkthrough. The goal is to empower your auditors to not just follow the template, but to actively make it better. Create a clear feedback loop. If an auditor finds a procedure that's confusing or a risk that's missing, they should know exactly how to suggest an update. This turns your internal audit checklist template from a top-down mandate into a collaborative tool that harnesses the collective wisdom of your entire team.

Even with a detailed guide, a few questions always seem to come up once you start putting a new tool into practice. Here are some straightforward answers to the common questions we get about creating and using an internal audit checklist template.

Think of your checklist template as a living document, not a static file you create once and forget about. At a bare minimum, it needs a thorough review at least once a year. The perfect time for this is when you're already doing your annual risk assessment and audit planning.

That said, don't wait for the annual review if something big changes. You’ll want to update it immediately whenever a significant event happens. This could be anything from rolling out a new ERP system, facing major regulatory shifts like the new IIA Global Standards, or when leadership flags a new strategic risk. Staying on top of these changes ensures your audits are always focused on what truly matters to the business right now.

You can, but it’s a two-step process. The best approach is to start with a foundational or "master" template. This core document will hold all the universal elements that apply to every audit, like sections for planning, defining objectives, and outlining the reporting process.

From that master template, you absolutely need to create specialized versions. An operational audit checklist will naturally focus on process efficiency, resource allocation, and workflow bottlenecks. A financial audit checklist, on the other hand, will be all about the accuracy of financial statements and the strength of internal controls over reporting.

The key is to use the master template for consistency but then customize it heavily for the specific scope and goals of each type of audit.

The single most common—and damaging—mistake is treating the checklist as a rigid script instead of a flexible guide. It’s supposed to be a guardrail, not a straitjacket.

The biggest mistake is treating the checklist as a box-ticking exercise instead of a guide. A checklist is there to ensure thoroughness and consistency, not to replace professional judgment or critical thinking.

When auditors just go down the list checking boxes, they often fail to apply professional skepticism. They miss the subtle red flags and the unique nuances of the process they’re reviewing. The whole point of the template is to spark deeper inquiry, not shut it down.

A great auditor uses the checklist to make sure all the core risks are covered, but they stay nimble enough to chase down unexpected findings. The template should be a launchpad for a thoughtful examination, prompting the auditor to think critically about potential weaknesses, not just confirm that a control exists on paper.

This is what separates a basic compliance audit from a strategic one that actually adds value to the organization. The checklist is a tool to support the auditor's expertise, not a substitute for it.

Ready to move beyond manual processes and elevate your fund's operations? Fundpilot empowers emerging fund managers to upgrade from cumbersome spreadsheets to institutional-grade reporting, administration, and compliance. Our platform provides the audit-ready records and professional tools you need to secure larger commitments and focus on what you do best—sourcing deals and raising capital. Discover how Fundpilot can accelerate your growth.