Master your next audit with our comprehensive financial audit checklist. Explore 7 key steps for a seamless and compliant review process in 2025.

A financial audit can feel like a daunting, high-stakes examination. Yet, with the right preparation, it transforms into a valuable opportunity to validate financial health, uncover operational efficiencies, and strengthen stakeholder confidence. For emerging fund managers and growing businesses, a smooth audit is not just about compliance; it is a cornerstone of building institutional credibility and attracting investment. This comprehensive financial audit checklist breaks down the entire process into manageable, high-impact focus areas, turning a complex requirement into a clear roadmap for success.

We will move beyond generic advice, providing you with actionable steps, real-world examples, and specific documentation you need to gather for each stage of the audit. Think of this as more than just a list. It is a strategic guide designed to help operations teams, compliance officers, and fund managers proactively organize their financial records. By following this guide, you can shift your audit from a stressful obligation to a strategic asset, ensuring your records are not just correct, but truly audit-ready.

This article specifically focuses on the core financial components, but a successful audit often begins with broader organizational readiness. For a comprehensive guide on readying your entire organization for any type of audit, you might find our ultimate audit preparation checklist to be an invaluable resource. Now, let’s dive into the seven critical financial areas you need to master.

A financial audit checklist is incomplete without a rigorous evaluation of your organization's internal controls. This foundational step involves assessing the design and operational effectiveness of the policies and procedures management has established. Strong internal controls are the bedrock of reliable financial reporting, operational efficiency, and regulatory compliance, acting as the first line of defense against fraud and error.

The process is not just about ticking boxes; it's a deep dive into how your company safeguards assets, authorizes transactions, and maintains accurate records. Auditors examine everything from segregation of duties, where no single individual has control over all aspects of a financial transaction, to the automated systems governing revenue recognition. The infamous 2016 Wells Fargo scandal, where control failures led to fraudulent accounts, serves as a stark reminder of the critical importance of this process. A thorough review ensures that the controls you have on paper are functioning effectively in practice.

To effectively test internal controls, auditors and finance teams must adopt a structured, risk-based methodology. This ensures that the most critical areas of the business receive the most attention, optimizing audit resources and maximizing effectiveness.

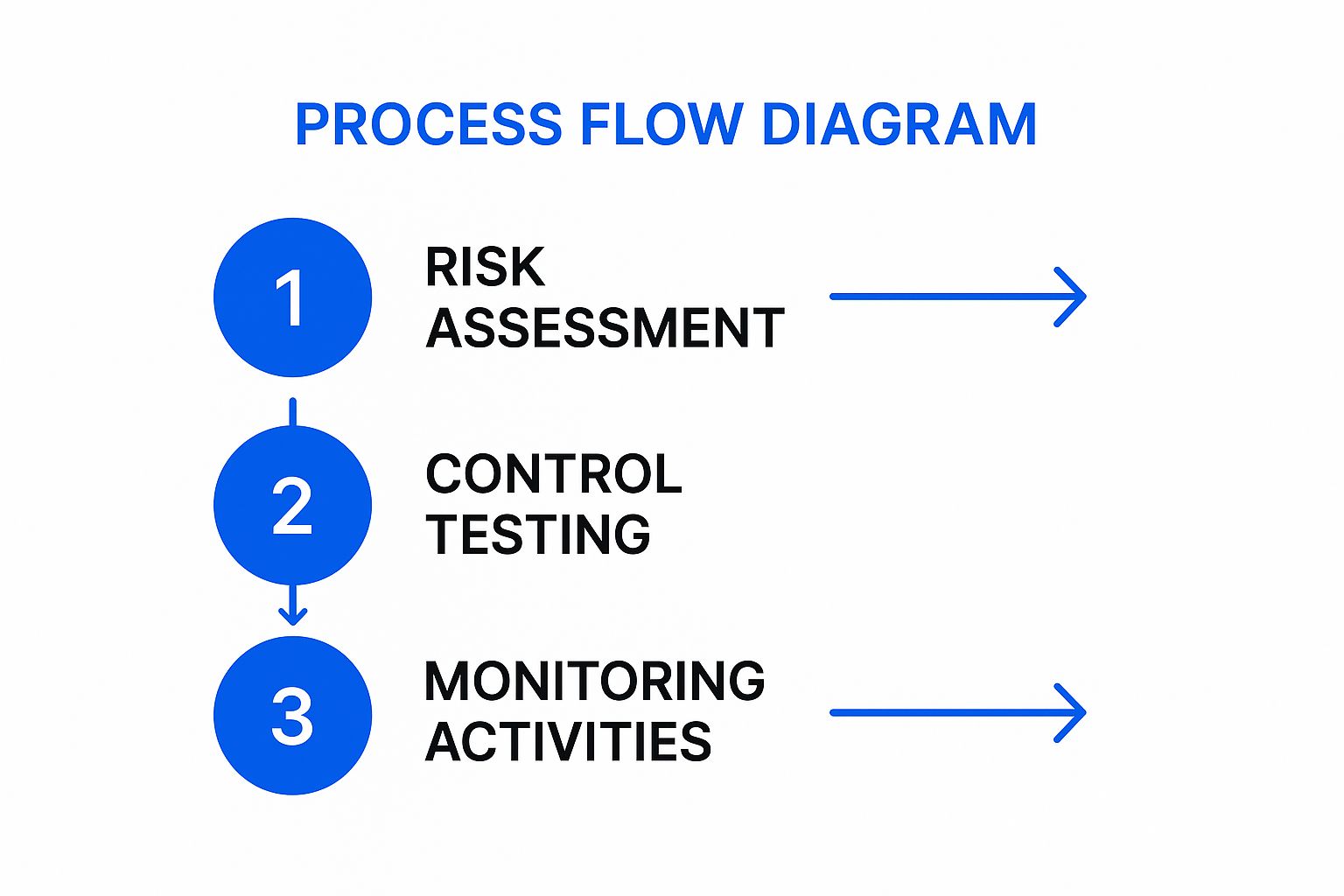

The following infographic illustrates the cyclical, three-step process for a systematic evaluation of internal controls.

This process flow highlights that effective control evaluation is an ongoing cycle, not a one-time event, starting with identifying risks and culminating in continuous monitoring for sustained compliance.

To make this a practical part of your financial audit checklist, consider these strategies:

By proactively reviewing and testing your internal controls, you not only prepare for a smoother audit but also strengthen your organization's overall governance and risk management framework. For more guidance on structuring your review, you can find valuable insights on how to build a better internal audit checklist template.

A cornerstone of any financial audit checklist is the rigorous verification of cash and bank reconciliations. This process confirms one of the most liquid and susceptible assets an organization holds: cash. It involves a detailed examination of cash balances, bank statements, and the reconciliations that tie them together to ensure accuracy, completeness, and the proper cutoff of cash transactions. Strong cash verification procedures are vital for detecting misstatements, preventing fraud, and ensuring the company's reported cash position is reliable.

The goal is to substantiate the cash balance reported on the balance sheet. Auditors achieve this by independently confirming balances directly with financial institutions and meticulously scrutinizing the reconciling items, such as outstanding checks and deposits in transit. This step is critical because cash is universally high-risk. A famous example is the early 2000s Enron scandal, where complex and often misleading cash management structures were used to hide debt and inflate earnings, underscoring the need for auditors to perform extensive bank confirmation and reconciliation procedures.

To effectively audit cash, a methodical approach is necessary. This involves more than just agreeing on a number; it requires understanding the entire cash management process, from receipts to disbursements, and verifying the integrity of the reconciliation process itself. This systematic evaluation confirms that recorded cash exists and that all cash transactions for the period have been recorded correctly.

The following process provides a clear framework for conducting a thorough verification of cash and bank balances, ensuring all key assertions are addressed.

This structured procedure ensures that the cash balance is not only mathematically correct but also fairly presented in the context of the company's overall financial position.

To integrate this verification process into your financial audit checklist effectively, consider these practical strategies:

A crucial component of any financial audit checklist is the rigorous examination of revenue recognition and cutoff procedures. This step focuses on verifying that revenue transactions are recorded in the correct accounting period and measured accurately according to standards like ASC 606. Improper revenue recognition is a leading cause of financial restatements, making this area a high-risk focus for auditors.

The process involves more than just matching invoices to payments; it's a deep dive into the specifics of contracts and performance obligations. Auditors scrutinize whether revenue is recognized when control of goods or services is transferred to the customer, not just when cash is received. The infamous Xerox accounting scandal in the early 2000s, where the company prematurely booked revenue from long-term leases, underscores the severe consequences of getting this wrong. A thorough review ensures revenue is not overstated in the current period or understated to manipulate future earnings.

To effectively audit revenue, finance teams and auditors must employ a structured methodology that addresses timing (cutoff), measurement, and presentation. This approach ensures that the audit procedures are comprehensive and specifically target the areas most susceptible to misstatement, as dictated by the complexity of the company's revenue streams.

This systematic process involves verifying transaction details against underlying contracts, assessing the timing of revenue recognition around the period-end, and confirming compliance with applicable accounting frameworks. This structured verification is essential for providing assurance over the accuracy of the most critical figure on the income statement.

To make revenue testing a practical and effective part of your financial audit checklist, consider these strategies:

By systematically testing revenue recognition and cutoff, you validate the accuracy of your reported performance and strengthen investor confidence in your financial statements. For those navigating complex revenue streams, understanding the nuances of fund accounting vs. corporate accounting can provide valuable context for these critical audit areas.

A crucial component of any financial audit checklist is the rigorous examination of accounts receivable (AR) and the corresponding allowance for doubtful accounts. This step involves more than just verifying outstanding balances; it's a critical assessment of an asset's collectibility and the reasonableness of management's estimates. An accurate AR valuation is fundamental to presenting a true and fair view of a company's financial health, directly impacting reported revenue and net income.

Auditors delve into the processes for granting credit, invoicing customers, and collecting payments to evaluate the overall health of the receivables portfolio. This scrutiny ensures that the balance sheet doesn't overstate assets with amounts that are unlikely to be collected. For instance, a healthcare organization must meticulously manage complex insurance and patient receivables, where collection rates can vary dramatically. Failure to properly estimate uncollectible accounts can materially misstate financial results, undermining investor confidence and regulatory compliance.

To effectively audit accounts receivable, auditors must employ a structured methodology that combines direct confirmation, analytical procedures, and a detailed review of aging schedules. This ensures that the recorded receivables are valid, accurate, and likely to be converted into cash.

The evaluation process typically follows a clear path from confirming existence to assessing valuation. This involves verifying balances directly with customers, analyzing historical collection patterns, and stress-testing the assumptions used to calculate the allowance for credit losses. This systematic review provides comprehensive assurance over one of the most significant assets on the balance sheet.

To make this a practical part of your financial audit checklist, consider these strategies:

By systematically analyzing your accounts receivable and the adequacy of your allowances, you ensure the integrity of your reported earnings and provide stakeholders with a reliable picture of your company's liquidity and operational effectiveness.

For companies holding physical goods, the inventory line item on the balance sheet is often one of the most significant assets. A crucial component of any financial audit checklist is the verification of inventory quantities and the assessment of its valuation. This process goes beyond simply agreeing on numbers; it involves physically observing inventory counts, testing the costing methods used (like FIFO or weighted average), and ensuring the inventory is valued correctly according to accounting standards.

This step is vital for confirming that the asset is not materially misstated, either through inaccurate counts or improper valuation. Auditors must scrutinize the entire process to guard against overstatement of assets and understatement of expenses. For example, automotive companies like Ford rely on precise just-in-time inventory systems where even small discrepancies can signal significant operational or financial issues. A robust verification process provides assurance to stakeholders that the reported inventory value is both accurate and fairly presented.

To effectively audit inventory, both the physical existence and its carrying value must be substantiated. This requires a structured methodology that combines direct observation with detailed analytical testing. Auditors and management must work together to ensure the process is efficient, comprehensive, and minimizes disruption to daily operations.

This approach ensures that every angle is covered, from the physical items on the shelves to the complex calculations that determine their financial value. It addresses the core risks associated with inventory: existence, completeness, and valuation.

To make inventory verification a smooth part of your financial audit checklist, consider these practical strategies:

By systematically verifying both the physical count and the valuation method, you provide strong evidence supporting one of the most material assets on the balance sheet. For further reading on asset valuation principles, you can gain more insights from this guide to the valuation of private company assets.

A comprehensive financial audit checklist must include a detailed review of an organization’s fixed assets and related depreciation. This step involves examining the lifecycle of property, plant, and equipment (PP&E), from acquisition and capitalization to depreciation and eventual disposal. Proper management and accounting for these long-term assets are crucial for accurately reflecting a company's financial health, as they often represent a significant portion of the balance sheet.

This is not a simple inventory count; it's a deep dive into the policies and calculations that govern these substantial investments. Auditors scrutinize whether asset additions are capitalized correctly, if depreciation methods are applied consistently and are appropriate for the asset type, and if disposals are recorded accurately. For asset-intensive industries, this process is paramount. For example, an airline like Delta must meticulously manage aircraft depreciation schedules and maintenance reserves, while technology firms must properly evaluate the capitalization of software development costs. A thorough review ensures that asset values are not overstated or understated, preventing material misstatements.

To effectively audit fixed assets, finance teams and auditors need a structured methodology that covers acquisition, valuation, and disposal. This ensures all facets of the asset lifecycle are examined for accuracy, compliance with accounting standards, and consistency with prior periods.

This systematic verification process ensures that the physical existence, valuation, and accounting treatment of fixed assets are rigorously tested, providing confidence in the figures presented on the financial statements.

To integrate this critical step into your financial audit checklist, consider these practical strategies:

By diligently analyzing fixed assets and depreciation, you safeguard the integrity of your balance sheet and provide stakeholders with a true and fair view of the company's operational base. For fund managers dealing with portfolio companies that have significant fixed assets, understanding these nuances is essential. You can find more detailed guidance on handling complex asset structures by mastering private equity accounting.

A crucial element of any comprehensive financial audit checklist involves the meticulous verification of debt obligations and related interest expenses. This process goes beyond simply agreeing balances to statements; it's a deep-seated examination of all borrowings, including bank loans, bonds, convertible notes, and lines of credit. The primary goal is to ensure that liabilities are completely and accurately reported and that the associated interest expenses and financing costs are correctly calculated and recognized in the proper period.

Misstating debt can have a significant ripple effect across the financial statements, impacting key metrics like leverage ratios, solvency, and profitability. Auditors scrutinize these areas closely because debt agreements often contain complex terms and covenants that can affect a company's financial health and operational freedom. For instance, Tesla's use of convertible bonds involves complex accounting for embedded derivative features, which requires specialized knowledge to audit correctly. A thorough review in this area provides stakeholders with confidence that the company's financial obligations are transparently and accurately disclosed.

To effectively audit debt and interest, both finance teams and auditors should follow a structured approach that confirms existence, completeness, valuation, and disclosure. This method ensures all aspects of debt accounting, from initial recognition to covenant compliance, are thoroughly vetted.

The process involves obtaining independent confirmations, analyzing agreements for critical terms, recalculating expenses and amortization schedules, and ensuring compliance with all contractual obligations. This systematic verification prevents surprises and ensures the financial statements present a true and fair view of the company’s liabilities.

To integrate this verification process into your financial audit checklist effectively, consider these practical strategies:

By diligently verifying debt and interest expenses, you ensure accurate financial reporting and demonstrate robust control over your organization's financial obligations, which is a cornerstone of a successful audit.

| Audit Procedure | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Review and Test Internal Controls | High - requires experienced judgment and specialized IT audit skills | High - time-intensive and resource-heavy | Identification of control weaknesses, reduced substantive testing, compliance assurance | Companies seeking operational improvements and regulatory compliance | Early detection of risks, valuable management insights |

| Cash and Bank Reconciliation Verification | Moderate - coordination with banks needed, follow-ups can be extensive | Moderate - straightforward testing but time-consuming if many accounts | Assurance over cash accuracy and fraud prevention, understanding liquidity | Entities with multiple bank accounts and high fraud risk | High regulatory focus, critical for cash flow accuracy |

| Revenue Recognition and Cutoff Testing | High - involves complex accounting standards and subjective judgments | High - extensive documentation review and specialized knowledge | Accurate revenue reporting, compliance with ASC 606/IFRS 15, prevention of misstatements | Revenue-heavy businesses with complex contracts | Addresses high inherent risk, critical for stakeholder decisions |

| Accounts Receivable and Allowance Analysis | Moderate - requires judgment and statistical techniques | Moderate - dependent on confirmations and subsequent collection testing | Evaluation of collectibility, allowance adequacy, and credit quality | Businesses with significant receivables and credit risk | Insights into customer relations and cash flow forecasting |

| Inventory Valuation and Physical Count Verification | High - physical counts and costing methods can be complex and disruptive | High - manpower and coordination needed for counts and testing | Accurate inventory valuation, detection of obsolescence, compliance with standards | Manufacturing, retail, and industries with large inventories | Strong physical evidence, directly impacts margins |

| Fixed Assets and Depreciation Analysis | Moderate - requires review of depreciation, impairment, and capital transactions | Moderate - testing calculations and asset verification | Proper asset capitalization, accurate depreciation, impairment assessment | Organizations with significant PP&E and capital expenditures | Systematic testing possible, physical verification of assets |

| Debt and Interest Expense Verification | Moderate - may require specialized review of complex instruments | Moderate - confirmations and legal document reviews needed | Accurate liability reporting, proper interest expense recognition, covenant compliance | Entities with significant borrowings and debt covenants | Easily confirmable balances, critical financial risk clarity |

Navigating the intricacies of a financial audit can feel like a monumental task, but as we've detailed, it's a process that can be systemized and mastered. The comprehensive financial audit checklist provided in this guide is more than a simple to-do list; it's a strategic framework for building institutional-grade operational integrity. From meticulously verifying cash and bank reconciliations to conducting thorough fixed asset and depreciation analyses, each step is a building block toward a stronger, more transparent financial foundation.

The true value of this process extends far beyond a clean audit opinion. For emerging fund managers, mastering this level of diligence is a critical differentiator. It demonstrates to potential and existing Limited Partners that your firm is not just focused on generating returns, but is also committed to robust governance, risk management, and operational excellence. This commitment is the bedrock of long-term trust and sustained capital allocation.

The ultimate goal should be to transform the audit from a reactive, annual scramble into a proactive, continuous state of readiness. The key takeaways from our checklist reinforce this shift in mindset:

By internalizing these principles, your back office evolves from a cost center into a strategic asset. The discipline required to maintain an audit-ready state fosters a culture of accuracy and accountability that permeates the entire organization, from the deal team to investor relations.

An audit is a snapshot in time, but the processes you build to prepare for it create lasting value. Diligently applying this financial audit checklist ensures that your firm is not just passing an examination but is building a resilient operational infrastructure. This infrastructure supports scalability, reduces operational risk, and frees up your team's most valuable resource: time.

Instead of dedicating weeks or months to manually gathering data, reconciling spreadsheets, and answering auditor queries, your team can focus on higher-value activities like performance analysis, LP communication, and sourcing the next great investment. This operational efficiency is not a luxury; for funds managing between $10M and $100M, it's a competitive necessity for scaling AUM and attracting institutional capital. The message to the market becomes clear: your firm is built on a foundation of integrity, ready for scrutiny, and poised for growth.

Ready to move beyond manual spreadsheets and embed audit-readiness into your daily operations? See how Fundpilot centralizes your data, automates fund administration, and provides a complete compliance trail, turning your next audit into a simple verification process. Explore the platform built for institutional-grade fund management at Fundpilot.