Learn what is subscription agreement, how it works, and its key terms. Our comprehensive guide explains this essential document for investors and founders.

When you hear "subscription," you probably think of your favorite streaming service. But in the world of private funds and investments, a subscription agreement is something entirely different—and far more significant.

Think of it as the documented, legally-binding handshake that finalizes a private investment. It’s the formal contract that takes a potential investor’s interest and solidifies it into a concrete, legally recognized commitment to buy into a fund or company.

This single document is where the rubber meets the road. It serves two crucial, intertwined purposes. For the investor, it's their official offer to purchase a specific number of shares or a certain partnership interest at a set price. For the company or fund, it’s the formal acceptance of that offer, locking in the capital and ensuring the entire transaction is above board and properly documented.

Before a single dollar is wired, the subscription agreement lays out the rules of the game for the entire investment relationship. It’s all about getting everyone on the same page, which is absolutely critical because private investments are a different beast than buying public stocks. They come with their own set of rules, disclosures, and legal hurdles.

A well-drafted subscription agreement leaves no room for ambiguity. It’s designed to accomplish a few key things right from the start:

To help visualize how this works for both sides, here’s a quick breakdown of the core components.

| Component | What It Means for the Investor | What It Means for the Company |

|---|---|---|

| Commitment Amount | This is your formal offer to invest a specific amount of money. | This confirms the exact amount of capital you can expect from this investor. |

| Representations & Warranties | You are legally certifying your status (e.g., as an accredited investor) and your understanding of the risks. | This provides legal protection by ensuring the investor is qualified to participate in the offering. |

| Acknowledgement of Risk | You formally acknowledge that you have read the offering documents and understand the investment is speculative and illiquid. | This is a critical disclosure step that helps mitigate future legal disputes. |

| Signature & Acceptance | Your signature makes your offer official and legally binding. | The company's countersignature formally accepts your investment and closes the contract. |

This table shows how the agreement creates a clear, two-way street of obligations and protections.

Ultimately, the subscription agreement is the cornerstone of any private placement. It’s the document that officially brings an investor into the fold. It's important to distinguish it from other key documents. For example, our guide on the LP partnership agreement explains how that document governs the ongoing relationship between partners, whereas the subscription agreement is about the initial entry.

In essence, the subscription agreement is the gatekeeper. It ensures that only qualified investors who have formally agreed to the company's terms are allowed to participate in the offering.

This structured process protects everyone involved. The company gets to raise capital in a compliant way, sidestepping the massive legal headaches of an illegal public offering. At the same time, the investor gets a clear title to their ownership stake and a documented record of the terms. It’s the first, essential step toward building a relationship on trust and clarity.

Alright, now that we've covered the big picture, it's time to get into the weeds. A subscription agreement is packed with dense legal language where every word matters. For any investor or fund manager, getting a handle on these terms is non-negotiable. These clauses aren't just legal fluff; they are the very gears that make the investment work, spelling out obligations, confirming who’s eligible, and protecting everyone involved.

Think of it as the blueprint for your investment. Just like an architect’s plan details every material and measurement, the agreement lays out the precise terms of your financial commitment. Let’s break down the most critical parts, translating the legalese into plain English.

This is the most straightforward part of the document: the subscription price. It’s the specific price you agree to pay for each share or unit in the fund. This is always paired with your total commitment, which is simply the total dollar amount you're investing.

For example, you might agree to subscribe to 10,000 shares at a price of $5.00 per share, making your total commitment $50,000. This section locks in the valuation for your entry point, leaving no room for confusion about what you’re paying and what you’re getting.

This part of the agreement also gets into the nuts and bolts of payment, like wiring instructions and deadlines. It’s the foundational economic pillar the entire deal rests on.

Pay close attention here, because this is arguably the most important section from a legal and compliance standpoint. Representations and Warranties (often just called "Reps and Warranties") are a series of statements that you, the investor, must confirm are true. When you sign that document, you're legally attesting to the accuracy of these facts.

This isn't just a simple checkbox exercise—it's a binding legal promise. If you misrepresent something, even by accident, the consequences can be severe. The fund could have the right to cancel your investment or even take legal action if your misstatement causes them damages.

So, what are you actually warranting?

In the world of private investments, the party is usually open only to accredited investors. This isn't a snobby country club rule; it's a legal definition created by regulators like the SEC. The goal is to ensure that only people or entities with a certain level of financial sophistication—and the ability to absorb a potential loss—are participating.

To qualify, an investor has to meet specific income or net worth tests. For example, an individual generally needs an annual income over $200,000 (or $300,000 with a spouse) for the past two years, or a net worth exceeding $1 million, not counting their primary home.

When you sign a subscription agreement, you are legally certifying—under penalty of perjury—that you meet these financial criteria. This is what protects the fund from breaking securities laws that prohibit selling private shares to the general public.

This is a hard and fast rule. If a fund were to take money from a non-accredited investor without a proper legal exemption, it could face massive regulatory fines and put the entire fundraising effort at risk.

The subscription model itself is rapidly evolving, with the subscription economy projected to hit USD 196.34 billion by 2025 and an incredible USD 378.08 billion by 2030. This growth is being driven by trends like AI-driven personalization and a cultural shift from ownership to access, which influences how these agreements are structured. You can dig deeper into the research behind these market trends.

Finally, almost every subscription agreement will have language that restricts your ability to sell your shares. A lock-up period is a defined amount of time after the deal closes during which you are contractually forbidden from selling or transferring your stake.

This is standard practice, especially for companies heading toward an IPO, as it helps maintain stability in the market. Beyond a specific lock-up, the agreement will also state that the shares are "restricted securities." This is a legal term meaning they can't be sold on a public exchange like the NYSE and can only be transferred under very specific, legally-compliant circumstances. This clause is there to make sure you formally acknowledge the illiquid nature of private investments—a key risk you need to be comfortable with.

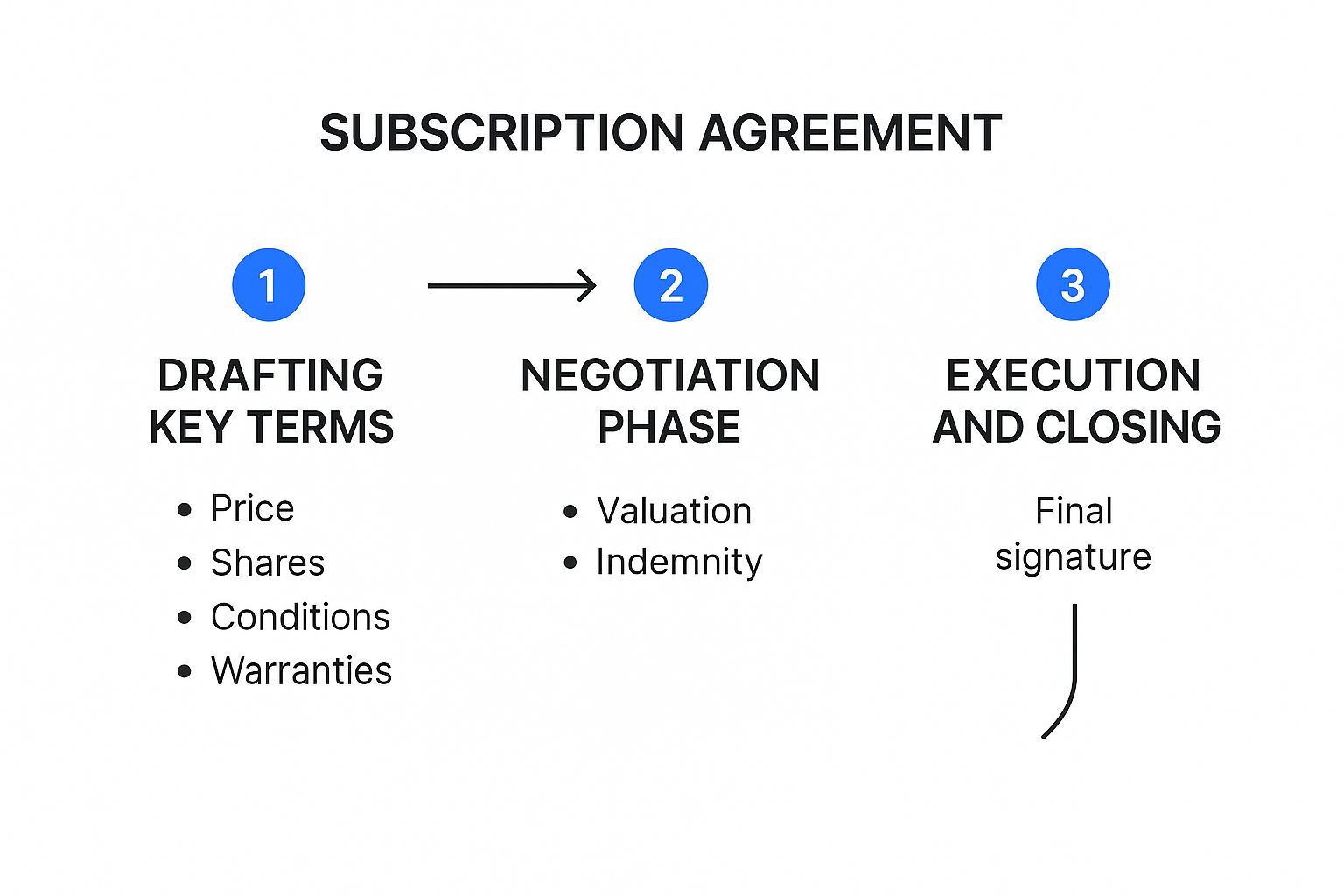

A subscription agreement isn't just a document that magically appears. Think of it as the final, crucial chapter in a story that turns a potential investor into a legal owner. It’s the culmination of a deliberate process, one with clear steps that protect everyone involved—both the fund managers raising capital and the investors committing to it.

Let's walk through how this journey unfolds, from the initial paperwork to the moment an investor officially has skin in the game.

Long before an investor even sees an application, the company and its legal team are hard at work preparing a full package of documents. The star of this show is usually the Private Placement Memorandum (PPM). This is the detailed playbook that lays out the business, the terms of the investment, and, most importantly, the risks.

The subscription agreement is drafted right alongside the PPM. In essence, it’s the official application form for the investment opportunity described in the memorandum. Getting this initial preparation right is everything—it ensures a compliant and transparent fundraising round from the get-go.

Once the investment opportunity is presented, the ball is in the investor's court. This is the due diligence phase. It’s time for the investor to roll up their sleeves and dig into the PPM and all the other documents.

They’ll analyze everything from the company's financial health and market position to the viability of its business plan. A smart investor will look at every angle, from the management team’s background to the competitive landscape.

During this stage, the subscription agreement gets a thorough review. The investor needs to be comfortable with the specific terms, the representations and warranties they’re making, and any restrictions on their shares. If it all checks out, they sign the agreement and send it back.

But here’s a key point: signing and returning the agreement isn't the final handshake. In legal terms, this is a formal 'offer' from the investor to buy the securities. The company hasn't actually accepted their money yet.

With the signed agreement in hand, the company now does its own due diligence on the investor. This is a critical step for keeping the capital raise clean and legal. The company’s checklist typically includes:

After this review, the company decides. They can accept the investor's subscription by countersigning the agreement, or they can reject it. A rejection might happen if the investor doesn't meet the criteria or if the funding round is already full.

The moment the company countersigns the agreement, the deal becomes legally binding. This kicks off the final leg of the journey.

First, the company will officially let the investor know they’ve been accepted. Then comes the capital call—the formal request for the investor to send over their committed funds. You can learn more about how this works in our guide: https://www.fundpilot.app/blog/a-guide-to-capital-call-in-private-equity

For founders going through this for the first time, understanding the nuances of early-stage fundraising is essential. These insights into raising a pre-seed round can be a fantastic resource.

Once the funds are received, the company finalizes everything by issuing the shares or partnership units to the investor. This might be a physical stock certificate or, more commonly, a simple book-entry record. Just like that, the investor has officially gone from an interested party to a part-owner.

Think of a subscription agreement less like a generic form you download and more like a custom-tailored suit. It’s built from the ground up to fit the unique contours of a specific investment. While the basic purpose is always the same—to bring an investor into a deal—the details shift dramatically depending on what you’re actually investing in.

This flexibility is the document’s real strength. An agreement has to reflect the specific risks, rewards, and legal realities of the opportunity on the table. The contract you’d use for a scrappy tech startup would be a terrible fit for a stable real estate syndication, and the other way around. Let's dig into how these documents change shape.

To really see this in action, let’s compare two completely different deals: a pre-seed tech startup and a real estate syndication buying a large commercial building. Both use a subscription agreement, but the content and focus couldn't be more different.

For the tech startup, the agreement is all about managing the wild ride of early-stage growth and potential. The document will lean heavily on terms like:

Switching gears, the real estate syndication agreement is grounded in the physical world. The investment is tied to a tangible asset, so the contract has to address a whole different set of concerns.

Here, you’ll find clauses covering:

A subscription agreement acts as a mirror, reflecting the unique economic reality of the asset being funded. Its job is to preemptively answer the most important questions an investor should be asking for that particular deal.

By tailoring the document this way, fund managers give investors the clarity they need to make a truly informed decision, all while providing critical legal protection for everyone involved.

This level of customization goes far beyond just startups and real estate. A subscription agreement for a venture capital fund will have clauses about portfolio diversification and how management fees are calculated. One for an oil and gas partnership will be packed with disclosures on geological survey risks and the wild swings of commodity prices.

In a way, this mirrors a much broader business trend. Look at the consumer world—the subscription e-commerce market is projected to grow from USD 20.58 billion in 2025 to USD 46.05 billion by 2034, all because companies are getting better at personalizing their offerings. The same principle applies here; the "product" is just a financial stake in a venture. You can read more about this explosive growth in the global subscription e-commerce market on Precedence Research.

This deep customization ensures that the answer to what is a subscription agreement? is never just "a legal form." It’s a dynamic instrument. For a startup investor, the big question is, "What happens in the next funding round?" For a real estate investor, it’s, "How is net operating income calculated and paid out?" A well-drafted agreement provides the right answers for the right deal.

https://www.youtube.com/embed/bgz2vNMTpxQ

Think of a subscription agreement as more than just a contract to invest—it's your legal fortress. Its most important job is to make sure your capital raise stays on the right side of some very complex securities laws. Anytime you sell shares to an investor, you're conducting a securities offering, a process that is watched closely by regulators like the Securities and Exchange Commission (SEC).

If you don't have the right legal framework in place, your private capital raise could accidentally be considered an illegal public offering. That's a mistake you don't want to make. It can trigger massive fines and, in some cases, force you to return every dollar you raised. The subscription agreement is the primary tool that helps you find a safe harbor, most often under an exemption called Regulation D.

Regulation D is a lifeline for private companies. It lets you raise money without going through the incredibly expensive and time-consuming public registration process, but only if you play by the rules. The biggest rule of all? You can only sell to qualified, sophisticated investors.

This is where the term accredited investor becomes critical. A subscription agreement is designed to get investors to formally state—or "represent and warrant"—that they meet the specific income or net worth criteria defined by the SEC. When an investor signs on the dotted line, they are making a legally binding statement about their financial standing.

This isn't just a box-ticking exercise; it’s your first line of defense. If a regulator ever questions your offering, you can present these signed agreements as proof that you took reasonable steps to ensure your investors were legally qualified to be in the deal.

This verification is a two-way street, protecting everyone involved.

Failing to properly document an investor's status can jeopardize your entire funding round. It’s a perfect example of why truly understanding a subscription agreement is so fundamental to raising capital legally.

Beyond just verifying investor status, the agreement helps you navigate other legal minefields. A well-drafted document acts as the single source of truth for the entire investment, heading off the kind of misunderstandings that can easily escalate into messy legal fights down the road.

The guiding principle is straightforward: if a promise or term isn't written into the agreement, it's not part of the deal. This prevents disputes over verbal commitments or unspoken expectations that were never formally agreed upon.

Here are a few common traps that a solid subscription agreement helps you avoid:

Compliance also means verifying who your investors are, a process governed by Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. To get a better handle on these critical steps, check out our fund manager's guide to KYC and AML compliance.

At the end of the day, the subscription agreement is the backbone of a transparent, compliant, and legally defensible investment process.

Let's be clear: a subscription agreement isn't just a formality. For both founders raising capital and investors putting it to work, getting this document right is crucial. This isn't about one side "winning" a negotiation; it's about laying a strong, transparent foundation for a partnership that could last for years.

A little diligence upfront can prevent a world of headaches down the road. By thinking proactively, both parties can sidestep common traps and start the investment relationship on the right foot.

As an investor, your signature is a major commitment. Before you even think about signing, you need to do your homework to protect your capital and fully grasp what you're stepping into. This goes beyond just liking the company—it's about digging into the legal framework that will define your investment.

Here's a practical checklist to make sure you've covered your bases:

For founders, the goal is to run a fundraising process that’s clean, compliant, and efficient. A smooth subscription process does more than just bring in cash; it builds immediate trust and credibility with your new partners. Think of it as setting a professional standard for the entire relationship.

Executing a capital raise is a direct reflection of your company's discipline. A sloppy, disorganized process can signal deeper operational problems to sharp investors, souring the relationship before it even starts.

Key strategies for a successful raise include:

The subscription model itself is a massive economic force. Beyond private equity, the global subscription e-commerce market hit a staggering USD 278.0 billion in 2024. It’s expected to explode to USD 6,369.9 billion by 2033, as more companies use recurring revenue models to build stability. You can dig into the trends driving this explosive market growth.

For founders, maintaining that investor trust long-term also means sticking to solid financial reporting best practices. By following these balanced guidelines, both founders and investors can move forward with confidence, ensuring everyone is protected and aligned for the journey ahead.

Even after you get the hang of the process, a few common questions always seem to pop up. Let's tackle some of the most frequent points of confusion we see from both investors and fund managers when they're working through a subscription agreement.

It helps to think of these as two separate steps in a journey. The subscription agreement is your ticket to get on the train—it's the one-time contract you sign to buy into the fund and become a limited partner (LP) or shareholder.

The shareholder agreement (or in the fund world, the Limited Partnership Agreement or LPA) is the rulebook for everyone already on the train. It lays out the ongoing relationship between all the partners, defining things like voting rights, distributions, and what happens if someone wants to leave. One is for getting in, the other is for how everyone behaves once they're in.

For the most part, no. To keep things fair and consistent for everyone investing in a particular round, the fund manager will present a standardized agreement. It's a take-it-or-leave-it situation for most investors.

The exception? A major lead investor—the one putting in a significant chunk of capital—might have the clout to negotiate special terms. These unique conditions aren't usually baked into the main agreement. Instead, they're documented in a separate contract called a "side letter." This keeps the core agreement the same for everyone else while giving the lead investor their negotiated perks.

Be warned: Misrepresenting your accredited investor status is a huge deal. It’s not just a minor fib. This can void your entire investment and create serious legal headaches for both you and the fund, potentially torpedoing the whole capital raise by violating critical securities laws.

Ready to move beyond spreadsheets and manage your fund like a top-tier firm? Fundpilot provides the institutional-grade reporting, streamlined operations, and automated administration you need to focus on what matters most: sourcing deals and raising capital. Learn more and book your demo today.