Learn what is an evergreen fund and how its perpetual structure provides long-term growth and liquidity for private market investors.

Imagine an investment fund that never has to close its doors. That’s the basic idea behind an evergreen fund. It's a type of investment vehicle with no expiration date, designed to continuously raise money and make new investments over and over again. Think of it less like a project with a deadline and more like a perpetually running business.

Most people in finance are familiar with traditional closed-end funds. These have a fixed lifespan, usually around 10 to 12 years, where they raise money, invest it, and then eventually sell everything off to return capital to investors. An evergreen fund completely flips that model on its head by being perpetual.

This open-ended structure fundamentally changes how a fund manager approaches their work and how investors think about their commitment. Instead of a single, massive fundraise followed by a slow wind-down, the capital flow is much more dynamic. It’s a model that offers a unique mix of stability and flexibility, making it an attractive option in certain corners of the investment world. To see how it fits into the bigger picture, it helps to understand broader financing strategies as well.

The most defining feature of an evergreen fund is its ability to accept new capital on a regular basis. There isn't a single, high-pressure "closing" period. The doors are, for the most part, always open.

At its core, the evergreen model is about strategic patience. It allows fund managers to avoid forced exits at inopportune times, focusing instead on long-term value creation without the pressure of a ticking clock.

This structure is a natural fit for asset classes that don't fit neatly into a 10-year box, like long-hold real estate or certain types of private equity.

So, how does this actually work? The mechanics are built around longevity and adaptability. While the fine print can vary from fund to fund, a few core elements are almost always present:

To really get your head around an evergreen fund, don't think of it as a fixed pot of money. It's more like a living, breathing financial ecosystem. Capital is always moving—flowing in from new investors and out to those who need liquidity—which creates a dynamic balance that fuels both long-term growth and flexibility. This whole setup is built on a few core mechanics that make it unique.

The lifeblood of this model is continuous fundraising. A traditional fund slams the door shut after its initial fundraising push. An evergreen vehicle, on the other hand, keeps the door open, welcoming new capital at regular intervals, usually every quarter or six months. This lets the fund grow organically over time, freeing the manager from the intense pressure of launching a brand new fund every few years.

This constant inflow of cash is crucial for two reasons. First, it gives the fund manager fresh "dry powder" to seize new investment opportunities as they pop up. Second, it's the engine that powers one of the structure's biggest draws for investors: getting their money out when they need it.

Perhaps the most critical piece of the puzzle is how investors can actually access their capital. Evergreen funds are semi-liquid, striking a balance between the instant liquidity of public stocks and the decade-long lock-ups you see in most closed-end private funds.

This is all managed through scheduled redemption windows. At set times—typically quarterly, semi-annually, or annually—investors can put in a request to pull out some or all of their money. To keep the fund from being destabilized by a sudden rush for the exits, these redemptions are usually governed by a few ground rules:

This structure gives investors a clear, predictable path to liquidity, which is a world away from traditional private funds where your capital is tied up for a fixed term. It’s a huge reason these vehicles are becoming so popular.

To make all this buying and selling work, the fund’s Net Asset Value (NAV) has to be calculated on a regular basis, most often quarterly. This isn't a simple process; it involves putting a current value on every single underlying asset, from shares in a private startup to a portfolio of commercial real estate. Once the NAV is set, it determines the price per share for new investors coming in and for existing investors heading out.

This structure is a different breed of alternative investment vehicle. It stands apart from typical private equity funds, which generally have a fixed lifespan of around 10 years. Evergreen funds are built to last indefinitely, allowing managers to reinvest profits and let returns compound over the long haul.

This whole operational cycle—bringing in new money, investing it, valuing the assets, and handling redemptions—is a sophisticated juggling act. For a deeper dive into the building blocks of these vehicles, our guide to private investment fund structure is a great place to start.

The buzz around evergreen funds isn't just hype. This structure has gained serious traction for one simple reason: it offers a clear win-win for both the investors putting up the capital and the managers putting it to work. It’s a dynamic that traditional closed-end funds often can't replicate, blending long-term thinking with some much-needed flexibility.

For investors, one of the biggest perks is that their money gets deployed almost right away. Think about a typical closed-end fund—your capital can sit idle for months during a long fundraising slog. That "cash drag" can really blunt your initial returns. Evergreen funds, on the other hand, put your capital to work quickly, letting the power of compounding start on day one.

This structure also promotes a more natural approach to diversification. Since the fund isn't under pressure to invest a huge pile of money by a specific deadline, managers can be more deliberate. They can patiently build a well-rounded portfolio over time, whether it's in real estate, private equity, or other alternative assets.

From a fund manager’s perspective, the evergreen model is liberating. Traditional funds are usually handcuffed to a 10- or 12-year lifespan. This fixed timeline can force a manager’s hand, making them sell a fantastic asset too early simply because the clock is ticking, even if it's during a major market downturn. That kind of pressure can leave a lot of money on the table.

An evergreen fund scraps that artificial timeline. It empowers managers to hold onto great assets through entire market cycles, waiting for the perfect moment to exit and maximize returns for everyone involved.

This long-term mindset is a game-changer. Instead of being stuck in a perpetual fundraising cycle for the "next" fund, managers can actually focus on what they do best: sourcing great deals and growing their value. This stability also smooths out the operational side of things. If you want to dive deeper into the nuts and bolts, you can read our guide on what is fund administration.

When you look at it closely, the advantages for each party feed off each other. Investors get their capital deployed faster and have the potential for smoother, more consistent returns. In return, managers get the freedom to make smarter, long-term decisions without a countdown clock looming over their heads.

This alignment of interests is precisely why the model works so well. Evergreen funds give General Partners (GPs) the runway to navigate both booming markets and tough downturns without being forced to sell at the wrong time—a strategic advantage that ultimately benefits the Limited Partners (LPs). This is a core reason why understanding what is an evergreen fund has become essential for anyone serious about private market investing.

To really get a handle on what makes an evergreen fund tick, it’s helpful to compare it against its more traditional cousin, the closed-end fund. Think of them as two different road trip plans. One has a clear final destination and a set arrival date, while the other is an open-ended journey with no finish line in sight.

While both are used for private market investing, their core mechanics create fundamentally different experiences for everyone involved—from the fund manager to the limited partners (LPs).

The most glaring difference is the lifespan. A traditional closed-end fund is built to end. It typically has a fixed 10- to 12-year term. You raise the money once, you invest it, and then you sell everything off to return the capital and profits to your investors. An evergreen fund, on the other hand, is designed to run indefinitely. It's perpetual.

This one distinction creates a domino effect, influencing everything from how you raise money to how and when your investors can get their cash back.

In a standard closed-end fund, an investor’s capital is pretty much locked up for the entire life of the fund. If you need your money back early, you’re usually out of luck. Liquidity is essentially zero until the fund starts selling off its investments many years down the road. For a lot of investors, that's a tough pill to swallow.

Evergreen funds tackle this head-on with a semi-liquid structure. They offer scheduled windows—often quarterly or annually—where investors can redeem a portion of their stake. This is possible because the fund is always open to new capital, creating a balanced flow of money coming in and going out.

The core trade-off is simple: closed-end funds demand a long, illiquid commitment in the hunt for higher returns, while evergreen funds offer a blend of long-term growth with a welcome dose of predictable liquidity.

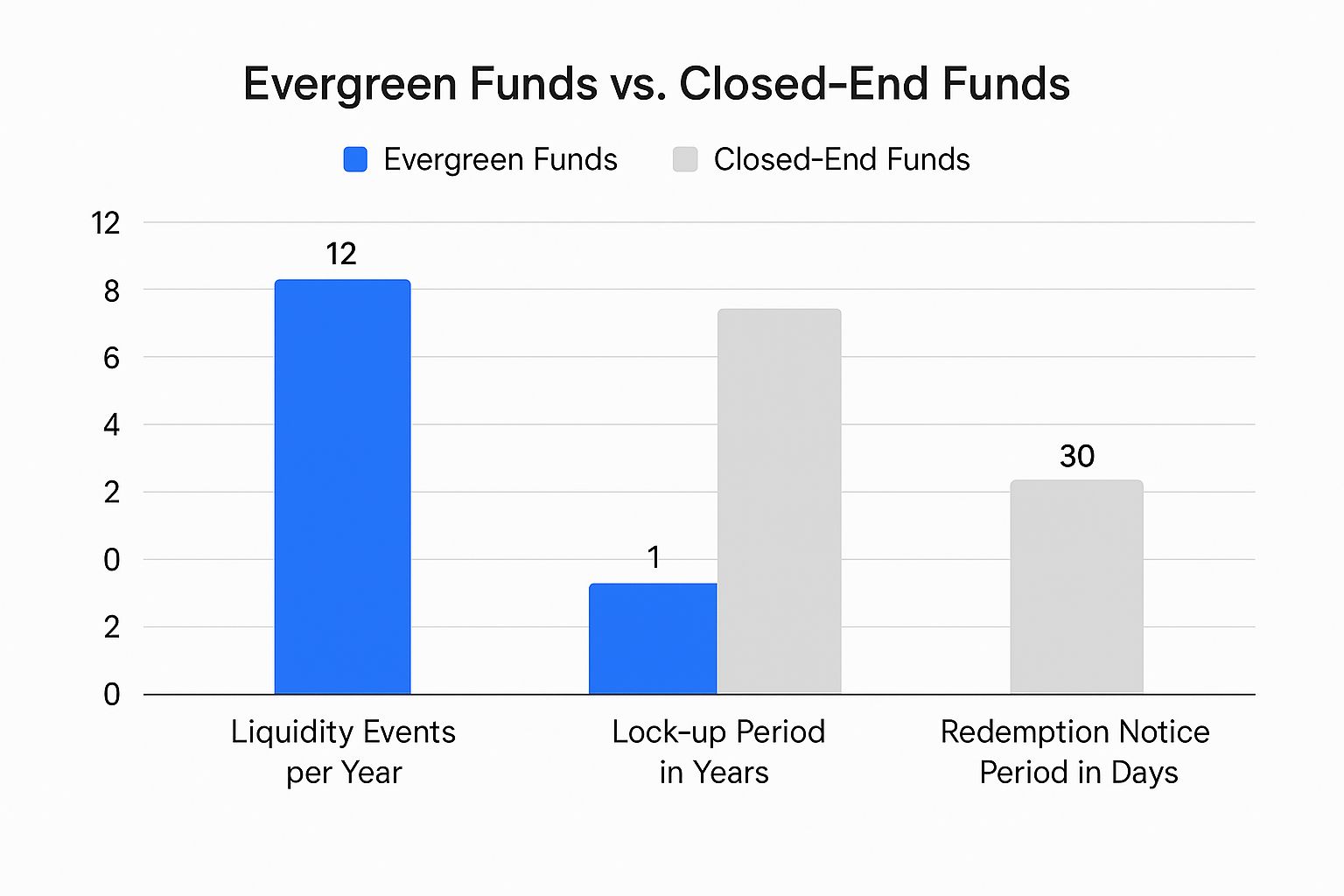

This image below paints a clear picture of just how different the liquidity experience is between these two models.

As you can see, the evergreen structure is built for flexibility, offering regular chances for investors to access their funds. It's a stark contrast to the decade-plus lock-up that’s standard for traditional funds.

For a closed-end fund, fundraising is a huge, all-or-nothing event. Managers are under immense pressure to raise a massive pool of capital in a single, concentrated push. The problem? That money often sits on the sidelines as uninvested "dry powder," which can drag down a fund’s initial performance.

The evergreen model completely changes this dynamic. Fundraising is a continuous, ongoing process. This means managers can deploy capital almost as soon as it comes in, jumping on good deals without delay. It’s a much more efficient approach that avoids cash drag and puts investor money to work right away, letting the power of compounding kick in sooner. This is a big part of what makes an evergreen fund so compelling in today's market.

Let's break down these differences side-by-side.

This table provides a simple, at-a-glance comparison of the core characteristics of evergreen and traditional closed-end fund structures.

| Feature | Evergreen Fund | Traditional Closed-End Fund |

|---|---|---|

| Lifespan | Perpetual / Indefinite | Fixed Term (e.g., 10-12 years) |

| Fundraising | Continuous / Ongoing | One-time capital raise |

| Liquidity | Periodic (e.g., quarterly) | Illiquid until asset sales |

| Capital Deployment | Immediate and continuous | Delayed by fundraising |

Ultimately, the choice between these two structures boils down to your long-term goals. One is a finite project with a clear beginning and end, while the other is a perpetual vehicle designed for continuous growth and compounding.

The evergreen fund model has some incredible upsides, but let's be real—no structure is perfect. For all its flexibility, this perpetual vehicle comes with its own unique set of trade-offs and complexities that both managers and investors need to get their heads around.

For the fund manager, it's a constant, delicate balancing act. You're trying to keep enough cash on hand to honor investor redemption requests while, at the same time, deploying capital to jump on new growth opportunities. This isn't like a closed-end fund with a predictable start and finish; it demands a completely different level of forecasting and liquidity management.

If you're an investor, the biggest risks usually come down to liquidity, especially when the market gets rocky. The promise of getting your money out periodically is a huge draw, but it's not always a guarantee.

A crucial concept here is the "redemption gate." Think of it as a safety valve. A fund manager can use it to limit or temporarily pause investor withdrawals. This prevents a "run on the fund" during a crisis, which protects the remaining investors from the fund having to sell assets at rock-bottom prices.

Another thing to keep an eye on is the long-term drag of management fees. Since the fund runs indefinitely, those fees keep coming, year after year. Over time, they can really compound and eat into your total returns if the fund's performance doesn't keep pace.

Managers face their own distinct operational headaches. Juggling cash flows, managing ongoing portfolio valuations, and making sure there's always enough liquidity is a continuous challenge.

Despite these hurdles, the evergreen structure is exploding in popularity. Over 1,000 such funds closed in just the first nine months of 2022 alone, which shows just how much global appetite there is for this model. You can dig deeper into this trend in a report from Private Equity International.

Getting a handle on these complexities is step one. Step two is making sure you have a firm grasp of the regulations. For a full breakdown, check out our guide to navigating private fund rules to stay compliant.

So, you're weighing your options and wondering, "Is an evergreen fund the right play for me?" It’s a great question, whether you’re looking to invest your own capital or manage it for others. This model has some unique perks, mixing the upside you see in private markets with a level of flexibility you don't typically get. But let's be clear—it's not a one-size-fits-all solution.

If you're an investor, think about your timeline. The ideal evergreen investor is someone playing the long game. You're chasing those higher private market returns but aren't willing to have your cash locked away for a decade or more.

An evergreen fund could be a perfect fit if you want your capital in assets like private equity or real estate, but you still want the option to get it back periodically. You get that "semi-liquid" middle ground—understanding it’s still a multi-year commitment, but with an escape hatch that traditional funds just don't offer.

For new and emerging fund managers, choosing an evergreen structure is a major fork in the road. It’s a commitment. Before you jump in, you need to be brutally honest about a few things.

The real takeaway is this: an evergreen fund is a powerful tool for those who prioritize long-term compounding and strategic patience over short-term liquidity. It’s a marathon, not a sprint.

In the end, it all comes down to a trade-off. You're balancing the desire for access and flexibility against the very real complexities of running a perpetual investment vehicle. For the right investor and the right manager, an evergreen fund provides a fantastic, sustainable framework for building real, lasting value.

As we dig into the world of evergreen funds, a few practical questions always pop up. This structure is a unique blend of private market investing and liquidity, which means it plays by a slightly different set of rules. Let's break down some of the most common queries to get a clearer picture of how these funds work on the ground.

The option for investors to redeem their capital is a key feature of the evergreen model, but don't mistake it for selling a public stock. The whole process is carefully managed through redemption windows, which are usually offered on a quarterly or semi-annual basis.

Investors can't just cash out on a whim. They need to submit a redemption request ahead of time, typically 30 to 90 days before the window opens. This lead time is crucial; it gives the fund manager the breathing room to line up the necessary cash without being forced into a fire sale of valuable assets. It’s a system built for orderly exits, not instant gratification.

It's also critical to understand the concept of "gates." Most funds cap the total amount of capital that can be withdrawn in any single period. For instance, a fund might limit redemptions to 5% of its Net Asset Value (NAV) per quarter. This is a protective measure to maintain the fund's stability, especially when markets get choppy.

Evergreen funds are built for the long game, so their portfolios are filled with assets that thrive on patient capital. You won't find managers day-trading stocks here. Instead, their holdings are focused on long-term, illiquid asset classes where true value is unlocked over years, not months.

You’ll commonly find assets like:

The perpetual nature of the fund means managers can hold these assets through entire economic cycles, sidestepping the pressure to sell at an arbitrary deadline like a traditional closed-end fund would have to.

The fee structure in an evergreen fund can be a bit more nuanced than the classic "2 and 20" model you see in many closed-end funds. Since there's no single, final exit event to trigger carried interest, performance fees have to be handled differently.

Management fees are pretty standard, usually around 1-2% of the fund's assets each year. The real difference is in the performance fees. These are often calculated and paid out periodically—say, annually—based on the fund's growth in value. These calculations almost always include a high-water mark, which ensures the manager only earns a performance fee if the fund's value is higher than its previous peak. It’s a smart mechanism that prevents investors from paying for the same performance twice.

Ready to move beyond spreadsheets and manage your fund with institutional-grade tools? Fundpilot empowers emerging managers with automated LP reporting, a professional investor portal, and streamlined back-office operations. Discover how Fundpilot can help you scale your fund today.