Master the complex world of private fund rules. Our guide simplifies SEC regulations, exemptions, and compliance for emerging fund managers.

Think of private fund rules as the house rules for an exclusive investment club. They dictate who gets on the guest list and how the club itself has to operate. While these funds, like hedge funds or private equity, aren't open to the public, regulators like the SEC still keep a close eye on them to protect investors and keep the broader market on stable ground.

Let's stick with that "exclusive investment club" analogy. A private fund is exactly that—invitation-only. This is the complete opposite of a public mutual fund, which anyone with a brokerage account can buy into. That exclusivity is the entire reason they're called "private," and it’s why they play by a different set of rules than their public cousins.

The main reason for this split comes down to the investors themselves. Private funds are typically restricted to accredited investors and qualified purchasers. In simple terms, these are people or institutions that the SEC considers financially savvy enough to understand the risks involved in complex, less-regulated investments. The assumption is they don't need the same hand-holding as the general public.

So, if these funds are so private, why do regulators get involved at all? It really boils down to two big goals: protecting investors and maintaining financial stability.

Even the most sophisticated investors can fall victim to fraud or outright mismanagement. The private fund rules set a baseline for professional conduct, making sure advisors act in their investors' best interests and are upfront about any potential conflicts.

More importantly, the private fund world has exploded in size. Global assets under management hit a staggering €13.2 trillion in 2024. When you're dealing with that much capital, what happens in private markets doesn't stay in private markets. A major blow-up could send shockwaves through the entire financial system, so regulators monitor these funds to keep systemic risk in check.

At their core, the private fund rules are a balancing act. They aim to give sophisticated investors the freedom to make their own deals while protecting the integrity of the capital markets from systemic risks. The whole framework is built on a foundation of disclosure and fiduciary duty.

This structure allows private funds to pursue complex, aggressive strategies that just wouldn't be appropriate for the retail market. Managing all the compliance that comes with this freedom is a heavy lift, which is why many managers turn to outside experts for help. You can get a better sense of this by reading about what fund administration is and the critical role it plays.

Putting private and public funds side-by-side really highlights just how different they are. From who can invest to how they operate, they occupy two distinct worlds. The table below breaks down the major distinctions.

| Characteristic | Private Funds | Public Funds (e.g., Mutual Funds) |

|---|---|---|

| Investor Access | Limited to accredited investors and qualified purchasers. | Open to the general public, no wealth or income tests. |

| Regulation | Governed by specific SEC rules and exemptions (e.g., Reg D). | Heavily regulated under the Investment Company Act of 1940. |

| Disclosure | Minimal public disclosure; reporting is confidential to LPs. | Extensive and frequent public disclosure of all holdings. |

| Flexibility | High degree of freedom in investment strategies and fees. | Strategies are restricted and fee structures are standardized. |

As you can see, the trade-off is clear: private funds offer greater flexibility and the potential for higher returns in exchange for higher risk and less transparency. Public funds, on the other hand, prioritize safety and accessibility for the average investor.

The world of private fund rules isn't standing still; it's a living, breathing thing. If you’re an emerging manager, just knowing today’s regulations won't cut it. To build a fund that lasts, you have to watch where the goalposts are moving across the globe. What’s happening in London or Singapore often gives you a sneak peek at what’s coming to your own backyard.

Think of it like seeing storm clouds gathering on the horizon. When you spot regulators in one part of the world digging into a specific issue, it gives you a crucial heads-up. You can start shoring up your own processes before the storm hits. This isn't just about avoiding trouble; it’s a genuine strategic advantage that turns compliance from a chore into a tool for building a stronger, more adaptable fund.

Major financial centers, especially the United Kingdom and Singapore, are paving the way toward stricter oversight of private markets. Their recent moves are a great preview of what regulators everywhere are starting to worry about. It’s not that rules will be copied verbatim, but there’s a clear, shared focus on protecting investors and keeping the market stable.

Three topics keep coming up again and again:

These aren’t just abstract ideas. Regulators are actively putting fund operations under a microscope. A perfect example is the UK's Financial Conduct Authority (FCA), which has really ramped up its scrutiny of private funds. The FCA's recent deep dive into how private market assets are valued shows just how essential strong governance is for maintaining fairness and investor trust. You can find a great breakdown of the FCA’s findings and other global trends in this detailed analysis from Kroll.

"Regulatory attention is a lagging indicator of market risk. When supervisors start asking questions about valuation and conflicts, it’s because those issues have already become pressure points within the financial system. Smart managers address them long before they are asked."

This global push for more transparency gets right to the heart of how you run your fund. It shapes everything from your firm's structure to how you talk to your investors. For example, the terms you lay out in your foundational documents carry more weight than ever. Getting those relationships and responsibilities right from the start is non-negotiable, and our guide on key clauses in an LP partnership agreement can help you navigate that.

As an emerging manager, staying ahead of this trend is your best bet. The direction of travel is clear: regulators are demanding more sophisticated risk management, clearer disclosures, and stronger internal controls from everyone—even smaller and newer funds.

Don't look at this as just another compliance burden. See it for what it is: a chance to build an institutional-quality firm from day one.

By getting your valuation, conflict management, and liquidity planning in order now, you’re not just ticking a box for today's private fund rules. You’re future-proofing your firm. This proactive approach builds incredible trust with limited partners, makes your fund stand out during due diligence, and lays a solid foundation for real, long-term growth.

Every private fund manager eventually hits a fork in the road, a critical decision point that will define their entire relationship with regulators. This choice is governed by the Investment Advisers Act of 1940, a cornerstone piece of legislation. You have to decide: will you become a fully Registered Investment Adviser (RIA) with the SEC, or can you operate under a specific exemption?

Think of it like this: an RIA is like a commercial truck driver. They need a special license, face more rigorous testing, and have to follow strict rules because they're responsible for a large, complex vehicle. On the other hand, an Exempt Reporting Adviser (ERA) is more like someone with a standard driver's license. They still have to obey the rules of the road, but the regulatory burden is much lighter.

Neither path is inherently "better." The right choice depends entirely on the kind of fund—or vehicle—you're driving.

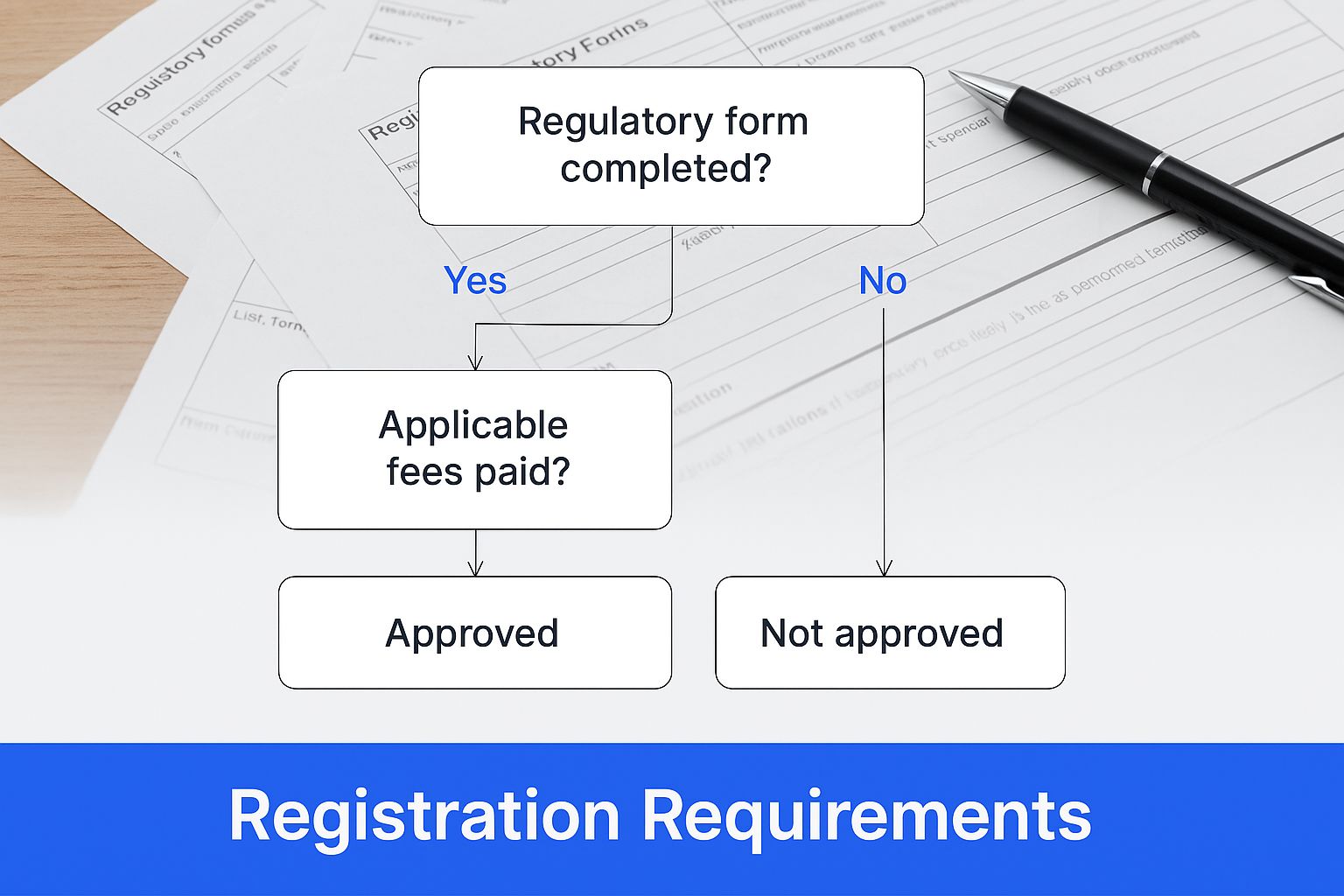

This chart helps visualize the decision tree you'll face as you work through these initial requirements.

As you can see, understanding your fund’s specific characteristics is the first step. That knowledge directly dictates which path you'll take through the regulatory maze.

For larger fund managers, becoming a fully Registered Investment Adviser is the main highway. If you manage $150 million or more in private fund assets, SEC registration isn't a choice—it's mandatory. This number is a major trigger in the private fund world.

Stepping into the RIA world means embracing a comprehensive set of obligations built for maximum investor protection. It's a serious commitment.

Going the RIA route requires a significant investment in compliance infrastructure. The upside? It signals to large, institutional investors that your firm operates at the highest regulatory standard.

For most new and emerging managers, jumping straight into full SEC registration isn't practical or even necessary. Thankfully, the Advisers Act provides a few off-ramps that allow smaller advisers to operate with a lighter regulatory touch. These firms are known as Exempt Reporting Advisers, or ERAs.

Now, "exempt" doesn't mean you're invisible. ERAs are still very much on the regulatory map. They have to file certain parts of Form ADV and are always held to fiduciary standards. The real benefit is sidestepping the most demanding and costly parts of full RIA compliance.

Don't mistake being an ERA for a regulatory free pass. It's a specific, limited exemption from full registration. You still owe a serious fiduciary duty to your investors and have important reporting obligations to the SEC.

So, how do you qualify as an ERA? Most private fund managers rely on one of two key exemptions.

This is the most well-traveled path for managers of typical hedge funds, private equity funds, and other similar vehicles. The requirements are straightforward:

This exemption is perfectly suited for managers who are growing their firms but haven't yet hit that mandatory registration threshold. It creates a clear runway to scale your operations without immediately taking on the heavy cost and complexity of an RIA compliance program.

This is a special carve-out designed specifically for managers of venture capital funds. The SEC's definition of a "venture capital fund" is quite detailed, but it generally means a fund that:

Here’s the big difference: unlike the Private Fund Adviser Exemption, this one has no AUM limit. A VC manager could have well over $150 million in AUM and still qualify as an ERA, as long as their funds check all the right boxes. This special treatment acknowledges the unique, long-term nature of venture capital and its crucial role in fueling innovation.

To make the distinction clearer, here's a quick summary comparing the key obligations and thresholds for RIAs and ERAs.

| Requirement | Registered Investment Adviser (RIA) | Exempt Reporting Adviser (ERA) |

|---|---|---|

| AUM Threshold | Required over $150M in private fund AUM | Generally under $150M in AUM (with exceptions for VC funds) |

| Form ADV Filing | Full, publicly available filing | Abbreviated, non-public filing |

| Compliance Program | Formal, written program required | Not explicitly required, but still subject to anti-fraud rules |

| Chief Compliance Officer | CCO designation is mandatory | Not required |

| Custody Rule | Subject to the full, complex rule | Not directly subject to the full Custody Rule |

| SEC Examinations | Subject to regular, routine exams | Not subject to routine exams, but can be investigated |

This table boils it down, but the nuance matters. The choice between RIA and ERA status is one of the first and most important strategic decisions you'll make. It directly shapes your budget, your day-to-day operations, and your compliance workload. Carefully weighing these rules against your fund's strategy and AUM is the critical first step toward building a successful and compliant firm.

Choosing your registration path is just the first step. The real test is keeping up with your compliance duties day in and day out. It's best to think of this not as a series of bureaucratic hurdles, but as the regular "health and wellness" routine for your fund.

This is the steady, disciplined work that keeps your firm strong, protects your investors, and builds a rock-solid reputation. A proactive system turns compliance from a burden into a genuine asset. It’s about more than just staying out of trouble with regulators; it’s about creating the kind of operational excellence that serious investors look for and trust.

For private fund managers, regulatory filings are your most direct and formal line of communication with the SEC. These aren't just forms you fill out. They are your firm’s official report card, detailing your activities, assets, and how you follow the rules.

The two most important filings you’ll get to know are Form ADV and Form PF.

For a closer look at the specific requirements for ERAs, our key compliance guide for Exempt Reporting Advisers breaks down everything you need to know to stay on track.

Beyond the big annual filings, a handful of rules govern your fund's day-to-day life. Three areas, in particular, demand constant attention: how you hold assets, how you talk about your fund, and how you keep your records.

The Custody Rule (Rule 206(4)-2) This rule exists for one simple reason: to prevent the loss or misuse of investor assets. It generally requires an adviser with custody of client funds to keep those assets with a "qualified custodian," like a bank or a registered broker-dealer. It also means you’ll need a surprise annual exam from an independent accountant to verify the assets are actually there.

The Marketing Rule (Rule 206(4)-1) This rule governs all your advertising and communications. For private funds, one of the most important aspects is how you present performance. If you show off your track record, you have to do it fairly and without being misleading. That means showing net performance (after all fees) and following very strict guidelines on using testimonials, endorsements, and third-party ratings.

Record-Keeping (Rule 204-2) Regulators live by a simple but powerful principle: if it isn’t written down, it didn’t happen. You are required to maintain extensive, organized records of just about everything—every investor email, every trade ticket, and every compliance decision. These records must be easy to access and kept for a set period, which is typically five years.

The ground is constantly shifting under private funds. Recent legal challenges to the Private Fund Adviser Rules (PFAR) put a spotlight on the SEC's authority, pausing a wave of new rulemaking. This came right after a period of intense proposals that aimed to apply a more retail-style disclosure framework to private funds. Advisers now have to navigate this uncertain environment, which could also present opportunities to shape a more practical regulatory future. You can explore what this new era means in this analysis from Cleary Gottlieb.

Knowing the private fund rules is one thing, but actually implementing them is a whole different ballgame. Building a compliance framework from the ground up can feel overwhelming, but it’s the bedrock that separates successful, scalable firms from those that eventually crumble under regulatory pressure. This isn't just about ticking boxes; it's about building a system that proves your fund’s integrity.

Think of it as creating the central nervous system for your firm. This system has to connect every moving part—from investor relations to portfolio decisions—back to a solid core of regulatory discipline. Honestly, it's less about avoiding SEC fines and more about earning institutional-grade trust from day one.

Let's be clear: you can't do this alone. The very first move is surrounding yourself with the right experts. Your choices here will determine how sturdy your entire framework is.

Choosing a Chief Compliance Officer (CCO): This is a non-negotiable for Registered Investment Advisers (RIAs) and a smart move for Exempt Reporting Advisers (ERAs). Your CCO can be an in-house hire or an outsourced professional. The key is finding someone with hands-on experience in your specific corner of the market, whether that's venture capital, private equity, or something else. You want a pragmatic partner, not just a rule-thumper.

Hiring Specialized Legal Counsel: This is no time for a generalist lawyer. You need a law firm that lives and breathes the Investment Advisers Act. They're critical for everything from structuring the fund and drafting your Form ADV to giving you straight answers when you hit a regulatory gray area.

This team is the foundation of your compliance program. They’re the ones who will translate dense legalese into practical, day-to-day policies for your firm.

I see a lot of new managers make the same mistake: treating compliance like a one-and-done setup project. The reality is, it's a living, breathing part of your business. A good compliance framework thrives when everyone on the team, from the analyst to the GP, understands their role in upholding the firm's duties.

A truly robust framework is more than just a binder of policies gathering dust. It's about weaving compliance into the very fabric of your fund's DNA. This "culture of compliance" means that ethical questions and regulatory rules are part of every decision, not a panicked afterthought.

This has to start at the top. As the manager, your commitment to doing things the right way sets the tone for everyone else. It means communicating clearly, conducting regular training, and fostering an environment where people feel safe to speak up about potential issues.

To put this into practice, I always recommend creating a compliance calendar. This simple tool maps out all of your recurring deadlines for the year—Form ADV amendments, investor reports, required training, you name it. It turns a mountain of abstract rules into a manageable workflow, so nothing gets missed while you’re out there finding deals and managing your portfolio. Getting ahead of these tasks is the final piece of the puzzle in building a fund that's resilient, trustworthy, and built for the long haul.

Jumping into the world of private funds can feel like learning a new language, especially when it comes to the rules. I've heard just about every question in the book from new managers. Let's tackle some of the most common ones to help you sidestep a few rookie mistakes and start with confidence.

Hands down, it's poor documentation and disclosure. It's easy to get tunnel vision on raising capital and sourcing deals—that’s the exciting part, after all. But new managers often forget to meticulously document everything from key decisions and investor updates to potential conflicts of interest.

Remember, regulators live by a simple creed: if it wasn't written down, it never happened. A minor hiccup that could have been easily explained can escalate into a serious violation during an SEC exam simply because the records aren't there. This isn't just about ticking boxes; it's about protecting investor trust and avoiding huge legal and financial headaches down the road.

This is a big one. For a new manager just getting started, you should plan for an initial legal and compliance setup cost anywhere between $50,000 to over $150,000. The final number really depends on your fund's strategy, how complex it is, and who your investors are.

A crucial thing to remember is that the ongoing annual costs for an Exempt Reporting Adviser (ERA) are typically a fraction of what a fully Registered Investment Adviser (RIA) pays. Your biggest expenses will be drafting the fund formation documents, managing SEC filings, and having a solid Chief Compliance Officer (CCO) on board, whether that's an in-house hire or an outsourced firm.

Absolutely, and it's a game-changer. Regulatory Technology, or "RegTech," has become a must-have for any fund manager who wants to operate efficiently. These platforms are built specifically to automate and simplify the more tedious parts of staying compliant.

Think of it this way. Technology can help you:

Technology won't replace a sharp CCO, but it will make them infinitely more effective. It frees up your team from drowning in paperwork, reduces the chance of human error, and builds a compliance program that can grow with you.

Ready to move beyond spreadsheets and operate like an institutional-grade firm? Fundpilot provides the tools emerging managers need for professional LP reporting, streamlined fund administration, and audit-ready compliance. Discover how Fundpilot can accelerate your growth.