Learn how to start investment firm with this guide. Discover legal steps, raising capital, and building a thriving investment business.

Launching a new investment firm is a marathon, not a sprint. It's a deliberate process involving strategic planning, getting your legal house in order, and building a solid operational framework. It all starts with a crystal-clear investment philosophy and a rock-solid business plan—long before you ever think about managing a single dollar of client assets.

Every great investment firm I've seen wasn't built on a hot stock tip; it was built on a meticulously crafted blueprint. This foundational stage is where your big idea gets real, transforming from a concept into a viable, investable business. It’s all about asking—and answering—the tough questions upfront to make sure you're building on solid ground. Don't think of this as just paperwork. This is the strategic core of everything that comes next.

Your very first move? Nail down your investment philosophy. This is your firm's North Star, the principle that guides every decision you'll make.

Are you a deep-value investor, hunting for diamonds in the rough? Maybe you're focused on high-growth tech disruptors. Or perhaps you're carving out a niche in alternatives like private credit or real estate. Having a clear, compelling philosophy isn't just an intellectual exercise; it's what will attract the right kind of clients and investors who believe in what you do.

Once your philosophy is set in stone, it's time to build your business plan. This document is far more than a formality to show potential backers; it’s your operational roadmap. It forces you to think through every single aspect of your firm, from the daily grind to your long-term vision for growth.

A truly effective business plan should clearly lay out:

For a broader look at the entrepreneurial journey, it’s worth reviewing these foundational 5 steps to starting your own business.

Let's be clear: when you start an investment firm, you're stepping into a massive and highly competitive arena. Recent data shows the U.S. investment adviser industry has 15,870 registered firms managing an incredible $144.6 trillion in assets.

But here’s the encouraging part: 92.7% of these are small businesses with fewer than 100 employees, and most manage under $1 billion. This tells you that new firms almost always start small. A typical new shop might have around 8 employees and handle about $393 million in assets. It’s a world where focused, nimble players can thrive.

Think of your business plan as your firm's story. It needs to be a compelling narrative that explains why your firm deserves to exist, how it will win, and what makes it different from the thousands of others out there.

This initial planning phase is absolutely critical. Our detailed guide on how to start an investment firm from the ground up dives even deeper into these crucial early-stage decisions. https://www.fundpilot.app/blog/how-to-start-an-investment-firm-from-the-ground-up

Your business plan needs to cover several key areas to be taken seriously by potential partners and investors. The table below breaks down what you absolutely must include.

A summary of the essential elements to include in your initial business plan for a structured and convincing proposal.

| Component | Key Questions to Address | Example Focus |

|---|---|---|

| Executive Summary | What is your firm's mission, vision, and unique value proposition? | "To provide bespoke wealth management for tech executives using a growth-at-a-reasonable-price (GARP) strategy." |

| Investment Philosophy | What is your core strategy? Value, growth, quant, or alternative? | "We focus on undervalued small-cap companies with strong fundamentals and a defensible moat." |

| Target Market | Who are your ideal clients? How will you reach them? | "Accredited investors and family offices in the Midwest with a focus on sustainable investments." |

| Financial Projections | What are your startup costs, projected AUM, and break-even point? | "Initial capital of $250k, targeting $50M AUM in Year 1, with a break-even projected at 18 months." |

Nailing these components gives your plan the structure and credibility it needs to make a powerful first impression.

The financial world operates under a microscope, and for very good reason. Getting the legal and regulatory side of your new firm right isn't just a box-checking exercise—it's the absolute bedrock of your credibility and long-term survival. Any misstep here can be catastrophic, so this requires your full attention from the moment you decide to launch.

Your first major fork in the road is choosing a legal structure. This decision will ripple through every part of your business, affecting everything from personal liability and taxes to how you can raise capital and pay out profits.

For most emerging managers, the decision really boils down to two main options: the LLC or the LP.

A Limited Liability Company (LLC) is often the go-to for smaller advisory firms, especially if you're starting out as a solo founder. It strikes a nice balance between liability protection and operational flexibility, making it a relatively simple way to get off the ground. The compliance burden is also generally lighter.

On the flip side, the Limited Partnership (LP) is the undisputed standard for most private equity, venture capital, and hedge funds. This structure creates a crucial firewall between the General Partners (GPs), who manage the fund, and the Limited Partners (LPs), who are the passive investors. This separation is exactly what institutional capital expects to see; it provides a clear line of sight into roles and liabilities.

| Feature | Limited Liability Company (LLC) | Limited Partnership (LP) |

|---|---|---|

| Best For | Smaller advisory firms, solo founders | Private equity, VC, hedge funds |

| Liability | Shields the personal assets of all members | GPs have unlimited liability; LPs are limited to their investment |

| Management | Flexible, member-managed or manager-managed | Managed exclusively by the General Partner(s) |

| Fundraising | Can be a tougher sell for institutional capital | The gold standard structure that institutional LPs prefer |

Once you've formed your entity, it's time to register. This isn't optional. The big question you need to answer is whether you'll register with the U.S. Securities and Exchange Commission (SEC) or with your state's securities authorities.

The main trigger for federal registration is your Assets Under Management (AUM). As a general rule, firms with $100 million or more in AUM must register with the SEC. If you're managing less than that, you'll typically register with your state regulator. But like anything in this field, there are important exceptions.

For instance, you might qualify as an Exempt Reporting Adviser (ERA). This category often applies to managers who advise only private funds and have less than $150 million in AUM. While ERAs get to sidestep full-blown SEC registration, they still face significant reporting and compliance duties. For a closer look at what this entails, our key compliance guide for Exempt Reporting Advisers is a great resource.

With your registration path mapped out, your focus shifts to drafting the foundational documents that govern your relationship with investors. These are legally binding contracts that demand meticulous preparation, almost always with the help of seasoned legal counsel. Don't try to go this alone.

Three documents are the pillars of your legal framework:

"Your compliance program is not a static document you file away. It's a living, breathing part of your firm's culture that protects you, your employees, and your clients from significant legal and reputational harm."

Finally, you need a robust compliance program from day one. This is your firm’s internal rulebook, designed to keep you on the right side of all applicable laws and regulations. A weak compliance framework is one of the fastest ways for a new investment firm to implode.

Your program must include written policies and procedures that cover all the critical areas. This starts with appointing a Chief Compliance Officer (CCO) to own and administer the program.

These are the policies you need to have in place immediately:

Laying this legal and compliance foundation is an intensive process, but it’s completely non-negotiable. It’s the essential structure that gives you the confidence to manage capital and build unshakable trust with your investors.

An investment firm is only as strong as its operational backbone. Without the right systems and partners in place, even the most brilliant investment strategy will stall before it ever gets going. Building out your technology and operations stack is all about creating a seamless, scalable infrastructure that can support your firm from day one and beyond.

This isn't just a shopping trip for software. It’s about thoughtfully architecting an ecosystem that can handle everything from trade execution and portfolio analysis to client relationships and regulatory reporting. Getting this right is absolutely fundamental to launching a firm that can actually compete.

Long before you start demoing software, you need to lock in your essential external partners. These providers form the operational foundation of your firm, handling critical functions that are far too complex and high-stakes to manage in-house—especially when you're just starting out.

Choosing the right partners is one of the most critical decisions you'll make. Your goal is to find providers who genuinely understand the needs of emerging managers and have a service model that can scale with you as your AUM grows.

With your core partners selected, it’s time to turn your attention inward to your technology stack. The right tools will automate the mundane, deliver critical insights on demand, and free you up to focus on what you do best: managing investments and building client relationships.

A modern firm's tech stack has several key components that need to talk to each other. A truly robust setup must include comprehensive financial reporting software to accurately track performance, manage budgets, and provide transparent reports to investors and regulators. This is crucial for building credibility and succeeding in your fundraising efforts.

Here are the key software pieces you'll need to consider:

Building a modern tech stack is less about having the most expensive tools and more about integrating the right tools. The goal is to create a unified system where data flows smoothly, slashing manual work and the risk of costly errors.

Nailing this integration is a cornerstone of firm productivity. In fact, improving your back-office systems is one of the most direct paths to better fund performance. You can explore a deeper dive into these concepts in our guide on https://www.fundpilot.app/blog/operational-efficiency-improvement-for-fund-managers.

Once you've handled the legal and operational setup, you get to the heart of the matter: your investment strategy and raising the capital to execute it. This is where the rubber meets the road. All your planning and structuring are about to be tested by the very people you need to convince—your future investors.

You absolutely must have a clear, documented investment process. It’s not enough to just have a great idea; you need a repeatable system that shows you’re a disciplined manager, not just a speculator. This playbook is the engine of your firm.

A well-defined process isn't just for show. It builds investor confidence and, just as importantly, instills discipline in your own decision-making. Investors need to see that you have a rigorous, thoughtful approach to deploying their capital.

Your documented process should walk them through every critical stage:

Your pitch deck is your firm's story, told in a concise, powerful, and visual way. For many potential investors, it’s their first real look at your strategy and team. It has to be sharp. It has to be persuasive.

A great pitch deck does more than just throw data on a slide. It tells a compelling story and answers the one question on every investor’s mind: "Why you? Why now? And why should I trust you with my money?"

Make sure your deck nails these key points:

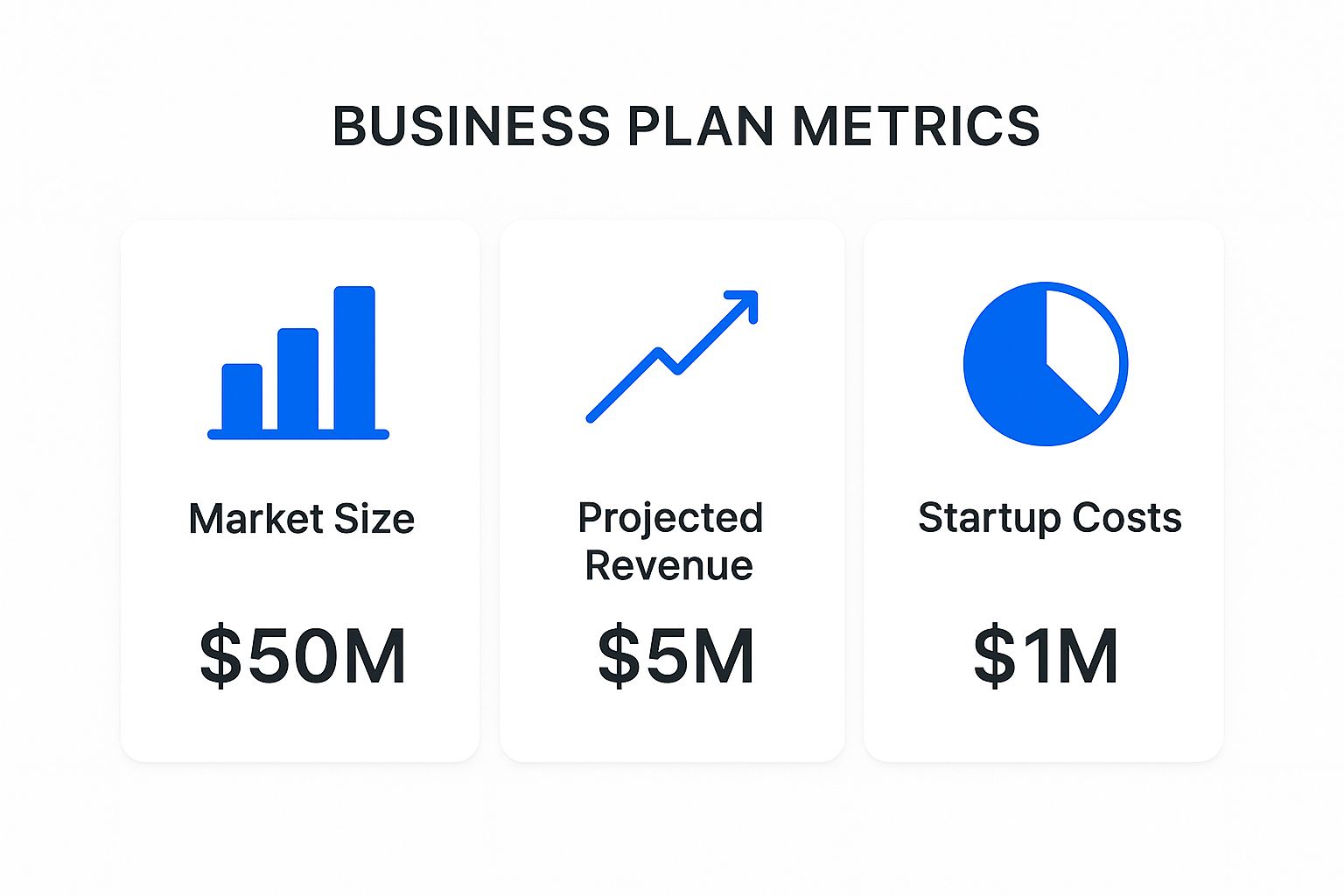

High-level financial metrics are the anchor of your business case. They give investors a quick, digestible view of the opportunity and your goals.

This kind of visual data makes your projections feel tangible, showing the revenue potential and the capital required to get there.

With a polished pitch deck, the real grind begins. Landing that first round of capital is almost always the biggest challenge for a new firm. Your early investors are taking a significant leap of faith, and earning that trust requires a smart, targeted approach.

You’ll almost certainly start with your "warm" network—friends, family, and former colleagues who already know and trust you. This is the classic "friends and family" round. But don't make the mistake of being too casual. Treat them with the same professionalism you would any institutional investor, with proper legal documents and full transparency about the risks.

From there, you'll likely target angel investors and family offices. They are often more open to backing new managers than large, bureaucratic institutions are, and they can become fantastic long-term partners. The goal is to find investors whose risk appetite and timeline align perfectly with your strategy.

To help navigate this, here’s a look at different capital sources and what to expect from each.

| Investor Type | Typical Investment Size | Key Considerations | Best For |

|---|---|---|---|

| Friends & Family | $10k - $100k+ | Based on personal trust. Requires extreme professionalism and clear risk disclosure to preserve relationships. | Securing seed capital and validating the concept. |

| Angel Investors | $25k - $250k | Often experienced entrepreneurs themselves. They seek high growth and may want an advisory role. | Early-stage funds needing "smart money" and industry connections. |

| Family Offices | $500k - $5M+ | Highly sophisticated, but more flexible and faster-moving than institutions. Value long-term relationships. | New managers with a strong track record and a well-defined niche. |

| Institutional Investors | $5M+ | Require a multi-year track record, significant AUM, and a robust operational infrastructure. | Established firms looking to scale, not a realistic target for a first-time fund. |

Choosing the right partners is far more important than just taking the first check that comes your way.

Your initial fundraising isn't just about money; it's about finding the right partners. Seek out "smart money"—investors who bring valuable expertise, industry connections, or mentorship to the table. Their endorsement can be a powerful signal to future investors.

Market timing also plays a huge role. In a hot market, fundraising is easier; in a downturn, it's a slog. For instance, in private equity, tailwinds are building. Some projections suggest the market could see 10,000 deals with a transaction value of around $1 trillion. Tapping into this kind of momentum can create a very compelling story for your firm, as detailed in a recent private equity report.

When you get into those meetings, be prepared. You will get grilled on your track record, your risk management process, and exactly how you plan to deliver returns. Every conversation is a chance to build a relationship and prove you are a credible, trustworthy steward of their capital.

Popping the champagne on launch day is a huge milestone, but it’s really just the starting gun. The real marathon begins now. To build a firm that lasts, you need a smart marketing strategy, the right people in your corner, and an obsession with client success.

Your early momentum will come from having a strong brand and a message that cuts through the noise. This isn’t about a fancy logo. It’s about being able to clearly and confidently explain what makes you different. Your website is your firm’s front door—it needs to immediately tell prospects who you are, what you do, and why you’re the right choice for them. Keep it clean, professional, and easy to find.

Beyond just having a website, you need to prove you’re an expert. This is where creating insightful content becomes your best marketing play. When you consistently publish sharp market commentary, in-depth case studies, or white papers that showcase your strategy, you build trust with potential investors before you ever have a single conversation.

Let’s be honest: you can’t do this alone. The first few people you hire will set the entire tone and trajectory for your firm. As you start out, look for people who don’t just have the right resume but who genuinely buy into your vision and have that entrepreneurial fire.

Here are the first key hires you absolutely need to get right:

As you grow, you’ll naturally bring on people for business development and investor relations. But this core trio is the foundation you’ll build everything else on.

Once your brand is defined and your team is in place, it's all about bringing in clients. Your first investors are almost always going to come from your existing network. Treat these early relationships like gold—they’re trusting you based on your personal credibility, and you have to deliver with outstanding service and total transparency.

Networking is more than just showing up at conferences. It’s about systematically building real connections. Figure out which industry events matter, join the right associations, and actually contribute to the conversations happening in your niche.

Your firm’s long-term success hinges on one thing: the trust you build with investors. That trust is earned through consistent, transparent communication and performance reporting that tells the whole story—not just the good news.

Speaking of reporting, this is where many firms fall flat. Your limited partners (LPs) deserve clear, timely, and insightful updates on their investment. Today’s software can help you create institutional-quality quarterly reports, packed with portfolio analytics and market commentary, without bogging down your team.

Getting this right does more than just keep your current clients happy; it’s a powerful engine for growth. When your LPs feel informed and respected, they’re far more likely to re-invest. More importantly, they’ll refer their friends and colleagues. That’s how you create a flywheel effect, scaling your firm by building a stellar reputation, one happy client at a time.

https://www.youtube.com/embed/At3tcAu2MEg

When you’re thinking about how to start an investment firm, the big-picture strategy is just the beginning. The real journey starts when you dig into the practical, day-to-day questions that every founder has to answer. These are the nuts-and-bolts challenges that come up time and time again.

Let's walk through some of the most common questions I hear from aspiring founders. Getting these right from the start can be the difference between a smooth launch and a frustrating false start.

This is the million-dollar question—sometimes literally. The truth is, there's no single magic number. The capital you need breaks down into two main buckets: operational capital to keep the lights on and investment capital (your initial AUM) to get the strategy off the ground.

For your operational budget, a lean, remote-first model might scrape by on $100,000 to $200,000 for the first year. But if you’re planning on a physical office and even a small team, you should be thinking more in the range of $300,000 to $500,000, and that can climb quickly.

Your strategy is the biggest variable here.

Technically, yes. Realistically, it’s a monumental undertaking. A successful firm isn't just about picking great investments. It’s a three-legged stool: investment management, operations/compliance, and business development. Finding one person who is an expert in all three is incredibly rare.

Think about it. Most of the successful launches you see are teams of two or three partners with complementary skills. You have the investment guru, the operational whiz who knows compliance inside and out, and the rainmaker who can build relationships and raise capital.

If you're determined to go solo, you have to get comfortable with outsourcing. It’s not a sign of weakness; it's a smart business decision. Hiring a third-party fund administrator and a fractional Chief Compliance Officer (CCO) can fill those critical gaps without the burden of full-time salaries right out of the gate.

I’ve seen a lot of brilliant investors stumble, and it’s usually for the same few reasons. If you can avoid these common pitfalls, you're already ahead of the game.

The biggest one? Underestimating the regulatory beast. Compliance isn’t just a form you fill out once. It’s a continuous, time-sucking, and expensive part of the business. New managers often get completely blindsided by the sheer effort required for record-keeping, reporting, and just staying on top of rule changes.

Another classic mistake is having a fuzzy investment niche. If you try to be everything to everyone, you end up being nothing to anyone. In a market this crowded, you have to be able to clearly and concisely articulate your unique value. Without that sharp focus, you’ll never attract the right kind of capital.

"A common mistake is focusing 100% on the investment strategy while completely neglecting the business of running the business. Marketing, client acquisition, and operational excellence are just as vital as picking the right investments."

Finally, and this one hurts to watch, is a brilliant manager who simply can't sell. They think their amazing track record will do all the talking. It won't. You have to actively get out there, tell your story, build a network, and ask for the money.

Be patient. This is not an overnight process. From the moment you start seriously planning to the day you can actually manage client capital, you should realistically budget for 6 to 12 months.

The timeline breaks down into a few key phases, and they often overlap:

Of course, a more complex strategy or a difficult fundraising environment can easily stretch this timeline out even further.

Ready to elevate your new firm's operations from day one? Fundpilot provides the institutional-grade reporting and administration tools you need to build investor trust and scale effectively. Stop wrestling with spreadsheets and start competing with established players. Discover how Fundpilot can streamline your launch.