Learn how to start an investment firm with this battle-tested guide. Get actionable steps on legal setup, fundraising, operations, and building your strategy.

Before you even think about raising a single dollar or filing a single legal document, you need to answer one fundamental question: Why should anyone give you their money to invest?

The journey of starting your own investment firm doesn't begin with lawyers or software. It begins with a razor-sharp, defensible strategy. This is the bedrock. Get this wrong, and nothing else matters.

A vague notion like "I'll invest in tech" isn't a strategy; it's a wish. A real investment thesis is specific, opinionated, and shows you have an edge nobody else does. It's your firm's DNA.

Your investment thesis is your story. It’s the narrative that explains what you invest in, why you’re the one to do it, and how you’ll make money for your partners. It's the north star for every decision you'll make.

Think of it as your unique fingerprint on the market. Instead of saying you'll "invest in real estate," a killer thesis sounds more like: "We acquire and reposition underperforming B-class multifamily properties in secondary sunbelt markets." That kind of focus tells LPs you're an expert, not a tourist.

To build a thesis that commands attention, you need to lock down a few things:

Your thesis can't just be a good idea. It has to be a compelling story backed by data and your personal history. It's the most powerful tool you have for convincing partners, key hires, and, most importantly, your first Limited Partners (LPs).

Once your thesis is sharp, you need to translate it into a practical roadmap. That’s your business plan. This isn't just a document for fundraising; it's for you. It forces you to confront the cold, hard realities of building a business from scratch.

This is where you move from the "what" to the "how." A solid plan shows you've thought through every angle and are approaching this venture like a professional, not a hobbyist.

Your business plan needs to tackle the nitty-gritty details:

Once you've nailed down your investment strategy, it's time to face the legal and regulatory marathon. This isn't just about paperwork; it's about building the legal skeleton of your firm. Getting this wrong can be a fatal blow before you’ve even made your first investment.

Your first real legal hurdle is choosing a business structure. This decision ripples through everything—liability, taxes, how you operate, and how you bring on investors. You’re not just managing a portfolio; you're building a formal company, and the structure matters immensely.

Most new managers go with either a Limited Liability Company (LLC) or a Limited Partnership (LP).

An LLC is often the simpler route, especially for smaller, more nimble firms. It protects you (the "members") from being personally on the hook for business debts. It's a practical choice for getting started without too much complexity.

The LP is the more traditional structure for investment funds. Here, your management company acts as the General Partner (GP), making all the investment decisions and shouldering the liability. Your investors are the Limited Partners (LPs), and their risk is typically capped at the amount of capital they've put in.

Your path to becoming a registered investment adviser (RIA) is almost always dictated by one thing: your Assets Under Management (AUM). This isn't a suggestion; it's a hard-and-fast rule with specific dollar thresholds.

In the U.S., you're generally required to register with the Securities and Exchange Commission (SEC) once you cross the $110 million AUM mark. Below that, you'll likely register with state regulators. Either way, you'll need to file Form ADV, a public document that lays out everything about your firm’s ownership, business practices, and client base.

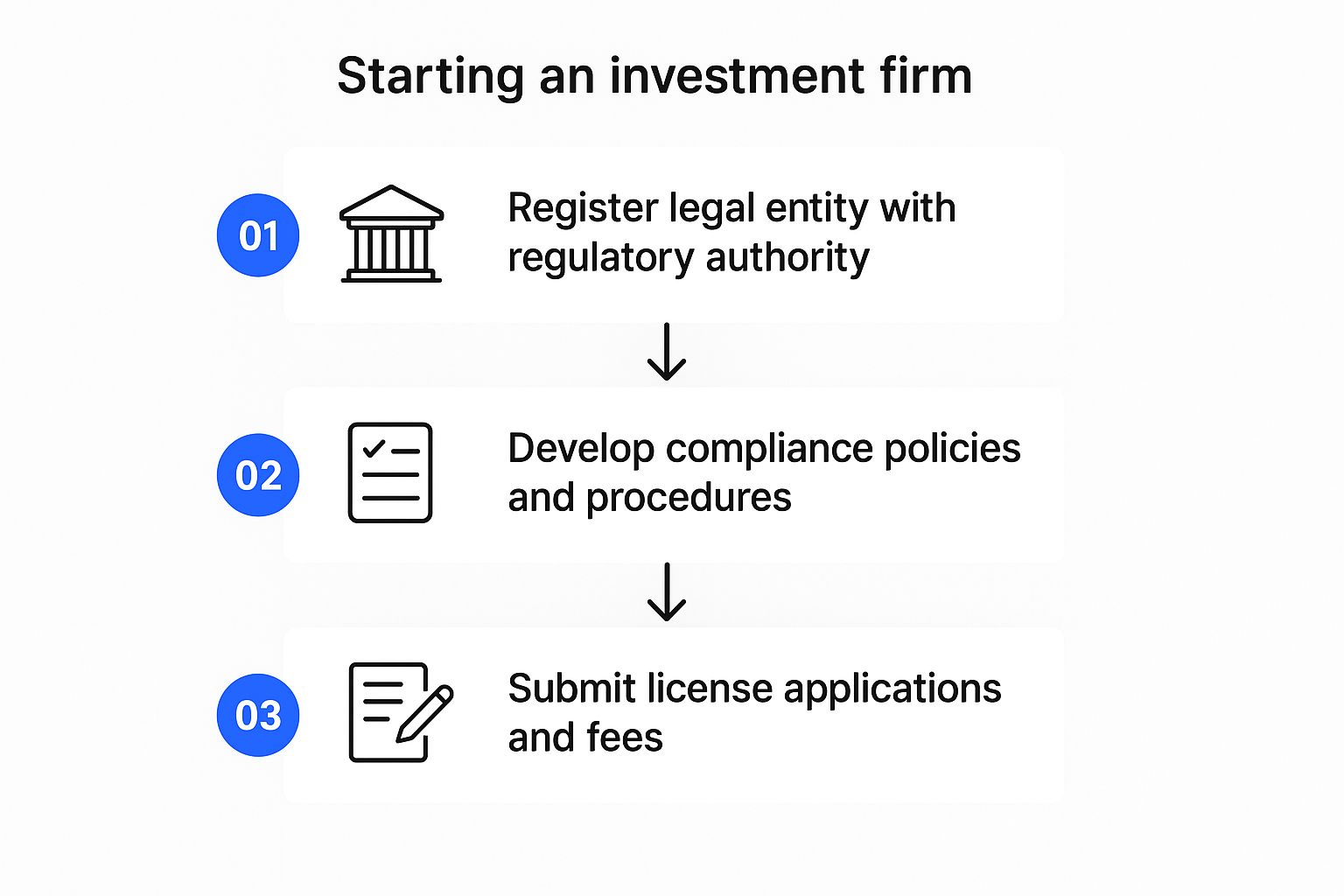

As you can see, setting up your legal entity is just step one. The real internal work of crafting compliance policies comes next, well before you submit any applications.

For most emerging managers, state registration is the natural starting place. But there are crucial exceptions. If you advise venture capital funds, for example, you might qualify as an Exempt Reporting Adviser (ERA). This status comes with much lighter reporting requirements than a full-blown RIA registration. It's worth exploring if this path fits your strategy—you can learn more in our complete guide on Exempt Reporting Advisers.

Compliance can't be a box you check later. You need a robust compliance program running from day one. Think of it as your firm's internal rulebook, designed to prevent, spot, and fix any violations of securities laws.

This program has to be formalized in a written compliance manual. And let me be clear: this is not a generic template you can download. It must be a living document, tailored specifically to your firm’s strategy, risks, and business model.

A solid compliance program will always include:

A common pitfall is treating compliance like a chore. The smart move is to see it as a competitive advantage. A strong compliance culture builds deep trust with investors and regulators, creating a stable foundation for growth.

Finally, finding the right legal counsel is non-negotiable. Don't hire a general business lawyer. You absolutely need a specialist who lives and breathes investment management law. They’ll understand the nuances of fund formation, SEC and state regulations, and the specific hurdles new managers face. This person will be your most critical partner in the entire process, guiding you through filings like Form ADV and helping you build a compliance framework that will stand up to intense scrutiny.

An investment thesis is just a theory without the operational engine to execute it. Once your legal framework is squared away, your focus has to shift to building the actual machinery of your firm. This is where you’ll choose the critical partners and technology that will either empower your growth or become a constant source of friction.

Frankly, your operational choices directly impact your ability to function, report to investors, and stay compliant. I've seen too many emerging managers try to skimp here, only to face catastrophic problems down the road. This isn't the place to be penny-wise and pound-foolish.

Picking your service providers is one of the most consequential decisions you'll make. These partners—your fund administrator, custodian, and auditor—form your operational backbone. Their competence (or lack thereof) is a direct reflection on you.

Think of it this way: your LPs will constantly interact with the output of these firms through statements, capital call notices, and K-1s. A cheap, unreliable provider will erode investor confidence much faster than a quarter of underperformance.

When you're evaluating potential partners, look well beyond the price tag. Your decision needs to be a blend of their reputation, their tech capabilities, and, most importantly, their experience with funds of your specific size and strategy.

Your service providers are a reflection of your firm's quality. A top-tier auditor or a well-known fund administrator provides immediate credibility to LPs, signaling that you're serious about institutional-grade operations from day one.

Choosing the right partners is a critical diligence process. Here’s a quick checklist to guide your conversations and help you identify the best fit for your new firm.

| Service Provider | Key Evaluation Criteria | Red Flags to Watch For |

|---|---|---|

| Fund Administrator | Do they have a modern, intuitive investor portal? How do they handle complex allocations and waterfall calculations? Ask for references from managers with similar fund structures. | Outdated technology, slow response times during the sales process, lack of experience with your specific asset class. |

| Auditor | Have they audited funds like yours before? An auditor focused on large-cap public equity might miss the nuances of a private credit or venture capital portfolio. | A "one-size-fits-all" approach, inability to provide relevant references, pricing that seems too good to be true. |

| Custodian/Prime Broker | What are their trading costs, execution capabilities, and financing rates? Do they offer robust reporting tools that can integrate with your other systems? | Hidden fees, poor technology integration, a service model that isn't built for a fund of your size. |

Ultimately, you're not just hiring a vendor; you're building a team that will be with you for years. Choose wisely.

In today's market, trying to run a successful investment firm on a patchwork of spreadsheets is a recipe for disaster. A modern, integrated technology stack isn't a luxury—it's a competitive necessity that lets a small team operate with the efficiency and accuracy of a much larger institution.

The right software frees you from the soul-crushing manual work, giving you back the time to focus on what actually matters: sourcing great deals and managing your portfolio. Your tech should create a seamless system that connects your front and back office.

At a minimum, your firm will need a few core systems to function effectively.

Essential Investment Firm Software:

This integration is the key to building a scalable operation. When your portfolio management system can feed data directly into your investor portal, you eliminate manual entry errors and save countless hours during reporting season. For a deeper look, our guide on operational efficiency improvements for fund managers offers more strategies.

The goal here is to build an infrastructure that supports your firm not just today, but five years from now. A scalable and secure foundation allows your team to do what they do best: execute your strategy and deliver returns.

Capital is the lifeblood of any investment firm. You’ve designed the strategy, hammered out the legal framework, and built the operational engine. Now comes the real test: raising your first fund and forging lasting relationships with the Limited Partners (LPs) who will trust you with their capital.

This process is far more art than science. It's a delicate dance of telling a compelling story, relentless follow-up, and building unshakable trust. Success isn't about generic advice like "network more." It’s about a sophisticated approach to finding the right investors, proving your worth, and confidently navigating the intense due diligence that separates serious contenders from the merely aspirational.

Think of your pitch deck as your firm's story, distilled into its most potent form. It’s not just a collection of slides; it’s a carefully crafted narrative designed to answer one core question in an LP’s mind: Why you, why this strategy, and why right now?

A magnetic pitch goes beyond just numbers and projections. It needs to convey your unique edge and build a genuine connection.

This document is your calling card. It has to be professional, concise, and powerful enough to get you that next meeting.

Not all capital is created equal. Your fundraising will be infinitely more effective if you target investors who are the right fit for your fund's size, stage, and strategy. Blasting your deck to a generic list of LPs is a surefire way to waste time and burn bridges.

Instead, think about your potential investors in archetypes and tailor your approach.

Fundraising is a sales process, plain and simple. Your job is to systematically find qualified leads, build relationships, and guide them through your pipeline. A CRM built for investor relations isn't a luxury; it's essential for managing this complex, long-haul effort.

Getting the commitments is just the start. The real work of building an enduring firm is in fostering deep, trust-based relationships with your LPs. This is all about consistent, transparent communication—especially when things get rocky.

Effective investor relations means managing expectations from day one. Be crystal clear about your strategy, how you'll report performance, and how you’ll handle both good and bad news. Your LPs are your partners, so treat them that way. This means providing high-quality quarterly reports that offer real insight, not just a data dump. Explain what’s happening in the portfolio and the logic behind your decisions.

This is especially critical in the current market. For instance, recent M&A data highlights a real challenge for private equity. By early 2025, the number of PE-owned portfolio companies shot past 30,000 globally, and nearly half of those have been held since 2020. While PE exits climbed to 903 in the first quarter of 2025, it’s still a tough environment for firms needing to return capital.

You can learn more about these global M&A trends from PwC. Being able to intelligently discuss these dynamics with your LPs shows you’re on top of your game and builds immense confidence.

Ultimately, long-term trust is the currency that lets you raise your next fund, and the one after that. It isn't built in bull markets; it's forged by navigating turbulence with integrity and clear, honest communication.

Let’s be honest. In this hyper-competitive market, a generic, “copy-paste” investment strategy is a one-way ticket to obscurity. Standing out isn't just a nice-to-have; it’s a prerequisite for survival. The long-term viability of your firm will be decided by your ability to carve out a defensible niche—a space that larger, slower incumbents have either missed or simply can't replicate.

This means you have to build your firm around specialization and innovation from the ground up. The most successful emerging managers I've seen build a competitive moat by being more focused, more nimble, and more technologically savvy than the Goliaths they’re up against.

The most direct path to differentiation is deep specialization. Forget trying to be a generalist. Instead, become the go-to expert in a specific, often complex, corner of the market. This focus is what allows you to build a recognizable brand, cultivate proprietary deal flow, and confidently justify your value to potential Limited Partners (LPs).

Think about it in real terms. You could build a fund around:

This narrow focus is your greatest strength. It signals to investors that you possess a depth of knowledge that a sprawling, generalist fund just can't match. That’s your edge in sourcing, diligence, and ultimately, in creating value.

A specialized strategy becomes your firm's core narrative. It tells LPs not just what you do, but why you are uniquely equipped to do it effectively. This story is your single most powerful fundraising tool.

Another powerful way to stand out is to look beyond the well-trodden path of public equities and bonds. The universe of alternative assets is vast and expanding, offering fertile ground for new firms to make their mark.

Take private credit, for instance. It’s seen explosive growth. According to recent analysis, private credit assets shot past $2.1 trillion globally in 2023, with the sector seeing double-digit annual growth. This isn't just a fleeting trend; it’s a massive opportunity for nimble firms to launch specialized credit strategies. You can dig into this further with Deloitte's investment management outlook to grasp these market shifts.

But innovation doesn't stop at asset classes. You can also get creative with your fund structure. Hybrid funds that blend private equity-style investments with more liquid credit positions can offer investors a unique risk-reward profile that really gets their attention. Of course, these structures require meticulous planning and a rock-solid LP partnership agreement. For more on that, take a look at our guide to key clauses in LP partnership agreements.

Technology is no longer just a back-office tool for efficiency. It’s a weapon. As a new firm, you can use technology to punch far above your weight, creating advantages in areas where large incumbents are notoriously slow to adapt.

Integrating technology strategically can completely transform your core functions:

By building a tech-forward firm from day one, you’re not just improving your investment decisions; you’re creating a scalable, data-driven operation. That sends a powerful message to LPs that you are building a modern firm designed for the future of finance, not one stuck in its past.

Starting an investment firm is a huge leap, and it’s completely normal to have a ton of questions swirling around. I've been there. Let's tackle some of the most common ones I hear from up-and-coming managers to give you a clearer path forward.

This is the big one, and the honest answer is: a lot more than you think. You can’t just think about the money you'll be investing. You absolutely must budget for at least two years of operational runway. Anything less, and you're not giving your firm a real shot.

This operational budget covers everything from salaries (even if it's just for you and a co-founder), office space, critical tech subscriptions, and marketing. And don't forget the legal and compliance fees right out of the gate—those can easily hit anywhere from $50,000 to over $150,000 before you’ve even made your first investment.

For a small, new firm, a realistic operational budget falls somewhere between $500,000 and $2 million. This is completely separate from the AUM you plan to manage. On top of that, regulators have their own net capital requirements you'll need to meet.

Hands down, the most common—and fatal—mistake is grossly underestimating the grind of fundraising and just running a business. I see it all the time: brilliant investors who are complete novices when it comes to being a business owner.

They think their personal track record or a killer thesis is all it takes for capital to flow in. It isn't.

In reality, fundraising is a full-time job. Be prepared for it to consume you for 12 to 24 months. In the early days, you have to accept that most of your time will be spent building the business—pitching, networking, and handling operations—not perfecting your investment models.

For most new managers, hiring a full-time Chief Compliance Officer (CCO) from day one is just not practical. It's a massive fixed cost at a time when every dollar counts.

A much smarter and more common approach is to partner with an outsourced CCO service or a specialized compliance consulting firm. This gives you instant access to institutional-grade expertise for a fraction of what a full-time hire would cost.

These firms are pros at getting you set up correctly and will handle the essentials, like:

Once your Assets Under Management (AUM) grow, you can then start planning to bring that role in-house.

If you can't bring a portable, documented track record with you from a previous firm, you have to create one. No serious LP is going to invest based on a thesis alone. They need to see proof that your process works.

You have a few solid options here. You could run a small friends-and-family fund to get started. Another path is to manage your own money in a separately managed account (SMA) and, crucially, have it formally audited by a reputable third-party firm.

If those aren't feasible, you can build a detailed "paper portfolio." This means meticulously documenting every investment decision, the rationale behind it, and the performance over time—as if you were managing real capital. Whichever route you choose, the goal is the same: create a verifiable, auditable record you can confidently show potential investors when you launch your first official fund.

Ready to move beyond spreadsheets and operate like an institutional-grade firm? Fundpilot empowers emerging managers with automated LP reporting, an integrated investor portal, and streamlined fund administration. Stop wrestling with manual tasks and start focusing on what you do best—generating returns. Schedule your free demo of Fundpilot today and see how you can build a firm that inspires confidence.