Learn how to start an investment fund with this practical guide. We cover your investment thesis, legal structure, capital raising, and operations.

Launching an investment fund is a serious undertaking. It's a marathon, not a sprint, typically taking 12 to 18 months from the initial idea to making your very first investment. It all boils down to three core pillars: a razor-sharp strategy, an ironclad legal framework, and, of course, raising the capital.

Before a single legal doc is drafted or you even think about pitching an investor, you need a powerful, specific investment thesis. This is far more than just a good idea; it's the guiding philosophy for every decision you'll make, from sourcing deals to managing exits. It's your fund's North Star.

A killer thesis carves out a niche where you have a clear, defensible advantage. This "edge" might come from deep expertise in an overlooked sector, a proprietary network that feeds you deals no one else sees, or a completely novel way of analyzing opportunities. I've seen many successful emerging managers get their start by going deep into specialized areas like vertical SaaS, niche real estate markets, or ESG-focused supply chains.

Finding your edge means getting your hands dirty with real market analysis. You're looking for specific gaps that the big, established funds are too slow or too generalized to notice. The global investment fund industry is massive—eclipsing $145.4 trillion—so it's both vast and incredibly competitive. To make your mark, you have to prove you can generate returns where others can't.

Your unique value proposition must give a compelling answer to one simple question from potential investors: "Why you?"

Here are a few strong answers I've seen in the real world:

Before you can build a compelling fund, you need to be crystal clear on what you're building. This table outlines the core pillars you need to define to crystallize your vision and market position.

| Pillar | Key Questions to Answer | Example |

|---|---|---|

| Asset Class | What will you invest in? (e.g., Venture Capital, Private Equity, Real Estate, Hedge Fund) | "We are a venture capital fund focused exclusively on early-stage technology companies." |

| Sector/Industry | What specific industries will you target? Are you a generalist or a specialist? | "Our focus is on B2B SaaS companies in the fintech and healthtech verticals." |

| Geographic Focus | Where will you invest? (e.g., North America, Southeast Asia, a specific city) | "We invest only in companies headquartered in the Pacific Northwest." |

| Investment Stage | At what point in a company's lifecycle will you invest? (e.g., Pre-Seed, Series A, Growth Equity) | "Our sweet spot is leading or co-leading Seed and Series A rounds." |

| Check Size | What is your target initial investment size and follow-on allocation? | "Initial checks will range from $500k to $1.5M, with reserves for follow-on investments." |

Defining these elements turns a vague idea into a concrete, investable strategy that you can build a narrative around.

Once you've nailed down your edge, you have to weave it into a story. This narrative is what will attract not just any capital, but the right capital—from Limited Partners (LPs) who truly get what you’re doing and believe in your vision. Your thesis needs to be clear, concise, and backed by hard data and solid market analysis.

For example, you can't just say you're investing in "AI." You need to show you understand the nuances. A deep dive into current trends, like unpacking venture capital AI investing, can provide the specific context you need to build a credible, tech-focused strategy.

Your investment thesis isn't just a slide in your deck; it's the absolute foundation of your fund. It drives your strategy, shapes your fundraising story, and ultimately dictates your success. A fuzzy or generic thesis is a non-starter for serious LPs.

This whole process of defining your fund's mission is just one piece of the puzzle. For a look at the bigger picture, check out our guide on https://www.fundpilot.app/blog/how-to-start-an-investment-firm-from-the-ground-up.

Finally, your thesis must set realistic expectations. How will you define and measure success? What kind of returns can your LPs reasonably expect? Being transparent about this from day one builds crucial trust and sets you up for a healthy, long-term fund.

With a sharp investment thesis in hand, you’re ready to build the container that will hold your strategy and your investors' capital. This is where the abstract idea of a fund becomes a real, legal entity. I know this part can feel like the most intimidating step on the journey, but getting the legal framework right is absolutely non-negotiable for long-term success.

The structure you choose is the bedrock of your entire operation. For most emerging managers in the U.S., the decision usually boils down to two primary options: a Limited Liability Company (LLC) or a Limited Partnership (LP). While an LLC might seem simpler on the surface, the vast majority of venture capital and private equity funds are structured as LPs for a critical reason—it creates a clean separation between you (the General Partner) and your investors (the Limited Partners).

A Limited Partnership is the undisputed industry standard because it establishes a precise legal and financial distinction. The General Partner (GP) makes all the investment decisions and runs the fund, but also assumes unlimited liability. The Limited Partners, on the other hand, contribute capital but have their liability capped at the amount they invested.

This separation is vital for attracting serious capital. Sophisticated investors need to know that their role is strictly passive and that their personal assets are shielded from any of the fund's liabilities. An LP structure gives them that clean, well-understood framework.

As you weigh your options, don't just think domestically. Many fund managers I've worked with explore an offshore company setup to take advantage of more favorable regulatory and tax environments. This can be a smart strategic move, depending on your target investors and the scope of your investment mandate.

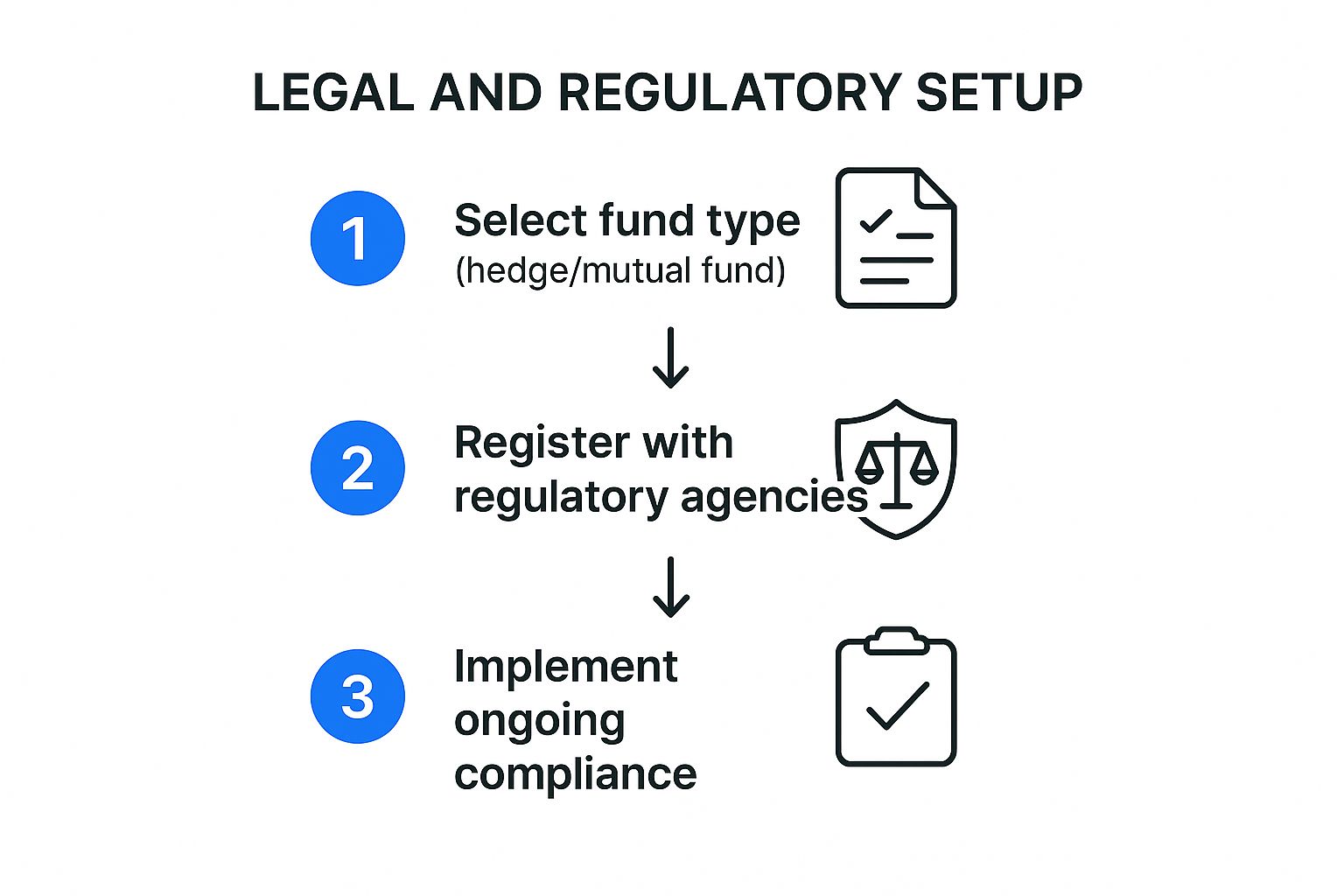

This infographic lays out the high-level legal and regulatory path you'll be on.

As you can see, locking in your fund type and registering with the right agencies are foundational steps that have to happen before you can even think about ongoing compliance.

Once your structure is chosen, your legal team will get to work drafting a set of critical documents. These aren't just formalities; they are the rulebook for your fund, governing your relationship with investors and defining every single aspect of its operation.

Three documents form the core of your fund’s legal architecture:

Think of your legal docs as a prenup between you and your investors. It’s the uncomfortable but necessary process of agreeing on all the rules before there's money—or trouble—on the table. Getting this right from day one builds a foundation of trust and clarity.

Hiring the right legal counsel is arguably one of the most important decisions you'll make. Please, don't just shop for the cheapest option. You need a law firm with deep, specific experience in fund formation. A seasoned lawyer won't just draft documents; they'll act as a strategic partner, helping you navigate complex choices about fees, governance, and regulatory exemptions that can save you incredible headaches and money.

Likewise, bringing on key service providers like a fund administrator early on is a huge sign of professionalism. They handle the complex back-office work—things like capital calls, distributions, and calculating the Net Asset Value (NAV)—freeing you up to focus on what you do best: finding and making great investments. Building this compliant and scalable operational backbone is an essential part of getting this right.

So, you've jumped through all the legal hoops and your fund is no longer just a great idea—it's a real, legal entity. Now comes the part that separates the dreamers from the doers: raising the capital. An investment fund without capital is just an expensive hobby. This is where the human side of the business truly kicks in.

Let me be clear: your first capital raise isn't about blasting out mass emails or cold-calling a list. It's about strategic, genuine relationship-building. Your journey begins with a surprisingly simple, focused list of names.

Forget casting a wide net. Your first investors, the ones we call anchor LPs, will almost certainly come from your existing professional network or people who are just one degree of separation away. Start thinking about former colleagues, old bosses, mentors, and industry contacts who have seen your work and know what you're capable of.

These warm connections are pure gold. An introduction from a trusted mutual friend is infinitely more powerful than the most well-crafted cold email. You’re not just looking for people with money; you’re looking for people who believe in you and your unique take on the market.

Before you make a single call, get organized. Start by mapping out your network and bucketing contacts into tiers based on their likely interest and investment capacity. Your initial targets should be high-net-worth individuals, family offices, and maybe some smaller institutional players who already get your niche. This focused approach is so much more effective than trying to appeal to everyone.

Here’s a practical way to think about your outreach list:

Make no mistake, you're stepping into a competitive ring. The global demand for alternative investments is massive. In fact, PwC forecasts that global assets under management will hit a staggering $145.4 trillion by 2025. You can dig into the specifics in PwC's global asset management report.

With that much money in motion, investors have endless choices. It's your job to prove why your fund is the absolute best home for their capital.

Your pitch deck is your story, printed on paper (or, more likely, a PDF). It needs to be compelling, crystal clear, and concise. Investors see dozens of these things, so yours has to cut through the noise by telling a real narrative, not just throwing a bunch of numbers at them.

A classic rookie mistake is leading with overly complex financial models. Don't do it.

Instead, start with your "why." Why this particular strategy? Why is now the perfect time for it? And most critically, why are you the one person who can pull it off? Your personal journey and track record are just as important as any financial projection.

A solid deck should build a case for your fund, piece by piece. A good flow often looks like this:

Fundraising is a transfer of conviction. If you don't have unwavering belief in your strategy, you can't expect an investor to. Your passion and confidence during a pitch are often the deciding factors.

Getting a meeting is a win, but it’s just the start. The real work is in the follow-up and the ongoing conversation. I highly recommend treating your fundraising process like a sales pipeline. Use a simple CRM to meticulously track every email, call, and meeting. This discipline ensures no potential LP slips through the cracks.

Get ready for some tough questions, because they're coming. Investors will poke holes in your thesis, challenge your assumptions, and dig into your track record. Don't get defensive. View every question as an opportunity to showcase how deeply you've thought about your strategy.

Finally, you have to get comfortable with hearing "no." It’s just part of the game. Not every investor is going to be the right fit, and that's okay. Use every rejection as a chance to gather feedback. A thoughtful "no" from a smart investor can give you incredible insights to sharpen your pitch for the next meeting. Your goal is to build momentum, turning those first few "yeses" into a first close that validates your fund and makes it easier to attract the next wave of capital.

You've secured your first close. That’s a huge milestone, but now the real work begins. The focus has to pivot from raising money to actually running the fund. This is where you build the operational engine that will not only execute your investment strategy but also give your investors confidence for years to come.

So many emerging managers get this wrong. They try to patch things together with spreadsheets and manual processes, thinking they'll build "institutional-grade" infrastructure later. That's a classic mistake. You have to build it from day one.

The absolute cornerstone of this setup is a third-party fund administrator. Seriously, don't even think about doing this yourself. Trying to manage the complex back-office work in-house as a new manager is a straight path to distraction, burnout, and costly errors. A fund admin is your operational partner; they do the heavy lifting so you can focus on what you do best.

And we're not just talking about bookkeeping. A solid administrator handles the entire investor journey—from onboarding new LPs and processing their sub docs to managing capital calls and, eventually, distributing those hard-earned returns. They're the ones calculating your official Net Asset Value (NAV), preparing the financial statements, and dealing with the auditors. This isn't a cost center; it's leverage.

Beyond your fund administrator, the right technology is what separates a modern, scalable fund from one drowning in spreadsheets. We're in an industry where private market funds managed €13.2 trillion in 2024, and the firms managing that capital are becoming incredibly tech-savvy. Your toolkit needs to match that reality.

At a minimum, you'll need a few key pieces of software:

Your tech stack isn’t just an expense—it’s a strategic investment in your fund’s future. The right tools build repeatable processes, slash the risk of human error, and deliver the data you need to make smarter, faster decisions.

The real magic happens when these platforms can talk to each other. Look for integrated solutions. For example, a platform like Fundpilot can pull many of these functions under one roof. It offers institutional-quality LP reporting, a secure investor portal for sharing documents, and tools to manage your deal flow, effectively bridging the gap between a scrappy startup fund and a major institution.

Now, let's talk about the most critical function of your operational engine: how you process potential investments. A well-defined deal pipeline is non-negotiable. Without a structured process, deals get lost in email chains, due diligence gets rushed, and you completely miss out on learning from your past decisions.

A good workflow breaks the process down into clear, distinct stages. This isn't just for organization; it lets you track every opportunity, spot bottlenecks, and keep the momentum going from a first look to a signed term sheet.

Here’s a simple, battle-tested workflow you can steal and adapt:

Following a structured approach like this does more than just make your team efficient. It sends a powerful signal to your LPs that you are a disciplined, professional steward of their capital.

Once your fund is up and running, your focus shifts to the two pillars that will define your long-term success: staying compliant with regulators and keeping your investors happy. Getting either of these wrong is a fast way to see your fund unravel.

Once your fund is up and running, your focus shifts to the two pillars that will define your long-term success: staying compliant with regulators and keeping your investors happy. Getting either of these wrong is a fast way to see your fund unravel.

This isn’t just about checking boxes or avoiding penalties. It’s about building a rock-solid reputation. When it comes time to raise your next fund, believe me, sophisticated Limited Partners (LPs) will scrutinize your operational integrity just as closely as they do your investment returns.

The world of fund compliance can feel like a maze of rules and acronyms. In the U.S., your main regulator is the Securities and Exchange Commission (SEC). One of your first major decisions is determining whether you need to register as an investment adviser or if you can operate under an exemption.

For many emerging managers, exemptions under the Investment Advisers Act of 1940 are the go-to path. Two of the most common are:

Figuring out which path to take requires a careful legal review of your fund’s strategy and who your investors are. This is not the place for educated guesses. Consulting a comprehensive compliance guide is a great starting point, but you'll almost certainly need experienced legal counsel to get it right.

The classic "2-and-20" fee model is the standard compensation structure in the world of private funds. It's crucial to understand its components, as they impact everything from your legal documents to your investor conversations. The structure is built on two core fee types.

| Fee Type | Typical Rate | Purpose | Key Consideration |

|---|---|---|---|

| Management Fee | 1.5% - 2.0% of AUM | Covers the fund's operational costs—salaries, rent, legal, admin. This is what keeps the lights on. | Paid annually, regardless of performance, providing stable revenue for the management company. |

| Carried Interest | 20% of fund profits | The manager's share of investment profits, often called "carry." This is where the real upside is. | Earned only after returning all investor capital, often plus a preferred return (hurdle rate). |

This model is designed to align your interests with your investors'. You don't get the big payout from carried interest unless you generate great returns for them first. This alignment is the foundation of the entire GP-LP relationship.

Your work doesn't stop once the capital is wired. In many ways, it's just beginning. The key to maintaining strong investor relationships is proactive and transparent communication. LPs aren't silent partners; they've entrusted you with their money and expect to hear from you regularly.

The quarterly investor report is your most important communication tool. A world-class report is much more than a simple list of portfolio companies and their latest valuations. It needs to tell a story.

A report that truly adds value should always include:

Investor reporting is not a compliance chore; it's your single best opportunity to reinforce your thesis, manage expectations, and prove you are a disciplined steward of capital. Don't waste it with generic updates.

This level of detail is exactly what sophisticated investors expect. For a deeper look at crafting your communication strategy, our article on what investor relations means for fund managers is a great resource.

By mastering both the technicalities of compliance and the art of communication, you're not just running a fund—you're building an enduring franchise that can last for decades.

Even the best-laid plans come with questions. When you're launching your first fund, you're bound to hit a few snags or wonder if you're on the right track. Let's walk through some of the most common issues I see new managers grapple with and give you some straight answers to keep you moving forward.

There’s no magic number here. The answer really depends on what you plan to invest in. If you're launching a venture capital fund, you might be aiming for a $5-10 million first close. That gives you enough dry powder to make a few solid bets. For a real estate fund, that same amount might just cover your first decent acquisition.

A lot of first-time managers get their start with a smaller "friends and family" fund, often in the $1-2 million range. It’s a great way to get your feet wet, prove your strategy actually works, and build a track record without the immense pressure of a huge institutional raise.

No matter the size, the key is to raise enough to cover all your operating costs—think legal, admin, salaries, and tech—for at least 18-24 months. Your Private Placement Memorandum (PPM) will actually state the minimum amount you need to raise to "break escrow" and officially get to work.

I’ve seen a lot of new managers stumble out of the gate. Usually, it comes down to a few classic, and entirely avoidable, mistakes. If you're learning how to start an investment fund, dodging these is half the battle.

Here are the big three:

A rock-solid operational plan, a specific and compelling strategy, and an obsessive focus on raising capital are your best defenses. Don't let a preventable error derail your launch.

Be prepared for a marathon, not a sprint. From the moment you decide to do this until you're making your first investment, you should realistically budget between 12 and 18 months. This is exactly why having a clear roadmap from day one is non-negotiable.

You can break the journey down into a few key stages.

First comes strategy and thesis refinement, which usually takes 2-3 months. This is where you're sharpening your pencil, building financial models, and really pressure-testing your core ideas.

Next is the legal and documentation phase, which can take another 3-4 months. You’ll be hiring lawyers, deciding on the right fund structure, and drafting all the critical documents like the PPM and the Limited Partnership Agreement (LPA).

Finally, you have the initial fundraising period. This is the big variable, often taking anywhere from 6-12 months. How quickly you close depends entirely on your network, the current market appetite, and how well your story resonates with potential investors.

Once you hit that first close and the money is in the bank, you're off to the races and can start deploying capital immediately.

Ready to move past spreadsheets and manage your fund like a professional institution? Fundpilot provides the operational backbone you need, from institutional-grade LP reporting and a secure investor portal to streamlined deal flow management. See how we help emerging managers scale their operations by visiting https://www.fundpilot.app and requesting a demo today.