Learn how to start an investment company with this practical guide. We cover legal setup, fund structuring, capital raising, and RIA compliance.

So, you're thinking about launching your own investment company. It's an ambitious goal, but the rewards—both financial and personal—can be immense. This isn't just about picking stocks; it's about building a business from the ground up. The foundation you lay in these early stages will dictate your firm's trajectory for years to come.

It all starts with a clear investment philosophy, meticulous legal planning, and of course, raising capital. Getting this right from day one is about building a resilient, long-term business, not chasing quick wins.

Before a single dollar is raised or one investment is made, you need a solid blueprint. The journey begins with some serious self-reflection and strategic planning. What’s your unique edge in a crowded market? Who are you trying to serve? Nail these down first, and the path forward becomes much clearer.

Think of your investment philosophy as your firm's DNA. It will guide every single decision you make, from the assets you target to the level of risk you’re comfortable with. Are you a deep-value investor hunting for overlooked gems, or are you chasing high-growth tech startups? Defining this early on is crucial for attracting the right kind of investors—those who genuinely believe in your vision.

One of the biggest pitfalls for new managers is trying to be everything to everyone. The truth is, the most successful new firms I've seen start by absolutely owning a specific niche. This could be anything from renewable energy projects in Southeast Asia to early-stage B2B SaaS companies in the Midwest.

Focusing on a niche gives you a serious leg up:

Once your niche is defined, the real work of due diligence begins. This is non-negotiable. To help you get started, we've put together a comprehensive due diligence checklist template that provides a structured framework to make sure you've covered all your bases.

The investment management world isn't just competitive; it's growing at an astonishing rate. For new firms with a unique angle and a solid plan, this presents a massive opportunity.

And the numbers back this up. Global assets under management (AuM) are projected to climb from $84.9 trillion in 2016 to an estimated $145.4 trillion by 2025, according to a report from PwC. This flood of capital means sophisticated investors are actively searching for skilled managers, creating the perfect environment for a well-planned firm to launch and thrive.

To help you organize these foundational steps, here's a quick checklist of the initial milestones you'll need to hit.

This table outlines the essential milestones for getting your firm off the ground, broken down by key business areas.

| Phase | Key Action Items | Primary Objective |

|---|---|---|

| Strategy & Niche | • Define core investment philosophy. • Identify target market/sector. • Conduct competitive analysis. | Establish a unique value proposition and a clear market position. |

| Legal & Structuring | • Choose legal entity (LLC, LP). • Draft foundational documents (PPM, LPA). • Consult with legal counsel. | Create a compliant and legally sound operational framework. |

| Operations | • Select fund administrator. • Set up banking and brokerage accounts. • Establish initial compliance protocols. | Build the infrastructure needed to manage the fund and its investments. |

Tackling these items systematically will ensure you have a robust foundation before you even begin speaking with your first potential investor.

Once you've mapped out your strategy, it's time to build the legal and regulatory scaffolding that will hold it all together. This part is much more than just paperwork; you're creating the very foundation that protects your firm, your investors, and your future. Get these early decisions right, and you'll build a business grounded in trust and ready to scale. In this business, those two things are non-negotiable.

Your first big call is what kind of legal entity to form. This choice dictates your liability, tax situation, and the operational rules you’ll live by. For most new managers, this decision usually comes down to two options: a Limited Liability Company (LLC) or a Limited Partnership (LP).

The LLC is a popular starting point, mostly because of its simplicity and flexibility. It gives you personal liability protection, which keeps your personal assets safe from business debts. Plus, it offers "pass-through" taxation, so profits are taxed on your personal return, neatly sidestepping the double taxation that hits C-corporations.

An LP, on the other hand, is the more traditional route for investment funds. This structure has two key players: a General Partner (GP), which is your management company, and Limited Partners (LPs), who are your investors. The beauty of this setup is the clear line it draws between management (the GP) and the passive investors (the LPs). Institutional investors know this structure well and often prefer it.

Here’s a quick breakdown to help you weigh the options:

| Feature | Limited Liability Company (LLC) | Limited Partnership (LP) |

|---|---|---|

| Liability | All members have limited liability. | General Partner has unlimited liability; Limited Partners have limited liability. |

| Management | Flexible—can be member-managed or manager-managed. | Managed exclusively by the General Partner. |

| Taxation | Pass-through taxation. | Pass-through taxation. |

| Investor Preference | Often used for smaller, closely-held firms. | The gold standard for traditional PE, VC, and hedge funds. |

Ultimately, your long-term vision should guide this decision. If your game plan involves raising serious capital from sophisticated institutional LPs, the familiar LP structure is probably the path of least resistance.

After you've chosen your entity, the next hurdle is registering as a Registered Investment Adviser (RIA). This isn't a "nice-to-have"—it's a legal requirement if you're providing investment advice for a fee. The main question is where you'll register: with your state's securities regulator or the federal Securities and Exchange Commission (SEC).

The trigger for SEC registration is almost always Assets Under Management (AUM). As a general rule, firms managing over $100 million in AUM have to register with the SEC. If you're under that mark, you’ll typically register with your state. Keep in mind, some states have their own thresholds, so you absolutely must check your local regulations.

The registration process itself centers on filing Form ADV. This is your firm's public disclosure document, and it lays out everything from your investment strategy and fees to any potential conflicts of interest. It’s a foundational document that demands total accuracy and transparency.

Your Form ADV is more than a regulatory filing. Think of it as a public statement about your firm's integrity. It's one of the first things a serious investor will review during their due diligence. You have to get it right from day one.

Beyond the Form ADV, a few other documents are absolutely critical to running a compliant firm. These aren’t just legal formalities; they are your operational playbooks.

These documents are the backbone of your compliance program. If you're managing private funds, the SEC has a whole other layer of specific rules you need to follow. Getting a handle on these regulations is crucial, and our guide on mastering the SEC private fund rules offers a much deeper look into those requirements.

And as a final thought, if your firm has a global vision or a distributed team, getting smart on the complexities of international employment law early on can save you major operational headaches down the road.

Your investment strategy is the product. It’s the story, the method, and the promise of returns all rolled into one that an investor is buying into. Once the legal paperwork is sorted, the next make-or-break phase is nailing down the fund's structure and figuring out how you'll pitch its unique edge to potential limited partners (LPs). This is where your investment thesis gets real.

The structure you land on has to be a perfect match for your strategy. Think about it: a fund focused on long-term, illiquid bets in early-stage biotech needs a completely different vehicle than one trading liquid, public stocks daily.

The world of fund structures is vast, but most new managers find themselves choosing from a few well-trodden paths. Each model comes with its own set of investor expectations, standard fee arrangements, and operational headaches. Getting this right from the start is absolutely crucial for attracting the right kind of capital and actually being able to execute your plan.

I’ve seen new managers make this mistake time and again: they pick a fund structure because it seems trendy, not because it fits their strategy. If you're making concentrated, long-term investments, forcing that into a hedge fund structure with monthly liquidity is a recipe for disaster. Let your investment thesis drive the choice of vehicle, not the other way around.

While the traditional fund models aren't going anywhere, the market is constantly evolving. New vehicles are popping up that can offer real advantages in cost, liquidity, and accessibility, and any new firm needs to pay attention to these shifts.

Just look at the explosion in Exchange-Traded Funds (ETFs). A recent record-breaking year saw 757 new ETF launches, a jump of 46% from the year before. With total ETF assets blowing past $10 trillion, it’s undeniable that investors—both retail and institutional—are hungry for these kinds of products. You can dig into the numbers and see the full picture by checking out the research on ICI's website.

What does this mean for a new manager? While launching your own ETF is a massive undertaking, the trend itself is a valuable lesson. It signals a clear demand for transparency and lower fees, reinforcing the need to build a compelling value proposition, no matter what kind of fund you’re launching.

With your structure and strategy locked in, it’s time to put it all down in your Private Placement Memorandum (PPM). This is the master document for prospective investors. It’s part sales pitch, part legal shield, and it needs to be flawless.

The PPM is your chance to formally lay out your entire case. It has to cover several key areas in painstaking detail—not just to win over investors, but also to keep the regulators happy.

Here's what every solid PPM must include:

Treat your PPM as the ultimate stress test for your business plan. If you can't articulate your strategy clearly and persuasively in this document, you're going to have a tough time convincing sophisticated LPs to cut a check. It’s the foundational document that officially turns your idea into an investable fund.

A brilliant investment strategy is only half the story when you're starting an investment company. The other half—the one that often gets overlooked until it's too late—is building a seamless, scalable back-office engine that can actually support your every move.

Without a solid operational foundation, even the most promising deal flow can crumble under the weight of manual errors, compliance headaches, and frustrated investors. This is the core that allows a small, nimble firm to punch far above its weight. It’s the smart combination of trusted partners and the right technology that handles the administrative grind, freeing you up to focus on what you do best: finding great investments and raising capital.

Let's be clear: no successful investment firm is an island. You’re going to rely on a team of external experts to handle critical functions. These partners bring specialized knowledge to the table and provide the third-party validation that serious investors demand.

Trying to manage all this in-house from day one is not just an operational nightmare; it’s a massive red flag for sophisticated LPs.

Here are the non-negotiable partners you need on your team:

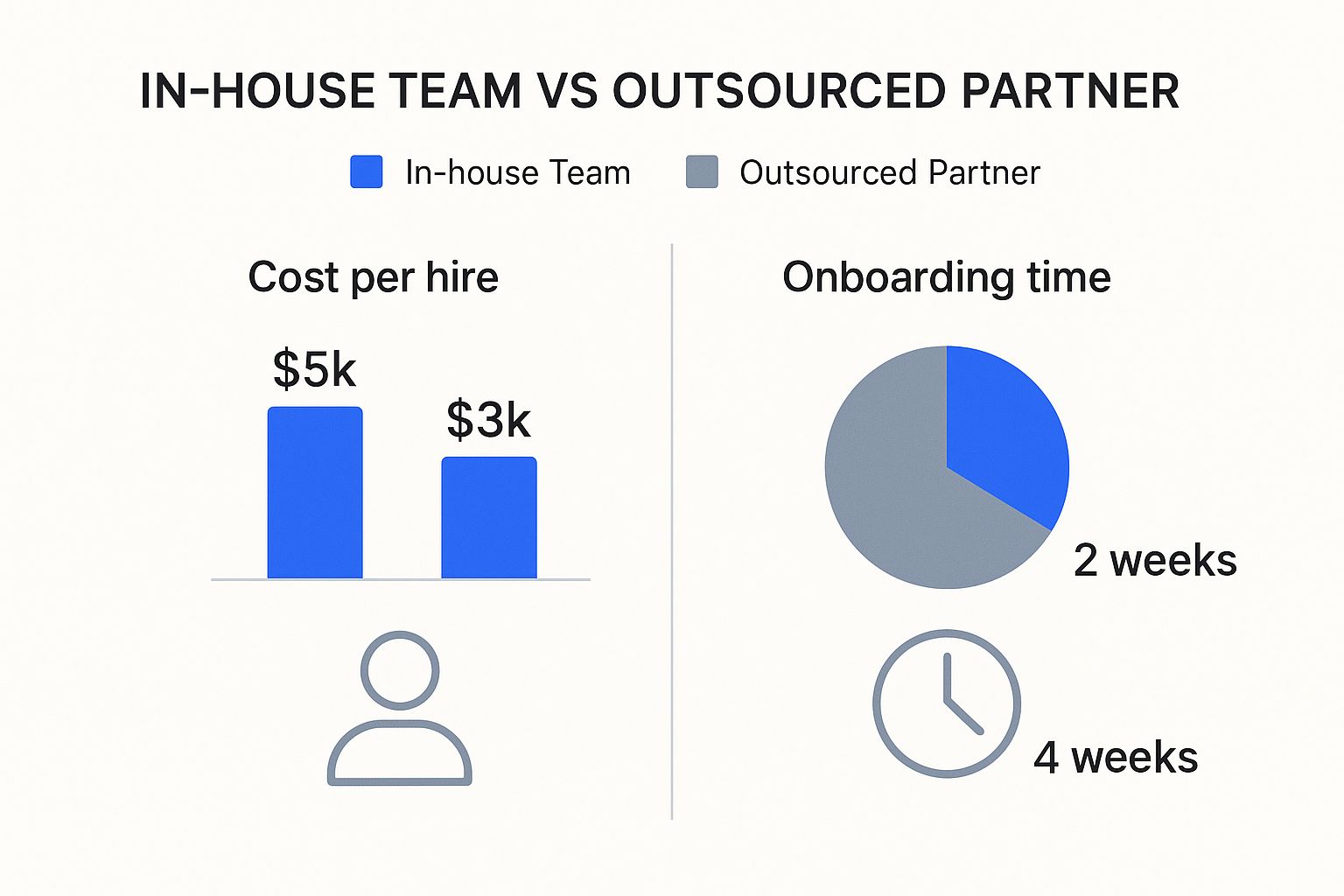

The benefits of outsourcing these functions become crystal clear when you look at the numbers.

As you can see, outsourcing doesn't just dramatically lower your direct costs. It also slashes the time it takes to get your operations off the ground, letting you move much faster.

While service providers handle specific functions, your internal technology is the glue that holds everything together. The right software does more than just automate tasks; it gives you the data and insights you need to make better decisions and communicate effectively with your limited partners.

Don’t fall into the trap of thinking you can run a serious fund on spreadsheets forever. Excel is a great starting tool, but it quickly becomes a liability as you scale. Manual data entry invites errors, version control turns into chaos, and generating professional LP reports is a painfully slow ordeal.

Investing in a purpose-built platform from the start is one of the smartest moves a new manager can make. Look for an integrated solution that covers the core pillars of your operation. A powerful fund management platform provides the essentials you'll need to operate like an institutional-grade firm, right from day one.

Choosing the right tools is critical for building a scalable and efficient operation. Here's a look at the core components you'll need.

| Technology Category | Primary Function | Key Features to Look For | Example Platforms |

|---|---|---|---|

| Portfolio Management | Central hub for tracking investments, monitoring performance, and analyzing portfolio-level data. | Real-time position tracking, performance attribution, scenario analysis, customizable reporting. | Addepar, eFront, Chatham Financial |

| CRM (for Fund Managers) | Manages the deal pipeline and tracks all interactions with current and prospective LPs. | Pipeline management, contact history, email integration, capital-raising dashboards. | Affinity, Salesforce, DealCloud |

| Investor Portal & Reporting | Secure, branded hub for LPs to access statements, K-1s, and other key documents. | Secure document vault, subscription management (e-signatures), distribution notices, capital call automation. | Fundpilot, Juniper Square, AppFolio |

| Data Room | Securely shares sensitive fundraising and due diligence materials with prospective investors. | Granular access controls, document watermarking, user activity tracking, Q&A module. | Datasite, Intralinks, Firmex |

This stack forms the technological backbone of your firm, ensuring data integrity, improving investor relations, and ultimately, making your life easier.

By thoughtfully combining the right external partners with a modern, integrated tech platform, you're not just building an efficient operation—you're building a competitive advantage. It sends a clear signal to investors that you're a serious, professional organization built for the long haul.

You’ve done the hard work of building a rock-solid legal and operational foundation. Now comes the part that turns your well-laid plans into a real, functioning business: raising capital. An investment firm without funds is just a great idea on paper. This is where you bring that idea to life by attracting the right limited partners (LPs).

Fundraising is both an art and a science. It’s a disciplined process of finding the right investors, telling a story that resonates, and building genuine relationships. Your goal isn't just to get a check; it's to find partners who are in it for the long haul because they truly believe in your vision.

The first rule of fundraising is to know who you’re talking to. Chasing the wrong kind of capital is one of the most common and draining mistakes a new manager can make. The investors you should be targeting depend entirely on your fund's size, your strategy, and your risk appetite.

Get to know the different types of investors out there:

It's also crucial to understand the sheer scale of the capital you're tapping into. For perspective, the U.S. net international investment position was recently a negative $24.61 trillion, with total U.S. assets abroad hitting $36.85 trillion and foreign-owned assets in the U.S. reaching $61.47 trillion. These aren't just numbers; they represent the immense flow of global capital, creating opportunities for sharp managers who know where to look. You can dig deeper into these trends by looking at recent U.S. economic data analysis.

Your pitch deck is your first impression—make it count. Too many fund managers create dry, data-heavy documents that feel more like a textbook than a business case. A powerful pitch deck tells a compelling story. It identifies a problem or an overlooked opportunity in the market and positions your firm as the only logical solution.

Your pitch deck should answer one fundamental question for a potential LP: "Why should I trust you with my money, and why now?" Every slide should work to build a compelling answer to that question, blending data with a clear narrative.

A deck that gets meetings will almost always include:

Getting that first commitment is a huge milestone, but it's just the start. The real work is in building and strengthening your relationships with LPs over the entire life of the fund. And the bedrock of that relationship is consistent, transparent communication.

Great investor relations is about more than just sending a quarterly report. It’s about managing expectations, offering insightful commentary, and always being accessible. This is where having a dedicated investor portal is no longer a luxury but a necessity. A platform like Fundpilot gives your LPs a secure, professional hub where they can instantly access performance data, capital call notices, and tax documents like K-1s whenever they need them.

By using a tool to automate your reporting and communications, you’re not just saving yourself hundreds of hours. You're delivering an institutional-quality experience that builds incredible confidence. This proactive approach to transparency is what creates the trust you'll need when it's time to raise your next fund.

Embarking on the journey of starting your own investment company will undoubtedly bring up a host of pressing questions. Even with a rock-solid business plan, I've seen aspiring fund managers run into the same handful of concerns time and time again.

Getting clear, direct answers to these common queries from the outset can help you anticipate challenges and make smarter, more confident decisions as you get your firm off the ground. Let's tackle four of the most critical questions I hear most often.

This is the million-dollar question, sometimes literally. The capital required to launch an investment firm varies wildly depending on your model, so there's no single magic number. The best way to get a realistic estimate is to break down the costs into key categories.

For a lean advisory firm, for example, you might be able to get off the ground with $50,000 to $150,000.

This initial budget is going to get eaten up by essential startup expenses pretty quickly:

Now, if you're launching a fund that requires a general partner (GP) commitment to show you have "skin in the game," that number can jump dramatically into the millions. And don't forget your personal runway. I've seen it take 12 to 18 months to raise a first fund. You absolutely have to have enough saved to cover all business and personal expenses for that entire period.

It’s definitely a tougher climb, but I've seen it done. If you don't have a portable, audited track record from a previous firm, you just have to completely shift the focus of your pitch. You're no longer selling past performance; you're selling your process, your deep expertise, and your unique insight into a specific niche.

Building that credibility from scratch means you have to get creative. I've seen managers successfully demonstrate their thesis by creating a detailed "paper portfolio" that showcases their strategy in action. Publishing in-depth research or white papers on your niche is another powerful way to establish yourself as a thought leader before you even have a fund.

When you lack a track record, your first investors are betting on you, not your past returns. Your job is to make that bet as logical and compelling as possible by proving your expertise and building trust through every single interaction.

Lean on your professional network to find those crucial first anchor investors who already know and trust you. You also need to be prepared to offer more favorable terms, like a lower management fee or a hurdle rate, to incentivize them. They're taking a chance on your potential, and your fund's terms should absolutely reflect that.

New firms stumble on compliance all the time, and the mistakes can be incredibly costly. The most frequent missteps usually aren't dramatic, front-page news kinds of things. They're born from inexperience and a simple lack of robust internal controls from day one.

From what I've seen, here are some of the biggest compliance tripwires for new managers:

The best prevention is a proactive stance. Appoint a Chief Compliance Officer from day one—even if it's one of the founders wearing multiple hats—and invest in good compliance software from the very beginning.

For almost any new fund looking to raise outside capital, the answer is a resounding yes. It's not even a question anymore; it has become the industry standard for very good reasons.

Trying to handle administration internally creates a massive operational burden and, more importantly, introduces a conflict of interest that will scare away any sophisticated investor. Limited partners, especially institutional ones, fully expect an independent third party to be calculating the fund's Net Asset Value (NAV) and handling all financial reporting.

This provides crucial external verification and a layer of accountability that builds immense trust. While a fund administrator is a recurring expense, the credibility it provides is absolutely essential for both raising and retaining capital. Think of it not as a cost, but as an investment in your firm's reputation and long-term viability.

Building an institutional-grade firm from day one means using the right tools. Fundpilot empowers you to manage your pipeline, automate investor reporting, and maintain audit-ready records, allowing you to focus on raising capital and executing your strategy. See how Fundpilot works.