Discover how a fund management platform can streamline operations for emerging managers. This guide covers key features, benefits, and selection criteria.

Picture this: you're trying to conduct a full orchestra, but the sheet music is scattered everywhere, and each musician is in a different room. That's a pretty accurate picture of what managing a fund feels like without a single, unified system. A fund management platform is the conductor's podium, bringing every moving part of your operation into one harmonized space.

At its core, a fund management platform is specialized software built to tackle the biggest challenge in modern investment management: overwhelming complexity. It’s an integrated system that pulls all your critical operations together, turning chaotic manual work into a smooth, efficient workflow. Instead of drowning in endless spreadsheets, email threads, and a patchwork of different tools, the platform gives you a single source of truth.

Think of it as the central nervous system for your fund. It connects everything from tracking how your portfolio companies are performing to managing investor relations and automating financial reports. This operational backbone is what gives you accuracy, transparency, and real control over your fund's day-to-day activities.

Without a proper platform, fund managers often get bogged down in administrative muck that’s not only a massive time-sink but also ripe for human error. A fund management platform hits these pain points head-on by automating the most crucial functions.

A well-implemented fund management platform doesn’t just organize your data; it gives you operational leverage. It empowers a small, focused team to manage assets and communicate with the polish and professionalism of a major institution.

This shift from manual grunt work to automated efficiency frees up your most valuable asset: time. You can stop fighting administrative fires and get back to what actually drives returns—sourcing great deals, performing deep due diligence, and building solid relationships with your Limited Partners (LPs). For more perspectives on how modern tools are changing the game, you can find a wealth of information on the Fundpilot blog.

Ultimately, a fund management platform is far more than just a piece of software—it's the foundation you build your fund's future on. It puts in place the institutional-grade processes that sophisticated LPs demand, which instantly boosts your credibility and makes it easier to attract bigger checks. By creating a scalable operational model right from the start, emerging managers can confidently grow their assets under management (AUM) without worrying that their back-office will implode. This strategic investment in technology is often what separates the funds that fizzle out from the ones that scale successfully.

To really get what a fund management platform can do, you have to look under the hood. These aren't just collections of random tools cobbled together; they are tightly integrated features designed to solve the very specific, high-stakes problems fund managers wrestle with every single day. When working together, they create a single, powerful system that brings order to operational chaos.

Think of it like an orchestra. Each instrument plays a specific role, but it's only when they play in concert that you get a masterpiece. From building investor trust to maintaining bulletproof compliance, these are the core components every modern fund needs.

At the very heart of any good platform is the ability to track and manage the entire portfolio from one place. This is the fund's central nervous system, giving you a real-time, consolidated view of every investment, commitment, and performance metric. It finally puts an end to the dangerous game of managing deals across a patchwork of error-prone spreadsheets.

Instead of spending hours manually updating valuations or ownership percentages, the platform handles it all automatically. You can instantly see your fund's exposure by industry, geography, or asset class, which leads to much smarter strategic decisions. This turns portfolio oversight from a reactive chore into a proactive advantage.

A modern investor portal is so much more than a login screen. It's your dedicated channel for building trust through transparency. This is where your Limited Partners (LPs) can get on-demand access to everything that matters to them—performance dashboards, capital account statements, and crucial legal documents.

This self-service approach drastically cuts down on the time you spend answering one-off data requests. More importantly, it delivers the professional, institutional-grade experience that sophisticated LPs have come to expect. You're not just sharing data; you're actively reinforcing their confidence in you.

An investor portal shifts the dynamic from periodic, manual updates to continuous, transparent communication. It’s the difference between sending a postcard and giving someone a live video feed of their investment's progress.

Let's be honest: managing capital calls and distributions by hand is one of the most tedious and riskiest jobs in fund administration. A single typo in a spreadsheet can cause massive financial and reputational damage. A quality fund platform completely automates this workflow.

The system calculates each LP's pro-rata share, generates personalized notice letters, and tracks every payment in one dashboard.

This shift to automation is happening everywhere. As investors demand more efficiency and clarity, the global wealth management platform market—valued at $2.95 billion in 2023—is expected to hit $8.50 billion by 2032. This growth is all about meeting the need for smarter, tech-driven financial services, a trend you can read more about in the full market analysis from Fortune Business Insights.

Navigating the tangled web of regulatory requirements is a huge headache for any fund. A platform's compliance and reporting tools act as a shield, helping you manage risk and stay ready for an audit at all times. The system keeps a complete, time-stamped record of all activities, communications, and transactions.

This creates a "single source of truth" that makes generating regulatory filings like Form ADV or Form PF incredibly simple. When regulators come knocking, you can pull detailed, accurate reports in minutes instead of scrambling to piece together information from old emails and scattered files. It’s not just about ticking boxes; it’s about weaving a culture of compliance right into your fund’s DNA.

For an emerging manager, launching that first fund is just the beginning. The real challenge is the high-wire act of scaling assets under management (AUM) while juggling two full-time jobs: driving investment performance and keeping the operational gears from grinding to a halt.

It's a familiar story. A small, hungry team has a killer strategy but gets bogged down in a maze of spreadsheets, manual investor follow-ups, and late-night reporting sessions. This operational friction isn't just a time sink; it's an anchor holding the fund back. In this world, a fund management platform isn't just another piece of software—it's the engine that can propel a promising fund forward.

When you're fundraising, perception is everything. Sophisticated Limited Partners (LPs) and institutional investors aren't just buying into your investment ideas; they're kicking the tires on your entire operation. A back office run on scattered spreadsheets and manual processes screams "amateur hour" and signals risk.

Adopting a proper fund management platform is an instant upgrade. It professionalizes your operation from day one, giving you the polished, secure, and transparent setup that serious LPs expect to see.

This kind of operational maturity builds immediate trust. It tells potential investors you have your house in order and can responsibly manage their capital, leveling the playing field so you can compete with firms ten times your size.

An emerging manager's most precious asset is their time, but it's amazing how quickly administrative tasks can swallow the entire week. Manually tracking portfolio company metrics, processing capital calls, and answering bespoke LP data requests are low-value activities that pull you away from what you’re actually good at: generating returns.

A fund management platform automates these repetitive, error-prone jobs. This isn't just about saving a few hours; it’s about fundamentally changing where your team spends its energy.

By putting your back office on autopilot, you can finally stop working in the fund and start working on the fund. The focus shifts from administrative firefighting to finding the next great deal, running deep diligence, and refining your portfolio strategy.

Think about it. A week with zero hours spent wrestling with a spreadsheet to build a report or chasing down a signature. That time goes directly back into sourcing better deals, conducting deeper analysis, and building stronger LP relationships—the very things that drive success and attract more capital.

One of the classic growing pains for a fund is having to hire more operations staff every time your AUM grows. Adding headcount is expensive, slow, and adds layers of complexity you don't need. A solid fund management platform breaks this cycle, letting you grow without getting bloated.

The right system allows a lean team to manage a much larger and more complex fund than would ever be possible by hand. As you launch Fund II and Fund III, the platform scales right alongside you. Onboarding new LPs, managing a bigger portfolio, and handling more demanding reporting are all absorbed by the same efficient system.

This is what real operational leverage looks like. It’s the key to profitable, sustainable growth, ensuring that as your AUM climbs, your focus stays exactly where it should be—on investment excellence.

Picking a fund management platform is one of the biggest decisions you’ll make for your firm. This isn't just about buying a piece of software; it’s about choosing a long-term partner that will define your operational backbone, shape investor relationships, and ultimately determine how well you can scale. You have to look past a simple feature checklist to find a solution that truly fits your fund's DNA.

Think of it like picking a co-pilot for a long-haul flight. You don’t just need someone who can read the instruments. You need a partner who can handle unexpected turbulence, work flawlessly with your crew, and has the range to get you to your destination without any hiccups. It's all about strategic fit, not just surface-level features.

Let's be clear: not all funds are the same, and neither are the platforms built to serve them. A venture capital fund operates in a completely different world than a real estate fund. The very first thing you need to do is make sure any platform you're considering speaks your specific language and is built for your asset class.

A generic, one-size-fits-all platform might claim it can do everything, but a specialized one will have the nuanced workflows that actually save you time and prevent the headache of clumsy workarounds.

This need for specialized digital tools is a huge driver in the market. The global wealth management platform market was valued at USD 6.72 billion in 2025 and is expected to skyrocket to USD 17.88 billion by 2032. This explosive growth shows a clear demand for focused, digital-first solutions. You can discover more insights about these market dynamics from Coherent Market Insights.

The platform that feels perfect for your $10M Fund I might start to crack under the pressure of a $100M Fund III. Scalability isn't just a buzzword; it’s a make-or-break requirement. You have to dig into a platform's ability to grow with your assets under management (AUM) without your costs or operational complexity ballooning alongside it.

Ask the hard questions. How does the system handle a ten-fold increase in LPs? What happens to performance when your transaction volume spikes? Do the reporting tools stay fast and flexible? A truly scalable platform is one you won’t outgrow in a couple of years.

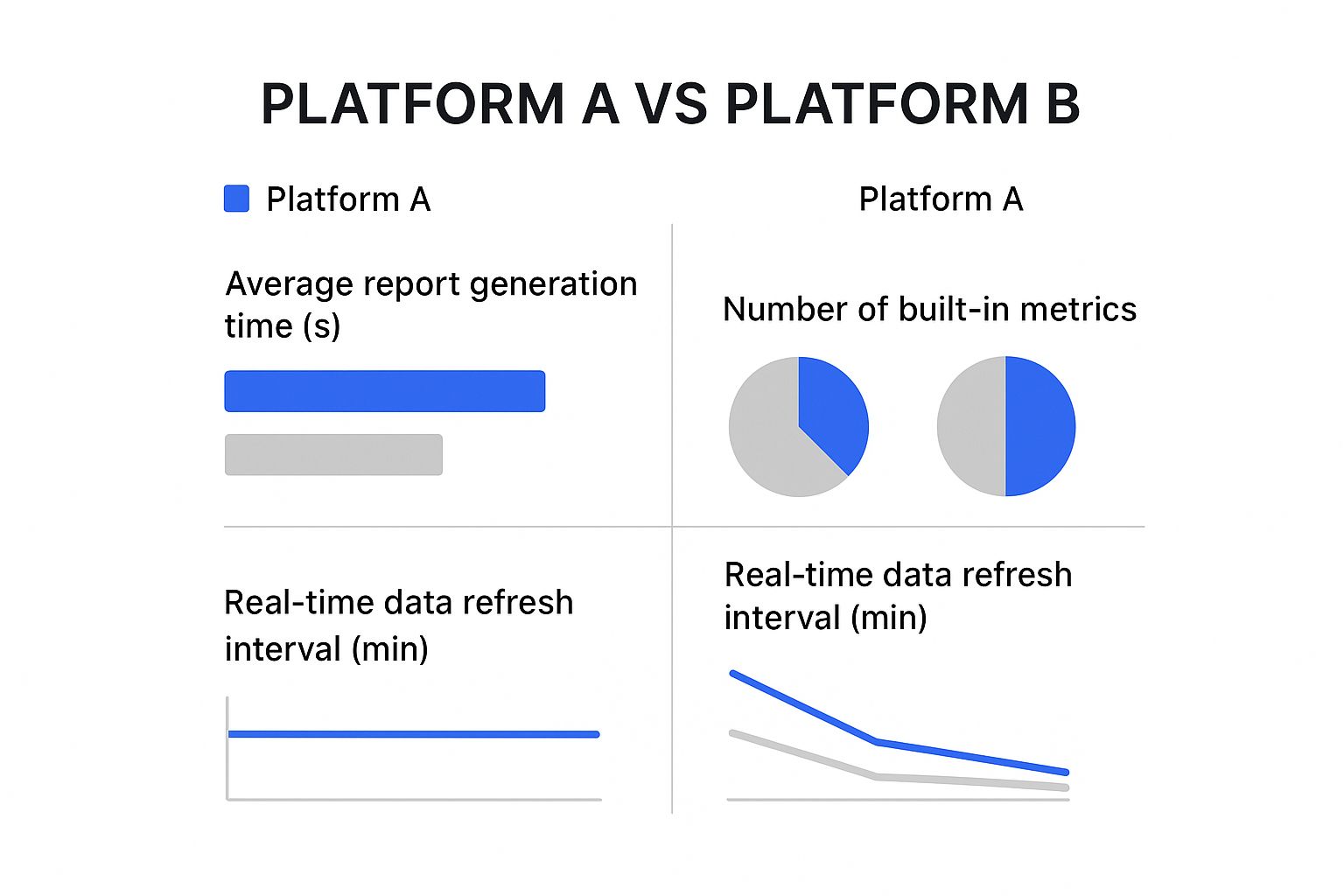

This chart helps visualize how performance can differ, comparing key metrics between two hypothetical platforms.

As you can see, Platform A delivers much faster reporting and more frequent data updates—essentials for any fund that needs to make decisions based on real-time information.

In today's world, data security is absolutely non-negotiable. Your LPs are trusting you with their capital and their sensitive personal information. A single data breach can shatter your reputation overnight. That’s why you have to be relentless when vetting a platform's security protocols.

A platform's security framework is the bedrock of investor trust. Look for SOC 2 compliance, multi-factor authentication, and robust data encryption both in transit and at rest. Don't be afraid to ask tough questions during the demo.

Just as important are its integration capabilities. Your fund management platform doesn't operate in a silo. It needs to talk to your other critical tools, especially your accounting software (like QuickBooks or Xero) and your bank. A solid API is the key here, ensuring data flows between systems automatically, which cuts out manual entry and dramatically reduces the chance of errors.

When you're evaluating cost, you have to look beyond the sticker price. A platform's pricing should be transparent and straightforward. Hidden fees for things like implementation, data migration, or adding new users can quickly turn an "affordable" solution into a serious financial drain.

As you compare your options, make sure you know exactly what you’re paying for. Take the time to explore the different pricing tiers available and see how the costs scale with the features you need and the size of your fund.

Finally, don't overlook the quality of customer support. When you’re in the middle of a capital call and something goes wrong, you need a knowledgeable human being on the other end of the line—not just a ticket number in a queue. Ask for references and talk to their current clients. A great platform with terrible support is a recipe for frustration and operational risk.

To help you stay organized, here's a checklist of essential factors to consider when comparing different fund management platforms. This will help ensure you select the best fit for your fund's specific needs and future growth.

| Evaluation Criterion | What to Look For | Why It Matters |

|---|---|---|

| Asset Class Specialization | Does it have features built specifically for VC, PE, Real Estate, etc.? | A specialized platform understands your unique workflows and reporting needs, saving you from clunky workarounds. |

| Scalability | Can it handle significant growth in AUM, LPs, and transaction volume without performance degradation? | You need a system that grows with you, not one you'll outgrow in a few years. |

| Security & Compliance | Does it have SOC 2 compliance, data encryption, and multi-factor authentication? | Protecting investor data is non-negotiable for maintaining trust and your firm's reputation. |

| Integration Capabilities | Does it offer a robust API to connect with your accounting, banking, and other essential software? | Seamless integrations eliminate manual data entry, reduce errors, and create a single source of truth. |

| Investor Portal | Is the portal intuitive and professional? Does it provide LPs with easy access to documents and performance data? | A great LP experience builds confidence and strengthens investor relationships. |

| Reporting & Analytics | Are the reporting tools flexible, customizable, and capable of generating institutional-quality reports? | Timely and accurate reporting is critical for both internal decision-making and investor communications. |

| Cost Transparency | Is the pricing model clear, with no hidden fees for implementation, support, or additional users? | Understanding the total cost of ownership is crucial for budgeting and avoiding financial surprises. |

| Customer Support | Is the support team responsive, knowledgeable, and accessible when you need them most? | Excellent support is your safety net, ensuring operational continuity when issues inevitably arise. |

Making the right choice comes down to taking a holistic view of the technology, the provider, and the long-term partnership you're building. A thorough evaluation using these criteria will set you up for success.

Adopting a fund management platform isn't just about cleaning up your internal processes. It’s a sign of a much bigger shift happening across the entire asset management world. This technology isn't just tweaking how individual firms work; it's completely reshaping the industry, setting new expectations for investors and managers alike.

One of the biggest changes we're seeing is the opening up of alternative investments. For a long time, asset classes like venture capital and private equity felt like a closed-off club, accessible only to the largest institutions. Modern platforms are changing that. With transparent investor portals and dead-simple subscription processes, they're tearing down the old walls and letting a much wider pool of investors get in on the action.

This newfound access is also forcing everyone to be more transparent. Limited Partners (LPs) are done with quarterly, static PDF reports. They now expect real-time data, instant access to documents, and a clear view into where their money is—a new standard that the platforms themselves have created.

If you look just around the corner, you'll see the next big wave forming: the integration of artificial intelligence (AI) and machine learning (ML). This is where things get really interesting. These tools are set to shift fund management from simply reacting to past performance to proactively predicting what's coming next.

This is where the real competitive edge will be won. Imagine AI algorithms that can:

The future of this space isn't just about being more organized. It's about generating smart, data-backed insights. AI is going to turn these platforms from a simple record-keeping system into a genuine strategic advisor.

All of this is happening as the broader asset management market is exploding. Projections show the industry could reach a massive $164.5 trillion by 2025, driven by new tech and a growing investor appetite for alternatives. That kind of growth brings a level of complexity that only a powerful fund management platform can really manage. You can dig into the trends shaping this massive market growth from CoinLaw.io.

In this new environment, sticking with spreadsheets and manual processes isn't just old-fashioned; it's a serious liability. The industry is moving too fast, LP expectations are too high, and the competition is fierce. The efficiency, transparency, and analytical power you get from a modern platform are quickly becoming the bare minimum.

Firms that get on board with this technology will find it easier to attract capital, deliver better returns, and grow without stumbling over their own feet. Those who don't will simply be left behind, struggling to keep up in a market that's more sophisticated and data-driven than ever. Choosing the right platform is no longer just an operational upgrade—it's a critical move for your firm's future.

Even after seeing all the benefits laid out, I find that most managers still have a few practical questions buzzing in their heads about cost, time, and whether a platform is even right for their specific fund. It's totally normal. Answering these is usually the last step before you can move forward with real confidence.

So, let's tackle the most common questions I hear from fund managers day in and day out.

There's no single price tag, and anyone who gives you one without asking questions isn't being straight with you. The cost of a fund management platform depends entirely on your situation. Key factors include your assets under management (AUM), how many LPs you have, and the complexity of your fund's structure. Naturally, the specific features you need will also move the needle on price.

Generally, you'll see a few pricing models. Some charge a small percentage of your AUM, others offer a flat monthly or annual subscription, and many use a tiered system that grows with you. The good news for emerging managers is that most modern platforms have startup-friendly packages designed to be affordable right out of the gate.

My best advice? Get detailed quotes and make sure you understand exactly what's included. Hidden fees for things like implementation, data migration, or priority support can pop up. Always ask for a completely transparent pricing structure to avoid any nasty surprises later.

The timeline for getting a new platform up and running can be anywhere from a few weeks to several months. It really comes down to three things: the state of your existing data, how much you need to customize the system, and how much time your own team can dedicate to the project.

For a brand-new fund with clean, organized data, you could be live in as little as 2-4 weeks. It's a pretty straightforward process. On the other hand, if you're an established fund migrating years of historical data from a tangled mess of spreadsheets, you should probably budget closer to 2-3 months.

The best platforms don't just throw the software at you; they provide dedicated onboarding teams to walk you through everything. They’ll help with data collection, system setup, and training your team. A pro tip to make this go faster: have all your fund documents, investor info, and portfolio data organized before you even start. It makes a world of difference.

Yes, but this is a critical point of diligence. While many modern platforms are built to be flexible—handling everything from Venture Capital and Private Equity to Real Estate and Hedge Funds—not all of them are created equal.

You'll find that some platforms are generalists, while others specialize in a particular niche to offer much deeper functionality. For example, a platform designed for VC funds will have killer features for tracking equity positions and managing complex cap tables. A real estate-focused platform, however, will be much stronger on property management workflows and asset-level financial reporting.

It is absolutely crucial to confirm that the platform you're looking at has the specific tools and workflows your asset class demands. The only way to know for sure is to get a demo and ask them to show you how it handles scenarios and reports that are directly relevant to your fund.

I hear this one all the time from emerging managers, and the answer is a firm "no." It's a common misconception. While these platforms used to be the exclusive domain of huge institutions, the market has changed. Many providers now focus specifically on serving the needs of smaller and up-and-coming funds.

Think of it this way: adopting a platform early on, even with a small AUM, sets a professional, scalable foundation from day one. This doesn't just look good to potential LPs; it saves you from the massive operational nightmare of trying to switch from chaotic spreadsheets when you're bigger and busier. The efficiency gains are immediate, freeing up your small team from mind-numbing manual reporting to focus on what actually drives returns: fundraising and executing your investment strategy.

More importantly, many platforms offer entry-level pricing that makes it a no-brainer for funds of almost any size. Before signing anything, just be sure to review the platform's terms and understand the legal side of the agreement. For a detailed overview of what to look for, you can learn more about the legal considerations that reputable platforms make available.

Ready to leave spreadsheets behind and build an institutional-grade operation? Fundpilot empowers emerging managers to automate reporting, streamline investor communications, and scale their AUM without scaling their back office. Book a demo today and see how you can professionalize your fund in weeks, not years.