Discover how to find fair market value with proven methods. Our guide provides real-world examples and practical steps for accurate asset valuation.

Figuring out an asset's fair market value isn't a shot in the dark. It's a calculated process that usually involves looking at it from three different angles: what similar assets are selling for (the market approach), how much income it can generate (the income approach), and what it would cost to replace it (the cost approach).

Often, the most accurate valuation comes from blending all three methods. This gives you a well-rounded picture of the price a well-informed buyer and a motivated seller would realistically agree on, with neither being under any pressure.

Before we start crunching numbers, it's critical to understand what fair market value (FMV) actually is. It's not just a price tag; it's a specific financial concept that serves as the bedrock for countless transactions.

At its heart, FMV is the price an asset would sell for on the open market. This simple idea is the starting point for valuing anything, from a small business to a rare piece of art. For real estate specifically, getting a solid grasp of what the market value for property is is the first step. Think of it as the price under normal conditions—not a fire sale or a rushed, desperate purchase.

One of the most important pieces of the FMV puzzle is the assumption that both the buyer and the seller know what they're doing. They're informed about the asset, its current state, and the broader market conditions. Crucially, neither side is being forced into the deal.

This requirement for two informed parties is what keeps the price grounded in reality. Without it, the final number wouldn't reflect the asset's true worth. Here’s what that looks like in practice:

This concept of an "arm's-length transaction" is the gold standard for valuation. It ensures the agreed-upon price is driven purely by market forces, not by personal relationships or external pressures.

When you put it all together, you can see why FMV is such a trusted metric for everything from official tax assessments to high-stakes corporate mergers. It provides an objective, standardized measure of what something is worth at a single point in time.

What’s the most straightforward way to figure out what something is worth? Simple: look at what similar things are selling for. This is the entire premise behind the market approach, a valuation method that leans heavily on analyzing "comparables" or "comps"—assets that have recently sold and are a lot like the one you're trying to value. It's a go-to method for everything from residential homes to heavy machinery.

Think about selling your car. You wouldn't just invent a price. You'd jump online to see what other cars of the same make, model, year, and condition are going for. The same principle holds true for more complex assets, but success really boils down to two things: finding truly comparable sales and making smart, logical adjustments for the differences.

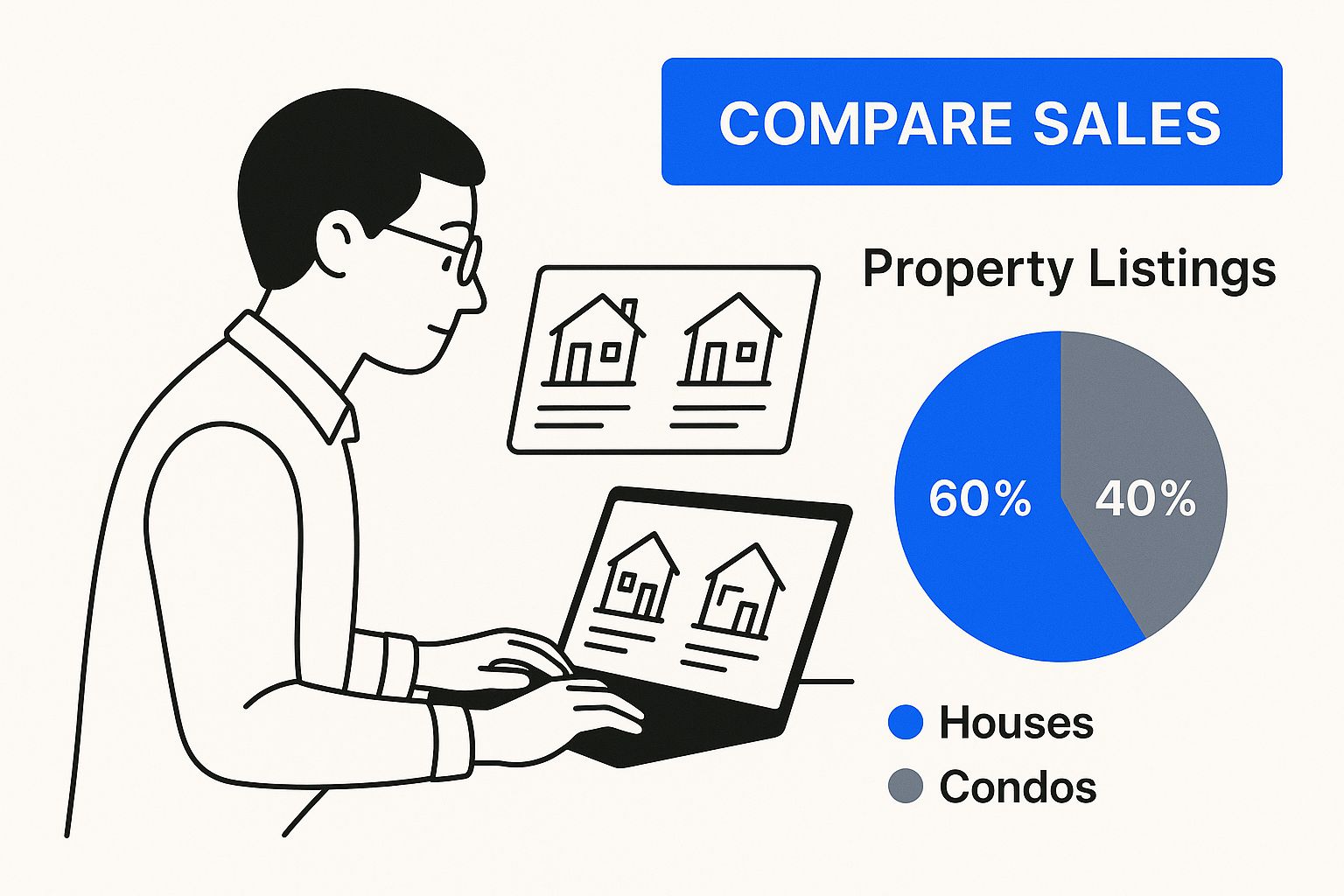

Here's a great visual of a researcher doing just that—digging into property sales data, which is where this process always begins.

This image gets to the heart of the market approach. It’s all about gathering solid data from real-world transactions to build a credible and defensible value range.

Your entire valuation is only as good as the comparables you choose. Pick the wrong ones, and your estimate of fair market value will be way off. The real goal is to get as close to an apples-to-apples comparison as you possibly can.

When you're on the hunt for solid comps, these are the factors that matter most:

The most persuasive valuations are built on a foundation of at least three to five strong, recent, and highly similar comparables. This provides a defensible basis for your final number and shows that your estimate isn't based on a single outlier.

Let's be realistic—finding a perfect comparable is like finding a needle in a haystack. Most of the time, you'll find assets that are mostly similar but have a few key differences. This is where you have to roll up your sleeves and make adjustments. You need to put a dollar value on those differences, then add or subtract it from the comp’s sale price to better estimate your asset’s value.

For example, if your house has a brand-new kitchen but the comparable property has an outdated one, you'd add the estimated value of that renovation to the comp's sale price. On the flip side, if you're valuing a business and a comparable company has a much stronger client list, you would need to adjust its sale price downward to get a more accurate picture of your own company's value. For a closer look at this process in a business context, our guide on valuing a private company digs into the specific methodologies.

The table below gives a simplified look at how these adjustments work in a real estate scenario. We're trying to find the value of the "Subject Property" by adjusting the sale prices of three different comps.

| Feature | Subject Property | Comparable A ($410,000) | Comparable B ($395,000) | Comparable C ($425,000) |

|---|---|---|---|---|

| Square Footage | 2,000 sq. ft. | +$10,000 (1,900 sq. ft.) | -$5,000 (2,050 sq. ft.) | No Adjustment (2,000 sq. ft.) |

| Garage | 2-car | No Adjustment (2-car) | +$15,000 (1-car) | -$5,000 (3-car) |

| Kitchen Condition | Updated | -$20,000 (Newly Remodeled) | +$10,000 (Outdated) | No Adjustment (Updated) |

| Location | Quiet Street | No Adjustment | -$5,000 (Busy Street) | +$10,000 (Cul-de-sac) |

| Total Adjustment | -$10,000 | +$15,000 | +$5,000 | |

| Adjusted Price | $400,000 | $410,000 | $430,000 |

After making these adjustments, we have a much clearer value range. The adjusted prices suggest the subject property's fair market value is likely around $400,000 to $430,000.

When you're looking at an asset that generates its own cash, like a rental property or an established business, its value is intrinsically linked to how much money it can make. This is the whole idea behind the income approach.

Instead of just comparing it to what similar assets have sold for, this method flips the script and asks a more forward-thinking question: How much income will this asset generate for me over its lifetime? It's a powerful way to look at value because it focuses on future potential, not just historical sales data.

There are two main ways to tackle this: a quick snapshot method and a more detailed, long-term projection.

If you need a fast, reliable valuation, especially for commercial real estate, the direct capitalization method is your best friend. It gives you a solid estimate of value based on a single year of income. Think of it as a quick health check.

To get started, you need two key numbers: the property's Net Operating Income (NOI) and the local capitalization rate (cap rate).

First, you'll calculate the NOI. This isn't just the gross rent you collect. It's the total income after you subtract all the necessary operating expenses—things like property taxes, insurance, maintenance, and management fees. It’s important to note that you don't include mortgage payments, depreciation, or income taxes in this calculation.

Next, you'll divide that NOI by the market cap rate. The cap rate is essentially the rate of return you can expect from a property based on its income. You find this by looking at what similar properties in the area have recently sold for relative to their own NOI.

Here’s a quick example: Let's say a small retail building brings in $60,000 a year in rent. After you pay $20,000 for taxes, insurance, and general upkeep, you're left with an NOI of $40,000.

If other, similar properties nearby are trading at a 5% cap rate, the math is simple:

$40,000 (NOI) / 0.05 (Cap Rate) = $800,000 (Fair Market Value)

This method is popular because it's straightforward. The big assumption, however, is that the property's income and expenses will stay pretty much the same year after year, which we all know isn't always realistic.

For a more granular and forward-looking valuation, especially for assets with fluctuating income, the discounted cash flow (DCF) method is the way to go. Instead of using a single year's income, DCF projects an asset's cash flow over a longer horizon—usually 5 to 10 years—and then discounts those future earnings back to what they're worth today.

This approach is built on a core financial truth: a dollar in your pocket today is worth more than a dollar you expect to receive next year. That's because of inflation and the simple fact that you could invest today's dollar to earn a return.

Running a DCF analysis involves a few key steps:

While DCF demands more assumptions about future growth and market conditions, it often paints a more accurate picture for assets with variable income streams. This fundamental idea of comparing an asset's value to the broader economy is used at the highest levels of finance. For example, the well-known Buffett Indicator compares the total value of the stock market to a country's GDP to get a read on whether the market is overvalued. You can explore this valuation model at Current Market Valuation to see it in action.

What happens when you need to value something truly unique? You can't always lean on recent sales of similar properties or project its future income.

This is often the case with one-of-a-kind assets—think of a custom-built factory, a historic church, or a piece of specialized machinery designed for a single task. For these situations, the cost approach isn't just an alternative; it's the most logical and sometimes only way to get to a credible valuation.

The whole method boils down to one fundamental question: What would it cost to build an identical, brand-new version of this asset from the ground up, right now? The answer to that is what we call the replacement cost new (RCN). Forget what it originally cost years ago; we're focused on today's material prices, labor rates, and building standards.

Calculating the RCN means you have to think like a builder and account for every single dollar that would go into the project. It’s a meticulous process, but it ensures you’re not missing anything.

You'll need to add up a few key categories of expenses:

Sum all that up, and you’ve got your starting number. This is the value of a modern, pristine equivalent of your asset. But of course, most assets aren't pristine, which leads us to the next, equally important, part of the equation.

The cost approach is built on the principle of substitution. A rational buyer simply won't pay more for a used asset than what it would cost to build a brand-new one with the same function.

An existing asset is almost never worth the same as its new replacement. That gap in value is called depreciation, and it’s a critical deduction you have to subtract from the RCN. But here's where people often get it wrong—depreciation isn't just about simple wear and tear. It actually comes in three different flavors.

Physical Deterioration: This is the most obvious form of value loss. It’s the leaky roof, the cracked foundation, the worn-out HVAC system. It's any tangible decay the asset has suffered over its lifespan.

Functional Obsolescence: An asset can be in perfect physical condition but still lose value because its design is outdated. Imagine an office building with low ceilings, an awkward floor plan, or electrical systems that can't support today's tech. That’s functional obsolescence.

Economic Obsolescence: This type of depreciation comes from factors completely outside the property's walls. A perfectly good factory might lose value because a new highway diverted traffic away, or a retail center could suffer if the town's main employer shuts down.

Once you’ve meticulously calculated the RCN and then subtracted the combined effect of these three types of depreciation, you're left with a well-supported estimate of fair market value.

This same logic applies not just to real estate but to business assets as well. To see how these principles work in a broader context, check out our guide to the valuation of private company assets. Using the cost approach correctly ensures that even the most unusual assets can be valued with precision and common sense.

You’ve crunched the numbers on comparable sales, projected potential income, and figured out the replacement cost. So now you’re sitting with three different valuation figures. What next? The true fair market value is rarely a perfect match to any single one of them.

This is where the real expertise comes in. The final, and arguably most important, step is reconciliation. It’s not about just averaging the three numbers together. Instead, it’s about making a judgment call, carefully weighing the results from each approach to land on a single, defensible value.

Think of it this way: each method has its strengths, but the specific property and the quality of your data will tell you which one to trust the most.

For instance, if you're trying to pin down the fair market value of a typical house in a busy suburban neighborhood, the market approach is almost always your best bet. With plenty of recent, similar sales to pull from, it provides the clearest picture of what a buyer would actually pay.

The property itself really dictates which method should take the lead. A seasoned appraiser doesn’t just stare at a spreadsheet; they look at the nature of the asset to figure out the most logical path to its value.

Let's walk through a few common scenarios:

The art of valuation truly shines in this final reconciliation. It’s where you blend hard data with professional judgment, explaining why one approach is more credible than the others to build a logical and cohesive final value.

To keep things objective, valuation also leans on standardized macroeconomic data. Global organizations provide historical data on GDP, exchange rates, and stock indices for over 200 countries. As of 2025, emerging markets boast a collective GDP (at PPP) of roughly 125 trillion international dollars, which is over 60% of the world's total economic output. Analysts use these massive datasets to benchmark asset prices against broader economic trends. You can dive into this yourself and explore global economic data from the IMF.

While these methods give you a solid framework, some situations are just too complex or high-stakes to tackle on your own. If you’re staring at wildly conflicting data, dealing with a highly unusual property, or need a valuation for legal or tax reasons, it’s time to bring in a professional appraiser.

After you've done your homework, the process often requires professional input, perhaps through working with an appraisal management company. They can ensure the valuation is impartial, thoroughly documented, and meets all industry standards, giving you a final number you can stand behind with complete confidence.

Even when you feel like you have a good handle on the three main valuation methods, some questions always seem to come up. The world of valuation is packed with little nuances, and getting these details right can be the difference between a good estimate and a truly defensible number.

Let's dig into some of the most common questions people ask when they're trying to pin down a property's value.

This one trips a lot of people up. While fair market value and appraised value often land on a similar number, they aren't technically the same thing.

Think of it this way: An appraised value is the specific conclusion reached in a formal report by a licensed appraiser. It's done for a particular reason, like when a bank needs to know what a house is worth before approving a mortgage.

Fair market value, or FMV, is a broader concept. It's the theoretical price that a willing buyer and seller would agree on, with neither being under pressure and both having reasonable knowledge of the facts. An appraisal is one of the best tools for finding the FMV, but the terms themselves aren't interchangeable.

Finding the market value for a three-bedroom house in a big subdivision is pretty straightforward because there's so much sales data. But what about a one-of-a-kind asset? Think vintage sports cars, custom-built industrial equipment, or a business that dominates a tiny, niche market.

When you can't find direct "comps," you have to adjust your strategy.

The key is to document your logic. When comps are thin, you must build a strong narrative explaining why you chose a certain method and how you arrived at your conclusion. A well-reasoned argument can be just as powerful as a list of direct comparables.

You bet it can. Fair market value is a snapshot in time. It's highly sensitive to what's going on in the wider world. A sudden spike in interest rates, a new zoning law, or a major employer leaving town can change an asset's value practically overnight.

This is exactly why the date of your valuation matters so much. A valuation from even six months ago might be completely out of step with today's market.

For more on the specifics of asset valuation, you can often find answers in a good list of frequently asked questions. Keeping your data fresh is the only way to ensure your final number is relevant and stands up to scrutiny.

At Fundpilot, we know that accurate valuation is the foundation of any smart investment strategy. Our platform gives emerging fund managers the institutional-grade reporting and analytics they need to track portfolio performance, keep LPs informed, and make decisions backed by solid data. It's time to upgrade from spreadsheets. See how our tools can streamline your operations by visiting us at https://www.fundpilot.app.