Learn how to create an investment company with this expert guide. We cover the legal steps, raising capital, and building your firm from the ground up.

Starting an investment company isn't just a financial endeavor; it's one of the most demanding entrepreneurial challenges you can undertake. It boils down to five critical pillars: crafting a unique investment thesis, building the right legal structure, mastering a maze of regulations, raising that first dollar of capital, and creating a rock-solid operational backbone. Get these right, and you're in the game.

Before you even think about deploying capital, you have to build the machine that will manage it. This initial blueprint is everything—it determines whether your firm has the legs to survive and thrive for the long haul. Think of it less as a checklist and more as the architectural plan for your entire enterprise.

The absolute cornerstone of this plan is your investment thesis. This is your firm's DNA. It's the story you'll tell and the strategy you'll execute, answering the only question that matters to potential investors: why should they give you their money? Without a razor-sharp thesis—whether it’s value-add multifamily real estate, seed-stage SaaS, or emerging market debt—you’re just another voice in the noise.

Let's be clear: you're stepping into an incredibly crowded and competitive arena. The global investment management market was valued at around $987 billion in 2021 and is on track to hit $1.343 trillion by 2025. North America is the juggernaut here, with the U.S. alone making up 77% of the region's revenue. These numbers shout opportunity, but they also whisper a warning about the intense competition you'll face from day one.

This competitive pressure means your initial groundwork has to be flawless. It’s not just one thing; it's a series of interconnected pieces you have to assemble correctly.

As you navigate the complexities of setting up your firm, resources like a comprehensive guide to company formation in the UAE can offer valuable perspectives on business structuring, no matter where you plan to operate.

To give you a clearer picture, here's a look at the key milestones you'll need to hit.

This table breaks down the essential stages of launching your firm, highlighting the primary objective and the critical factors to consider at each step.

| Milestone | Primary Objective | Critical Considerations |

|---|---|---|

| Thesis & Strategy Definition | To craft a unique, defensible investment strategy that provides a competitive edge. | Market differentiation, target asset class, risk management approach, and your personal track record. |

| Legal Entity Formation | To establish the correct legal structures for the management company and the fund itself. | Tax implications, liability protection (LLC vs. C-Corp), state of domicile, and cost of setup. |

| Regulatory Compliance | To register with the SEC or state authorities and establish a robust compliance program. | Form ADV filing, identifying as an ERO or RIA, creating a compliance manual, and understanding fiduciary duties. |

| Initial Fundraising | To secure commitments from Limited Partners (LPs) to reach a first close. | PPM and LPA drafting, investor pipeline development, pitch deck refinement, and due diligence preparation. |

| Operational Setup | To build the back-office infrastructure needed to manage the fund and investments. | Choosing a fund administrator, setting up bank accounts, implementing portfolio management software, and investor reporting. |

Think of these milestones not as a rigid sequence but as overlapping workstreams that demand constant attention.

The success of an emerging investment firm often hinges not on its first brilliant investment, but on the unglamorous groundwork of legal structuring, operational planning, and regulatory compliance laid months before any capital is deployed.

Ultimately, this blueprint is what separates the enduring firms from the ones that flame out. For a much deeper dive, you might find our complete guide on https://www.fundpilot.app/blog/how-to-start-an-investment-firm-from-the-ground-up to be a helpful resource.

Getting the legal and regulatory foundation right isn't just a box to check—it’s the bedrock of your entire firm. I’ve seen promising funds implode before they even make their first investment because of early mistakes here. This is where you build the framework that protects you, your partners, and most importantly, your investors.

The first major decision you'll face is choosing the right business entity. This choice has massive consequences for your personal liability, how you’re taxed, and your ability to raise capital down the road. It’s a foundational step that dictates a huge part of your firm's operational and financial life.

For most new investment management companies, it boils down to two common structures: the Limited Liability Company (LLC) and the C-Corporation.

Emerging managers often lean towards an LLC. Its biggest draws are flexibility and pass-through taxation, which means the fund's profits and losses are passed directly to the members without the company itself paying taxes. It keeps things simpler in the early days.

A C-Corporation, on the other hand, is a completely separate taxable entity. This can create a double-taxation scenario (the corporation is taxed on profits, and then shareholders are taxed on dividends). So why choose it? Because it can be far more attractive to institutional investors and provides a traditional structure for issuing stock options if you plan on building a large team.

Real-World Scenario: Picture two new managers starting out. The first one launches a small, single fund with a handful of LPs and chooses an LLC to keep the tax situation straightforward. The second manager has bigger ambitions—rapid expansion, multiple funds, and bringing on key hires. She opts for a C-Corp because it’s a more familiar structure for the venture capital firms she's courting to back the management company itself.

Your decision has to align with your long-term vision. Are you building a boutique firm or the next Blackstone? The answer will point you in the right direction.

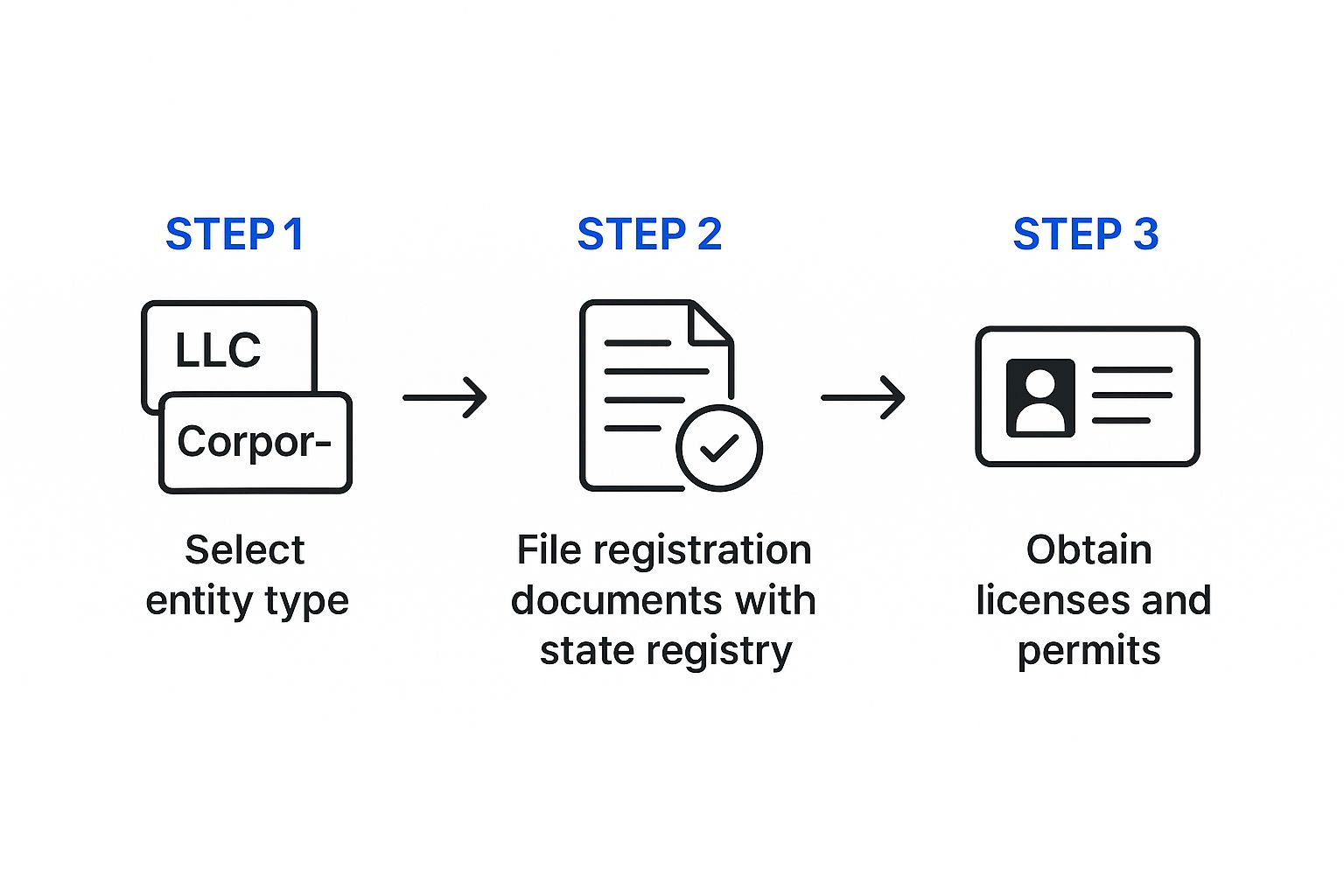

As you can see, selecting your entity is the critical first move that sets off all the subsequent registration and licensing requirements for your new company.

Once your entity is formed, you officially enter the world of securities regulation, which is primarily the domain of the Securities and Exchange Commission (SEC). Your registration path depends almost entirely on your Assets Under Management (AUM).

Many new firms get their start as an Exempt Reporting Adviser (ERA). You can typically qualify for this status if you solely manage private funds and have less than $150 million in AUM. But "exempt" is a misleading term. You are exempt from full SEC registration, not from regulation entirely. You still have to file parts of Form ADV and are absolutely subject to SEC examination.

If your firm doesn't qualify for an exemption or you grow past that $150 million AUM threshold, full registration as a Registered Investment Adviser (RIA) is mandatory. This is a much heavier lift, involving a comprehensive Form ADV filing that becomes your firm's public resume, detailing everything from your investment strategy and fees to any disciplinary history.

Whether you're an ERA or a full-blown RIA, a comprehensive compliance manual is non-negotiable. Think of it as your internal rulebook. It needs to meticulously outline procedures for everything from trade execution and handling conflicts of interest to preventing insider trading. Trust me, the SEC will ask to see it during an audit.

For a deeper dive, our key compliance guide for exempt reporting advisers unpacks these specific requirements in much more detail.

It doesn't stop at the federal level. You also have to deal with state-level regulations, often called "blue sky laws." These are designed to protect investors from fraud in each state and often require you to register your securities offerings where you have investors.

Navigating this dual system of federal and state law is a minefield for the inexperienced. A classic—and costly—mistake is misinterpreting an exemption. For example, a lot of new managers assume that qualifying for the federal private fund adviser exemption automatically gets them off the hook with state regulators. That's a dangerous assumption that can lead to serious trouble.

This is precisely why one of the smartest investments you can make, right from day one, is hiring a specialized securities lawyer. Don't just get a general business attorney. You need someone who lives and breathes the Investment Advisers Act of 1940 and understands the intricate details of fund formation.

This expert will do more than just file your entity formation and SEC paperwork. They’ll help you structure your actual fund (typically as a Limited Partnership), draft your Private Placement Memorandum (PPM), and make sure your anti-money laundering (AML) policies are rock-solid. The upfront cost might feel steep, but it's a tiny fraction of what it costs to clean up a regulatory mess.

Now that the legal framework is in place, we can get to the heart of your firm: the investment strategy. This is much more than a plan. It’s the story you'll tell, the one that answers the only question potential investors really care about: "Why should I trust you with my money?"

A vague, generic thesis is a non-starter. "We invest in good companies" won't get you past the first meeting. You need something sharp, specific, and defensible. A powerful thesis sounds more like this: "We acquire B2B SaaS companies with $1M to $5M in ARR that are struggling with sales execution. We then implement our proprietary go-to-market playbook and aim to exit to strategic buyers within five years."

That kind of clarity shows you have a repeatable process and a real edge. This thesis becomes the foundation for all your marketing materials, from your pitch deck to your Private Placement Memorandum (PPM).

Think of your pitch deck as your firm's first impression. It has to be more than just charts and numbers; it needs to build conviction. Your deck is a visual narrative that distills your complex strategy into something an investor can get excited about.

A winning deck has to nail a few key elements:

While the deck opens the door, the Private Placement Memorandum (PPM) is what seals the deal. This is the exhaustive legal offering document, drafted by your securities attorney. It lays out all the comprehensive details, disclosures, and risk factors the law requires. Expect investors to scrutinize every page during their final due diligence.

Let's be honest—fundraising is often the toughest part of launching a firm. It's a relentless grind of building relationships and earning trust, not a series of quick transactions. The first move is to figure out who your ideal Limited Partners (LPs) are.

Not all LPs are created equal. They have different motivations and risk appetites:

Set a realistic fundraising target. Aim for a "first close" that gives you enough capital to start deploying your strategy. This creates momentum and shows prospective investors that you have real traction.

Navigating due diligence is about more than having the right answers; it’s about demonstrating a disciplined process. When an LP asks a tough question about your risk management, they're not just testing your knowledge—they're testing your character and operational readiness.

Finally, you need to set your fee structure. The industry has long defaulted to the "2 and 20" model—a 2% annual management fee on assets and 20% carried interest (your share of the profits). But don't assume this is set in stone.

You might offer a "founder's class" of shares to your first anchor LPs, giving them a break on fees or carry to incentivize an early commitment. Being creative here can make a huge difference. You could also broaden your appeal by exploring emerging asset classes like Sports NFTs to attract investors with different interests.

Whatever structure you land on, the goal is simple: align your interests with those of your LPs. Make it undeniably clear that you only win when they win.

An brilliant investment thesis is worthless without the operational engine to execute it. I’ve seen too many emerging managers get so caught up in their strategy that they completely neglect the infrastructure. This oversight almost always leads to costly mistakes and, even worse, a loss of investor confidence right out of the gate.

Putting together your operational and technology stack isn’t a boring back-office chore; it's a strategic move that builds a scalable, professional, and audit-ready firm from day one.

The first piece of the puzzle is lining up your key external partners. Think of these firms less as vendors and more as extensions of your own team. They'll be handling critical functions you simply can't manage in-house when you're starting out, and your reputation is directly tied to their performance.

The "big three" you absolutely must get right are your fund administrator, prime broker, and auditor. Each one plays a unique and essential role.

When you're vetting these partners, don't just shop on price. Ask them about their experience with funds of your specific size and strategy. Just as you’d research the top investment research tools to inform your investment decisions, you need to do deep diligence here. Always check references and make sure their technology plays nice with the other systems you plan on using.

In today's market, running a fund on spreadsheets is a recipe for disaster. It's a classic rookie mistake that seems cheap upfront but creates massive operational debt down the road. Your tech stack needs to be robust enough to handle complex data, secure enough to guard sensitive information, and flexible enough to grow with your AUM.

At a minimum, your core technology should cover three fundamental areas:

The real magic happens when you build an integrated system where data flows seamlessly between your PMS, CRM, and fund administrator. Manual data entry is the enemy of both accuracy and efficiency.

The right tech does more than just stop you from making mistakes. It provides the data you need to make smarter decisions and delivers the polished, professional reporting that sophisticated LPs expect. By automating routine tasks, it frees up your most valuable resource—your time—to focus on what really matters: generating returns.

For managers looking to build a truly professional back office, finding ways to boost operational efficiency improvement for fund managers is a critical step in building a firm that can attract and keep institutional capital.

To get started, here's a look at the essential software categories every new investment firm should consider.

| Technology Category | Core Function | Example Providers |

|---|---|---|

| Portfolio Management (PMS) | Real-time position tracking, performance attribution, risk analytics, and P&L reporting. | Addepar, Masttro, Canopy |

| CRM / Investor Portal | Managing LP relationships, fundraising pipeline, capital calls, and investor reporting. | Juniper Square, FundPilot, Dynamo |

| Data Room / Document Mgmt | Securely storing and sharing sensitive documents like sub docs, K-1s, and DD materials. | Intralinks, Datasite, Box |

| Research Management | Centralizing investment notes, models, and due diligence on potential and current investments. | Tegus, PitchBook, FactSet |

This table isn't exhaustive, but it provides a solid framework for the key decisions you'll need to make. Choosing vendors who can integrate with each other will save you countless headaches and create a much more powerful, cohesive operational backbone for your firm.

You’ve navigated the legal maze, honed your strategy, and finally closed that first round of capital. It’s a huge milestone, but it's just the starting line. Now the real work begins. Managing the firm day-to-day is where you build a lasting reputation, and it all comes down to discipline, transparency, and earning unwavering trust from your investors.

At its core, this means staying true to the investment thesis you sold them on. Every single decision, from how you monitor the portfolio to how you manage risk, must tie back to that original vision. This isn't just a matter of good practice; it's your fiduciary duty and the very foundation of your credibility.

Think of active portfolio monitoring as your firm's central nervous system. It’s the constant, ongoing process of checking your investments against the original plan, catching red flags early, and finding opportunities to step in and add value. This isn’t something you can just check in on once a quarter—it needs to be a daily, disciplined routine.

For a venture capital fund, this could look like weekly calls with founders, obsessing over KPIs like burn rate or customer acquisition costs. If you’re running a real estate fund, it’s about staying on top of leasing activity, property-level cash flow, and what’s happening in the local market.

The other half of the equation is proactive risk management. It's about seeing what could go wrong before it actually does. And I'm not just talking about market risk. You need to be thinking about:

The best fund managers I know are obsessive risk managers. They spend less time celebrating their wins and more time stress-testing their losers, constantly asking, "What did we miss, and how could this go sideways?"

Your relationship with your Limited Partners (LPs) is the most valuable, non-negotiable asset you have. You build it through proactive, transparent, and consistent communication. Just sending a K-1 at tax time won’t cut it. You need a real investor relations strategy.

The quarterly report is the cornerstone of that strategy. This is your prime opportunity to shape the narrative and remind your LPs of the value you’re creating. A professional report has to be more than just a dry statement of returns.

An effective report should always include:

Beyond paper reports, hosting an engaging annual meeting is a game-changer. It’s your chance to bring the portfolio to life, let LPs meet the founders you’ve backed, and answer their questions face-to-face. This is how you turn a financial transaction into a genuine partnership.

The mechanics of moving money are where your operational skills are on full display for your investors. When you issue a capital call—the formal request for LPs to send in their committed capital for a new investment—the process has to be perfect. Your fund administrator will handle the back-end execution, but the communication is all on you.

Give your LPs plenty of notice, typically 10-15 business days, and be perfectly clear about what the funds are for. On the flip side, when an investment pays off and you’re ready to make a distribution, the process should be just as polished. Sending a detailed distribution notice that breaks down the return multiples and IRR builds incredible goodwill.

This operational discipline also means staying aware of the broader market. You have to consider how your fund fits into a world with constantly changing investment products and client tastes, especially with the explosion of exchange-traded funds (ETFs). In 2024 alone, a record 757 new ETFs launched globally—a 46% increase from the prior year. With total ETF assets now over $10 trillion, it’s a clear signal that investors want accessible, index-based options, which can influence how you position your own specialized strategy. You can discover more insights about these investment trends from the ICI.

As the firm grows, you won't be able to do it all yourself. Making those first key hires is a critical moment that will define your firm's future. The first person through the door is often an analyst to help with sourcing and diligence, followed by a dedicated compliance officer to handle the ever-growing regulatory load.

When you’re hiring, look for more than just technical chops. Find people who fit the culture you want to build. Your first few team members will set the tone for integrity, work ethic, and intellectual honesty for everyone who follows. In the end, managing a successful firm is a delicate balancing act: meticulously running the portfolio you have today while thoughtfully building the team that will carry you into tomorrow.

Starting an investment company opens up a firehose of questions, and they usually all come at once. Getting straight answers early on is the key to building your firm on solid ground. Let’s tackle some of the most common—and critical—questions we see from new founders.

There’s no single magic number here. The best way to think about it is to split your startup capital into two different pots: what you need to run the business, and what you need to invest.

First, you have your operational capital. This is the money that keeps the lights on—think legal bills, compliance consultants, salaries, software, and maybe an office lease. You need to budget for at least 12 to 24 months of runway. For most new managers, this number falls somewhere between $250,000 to over $1 million, depending entirely on your team's size and strategy. Trying to do this on the cheap is a classic, and often fatal, mistake.

Then there's your investment capital—the Assets Under Management (AUM) you'll raise from your Limited Partners (LPs). While you can technically start with any amount, most first-time funds aim to raise between $10 million and $50 million. That range tends to be the sweet spot where the management fees are finally enough to sustain the business and fuel growth. And don't forget, you'll also have regulatory net worth requirements to meet, which will factor into your total capital needs.

Not always, but this is a question you absolutely have to get right. Whether you need to register depends on your AUM and how many investors you have. The good news is that many new firms can launch under specific exemptions, which saves them from the massive undertaking of full SEC registration from day one.

The most common route is the “private fund adviser exemption.” This generally works for firms that only manage private funds and have less than $150 million in AUM.

Crucial Insight: "Exempt" doesn't mean you're invisible to regulators. As an Exempt Reporting Adviser (ERA), you still have to file parts of Form ADV and can be subject to an SEC examination. The penalties for getting this wrong are no joke.

Even if you’re exempt on the federal level, you will almost certainly have to register with state securities regulators under what are known as "blue sky" laws. These rules are a patchwork that varies from state to state. This complexity is exactly why one of your first calls should be to a specialized securities lawyer—before you talk to a single potential investor.

Learning from where others have tripped up can save you a world of hurt. Over the years, we've seen the same handful of avoidable mistakes sink otherwise promising firms.

Here are the biggest pitfalls to watch out for:

Ready to build an institutional-grade firm without the institutional-sized back office? Fundpilot gives you automated LP reporting, a professional investor portal, and streamlined fund administration, so you can focus on what you do best—sourcing deals and generating returns. See how we help emerging managers compete and win.