Wondering how do I start an investment company? Discover practical steps on legal setup, raising funds, and building a successful investment firm.

Starting an investment company begins with three critical moves: defining a sharp investment thesis, locking in the right legal structure, and building a business plan that actually gets read. Getting these foundational pieces right is everything—it sets the tone for your regulatory journey, your operational setup, and your ability to convince the first investors to take a chance on you.

Before you even think about raising capital or filing paperwork, you have to nail down the core identity of your firm. This isn't just about having a good idea; it's about building a strategic framework that gives you a real edge in a crowded market.

Think of it like building a house. You wouldn't start hammering nails without a detailed blueprint. Your firm needs that same level of planning to handle the operational and regulatory hurdles that will inevitably come your way. Without it, even the most brilliant investment concepts can collapse.

Your investment thesis is your firm’s North Star. It's a crisp, defensible statement that explains exactly how you plan to make money for your investors. A vague goal like "we invest in good tech companies" is a non-starter.

You have to get specific. A strong thesis sounds more like this: "We invest in seed-stage B2B SaaS companies in the Midwest that are solving supply chain inefficiencies. Our team will leverage its two decades of logistics experience to help them scale."

Instantly, that statement tells a potential investor everything they need to know:

A well-defined thesis doesn't just guide your deal flow; it attracts the right kind of Limited Partners (LPs)—the ones who understand your vision and are ready to back it. It answers the fundamental question: "Why should anyone trust you with their capital?"

The legal entity you select will have lasting effects on everything from personal liability and taxes to your firm's operational agility. The two most common structures you'll encounter are the Limited Liability Company (LLC) and the Limited Partnership (LP).

Most managers set up their management company—the entity that actually runs the fund—as an LLC. It provides solid liability protection and pass-through taxation, and it’s relatively straightforward to manage.

The fund itself is almost always structured as a Limited Partnership (LP). In this model, your management company acts as the General Partner (GP), managing the fund and assuming unlimited liability. Your investors are the Limited Partners (LPs), and their liability is capped at the amount they invest.

This GP/LP structure is the gold standard for a reason. It’s used across venture capital, private equity, and hedge funds because it aligns the interests of managers and investors while keeping everyone's roles crystal clear.

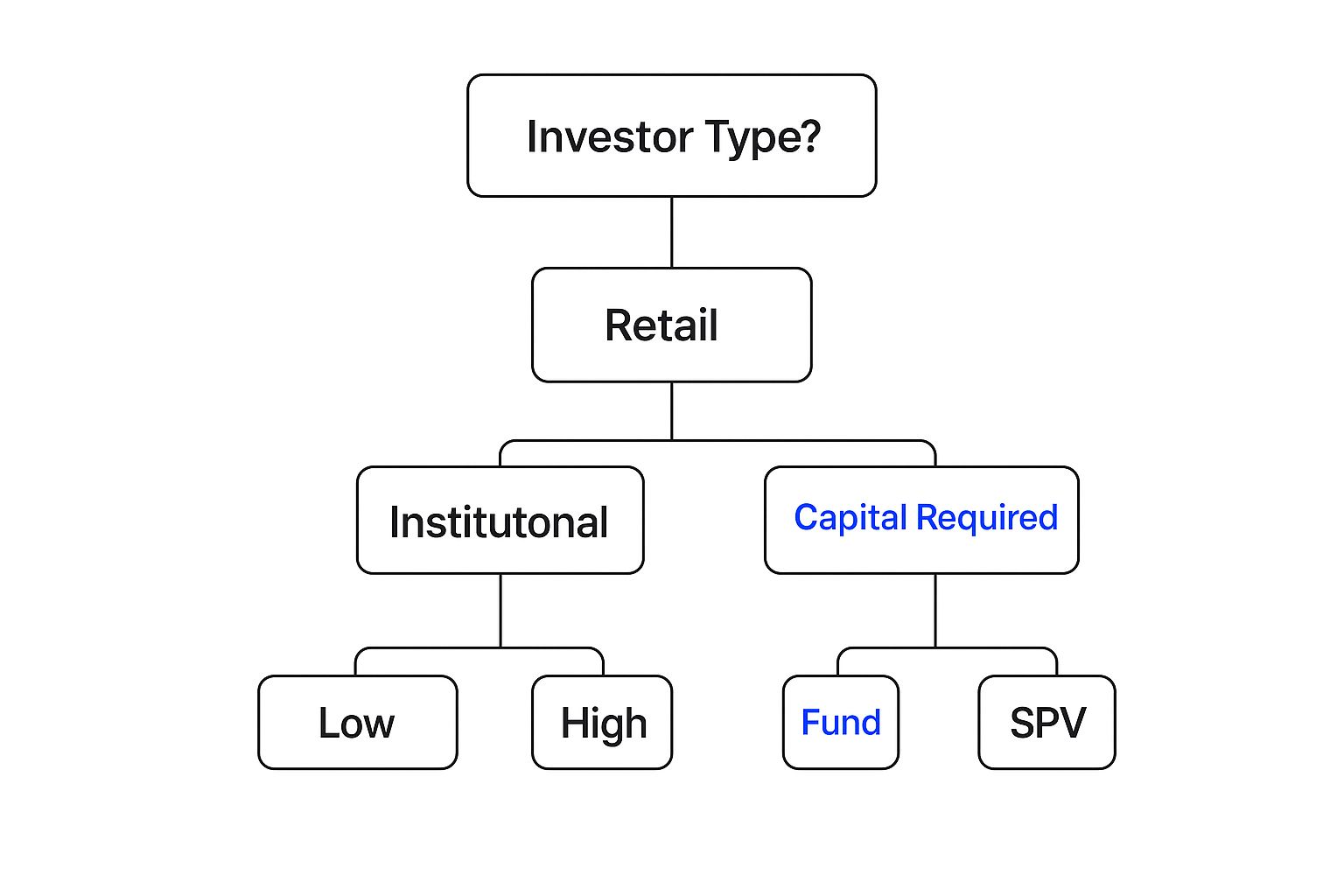

This decision tree gives you a good visual of how your goals will shape your choice of entity.

As you can see, if you're targeting institutional money and need to raise significant capital, the path almost always leads to a traditional fund structure.

Here's a quick summary of the key decisions you'll face at the very beginning, outlining what to consider for each foundational choice.

| Decision Area | Key Considerations | Impact on Your Firm |

|---|---|---|

| Investment Thesis | Your unique expertise, market opportunity, target asset class, and competitive advantage. | Defines your brand, attracts specific LPs, and guides all investment decisions. A weak thesis leads to a weak pipeline. |

| Legal Structure | Liability protection, tax implications, investor requirements, and operational complexity. | Affects your personal risk, tax burden, and the ease of bringing on investors. The GP/LP model is standard for a reason. |

| Business Plan | Market analysis, deal sourcing strategy, team bios, fund terms (fees, carry), and financial projections. | This is your primary marketing document. A sloppy plan signals a sloppy manager and will kill deals before they start. |

Making these choices thoughtfully is non-negotiable. They are the cornerstones upon which your entire firm will be built.

Your business plan is the formal document that pulls your thesis and structure together into a single, cohesive narrative. It’s your number one marketing tool for attracting those first crucial LPs and convincing top talent to join you. It needs to be detailed, data-driven, and above all, persuasive.

A great business plan doesn’t just describe what you will do; it tells a compelling story about a market opportunity that only your team is uniquely positioned to capture.

This document should meticulously cover your market analysis, deal sourcing strategy, team biographies, the competitive landscape, and realistic financial projections. It’s also where you'll lay out your fund’s terms, including management fees and carried interest (your cut of the profits).

These early decisions directly impact ownership and equity, so getting them right from day one is essential. To get a better handle on this, check out our founder’s guide to cap table management for practical insights on structuring equity from the start. A thoroughly researched business plan shows you're serious and have thought through every angle of building a successful investment company.

Alright, you've got your strategy and your business plan sketched out. Now comes the part that separates the professionals from the amateurs: regulations. The investment world is built on a mountain of rules designed to protect investors and keep the markets fair.

For a new firm, this can feel like trying to drink from a firehose of legal jargon and acronyms. But make no mistake, this isn't a step you can gloss over. Getting compliance right from day one is non-negotiable. A misstep here won’t just get you a slap on the wrist; it can torpedo your reputation before you’ve even managed a single dollar.

First things first, you need to figure out who your regulator is. This decision boils down to one primary factor: how much money you plan on managing, or your Assets Under Management (AUM).

You're generally looking at two main paths: registering with your state's securities authority or with the big one, the U.S. Securities and Exchange Commission (SEC).

State Registration: If you’re starting out and expect to manage less than $100 million in assets, you'll likely register with the securities regulator in the state where your main office is located. Every state has its own quirks and forms, so getting good local legal advice here is money well spent.

SEC Registration: Once your AUM crosses that $100 million threshold, you typically have to register with the SEC as a Registered Investment Adviser (RIA). This is a much heavier lift, starting with the comprehensive Form ADV, which lays out everything about your firm, from your fee structure to your investment philosophy.

Becoming an RIA isn’t just about paperwork. It means you are legally bound by a fiduciary standard—a promise to always act in your clients' best interests.

Hold on, though. Not everyone needs to become a full-blown RIA right out of the gate. For many new venture capital or private equity fund managers, there's another route: operating as an Exempt Reporting Adviser (ERA).

This is a common and often smarter starting point if you only advise private funds. As an ERA, your reporting burden is significantly lighter than an RIA's. You still have to file certain parts of Form ADV and are subject to anti-fraud rules, but the day-to-day compliance grind is less intense.

Key Takeaway: Choosing between RIA and ERA status is a major strategic call. Kicking off as an ERA can save you a ton on initial compliance costs, but you need a solid plan for when and how you'll make the jump to a fully registered RIA as your assets grow.

For instance, a new VC fund launching with $25 million is a perfect candidate for the ERA path. They’ll still need a rock-solid compliance program, but they won’t face the same level of scrutiny as a $200 million RIA that manages money for the public.

Think of your compliance manual as the operational bible for your firm. It's a living document that spells out your policies for everything—from how you execute trades and handle conflicts of interest to your cybersecurity protocols. A generic, off-the-shelf template just won't fly.

Regulators want to see a manual that’s specifically built around your business. If you say you have a policy, you'd better be able to prove you actually follow it.

At a bare minimum, your manual needs to cover:

Drafting these policies requires a deep understanding of the law. As you research and structure these critical documents, you might find that new AI tools for banking and finance law can help get you started.

Lately, the SEC has been zeroing in on private fund advisers, so staying on top of the latest rule changes is crucial. You can dive deeper into these requirements by learning how to go about https://www.fundpilot.app/blog/mastering-the-sec-private-fund-rules in our dedicated guide.

Ultimately, building a strong compliance culture from the start isn’t just about dodging fines. It's about sending a clear signal to investors that you're a serious, trustworthy professional.

Once you’ve navigated the legal and regulatory maze, it's time to build the engine of your firm: the fund itself. This is where your strategy moves from paper to practice, creating the actual vehicle for your investments. This phase splits into two critical tracks: designing the fund's structure and then going out to raise the capital that will power it.

The first tangible step is creating your Private Placement Memorandum (PPM). Don't let the formal name throw you. Think of the PPM as the detailed, legally-vetted blueprint for your fund. It’s the official disclosure document you’ll hand to potential investors, giving them every piece of information they need before they even consider writing a check.

Your PPM has to cover everything—the fund’s investment thesis, your team's background, how investors can subscribe, all the potential risks, and, of course, the fees. This isn't a glossy marketing brochure; it's a serious legal document. Any misstep here can create major headaches down the road.

Your PPM is the bedrock of your entire fundraising campaign. It needs to be crystal clear, completely transparent, and fully compliant with securities laws. This is the document your lawyers will spend late nights perfecting, and for good reason.

Every PPM worth its salt will include these core components:

Ultimately, this document is your shield. It ensures investors are fully informed, protecting both them and your new firm.

With a finalized PPM, you can officially hit the fundraising trail. For most founders, this is the toughest part of the journey. Raising that first fund is a relentless sales process that will push your network, your story, and your own grit to the limit.

Let’s be realistic: your first checks will almost certainly come from your immediate circle. We’re talking about friends, family, and former colleagues—the people who already trust you. Once you start putting points on the board and building a track record, you can start reaching out to a wider audience.

The goal of your first pitch isn't just to get a "yes." It's to find the right "yes"—from investors who truly buy into your long-term vision and won't get spooked by the first market dip.

It helps to grasp the sheer scale of the capital flows you're tapping into. For instance, the U.S. financial market is a complex beast. As of early 2025, its net international investment position was negative $24.61 trillion. This number, representing $36.85 trillion in foreign-owned assets versus $61.47 trillion in U.S.-owned assets abroad, highlights the vast, interconnected world of capital you’re now a part of.

Your pitch deck tells the story; your PPM backs it up with the facts. While the PPM is the legal "what," your pitch is the passionate "why." It has to connect with people on a level that numbers alone can't reach.

You need to hammer home your unique edge. What makes you the only person who can successfully execute this strategy? Is it your deep industry network? A proprietary algorithm you built? A contrarian view of the market that everyone else is missing? As you prepare, it's wise to get inside investors' heads by understanding the ins and outs of venture capital due diligence.

At the end of the day, you're not just selling a financial product; you're selling trust in yourself. Your ability to communicate your vision with conviction is just as critical as any chart in your deck. For a deeper dive into the mechanics of this process, our guide on how to raise capital, a founder's playbook is a great next step.

A powerful investment strategy is what truly separates a flash-in-the-pan firm from one built to last. It’s your disciplined, evidence-based roadmap for managing assets, and it’s what earns you the trust needed to drive real returns. Forget about chasing the latest market fad; this is about crafting a defensible philosophy that can ride out the inevitable storms and deliver.

Think of your strategy as the core promise you make to your investors. It clearly defines how you'll protect their capital while pursuing growth, setting the expectations that will define your relationship for years to come. Ultimately, a well-defined strategy becomes the very soul of your firm.

Your investment philosophy is the "why" behind every single trade. It has to be crystal clear, repeatable, and grounded in a unique perspective on the market. Vague, generic statements like "we find undervalued assets" just won't cut it with sophisticated investors.

You need something with teeth. For instance, a strong philosophy might be articulated like this: "We believe the global transition to renewable energy is creating long-term value dislocations in industrial supply chains. Our focus is on identifying and investing in public companies poised to benefit from this tectonic shift, using a proprietary model to screen for robust balance sheets and sustainable competitive advantages."

What makes this statement work?

Your philosophy is your firm's DNA. It guides every choice you make, from the assets you screen to the risks you're willing to accept, and it’s what will attract the right kind of investors who share your worldview.

So many people get this wrong. Diversification isn't just about buying a bunch of different stocks. It’s a sophisticated risk management discipline designed to build a portfolio that doesn’t live or die by the performance of a single asset class. The real goal is to smooth out returns and protect capital when—not if—a downturn hits.

The historical data on this is overwhelming. The UBS Global Investment Returns Yearbook 2025, which dug into 125 years of data across 23 global markets, found that diversified portfolios have consistently crushed undiversified ones by cutting risk while actually improving returns. As you start an investment company, building your funds with this principle in mind is absolutely essential. You can dive deeper into these long-term market insights from UBS to help shape your own approach.

A well-diversified portfolio is like a well-built ship. It’s constructed not just for calm seas but to withstand the unexpected storms that will inevitably arise in financial markets.

This means you need to think beyond just stocks and bonds. Depending on your fund's mandate, you should be considering allocations to things like real estate, commodities, or private credit to create a truly resilient mix.

Your model portfolio is where your philosophy gets real. It translates your big-picture ideas into a concrete asset allocation plan—the blueprint you'll use to build and manage every account. This model needs to clearly define target weights for each asset class and establish firm ranges for any tactical adjustments.

For example, a "balanced growth" model might look something like this:

| Asset Class | Target Allocation | Allowable Range |

|---|---|---|

| U.S. Large-Cap Equity | 35% | 30% - 40% |

| International Equity | 20% | 15% - 25% |

| Investment-Grade Bonds | 30% | 25% - 35% |

| Real Estate (REITs) | 10% | 5% - 15% |

| Cash & Equivalents | 5% | 0% - 10% |

This structured approach is your defense against making emotional, reactive decisions when the market gets choppy. It provides discipline and ensures every single portfolio adheres to the core strategy you promised your investors. It’s this repeatable, systematic process that builds a reputation for professionalism and earns you trust that lasts.

A brilliant investment strategy is worthless without the operational muscle to back it up. Your firm’s infrastructure isn’t just about administrative tasks; it’s the engine that powers your efficiency, keeps you compliant, and allows you to grow. Get this right from the start, and you’ll be free to focus on what actually matters: finding great investments.

This foundation is built on two key elements: the partners you bring on board and the technology you use. If you mess up either of these, you’ll quickly find yourself drowning in manual work, failing to keep investors updated, and always a step behind on compliance. A solid operational setup, however, can become a real competitive edge.

No investment firm is an island. Your ability to succeed hinges on a network of specialized service providers. You shouldn't think of them as mere vendors, but as extensions of your team. Picking the right ones is one of the most important decisions you'll make early on.

Here are the core partners you'll need:

When you're vetting potential partners, don't let price be the only factor. Ask for references from other fund managers. A cheap provider who makes constant mistakes will end up costing you far more in wasted time and a damaged reputation.

It used to be that only the big, established firms could afford top-tier technology. Not anymore. Modern platforms have completely changed the game, giving emerging managers access to tools that were once out of reach. Your tech stack is what will automate your workflows and give you the data you need to make smarter decisions.

This is especially true today, as the industry is moving faster than ever. We're seeing a massive wave of product innovation. For instance, the global market saw 757 new Exchange-Traded Funds (ETFs) launched in 2024 alone—a huge 46% jump from the year before. This just goes to show how critical it is to have a tech infrastructure that can keep up. You can dig deeper into these key industry trends from the ICI.

Your essential tech toolkit should include:

The good news is that modern, all-in-one platforms can bundle many of these functions together, which can seriously simplify your tech setup.

Take a look at the Fundpilot dashboard. It’s designed to pull all of your key operational data into one place.

An interface like this brings everything from LP reporting to pipeline management under one roof, giving you a clear, immediate picture of your firm's operational health.

Starting an investment firm is an intense journey, and it’s natural to have a lot of questions swirling around. You're not alone. Here are some of the most common—and critical—questions we see from founders who are just getting started, along with some straight-to-the-point answers.

There’s no one-size-fits-all answer here. The capital you need depends heavily on your strategy and the type of firm you're building.

For a small, independent advisory firm that's just managing a few local accounts, you might be able to get up and running for under $100,000. That would cover your legal formation, initial compliance setup, and basic operating expenses for the first year.

But if you’re launching a venture capital or hedge fund, that number gets a lot bigger, fast. LPs (Limited Partners) will expect you to have significant "skin in the game," meaning a substantial personal investment in your own fund. On top of that, you need a solid operational runway—enough cash to cover salaries, legal, tech, and admin for at least two years without bringing in any revenue. That can easily push your starting capital needs from a few hundred thousand to well over a million dollars.

It's a tough road, but not entirely impossible. The real challenge isn't a rulebook; it's credibility. Both regulators and potential investors are going to put your background under a microscope. If you don't have a proven track record in portfolio management, analysis, or trading, you're starting with a major trust deficit.

Your best bet, if you lack a traditional finance background, is to partner with people who have unimpeachable expertise. Bringing on co-founders or key team members with deep, verifiable track records in asset management and compliance isn't just a good idea—it's pretty much non-negotiable.

You'll also need an investment thesis that is truly unique and compelling. You have to prove you have a demonstrable edge that others—even those with more experience—have missed.

While both manage money, they live in very different parts of the investment world. The core differences come down to what they buy, their strategies, and how long they plan to hold their investments.

We see it all the time: brilliant investors who get tripped up by the business side of running a firm. If you can sidestep a few common landmines, your chances of success go way up.

Here are three of the most damaging mistakes new founders make:

Building an institutional-grade operational foundation isn't a "nice-to-have" anymore; it's table stakes. Fundpilot provides the tools to automate your reporting, streamline administration, and give your investors an experience that builds confidence from day one. This frees you up to focus on what you actually do best: investing.