Master cap table management with our guide. Learn to avoid common pitfalls, manage equity effectively, and choose the right software for startup growth.

Think of your cap table as the company's ownership blueprint. It's a dynamic document that shows, with absolute clarity, who owns what—from the founders and investors right down to employees with stock options. Getting cap table management right isn't just an administrative chore; it's a strategic discipline that's absolutely vital for fundraising, hiring top talent, and navigating a future sale or merger.

A capitalization table, or "cap table" for short, is much more than a simple spreadsheet. It's the single source of truth for your company's equity story. At its core, it tracks every single share, option, and warrant, linking each piece of ownership to a specific person or entity. This document is the very foundation of your company's financial structure, telling a detailed story of its journey through every funding round and growth spurt.

For a founder just getting started, it's easy to push cap table management to the back burner. That's a huge mistake. An accurate, well-managed cap table builds investor trust, keeps you legally compliant, and helps you sidestep the kind of expensive, complicated disputes that can sink an otherwise promising company. Honestly, getting this right from day one is one of the smartest things a founder can do.

When you stop seeing your cap table as just a record and start seeing it as a strategic tool, you unlock its real power. It impacts major business decisions and directly influences your ability to scale.

Fundraising and Investor Confidence: During due diligence, potential investors will comb through your cap table. They want to understand the ownership structure and spot any potential risks. A messy or confusing cap table is a massive red flag that can kill a deal. Presenting a clean, professional ownership structure is critical when you're finding startup investors and trying to close a round.

Employee Equity and Talent Acquisition: Stock options are a game-changer for attracting and keeping the best people, especially when you can't compete on salary alone. An organized cap table lets you manage your employee stock option pool (ESOP) effectively, ensuring you have enough equity to offer compelling packages without giving away the farm.

Strategic Decision-Making: How will this new funding round dilute the founders' stake? What's the company's fully diluted ownership? A well-maintained cap table gives you the data to model these scenarios, helping you negotiate smarter terms and make informed choices that protect your own equity.

Without a disciplined approach, it’s frighteningly easy to fall into common traps. Simple clerical errors, undocumented "handshake" equity promises, or forgetting to track vesting schedules can snowball into enormous legal and financial messes. Just imagine finding a critical error in your ownership records right as a multi-million dollar acquisition is about to close. It happens.

An outdated or inaccurate cap table is a ticking time bomb. It creates uncertainty, undermines trust, and can lead to serious disputes that drain resources and threaten the company's future.

Ultimately, proper cap table management is all about maintaining clarity and control over your company's most valuable asset: its equity. It ensures that every single stakeholder—from the co-founders to the newest hire—has a clear, accurate, and fair understanding of their piece of the pie. That kind of foundational stability is essential for building a company that lasts.

A cap table can look intimidating at first, like a dense spreadsheet filled with financial jargon. But once you get a handle on the core components, it becomes a surprisingly clear map of your company's ownership structure. Think of it less as a dry legal document and more as a "who's who" of your company's equity story.

Every line item tells a piece of that story, and understanding how they all fit together is the key to mastering your cap table management.

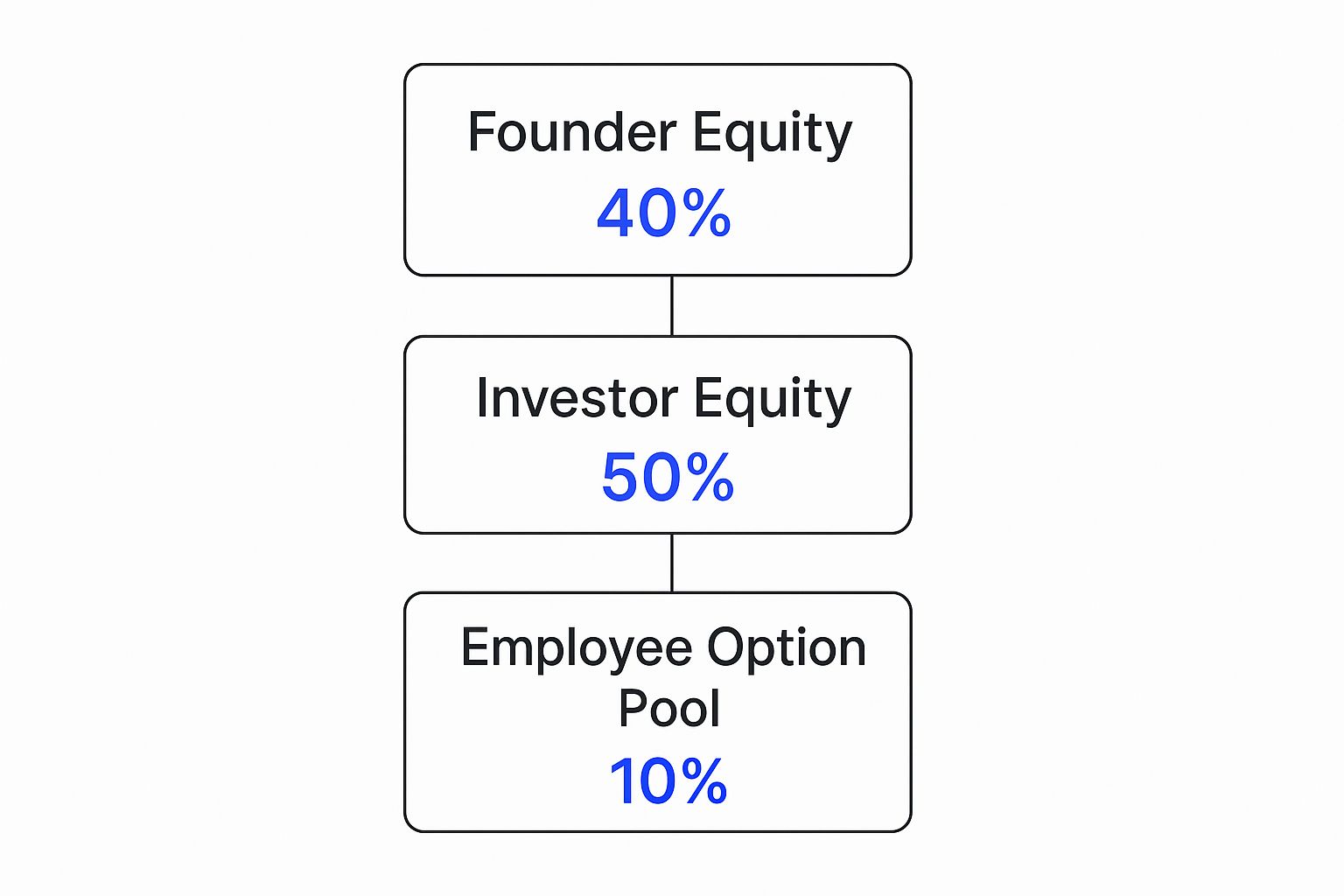

This diagram gives a simple, high-level view of how ownership might be split between founders, investors, and employees.

As you can see, investor equity can quickly become the biggest piece of the pie. This is exactly why it's so critical to keep a close eye on dilution from day one.

Let's start with two of the most fundamental concepts: authorized shares and issued shares.

Authorized shares are the total number of shares your company is legally allowed to create. This number is set in your company's articles of incorporation. It's like having a full deck of 52 cards, ready to be dealt out as needed.

Issued shares, on the other hand, are the shares you've actually given to people—founders, employees, or investors. These are the cards already in players' hands. The shares left over between authorized and issued give you the flexibility for future fundraising rounds or employee grants.

It’s important to know that not all shares are created equal. The main distinction is between common stock and preferred stock, and they come with very different rights.

Think of it like getting on a plane. Preferred stockholders have priority boarding—they get their seats first. Common stockholders get on after them. This hierarchy is a crucial detail to track on your cap table.

To make these terms a bit clearer, here's a quick breakdown of the core components you'll find on any cap table.

| Component | What It Is | Why It Matters |

|---|---|---|

| Authorized Shares | The total number of shares a company is legally allowed to issue. | Sets the upper limit for how much equity can be distributed. |

| Issued Shares | Shares that have actually been granted to shareholders. | Represents the current outstanding ownership of the company. |

| Common Stock | The basic form of ownership with voting rights, held by founders and employees. | Represents the foundational equity of the company, but is last in line during a liquidation. |

| Preferred Stock | A class of stock with special rights, usually issued to investors. | Provides investors with priority payouts and other protections, affecting founder dilution. |

| Stock Options | The right for an employee to buy stock at a fixed price in the future. | A key tool for attracting and retaining talent, but also a future source of dilution. |

| Fully Diluted Shares | The total number of shares if all options, warrants, etc., were exercised. | Gives the most accurate picture of ownership stakes; it's the number investors focus on. |

This table covers the basics, but the real magic happens when you see how they all interact, especially when it comes to dilution.

As your company grows, you won't just be issuing stock. You’ll set up an employee stock option pool and might use other tools like warrants or convertible notes to raise money. This is where the idea of fully diluted ownership becomes absolutely critical.

This calculation shows what ownership percentages would look like if every single potential share—options, warrants, and other convertible instruments—was converted into common stock.

Fully diluted ownership provides the most accurate and conservative view of each person's stake in the company. It's the number investors care about because it shows what ownership will look like after all potential shares are on the table.

Looking at ownership on a non-diluted basis is a recipe for trouble. A founder might think they own 50% of the company, but after accounting for the employee option pool, their fully diluted stake could be closer to 40%. Getting this right is a cornerstone of good cap table management. The value of these shares is also a major piece of the puzzle; our guide to valuing a private company can help you understand the financial impact.

Here are the key things that contribute to full dilution:

By breaking down these core elements, you can start to read your cap table not just as a list of numbers, but as the strategic story of your company's journey—past, present, and future.

Almost every startup begins its life on a spreadsheet. It’s free, everyone knows how to use it, and for tracking a couple of founders' initial shares, it seems like the obvious choice. But what starts as a simple ledger quickly becomes a ticking time bomb as your company grows.

Relying on a spreadsheet for your cap table management is like trying to navigate a ship through a storm with a hand-drawn map. It might get you started, but one wrong move—one broken formula or misplaced decimal—and you're completely lost, with potentially disastrous consequences.

Spreadsheets are incredibly fragile. A single typo, a copy-paste error, or a formula that breaks without anyone noticing can ripple through the entire document. These aren't just minor clerical mistakes; they can fundamentally misrepresent who owns what in your company, creating a legal and financial mess that can spook investors and derail your future.

Let's imagine a startup, "InnovateCo," that’s on the verge of closing its Series A round. They've been managing their cap table on a shared spreadsheet from day one. An excited new investor group starts its due diligence and asks to see the ownership records.

The InnovateCo team sends over what they think is the final, accurate version. What they don't know is that months ago, an intern accidentally deleted a key formula while adding a new employee's stock options. This tiny error meant the fully diluted share count was wrong, inflating the founders' ownership stake by a critical 3%.

The investor's legal team spots the discrepancy almost immediately. The deal, which was moving along smoothly, grinds to a halt. The funding round is now on ice while InnovateCo's founders frantically comb through years of manual entries to pinpoint the mistake. The error costs them precious time and piles of legal fees, but the real damage is to their credibility. The investors are left wondering what other operational details the team has missed.

This scenario, while fictional, happens all the time. It shines a light on the core dangers of spreadsheet management:

The biggest danger of a spreadsheet isn't just making a mistake; it's the trust you lose when that mistake comes to light. A messy cap table tells investors that your financial house isn't in order, putting your entire fundraise at risk.

The risks of managing your cap table manually are just too great for any serious, growing company. It’s a common story that these preventable errors cause major delays and can even jeopardize funding deals. This is precisely why modern cap table software exists—to automate the calculations, reporting, and data entry that are so prone to human error. This saves a massive amount of administrative time and helps ensure you stay compliant. If you want to see how this works in practice, you can discover more about how software solves these startup challenges on eqvista.com.

At the end of the day, a spreadsheet is a static document trying to track something that is constantly changing. Your company's ownership is a living, breathing thing. Graduating to a dedicated platform isn't just a minor upgrade; it's a fundamental shift from reactive bookkeeping to proactive, strategic equity management. It gives you a single source of truth that protects your company, builds confidence with your investors, and creates a solid foundation for growth.

Let's move beyond the risks of messy spreadsheets and talk about building a smarter system. Good cap table management isn't a one-time cleanup job; it's a set of proactive habits you bake into your company's DNA from day one. The most successful founders treat their equity not as a static document, but as a living, breathing asset that needs constant attention.

The absolute foundation of this approach is establishing a single source of truth. This simply means having one central, universally accepted record for every piece of equity information. When founders, investors, and lawyers are all looking at different spreadsheet versions, you're just asking for trouble. A centralized platform gets everyone on the same page, ensuring every decision is based on the same accurate, real-time data.

Here’s a non-negotiable rule: update your cap table the moment an equity event happens. Procrastination is the enemy of accuracy. Every single transaction, no matter how small, has to be logged immediately.

This discipline saves you from the nightmare of a massive backlog and the frantic, last-minute rush to fix things during a funding round or audit.

Key events that demand an instant update include:

Sticking to this real-time cadence turns your cap table from a dusty historical record into a live dashboard of your company's ownership. It’s also important to see how these grants fit into your overall compensation strategy. For a deeper look, check out our guide to boosting growth with a share incentive plan.

A well-kept cap table is more than just a ledger; it's one of the most powerful strategic tools you have as a founder. Its real power comes from scenario modeling—running simulations of future events to see exactly how they'll impact your ownership structure. This is how you stop reacting to events and start shaping them.

Picture this: you're getting ready for your Series A. With the right software, you can model different outcomes in minutes:

This isn't just a numbers game; it's a core part of your negotiation strategy. Walking into a term sheet discussion armed with a crystal-clear understanding of how different terms will play out allows you to negotiate from a position of strength, backed by hard data.

By simulating a future fundraise, you can see dilution coming and negotiate smarter terms. For instance, if one offer dilutes the founding team too much, you’ll have the data to push for a higher valuation or different terms to protect your stake. This kind of foresight helps you make decisions that protect the company's long-term health and keeps the ownership structure fair and motivating for the whole team.

Choosing the right software to manage your cap table is a defining moment for any growing business. Think of it less as buying a tool and more as investing in your company’s financial backbone—one that builds accuracy, efficiency, and a whole lot of investor confidence.

Today’s platforms are light-years beyond a fancy spreadsheet. They are true equity ecosystems, built to handle every twist and turn of your company's ownership story.

What works for a pair of founders in a garage will absolutely shatter under the weight of a Series A round, a growing employee stock option pool, and different classes of shares. The key is finding a solution that doesn't just solve today's problems but can scale with you from that first angel check all the way to a potential IPO.

When you start shopping around, it’s easy to get lost in a sea of features. My advice? Don't chase the platform with the longest list of bells and whistles. Instead, zero in on the core functions that will actually move the needle for your operations and long-term strategy.

Every founder and finance leader should put these at the top of their list:

A great cap table platform acts as your single source of truth for all things equity. It takes the guesswork out of complex math, keeps you compliant, and arms you with the data you need to make smart, strategic decisions for growth.

Beyond the number-crunching, remember that this platform is the main touchpoint for your investors and employees regarding their ownership. The experience it delivers says a lot about your company’s professionalism.

Look for a solution with a secure, intuitive portal where stakeholders can log in to see their holdings, review documents, and e-sign their grants. This kind of transparency builds trust and cuts down on the endless administrative questions that can bog down your team.

The perfect software for you really depends on where your company is right now. A seed-stage startup has vastly different needs than a company prepping for its Series C. For a detailed breakdown, check out our in-depth analysis of the top 10 capitalization table management software in 2025.

As you compare platforms, it's helpful to see how different features serve companies at different points in their journey.

This table gives a quick overview of how top-tier software meets the distinct needs of startups versus more established, scaling companies.

| Feature | Benefit for Early-Stage Startups | Benefit for Scaling Companies |

|---|---|---|

| Ease of Use | Allows founders to manage equity without a dedicated finance team, ensuring accuracy from day one. | Simplifies onboarding for new finance and HR team members, maintaining consistency across the board. |

| Cost-Effectiveness | Provides essential features without a hefty price tag, fitting neatly into an early-stage budget. | Offers advanced tiers and integrations that deliver a strong ROI as complexity and scale increase. |

| Scalability | Ensures a smooth, error-free transition as you add your first investors and employee option holders. | Effortlessly handles complex multi-round financing, international employees, and pre-IPO requirements. |

| Integrations | Connects with payroll and HR systems (like Gusto or Rippling) to streamline option grants for new hires. | Syncs with accounting and legal platforms for a fully integrated financial tech stack that works in harmony. |

Ultimately, picking the right management software is about future-proofing your company. Making a smart investment in a robust, scalable platform early on saves you from the painful and expensive process of migrating messy data later. It gives you a clean, solid foundation to build on for years to come.

Equity management has come a long way from just being about record-keeping. What used to be a tedious, reactive chore is now a critical, forward-looking part of a company's growth strategy. This isn't just a minor shift; it's a fundamental change driven by more complex startup financing and higher expectations from everyone involved.

The numbers tell the same story. The global Cap Table Management Software market, currently valued at around USD 1.2 billion, is expected to skyrocket to nearly USD 3.5 billion. That’s a compound annual growth rate of about 12.5%, fueled by the sheer complexity of managing equity in a globalized world. You can explore more about these market dynamics to get a sense of just how fast this space is moving.

Looking ahead, a few key trends are really changing the game for cap table management. These aren't just small tweaks; they're major leaps forward in how companies will use their ownership data.

Predictive Fundraising Models: AI is set to play a much bigger role. Imagine being able to analyze market data and your own metrics to predict the best time to raise capital or model out deal terms with stunning accuracy. That's where we're headed.

Automated Global Compliance: As businesses hire talent across borders and take on international investors, the legal and tax paperwork gets messy. Automated systems will become essential for untangling the web of global securities laws, cutting down on both risk and headaches.

Radical Transparency: Both investors and employees are tired of being in the dark. The demand for clarity is growing, and future platforms will provide intuitive, real-time access to equity information so everyone can see exactly what their stake is worth and what it could become.

The future of cap table management isn't just about a better spreadsheet. It's about a smarter, more proactive, and transparent way of handling ownership itself.

This whole transformation is about turning a static document into a living, breathing strategic tool. Being proactive with your company's equity isn't just a "nice-to-have" anymore—it’s a direct investment in your future.

It paves the way for smoother growth, builds trust with your team and investors, and ultimately helps everyone working to build your vision succeed. This disciplined approach gives you the stability and foresight needed to tackle the challenges of scaling a great business.

Ready to move past spreadsheets and build a foundation for institutional-grade growth? See how Fundpilot delivers the clarity, security, and strategic foresight your company needs. Schedule a demo with Fundpilot today.