Wondering what is a share incentive plan? Learn how it drives growth, different types, benefits, and tips for successful implementation.

At its core, a share incentive plan is a way for companies to give their employees a direct stake in the business, usually by offering them shares or stock options. The goal is to transform team members into part-owners, making the company's success their personal success.

Think of it like this: you give your most dedicated gardeners a small patch of the garden they tend every day. A share incentive plan follows that same logic. It’s a formal framework that gives employees a piece of the company, turning them from people who just work there into genuine partners in its future.

The fundamental idea is to get everyone pulling in the same direction. When the company does well, its people do well too. This shared-success model is an incredibly powerful way to attract, motivate, and hold onto top talent by offering them a tangible slice of the company's future value.

This isn't just a niche strategy for startups, either. It’s a global standard. In fact, an overwhelming 97% of multinational public companies with equity programs extend these plans beyond their home countries, which really speaks to how common and effective they are. You can read more about the global trends in equity compensation to see just how widespread this has become.

To really get a handle on what a share incentive plan is, let's break it down into its core moving parts.

At its heart, every plan is built on a few key elements that spell out how it works and who gets to participate. These components are the nuts and bolts of any good incentive strategy.

A well-designed share plan acts as more than just a financial reward. It fosters a culture of ownership where employees are motivated to think and act like business owners, driving long-term value for everyone involved.

The table below gives you a quick snapshot of the core elements that you'll find in almost any Share Incentive Plan (SIP).

| Component | Brief Explanation | Common Example |

|---|---|---|

| Eligibility | This defines which employees can join the plan, often based on their role, seniority, or performance. | The plan is open to all full-time senior managers and above who have completed one year of service. |

| Award Type | This is the specific form of equity being granted, like stock options, restricted stock units (RSUs), or performance shares. | Employees receive RSUs that convert into company shares after a set period. |

| Vesting | This is the process of earning the right to your shares, which usually happens over a period of time or by hitting certain goals. | Awards vest incrementally, with 25% vesting each year over a four-year period. |

These three components—who gets in, what they get, and when they get it—form the foundation of the entire plan. Getting them right is critical to making the whole thing work.

To really get what a share incentive plan is today, you have to look back at how far they've come. The plans of yesterday were much simpler, often just a straightforward reward for hitting a basic financial target. They worked for their time, but the business world has gotten a lot more complicated since then.

This evolution tracks a deeper shift in how companies think about success and what truly motivates their key people. Yesterday’s simple stock options have given way to more sophisticated, strategic tools designed to align with a much broader set of goals.

Back in the mid-1990s, stock options were king. These plans were almost always tied to a single, direct metric like earnings per share (EPS). The thinking was simple: if profits go up, the stock price should follow, and employees holding options get a nice payout. It was an easy model to understand.

But as markets became fiercer, companies realized they needed sharper instruments. This gave rise to performance-based awards like Restricted Stock Units (RSUs) and performance shares. These aren't just handed out; they have to be earned by hitting specific, often multi-layered, business objectives over several years.

A major leap forward was the move to relative performance measures. Instead of just looking at internal growth, modern plans often measure a company’s performance against a handpicked group of its peers.

This is where metrics like relative Total Shareholder Return (TSR) enter the picture. TSR compares how a company's stock does against a competitor index. This ensures executives are rewarded for genuinely outperforming the market, not just for riding a bull market wave. It’s a powerful change. In fact, about 76% of U.S. public companies now use relative TSR as a key performance measure in their Long-Term Incentive (LTI) programs.

A modern share incentive plan is no longer just a financial instrument. It's a strategic tool designed to drive specific behaviors, reward relative outperformance, and broadcast a company's core values to stakeholders and the market.

This strategic pivot means that truly understanding and managing these plans is now a core function for any forward-thinking fund manager. For more on this, you can find further insights on talent retention and growth strategies on the Fundpilot blog.

Maybe the most important recent shift has been weaving Environmental, Social, and Governance (ESG) criteria into these plans. Today’s stakeholders, from massive investors to individual employees, expect companies to deliver more than just profit. They demand real accountability on sustainability, diversity, and ethical governance.

In response, companies are now tying executive pay to non-financial goals, like cutting carbon emissions, improving employee diversity, or strengthening data security. This isn't a niche trend anymore—it's mainstream. Over 75% of large U.S. companies and even more in Europe are now baking ESG metrics into their plans, proving that modern incentives are all about building long-term, sustainable value.

Not all share incentive plans are created equal. Just as a skilled craftsperson has a workshop full of specific tools for different jobs, companies pick and choose from various plan types to hit their strategic goals. Getting these distinctions right is absolutely critical if you want to design a program that genuinely motivates your team and supports your company’s growth.

Think of these plans as different kinds of reward contracts, each with its own set of rules and potential payoffs. Some offer a shot at high returns but come with more risk, while others deliver more predictable, steady value over time. For any fund manager or business leader, a key part of understanding what a share incentive plan is comes down to knowing these variations inside and out.

Stock options are probably the first thing that comes to mind when you hear "employee equity." At their core, they give an employee the right to buy a specific number of company shares at a locked-in price—often called the "strike price" or "exercise price"—after a certain amount of time has passed.

The motivation here is simple and powerful. If the company’s stock value climbs above that strike price, the employee can buy shares at a significant discount and pocket the difference. It's a direct link between their hard work and a tangible financial reward, creating a clear incentive to help push the company's valuation skyward.

Now, let's switch gears. Unlike options, Restricted Stock Units (RSUs) aren't a right to buy shares; they are a promise to grant them at a future date. Once an employee fulfills the vesting requirements, which are usually tied to how long they stay with the company, those RSUs convert into actual shares. No purchase necessary.

Many people see RSUs as a less risky proposition than stock options. Why? Because they hold value even if the stock price stagnates or dips. As long as the company's shares are worth something, the employee receives a tangible asset. This makes RSUs a fantastic tool for retaining key talent.

The choice between options and RSUs often says a lot about a company's stage and philosophy. Early-stage startups hungry for explosive growth might lean toward options, while more established firms often prefer RSUs to offer a more stable and predictable form of equity compensation.

Some companies want to take alignment a step further by tying equity directly to hitting specific business goals. This is where more specialized plans come into play.

To give you a clearer picture of how these plans compare, let's break them down.

The table below outlines the key features, benefits, and considerations for the most popular types of employee share plans. It's a quick reference guide to help you see which structure might be the best fit for your specific goals, whether you're aiming for aggressive growth or stable, long-term retention.

| Plan Type | How It Works | Best For | Key Consideration |

|---|---|---|---|

| Stock Options | Grants the right to buy shares at a fixed price in the future. Value comes from the stock price increasing. | High-growth, early-stage companies aiming to motivate aggressive performance. | Can become worthless ("underwater") if the stock price falls below the strike price. |

| Restricted Stock Units (RSUs) | A promise to grant shares at a future date upon vesting. Employees receive the full value of the shares. | Mature or public companies focused on retention and providing predictable value. | Less potential for explosive gains compared to options in a bull market. |

| Performance Shares | Shares are awarded only if specific company or individual performance metrics are met. | Aligning executive and senior leadership incentives with strategic goals. | Can be demotivating if targets are perceived as unrealistic or unattainable. |

| Share Appreciation Rights (SARs) | Provides a cash payout equal to the increase in share value, without issuing actual shares. | Companies looking to offer an option-like incentive without shareholder dilution. | The cash payout can impact the company's financials directly. |

Each of these structures serves a different purpose, and the right choice depends entirely on your company's culture, financial position, and long-term vision.

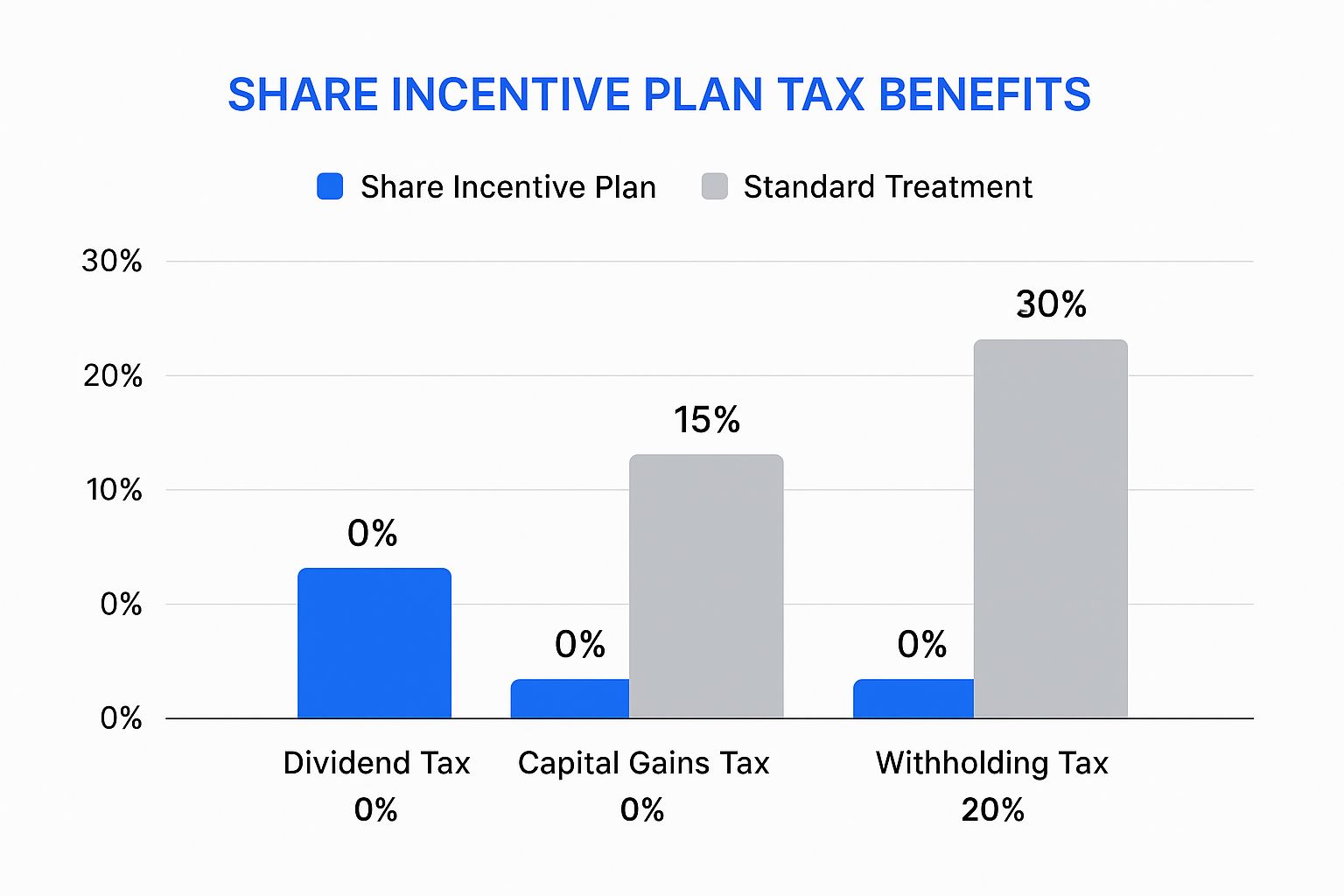

The infographic below highlights just how valuable certain government-approved share plans can be from a tax perspective when compared to standard income.

As the data shows, qualifying plans can create significant tax efficiencies for employees. In some cases, they can completely eliminate or drastically reduce common taxes on dividends and capital gains, making the reward that much sweeter.

A well-designed share incentive plan is more than just another line item in a compensation package. It's a strategic move that fundamentally changes the relationship between a company and its people, creating a powerful win-win scenario.

For the business, it's about building a team that’s in it for the long haul. For employees, it’s a tangible way to share in the success they help build every day. When people have skin in the game, their mindset shifts. Suddenly, they're not just employees—they're owners.

This single shift from a "me" to a "we" mentality is the magic ingredient. It fosters a culture where everyone is pulling in the same direction, making decisions that fuel sustainable growth, not just hitting quarterly targets.

From the company's point of view, share plans are a secret weapon for building a competitive edge. They tackle some of the biggest challenges businesses face, from attracting top-tier talent to keeping them motivated for years to come. The key benefits really boil down to:

A share incentive plan transforms the employer-employee dynamic from a simple transaction into a genuine partnership. This shared-success model is a cornerstone of building a loyal and motivated workforce dedicated to sustainable growth.

The upside for employees is just as compelling, offering a unique blend of financial opportunity and a real sense of purpose at work. When you understand what a share incentive plan is from their perspective, you see why it’s such a powerful motivator.

For many, it’s a path to wealth creation that a salary alone could never provide. It’s the difference between earning a living and building a future. In fact, research shows that employees who feel valued are 55% less likely to leave their jobs, and equity is one of the most powerful forms of recognition there is.

This feeling of being a true partner, not just a cog in the machine, creates incredible loyalty and job satisfaction. Seeing your hard work directly translate into personal financial growth is a huge psychological boost. You get a team member who is more engaged, more proactive, and who takes genuine pride in their work.

Taking a share incentive plan across borders isn't as simple as hitting "copy and paste" on your domestic strategy. You're stepping into a complex maze of legal, tax, and regulatory hurdles that can trip up even the most well-thought-out plans. Every country has its own rulebook, which means a ‘one-size-fits-all’ approach to global equity is doomed from the start.

For fund managers and leaders of multinational companies, ignoring these differences is a recipe for disaster. A plan that's a home run in the United States could easily become a massive tax headache in Germany or get tangled in red tape in China. These variations don't just affect the bottom line; they can kill the motivational power of your incentives, turning a great idea into an administrative nightmare.

Getting a handle on these international complexities is the only way to ensure your plan is compliant and, more importantly, effective. It demands serious homework and a flexible game plan.

The world of international regulation is anything but static. Governments are constantly tweaking laws on everything from taxation and social security to corporate reporting. Keeping up feels like a full-time job in itself, and these aren't just minor adjustments—they can have a massive financial impact.

Just look at the recent shifts. In 2025, France's new Finance Bill hiked employer social security contributions on Restricted Stock Units (RSUs) to a hefty 30%. At the same time, China decided to extend its favorable tax rules for public company equity awards through the end of 2027, while Germany scrapped its mandatory “one-fifth rule” for taxing equity awards on January 1, 2025. You can explore more about these global share plan updates to get a sense of just how different these rules can be.

A global share incentive plan has to be built for change. The real mark of a successful international strategy is its ability to pivot when a country's regulations shift overnight. Without that flexibility, you're just waiting for a compliance failure.

When you launch a share plan in a new country, a few critical areas need your immediate attention. These factors can vary wildly from one place to the next, creating a web of compliance duties you have to manage carefully.

Here’s what you need to keep a close eye on:

Juggling all these variables requires specialized know-how and solid systems. For fund managers trying to get this right, it’s smart to bring in experts. You can learn more by checking out our resources on legal and compliance management designed for fund operations.

Alright, let's get down to brass tacks. You understand what a share incentive plan is and why you need one. Now, how do you actually build one that works?

Think of it less like a one-off project and more like laying the foundation for a core part of your company's future. Each decision you make is a brick in that foundation. If you rush it, you'll end up with a wobbly structure that helps no one.

First things first: what are you really trying to achieve? Your goals will be the blueprint for the entire plan. Are you trying to lock in your C-suite for the long haul? Or maybe you want to give every single employee a reason to think and act like an owner. A plan built to keep three senior execs happy looks completely different from one designed to motivate a team of 100. Be crystal clear on this before you do anything else.

With that North Star in place, you can start getting into the nitty-gritty of the plan's design. This is where the magic happens—where you decide how the plan will actually feel and function for your team.

Okay, you’ve got your strategic goals. Now it's time to build the engine of your plan. These details have to be thought through carefully to make sure the incentive truly lines up with what you want to happen in the business.

One of the most important pieces is the vesting schedule. This is simply the timeline that determines when an employee actually owns their shares or options. A classic setup you'll see everywhere is a four-year schedule with a one-year "cliff." That means an employee gets nothing for the first 12 months, but on their first anniversary, 25% of their grant vests at once. This simple mechanism is brilliant for encouraging new hires to stick around and prove their commitment.

Just as critical is how you talk about the plan. You can have the most generous plan in the world, but if your employees don't understand it, it’s worthless. It just becomes a confusing line item on a document they don't read.

A great incentive plan is only as good as its communication. When you make it simple and clear, you're not just handing out a financial instrument; you're building a culture of ownership and shared success.

Finally, and this is the part you absolutely cannot skip, you must get the legal and financial side buttoned up. This means bringing in the experts—lawyers and tax advisors who live and breathe this stuff. They'll help you navigate the complex regulations, figure out shareholder dilution, and handle the accounting headaches. A poorly set up plan can become a massive liability, completely wiping out all the good you were trying to do. Get it right from day one to protect yourself and your team.

As you start to wrap your head around share incentive plans, a few practical questions always pop up. Getting straight answers to these is crucial for figuring out how these plans work on the ground and if one makes sense for your company. Let's tackle some of the most frequent ones.

First off, people often ask how a share plan is any different from a regular cash bonus. It's a great question.

Think of a cash bonus as a short-term reward. It’s a pat on the back for hitting last quarter’s numbers—a direct, transactional "thank you" for a job well done.

A share incentive plan, on the other hand, is all about the long game. It’s an investment in the future. By giving employees a real stake in the company’s growth, you're encouraging them to think like owners, not just staff. The aim isn't just to reward what they’ve already done, but to fire them up to build lasting value for years to come.

Another common point of confusion is the vesting period. What’s it for? In short, vesting is simply the process of earning your shares over time. It’s a powerful tool for encouraging commitment and keeping your best people around.

A vesting schedule ensures that equity is a reward for sustained contribution and commitment, not just for showing up. It locks the employee's timeline together with the company's long-term vision.

For instance, a classic four-year vesting schedule with a one-year cliff means an employee has to stick around for at least a full year before their first chunk of shares becomes theirs. This simple structure is incredibly effective at retaining key talent through those make-or-break growth stages.

Finally, there’s always the question of whether private companies can get in on this. The answer is an enthusiastic yes. Just because you don't have a stock ticker doesn't mean you can't grant equity.

However, private companies have their own set of hurdles to clear, mostly around valuation and liquidity. You'll need formal appraisals to figure out what the company is worth, and you have to plan for liquidity events—like an acquisition or an IPO—so employees can eventually turn their shares into cash. It definitely takes careful planning, and you can see how we handle sensitive data in our privacy policy.

Fundpilot empowers fund managers with institutional-grade tools to streamline operations, from LP reporting to compliance. Upgrade from manual workflows and focus on what matters most: sourcing deals and raising capital. Learn more at https://www.fundpilot.app.