A practical guide on how to raise capital. Learn to build a killer pitch deck, find the right investors, navigate due diligence, and close your deal.

Raising capital is a marathon, not a sprint. The real work begins long before you ever step into a meeting room or hop on a Zoom call. It starts with a deep, honest assessment of the current venture capital climate and a clear understanding of what investors are actually looking for today.

Before you even think about building a pitch deck or drafting an email, you need to survey the playing field. Fundraising isn’t just about having a brilliant idea; it’s about knowing the market forces that shape investor decisions and tailoring your approach to fit. The VC climate is always in flux, driven by everything from global economic shifts to the latest tech breakthroughs.

The numbers tell the story. In the second quarter of 2025, for instance, global venture funding hit $109 billion. While that was a 17% dip from the prior quarter, the drop was mostly noise caused by a single mega-deal that skewed the earlier numbers. The U.S. continues to be the dominant force, pulling in 64% of all global VC funding and proving the enduring strength of its startup ecosystem.

Investors aren’t just backing a product; they’re betting on a future. They sift through hundreds, if not thousands, of deals, and they've developed sharp instincts for signals that separate a massive opportunity from a dead end. To get their attention, you have to think like they do.

They’re going to grill you on a few key areas:

Getting these fundamentals right is table stakes. An investor’s first mental checkpoint is simple: “Could this be a 10x return?” Your entire story needs to be built around answering that question with an unequivocal “yes.”

Capital flows toward growth. Knowing which sectors are attracting the most investment helps you frame your company in the right light. Lately, software and AI have been magnets for capital, together accounting for about 45% of all VC funding. This tells you exactly where investors see the future.

On the other hand, areas like Europe and China have been quieter, feeling the pinch of high interest rates and a sluggish IPO market. At the same time, India has become a hotbed for innovation, especially in fintech and mobility. Understanding these geographic and sector-specific trends helps you set realistic goals and find the investors who are actively writing checks in your domain.

Don't overlook the rise of corporate venture capital (CVC), which consistently makes up around 36% of total deal value. These corporate VCs often invest for strategic reasons, not just financial returns, which can lead to powerful partnership opportunities. This kind of market intelligence isn't just "nice to have"—it's the bedrock of a fundraising strategy that actually works. A big part of this is also knowing what your company is worth; you can learn more by reading our guide to valuing a private company.

Think of your fundraising materials as your silent co-founder. Long before you shake a hand or even send an email, these documents are out there, making a first impression on your behalf. They have to be sharp, convincing, and ready for some serious scrutiny from people who see dozens of pitches a week.

The real goal here isn't just to dump a bunch of data on a potential investor. It’s about building a compelling narrative—a story so clear and powerful that they feel like they’d be crazy to miss out. This isn't about using a generic template; it’s about creating a bespoke toolkit where every single piece has a job to do.

Your pitch deck is the star of the show. Its primary function is to sell the story of your company, not just drone on about its features. Here's a hard truth: most investors spend less than four minutes skimming a deck. That means every slide, every image, and every bullet point has to fight for its right to be there.

The biggest mistake I see founders make is packing their slides with way too much text. Don't do it. Use strong visuals and keep your text short and punchy. Your deck should be the visual aid that guides the conversation you want to have, sparking curiosity and leaving them wanting more.

An effective pitch deck doesn't just answer questions; it inspires them. It should leave an investor thinking, "This is fascinating. I need to understand how they're going to pull this off." That curiosity is what gets you the next meeting.

If the pitch deck is the story, your financial model is where the story gets real. This is the spreadsheet that grounds your vision in numbers, translating your big ideas into a concrete, assumption-driven forecast. Make no mistake, investors will pick this apart to see if your growth story holds water.

Resist the urge to just throw in a "hockey stick" graph and hope for the best. Every single projection, from your customer acquisition costs to your revenue targets, needs to be tied to a logical assumption you can defend. Show your work. Your model should tell a story of sensible, scalable growth.

Here’s what you absolutely must include:

A solid financial model screams that you’ve done your homework. It builds an incredible amount of confidence and shows you're a founder who truly gets the nuts and bolts of your business.

While your deck tells the whole story, the executive summary is your hook. This is a punchy, one-to-two-page document built for one purpose: to get an investor's attention, and get it fast.

Think of it as the trailer for your movie. It has to hit all the highlights—the problem, your solution, the market opportunity, the team, and any traction—without getting bogged down in the weeds. This is often the very first thing an investor sees, so it has to be absolutely perfect. A weak summary means your pitch deck might never even get opened.

Finally, let’s talk about the virtual data room. This is your back office, the secure online space where you house all the documents an investor will need for due diligence. Having this organized before you even think about outreach is a pro move. It signals you’re prepared and that you respect their time.

Nothing kills momentum like a messy or incomplete data room. It’s a huge red flag that suggests disorganization and can stall or even kill a deal. Structure it logically with clear, intuitively named folders.

Before you start your outreach, take the time to assemble these core fundraising documents. They are the foundation of a successful capital raise.

This table breaks down the must-have materials for your fundraising toolkit. Each one serves a unique purpose in convincing investors to back your vision.

| Document | Primary Purpose | Key Elements to Include |

|---|---|---|

| Pitch Deck | To tell a compelling narrative about your vision and opportunity. | Problem, Solution, Market Size, Product, Team, Financials, The Ask. |

| Financial Model | To provide a credible, assumption-based forecast of business growth. | 3-5 Year Projections, Key Assumptions, Unit Economics, Cap Table. |

| Executive Summary | To provide a concise, high-impact overview that grabs attention. | One-page summary of the problem, solution, market, and team. |

| Data Room | To facilitate a smooth and professional due diligence process. | Corporate docs, financial statements, contracts, IP, team bios. |

Putting in the effort to get these materials right from the beginning sends a clear message: you're a serious founder building a serious company. This prep work isn't just a box to check; it’s a critical step on your path to closing your round.

Sending your beautifully crafted pitch deck out into the void is a classic recipe for burnout. The most common mistake I see emerging managers make is treating fundraising like a numbers game—blasting a generic email to a massive, unfiltered list of investors. The reality is, a successful fundraise is all about precision targeting, not sheer volume. It’s about finding the right partners, not just any partners.

This is where you shift from just seeking capital to finding "smart money." Smart money isn’t just about the check; it’s about what comes with it. These are the investors who bring deep industry expertise, open up their networks for you, and genuinely believe in your vision. They're the ones who will make critical introductions and pick up the phone when you’re facing a tough decision.

Before you can target anyone, you have to understand the different players on the field. Pitching the wrong type of investor for your stage is a complete waste of everyone's time. Each has a different thesis, risk tolerance, and reason for investing.

Let's break down the main categories you'll encounter:

Choosing your target depends almost entirely on your fund's stage, size, and thesis. A first-time manager with a micro-fund focused on B2C apps might be perfect for an angel syndicate, while a deep-tech fund will need the firepower of a specialized institutional VC.

Once you know the type of investor you’re after, it's time to get specific and build a curated list. This is where your research skills become your secret weapon. Tools like PitchBook and Crunchbase are goldmines here, letting you filter investors by industry focus, stage, geography, and past investments.

Your goal isn't a list of hundreds. It's a "Tier 1" list of 25-50 investors who are a perfect match. Don't just skim their firm's website. You need to dig into the individual partners. Who has a track record in your specific niche? Who has written blog posts or given interviews that really resonate with your fund's mission?

An investor’s portfolio is their resume. If they've already backed five of your direct or adjacent competitors, they're almost certainly not going to invest in you. On the other hand, if they've invested in companies that could be future partners or customers for your portfolio companies, that’s a powerful signal of alignment.

This kind of meticulous research does more than just identify targets; it gives you the ammunition you need to craft a truly personalized outreach.

With your target list in hand, the next hurdle is actually getting their attention. Cold emails have an absolutely abysmal success rate. By far, the most effective way to land a meeting is through a warm introduction—a connection made by someone trusted by both you and the investor.

It’s time to map your network. Use LinkedIn to see who in your circle is connected to the partners on your list. Your existing LPs, advisors, and even your fund's legal counsel can be fantastic sources for introductions. When you ask for that intro, make it incredibly easy for them. Give them a short, forwardable email that crisply explains what your fund does and, most importantly, why it's a specific fit for that particular investor.

This methodical approach transforms your fundraising from a random shot in the dark to a strategic campaign. The global investment landscape is buzzing; total funding rounds hit about $189.93 billion in the first half of 2025 alone, a 25% jump from the same period in 2024. Power players like Andreessen Horowitz deployed nearly $120 million across 85 rounds, which shows that while capital is out there, it flows to managers who do their homework. You can explore more insights on recent venture capital funding trends on spglobal.com. By focusing your energy on investors who are a genuine fit, you dramatically increase your odds of finding a partner who will help you build a truly great firm.

You’ve done the behind-the-scenes work. Your materials are sharp, and you know who you’re targeting. The theoretical phase is over. Now, it’s all about execution—running a methodical, disciplined outreach campaign to turn that well-researched list into actual meetings and, eventually, capital commitments. This is where persistence and process truly shine.

The goal isn't just to blast your deck into inboxes; it's to start meaningful conversations. And that begins with an email that shows you respect an investor's time and intelligence. Forget the generic, copy-pasted templates—they’re a fast track to the trash folder. Every single outreach needs a personal touch. Mention a specific portfolio company, a recent article they wrote, or a mutual connection to prove you’ve done your homework.

Nothing beats a warm introduction. A referral from a trusted source instantly pulls your name out of the slush pile and puts it at the top. But even a warm intro needs a compelling reason for the investor to take the meeting. You have to make it incredibly easy for your contact to help you. Give them a concise, forwardable blurb that nails your fund's thesis and explains exactly why this specific investor is a perfect fit.

If you have to go in cold, be ruthlessly brief. Your initial email should be three or four short paragraphs, max. Hook them with your unique insight, state your traction, and make a clear, direct ask for a brief introductory call.

Your outreach is a test of your ability to communicate value concisely. If you can’t articulate why an investor should spend 20 minutes with you in an email, they’ll have zero confidence you can do it in a pitch meeting. Brevity and clarity are your best friends.

Once you land that meeting, the real performance begins. Remember, the investor pitch is not a monologue. It’s a strategic conversation designed to build conviction, brick by brick.

Walking into a pitch meeting is like stepping onto a stage. You need to command the room from the very first minute. Don't waste that opportunity fumbling with your laptop or jumping straight into slide one. Start by telling your story.

Investors are pattern-matchers at heart. They’re looking for signals that a fund manager has a unique, almost unfair, advantage. Your personal journey, your deep industry expertise, your "aha" moment—this is the emotional hook that makes them lean in and listen. Only after you've forged that personal connection should you transition to the deck.

A proven narrative flow looks something like this:

Following this structure transforms your presentation from a dry list of facts into a compelling story of inevitability.

Let's be real: no pitch goes perfectly. You will face tough questions and pushback. That’s a good thing! Objections are a clear sign of engagement. The key is to handle them with poise and confidence, not defensiveness.

Think through the hardest questions you could get before you ever walk in the door. What are the biggest risks in your strategy? Where are the holes in your thesis? Rehearse your answers until they are thoughtful and direct. If an investor points out a genuine weakness, acknowledge it and explain how you plan to mitigate it. This builds immense credibility and shows you're a clear-eyed operator, not a salesperson.

Throughout the meeting, pay close attention to the non-verbals. If someone is glued to their phone, you've probably lost them. It's on you to pivot. Ask them a direct question to pull them back into the conversation. Learning to read the room is a critical skill that separates rookie fundraisers from the pros. Your goal is to leave them not just impressed, but genuinely intrigued and eager to find out what happens next.

Getting a term sheet is a huge moment. It's the signal you've been waiting for—an investor is serious about backing you. But don't pop the champagne just yet. This isn't the finish line; it’s the starting gun for due diligence, an intense period of scrutiny that can make or break your deal.

This is the point where the investor’s team shifts from being a potential partner to a forensic investigator. They will dig into everything: your financials, legal structure, team's background, and every assumption you've made. Your job is to be an open book, but a very, very organized one.

The whole point of due diligence is to verify all the claims you made in your pitch deck and conversations. Investors are hunting for red flags or hidden issues that could sink their investment down the road. An organized, transparent approach here builds a massive amount of trust and can seriously speed things up.

You can find a deep dive into the nuts and bolts here: https://www.fundpilot.app/blog/what-is-the-due-diligence-process-a-complete-guide

As they dig in, investors will also be on the lookout for potential legal landmines. Getting a handle on common tripwires like Intellectual Property considerations ahead of time is critical to sailing through this stage.

Expect their focus to fall into three main buckets:

The secret to a smooth process? Preparation. Having a well-structured data room ready to go from day one signals that you're a professional who respects their time.

While all this digging is going on, you'll be negotiating the term sheet itself. Think of this document as the blueprint for the final, binding legal agreements. It’s dense with jargon that can have enormous consequences for you and your fund for years to come.

Don't just fixate on the valuation. The other terms—like liquidation preferences and anti-dilution rights—can have a much bigger impact on what you and your team actually pocket in an exit. The devil is truly in the details here.

The entire pitching process, from initial research to your final presentation, is designed to get you to this critical negotiation stage with as much leverage as possible.

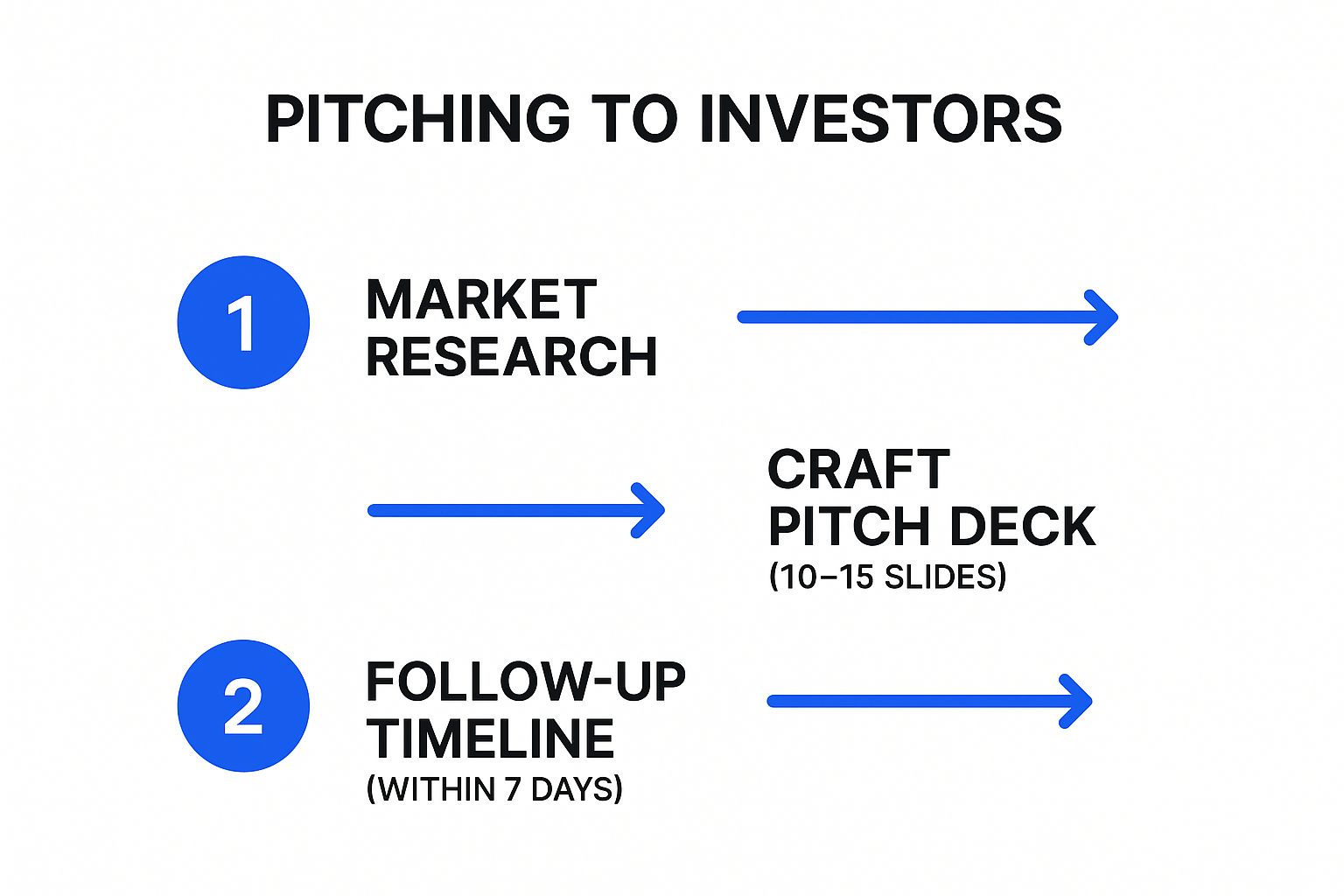

This visual just hammers home the point: the hard work you put into your market research and pitch directly translates into a stronger negotiating position when that term sheet hits the table.

Every term sheet is unique, but a few core clauses are always at the heart of the negotiation. As a founder, you absolutely have to master these.

Remember, the broader market climate heavily influences how investor- or founder-friendly these terms are. For instance, Q4 2024 saw a ten-quarter high in venture funding, with VC-backed firms pulling in a staggering $108.6 billion. That surge, fueled by the AI boom, led to better deal terms for founders in hot sectors. But with markets like Asia hitting record lows, your negotiating power can shift dramatically based on your industry and geography.

Successfully closing this final stage of your fundraise is a mix of meticulous prep work, clear communication, and sharp negotiation. By understanding what investors are looking for and mastering the key deal terms, you won't just secure capital—you'll build a foundation for a healthy, successful partnership.

The fundraising trail is notoriously tough, especially when you're just starting out. As you get ready to hit the road, a few critical questions always seem to pop up. Getting straight answers to these can be the difference between a confident, strategic process and a frantic, uncertain one.

We've been in the trenches and have heard every question imaginable from new managers. Here are the most common—and most important—ones, along with some hard-won advice to help you navigate the path ahead.

Let's get one thing straight right away: fundraising is a marathon, not a sprint. A successful raise demands a serious chunk of your time. From the moment you start prepping your materials to the day the capital actually hits your bank account, you should realistically budget six to nine months.

That timeline isn't just a random guess. It breaks down into a few distinct, demanding phases.

If there's one piece of advice to tattoo on your brain, it's this: start raising long before you think you need to. Raising capital from a position of desperation is a weakness LPs can smell from a mile away, and it will kill your negotiating leverage.

Hands down, the most common and damaging mistake is launching into outreach without doing the proper homework on potential investors. Firing off a generic, blast email is the fastest route to the trash folder. It screams that you haven't done your work and don't understand how this world operates.

The best fundraisers approach LP targeting like a strategic sales process. They don't just build a list; they curate a pipeline. This means digging into each LP's mandate, understanding their allocation strategy, and analyzing their existing portfolio to see where you might fit. Every single piece of outreach should be personalized. This respect for their time is what gets you that crucial first call.

For an early-stage company, this feels like one of the most high-stakes, stressful parts of the process, but it doesn't need to be. Without much revenue or history, valuation is far more art than science. It's not about a complex spreadsheet formula; it’s a negotiation rooted in a few key factors.

Here’s what investors are really looking at:

Instead of getting obsessed with a specific number, reframe the question: How much capital do we need to hit our next major set of milestones? You want to raise enough fuel to make meaningful progress and build a great story for the next round, all without giving away too much of the company too early on.

This is a great question that depends heavily on your stage. For those first checks—what we typically see in a pre-seed or seed round—the SAFE (Simple Agreement for Future Equity) is incredibly common and often the best tool for the job.

It's built for speed. A SAFE lets you bring on capital without formally setting a valuation, pushing that complex negotiation down the road to your first "priced" round (like a Series A). This can save a ton of time and legal fees, which is critical when you're just getting started.

But as your company grows and the checks get bigger, investors will almost always insist on a priced round. This is where you formally set a price-per-share, giving investors more defined rights and establishing a clear valuation for the company. The right choice really comes down to your company’s stage, how much you're raising, and what your lead investors expect.

Ready to move beyond manual spreadsheets and manage your fund like a top-tier firm? Fundpilot provides the institutional-grade reporting, administration, and analytics you need to impress LPs and scale with confidence. Discover how Fundpilot can streamline your operations today.