Master fund accounting basics with our step-by-step guide. Learn core principles, NAV calculation, and workflows to manage your fund with confidence.

At its heart, fund accounting boils down to one simple idea: accountability over profitability.

Imagine you have separate savings jars for different goals—a vacation, a new car, an emergency fund. You wouldn't dip into the car fund to pay for a weekend getaway. Fund accounting applies that same logic on a much larger scale, ensuring that financial resources are used exactly as intended.

If your background is in traditional business, the concepts behind fund accounting can feel a bit backward at first. Corporate accounting is a straightforward race to the bottom line. Every dollar of revenue and every expense is tracked to answer one main question: Is the business making a profit?

Fund accounting, on the other hand, serves a completely different master: stewardship. Its goal isn't to measure profit but to prove compliance and the responsible management of funds that come with specific restrictions.

This specialized approach is tailor-made for organizations where money comes with strings attached. These entities are constantly juggling multiple pools of capital, each with its own unique set of rules, goals, and reporting demands.

The entire system is built around creating self-balancing sets of books for each individual "fund." This structure is absolutely critical for transparency and is the standard for a diverse range of organizations:

This segregation is the very soul of fund accounting. It’s how you prove to donors, investors, and regulators that resources are being deployed correctly, which in turn builds trust and ensures you stay on the right side of the law.

At its core, fund accounting shifts the financial narrative from "How much profit did we make?" to "Did we honor our financial commitments?" This focus on accountability is what separates it from every other form of accounting.

It wasn't always this streamlined. Historically, these principles were managed through painfully detailed manual ledgers. The shift to sophisticated fund accounting software, which really took off in the late 20th century, has made tracking and reporting far more efficient and accurate. Today’s technology gives managers the power to handle incredibly complex fund structures with a level of precision that was almost unimaginable just a few decades ago. You can read more about the evolution of fund accounting systems and their market growth.

For an emerging manager, getting a firm grip on these fund accounting basics isn't optional—it's essential. This is the language your investors speak, the framework for your daily operations, and the very foundation of your fund’s credibility. Mastering these concepts is the first real step toward building a transparent, scalable, and successful operation.

At its heart, fund accounting boils down to one powerful idea: a fund is its own self-contained financial world. You can think of each fund as a separate mini-business, complete with its own dedicated set of books. This means its assets, liabilities, income, and expenses are tracked entirely on their own, separate from any other fund the organization manages.

This approach creates a series of independent financial silos. The whole point is to make absolutely sure that money earmarked for one specific purpose doesn't get mixed up with or spent on something else. It's this strict separation that forms the bedrock of accountability in the world of fund management.

Let’s look at a practical example. Imagine a city government gets a $1 million grant specifically to upgrade playground equipment in its public parks. That money would be put into what’s called a Special Revenue Fund.

This structure makes it impossible for the playground grant to be accidentally used to pave a road or plug a budget gap somewhere else. It creates a clean, auditable trail that proves the money was spent exactly as the grantor intended.

Beyond just keeping funds separate, the money inside each fund is also sorted by its intended use. This classification is crucial because it dictates how and when you're allowed to spend the capital. The two main categories you'll deal with are:

Breaking these rules is a serious compliance issue. A university, for example, can't dip into a permanently restricted endowment meant for a new research lab to buy uniforms for the football team. The entire accounting system is built to prevent mistakes like that from ever happening.

The core principle is straightforward: Every dollar has a job. Fund accounting is the system that ensures each dollar does the job it was assigned—and nothing else.

To really get a feel for what makes fund accounting unique, it helps to compare it to the traditional corporate accounting most of us know. They both use the language of debits and credits, but their ultimate goals are worlds apart. One is chasing profit, while the other is proving responsible stewardship.

The table below breaks down the key distinctions. It shows why a simple profit-and-loss mindset just doesn't apply when accountability is the name of the game.

| Aspect | Fund Accounting | Corporate Accounting |

|---|---|---|

| Primary Goal | Accountability and compliance. The focus is on showing that funds were used according to legal or investor restrictions. | Profitability. The main objective is to measure financial performance and maximize shareholder wealth. |

| Key Metric | Adherence to budgets and restrictions. Success is measured by the responsible management of assets. | Net Income (Profit or Loss). The "bottom line" is the ultimate measure of success. |

| Financial Focus | Individual funds. Each fund is a self-balancing entity and often has its own set of financial statements. | Consolidated entity. All financial activity is rolled up into a single set of statements for the whole company. |

| Reporting Style | Emphasizes the sources and uses of funds, clearly separating restricted from unrestricted assets. | Focuses on revenue, expenses, assets, and liabilities for the entire organization as a whole. |

Getting your head around these differences is the first big step. It requires a mental shift away from thinking about overall profitability and toward ensuring every single transaction honors the specific rules tied to its source of capital. This disciplined approach is what builds lasting trust with investors, donors, and regulators alike.

If a fund has a heartbeat, it’s the Net Asset Value, or NAV. This single number is the most critical calculation you’ll perform. Why? Because it represents the value of a single share in your fund. It's the price at which investors buy in and sell out, making its accuracy the absolute bedrock of investor fairness and trust.

Think of the NAV as a straightforward snapshot of what your fund is worth on a per-share basis at a specific moment. While the calculation itself looks simple on paper, getting the inputs right requires precision, consistency, and a strict adherence to your fund's valuation policies.

The formula for NAV per share is elegantly simple: (Total Assets - Total Liabilities) / Total Number of Shares Outstanding.

Let's unpack each piece to see how it all fits together.

This calculation is usually done at the end of each business day, a process often called "striking the NAV." This daily rhythm ensures every investor, whether they're coming in or cashing out, gets a fair and current price.

To really see how this works, let’s imagine we’re running a hypothetical fund, the "Emerging Growth Fund."

Day 1: The Launch Our fund launches with $10 million in initial capital from our first investors. We issue 1,000,000 shares, which sets our starting NAV per share at a clean $10.00. On day one, the balance sheet is as simple as it gets: $10 million in cash (an asset) and zero liabilities.

Day 2: The Market Moves We put that cash to work, investing in a portfolio of stocks. The market has a good day, and by the closing bell, our portfolio's value has climbed to $10.1 million. At the same time, we've accrued $1,000 in daily management fees, which is now a liability.

Just like that, the NAV has increased, reflecting the portfolio's solid performance. Any new investors wanting in would now buy shares at $10.099, and any existing investors who wanted to redeem would receive that same amount per share.

The daily NAV calculation ensures equity among all investors. It guarantees that the price of entering or leaving the fund accurately reflects its current performance, preventing the value from being diluted for existing shareholders.

An accurate NAV is completely dependent on a robust valuation policy. This is the document that outlines exactly how you will price your assets—especially the tricky ones that aren't traded daily on public markets, like private equity holdings or real estate. A clear, well-defined policy ensures consistency and makes your numbers defensible during an audit.

This entire process is almost always overseen by a fund administrator. They act as an independent third party, handling the NAV calculation, maintaining the fund's official books, and managing all the investor transactions. Their role is to ensure the integrity of the NAV, providing a crucial layer of oversight that gives investors real confidence in your numbers.

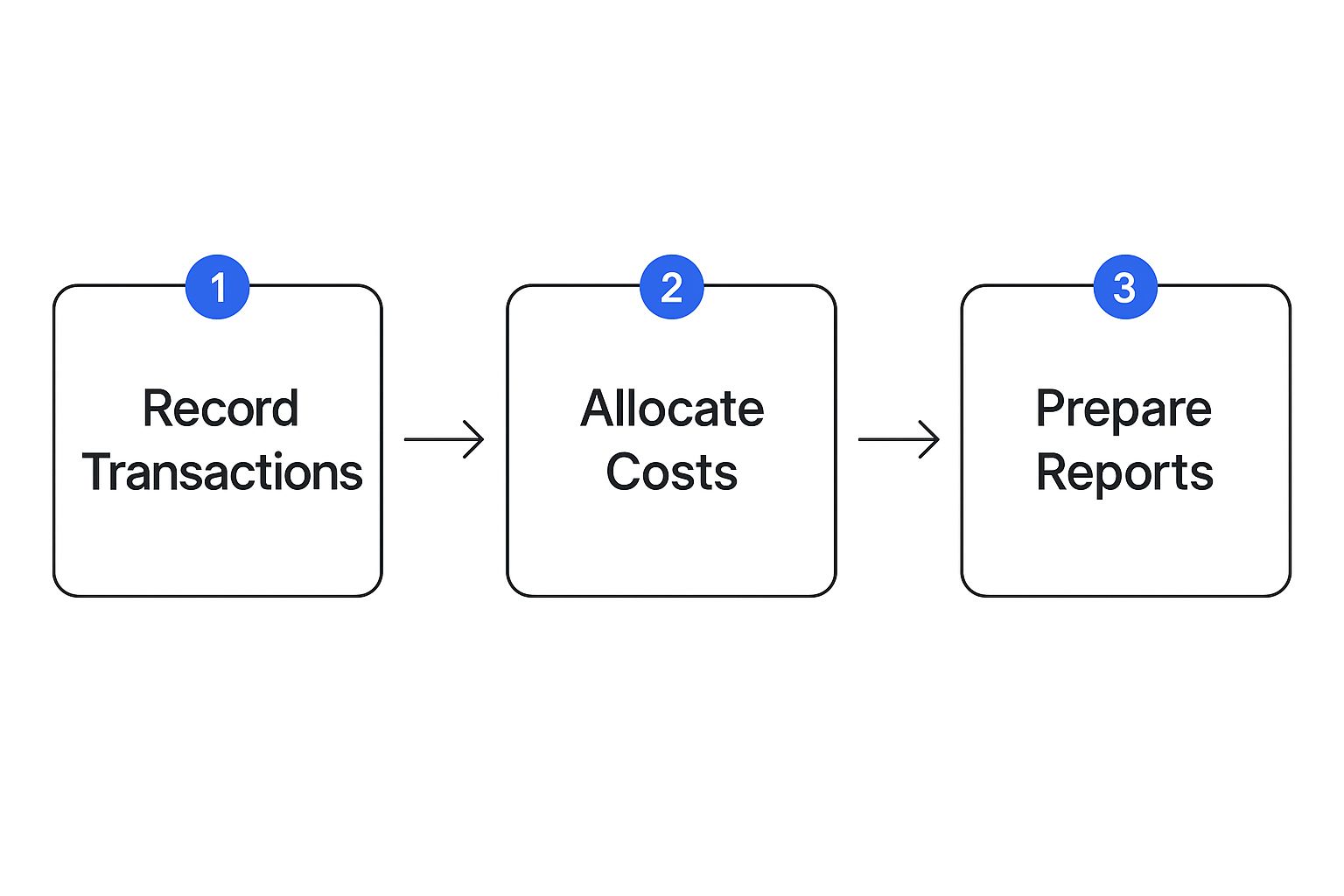

The infographic below shows the basic operational flow that feeds into preparing these crucial calculations.

As you can see, accurate reporting all starts with meticulous transaction recording and proper cost allocation from day one.

The need for precise, repeatable processes has fueled massive demand for specialized technology. In fact, the global fund accounting software market was valued at around $10.26 billion in 2023 and is projected to hit $18.18 billion by 2032. You can learn more about the fund accounting software market on wiseguyreports.com. This growth just underscores how critical the right tools are for ensuring accuracy and transparency in today's complex fund environment.

Ultimately, a reliable NAV isn't just a number—it’s the ultimate measure of your fund's performance and the foundation of your entire relationship with your investors.

Knowing the core concepts of fund accounting is one thing. But seeing how they play out in a daily, weekly, and monthly rhythm is where the theory hits the road. Think of a fund's operational cadence as a structured cycle of tasks that ensures everything is accurate, compliant, and ready for investor reporting.

For an emerging manager, getting a firm grip on this workflow is non-negotiable. It doesn’t matter if you’re building an in-house team or looking for the right third-party administrator—you need to understand the moving parts. This cycle isn't just about closing the books; it’s a constant process of checks and balances that protects your fund's integrity and your investors' capital.

The daily workflow is easily the most intense part of the fund accounting cycle. Everything revolves around one critical outcome: striking an accurate Net Asset Value (NAV). This single number is the bedrock for all investor transactions for that day.

Trade Capture and Reconciliation: The day kicks off by gathering all trading activity from the day before. This means confirming every single executed trade with your brokers to make sure your internal records match what the market says happened. Any mismatch, known in the industry as a "break," has to be flagged and fixed immediately.

Cash and Position Reconciliation: At the same time, your team is reconciling the fund's cash balances and security positions with your custodian bank. This is a crucial control. It verifies that what you think you own perfectly aligns with the independent records of the custodian actually holding the assets.

Pricing and Valuation: Every security in the portfolio needs a price tag. For publicly traded stocks and bonds, this is usually straightforward. But for more complex, illiquid assets, this step demands strict adherence to your fund’s valuation policy. No winging it.

Expense Accrual: Daily expenses, like management and performance fees, are calculated and accrued. This keeps your fund’s liabilities up-to-date, which is essential for a precise NAV.

Striking the NAV: Finally, with all assets valued and liabilities tallied, the NAV is calculated and sent out.

The daily NAV process is the heartbeat of a fund's operations. It is a non-negotiable sequence that guarantees fairness and transparency for every investor transaction, whether it's a subscription or a redemption.

While the daily tasks are all about the immediate processing of transactions, the weekly rhythm is your chance to take a breath and make sure everything is still in sync. Think of it as a critical check-in to catch any small issues that might have slipped through the cracks during the daily hustle.

Most weekly processes involve a deeper, more thorough portfolio reconciliation against your custodian's records. It’s an opportunity to confirm that any breaks from the past week have been fully resolved and that no new ones have popped up. This regular validation stops tiny errors from snowballing into major headaches down the line.

The monthly and quarterly cycle is where all the daily and weekly groundwork culminates in formal reporting. This is when you package up the fund's performance and financial health and communicate it clearly to your limited partners.

Key Monthly/Quarterly Tasks Include:

This structured cadence is the backbone of any well-run fund. By establishing this rhythm early on, you create a scalable and defensible operational framework. For more on this, our guide on operational efficiency improvement for fund managers offers practical strategies for building robust workflows.

In fund accounting, financial statements are far more than a box-ticking exercise for compliance. They’re the narrative of your fund’s journey—a detailed story about its performance, financial health, and how well you're stewarding investor capital. For new managers, learning to interpret these reports is non-negotiable, and it’s a skill you can build by understanding how to read company financial statements.

Unlike a standard corporate report that just boils down to a single bottom line, fund accounting statements are built for transparency. They answer the big questions your LPs and auditors will always have: Where did the money come from? How was it put to work? And what's it all worth today?

Think of this as a high-resolution snapshot of your fund on a single, specific day. Often just called the balance sheet, it gives you a crystal-clear picture of everything the fund owns (assets) and everything it owes (liabilities). The difference between the two is your fund’s net assets.

This report is ground zero for the fund accounting basics. It’s where anyone can see the raw ingredients that make up your NAV.

An LP can glance at this and immediately see the fund's cash position versus its short-term liabilities, offering a powerful, back-of-the-napkin insight into its operational stability.

If the balance sheet is a snapshot, the Statement of Operations is the highlight reel. It captures your fund's performance over a specific period, like a quarter or a year. It's a lot like a corporate income statement, but it’s laser-focused on what caused your fund's value to change.

This statement explains the "why" behind the change in your fund's Net Asset Value. It breaks down every bit of investment income and every expense, showing exactly what drove performance.

You'll see performance broken down into key drivers:

This level of detail lets investors see not just that the fund made money, but how it made money. Was it from smart exits, a rising market, or consistent dividend income? The story is all here.

This final piece of the puzzle connects the dots between the other two reports. It reconciles the fund's net assets from the beginning of the period to the end by summarizing all the activity in between. It’s where the performance data from the Statement of Operations meets all the capital comings and goings.

This report clearly shows:

Getting these reports right is where technology has become a game-changer. By 2024, the fund accounting software market had grown to an estimated $3.7 billion, as cloud-based platforms have made institutional-grade tools accessible to emerging managers. You can see more on the growth of fund accounting systems and why this matters.

Taken together, these three statements give you—and your investors—a complete, 360-degree view of your fund’s health, performance, and operational integrity. Getting comfortable with them is a critical step in building trust and communicating like a pro. To go a level deeper, check out our article on what fund administration is and the essential insights you need.

When you make the leap into fund management, you’ll quickly find that the accounting rulebook is different from that of a standard business. The core ideas might seem simple enough, but applying them in the real world is where things get tricky. Getting ahead of these predictable roadblocks is the secret to building an operation that’s scalable, compliant, and won't keep you up at night.

For most emerging managers, three headaches tend to pop up right away: wrestling with complex fee structures, getting expense allocation right, and, of course, surviving that first audit. Let's break down how to tackle them so you can avoid costly mistakes and save yourself a ton of time down the road.

One of the first real tests you'll face is calculating things like waterfall distributions and performance fees. These are a far cry from simple percentage markups. They often involve multiple hurdles, different tiers, and clawback provisions that can shift with every single distribution. A tiny spreadsheet error here can mean misallocating profits, and nothing damages investor trust faster than that.

The key is to model everything out meticulously before it becomes a reality. Don’t wait for your first big exit to start figuring out the waterfall. Sit down with your fund administrator and legal team to build and stress-test a calculation model that perfectly mirrors the language in your Limited Partnership Agreement (LPA).

Your LPA is the ultimate source of truth. Every calculation, from management fees to the final carry, must be directly traceable back to the legal language agreed upon by you and your investors.

Another frequent pain point is figuring out how to properly allocate fund expenses. It sounds straightforward, but the line between a legitimate fund expense and a management company cost can get blurry, fast. If you get this wrong, your LPs might feel like they're on the hook for your firm's overhead, which is a conversation you want to avoid.

The best approach is to create a crystal-clear and defensible expense allocation policy from day one. This document should spell out exactly what the fund pays for and what the management company covers. No ambiguity.

Common Allocation Issues to Address:

Document your policy, stick to it religiously, and be completely transparent in your reporting. This clarity not only prevents misunderstandings but also shows your investors that you're a responsible steward of their capital.

For a new manager, the annual audit can feel like a high-stakes exam. Auditors will comb through every transaction, valuation, and calculation, and being unprepared can turn the process into a long, expensive ordeal. Worse, it could lead to a "qualified" audit opinion—a major red flag for any current or potential investor.

The secret to a painless audit is to keep your books "audit-ready" from the very beginning. This isn’t a task you can cram for a month before the auditors show up. It means maintaining a clean, organized trail for every single number on your financial statements.

Choosing the right partners—like a reputable fund administrator and auditor—is just as important. They’ve been through this hundreds of times and can guide you on what it takes to meet institutional standards. Ultimately, if you treat every day like it's audit day, you'll be setting yourself up for success.

Getting into fund management means learning a whole new language. It's completely normal for questions to pop up as you find your footing. Let's tackle some of the most common ones that new managers have about the basics of fund accounting.

The biggest distinction boils down to one word: purpose.

Regular accounting, the kind you'd see for a typical corporation, is all about measuring profitability. It answers the simple question, "Did the company make money?"

Fund accounting, on the other hand, is driven by accountability. It’s set up to track money within separate, self-contained buckets (funds) to prove every dollar was used exactly as promised to investors or as required by law. Its core question is, "Did we follow the rules with the money entrusted to us?"

Think of the Net Asset Value (NAV) per share as your fund's official "price tag" for the day. It’s the number used whenever an investor buys in (a subscription) or cashes out (a redemption). Getting this number right, every single day, is non-negotiable for a couple of key reasons.

A precise and timely NAV is the bedrock of your fund's integrity. It's fundamental to building strong relationships with your LPs. Our guide on what investor relations means for fund managers dives much deeper into how these pieces all fit together.

Imagine your fund’s NAV is its daily stock price. If that number is off, every single transaction for that day is flawed. This immediately erodes investor trust and throws you into a world of compliance headaches.

Technically, yes, you could. But the real question is, should you? The answer from almost every experienced manager is a hard no.

Fund accounting is a minefield of complexity. It requires specialized software and a deep understanding of constantly changing regulations. One tiny error in a fee calculation, a misstep in valuing an asset, or a mistake in striking the NAV can create a domino effect of costly problems.

This is why the vast majority of new managers outsource this critical function to a professional fund administrator. They have the expertise, the technology, and the independent controls to get it right. This not only keeps you compliant but also frees you up to do what you're actually good at: finding and managing great investments. Besides, that third-party stamp of approval is exactly what serious investors want to see.

Ready to move beyond spreadsheets and manage your fund with institutional-grade tools? Fundpilot empowers emerging managers with automated LP reporting, a professional investor portal, and audit-ready records, letting you focus on growth, not paperwork. Schedule your demo today.