Deciding between a financial review vs audit? This guide clarifies the scope, cost, and assurance to help you make the right choice for your business.

Deciding between a financial review and an audit really boils down to one crucial question: How much certainty do your stakeholders need?

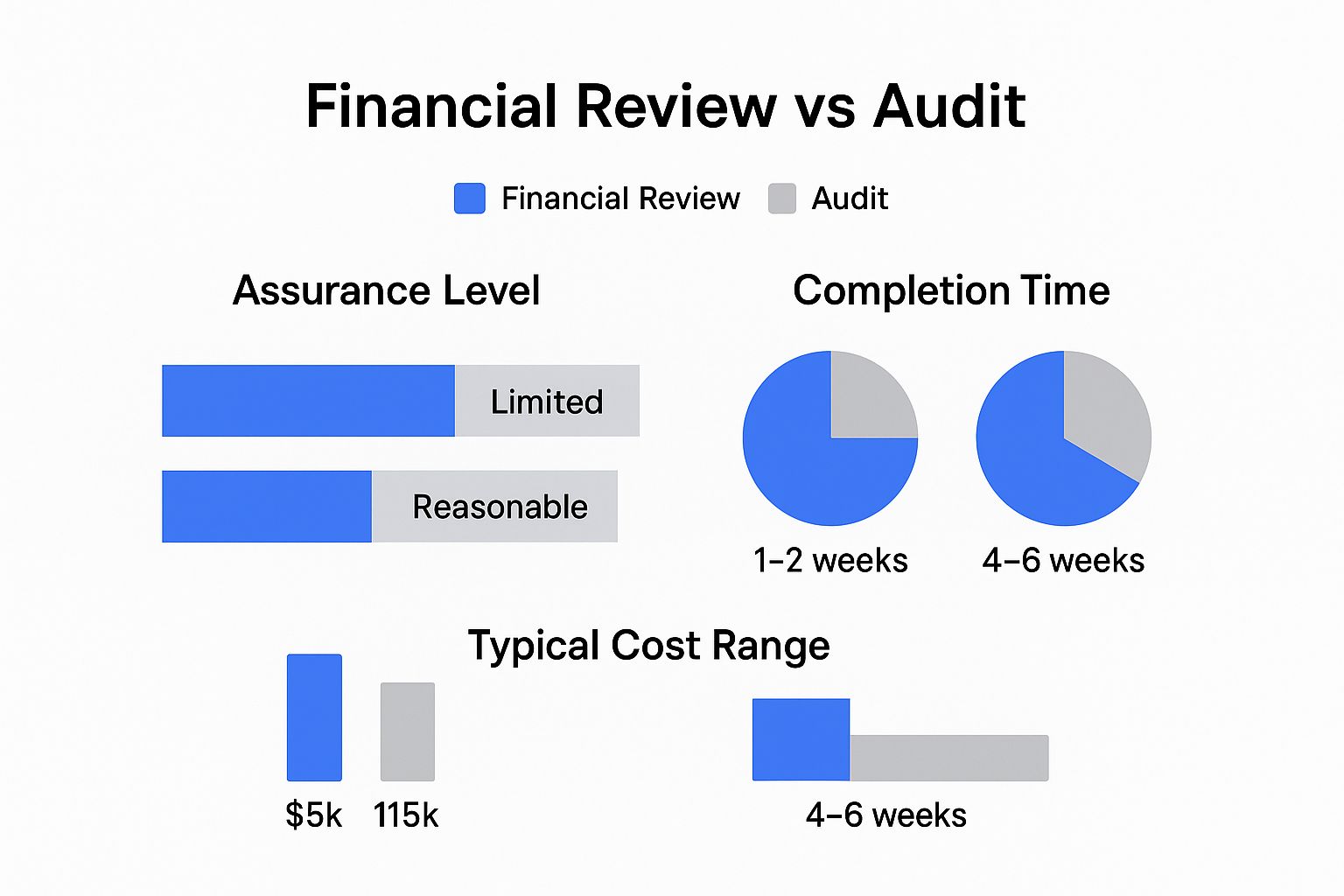

Think of a financial review as a pragmatic check-up. It provides limited assurance through analytical procedures and inquiries. An audit, on the other hand, is a full-blown physical exam. It delivers reasonable assurance by getting deep into the weeds with verification and testing.

For fund managers, choosing between a review and an audit is a foundational decision. Each process serves a very different purpose, and the right choice depends entirely on your specific circumstances—stakeholder demands, budget, and deadlines. Getting a handle on these differences is the first step to making the right call.

A financial review is the less intensive of the two. An independent CPA will run analytical procedures and ask management questions to provide limited assurance that your financial statements don't have any obvious, material errors. It's a high-level look, not a forensic investigation.

In contrast, a full financial audit is an exhaustive, systematic examination of your books. This process involves testing individual transactions, confirming account balances with third parties, and evaluating your internal controls to provide a high level of assurance.

To quickly see how they stack up, this table highlights the main differences at a glance.

| Attribute | Financial Review | Financial Audit |

|---|---|---|

| Assurance Level | Limited Assurance ("Nothing has come to our attention...") | Reasonable Assurance ("In our opinion, the statements are fairly presented...") |

| Scope | Analytical procedures and inquiries | In-depth testing, verification, and control assessment |

| Outcome | Review Report (negative assurance) | Audit Opinion (positive assurance) |

| Typical Use Case | Satisfying loan covenants, providing comfort to minority shareholders | SEC requirements, attracting institutional investors, preparing for a sale |

While a table is helpful, the practical implications for your fund—especially around cost and time—are significant.

As you can see, gaining the higher level of assurance from an audit requires a much bigger investment of both time and money.

The core distinction is investigative depth. A review asks, "Do these numbers make sense?" An audit asks, "Are these numbers correct, and can we prove it?"

This decision is often a key part of getting your fund operationally ready for serious scrutiny. For a complete look at what sophisticated investors expect to see, check out our expert due diligence checklist template.

Ultimately, your choice will be driven by the non-negotiable demands of your lenders, investors, and any regulators you answer to.

When you get down to it, the whole debate between a financial review and an audit boils down to one word: assurance. This isn't just jargon; it’s the heart of the matter. Assurance defines the level of confidence an accountant can publicly express about your financial statements, which in turn dictates how deep they have to dig.

A financial review offers what’s called limited assurance. Think of it as a professional gut check. The CPA performs high-level analytical procedures and asks questions to see if the financials look plausible. They’re checking for obvious, material issues that would need fixing to align with standard accounting principles.

An audit, on the other hand, provides reasonable assurance. This is a much higher bar. It means the auditor has done the legwork to confidently state that the financial statements are free from material misstatement. For anyone outside your fund, this is the gold standard.

The difference in assurance levels creates a massive gap in scope. A review is intentionally kept narrow. The accountant's job is mostly analytical—they’re looking at your numbers and comparing them to prior periods, budgets, and what’s happening in the industry to spot anything that looks unusual.

Because it's a more passive process, a review is really only designed to catch anomalies that are sitting on the surface. It’s not a deep dive to hunt for errors or fraud.

In stark contrast, an audit's scope is broad and investigative. The auditor has to get into the weeds of your business and understand your internal controls inside and out. It’s a proactive process that involves gathering hard evidence to back up the figures on your financial statements.

An easy way to frame the difference is to think of a review as an accountant asking, "Do these numbers seem plausible based on our analysis?" while an audit demands the auditor to prove, "Are these numbers accurate, and do we have the external evidence to back them up?"

This gap in assurance and scope has a direct, real-world impact on how much trust stakeholders place in your numbers. Limited assurance from a review might be perfectly fine for an internal management team or a small lender who already knows your business well. It gives them a basic level of comfort that nothing is glaringly wrong.

Reasonable assurance from an audit is built for a different audience—the external parties with significant capital on the line.

At the end of the day, an audit opinion carries serious weight because it’s backed by an active, evidence-based investigation. A review provides a useful checkpoint, but it’s a much lighter touch.

To really get what separates a financial review from an audit, you have to look past the textbook definitions. It’s about what the accounting firm actually does and what it means for your team day-to-day. The procedures are worlds apart, highlighting the massive gap between analysis and flat-out verification.

A financial review is mostly an analytical exercise. The accountant’s main tools are inquiry and comparison. They’ll spend their time poring over financial trends, stacking current figures against prior periods, and asking management why certain numbers look off or relationships in the data seem strange.

An audit, on the other hand, is a boots-on-the-ground mission. Think of it as an active investigation to find concrete proof for every material figure on your financial statements.

During a review, the accountant’s work pretty much stays within the walls of your office, focused on your data. The whole point is to make sure the numbers look reasonable on the surface.

The entire process hinges on the idea that management is giving them accurate information. The accountant isn't there to second-guess it, but to check if it all hangs together and makes logical sense.

In a review, the accountant is basically asking one question: "Do your financial statements appear plausible?" They aren't required to hunt for evidence outside of what your team provides.

An audit pushes way past plausibility and deep into the territory of verification. The auditor's job is to gather enough solid evidence to form an official opinion. This means more invasive, time-consuming work that will directly involve your operations team.

For instance, an auditor won't just ask you what your cash balance is—they’ll get in touch with your bank to confirm it themselves. This methodological difference is the core of the financial review vs. audit debate. Other common audit procedures include:

Getting ready for this level of scrutiny takes a lot of prep work from your fund’s team. We've got some great guidance in our article on your 2025 financial audit checklist with 7 essential steps. An audit demands a level of transparency and documentation that a review just doesn't come close to.

When you're weighing a financial review against an audit, the conversation always lands on two things: budget and deadlines. Let's be clear—the difference isn't just a small step up. It's a massive leap in both the money you'll spend and the time your team will have to invest. Figuring out why that gap is so big is crucial for making the right call for your fund.

The steep price of an audit comes down to the sheer volume of work and the level of risk the accounting firm takes on. A review is mostly about asking questions and running analytics. An audit, on the other hand, demands intensive, on-the-ground fieldwork, painstaking evidence gathering, and direct, independent verification of your numbers.

This difference in labor is huge. It’s not unusual for a full-scope audit to take 10 times longer to finish than a review, with the final bill reflecting that. Auditors have to perform extensive procedures that reviews just don't touch, like physically observing inventory counts, poring over legal contracts, and confirming balances directly with banks or investors.

The invoice from the CPA firm is only part of the story. An audit puts a much heavier strain on your own finance team. While a review requires your staff to answer some questions and pull reports, an audit demands their active, deep involvement for an extended period.

A financial review asks for your team's time for interviews and data pulls. An audit requires their deep involvement for weeks, assisting with evidence gathering, explaining processes, and tracking down source documents.

Your team will be on the hook for preparing detailed schedules, pulling transaction samples, and being constantly available to walk auditors through your internal controls. This internal time commitment is a very real, though often overlooked, cost that can pull key people away from their day-to-day work for weeks on end.

The best way to manage this is with immaculate documentation. For funds, keeping clean, organized, and accessible records isn't just a good idea—it's essential. You can get a head start by checking out our guide on 8 crucial audit trail best practices for 2025. When your records are in order, you can drastically cut down the time auditors spend on-site, which helps control both the internal and external costs of the engagement.

Ultimately, the higher price of an audit is what buys you a much higher degree of certainty for your stakeholders.

Let's get practical. The decision between a review and an audit rarely comes down to what you want. It’s almost always driven by what your stakeholders—the people with money on the line—demand. The real key is understanding who needs your financials and what level of assurance they're looking for.

This is where you figure out the most cost-effective path forward for your fund.

A financial review is often the perfect middle ground for smaller funds or private companies. It's for stakeholders who need a basic level of comfort that your numbers make sense, without demanding the full-blown, ironclad guarantee an audit provides. Think of it as a pragmatic, efficient choice.

A review is likely the right move if you're trying to:

Things change when the stakes get higher. When you're dealing with serious capital, major transactions, or regulatory bodies, an audit isn't just a good idea—it's the only option. It’s the cost of entry for playing in a bigger league.

You’ll almost certainly need a full audit when you're:

Here’s the bottom line: a review provides comfort, but an audit provides confidence. The level of risk your stakeholder is willing to tolerate will tell you exactly which one you need.

From a compliance standpoint, these two services are worlds apart. An audit is designed to provide reasonable assurance that your statements are free from major errors, which requires the CPA to dig deep into internal controls and gather hard evidence. A review, on the other hand, only offers limited assurance. The accountant primarily uses analytical procedures and asks questions, but they aren't performing the rigorous verification you'd see in an audit. You can discover more about how these financial services meet different stakeholder needs.

Ultimately, the "review vs. audit" choice is usually made for you by the people you answer to. Your job is to listen, understand their requirements, and pick the service that gets the job done without overspending on a level of scrutiny you simply don’t need.

When the work is done, you're left with a final report. But the language inside a review report and an audit report tells two completely different stories about your fund's financials.

Getting a handle on this difference is key, because the specific wording directly reflects how deeply the accountant dug into your numbers. It’s the gap between a statement of surface-level awareness and a firm, evidence-backed professional opinion.

A financial review wraps up with a report offering negative assurance. This is very deliberate, cautious language. The accountant is essentially saying that, based on their limited procedures, nothing jumped out at them to suggest the financial statements are materially misstated.

An audit report, on the other hand, delivers positive assurance. This is a much bolder, more definitive statement. Here, the auditor issues an opinion declaring that, in their professional judgment, the financial statements are a fair and accurate representation in all material respects.

The phrasing isn't just about semantics—it dictates the report's entire weight and value. Negative assurance is passive; it means no obvious red flags were spotted during a high-level check. Positive assurance is active; it confirms the auditor rolled up their sleeves and did the deep work needed to back up their conclusion.

A review report says, in effect, "We didn't see anything wrong." An audit opinion confidently states, "We believe these numbers are right."

This is why any conversation about a financial review vs. audit always comes back to what your stakeholders need. One provides a degree of comfort, while the other offers the solid confidence required for big-ticket decisions like securing major investments or loans.

To get the most out of these documents, it helps to check out expert tips on financial statement analysis. Learning to read between the lines helps you turn the accountant's findings into real-world business intelligence.

Fund managers often have questions when trying to decide between a financial review and a full audit. Let's tackle some of the most common ones to help you make the right call.

Yes, it's not uncommon for a review to escalate into a full audit. This usually happens when the accountant, even with their limited procedures, stumbles upon something that looks like a significant error or a material misstatement.

If the initial work raises serious red flags, the accountant will likely recommend upgrading the engagement to a full audit to dig deeper. It's also possible that a stakeholder, like a lender who was initially fine with a review, changes their mind and demands an audit later. This is why it's so important to get everyone's requirements in writing upfront.

It really depends on the bank and how much you're borrowing. For smaller loans, especially if you have a great relationship with the bank and solid collateral, a review might be all they need. It gives them a baseline level of comfort that your numbers aren't completely out of left field.

However, once you start talking about larger or more complex financing, almost any major institution will demand the reasonable assurance that only a full audit provides. From their perspective, an audit dramatically reduces their risk by giving them a much higher degree of confidence in your fund’s financial health.

As a rule of thumb, the more money you ask for, the more likely the lender is to require a full audit instead of just a review.

A compilation sits at the bottom of the assurance ladder—it actually offers no assurance at all. When a CPA performs a compilation, they are simply taking the financial information you provide and putting it into the proper financial statement format.

There’s no testing, no analytical work, and no verification of the numbers. It’s the most basic of accounting services.

Think of a compilation as just organizing your financial data professionally. It's the fastest and least expensive of the three options, but it also carries the least weight.

Ready to move beyond manual spreadsheets and produce institutional-grade reports that impress investors? Fundpilot provides the tools you need to streamline operations, maintain audit-ready records, and focus on what matters—sourcing deals and raising capital. See how we can elevate your fund at https://www.fundpilot.app.