Define capital call with our guide for private investors. Learn how this process works in private equity, venture capital, and real estate funds.

When you invest in a private fund, you don’t just write one big check on the first day. Instead, the fund manager calls on you for the money as it's needed. This process is known as a capital call.

Think of it like building a custom home. You wouldn't hand over the entire construction budget to the builder before they've even broken ground. You pay them in stages—when the foundation is poured, when the framing goes up, and so on. A capital call works the same way; it's a just-in-time funding model that lies at the heart of private market investing.

A capital call, sometimes called a drawdown, is simply the official notice a fund manager sends to investors when it's time to collect a piece of their investment. The manager, or General Partner (GP), formally requests that the investors, known as Limited Partners (LPs), wire over a portion of the money they promised to the fund.

Typically, LPs have a set window, often around 10 to 15 business days, to send the funds. This is a fundamental difference from public markets, where you pay for a stock or bond in full the moment you buy it. You can discover more insights about how this drawdown model shapes private market operations.

To really get a handle on this, you need to understand the two types of money involved.

The difference between what an investor promises and what they've actually sent is critical. These two terms, committed capital and paid-in capital, are the bedrock of the entire process.

Committed Capital: This is the big number—the total amount you legally agree to invest in a fund over its entire life. It’s a firm commitment, but the cash stays in your bank account until the GP actually needs it.

Paid-In Capital: This is the running total of all the money you’ve actually sent to the fund in response to capital calls. It’s the portion of your commitment that the fund manager is actively putting to work.

Key Takeaway: Your entire commitment isn't due on day one. A fund with $100 million in committed capital might only call $10 million in its first year to make an initial investment, leaving the remaining $90 million as "dry powder" for future opportunities. This just-in-time financing model is designed for efficiency, ensuring capital is deployed only when a specific investment or expense arises.

Getting comfortable with the language of capital calls is the first step. Here's a quick cheat sheet for the essential terms you'll encounter.

| Term | Simple Definition |

|---|---|

| Capital Call / Drawdown | The official request from a fund for investors to send money. |

| General Partner (GP) | The fund manager who finds deals and manages the investments. |

| Limited Partner (LP) | The investor who provides the capital to the fund. |

| Committed Capital | The total amount an LP has promised to invest in the fund. |

| Paid-In Capital | The amount of committed capital an LP has actually sent to the fund. |

| Dry Powder | The amount of committed capital that has not yet been called by the GP. |

These terms form the foundation of how private funds operate, and understanding them makes the entire investment process much clearer.

A capital call isn't some random request for cash. It's a highly structured process, and the rulebook for it is a legally binding document called the Limited Partnership Agreement (LPA). This agreement is the cornerstone of the relationship, creating a clear and predictable system for both the General Partner (GP) managing the fund and the Limited Partners (LPs) who provide the money.

Think of an LP's commitment as a pre-authorized line of credit. By signing the LPA, they've given the GP permission to draw down funds, but only under specific circumstances. When the GP finds a promising investment that fits the fund's strategy, the formal capital call process kicks into gear.

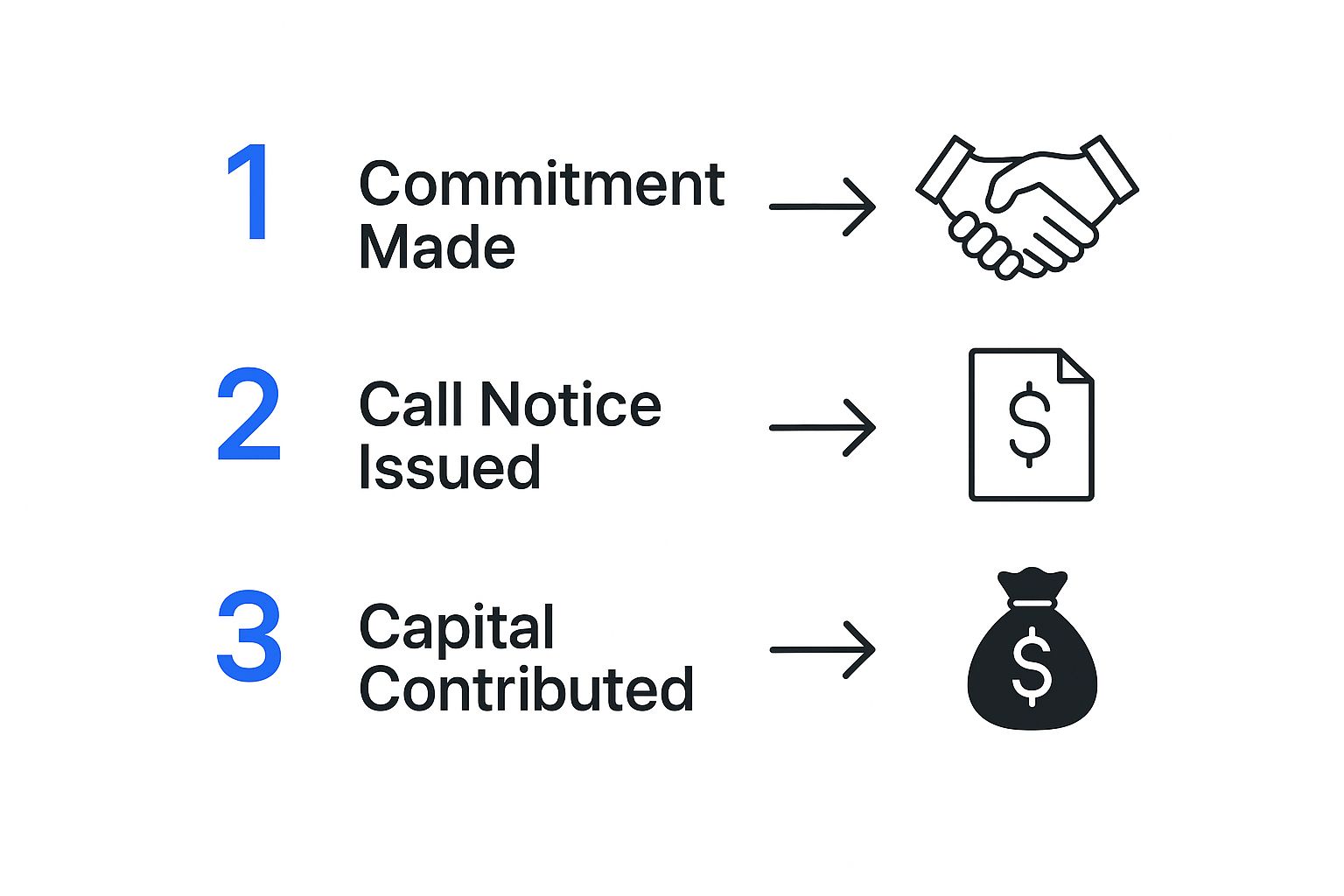

The flow is pretty straightforward, moving from the initial pledge to the final investment.

As you can see, it’s a clear, sequential process designed to get capital where it needs to go in an organized way.

Let's break that down even further. The whole thing usually unfolds across five distinct stages, each one a logical step forward.

The entire system is built to be fair. It balances the LPs' need to manage their own cash flow with the fund's need to seize investment opportunities. A GP can’t just demand the entire commitment at once; they call capital as needed, ensuring every investor contributes their proportional share.

This whole workflow is a core part of a fund's back-office operations. If you're curious about the teams that handle this, our guide on what fund administration is takes a much deeper dive into these essential functions.

It seems simpler to collect all the committed cash on day one, right? The truth is, the capital call model is a deliberate, strategic choice that lines up the interests of both the fund manager (the GP) and the investors (the LPs). It’s designed for one purpose: to maximize efficiency and returns.

For the General Partner, it all comes down to avoiding “cash drag.” Imagine a fund sitting on a massive pile of uninvested money. That cash isn't out in the market working; it's just sitting there, dragging down the fund’s overall performance metrics like the internal rate of return (IRR).

By calling capital only when a specific investment is ready to close, GPs ensure every dollar has an immediate job to do. This “just-in-time” approach is a massive advantage for everyone at the table.

As a Limited Partner, the benefits are even more direct. Instead of wiring your entire commitment at the very beginning, you get to hold onto your capital. This lets you keep that money working in your own portfolio until the fund manager has found the perfect opportunity for it.

Here’s what that means for you:

Think of it as a symbiotic relationship. The GP gets to be nimble and pounce on deals without the performance hit of idle cash. Meanwhile, the LP gets greater financial flexibility and keeps their portfolio working harder. It’s a smarter, more efficient way to put money to work.

A capital call isn't a one-size-fits-all event. Its purpose and what it signals to investors can change dramatically depending on the asset class—from exciting growth in one sector to unexpected trouble in another.

When that notice lands in your inbox, the "why" behind it tells you everything. It gives you a window into what the General Partner (GP) is doing with your money, helping you understand the fund's strategy in real-time.

In the high-stakes world of venture capital (VC), a capital call is usually a sign of momentum. It often means a promising startup is ready for its next big step, like a Series B funding round. The GP calls capital to inject that cash, helping the company scale up, break into new markets, or bring on crucial new hires. It’s all about fueling that next stage of growth.

Things look a bit different in private equity (PE), where the deals are typically much larger. Here, a major capital call might be the first step in a leveraged buyout (LBO) of a mature company. This is a big, strategic move where the fund takes control of a business, planning to overhaul its operations to create more value down the road.

Understanding the timing and purpose of capital calls is absolutely essential for investors. It's the mechanism that turns commitments into action, directly affecting how deals get done. Properly timed calls are vital for optimizing private equity deal flow and getting acquisitions across the finish line.

Nowhere is the context of a capital call clearer than in real estate. In commercial real estate (CRE), these requests tend to fall neatly into two camps: the good and the bad.

Whether it’s to jump on a new opportunity or cover an unforeseen expense, capital calls are a key tool for CRE fund managers. Think of them as either offensive or defensive plays.

A 'Good News' Call: This is an opportunistic move. Imagine your fund owns a successful shopping center and the underperforming property right next door suddenly comes up for sale. The GP issues a capital call to snap it up, expanding the project's footprint and boosting its potential returns.

A 'Bad News' Call: This is a reactive call, usually to cover something that went wrong. Maybe construction is behind schedule, material costs shot up unexpectedly, or a major tenant needs expensive improvements to stay. This call is about solving a problem.

By digging into the "why" behind a capital call, you get a much sharper picture of your investment's health and the fund's strategy. Want to go deeper? Check out our complete guide to capital calls in private equity at https://www.fundpilot.app/blog/a-guide-to-capital-call-in-private-equity. It's the kind of knowledge that helps you truly understand what your GP is up to.

Think of a capital commitment as a legally binding promise. When an investor breaks that promise by failing to meet a capital call, it’s a serious problem with very real consequences. The fund's manager—the General Partner (GP)—has a duty to protect the fund and all the other investors from the fallout.

The exact penalties for a default are spelled out in black and white within the fund's governing documents. This is why it’s so critical for investors to understand the key clauses in a Limited Partnership Agreement, as this document lays out the GP's playbook for handling a default. While the specific remedies can vary, the end goal is always the same: make the other investors whole and send a clear message that defaulting is not an option.

When an LP fails to pay up, the GP isn't just going to send a polite reminder. They have some powerful, and frankly painful, tools at their disposal. These are designed to be a harsh deterrent.

Here are some of the most common actions a GP can take:

The Bottom Line: Defaulting on a capital call is a catastrophic mistake for an investor. The financial and reputational damage can be immense, potentially torpedoing their ability to get into other private funds down the road. It all comes back to one crucial point: LPs must manage their cash flow diligently to ensure they can always meet their commitments when the call comes.

If you’re a Limited Partner (LP), the capital call process can sometimes feel a bit like a black box. You’ve made a commitment, but when will the fund actually ask for the cash? Let's clear up some of the most common questions investors have.

Knowing the general rhythm and rules of the road can help you manage your own liquidity and know what to expect.

There’s no set calendar for capital calls. Their timing is driven entirely by the fund's investment pace. It’s a classic "hurry up and wait" scenario.

You’ll likely see a flurry of activity in the first few years of a fund's life—the "investment period." This is when the General Partner (GP) is putting your capital to work, actively sourcing and closing deals.

Once the fund shifts from buying new assets to managing what it already owns, you can expect the calls to slow down considerably.

Technically, it might be possible depending on the fine print in the Limited Partnership Agreement (LPA), but it’s almost unheard of. Calling 100% of commitments on day one would completely undermine the point of the capital call structure.

Fund managers call capital as they need it for specific deals and expenses. This "just-in-time" funding is a fundamental advantage of the private equity model, as it lets them put money to work immediately instead of letting it sit idle.

A GP's reputation is built on deploying capital wisely. Having a massive pile of uninvested cash sitting in a bank account would be a terrible look, tanking the fund's performance and eroding investor trust.

Yes, they are. When you receive a capital call notice, it’s not always 100% for a new investment. A slice of that call goes toward keeping the lights on.

The funds drawn are typically used to cover:

The capital call notice should give you a clear breakdown of where your money is going. You'll see one line item for the investment and another for these fees and expenses. Transparency here is standard practice.

Juggling capital calls, LP reports, and fund administration with spreadsheets is a recipe for headaches and errors. Fundpilot automates these crucial back-office tasks, giving emerging managers the tools to run their operations like a seasoned institution. See how you can get your time back to focus on what really moves the needle—sourcing deals and raising capital. Schedule your Fundpilot demo today.