Discover everything about data room for due diligence. Learn how to select, set up, and maximize your data room for a successful deal.

So, what exactly is a data room for due diligence? Think of it as a secure, digital vault built for high-stakes business deals like mergers or fundraising rounds. It's a central online hub where you can store and share your most sensitive company documents.

This isn't just another file-sharing tool. It's designed to replace the mess of endless email chains and the security nightmare of generic cloud storage, giving you a controlled, auditable space where everyone involved has exactly the access they need—and nothing more.

In the world of mergers and acquisitions, sending confidential files back and forth over email isn't just messy; it's a huge risk. Before we get into the nuts and bolts of a data room, it helps to understand the importance of due diligence itself. This deep-dive investigation demands a fortified command center, not a digital free-for-all.

That’s precisely what a virtual data room (VDR) provides. Imagine it as a digital fortress, purpose-built for your deal. Instead of chasing down the latest version of a spreadsheet or wondering who has access to what, you get one single, reliable source of truth.

Moving your deal into a dedicated data room brings immediate, tangible benefits. This isn't just about having a place to dump files; it's about gaining total command over the entire process.

Making the switch from scattered files to a controlled VDR isn't an extravagant upgrade anymore. It’s now the standard for closing deals with confidence.

A virtual data room gives you the power to manage the flow of information methodically, turning a potentially messy process into a streamlined, professional operation that instills confidence in all parties.

This shift is clearly reflected in the market. The global virtual data room market was valued at USD 2.42 billion in 2024 and is expected to grow at an impressive 22.2% annually through 2030, all thanks to the rising demand for secure, efficient ways to manage transactions. You can read more insights on VDR market growth from World Business Outlook.

So, what exactly is a data room for due diligence? It’s a common question, and the answer is far more interesting than just an online folder. Think of it as a high-security bank vault that’s also a smart, collaborative workspace, built specifically for the high-stakes world of fundraising or M&A.

This digital fortress isn't about simple storage. Its real job is to give you absolute control over your most sensitive information. Every document inside becomes the one and only source of truth, cutting through the chaos and security risks of sending files back and forth over email.

The magic of a data room is in its granular control. It’s like a building where everyone enters the same front door, but their keycard only works for specific floors and rooms. You get to decide who gets access to what.

A VDR applies that exact logic to your documents, letting you define precisely who can see, print, or download every single file.

This precise level of control wraps a secure bubble around your intellectual property and financial data. With a well-run data room, you stay in command of your information long after you’ve shared it.

A data room for due diligence turns information sharing from a potential liability into a strategic advantage. It gives you a framework to hand over sensitive data with confidence, knowing every single interaction is secure and tracked.

Nothing derails a deal faster than confusion over which version of a document is the right one. A data room solves this by creating one central, authoritative place for everything.

When a file gets updated, everyone with permission sees the new version instantly. No more digging through emails for an old attachment. This isn't just about convenience; it’s about integrity.

Everything that happens—every document view, every question asked, every answer given—is logged in a detailed audit trail. For fund managers, this creates an indestructible record, which is absolutely critical for staying on the right side of regulators.

Managing all this documentation is a core part of running a fund. To get a better handle on your internal processes, check out our guide on creating your fund’s document retention policy template. This will help ensure your data room is not just secure during the deal, but also compliant for years afterward.

Let's be clear: not all data rooms are the same. Sure, many platforms can hold your files, but a high-performance data room for due diligence is an entirely different beast. It's purpose-built with specific tools designed to protect and accelerate a deal.

These critical components fall into three main categories: impenetrable security, seamless collaboration, and effortless administration.

Think of it this way: a basic cloud drive is like a self-storage unit. You can pile things inside, but you have very little control once you hand someone the key. A VDR, on the other hand, is like a modern bank vault with a built-in conference room and a surveillance system that tracks every single move.

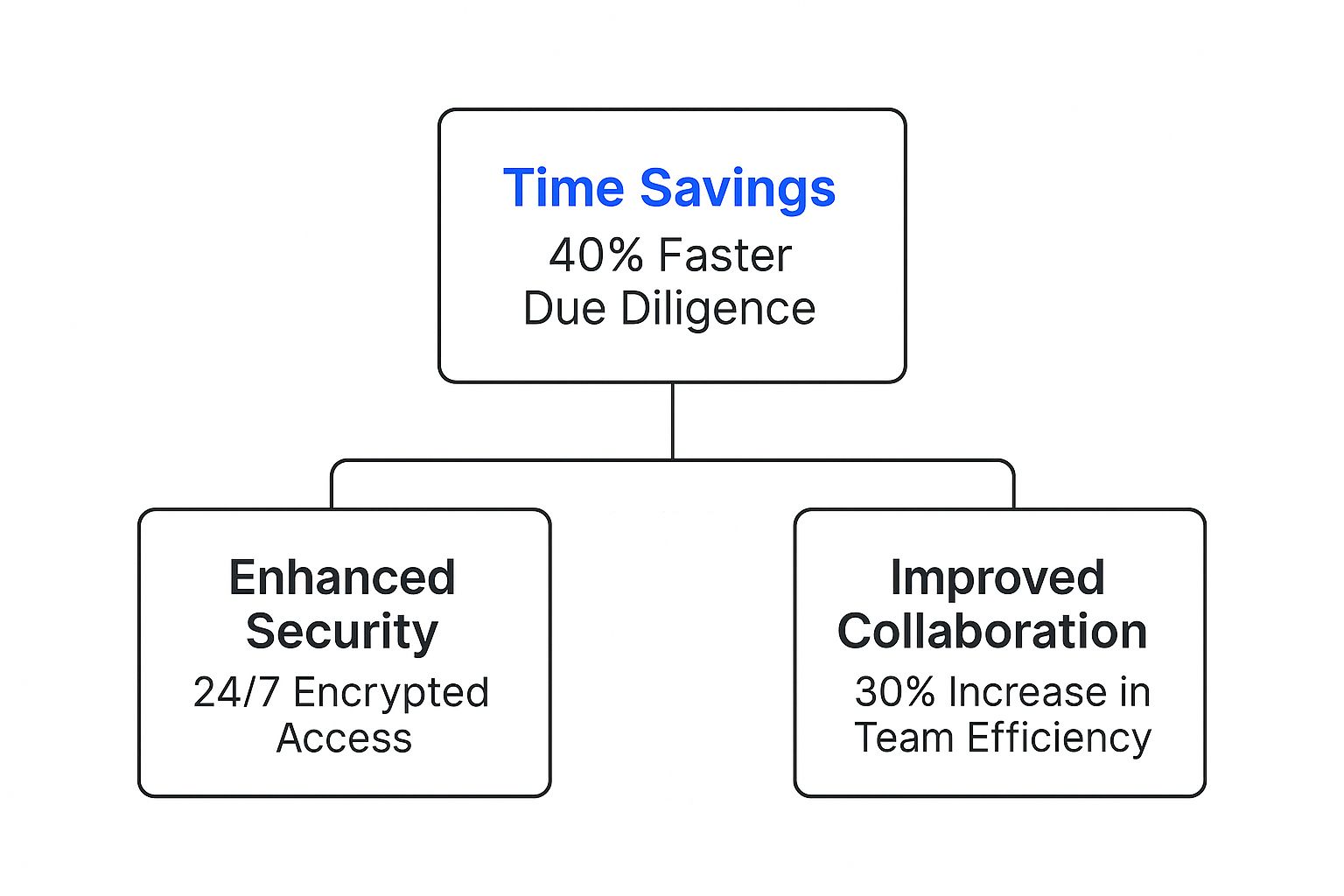

This infographic breaks down the real-world benefits teams see when they switch to a dedicated platform for due diligence.

The numbers don't lie. The right tool doesn't just add a layer of security; it creates huge efficiencies in how your team works and how quickly you can move.

Security is the absolute foundation of a serious data room. It's not just about a password. We're talking about multiple layers of defense to guard your most sensitive information at all times. Central to this are robust secure file sharing and encryption practices that ensure data stays confidential and untampered with.

Key security features you should expect include:

A great data room gets rid of the friction that slows deals down. It replaces chaotic email chains and version-control nightmares with one central hub for communication and workflow. This is where a VDR truly proves its worth.

The platform streamlines the entire due diligence process by tackling the biggest headaches: data security and disorganized teamwork. A VDR uses advanced controls like 256-bit encryption, dynamic watermarking, and strict user permissions to keep information safe and compliant with regulations like GDPR. At the same time, tools like built-in Q&A modules and complete audit trails make communication crystal clear and speed up decision-making.

To give you a better sense of how these features come together, here's a quick breakdown of what makes a VDR indispensable during due diligence.

Essential VDR Features for Due Diligence

| Feature Category | Specific Feature | Benefit for Due Diligence |

|---|---|---|

| Security | Dynamic Watermarking | Deters leaks by branding documents with user-specific data. |

| Security | Granular Access Controls | Ensures stakeholders see only the data relevant to their role. |

| Security | Remote Shredding | Allows you to revoke access and destroy downloaded files instantly. |

| Collaboration | Q&A Module | Centralizes all questions and answers, eliminating messy email threads. |

| Collaboration | Version Control | Guarantees everyone is working from the most up-to-date document. |

| Reporting | Detailed Audit Trails | Provides a complete, irrefutable log of all user activity for compliance. |

| Reporting | Engagement Analytics | Reveals which documents are getting the most attention from potential investors. |

These features work in concert to create a controlled, efficient, and transparent environment for one of the most critical phases of any transaction.

Finally, a top-tier data room should make your life easier, not harder. Detailed audit trails provide an indestructible record of every single action taken—who viewed what document, when they viewed it, and for how long.

This isn't just for show. This data is invaluable for compliance and for getting a real sense of which parties are most engaged in the deal. For fund managers, this level of detail is a must-have for answering questions during fundraising, especially when navigating standardized frameworks. To dig deeper into that, you can check out our guide on how to handle the ILPA Due Diligence Questionnaire, which is available at https://www.fundpilot.app/blog/your-guide-to-the-ilpa-due-diligence-questionnaire.

Putting together a data room for due diligence can feel overwhelming, a bit like building a house without a blueprint. The secret isn't just dumping files into a folder; it's about a methodical approach that creates a space that’s not just secure, but genuinely easy for investors and their teams to navigate.

Let’s walk through the essential steps. The real work starts long before you upload a single file, beginning with thoughtful preparation and organization. This upfront effort is what separates a smooth, professional process from one bogged down by confusion and delays.

A logical folder structure is the foundation of any good data room. Think like a librarian: you want to anticipate exactly what your readers are looking for and make it effortless for them to find it.

Start by gathering every document you'll need and sorting them into intuitive categories. A tried-and-true method is to create top-level folders that mirror the key areas of a due diligence investigation.

This kind of clear hierarchy keeps people from getting lost. To make sure you haven't missed anything, it's always smart to work from a comprehensive list. For a solid starting point, you can explore our expert due diligence checklist template to help build out your structure.

With your documents neatly organized, it’s time to control who sees what. Your guiding light here should be the principle of least privilege. It’s a simple concept: give people the absolute minimum level of access they need to do their job, and no more. This single practice dramatically cuts down on the risk of sensitive data getting into the wrong hands.

Most data room platforms let you create user groups with specific permissions. For instance:

By setting up role-based permissions from the start, you create a controlled environment where sensitive information is protected by default. It’s not an afterthought—it’s a clear signal of professionalism and security to everyone involved.

Once your data room goes live, your job shifts from setup to active management. A well-run VDR is all about being responsive and transparent. Keep a close eye on the Q&A section, assign questions to the right people on your team, and make sure answers are provided quickly. This is crucial for keeping the deal’s momentum going.

Don't forget to use the reporting and analytics features. These tools are a goldmine of information about user activity. You can see which documents are getting the most attention and who is looking at them, which gives you valuable clues about what investors are focused on. This intel helps you get ahead of follow-up questions and proactively steer the conversation, making sure your data room for due diligence works for you from start to finish.

The old-school data room for due diligence is getting a serious upgrade. For years, it was little more than a secure digital filing cabinet—a place to park documents. Now, with artificial intelligence baked in, it’s becoming an active partner in the deal-making process. This isn't just a minor feature update; it's a completely different way to approach analyzing a deal.

Think about the old way: teams of associates burning the midnight oil, manually combing through thousands of documents. AI-powered tools are now handling that heavy lifting. These systems can read and make sense of dense legal contracts, automatically flagging a risky clause or a missing signature in a tiny fraction of the time it would take a person.

The true game-changer here is AI's ability to pull out insights that would otherwise stay hidden deep within the data. It's like having a superhuman analyst on your team who works 24/7. This technology makes it possible to do things that were simply out of reach before.

This evolution from a static library of files to an interactive hub of knowledge is one of the biggest leaps forward for VDRs. The best AI-enabled data rooms can now categorize documents on their own, create summaries of long reports, and even answer questions posed in plain English. This slashes the time it takes to get through the review process. You can learn more about how AI is reshaping V7's data rooms for due diligence and what new capabilities it brings to the table.

For fund managers, this is about more than just efficiency. By taking over the most monotonous parts of due diligence, AI gives your team back its most valuable resource: time. They can stop drowning in document review and start focusing on what really matters—negotiation, strategy, and building relationships.

With AI, deal teams can move faster, make smarter decisions, and spot risks and opportunities that a manual review might have missed. It creates a real competitive edge in a market that doesn't wait around.

Firms that embrace these tools are discovering they can close deals not just faster, but with a lot more confidence. When you can surface critical information almost instantly and cut down on human error, you're left with fewer unwelcome surprises after the deal is done. It simply makes the entire due diligence process smarter and more dependable.

Picking a virtual data room provider is a critical decision, one that can genuinely make or break your deal's momentum. The right partner isn't just giving you a place to dump files; they’re an extension of your team, a silent partner dedicated to keeping things secure and moving smoothly.

On the flip side, the wrong choice can introduce security holes, frustrating user experiences, and a string of unexpected bills. This isn't a decision to rush.

You have to look past the shiny feature lists and marketing slogans. A true partner understands the pressure and stakes of a data room for due diligence. That means things like deep industry experience, always-on support, and transparent pricing are just as important as the technology itself.

Before you even think about signing a contract, you need to put potential providers under the microscope. Start with their track record. Do they have experience in your world, whether that's venture capital, real estate, or life sciences? A provider who knows your industry already understands your specific compliance headaches and workflow needs.

Next, how good is their support, really? When a critical document won't upload at 2 AM before a deadline, you need a human expert on the phone, not an automated email promising a response within 24 hours. Look for providers that offer 24/7/365 expert support—and don't be afraid to test it during the trial period.

Finally, insist on crystal-clear pricing. Hidden fees for things like data overages, extra admins, or even printing rights can turn a "great deal" into a financial nightmare.

A great VDR provider is a partner, not just a platform. Their expertise and support should give you the confidence to focus on closing the deal, knowing the technical and security aspects are handled flawlessly.

Not all VDR providers are created equal. They generally fall into a few different tiers, each built for different types of deals, teams, and budgets. Thinking about them in this way helps cut through the noise and find the right fit for your specific needs.

The table below breaks down these common tiers to give you a framework for your evaluation. It's a simple way to see where different providers land and match their strengths to the complexity and scale of your deal.

A comparative overview of different types of VDR providers to help users select the best fit for their specific needs and budget.

| Provider Tier | Ideal Use Case | Key Strengths | Potential Drawbacks |

|---|---|---|---|

| Budget | Small fundraising rounds, internal projects | Low cost, simple interface | Limited security features, basic support |

| Mid-Market | Mid-size M&A, private equity deals | Balanced features, good security, reliable support | May lack advanced AI or analytics |

| Enterprise | Large-scale M&A, IPOs, complex deals | Advanced AI, top-tier security, dedicated project managers | Higher cost, can be complex to set up |

Ultimately, whether you're handling a small seed round or a multi-billion dollar merger, there's a VDR out there for you. The key is to match the provider's capabilities—and cost—to the actual demands of your transaction.

When you start digging into the world of data rooms for due diligence, a few practical questions always pop up. Getting straight answers to these is key to feeling confident and picking the right platform for your deal. Let's tackle some of the most frequent ones.

The price tag on a virtual data room can swing pretty widely. It really boils down to the provider you choose, how much data you need to store, the number of people who need access, and the expected lifespan of your deal.

You’ll typically see a few different pricing structures out there:

For a smaller project, you might find basic plans starting in the low hundreds of dollars per month. On the other hand, a complex M&A deal with all the bells and whistles can easily climb into the thousands. The best advice? Always get a detailed quote that spells out every potential cost so there are no nasty surprises down the road.

People often ask if a VDR is truly more secure than something like Dropbox or Google Drive. The answer is a hard yes. While those everyday file-sharing tools are great for collaboration, VDRs are built like digital fortresses, specifically designed for high-stakes business.

Think of it this way: standard cloud storage gives you a key to a room, but a VDR lets you control who can look at what inside that room, for how long, and even tracks every single fingerprint. You get granular, document-level security features like dynamic watermarking, incredibly detailed audit trails, and crucial compliance certifications (SOC 2, for example) that are non-negotiable for protecting sensitive information.

Ready to elevate your fund's operations and impress investors with institutional-grade reporting? Fundpilot provides the tools you need to manage your pipeline, automate administration, and prepare professional due diligence packages. Discover how over 500 funds are scaling faster by visiting the Fundpilot website.