Discover how top firms use private equity deal tracking software to accelerate deal flow, enhance decision-making, and gain a competitive edge. Learn more.

For a surprising number of private equity firms, the entire multi-million-dollar deal pipeline still lives in a collection of spreadsheets. It’s a familiar, if clunky, way of working. But in today's fast-paced market, this manual approach isn't just inefficient—it's a serious competitive liability that often leads to missed opportunities and operational chaos.

Think about it. You're juggling a complex web of potential investments, critical relationships, and endless due diligence tasks, all scattered across dozens of disconnected Excel files. This setup isn't just messy; it's a high-stakes gamble. Each spreadsheet becomes its own little island of information, making a real-time, bird's-eye view of your pipeline completely impossible.

This fragmentation creates friction almost immediately. An analyst updates one version, a partner has another saved on their desktop, and a third is buried in someone’s email chain. What you get is a version control nightmare. No one is ever truly confident they're looking at the latest numbers or notes.

When your deal data is locked away in separate files, teamwork grinds to a halt. Important notes from a call with a founder might never leave one person's local drive, leaving the rest of the team in the dark. This lack of a single, reliable source of truth means people end up duplicating work and, worse, critical details get lost along the way.

This manual process creates a few classic headaches:

Trying to manage a dynamic PE pipeline with static spreadsheets is like trying to navigate a bustling city with a hand-drawn map. It’s outdated, slow, and you’re bound to miss the best routes.

At the end of the day, all this operational drag directly hurts your ability to close deals. In a fiercely competitive environment where speed is everything, firms stuck in manual processes are left in the dust. Every minute spent hunting for the right file or re-keying data is a minute you're not spending building relationships or digging deeper into due diligence.

This constant friction kills momentum at every turn. A simple request for a pipeline update can kick off a frantic scramble to consolidate information, delaying critical strategic decisions. It’s this reality that has pushed purpose-built private equity deal tracking software from a "nice-to-have" luxury to an essential tool for any firm serious about winning the best deals.

So, what are we really talking about here? In the simplest terms, private equity deal tracking software is your firm’s air traffic control tower. It gives you a single screen to monitor every potential investment, from the moment it appears on your radar all the way through to a successful landing.

Think of it as the central nervous system for your firm. It’s the platform that connects your deal team, your data, and all your communications, making sure information gets where it needs to go without getting lost. Its whole job is to bring a sense of order to the inherently chaotic world of deal flow.

It does this by creating a single source of truth. No more digging through shared drives for the latest version of a spreadsheet or second-guessing whether you have the most recent call notes. Everything is right there—organized, up-to-date, and in one secure place.

It's tempting to think of this as just another CRM, but that's a common mistake. A generic CRM is designed for a straightforward, linear sales process—moving a lead from prospect to customer. That model just doesn't fit the complex, multi-layered, and relationship-heavy reality of private equity.

A purpose-built deal tracking platform is engineered to handle the unique hurdles of the industry:

Private equity firms have long been bogged down by fragmented data, and that operational headache is exactly why these platforms have taken off. Unlike a traditional CRM that lives and dies by manual data entry, many modern solutions use AI to constantly scan and update company information, ensuring your data is actually reliable.

A generic CRM is like a family sedan—it’s great for a predictable daily commute. But private equity deal tracking software is more like a custom-built 4x4, specifically engineered to navigate the rugged, unpredictable terrain of the investment world.

A great platform is more than just a tool for staying organized; it's a powerful engine for finding new deals. By consolidating all your firm’s touchpoints—every email, meeting, and phone call—it builds an institutional memory. You can instantly see who on your team has the strongest connection to a target company’s CEO or a key advisor on a deal.

This transforms your firm's collective network from a fuzzy concept into a tangible, searchable asset. It takes the guesswork out of outreach and shows your team the fastest, warmest path to a real conversation. In a hyper-competitive market, that kind of intelligence is a massive advantage. If you want to dive deeper, you can master private equity deal sourcing strategies and tips with our in-depth guide.

This strategic function is what truly separates private equity deal tracking software from the pack. It becomes less of a database and more of a core component of your firm's growth strategy.

To really get what makes private equity deal tracking software so valuable, you have to look past a simple feature list. These platforms are built with specific tools that directly tackle the biggest headaches deal teams face every day. Think of each feature as a gear in a well-oiled machine, working together to transform a clunky, manual process into a smooth, high-performance pipeline.

At its core, the software gives you a centralized deal pipeline management hub. Imagine every single deal—from a whisper of an opportunity to a signed letter of intent—laid out on a clean, visual dashboard. This single source of truth ends the frantic scramble for updates before the Monday morning meeting. Everyone on the team sees the same reality, at the same time.

To truly speed up your deal flow, it helps to understand what pipeline management entails and why it's the foundation of any good platform. It’s not just about getting organized; it's about building a predictable, repeatable system for finding and advancing the right opportunities.

Manual data entry is one of the biggest time-wasters for junior analysts. They can spend countless hours just pulling information from different sources to build out company profiles. Modern deal tracking software puts an end to that grind.

By plugging into financial data providers and public records, the platform automatically fills in and updates critical information. We're talking about company financials, changes to the executive team, recent news mentions, and more.

This automation hits two crucial targets:

The difference this makes is night and day. Let's compare the old way with the new.

This table highlights the stark differences in efficiency, accuracy, and strategic capability between traditional manual methods and using specialized deal tracking software.

| Activity | Manual Method (Spreadsheets & Email) | Automated Software Solution |

|---|---|---|

| Data Entry | Hours of manual copy-pasting from various sources. High risk of human error. | Automatic population and enrichment from integrated data providers. |

| Pipeline Visibility | Siloed, often outdated spreadsheets. Requires manual updates for team meetings. | Real-time, centralized dashboard accessible to the entire team. |

| Relationship Mapping | Relies on individual memory ("Who knows someone at..."). Inefficient and incomplete. | AI-powered analysis of network data reveals hidden connections instantly. |

| Workflow Management | Inconsistent processes, missed steps, and tasks tracked in email or personal notes. | Standardized, customizable workflows with automated tasks and reminders. |

| Reporting | Time-consuming process of manually compiling data for LPs or internal review. | Instant, one-click reports on pipeline health, team activity, and deal progress. |

As you can see, automation doesn't just make things faster—it makes the entire operation smarter and more reliable.

This might be the most powerful feature of all: relationship intelligence. The software maps out your firm’s entire collective network by analyzing email and calendar data to show you who knows whom, and how strong that connection is. It turns your firm's network from a vague idea into a searchable, strategic weapon.

Let's say you're looking at a target company. The software can instantly tell you that one of your partners has a strong, long-standing relationship with the CFO. That gives you a direct path to a warm introduction, which is worlds more effective than a cold call. In fact, research shows a warm intro can make you over 50% more likely to land a new client.

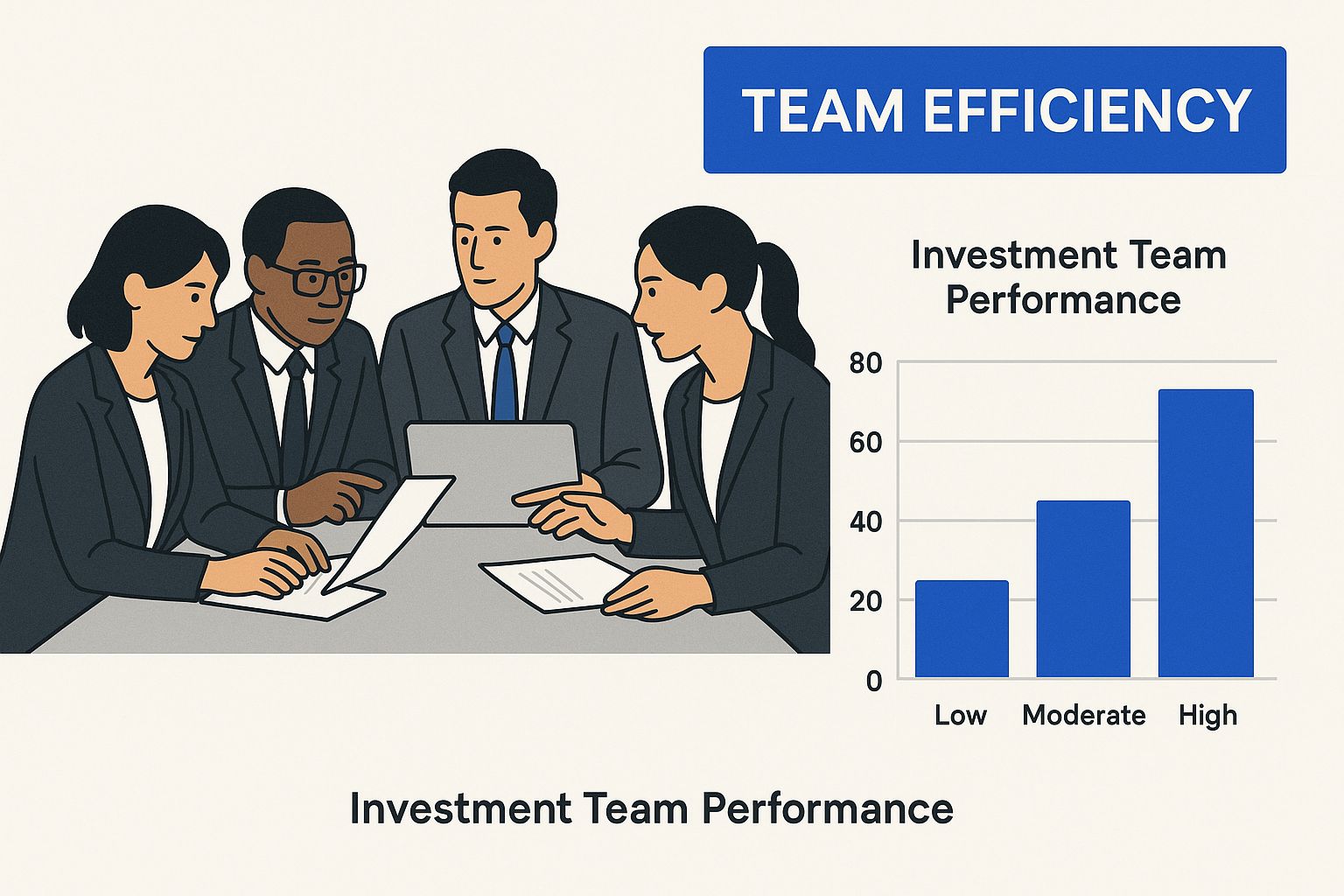

The image below gives you a great visual of how these connected features boost your team’s overall efficiency by improving collaboration and the flow of information.

This really drives home how integrated tools help teams act on intelligence faster, turning scattered data points into a coordinated, strategic move.

Every PE firm has its own "secret sauce"—a unique process for sourcing, vetting, and closing deals. Good software doesn't try to cram you into a rigid box. Instead, it offers customizable workflows and task management.

This means you can build your firm’s best practices right into the platform. You can create standardized checklists for each stage of the deal, assign tasks to specific team members, and even set up automated reminders for deadlines.

This feature effectively turns your institutional knowledge into a system. It ensures every deal gets the same rigorous attention to detail, no matter who's running point.

This kind of standardization is the key to scaling. As your firm and deal volume grow, these defined workflows stop things from falling through the cracks and maintain a high bar for quality across the board.

The due diligence phase is a whirlwind of sensitive documents, constant back-and-forth, and tight deadlines. Trying to manage this chaos with scattered email threads and basic file-sharing tools isn't just inefficient—it's a huge security risk.

Top-tier private equity deal tracking software solves this by including integrated virtual data rooms (VDRs) or secure portals for managing all your documents.

This gives you a single, controlled environment where you can:

By bringing this function directly into the main platform, you keep every piece of the deal under one roof. It creates a seamless handoff from initial evaluation to deep-dive diligence, ensuring total continuity and security through the entire lifecycle.

Let's be clear: switching to a dedicated private equity deal tracking software isn't just about cleaning up your operations. It's a strategic power play that helps you win more deals, plain and simple. For firm partners, the value isn't found in a tidier database—it's in building a machine that consistently outperforms the competition in a fiercely crowded market.

The first thing you'll notice is a massive boost in deal velocity. Think about it. Manual processes are full of dead time—analysts hunting for the latest spreadsheet, partners waiting on a pipeline report. A proper tracking platform kills those delays by giving everyone instant access to the same live information.

This means decisions that used to take days of painful data gathering can now happen in minutes. When a hot opportunity lands on your desk, your team can screen it, run the initial numbers, and start diligence before competitors have even finished sorting through their email attachments.

While gut instinct will always be part of the art of the deal, the best firms validate that instinct with solid data. A centralized platform is more than a glorified address book; it’s an analytics powerhouse. It turns years of deal flow, conversations, and performance metrics into intelligence you can actually use.

This data-first approach takes the guesswork out of your most important strategic questions:

Having these answers at your fingertips helps you sharpen your investment thesis and point your resources where they’ll have the biggest impact. You stop just chasing deals and start systematically hunting for the right deals.

In an industry built on relationships, a missed follow-up is a missed opportunity. A good tracking system becomes your firm's shared brain, making sure no conversation or connection falls through the cracks. Automated reminders and clear task assignments ensure that critical follow-ups just happen.

Even more importantly, the platform builds a secure, searchable institutional memory. When a star dealmaker leaves, their network and knowledge shouldn't walk out the door with them. Every note, email, and document is captured in one place, preserving intellectual capital that belongs to the firm, not just an individual.

A deal tracking platform transforms your firm’s collective experience from a collection of individual memories into a permanent, strategic asset. This institutional knowledge becomes a core part of your competitive moat.

This shared intelligence is essential for keeping momentum on long-cycle deals, no matter who is on the team. As the market gets hotter, this kind of operational resilience is a huge differentiator. For instance, in Q1 2025, private equity deal volume jumped by over 45% from the previous year, showing just how critical it is for firms to have systems that can handle a flood of new opportunities. You can find more details about this market trend on ascendix.com.

Finally, a single platform smashes the information silos that slow so many firms down. When everyone—from the newest analyst to the managing partner—is working from the same playbook, collaboration clicks into place.

The investment committee can see a deal’s entire history in one view. The legal team can grab diligence documents without chasing anyone down. And the IR team can pull accurate pipeline data for LP updates in seconds. This transparency builds a more agile and cohesive culture, empowering every single person with the context they need to do their best work.

Picking the right private equity deal tracking software is a high-stakes decision, but you can take the guesswork out of it with a clear, structured approach. Before you even watch a single demo, you need to define what success actually looks like for your firm. The whole point is to find a platform that molds to your workflow, not one that makes you bend over backward to fit its rigid structure.

Think of it this way: you wouldn’t buy a race car for a family road trip. The “best” software is simply the one that’s a perfect match for your firm's size, investment focus, and biggest operational headaches. A lean, fast-moving fund has completely different needs than a multi-billion-dollar institution.

The process has to start with an honest internal audit. Get in a room and map out your current deal lifecycle, pinpoint the most frustrating bottlenecks, and gather feedback from everyone on the team—from the analysts in the trenches to the partners making the final calls. This initial groundwork is what ensures you’re solving real problems, not just chasing shiny new features.

One of the most common pitfalls is picking a system that only solves today's problems. As your firm grows, your deal volume will ramp up, your team will get bigger, and your reporting demands will get a lot more complex. A platform that can’t grow alongside you will quickly become more of a liability than an asset.

When you’re evaluating scalability, ask yourself these questions:

A truly scalable solution should feel like a partner in your growth, not a roadblock. It needs to adapt seamlessly as you go from raising your first fund to managing a whole portfolio of diverse assets.

Your deal tracking platform doesn’t exist in a bubble. It has to talk to all the other tools you use every single day—your email client, your calendar, and your data providers. Bad integrations create digital friction, forcing your team right back into the time-sucking manual work you were trying to eliminate in the first place.

A platform without strong integrations is like an island. The information is there, but it's isolated and difficult to connect with the rest of your operational mainland, defeating the purpose of a centralized system.

Look for deep, native integrations with the heavy hitters like Microsoft Outlook and Google Workspace. The system should be smart enough to automatically capture emails and meetings, enriching contact records without anyone having to lift a finger. This is the kind of connectivity that powers truly useful features like relationship intelligence.

Every firm has its own unique process, so a certain degree of customization is non-negotiable. You’ll need the ability to create custom fields, define your specific pipeline stages, and build out workflows that mirror how your team actually gets work done. But be careful—excessive customization can be a double-edged sword.

Overly complex platforms can become so clunky and hard to navigate that your team just gives up and goes back to their trusty old spreadsheets. The trick is to find that sweet spot. The software should be flexible enough to fit your process but intuitive enough that it doesn’t take a week of training to figure out. A clean interface and a positive user experience (UX) are absolutely essential for getting your team to actually use the tool.

Given the incredibly sensitive nature of your data, security has to be a top priority. Don't just take a vendor's word for it; you need to dig into their security protocols. Ask them directly about data encryption, access controls, and their compliance with industry standards like SOC 2. A security breach could be catastrophic, so this is one area where you absolutely cannot afford to cut corners.

Finally, remember that you’re not just buying a piece of software—you’re starting a partnership. The quality of a vendor’s support can make or break your entire experience. Having a responsive, knowledgeable support team in your corner is invaluable, especially during implementation and beyond. To see how these factors fit into the bigger picture, you can learn more by reading this detailed guide to fund management platform essentials.

Trying to find the right private equity deal tracking software can feel like wading through a sea of options. The truth is, there's no single "best" platform. It’s far more helpful to think about the different philosophies driving the top contenders.

Some tools are built from the ground up for speed and simplicity, while others are massive, enterprise-grade systems designed for endless customization. The trick is to find the software whose philosophy aligns with your firm's DNA—your size, your strategy, and how your team actually works day-to-day.

Let's look at a couple of well-known players to see what this means in practice. A platform like Affinity has made a name for itself by zeroing in on relationship intelligence and automated data capture. Its whole purpose is to kill manual data entry. It syncs with your team's emails and calendars to automatically build a real-time map of your firm's entire network.

Founded in 2014, Affinity now serves over 3,000 clients who were struggling to manage a rising tide of deal flow. With integrations for over 40 other tools, like Microsoft Teams and Salesforce, it’s designed to slot right into the software you already use.

The right software doesn't just hold your data; it makes that data work for you. It connects the dots between people, companies, and conversations to surface opportunities you might have otherwise missed.

On the other side of the coin, you have platforms like DealCloud. It’s known for its incredible depth of customization. Think of it as a powerful engine you can build to match the very specific, often intricate, workflows of a large, established private equity firm. This level of tailoring creates a system that feels like it was built just for you, but it usually comes with a more involved setup process.

So, which path is right for you? It really boils down to what you value most right now.

There's no wrong answer here. The best choice is the one that solves your firm's biggest headaches today while supporting your goals for tomorrow. For a more detailed comparison, check out our guide to the 12 best deal flow management software options for 2025.

Let's tackle some of the most common questions we hear from firms when they're thinking about moving to a dedicated deal tracking platform. Getting these answers straight can help you make a much better, more confident decision.

This one comes up a lot. Firms wonder, "We already have Salesforce, why can't we just use that?" The short answer is that a standard CRM is built for a simple, linear sales process—a straight line from lead to close. Private equity is anything but a straight line.

Your typical CRM just can't keep up with the messy, interconnected, and long-term nature of PE deals. Private equity deal tracking software, on the other hand, is built from the ground up for this world. It has tools for visualizing complex webs of relationships, custom pipeline stages for everything from initial sourcing to due diligence, and built-in compliance features that a generic system wouldn't even consider.

Another big question is how long it takes to get up and running. Honestly, it varies. Modern, cloud-based platforms designed for small to mid-sized firms can often be deployed in just a few weeks. They're built for quick adoption.

On the other hand, a massive, highly customized enterprise system could take several months to fully roll out. You have to factor in data migration, deep configuration, and team-wide training. The best advice? Get a firm timeline from any vendor you talk to, based specifically on your firm's size and needs.

The right platform shouldn’t just be a digital version of your current workflow—it should actively make it better. The goal is a tool that starts adding value from day one.

People are often skeptical about whether software can really improve deal sourcing. The answer is a resounding yes. The best platforms are more than just databases; they're powerful sourcing engines.

Many integrate directly with market data providers, letting you screen for companies that fit your investment thesis like a glove. But the real magic is in the relationship intelligence. The software can instantly show you who in your network has the strongest connection to a founder or CEO you want to meet. That warm introduction is gold—it puts you leagues ahead of competitors who are still stuck sending cold emails. This feature alone can deliver a massive return on investment.

Ready to swap out those clunky spreadsheets for a platform built for professional investors? Fundpilot gives emerging managers the tools to professionalize their back office, deliver institutional-quality LP reports, and focus on what you do best—winning great deals. Book your personalized demo today.