Unlocking the hurdle rate meaning is key to smart investing. Learn how to calculate and use it for capital budgeting, private equity, and investment analysis.

Ever heard the term hurdle rate? At its core, it's the minimum rate of return you're willing to accept before you put your money into a project or investment.

Think of it like a high-jump bar. For an investment to be considered a "win," its expected return has to clear that bar. If it can't, you don't even attempt the jump.

In the world of investing, a hurdle rate acts as a critical gatekeeper for your capital. It's a specific, pre-agreed-upon return threshold that a potential investment must beat to get the green light.

This isn't just a number plucked from thin air. It’s a carefully calculated figure that bakes in the risk associated with the opportunity. It ensures that you only commit funds to ventures that actually justify the risk you're taking.

By setting this minimum, you build a disciplined framework for making investment decisions. It forces a clear "yes" or "no" based on hard numbers, moving you away from relying on a gut feeling. This process helps you avoid tying up precious capital in assets that are likely to underperform.

Of course, making smart investment decisions goes beyond just setting a minimum required return. It's also crucial to understand the tax implications of your earnings, which you can learn about if you Master the UK Dividend Allowance for Investors.

So, what actually goes into setting this bar? A hurdle rate is typically built from a few core financial concepts that, when combined, create a realistic and risk-adjusted benchmark.

Let's quickly break down the essential building blocks. We'll dive deeper into these later, but this table gives you a good overview.

| Component | Description |

|---|---|

| Cost of Capital | The baseline cost for a company to finance its assets, often the Weighted Average Cost of Capital (WACC). |

| Risk-Free Rate | The return you could get from a completely risk-free investment, like a government bond. |

| Risk Premium | The extra return an investor demands to be compensated for taking on the specific risks of an investment. |

These three pieces—the cost of money, the return for no risk, and the extra payment for taking a chance—come together to define the hurdle an investment must clear.

A hurdle rate isn't just another piece of financial jargon; it's the single most important filter you can apply to your investment process. Think of it as the minimum height a high-jumper must clear. If a potential investment can't get over that bar, it's not even in the running for your capital.

This benchmark is what injects discipline and objectivity into your decision-making. It forces you to compare every opportunity—whether it's a real estate deal, a new piece of equipment, or a stake in a startup—against the same clear, consistent standard. Without a hurdle rate, it's far too easy to get swayed by a good story or a charismatic founder, rather than cold, hard numbers.

This simple, disciplined approach is the bedrock of smart capital allocation. By establishing a minimum acceptable return, the hurdle rate becomes a practical tool that automatically weeds out weak projects and channels your money toward opportunities that have a real shot at creating significant value.

Figuring out the right hurdle rate is a bit of a balancing act, and the stakes are high. Set it incorrectly, and you could either hamstring your growth or destroy capital. The sweet spot is a rate that realistically accounts for your cost of capital plus a premium for the specific risks you're taking on.

A hurdle rate does more than just screen deals; it aligns the fund manager's goals with the investors' expectations. It’s a promise that you'll only pursue projects that are expected to generate returns above the cost of funding, protecting everyone's capital and driving real performance.

Getting this number wrong creates two very different, but equally damaging, problems. Let's look at what happens when you set the bar too high or too low.

Setting the Hurdle Rate Too High: You become overly cautious, passing on perfectly good investments that would have generated solid returns. This can starve your fund of growth and leave you sitting on the sidelines while others capitalize on great opportunities.

Setting the Hurdle Rate Too Low: This is even more dangerous. You end up green-lighting projects that don't adequately compensate you for the risk involved. This is how you destroy value, tying up precious capital in underperforming assets that can't even clear the cost of funding.

At its core, a hurdle rate is a tool for enforcing financial discipline. It replaces gut feelings and emotional bias with a systematic, data-driven framework. For new and emerging fund managers trying to build a solid track record, this is absolutely essential.

This structured evaluation is a foundational skill for anyone learning how to start an investment fund, because it creates a credible, repeatable process for putting capital to work.

By defining what success looks like before you even look at a deal, you build a powerful filter. A well-calibrated hurdle rate ensures every single dollar you invest is put to work with a clear, pre-defined performance target, protecting your financial health and setting you up for long-term success.

Figuring out a hurdle rate isn't nearly as complicated as it might seem. While the financial modeling can get deep, the most common way to do it comes down to a pretty simple idea: start with your basic cost of funding and add a little extra for the specific risk you're taking on.

The formula you'll see most often looks like this:

Hurdle Rate = Cost of Capital + Risk Premium

Think of the Cost of Capital as the basic price you pay for money, whether you're borrowing it from a bank or raising it from investors. The Risk Premium is the extra slice of return you need to make a specific, and potentially uncertain, investment worth your while.

This simple equation gives you a solid framework for setting a minimum acceptable return. It makes sure any project you move forward with will not only cover your financing costs but also properly pay you back for the risk you’re shouldering. Let's pull back the curtain on each piece.

To really get a feel for how this works, you need to understand what’s going on inside each part of the calculation.

Cost of Capital (WACC): For most established businesses, this is their Weighted Average Cost of Capital (WACC). It’s a blended rate that combines the cost of equity (the return shareholders expect) and the cost of debt (the interest lenders charge). Essentially, it's the company's average cost to get the cash it needs to operate and grow.

Risk Premium: This is where the art meets the science. It’s a judgment call, but a critical one. This is the extra return you demand to justify taking on project-specific risks that are above and beyond your company’s normal day-to-day. This number can be influenced by anything from market volatility and new competitors to technological unknowns. When setting this rate, having solid data is key for achieving measurable ROI gains.

So, you’re starting with your baseline cost of doing business (the WACC) and then tacking on a buffer that reflects just how risky this particular venture feels.

Let's walk through a real-world scenario. Imagine a software company, "Innovate Inc.," is thinking about investing $1 million into a new AI-powered analytics platform.

Determine the WACC: Innovate Inc. looks at its mix of debt and equity financing and calculates that its WACC is 12%. This is the company's fundamental cost of capital.

Assess the Risk Premium: The AI project has huge potential, but it also comes with big question marks around the technology and whether customers will actually adopt it. The leadership team agrees that a 3% risk premium is a fair price for these uncertainties.

Calculate the Hurdle Rate: Now, it's just simple addition. With a WACC of 12% and a risk premium of 3%, the hurdle rate is 15%. This means the new AI platform needs to project a return of at least 15% for the company to even consider it.

This final hurdle rate becomes the project's high-jump bar. The team will compare this 15% benchmark against the project's expected Internal Rate of Return (IRR). If the IRR is comfortably above 15%, the project gets a green light. If not, it’s back to the drawing board.

Want to get a better handle on that next step? Check out our guide on https://www.fundpilot.app/blog/how-to-calculate-irr-for-smarter-investments to see how IRR fits into the picture.

When you step into the high-stakes world of private equity (PE) and venture capital (VC), the hurdle rate isn't just a number on a spreadsheet. It's a foundational promise, a line in the sand that defines the entire relationship between investors and the fund managers they’ve backed.

This concept is a core part of how these funds are built, ensuring everyone is pulling in the same direction. For a deeper dive, check out our complete guide to private investment fund structure.

In PE and VC circles, the hurdle rate is usually called the preferred return. Think of it as the minimum annual return that investors—the Limited Partners (LPs)—must receive before the fund managers—the General Partners (GPs)—can touch a dime of their performance bonus. It's a non-negotiable term baked into almost every fund agreement.

This structure is brilliant in its simplicity. It protects the LPs' capital while giving the GPs a powerful reason to aim for truly outstanding results, not just coast along.

So, what's that performance bonus for the GP? It's called carried interest, or "carry" for short. This is the GP's share of the fund's profits, and the industry standard has long been 20%. But they can't claim that carry until the fund has passed a few crucial checkpoints, and clearing the hurdle rate is the very first one.

In private equity, the hurdle rate plays a pivotal role as a preferred return threshold that protects investors by requiring their investment to yield a minimum return before the fund managers (general partners) can share in profits through carried interest. Discover more insights about how carried interest and hurdle rates interact on carta.com.

It's a fantastic safety net for investors. The LPs are effectively telling the GPs, "First, get our money back and earn us a respectable baseline return. Then, and only then, can you start taking a piece of the extra value you've created." This prevents managers from getting paid for performance that an LP could have gotten from a much safer investment.

This preferred return model is the secret sauce that aligns everyone's goals. GPs are intensely motivated to hunt down investments that will blow past the hurdle rate because their own substantial payday—the carried interest—is locked away until they do.

So, what's a typical hurdle rate in the wild?

The hurdle rate is far more than a financial term; it’s a commitment. It sets a clear performance floor, forcing discipline and a relentless focus on generating true alpha. By making that coveted carried interest conditional, the hurdle rate ensures that GPs only win big when their LPs win first. It’s the bedrock of trust and long-term success in private markets.

Not all hurdle rates are built the same. In fact, how they’re structured can completely change the financial outcome for everyone involved, from the investors (Limited Partners or LPs) to the fund managers (General Partners or GPs).

This structure, often called a "waterfall" in the private equity world, sets the rules for how and when performance fees—known as carried interest—get paid. The two main flavors you'll encounter are the European and American models, and each one tells a very different story.

The European hurdle is what we often call a “hard” or “whole-fund” hurdle. It’s pretty straightforward and is generally seen as being more aligned with investor interests.

Here’s the deal: the fund manager can’t collect a dime of carried interest until two things have happened. First, the investors must get 100% of their initial capital contributions back. Second, they must also receive the full preferred return on that capital for the entire life of the fund.

Think of the fund as one giant bucket. All the profits and losses from every single investment are poured into it. The GP only gets to take their share after the investors have been made whole and have cleared the hurdle on the entire bucket. This structure protects investors from a scenario where a manager gets paid handsomely for a few early wins, only for the fund to fizzle out with later, poor-performing investments.

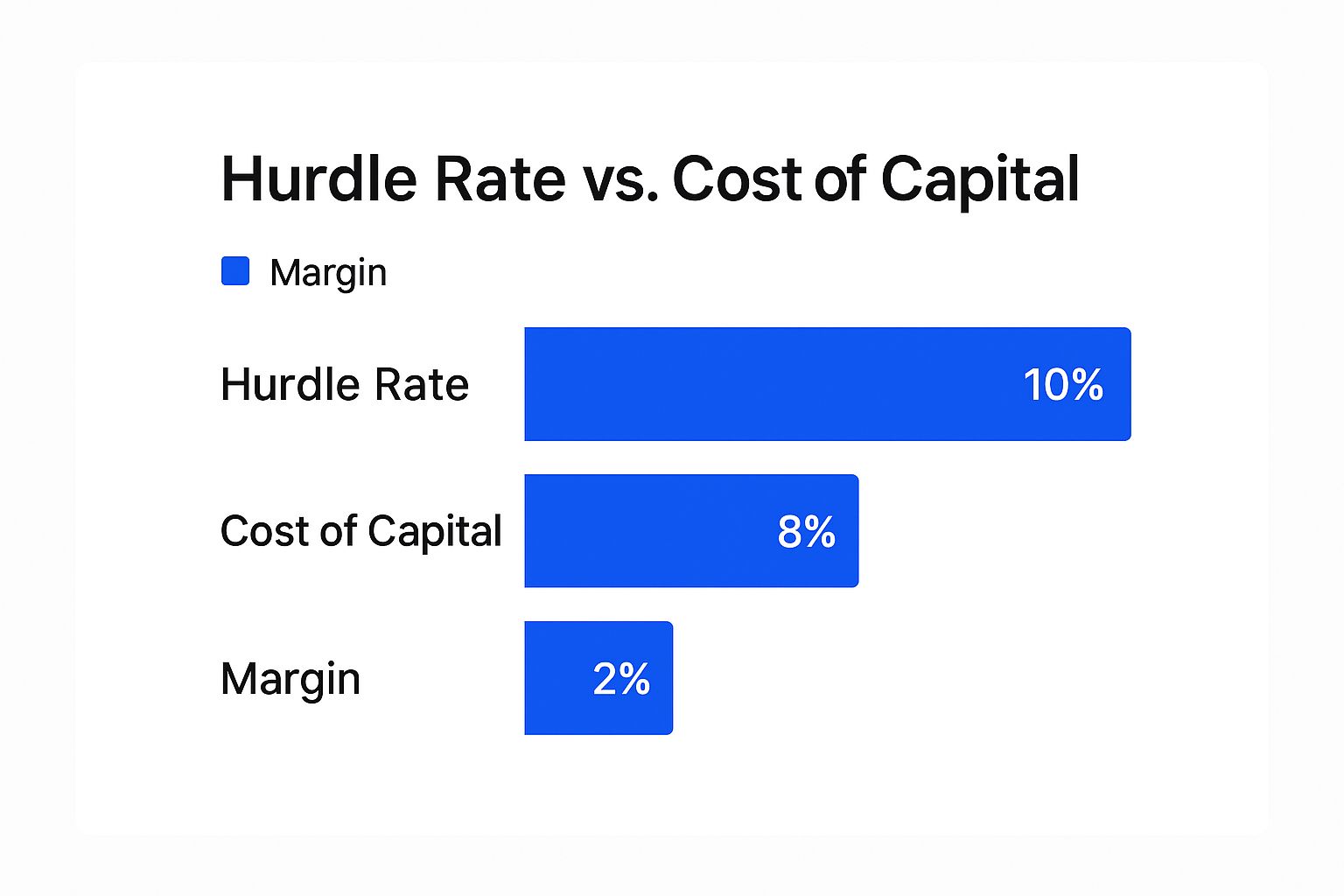

The image below gives you a simple visual of how a hurdle rate works in principle. For any project or fund to be considered a success, its return needs to climb over that hurdle, not just cover its initial costs.

As you can see, simply breaking even isn't enough. The return has to clear that higher bar—the hurdle rate—for the fund manager to earn their performance fee.

The American hurdle, on the other hand, takes a completely different approach. It works on a deal-by-deal basis, which can be much more attractive for fund managers.

Under this model, a GP can start collecting carried interest as soon as an individual investment is sold for a profit—as long as that specific deal clears the preferred return. This means the GP can start pocketing performance fees much earlier in a fund's life, sometimes long before investors have seen all their initial money back.

The real difference comes down to timing and perspective. The European model looks at the entire fund's performance over its whole life, making investors whole first. The American model looks at each deal individually, allowing for early profit-sharing on the winners.

So, what’s the catch for investors? To offer some protection, American waterfalls almost always include a "clawback" provision. This is a crucial safety net. It contractually obligates the GP to return any performance fees they’ve already been paid if the fund’s overall performance eventually dips below the hurdle rate by the end of its life. While it protects LPs, clawbacks can get complicated and messy to enforce years down the road.

To make the differences crystal clear, let's break them down side-by-side.

The choice between a European (whole-fund) and an American (deal-by-deal) waterfall fundamentally shifts the risk and reward dynamic. Here’s a simple comparison of how these two structures play out for both investors and fund managers.

| Feature | European Hurdle (Hard) | American Hurdle (Deal-by-Deal) |

|---|---|---|

| Calculation Basis | Entire fund performance is aggregated. | Each investment is treated individually. |

| GP Payout Timing | Delayed until LPs are fully repaid (capital + pref). | Can occur early in the fund's life on successful exits. |

| Investor Protection | Strong. Prevents GPs from profiting until LPs are whole. | Relies heavily on a "clawback" provision. |

| Alignment of Interest | Considered highly aligned with LPs. | Less aligned, as GPs can profit before LPs are repaid. |

| Complexity | Simpler and more straightforward to calculate. | More complex due to individual deal tracking and clawbacks. |

Ultimately, the European structure is a patient, long-term game that prioritizes investor security, while the American structure offers fund managers quicker access to their winnings, with the clawback acting as a final check and balance.

Getting the hurdle rate right isn't just about crunching the numbers correctly; it's also about steering clear of some common traps that can lead you astray. Even the most sophisticated calculations can be undermined by a few simple oversights, leading to bad investments and lost capital.

One of the biggest blunders is treating your hurdle rate like it's set in stone. Think of it less as a fixed rule and more as a living benchmark.

Markets are constantly in flux. Interest rates rise and fall, inflation ebbs and flows, and your own company's risk profile changes over time. A rate that made perfect sense last year could be completely out of sync with today's reality, causing you to either greenlight weak projects or pass on genuinely great opportunities.

It's easy to get tunnel vision and focus only on the math, but that’s a huge mistake. A project might sail over your financial hurdle rate, but does it actually fit with where your company is headed? You have to ask the tough questions. Sure, the ROI looks fantastic, but will it distract your team from your core business? Could it potentially damage your brand?

A smart hurdle rate is more than just a number. It’s a comprehensive filter that should account for strategic alignment, market positioning, and even ESG (Environmental, Social, and Governance) factors to give you a true sense of an investment's worth.

If you ignore these qualitative elements, you can end up making a decision that looks great on a spreadsheet but turns out to be a strategic disaster.

Finally, remember that a hurdle rate is only as good as the forecasts you measure it against. It’s human nature to be optimistic, but overly sunny cash flow projections can make a doomed project look like a home run. These forecasts often downplay costs while pumping up revenue estimates.

Always kick the tires on your assumptions. Here are a few ways to keep your projections grounded in reality:

By sidestepping these common pitfalls, you can turn your hurdle rate from a simple metric into a powerful tool for making sharp, disciplined investment choices.

You've got the basics down, but a few questions almost always pop up when people start working with hurdle rates. Let's tackle them head-on to clear up any confusion.

This is a great question, and the distinction is crucial. Think of the cost of capital as your company's break-even point. It's the minimum return you need to cover the cost of the money—both debt and equity—you're using to fund your operations. It’s the ground floor.

The hurdle rate is a step (or several steps) above that. It takes the cost of capital and adds a specific risk premium for a particular project. So, while the cost of capital tells you what you need to stay afloat, the hurdle rate tells you what a specific investment needs to achieve to be truly worthwhile.

A project that just meets the cost of capital isn’t actually making you money; it’s just paying the bills for its own financing. To create real value, an investment has to clear the much higher bar set by the hurdle rate.

Not necessarily. It’s all about finding the right balance.

On one hand, a high hurdle rate is a fantastic tool for discipline. It acts as a strict filter, automatically weeding out weak projects and forcing you to focus only on the most promising opportunities.

The danger, however, is setting the bar too high. An overly ambitious hurdle rate can make you overly cautious, causing you to pass on perfectly good investments that would have delivered solid, valuable returns. The sweet spot is a rate that accurately reflects a project's risk without choking off potential growth.

Inflation is the silent killer of returns. A 5% return looks great on paper, but if inflation is also running at 5%, your real gain in purchasing power is zero.

Because of this, any effective hurdle rate must account for expected inflation. By adding an inflation premium, you ensure the investment's "real" return—what you've actually gained after inflation has taken its bite—is still high enough to justify the risk and create genuine economic value.