Learn how to start a venture capital firm with our comprehensive guide. Tips, steps, and insights to kickstart your VC journey today!

So, you're ready to launch your own venture capital firm. The journey starts long before you meet your first founder or wire your first check. It begins with your investment thesis—the guiding philosophy that will shape every single decision you make.

Think of it as your firm's DNA. It's the story you'll tell potential investors, the magnet that will draw in the right kind of entrepreneurs, and the filter that will help you cut through the noise.

Before you can raise a single dollar, you need a powerful, coherent narrative. What’s your unique view of the world? Where do you see opportunities that others are missing? Why are you the right person to capitalize on them? That's your investment thesis.

A generic line like "we invest in great founders" just won't cut it. That’s a given. Limited Partners (LPs), the investors who will fund your firm, have heard it all before. They're looking for conviction and a differentiated point of view. So are the best founders.

The first step is to carve out your specific hunting ground. This isn't about chasing the latest trend; it's about identifying an area where your team's background, network, and genuine passion give you an unfair advantage.

You can build your focus around a few key pillars:

Before you go any further, it's crucial to lay out the core components of your thesis. This clarity will be invaluable when you start pitching LPs.

Here’s a simple framework to help you think through the essential elements:

| Component | Key Questions to Answer | Example Focus |

|---|---|---|

| Market/Sector | What industry or technology are you targeting? Why now? | "We focus on AI-native B2B SaaS tools for regulated industries like finance and healthcare." |

| Stage | At what point will you invest (pre-seed, seed, Series A)? | "Our sweet spot is the first institutional check at the pre-seed stage, writing $500k to $750k checks." |

| Geography | Where are your target companies located? | "We exclusively invest in founders based in the Nordic region (Denmark, Sweden, Norway, Finland)." |

| Unique Edge | What is your firm's 'superpower'? Why will you win deals? | "Our partners are ex-operators from top fintechs, giving us unique GTM and regulatory expertise." |

| Value-Add | How will you concretely help founders post-investment? | "We provide hands-on support with product strategy and introductions to our network of 100+ C-level banking execs." |

Getting these answers down on paper transforms a vague idea into a defensible strategy that you can build a firm around.

A strong thesis is both a magnet and a filter. It attracts the right founders and LPs who share your vision while filtering out distractions, allowing you to focus your limited time and capital where they’ll have the greatest impact.

With your focus defined, you need to answer the million-dollar question: What do you offer founders that they can't get from the dozens of other VCs knocking on their door?

In a world where capital is increasingly a commodity, your "value-add" is everything. What unique assets does your team bring to the table?

For example, a new firm might specialize in pre-seed B2B fintech startups in London. Their value-add isn't just money; it's the partners’ collective experience as early operators at Revolut and Wise. This gives them an almost unteachable understanding of UK financial regulations and go-to-market strategies. That's a compelling story.

Your thesis isn't just a static document; it's a living narrative that should also account for where the market is headed. Staying on top of macro shifts is key, so it's a good idea to explore the top venture capital industry trends for 2025 and see how your strategy stacks up.

Ultimately, this is the story you're going to tell hundreds of times. Make it sharp, make it defensible, and above all, make it authentic to you.

With a sharp investment thesis in hand, you're now facing the next mountain: fundraising. Let's be honest, securing capital from Limited Partners (LPs) is often the most grueling, relationship-driven, and humbling part of launching a venture capital firm. This is where your story, strategy, and personal credibility are put to the ultimate test.

Forget any notion of a quick roadshow. Raising a first-time fund is a marathon, not a sprint. It demands meticulous planning, relentless networking, and a genuine understanding of what actually motivates an investor to write that check.

Your entire fundraising effort hinges on a well-researched, highly curated list of potential investors. A scattergun approach—blasting your deck to every LP you can find an email for—is a surefire way to get ignored. Instead, focus your energy on investors whose mandates and interests truly align with your specific thesis.

Think of your target list as a strategic mix of different LP profiles:

This process has always been grounded in deep networks and credibility. When Andreessen Horowitz (a16z) launched back in 2009, they secured initial commitments from well-known Silicon Valley entrepreneurs, which helped them pull together around $300 million for their first fund. Today, the global venture capital investment market has ballooned to approximately $284.4 billion as of 2023, but the core principle of leveraging trust and expertise hasn't changed a bit. You can explore more data on the top global venture capital firms on DealRoom.

Your pitch deck isn't just a collection of slides; it's the visual narrative of your firm. It has to be clear, concise, and compelling, answering the fundamental questions every LP is going to have.

The real key is to tell a story that connects your team, your thesis, and your unique edge into one cohesive argument. Why is your team the only one that can execute this strategy? Why is this market opportunity happening right now? How will your firm generate the top-quartile returns they're looking for?

Your first fund is the hardest to raise because you're not selling a track record; you're selling a vision. You're asking LPs to take a bet on you, your judgment, and your ability to build an enduring franchise from the ground up.

Once your materials are polished, the real work begins. Fundraising is a full-contact sport that demands persistence and a very thick skin. Brace yourself for a long journey filled with meetings, follow-ups, and more than a few rejections.

Here are a few hard-won tips for navigating the process:

As you get closer to closing commitments, the focus will shift to finalizing the legal paperwork. Understanding the key clauses in your Limited Partner Agreement is absolutely essential for establishing a fair and functional partnership. This single document governs your relationship with investors for the life of the fund, so getting it right is non-negotiable. Don't rush this stage.

Once you have a solid thesis and fundraising conversations are getting serious, it’s time to shift gears and build the actual structure of your firm. This isn’t just about filing paperwork. You're laying a professional, scalable, and trustworthy foundation that needs to last for a decade or more. How you put together the legal and operational side of your venture capital firm is one of the most critical early steps.

Most VC firms you see are set up as limited partnerships (LPs). It’s a clean structure that defines two very distinct roles:

Getting this framework right from the start is about more than just compliance; it helps manage risk and establishes clear governance from day one. In a market where corporate venture capital (CVC) firms make up around 36% of the total VC deal value, the bar for professionalism is higher than ever.

The entire relationship between you and your LPs is spelled out in a single, critical document: the Limited Partnership Agreement (LPA). Think of it as the constitution for your fund. Getting these terms right is absolutely non-negotiable, as it dictates everything from the fund's lifespan to how you’ll split the profits.

The two terms everyone focuses on are management fees and carried interest—the classic "2 and 20" model.

The management fee pays the bills, but the carried interest is your reward for hitting home runs. This structure ensures that your goals are perfectly aligned with your investors'—everyone wins when you find and back massive successes.

As you start to map this out, a comprehensive guide to company formation can give you some great foundational knowledge for establishing your legal entity.

Legal documents are one thing, but you also need a real operational engine to run the firm. Trust me, trying to manage a multi-million dollar fund on a few spreadsheets is a recipe for disaster. Investing in the right systems and partners early on pays for itself in credibility and your own sanity.

At a minimum, your operational stack needs these key components:

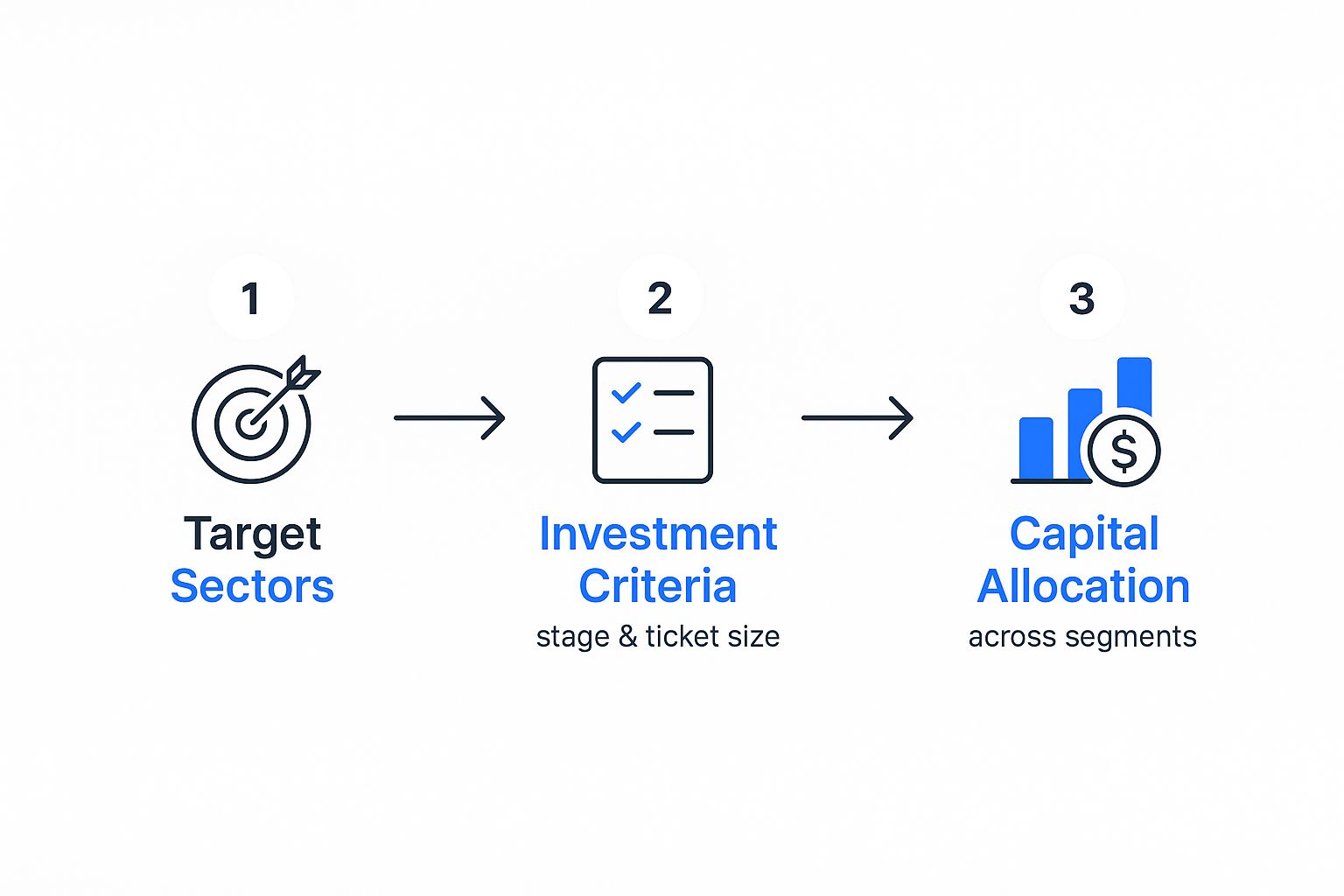

This flow chart gives a great visual of how your strategy connects to your operations.

It really shows how a clear thesis drives not just what you invest in, but how you deploy your LPs' capital.

When you boil it all down, every piece of your legal and operational setup is about one thing: building trust. Your LPs are writing huge checks based on their faith in your vision and your ability to execute. A professional, buttoned-up operation shows them you’re a serious and capable steward of their capital.

This means having a process for everything, from how you track your deal pipeline to how you communicate with investors. That’s where platforms like Fundpilot come in. They’re built specifically to help emerging managers run an institutional-grade back office without needing a huge team. By automating things like quarterly LP reports and capital calls, you and your team can get back to what you’re actually good at: finding and funding the next world-changing companies.

Let’s be honest: your firm's reputation will live or die by the quality of your investments. With the legal paperwork filed and capital in the bank, your focus has to shift. It's time to build a well-oiled machine for sourcing, vetting, and ultimately winning the most competitive deals out there. This is where the theory ends and the real work begins.

An empty pipeline is the silent killer of any new VC firm. You can't just sit back and hope the next unicorn finds its way to your inbox. You have to actively build a system that brings those opportunities to you. We call this deal flow, and it’s the absolute lifeblood of your operation.

The best, most sought-after deals rarely come from a public pitch competition or a cold email. They almost always come from proprietary sources—channels that are unique to you, your partners, and your network. The goal is to cultivate these channels relentlessly.

Here are a few proven ways to generate that proprietary deal flow:

A quick pro-tip: Your deal sourcing strategy should be a direct reflection of your investment thesis. If you're a deep tech fund, your time is better spent at an academic conference than a generic startup mixer. Focus your energy where your ideal founders actually are.

Once a promising company lands in your pipeline, the real work begins. Due diligence is the investigative process you undertake to truly understand an investment opportunity. It's about getting past the slick pitch deck and uncovering the ground truth about the business, the team, and the market they're trying to capture.

Sourcing, evaluating, and managing your portfolio—these are the core functions that define a VC's success. In today's market, you have to be strategic. Balancing early seed investments with later-stage opportunities is crucial, especially with so much capital chasing a few sectors like generative AI. As global deal volumes dip and founders are bootstrapping longer, new firms must be patient and incredibly focused with their diligence.

A disciplined, thorough process is your best defense against making a very expensive mistake. If you want to dive deeper into structuring this critical stage, we put together a complete guide on the due diligence process that you should check out.

Your diligence process needs to be structured and repeatable. While every company is unique, having a solid checklist ensures you never miss a critical detail. This is all about pressure-testing every single assumption behind the investment thesis.

Here’s a practical checklist to guide your investigation.

This table outlines the primary areas you need to dig into before you even think about wiring money. Think of it as your framework for uncovering the real story.

| Category | Key Evaluation Points |

|---|---|

| Team & Founder | Assess the team's resilience, coachability, and deep domain expertise. Conduct thorough, off-list reference checks on the founders—not just the ones they hand you. |

| Product & Technology | Go way beyond the demo. Understand the core tech, its defensibility (the "moat"), and the product roadmap. Is it solving a real, painful problem for customers? |

| Market & Competition | Analyze the total addressable market (TAM) realistically. Who are the incumbents, and what is this startup's unique, unfair advantage that will let them win? |

| Financials & Metrics | Scrutinize the financial model, unit economics, and key traction metrics. For very early-stage companies, you're looking for leading indicators of product-market fit. |

| Legal & Corporate | Review the cap table for any red flags, check all corporate documents, and verify any intellectual property claims. You're hunting for hidden legal liabilities. |

Ignoring red flags during due diligence is one of the fastest ways to destroy your returns. You have to be intellectually honest and willing to walk away from a deal, no matter how exciting it seems on the surface. Building a lasting venture capital firm requires this discipline above all else.

Here's a truth every seasoned VC knows: making the investment isn't the finish line. It’s the starting gun. The moment that wire transfer hits a founder's bank account, your real work begins. This next phase is a delicate dance of providing post-investment support while simultaneously scaling your own firm—two parallel tracks that will ultimately define your reputation and your returns.

Forget any notion of being a passive, hands-off investor. The best VCs, especially at the early stages, are deeply involved partners. They provide tangible value that goes far beyond a check. This is what it truly means to be a "value-add" investor, and it’s how you earn your spot on a founder's cap table for years to come.

Effective portfolio support is an art form. You have to be deeply engaged and helpful without ever crossing the line into micromanagement or trying to run the company yourself. Think of yourself as a strategic resource, not another manager on the payroll.

Your support will generally fall into a few critical areas:

The most valuable thing you bring to the table is pattern recognition. After you’ve seen dozens of companies wrestle with the same challenges, you can offer shortcuts and help founders sidestep common, unforced errors. That saves them precious time and capital.

At the end of the day, your job is to empower, not to control. You backed these founders for a reason. Trust them to execute their vision, but be ready to jump in with your specific expertise the moment they need it.

As you start deploying capital and your portfolio grows, you'll quickly realize you can't do it all alone. A one or two-person GP team might be able to handle Fund I, but scaling requires building out your own firm. Those first few hires are absolutely critical; they will set the tone and shape the capabilities of your organization for years.

So, who do you hire first? The answer depends entirely on your firm's biggest bottleneck.

As your firm grows, implementing effective strategies to find the right employees at scale becomes essential for building a team that can win. You're looking for people who are intensely curious, have a deep sense of ownership, and operate with a founder-first mentality.

Building a respected firm is about more than just a strong track record. It’s about creating a culture that rewards intellectual honesty, speed, and a relentless focus on helping founders succeed. That’s how you turn a brand-new fund into an enduring institution that the best entrepreneurs are lining up to partner with.

Getting a new venture capital firm off the ground is a massive undertaking, and it's natural to have a ton of questions. The path is paved with critical decisions and unique hurdles, so getting clarity early on is key. Let’s tackle some of the most pressing questions we hear from aspiring VCs.

The honest answer? It varies a lot. But you absolutely need to budget for some serious legal and operational bills before any management fees start rolling in. The biggest initial hit will almost always be your legal counsel, who is essential for drafting foundational documents like your Limited Partnership Agreement (LPA) and actually forming the fund entity.

You should plan on spending somewhere between $50,000 to over $150,000 just for the legal and formation work. And that's just the beginning. Other upfront costs include:

Most new managers have to dig into their own pockets for this or secure a "first close" with a friendly anchor investor who understands these initial needs. It's a significant cash outlay before you've even looked at your first deal.

Raising that first fund is a true test of endurance. It's a marathon, not a sprint. While you might hear stories of well-connected managers closing in six months, a much more realistic timeline for most is 12 to 24 months from your very first LP meeting to the final close.

What makes the clock tick faster or slower?

Brace yourself for a long, and at times, humbling journey. Persistence and building real relationships are everything. You're not just pitching a strategy; you're asking LPs to enter a decade-long partnership with you.

Plenty of new managers stumble into the same pitfalls. One of the most common is completely underestimating the sheer amount of operational work. It's easy to get consumed by the thrill of deal-making, but neglecting the back-office—LP reporting, compliance, financials—can quickly create a mess.

Another classic mistake is being vague about your "value-add." Many promise hands-on support for their portfolio companies but don't have a clear plan for delivering it. This leads to frustrated founders and a reputation that's hard to fix.

Finally, a lot of new GPs try to do it all themselves for too long. They burn out trying to be the deal sourcer, the due diligence expert, the fundraiser, and the office manager. Making an early investment in a junior analyst or even a part-time operations person can be the single best decision you make for scaling your firm effectively.

Ready to build your firm on a solid operational foundation and impress your LPs from day one? Fundpilot gives emerging managers the tools to automate reporting, simplify fund administration, and keep audit-ready records. This lets you focus on what you do best—finding the next great investment. Schedule your demo today and see how Fundpilot can help you build an institutional-grade firm.