Explore the top 10 venture capital industry trends for 2025. Get data-driven insights on AI, climate tech, and more for emerging fund managers.

The venture capital landscape is in a state of perpetual evolution, driven by technological breakthroughs, shifting global priorities, and a more sophisticated investor class. For emerging fund managers, staying ahead of these currents is essential for survival and success. The old playbook of pattern-matching and relying on established networks is no longer sufficient. Today's most successful VCs are data-driven, operationally excellent, and deeply specialized.

They understand that macro-level shifts, from the AI revolution to the urgent need for sustainable technology, are creating unprecedented opportunities for value creation. This article dissects the 10 most impactful venture capital industry trends shaping the market. We will move beyond headlines to provide actionable insights, data-backed analysis, and practical strategies that emerging managers can implement. The goal is to help you not only identify promising sectors but also build institutional-grade operations that attract and retain limited partners (LPs).

For funds managing portfolios between $10M and $100M, professionalizing every aspect of the firm, from deal sourcing to LP reporting, is critical for competing with larger players. This guide will provide a clear roadmap for navigating this new frontier and building a resilient, high-performing fund.

The explosion in artificial intelligence, particularly generative AI, has triggered an unprecedented investment surge, making it one of the most dominant venture capital industry trends today. Driven by the potential for massive market disruption, VCs are pouring capital into AI startups at a record-breaking pace. This trend spans foundational models like OpenAI and Anthropic, enterprise AI solutions that improve efficiency, and the critical AI infrastructure required to power them.

Mega-deals have become commonplace, with OpenAI securing a $10 billion investment from Microsoft and Anthropic raising $4 billion from Amazon. These high-profile rounds signal strong market confidence and are creating a ripple effect, drawing more capital and talent into the ecosystem.

For emerging managers, navigating this hyped-up sector requires a disciplined approach. Focus on companies that have moved beyond theoretical potential to demonstrate tangible value.

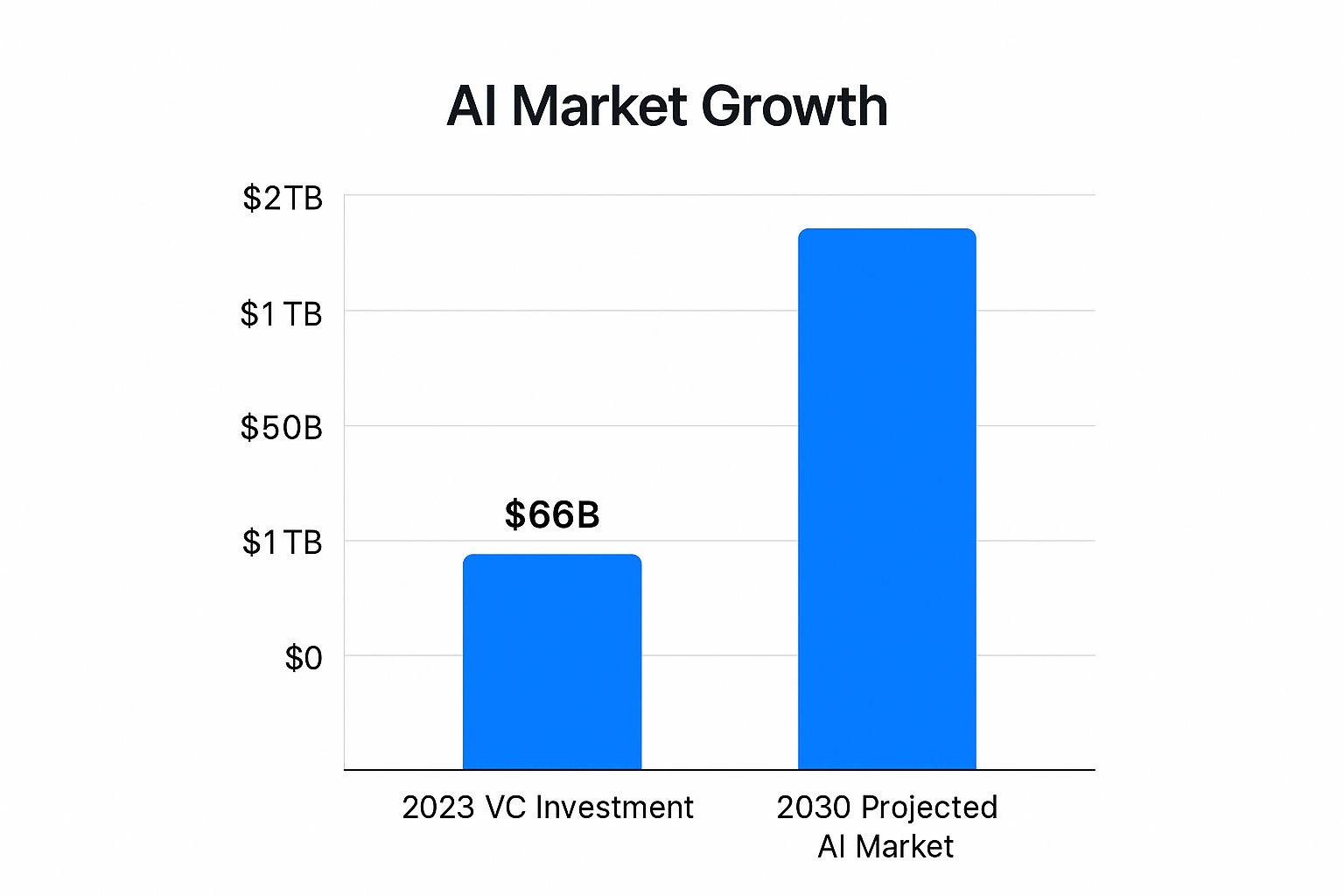

The following infographic visualizes the immense growth potential, comparing 2023 VC investment against the projected AI market size in 2030.

This chart highlights the significant runway for growth, illustrating why savvy investors see the current surge as just the beginning of a long-term value creation cycle.

Driven by regulatory pressures, rising consumer demand, and the urgent global imperative to decarbonize, climate tech has cemented its place as a pivotal venture capital industry trend. VCs are deploying significant capital into startups tackling carbon reduction, renewable energy generation, sustainable agriculture, and circular economy innovations. This isn't just about impact; it's about identifying the next generation of foundational industries and generating strong financial returns.

The scale of investment is telling, with landmark deals like Commonwealth Fusion Systems raising $1.8 billion for fusion energy and Climeworks securing $650 million for direct air carbon capture. These massive rounds, supported by specialized funds like Breakthrough Energy Ventures and Lowercarbon Capital, underscore the market's conviction that sustainable technologies are both economically viable and essential for future growth.

For fund managers entering this capital-intensive sector, a nuanced strategy is crucial for success. The focus must be on technologies that can scale commercially and survive long development cycles.

The venture capital landscape is increasingly defined by the prevalence of mega-rounds, which are investments of $100 million or more. This trend, a key indicator among current venture capital industry trends, fuels the rapid creation of "unicorns," or companies valued at over one billion dollars. This phenomenon reflects intense competition among investors and the vast capital required to build globally dominant technology companies.

Firms like Tiger Global Management and the SoftBank Vision Fund have popularized this aggressive, large-scale investment strategy. Notable examples include SpaceX reaching a $137 billion valuation through successive multi-billion dollar rounds and Canva securing a $200 million Series F to hit a $40 billion valuation, showcasing the immense scale of modern venture financing.

For fund managers, participating in or competing with these mega-rounds requires a sharp focus on fundamental value and strategic discipline. The influx of massive capital can distort valuations and create significant risks.

The venture capital industry is witnessing a significant pivot from broad, horizontal software to highly specialized Vertical SaaS. This trend involves creating solutions tailored to the unique workflows and regulatory demands of specific industries, such as construction, pharmaceuticals, or hospitality. Unlike horizontal platforms that serve a wide range of business functions, vertical solutions offer deep, purpose-built functionality that becomes integral to a company's core operations.

This targeted approach creates powerful competitive moats through high switching costs and deep customer entrenchment. Successful examples like Procore for construction management and Veeva Systems for the life sciences industry demonstrate the model's power. These companies command premium pricing and capture significant market share by solving problems that generic software cannot address effectively.

For fund managers, Vertical SaaS represents a compelling opportunity for durable, long-term returns. Success hinges on identifying the right niche and backing a team with authentic industry credibility.

A robust due diligence process is essential when evaluating these specialized opportunities. For a comprehensive guide, explore this detailed due diligence checklist to ensure all critical factors are assessed.

The fintech sector continues its dynamic evolution, moving decisively from standalone consumer apps toward embedded finance. This powerful shift, a key venture capital industry trend, involves integrating financial services directly into non-financial platforms. Any company, from a retailer to a software provider, can now offer services like payments, lending, or insurance, powered by Banking-as-a-Service (BaaS) platforms and sophisticated APIs.

This trend is driven by the demand for seamless user experiences and new revenue streams. The market has validated this approach with massive outcomes, including Stripe's dominance in payment infrastructure and Marqeta's successful IPO built on its card-issuing platform. These high-valuations underscore the immense value in providing the foundational "plumbing" that enables any business to become a fintech company. VCs like Ribbit Capital and QED Investors have built their reputations by capitalizing on this deep, structural change.

For fund managers, success in this space requires a focus on the underlying infrastructure and its scalability. The most attractive opportunities often lie in the B2B companies powering the consumer-facing experiences.

The convergence of technology and healthcare has created a massive investment opportunity, establishing digital health as a core venture capital industry trend. Spurred by aging populations, the push for greater efficiency, and the widespread adoption of telemedicine accelerated by the pandemic, VCs are funding innovations across the entire healthcare spectrum. This includes digital therapeutics, AI-driven diagnostics, remote patient monitoring, and the software modernizing healthcare infrastructure.

High-value exits and funding rounds underscore the sector's maturity. Landmark deals like Teladoc's $18.5 billion acquisition of Livongo and significant fundraises by companies like Tempus, which secured $200 million for its AI-powered precision medicine platform, demonstrate strong investor confidence. This trend is actively shaped by leading firms such as Andreessen Horowitz (a16z) and GV (Google Ventures), who are backing the next generation of healthcare disruptors.

Investing in this highly regulated and complex market requires specialized due diligence beyond typical software investments. Emerging managers must rigorously assess the clinical and commercial viability of potential portfolio companies.

One of the most transformative venture capital industry trends is the globalization of capital allocation. VCs are increasingly looking beyond traditional tech hubs like Silicon Valley, driven by the search for untapped growth. This geographic expansion focuses on emerging markets in Southeast Asia, Latin America, and Africa, where mobile-first populations, burgeoning middle classes, and localized digital economies present unique, high-growth opportunities.

This shift has created massive outcomes, validating the global investment thesis. Success stories like Latin America's Mercado Libre reaching a $75 billion market cap and Southeast Asia's Grab executing a $40 billion SPAC merger demonstrate the immense value being unlocked. These precedents, championed by firms like SoftBank and Tiger Global, have established a clear path for capital to flow into non-traditional markets.

For emerging managers, investing internationally requires a nuanced strategy that balances opportunity with significant operational and political risks. A "boots-on-the-ground" understanding is essential for success.

Venture capital is increasingly looking beyond software to fund deep technology, a category defined by significant scientific and engineering innovation. This trend in the venture capital industry reflects a growing appetite for companies tackling fundamental challenges in areas like quantum computing, advanced materials, biotechnology, and space exploration. Unlike typical software startups, deep tech ventures require substantial R&D, long development cycles, and patient capital to reach commercialization.

This shift is fueled by the potential for these breakthroughs to create entirely new markets and solve some of humanity's biggest problems. High-profile examples showcase this investor confidence, with Commonwealth Fusion Systems raising $1.8 billion for fusion energy and Relativity Space securing over $1.3 billion for its 3D-printed rocket technology. These ambitious bets signify a willingness to underwrite high technical risk for the chance at paradigm-shifting returns.

Investing in deep tech requires a different due diligence framework and risk tolerance compared to traditional VC. Success hinges on a fund's ability to accurately assess scientific viability alongside market potential.

The rise of corporate venture capital (CVC) arms represents a significant structural shift in the venture capital industry. Large corporations are no longer passive observers; they are actively establishing dedicated investment funds to drive innovation, acquire cutting-edge technologies, and forge strategic partnerships. This trend allows established companies to stay competitive by tapping into the agility and disruptive potential of startups.

Giants like Google Ventures (GV), Intel Capital, and Salesforce Ventures have become major players, deploying billions and leveraging their corporate infrastructure to support portfolio companies. Microsoft's M12, for example, focuses specifically on enterprise software and AI, aligning its investments directly with its core business strategy. This approach creates a powerful symbiotic relationship where the corporation gains access to innovation and the startup receives strategic value beyond just capital.

Co-investing with or taking investment from a CVC requires careful consideration. The strategic alignment can be a massive advantage, but it also introduces unique complexities.

The integration of Environmental, Social, and Governance (ESG) criteria has shifted from a niche interest to a core strategic consideration, marking it as one of the most transformative venture capital industry trends. Driven by demand from LPs and a growing awareness of global challenges, VCs are increasingly evaluating startups not just on their financial potential but also on their capacity to generate positive, measurable social and environmental impact. This has given rise to dedicated impact funds and a broader adoption of ESG principles across the investment lifecycle.

Funds like TPG’s Rise Fund and Bain Capital Double Impact have raised billions to prove that profit and purpose can be synergistic. They invest in sectors like renewable energy, sustainable agriculture, and accessible healthcare, targeting companies that embed impact directly into their business models. This trend signals a fundamental evolution in how value is defined and measured in venture capital.

For fund managers, successfully incorporating ESG requires a structured and authentic approach that goes beyond marketing claims. It involves embedding these principles into the very fabric of your investment strategy.

| Trend / Focus | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| AI and Machine Learning Investment Surge | High technical barriers; complex algorithms | High talent and infrastructure needs | Massive market potential; cross-industry impact | Generative AI, enterprise automation, healthcare AI | Scalability, proprietary tech moats, multiple revenue streams |

| Climate Tech and Sustainability Focus | Capital-intensive; long development cycles | Significant funding; regulatory navigation | Long-term growth; regulatory tailwinds | Carbon capture, renewable energy, sustainable agriculture | ESG compliance, government incentives, growing demand |

| Mega-Rounds and Unicorn Proliferation | Moderate complexity; large capital deployment | Very high capital and management bandwidth | Rapid scaling and market capture | High-growth startups requiring large funding | Enables fast growth, attracts top talent, competitive edge |

| Vertical SaaS and Industry-Specific Solutions | Moderate to high; requires domain expertise | Specialized teams and industry knowledge | Higher customer retention and premium pricing | Industry-specific software (pharma, construction) | Strong moats, deeper relationships, premium pricing |

| Fintech Evolution and Embedded Finance | High regulatory complexity; integration challenges | Significant regulatory and technical resources | Large market with network effects | Embedded finance, BaaS, blockchain infrastructure | High-margin models, platform effects, regulatory moats |

| Healthcare Technology and Digital Health | High regulatory hurdles; clinical validations | High R&D and compliance costs | Recurring revenue; cost reduction in healthcare | Telemedicine, AI diagnostics, digital therapeutics | Strong IP protection, large market, regulatory moats |

| Geographic Expansion and Emerging Markets | Moderate; regional adaptation required | Local partnerships and market research | High growth from underserved markets | Mobile-first fintech, localized platforms | Large underserved markets, lower competition |

| Deep Tech and Frontier Technology | Very high; long R&D cycles and uncertainty | Substantial capital and scientific expertise | Potential for breakthrough, high-return outcomes | Quantum computing, biotech, space tech | High IP barriers, first-mover advantage, government funding |

| Corporate Venture Capital Growth | Moderate; aligned with corporate strategy | Access to corporate resources and capital | Strategic and financial returns | Strategic tech investments, innovation partnerships | Corporate access, mentorship, acquisition potential |

| ESG Integration and Impact Investing | Moderate; additional due diligence and reporting | Resources for screening and impact measurement | Sustainable financial returns alongside impact | ESG-compliant startups, social/environmental impact | Improved risk management, brand reputation, LP demand |

Navigating the contemporary venture capital landscape requires more than just a sharp eye for innovation. As we've explored, the dominant venture capital industry trends—from the explosive growth in AI and deep tech to the critical focus on climate solutions and ESG integration—present both immense opportunity and significant operational challenges. The throughline connecting these disparate yet powerful forces is the escalating demand for institutional-grade execution. Limited Partners are scrutinizing not only your investment thesis but your fund’s operational resilience and professionalism.

The era of managing a fund on a patchwork of spreadsheets and manual processes is definitively over. For emerging managers, the ability to act with the speed, precision, and transparency of a seasoned, multi-billion dollar firm is no longer a luxury; it is a prerequisite for attracting and retaining sophisticated capital. Each trend we've detailed introduces a new layer of complexity. For instance, the due diligence required for a frontier technology startup is vastly different from that for a Vertical SaaS company, and reporting on ESG metrics demands a new level of data integrity and communication.

To thrive in this environment, you must internalize these core principles and translate them into a concrete operational strategy:

Ultimately, understanding these venture capital industry trends is just the first step. The true test lies in your ability to build a fund infrastructure that can support your ambitions. The future of venture capital belongs to those who master both the art of picking winners and the science of fund management. By professionalizing your operations and leveraging technology to automate and streamline your back office, you are not just mitigating risk; you are building a resilient, scalable platform poised to attract premier LPs and deliver superior returns. This commitment to operational rigor is what separates fleeting success from enduring franchise value in today's hyper-competitive market.

Ready to elevate your fund's operations to match your investment vision? Fundpilot provides the all-in-one platform to automate your reporting, streamline LP communications, and manage your pipeline with institutional-grade precision. See how you can master these venture capital industry trends by visiting Fundpilot and scheduling a demo today.