Discover the best fund administrator software to automate operations and drive growth. This guide helps you choose the right platform for your investment fund.

Think of fund administration software as the digital command center for an investment fund. It's a single platform designed to automate and organize all the critical back-office jobs that keep a fund running smoothly. This system takes you out of the messy world of spreadsheets and puts you in control of an efficient, scalable operation, covering everything from investor updates to regulatory filings.

If you've ever tried to manage a private equity, venture capital, or hedge fund, you know it can feel like trying to conduct an orchestra where every musician has a different sheet of music. The result is chaos—a jumble of spreadsheets, emails, and manual calculations that just don't sync up.

Fund administrator software is the conductor that brings precision and harmony to that chaos. It's a purpose-built digital platform designed to handle the complex financial and operational side of running an investment fund. At its core, its job is to replace tedious, manual back-office work with automated, reliable systems.

Not too long ago, fund administration was a mountain of manual labor. Calculating the Net Asset Value (NAV), managing capital calls, and preparing investor reports were all painstakingly slow processes, and they were wide open to human error. A single misplaced decimal in a spreadsheet could spiral into a serious financial and reputational nightmare.

This kind of software automates those core functions, locking in accuracy and, just as importantly, giving fund managers their time back. Instead of burning weeks to close the books every quarter, managers can pull detailed reports in a fraction of the time. That shift means they can focus on what they're actually good at: finding deals, making smart investments, and building strong investor relationships. To get a better feel for the responsibilities this software handles, check out our guide on what a fund administrator does and why the role is essential.

One of the biggest game-changers when you adopt dedicated software is creating a single source of truth for every piece of fund-related data. Everything is centralized in one place—investor contact info, commitment amounts, portfolio company performance, compliance documents, you name it.

This centralized hub breaks down data silos, slashes the risk of conflicting information, and gives everyone involved—from General Partners to Limited Partners—a clear, consistent, and current view of the fund.

This unified approach is a massive advantage in several key areas:

Fund administration software isn't just a nice-to-have for big, established firms anymore. It's a foundational tool for any modern fund manager who wants to operate professionally, earn investor confidence, and build a fund that lasts. It provides the tech backbone you need to compete in an incredibly complex financial world.

Good fund administrator software isn't a single tool; it’s more like a digital back office. Each feature is designed to take a specific, time-consuming task off your plate and automate it. Knowing what these core functions are is the key to finding a platform that actually solves the problems you face every day as a fund manager.

Instead of juggling scattered spreadsheets and disconnected services, this software creates a single, unified system. When you enter a new investor commitment, for example, that data instantly and correctly flows everywhere it needs to go—from capital call calculations to the investor portal. No more double-entry.

The lifeblood of any fund is its Net Asset Value (NAV), the final number that tells you what it's worth. Crunching the NAV by hand is notoriously difficult and, frankly, risky. A single misplaced decimal can throw everything off. The best software takes this risk off the table by automating the whole thing.

The system just pulls data straight from your portfolio, accounts for expenses and capital movements, and spits out an accurate, audit-ready NAV. This not only keeps your numbers consistent but also frees up countless hours you would have spent checking and re-checking your math.

Tied directly to NAV is partnership accounting. This is the feature that keeps a meticulous record of each Limited Partner's (LP) capital account. It handles all the complex profit, loss, and fee allocations based on your fund’s specific waterfall model, so you don’t have to.

This integrated system becomes the single source of truth for your fund's financial health, giving you a solid foundation for everything else you do.

Managing the flow of money in and out of the fund is a huge administrative chore. Fund administrator software turns these logistical nightmares into simple, automated tasks.

When it's time for a capital call, the platform can generate professional, personalized notices for every LP, figure out their exact contribution amount, and track the payments as they come in. The same goes for distributions—the system handles the tricky math and makes sure every LP gets their correct share, on time.

A manual capital call for a fund with 50 LPs can easily eat up over 40 hours of work. With the right software, that same process can be done in less than an hour. That's a 95% reduction in time spent.

This kind of automation doesn't just save you a ton of time. It also gives your investors a much better experience with professional, timely, and error-free communication.

Today’s LPs expect instant access to their investment data. A secure, white-labeled investor portal isn't a nice-to-have anymore; it's a must-have for building trust and transparency.

Think of the portal as a 24/7 resource center where investors can log in and find everything they need. You can securely share all kinds of documents and data, all in one place.

By giving LPs this direct line of sight, you slash the number of emails and calls you get asking for documents. This frees your team up to focus on what really matters—managing the fund. To see what other components make up a truly robust system, check out our complete guide to fund management platform essentials.

All of these core features work together to create a single source of truth for your fund. This ensures every calculation, report, and email is based on the same accurate, current information, turning your software from a simple tool into a genuine strategic asset.

Let's move past the spec sheet and talk about what really matters: tangible results. Picture an emerging fund manager who's a genius at sniffing out great deals but is getting absolutely buried by spreadsheets. Their days are a blur of manually tracking investor commitments, triple-checking NAV calculations, and piecing together quarterly reports. It’s slow, tedious, and a breeding ground for costly mistakes.

Sound familiar? This is the reality for too many managers. Their focus gets splintered, pulled away from high-value work like strategy and deal sourcing. Now, imagine that same manager after implementing a dedicated software platform. The back-office chaos is replaced by a smooth, efficient system. This one change unlocks a cascade of benefits that can fundamentally alter the way they do business.

The first thing you'll notice is how much time you get back. We’re talking about countless hours. Administrative chores that used to drag on for weeks can now be knocked out in a fraction of the time. This isn’t just about being faster; it’s about freeing up your team's brainpower for the activities that actually grow the fund.

Instead of battling spreadsheet formulas to run a capital call, your team can get it done with just a few clicks. The market is certainly catching on to these advantages. In 2023, the global fund management software market was valued at around $3.5 billion and is projected to hit $6.5 billion by 2032. That growth is fueled by a massive shift toward automation and real-time data to make smarter decisions. You can read the full research about fund management software to see the trends for yourself.

With all that time back, your team can finally focus on what matters most:

In the fund management world, trust is your most valuable currency. Your investors need to have complete faith in the accuracy and professionalism of your financial reporting. Manual processes, with their constant risk of human error, can chip away at that trust. One small mistake in a distribution calculation or a late K-1 can do real damage to your firm's reputation.

Fund administration software puts those risks to bed by creating a single source of truth. Every calculation is automated and every report is pulled from consistent, verified data, which gives your LPs immediate peace of mind.

When investors get timely, accurate, and professionally branded reports through a secure portal, it sends a clear message: your fund is run with institutional-grade discipline, no matter its size.

This level of precision directly strengthens your relationships with LPs, which makes future fundraising rounds that much smoother. After all, investors are far more likely to reinvest in a fund that demonstrates operational excellence.

For any emerging fund, growth is the name of the game. But growth can also be the thing that breaks you if your back office can't handle the pressure. Managing a fund with 20 LPs and five portfolio companies manually is tough. Trying to manage one with 100 LPs and 20 companies that way? It's next to impossible.

This is where the software delivers its most strategic advantage. It gives you a scalable operational backbone that can handle more complexity without cracking.

As your fund gets bigger, the software grows right alongside you. You can add new investors, manage more complicated waterfall structures, and handle a higher volume of transactions without having to hire an army of accountants. The system simply absorbs the complexity, keeping your operations lean and efficient as you expand. This isn't just a convenience—it's what turns your back office from a potential bottleneck into an engine for sustainable growth.

Picking the right fund administration software isn't just a purchase—it's more like bringing on a new strategic partner. This one decision will have a ripple effect across your firm for years, influencing everything from your daily operational grind to how your investors perceive you. It’s about more than just a slick feature list; it’s about finding a platform that fits your fund’s DNA now and can grow with you down the road.

Let's be clear: a one-size-fits-all solution is a myth in this industry. A venture capital fund juggling cap tables and funding rounds has completely different needs than a real estate fund focused on property-level accounting. Your evaluation has to be a deliberate, thoughtful process, not a race to sign up for the first shiny object you see.

Before you even book a single demo, you need an honest, crystal-clear picture of your non-negotiables. What are the biggest operational headaches keeping you up at night? Are you buried in manual NAV calculations? Is your investor communication process a clunky, time-consuming mess?

Start by mapping out the specific requirements that stem from your fund's unique structure and investment strategy.

This initial self-assessment is the most important step you'll take. It creates the lens through which you'll evaluate every potential software, helping you cut through the noise and focus on what truly matters to your fund.

The software that works perfectly for your $10M fund today might start to crack under the pressure of a $100M fund tomorrow. Thinking about scalability from day one is absolutely essential. The goal is to find a platform that not only solves today's problems but also supports your ambitions for the next five to ten years.

This means looking for a solution that can handle more investors, a higher volume of transactions, and increasingly complex fund structures—all without forcing you into a complete operational overhaul. True scalability is about growing your AUM without having to grow your back-office headcount at the same rate. You can dive deeper into this by exploring strategies for operational efficiency improvement for fund managers and see how technology is a core component.

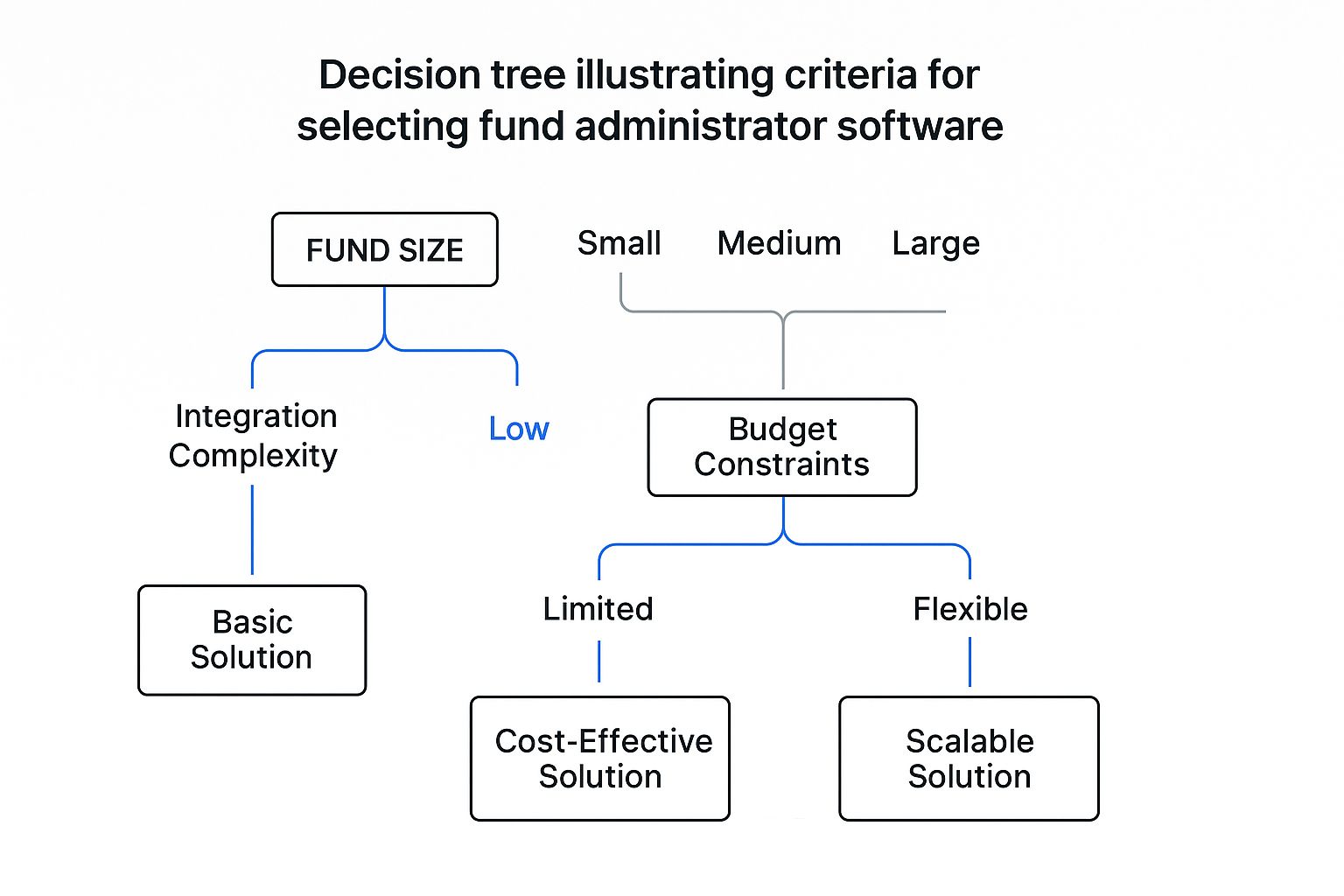

This decision tree shows how factors like fund size, integration needs, and budget can guide you toward the right type of fund administrator software.

As you can see, there is no single "best" platform. The right choice is always relative to your fund’s specific operational needs and financial constraints.

When you're managing a fund, data security is everything. You are the steward of incredibly sensitive financial and personal information, which means the security protocols of any software you consider must be enterprise-grade and completely non-negotiable.

Look for platforms that offer multi-factor authentication, data encryption (both at rest and in transit), and regular third-party security audits. A data breach could be catastrophic for your fund's reputation and your investors' trust.

Just as critical is the quality of customer support. When you're staring down a deadline for a critical capital call or a quarterly report, you need expert help, and you need it fast. Don't be shy about asking potential vendors about their support SLAs, what the onboarding process looks like, and whether you’ll have a dedicated account manager you can actually call.

Below is a quick-reference table to guide your evaluation process, ensuring you cover all the critical bases when comparing different software options.

| Selection Criterion | Why It Matters | What to Look For |

|---|---|---|

| Fund-Specific Functionality | A generic platform won't cut it. Your software must handle the unique accounting, reporting, and compliance needs of your specific fund type (e.g., VC, PE, Real Estate). | Features designed for your asset class, like cap table management for VC or waterfall distribution models for PE. |

| Scalability | Your software should support your growth from a $10M fund to a $100M+ fund without requiring a painful migration. It should grow with you. | Tiered pricing plans, ability to handle increasing numbers of investors and transactions, and a clear product roadmap. |

| Integration Capabilities | Disconnected systems create data silos and manual work. Seamless integration with your existing CRM, accounting software, and banking platforms is crucial for efficiency. | A robust API, pre-built integrations with common tools (e.g., QuickBooks, Salesforce), and clear documentation. |

| Investor Portal Experience | The portal is a direct reflection of your firm's professionalism. It needs to be secure, intuitive, and provide investors with the information they need, when they need it. | A clean user interface, mobile accessibility, secure document vault, self-service reporting, and clear communication tools. |

| Security & Compliance | A security breach can destroy your reputation. The platform must meet the highest standards for data protection and help you adhere to regulatory requirements. | SOC 2 compliance, data encryption, multi-factor authentication (MFA), role-based access controls, and a regular audit history. |

| Customer Support | When things go wrong (and they will), you need access to responsive, knowledgeable support. Poor support can bring your operations to a standstill. | Dedicated account managers, clear Service-Level Agreements (SLAs), multiple support channels (phone, email, chat), and strong onboarding programs. |

| Total Cost of Ownership | The price tag is just the beginning. You need to consider implementation fees, training costs, and potential hidden fees for extra modules or support. | Transparent, all-inclusive pricing. Ask directly about any additional costs for onboarding, data migration, or premium support. |

This table serves as a solid checklist, but remember to weigh each criterion based on your fund's specific priorities and long-term goals.

The increasing IT complexity in finance has made robust software management a major priority. In fact, the global software asset management market was valued at $3.67 billion in 2024 and is projected to hit $16.51 billion by 2034, largely driven by the intense demands for compliance and security. For a broader look at this topic, a guide on choosing the right platform for your business offers some great insights that are just as relevant when selecting fund administration software.

We're watching the world of fund administration evolve right before our eyes. It's moving well past the days of just automating basic bookkeeping. The next wave of fund administrator software is shaping up to be a true strategic partner for General Partners (GPs). The conversation is no longer about simply organizing what happened yesterday; it’s about anticipating what’s coming next and finding opportunities buried deep inside your portfolio.

This shift is all thanks to some powerful new tech that’s completely changing what managers should expect from their back-office systems. These aren't just incremental upgrades. The right tools are designed to give you a real competitive edge, making sure your software doesn't just keep pace but actively helps you get ahead.

Artificial Intelligence (AI) and machine learning have finally moved from conference buzzwords to practical, core features in fund administration. These aren't just shiny objects; they are engines for analyzing massive amounts of data to spot patterns and deliver insights that were simply out of reach before.

Think about it this way: instead of just calculating past performance, AI-driven software is starting to offer genuinely useful predictions. Imagine a system flagging a potential cash flow crunch three months from now, or modeling how a sudden market swing might affect your portfolio companies.

Suddenly, your software goes from a reactive tool to a strategic advisor. It helps you:

AI isn't just about making things faster; it's about making them smarter. It gives emerging managers the kind of analytical horsepower that used to be exclusive to massive, billion-dollar institutions. It’s a huge step toward leveling the playing field.

The industry-wide move to cloud-based Software-as-a-Service (SaaS) is pretty much a done deal, and for good reason. Modern cloud platforms provide better security, seamless updates without any downtime, and the ability to scale up as your fund grows. This migration is a huge part of why the market is growing so fast.

In fact, the global fund accounting software market is on track to hit an estimated $2.5 billion by 2025. A big chunk of that growth is coming from firms adopting cloud models and advanced analytics to work more efficiently and make better decisions. You can dig into more of the numbers in this fund accounting software market report.

But great technology isn't just about what's under the hood; it's also about what you see. The best fund administration software is heavily focused on data visualization. Let's be honest, raw numbers in a spreadsheet don't tell you much. But turn that same data into interactive charts and dashboards, and you have a clear story.

These visual tools make it incredibly easy for both GPs and Limited Partners (LPs) to see what's going on. An LP can log into their portal and, at a glance, understand capital deployment, value creation, and returns through intuitive graphs. This builds trust and transparency. For GPs, these dashboards are mission control—a central hub for making faster, smarter decisions based on data you can actually understand.

Even after you've weighed the features and benefits, some very real, practical questions always come up when you're on the brink of adopting a new technology. Choosing the right fund administration software is a big move, so it's completely normal to have specific concerns about the rollout, security, and true capabilities. This section tackles the questions we hear most often from fund managers in the evaluation stage.

Getting solid answers to these questions is often the last step before you can make a confident decision. Let's dig into the details that really matter as you get ready to take your fund's operations to the next level.

The first question is almost always, "How long will this take to get up and running?" While the exact timing depends on how complex your fund is and the state of your current data, a platform like Fundpilot usually follows a clear, phased approach.

The whole process typically takes between four to eight weeks. Think of it as a structured journey, not just flipping a switch.

Funds aren't one-size-fits-all. You might be running a fund-of-funds, a master-feeder structure, or have a multi-tiered waterfall that gives accountants nightmares. A major concern for managers is whether a new platform can actually handle that complexity without forcing you into clunky manual workarounds.

The short answer is yes. Good fund administration software is built precisely for these kinds of intricate setups. The system’s partnership accounting engine needs to be flexible enough to let you configure custom allocation rules that mirror your Limited Partner Agreement (LPA) exactly.

This means the software can automatically crunch the numbers for complex management fees, carried interest, and preferred returns across different investor classes or tiers. For a fund-of-funds, it can effortlessly track the performance of all the underlying investments and roll it all up into a single, seamless report.

Basically, the software does the heavy lifting that you'd otherwise be wrestling with in a spreadsheet, which ensures everything is accurate and perfectly aligned with your fund's legal documents.

In our world, data security isn't just a feature; it's everything. You're responsible for highly sensitive personal and financial information, and a breach would be devastating. That’s why serious security is a non-negotiable part of any fund administration software worth its salt.

Leading platforms use a multi-layered security strategy to guard your data. It's like a digital fortress with several lines of defense.

These measures all work in concert to create a secure ecosystem, giving both you and your investors peace of mind. For more industry insights and deep dives that often touch on common questions and new trends in fund tech, check out fensory's blog.

Ready to finally ditch the spreadsheets and professionalize your fund's operations? Fundpilot is built for emerging managers who need institutional-grade tools without the institutional-grade price. Schedule your personalized demo today and see how you can automate your back office and build unbreakable investor trust.