Unlock the secrets of QSBS tax treatment. Our guide covers Section 1202, eligibility, and strategies to help you legally minimize your capital gains tax.

Tucked away in Section 1202 of the tax code is one of the most powerful wealth-building tools available to startup founders, employees, and investors: the Qualified Small Business Stock (QSBS) exemption. It’s an incentive designed to reward those who take a chance on a new American business, allowing them to potentially exclude 100% of their capital gains from federal taxes when they sell their stock.

This isn’t just about trimming your tax bill. It’s a complete game-changer that can dramatically multiply the financial rewards of a successful exit.

Imagine investing time or money into a fledgling company. If that company takes off and your stock becomes incredibly valuable, the government essentially says, "Congratulations, you can keep all of it." That’s the core of the QSBS exclusion.

For stock acquired after September 27, 2010, the benefit is at its peak, offering a full 100% exclusion from federal capital gains tax. This provision transforms a great investment return into a potentially life-altering financial event.

The QSBS rules were written specifically for the people who build and back early-stage companies. Failing to understand its value is a massive missed opportunity for:

The tax savings are staggering. That money, instead of going to the IRS, can be reinvested into other ventures, fueling a cycle of growth and opportunity.

At its heart, the logic is straightforward: The government wants to encourage risk-taking and investment in small, domestic C-corporations to spur job creation and economic growth. The QSBS tax break is the carrot that makes those risky bets far more appealing.

To get a clearer picture, let's break down the main components of this powerful tax incentive. The table below gives a quick snapshot of what you need to know.

| Benefit Component | Description | Key Detail |

|---|---|---|

| Gain Exclusion | The percentage of capital gains you can exclude from federal income tax. | Up to 100% for stock acquired after Sept. 27, 2010. |

| Exclusion Cap | The maximum amount of gain that can be excluded per issuer, per taxpayer. | The greater of $10 million or 10 times your stock's basis. |

| Eligible Entity | The type of company whose stock can qualify for the benefit. | Must be a domestic C-corporation. |

| Holding Period | The minimum amount of time you must hold the stock before selling. | Must be held for more than five years. |

While this is just a high-level overview, it highlights the immense potential. With careful planning, the QSBS exemption can turn a successful startup exit into a truly monumental financial windfall, free and clear of federal taxes.

To really get a handle on the powerful QSBS tax break we have today, it’s helpful to look back at how we got here. The rules for Section 1202 weren't created in a vacuum. They were shaped over decades, reflecting a consistent goal across political lines: to fuel investment in American startups.

This history isn’t just a fun fact—it’s absolutely critical. Why? Because the date you acquired your stock is the single most important factor determining how much tax you'll save.

The original provision, rolled out way back in 1993, was much more modest. It started with a 50% exclusion on capital gains. That was a nice perk, for sure, but it didn't have the game-changing impact it carries today. It was like the government dipping its toes in the water, testing a new incentive to reward long-term risk-takers.

But as startups became a more central part of the economy, policymakers saw an opportunity to supercharge this incentive. This led to a series of updates that steadily dialed up the benefit for founders and investors.

The journey from a 50% break to a 100% tax-free ride didn't happen overnight. It was a gradual process, with each change making QSBS more attractive and showing a stronger commitment to fostering innovation. This timeline is precisely why your stock's acquisition date is so important.

The first real jump happened in 2009, when the exclusion was bumped up to 75%. This was a welcome improvement, but the biggest changes were yet to come. Then, in 2010, Congress introduced a temporary 100% exclusion, which was a massive signal to the market. You can dig into the full history of these rate changes on Wikipedia.

This period of temporary rules created some complexity, but it ultimately paved the way for the permanent, powerhouse incentive we have now.

The most pivotal moment for QSBS came with the Protecting Americans from Tax Hikes (PATH) Act of 2015. This law made the 100% federal tax exclusion permanent for all qualifying stock acquired after September 27, 2010.

This was a landmark piece of legislation for the entire startup world. It swept away the uncertainty and cemented Section 1202 as one of the most valuable tax benefits out there, solidifying its role as a key driver for venture capital and founder-led companies.

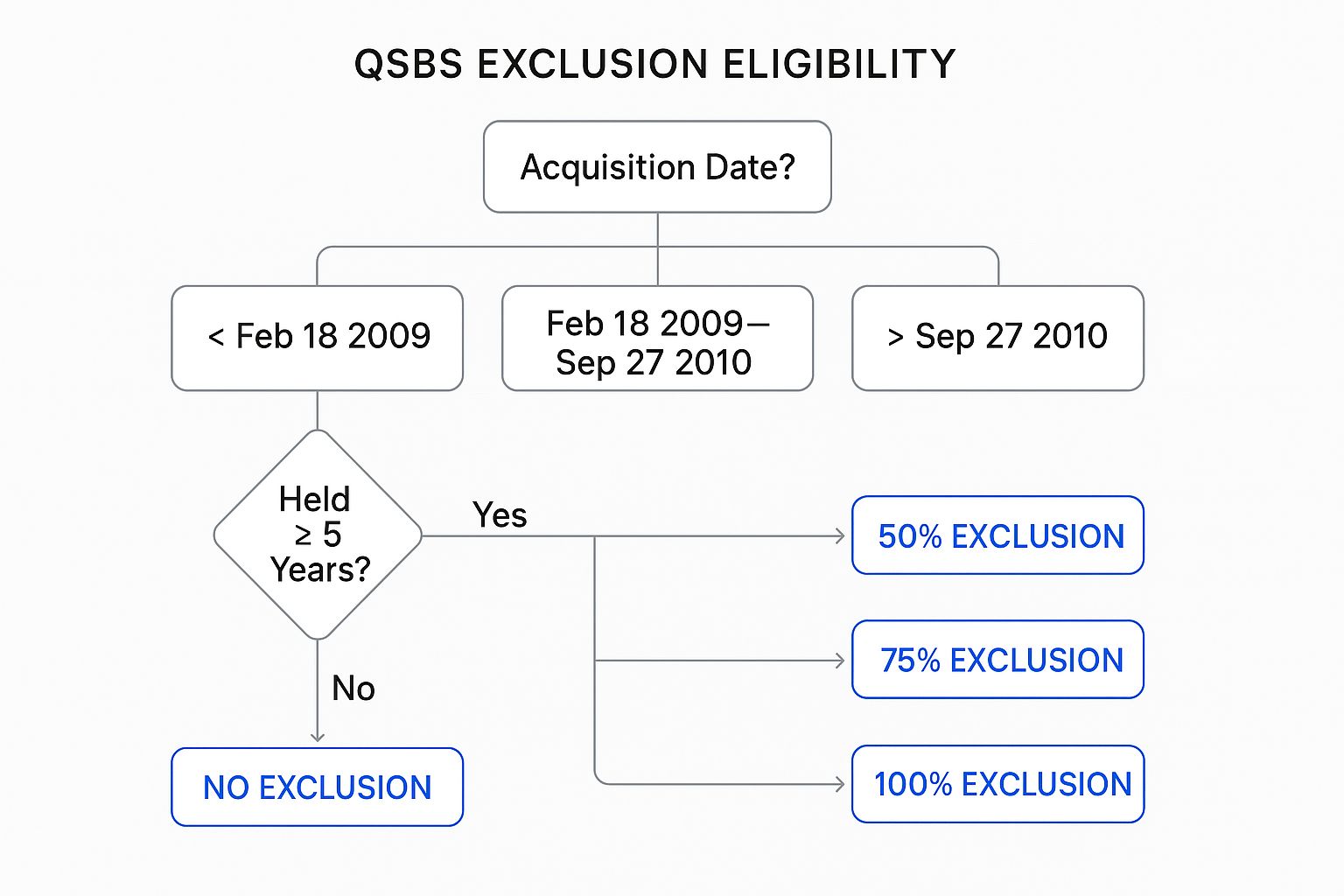

This legislative timeline effectively created three distinct "eras" for QSBS benefits. Depending on when you got your shares, you fall into one of these buckets. Knowing which era your stock is in is non-negotiable for smart tax planning.

Here’s a simple breakdown of the exclusion tiers based on when you acquired the stock:

This tiered system is exactly why keeping meticulous records is so crucial. The difference between acquiring stock on September 27, 2010, and just one day later on September 28 could literally mean millions of dollars in tax savings after a successful exit. It’s no wonder that forming as a C-corporation and aiming for QSBS eligibility are now foundational strategies in the modern startup playbook.

Nailing the strict criteria for QSBS tax treatment is an absolute must. Think of it as a three-legged stool—if even one leg is wobbly or missing, the whole thing comes crashing down, taking your tax savings with it. These three essential pillars of eligibility cover the company itself, the specific stock you own, and you, the shareholder.

Missing just a single requirement can completely invalidate your claim. That would turn a potential tax-free windfall into a painful, and entirely avoidable, tax bill. Let’s break down each of these pillars into a clear, actionable checklist.

First things first, the company that issued the stock has to fit a very specific profile. The rules are designed to pump capital into genuine American small businesses, not large, established corporations or certain types of service firms.

The most basic rule is that the issuer must be a domestic C-corporation. That's a hard and fast rule. Stock from S-corps or LLCs simply won't qualify. For any founder or investor, this is check number one.

Next, the company has to pass a critical financial test.

The corporation’s aggregate gross assets must not have exceeded $50 million at any point before you got your stock, or immediately after it was issued. This test is a snapshot in time, which makes having solid documentation from that period absolutely essential.

This asset test is what keeps the benefit focused on "small" businesses. You can get into the nitty-gritty of how assets are valued in our guide to valuing a private company.

Here's a quick rundown of the key corporate rules:

It's also important to know that certain industries are specifically excluded. This includes most businesses in fields like finance, hospitality, consulting, and professional services such as law or health.

Even if the company is a perfect match, not all of its shares will qualify. The stock itself has to meet a crucial condition related to how you got it. This rule is there to make sure the incentive rewards people who provide direct, early-stage capital to a growing business.

To put it simply, you must acquire the stock at its original issuance. This could be in exchange for cash, property (but not other stock), or as payment for services you provided to the company.

What this means is that buying shares from another investor on a secondary market disqualifies those shares from ever getting the QSBS tax break. The chain of ownership has to start with you and the company, period.

Finally, the spotlight turns to you. Even if the company and the stock tick all the boxes, your own actions are what ultimately determine the outcome. And the single most important shareholder requirement is the holding period.

To qualify for the gain exclusion, you must hold the stock for more than five years. Selling your shares even one day short of that five-year anniversary means you lose the federal tax benefit entirely.

The clock on your holding period starts ticking the day after you acquire the stock. This rule really highlights the government's intent: to reward patient, long-term investors, not short-term speculators. Keeping meticulous records of your acquisition dates isn't just good practice—it's critical.

This simple chart helps visualize how your timing impacts the tax break you might receive.

As you can see, holding the stock for at least five years is the mandatory gate you have to pass through to get any QSBS benefit. The full 100% exclusion is only on the table for stock acquired after September 27, 2010.

To help you put all this together, we've created a simple checklist.

Use this table to run through the core requirements and see where you stand. Remember, every single one of these criteria must be met.

| Requirement Category | Criteria | Pass/Fail |

|---|---|---|

| The Corporation | Must be a domestic C-corporation. | |

| Gross assets were $50 million or less at stock issuance. | ||

| At least 80% of assets used in a qualified business. | ||

| Not an excluded industry (e.g., finance, health, law). | ||

| The Stock | Acquired at original issuance directly from the company. | |

| Acquired for cash, property, or as compensation. | ||

| NOT acquired on a secondary market. | ||

| The Shareholder | Must hold the stock for more than five years. |

This checklist is a great starting point, but it's not a substitute for professional tax advice.

Ultimately, mastering these three pillars—the right company, the right stock acquisition, and the right holding period—is the key to unlocking one of the most powerful incentives in the entire tax code. Diligent record-keeping and a clear understanding of these rules from day one are your best allies in making sure your successful exit is also a tax-efficient one.

Alright, let's get to the part everyone's been waiting for: figuring out exactly how much of your profit gets shielded from federal taxes. This is where the real power of Section 1202 hits home. The calculation itself is surprisingly straightforward, but its generosity is what makes it a game-changer for founders, early employees, and investors.

When you sell your qualified stock, the amount of capital gain you can exclude is the greater of two possible limits:

That "greater of" language is the magic key. It creates incredible flexibility and massive upside, catering to everyone from a founder who built the company with sweat equity to an angel investor who cut a significant early check. Nailing down which of these two caps applies to you is the first step in maximizing your tax-free exit.

Let's break down those two limits. The first one, the $10 million cap, is simple. Think of it as a lifetime exemption for gains you realize from a single company's stock. If you sell QSBS from one startup and pocket an $8 million gain, you can exclude the entire amount. If you sell more shares from that same company down the road, you still have $2 million of your exclusion left to use.

The second limit, the 10x basis cap, is where smart planning can unlock a much bigger tax-free payday. Your "basis" is just what it cost you to acquire the stock. For an investor, that's usually the cash they put in. For a founder or employee, it could be the fair market value of the stock when it was granted or the cash paid to exercise options.

By letting you pick the greater of these two amounts, the rule provides a huge advantage. It guarantees a substantial baseline exclusion of $10 million for nearly everyone, while also rewarding those who made larger early-stage capital investments with a potentially much higher tax-free gain.

To see how this plays out, let's walk through a few common scenarios. These examples perfectly illustrate how the "greater of" rule benefits different stakeholders.

Example 1: The Founder A founder gets her company off the ground with a minimal cash investment, giving her a very low basis of $50,000.

Example 2: The Angel Investor An angel investor steps in with crucial seed funding, investing $1.5 million for her shares.

Example 3: The Early Employee An early employee exercises their stock options, paying $200,000 to acquire the shares.

In the early days of QSBS, there was a bit of a catch. A portion of the excluded gain was considered a "preference item" for the Alternative Minimum Tax (AMT), which sometimes clawed back some of the tax savings.

Thankfully, that's ancient history. For any QSBS acquired after September 27, 2010, the AMT preference item has been completely eliminated. A detailed analysis from the Columbia Law Review explains how legislative changes supercharged the exclusion's value.

This means the 100% federal tax exclusion is exactly that—100% free from both regular capital gains tax and the AMT. It makes the benefit cleaner and far more powerful than ever before.

https://www.youtube.com/embed/J7bQaJg09TE

Once you’ve got a handle on the basic QSBS rules, you can start to explore some of the more advanced planning strategies. While the standard $10 million exclusion is already a fantastic deal, founders and investors who are really on the ball look for ways to legally and ethically push that tax-free ceiling even higher. These techniques take some serious foresight and careful execution, but they can multiply the benefits well beyond the baseline cap.

The real key is to stop thinking of the $10 million exclusion as one absolute limit. Instead, see it as a benefit that can be applied per taxpayer, per company. This simple shift in perspective opens the door to some powerful strategies that can dramatically boost your after-tax returns when you finally exit.

So, what happens when a great exit opportunity lands in your lap, but you haven't hit that crucial five-year holding period yet? This is where the Section 1045 rollover comes in. Think of it as hitting the "pause" button on your tax bill.

This rule lets you sell your original QSBS and defer the capital gains tax, but there's a catch: you have to reinvest the proceeds into another QSBS-eligible company within 60 days. It's an incredible tool for serial investors who want to cycle capital from one promising startup to the next without getting hit with a huge tax event.

Best of all, the holding period from your first stock tacks onto your new one. Let's say you held the original stock for three years. You only need to hold the replacement stock for two more years to satisfy the full five-year requirement and claim the exclusion.

This might just be the most powerful strategy out there for maximizing QSBS benefits. Because the $10 million exclusion cap applies to each individual taxpayer, you can gift your qualified shares to family members or specific types of trusts. When you do this, each person or trust gets their very own $10 million exclusion on any future gains from that stock.

Imagine you're sitting on QSBS with a potential $40 million gain. If you gift shares to three non-grantor trusts set up for your children, you could effectively create four separate taxpayers—yourself and the three trusts. Each one now has its own $10 million cap. Suddenly, what would have been a $30 million taxable gain could become a completely tax-free event.

Gifting is a cornerstone of advanced QSBS planning. It effectively allows a family to multiply the tax-free potential of a single, highly successful investment across multiple individuals and legal entities, provided the strict rules for trusts and gifts are followed.

Of course, a move like this requires meticulous planning with estate and tax professionals, but the potential tax savings are just massive.

The idea of "stacking" is all about creating multiple, separate exclusion caps for yourself within the same company. While you technically only get one $10 million cap per company, the 10x basis rule provides a pretty clever workaround.

Here's how it works. An investor might make an initial $2 million investment. That investment creates a potential exclusion of $20 million (10 x $2 million). Now, say a year later, they invest another $1 million in a subsequent funding round. This second block of stock establishes its own, separate 10x basis calculation, completely independent of the first one.

This technique is particularly useful for investors who get in on multiple funding rounds. Each round can be treated as its own block of stock for basis calculations, potentially creating "stacked" exclusions that blow past the standard $10 million limit. It's also a critical factor when looking at emerging venture capital industry trends, as savvy fund managers often structure deals to optimize these kinds of outcomes for their limited partners.

The economic impact of these strategies isn't small. One Treasury Department report on QSBS utilization findings shows that between 2012 and 2022, taxpayers used the QSBS exclusion to shield over $140 billion in capital gains from federal taxes. Interestingly, about 75% of those excluded gains belonged to taxpayers with incomes over $1 million, which just goes to show how effective these planning techniques can be for high-growth investments.

Navigating the world of QSBS can be tricky. Even a small misstep, sometimes years before you even think about selling, can vaporize what should have been millions in tax-free gains. Honestly, it feels like a minefield at times. But knowing where the most common traps are is the best way to make sure you come out on the other side with your profits intact.

The most painful errors are usually the simplest ones. A forgotten date, a misunderstood rule, or sloppy record-keeping can be the difference between a tax-free windfall and a massive, unexpected bill from the IRS. Let's walk through the mistakes I see most often and, more importantly, how you can sidestep them.

This one is probably the most common—and most gut-wrenching—mistake of them all. To get that incredible 100% federal tax exclusion, you absolutely must hold your stock for more than five years. Selling even one day too soon means you lose the entire benefit.

A simple calendar miscalculation can turn a zero-dollar federal tax bill into a seven-figure liability. Precision here isn't just a good idea; it's a financial necessity.

The entire point of the QSBS incentive is to encourage people to invest directly in new, growing businesses. That's why the stock has to be acquired at its original issuance—meaning, you got it straight from the company, not from another investor.

When you eventually sell and claim that big QSBS exclusion on your tax return, the IRS puts the burden of proof squarely on your shoulders. If they decide to audit you, you have to be ready to prove that everything was done by the book.

This means you need records showing the company was a C-corporation and had less than $50 million in gross assets when you got your stock. For venture fund managers, keeping these records isn't just good practice; it's a fundamental part of their job, much like the diligence outlined for exempt reporting advisers in their compliance guide.

Think of your documentation as your armor in an audit. Without it, your claim is just a story you're telling the IRS, and they aren't in the business of believing stories. Protect your QSBS gains by being obsessively organized from the very beginning.

As you get closer to a sale or IPO, the "what ifs" around your stock start to feel a lot more real. The theoretical tax benefits of QSBS suddenly become very practical, and founders, investors, and employees often have the same pressing questions. Let's walk through some of the most common ones.

This is probably the number one question I hear, and for good reason. The five-year holding period is a hard-and-fast rule. If your company gets acquired before you’ve held the stock for five full years, you can't claim the Section 1202 exclusion on that sale. Simple as that.

But don't panic—you might still have a powerful alternative. This is where the Section 1045 rollover comes into play. It’s a fantastic provision that allows you to defer the capital gains from the sale by reinvesting your proceeds into another QSBS-eligible company. You have to act fast, though; you only have 60 days to make that new investment. The best part? Your original holding period tacks onto the new one, giving you a path to eventually hit that five-year mark and claim the exclusion down the road.

Yes, absolutely. This is great news for early employees. Stock you get from exercising either Incentive Stock Options (ISOs) or Non-Qualified Stock Options (NSOs) can be eligible for QSBS treatment, as long as it meets all the other standard requirements.

Here's the critical detail: your holding period clock doesn't start when you were granted the options. It starts the day after you exercise them and officially become a shareholder. That's the date the IRS considers the "original issuance" to you, and getting that timing right is crucial for planning your exit.

When it comes to the IRS, the burden of proof is on you, the taxpayer. You can't just assume your stock qualifies and hope for the best. If you sell your shares and claim the exclusion, you need to have your paperwork in order to back it up in an audit.

The best way to do this is to get a "QSBS attestation letter" from the company.

This is a formal document from the corporation confirming that it met the key criteria when you received your stock. Specifically, it should state that it was a domestic C-corp with gross assets under $50 million and was running a qualified active business. Keep this letter safe with your other records, like your acquisition date and cost basis. It’s your golden ticket for a smooth tax process.

This is a huge source of confusion and, unfortunately, the answer is "it depends." While Section 1202 can wipe out 100% of your federal capital gains tax, states are all over the map.

Some states follow the federal rules completely, which is fantastic. But many others, including major tech hubs like California and Pennsylvania, don't conform to the federal QSBS rules. In those states, you'll still owe state capital gains tax on your profits. Because these laws can and do change, you have to check the current rules for your specific state. It’s a non-negotiable step for understanding your true, final tax bill.

Are you an emerging fund manager tired of wrestling with manual spreadsheets for LP reporting and fund administration? Fundpilot offers an institutional-grade platform designed to automate your operations, from capital calls to audit-ready compliance. Learn how over 500 funds are using Fundpilot to streamline their back office and focus on what matters most—sourcing deals and raising capital. Upgrade your fund's operations with Fundpilot.