Master fund to fund accounting with this guide. Learn how to navigate complex NAV calculations, fee structures, and reporting with expert strategies.

Fund to fund accounting is the specialized financial practice behind a unique type of investment vehicle: the Fund of Funds (FOF). Instead of buying individual stocks or bonds, an FOF invests in a hand-picked portfolio of other investment funds. This accounting discipline is all about tracking the value and performance of that entire collection.

Think of yourself as the curator of a world-class art museum. You don't paint the pictures yourself. Instead, your expertise lies in selecting entire galleries—each with its own roster of artists and masterpieces—to create one breathtaking, unified exhibition.

In this analogy, your "museum" is the Fund of Funds. The "galleries" are the underlying investment funds you've strategically chosen.

Fund to fund accounting is the meticulous work of calculating the total value of your entire exhibition. It answers the one question that matters most: After tallying up all the gains, losses, and fees from every single gallery in the portfolio, what is the true, consolidated worth of our master fund?

This isn't your standard, run-of-the-mill accounting. It demands a sophisticated approach to manage the multiple layers of complexity that come with holding a portfolio of other funds.

To truly grasp why this specialized accounting is so vital, it helps to see how an FOF structure stacks up against direct investing. An FOF introduces an intermediary layer—the FOF manager—who is responsible for due diligence and selection of underlying funds, which contrasts sharply with the direct approach.

This table breaks down the core differences:

| Attribute | Fund of Funds (FOF) Investing | Direct Investing |

|---|---|---|

| Investment Target | Portfolios of other investment funds (e.g., hedge funds, private equity funds) | Individual assets (e.g., stocks, bonds, real estate) |

| Due Diligence | Performed on underlying fund managers and their strategies. | Performed on individual companies, assets, or securities. |

| Fee Structure | Layered fees: Management and performance fees at both the FOF and underlying fund levels. | Direct fees: Brokerage commissions, advisory fees. |

| Reporting Complexity | High. Requires aggregating data from multiple, non-standardized reports. | Lower. Data is sourced directly from market exchanges or brokers. |

| Access | Provides access to exclusive or high-minimum funds otherwise unavailable to smaller investors. | Access is limited by the investor's own capital and brokerage relationships. |

The key takeaway here is that the FOF's "portfolio of portfolios" model fundamentally changes the accounting workflow, demanding processes built to handle layered fees and aggregated data.

The FOF model gives investors some powerful advantages, but those very benefits are what create the unique accounting headaches. This is why a specialized approach isn't just helpful—it's absolutely essential.

Here’s what’s at stake:

The core purpose of fund to fund accounting is to translate a complex, multi-layered investment structure into a single, clear, and accurate Net Asset Value (NAV) for the master fund and its investors.

The sheer scale of this task is massive. Investment funds in the Americas alone are responsible for an estimated $37.4 trillion in assets under management, based on data from the Investment Company Institute. This staggering figure underscores just how critical precise valuation and reporting are.

Ultimately, this accounting method provides the solid bedrock for transparent investor reports, bulletproof regulatory compliance, and confident, well-informed investment decisions.

Trying to value a Fund of Funds (FOF) can feel like putting together a complex puzzle where each piece is a smaller, finished puzzle on its own. The master fund’s total value is essentially the sum of all its underlying investments, but getting to that final number is a careful, step-by-step process. The whole operation rests on meticulously tracking every dollar that moves in and out and pulling together data from all the different funds in the portfolio.

At its heart, the operational cycle for an FOF boils down to three main activities: managing capital calls, processing distributions, and—most critically—calculating the Net Asset Value (NAV). Unlike a standard fund that holds direct assets like stocks or real estate, a FOF’s main assets are its shares in other funds. This means its value is almost entirely dependent on the NAV statements it gets from those underlying investments. This reliance creates a unique workflow and rhythm for the fund to fund accounting team.

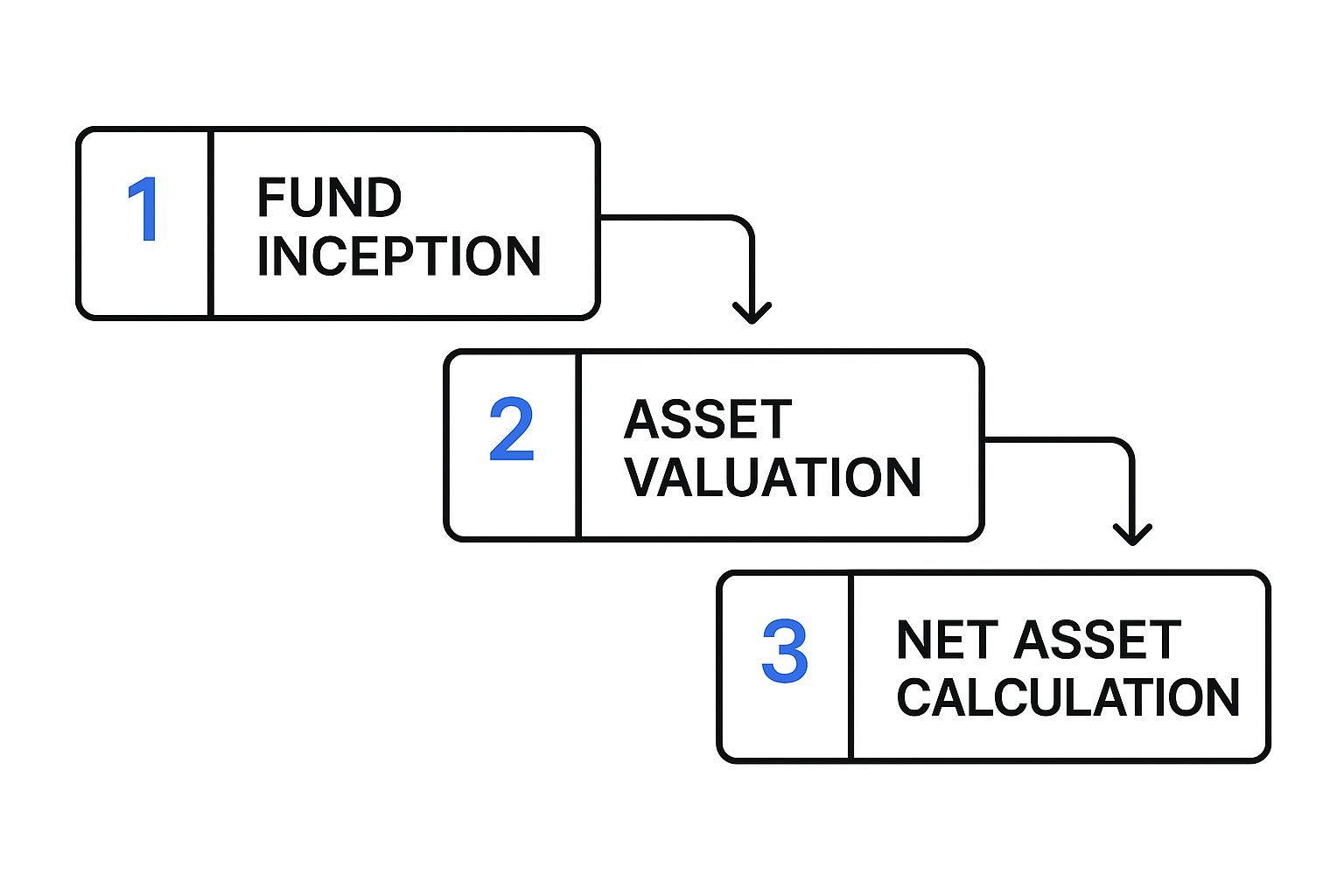

This simple infographic gives you a bird's-eye view of how it all flows together, from the initial investment to the final NAV calculation.

As you can see, each step builds on the one before it, all leading up to that all-important Net Asset Value that investors need.

The "NAV Roll-Up" is the absolute core of FOF valuation. This is where the accounting team takes the NAV reported by each underlying fund, checks it against their own books, and then combines—or "rolls up"—these individual values to figure out the master fund's total worth.

But it's not as simple as just adding up a few numbers. This process involves a few key steps:

Once all that is done, you get a comprehensive NAV for the master fund. This number becomes the foundation for all investor reporting and performance tracking.

Distributions from underlying funds introduce yet another layer of complexity. When a fund sells one of its assets and returns capital, the FOF gets its slice of the pie. Recording this cash coming in is straightforward enough, but the real challenge lies in the waterfall calculations that follow.

A waterfall distribution model is just a method for splitting up profits among partners in a specific order, like water flowing down a series of tiers. The first tiers usually focus on paying back the initial investment, while the later tiers distribute profits and performance fees, which are known as carried interest.

For a Fund of Funds, this creates a double-decker challenge. The accounting team has to track the waterfall within each underlying fund and the master fund's own waterfall for its investors. They must precisely account for the carried interest paid out to the managers of the underlying funds before they can determine the net amount available for the FOF's own investors and calculate its own performance fees. This dual-layered calculation is a signature challenge of sophisticated fund to fund accounting and is critical for ensuring everyone gets paid correctly based on the fund's agreements.

While the fund of funds model has clear advantages, it comes with some serious operational headaches. From my experience, the entire world of fund to fund accounting is built around solving one fundamental problem: you are completely dependent on outside sources for your valuation data.

One of the most frustrating and persistent issues is dealing with inconsistent reporting schedules. Imagine your FOF holds stakes in a dozen different underlying funds. There’s no universal rule that forces them all to report their Net Asset Value (NAV) at the same time. You might get one fund's report on the last business day of the month, another on the 25th, and a third a few days later. This creates a mad dash every single reporting period to get all the data you need before your own deadlines hit.

Beyond the timing, the way you receive the data is a whole other beast. It’s rarely straightforward. Critical capital account statements often land in your inbox as password-protected PDFs or, even worse, scanned documents. This immediately turns what should be a simple data import into a tedious, manual extraction job that's just begging for errors. The lack of standardization across the industry creates a huge amount of operational risk.

This headache gets even bigger when you start dealing with certain types of assets. The valuation puzzle has several tricky pieces:

The core operational challenge in FOF accounting isn't just about managing your own books. It's about wrangling a constant, unpredictable inflow of mismatched data from all the funds you've invested in.

Perhaps the most scrutinized part of FOF accounting is the layered fee structure. Your FOF has its own management and performance fees, but you're also paying the fees charged by all the underlying funds. Correctly tracking, calculating, and disclosing this “fee-on-fee” structure is absolutely critical. Get it wrong, and you risk losing investor trust and facing regulatory scrutiny.

These operational complexities are a major reason why the market for fund accounting services is growing so fast, especially with the boom in private equity and hedge funds. To see how the industry is adapting, check out these data-driven insights from Magistral Consulting. Understanding these real-world pressures is the first step toward seeing why so many firms are looking for better, more modern solutions.

After walking through the endless headaches of inconsistent data and manual processes, it’s obvious that old-school tools like Excel just can't keep up. They buckle under the pressure. The sheer volume and complexity of fund to fund accounting demand something built for the job, and this is where specialized technology comes in. It’s more than just a fancy calculator; it’s the operational brain of the entire fund.

Think of it like having an expert assistant who can instantly read, understand, and file every single capital account statement that hits your inbox, no matter how chaotic the formatting. That’s precisely what modern fund accounting platforms are designed to do. They attack the biggest bottleneck—data entry—and automate the most tedious, error-prone tasks right out of the gate.

These systems use sophisticated data extraction to lift critical numbers directly from PDF statements. Forget about manually typing in capital contributions, distributions, or ending balances. This immediately slashes the risk of a simple typo throwing off an entire NAV calculation.

One of the biggest wins with this kind of technology is its ability to bring order to chaos. Every underlying fund manager has their own way of reporting, but a dedicated platform can take all that varied data and translate it into a single, clean format. This gives the FOF a consistent and reliable dataset to work with.

Once the data is standardized, the system gets to work on reconciliation. It automatically cross-references the NAVs reported by underlying funds with the FOF’s own cash flow records, instantly flagging any mismatches that need a closer look.

This level of automation delivers a few huge benefits:

When you automate the foundational work of data aggregation and reconciliation, you free up your senior accountants from low-value clerical tasks. Their expertise can be redirected to what really matters: analyzing performance, making strategic calls, and building stronger investor relationships.

For any growing fund trying to deliver institutional-grade service, this shift isn't just helpful—it's essential.

It's no surprise that the demand for these solutions is booming. The global fund accounting software market was recently valued at around $3.5 billion and is expected to grow at a compound annual growth rate (CAGR) of over 6%. North America makes up about a third of this market, largely because of strict regulations like IFRS, GAAP, and the Sarbanes-Oxley Act (SOX), all of which demand flawless financial reporting. You can explore detailed fund accounting software market analysis on GMI Insights to see the forces driving this trend.

Platforms like Fundpilot are leading the charge, giving emerging managers access to tools that were once only available to the giants. By bringing everything together—from LP reporting and capital call automation to a secure investor portal—this kind of technology helps smaller funds operate with a level of polish that builds investor trust and attracts larger commitments.

In the end, the right tech stack transforms fund to fund accounting from a reactive, administrative headache into a proactive, strategic advantage.

Pulling together all the data and calculating an accurate NAV is a huge accomplishment, but it's really just the beginning of the story. The true test of a fund's operational backbone is in its reporting and how well it stands up to strict compliance rules. For a Fund of Funds, this means taking a mountain of complex data from underlying investments and turning it into something clear, insightful, and completely trustworthy for investors and regulators.

At its core, solid fund to fund accounting is all about building and keeping trust. Investors need to see exactly how their money is doing, where the fees are going, and how the fund is handling the market. This isn't just a "nice-to-have"—it’s essential for holding onto the capital you have and attracting new investors.

For any report to be taken seriously, it has to follow a common set of rules. Think of these accounting standards less as technical manuals and more as the shared language of financial honesty.

Two main frameworks dominate the industry:

Following these standards isn't optional. It’s the clearest signal you can send to investors and auditors that your numbers are solid and your financial statements show a true and fair picture of the fund’s health.

Beyond the formal financial statements, a Fund of Funds needs to provide a handful of key reports that give Limited Partners (LPs) a clear window into their investment. The quality of these documents says a lot about the manager’s professionalism and attention to detail.

Here are the key communications investors expect:

Great reporting does more than just present numbers; it tells a story. It explains the why behind the what, building investor confidence through clarity and demonstrating a commitment to full transparency, especially around layered fees and valuations. This is how emerging managers build institutional-grade credibility.

Even after you get the hang of the basics, the unique structure of a Fund of Funds (FOF) still throws some curveballs. Let's tackle the questions that pop up most often for managers, accountants, and investors trying to get their arms around fund to fund accounting.

The biggest difference boils down to a single concept: the source of truth.

In standard fund accounting, you're dealing with direct assets—stocks, bonds, maybe a piece of real estate. These assets have market prices you can look up or well-established methods for valuation. You're in control, valuing your own portfolio from the ground up.

But fund to fund accounting is a different game entirely. It's completely dependent on outside information. Your main assets aren't stocks; they're your stakes in other funds. This means your entire valuation is built on the Net Asset Value (NAV) statements you get from those underlying fund managers. The challenge isn't direct valuation anymore—it's managing, reconciling, and making sense of data from dozens of different sources, each with its own reporting schedule and format.

Think of it this way: A standard fund accountant is like a chef who buys fresh ingredients to create a meal. A fund to fund accountant is a restaurateur who has to evaluate the finished dishes from many different chefs to create a single, cohesive menu.

A Fund of Funds NAV isn't based on the day-to-day market prices of individual stocks. Instead, it’s a "roll-up" of the values from all the underlying funds it holds.

The process generally looks like this:

This final NAV is the crucial number used to calculate the share price for the FOF's own investors.

When regulators look at FOFs, their biggest concerns are almost always about transparency and accuracy, especially in two key areas: fees and valuations.

Technology is the only real answer to the biggest operational headache in FOF accounting: manually wrangling all that data. Specialized software comes at this problem from a few different angles.

For starters, it can use intelligent data extraction to automatically pull the key numbers—like capital contributions, distributions, and the ending NAV—right from the different PDF statements you receive from underlying funds. This gets rid of the soul-crushing (and mistake-prone) task of typing everything into a spreadsheet by hand.

Then, it organizes all that information. No matter how each underlying manager formats their report, the software puts the data into a single, consistent structure. This gives you a clean, reliable dataset you can actually work with. It enables automated reconciliation that can instantly flag a mismatch between your records and a manager's statement. This kind of automation hands precious time back to accounting teams, drives up accuracy, and helps you close the books and get reports out the door much faster.

Ready to move beyond manual spreadsheets and deliver institutional-grade reporting? Fundpilot provides the automated tools and professional investor portal you need to streamline operations and build trust. See how you can transform your fund administration by exploring Fundpilot today.