Understand what is investment accounting and its critical role in managing investment portfolios. Learn key methods, compliance, and best practices.

Investment accounting is a very specific type of accounting. It’s all about how you track, value, and report the performance of all the investment assets a fund or company holds. The whole point is to make sure your financial statements show the real, current value and income your portfolio is generating. This transparency is absolutely critical for your investors and for staying on the right side of regulations.

Let’s get past the textbook definition for a minute. At its heart, investment accounting is the financial language of your fund. It’s the system that translates every single trade, dividend, and market fluctuation into a clear, unified story for your investors, regulators, and your own team.

Think of it like a sophisticated GPS for your fund. It doesn't just show you where you are right now; it tracks how you got there and helps map out where you're headed.

This is a whole different ballgame from simple bookkeeping. It’s a specialized field dedicated to recording, analyzing, and reporting on all the financial moving parts related to your investments. With the asset management world growing so quickly, getting this right has never been more important.

Consider this: global assets under management are expected to jump from $84.9 trillion in 2016 to a staggering $145.4 trillion by 2025. You can dig into more of this data in PwC's analysis on this massive industry growth.

The main goal here is to give a true and fair picture of your fund’s financial health and performance. This isn't just about checking a compliance box; it's about building trust and making smart, informed decisions.

When done right, investment accounting achieves a few key things:

In the end, solid investment accounting is what separates the serious, institutional-grade funds from the amateur ones. It’s the operational backbone that gives you the credibility needed to attract and keep significant capital.

By nailing these fundamentals, you’re setting your fund up to scale successfully. For more deep dives into fund management, you can explore the resources on the Fundpilot blog. Getting your accounting process right is the starting line for everything else, from picking the right accounting methods to using technology to make it all run smoothly.

Picking the right accounting method isn't just about checking a box; it fundamentally changes how an investment's story gets told on your financial statements. The choice you make boils down to one critical factor: how much influence or control you have over the company you've invested in.

Think about it like this. Owning a few shares of a huge public company is a world away from holding a major, influential stake in a private startup. Each scenario has a different economic reality, and you need the right accounting language to capture it accurately.

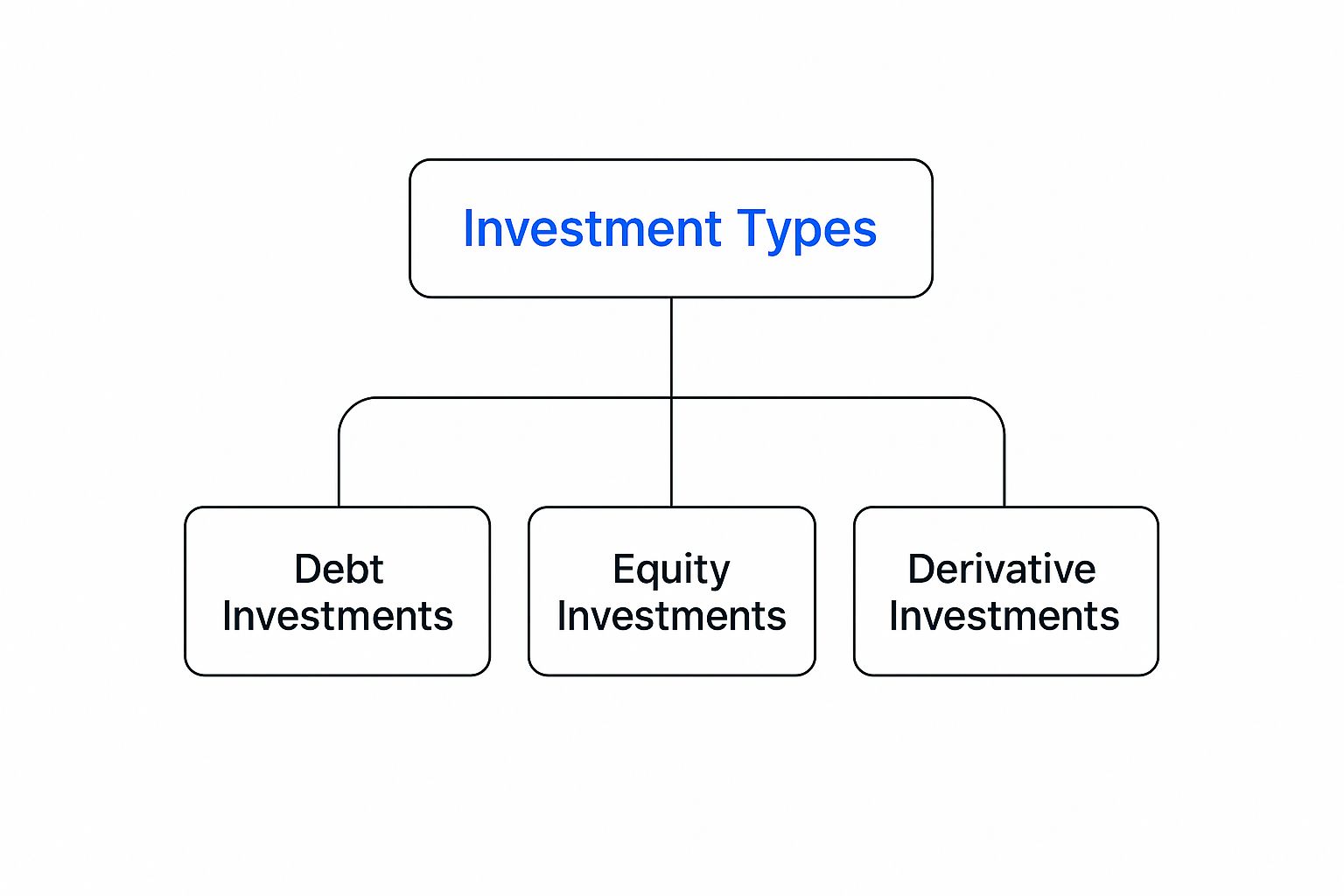

Most investments will fall into one of three main buckets. This hierarchy gives you a sense of the different types of investments a fund might hold.

As you can see, investment accounting covers everything from simple bonds to complex derivatives and equity positions. The method you use for each depends on its unique traits and your relationship with the asset.

Let's start simple. When you own a small slice of a company—usually less than 20%—and have virtually no say in its operations, you’ll use the cost method. It's the most straightforward of the bunch.

With this approach, you record the investment on your balance sheet at its original purchase price. That's it. The value stays put unless you sell it or something goes seriously wrong and it becomes "impaired" (meaning its value has dropped significantly below what you paid, with no real hope of recovery). You only recognize income when the company pays you a dividend.

Now, what happens when your ownership stake grows to somewhere between 20% and 50%? At this point, the rules assume you have significant influence over the company’s policies and decisions. This new level of involvement calls for a more sophisticated accounting treatment: the equity method.

Instead of just waiting for dividends, you now get to recognize your proportional share of the company's net income or loss right on your own income statement. This income bumps up the investment's value on your balance sheet. When you do receive dividends, they’re treated as a return of your investment, which decreases its carrying value.

The equity method gives a much more dynamic and accurate view of how the investment is actually performing. It mirrors the underlying company's profitability in near real-time, rather than just when cash changes hands.

This approach makes sense because your influence creates a much tighter economic link between your fund and the investment.

Finally, we have the fair value method, which you might also hear called mark-to-market accounting. This method is the standard for most investments that can be easily bought and sold, like the stocks and bonds you'd hold in a brokerage account.

Under fair value, investments are constantly re-valued to their current market price at the end of each reporting period. Any unrealized gains or losses—the on-paper changes in value for assets you haven’t sold yet—hit your income statement directly. This provides the most current snapshot of your portfolio's worth, which is absolutely critical for calculating your fund’s Net Asset Value (NAV).

To make it even clearer, let's break down the key differences between these methods.

This table lays out the three main approaches side-by-side, helping you see when and how to use each one.

| Method | When to Use (Ownership %) | How Income Is Recognized | Balance Sheet Value |

|---|---|---|---|

| Cost Method | Less than 20% | Only when dividends are received | Remains at historical cost unless impaired |

| Equity Method | 20% to 50% | Proportional share of the investee's net income or loss | Adjusts based on income/loss and dividends |

| Fair Value Method | Actively traded assets | Changes in market value (unrealized gains/losses) | Reflects current market price |

Getting a handle on these distinctions is the bedrock of proper investment accounting. The method you choose has a direct impact on your financial reporting, your performance metrics, and your ability to stay compliant with standards like US GAAP or IFRS.

Investment accounting doesn’t happen in a bubble. It’s shaped by a dense web of regulations that govern the entire global financial system. As a fund manager, this means every single valuation, report, and disclosure you produce has to follow a strict set of rules.

Think of these regulations as the universal grammar of finance. They ensure everyone, from a fund in New York to a company in Tokyo, is speaking the same financial language. Without this common ground, investing across borders would be chaotic, opaque, and wildly risky. It’s this standardization that builds the trust necessary for international markets to function.

For most funds, your world of compliance will revolve around two primary frameworks. The one you’ll follow largely depends on where your fund is based and, just as importantly, where your investors are.

These frameworks aren't just suggestions; they are the rulebook. They dictate exactly how you must classify investments, measure their fair value, and report critical information to your LPs and other stakeholders. Following them isn't just a good idea—it's the law.

The real challenge for emerging managers is that cutting corners on compliance is a recipe for disaster. The consequences aren’t just a slap on the wrist. We’re talking about hefty financial penalties, regulatory sanctions, and the kind of reputational damage that can make it impossible to raise your next fund.

In this light, solid investment accounting is your first and most critical line of defense.

The sheer scale of global capital flows is what makes this so important. Just look at the numbers. At the end of Q1 2025, the U.S. net international investment position was negative $24.61 trillion. That’s based on U.S.-owned assets abroad totaling $36.85 trillion versus foreign-owned assets in the U.S. hitting $61.47 trillion. You can dig into this data yourself over at the Bureau of Economic Analysis.

With that much money moving across borders every single day, meticulous tracking is non-negotiable. Proper accounting is what allows you to accurately value volatile investments, manage the complexities of foreign exchange risk, and provide the level of transparency regulators now demand.

When the stakes are this high, there's no room for error. For a closer look at the specifics, you can check out Fundpilot's legal and compliance resources.

Trying to manage a fund's accounting with manual spreadsheets today is like trying to navigate a bustling city with a hand-drawn map. You might get there eventually, but it’s going to be slow, frustrating, and you’re almost guaranteed to make a wrong turn. Given the complexity of modern portfolios and the eagle eye of regulators, technology isn't just helpful—it's essential.

The move away from manual data entry towards specialized software has been a game-changer. These platforms take over the tedious, repetitive tasks that used to bog down operations, transforming a painful administrative chore into a real strategic asset for fund managers.

Simply put, the right tech stack isn't a luxury anymore; it's a foundational piece of your firm's infrastructure.

Modern investment accounting software goes straight for the most time-consuming parts of the job. By putting key functions on autopilot, these platforms give you back your time and slash the risk of the kinds of costly errors that can shake an investor's confidence.

Here’s where you’ll feel the difference immediately:

The real beauty of this level of automation is that it does more than just save time. It builds a complete, audit-ready trail for every single transaction, giving you the kind of transparency that both regulators and serious investors expect.

You can see how critical this has become just by looking at the numbers. The global accounting software market is on track to jump from $12.01 billion to $19.59 billion by the end of 2025. And it’s no surprise that cloud-based platforms are the driving force here, with 67% of accountants now using them to run a better business. You can discover more insights about these trends on LLCBuddy.com.

Great technology does more than just make you more efficient; it fundamentally changes how you use your financial data. With real-time information at your fingertips, you can stop spending all your time looking in the rearview mirror and start making proactive, forward-looking decisions.

Think about it. A platform like Fundpilot gives you a live dashboard showing portfolio performance, current exposures, and other key metrics. This lets you analyze your positions on the fly, model how market shifts might affect your fund, and talk to your LPs with information that’s current as of right now. Your accounting function stops being a historian and becomes an active partner in guiding your fund's strategy.

Ultimately, integrating a solid tech solution allows emerging funds to compete on a level playing field. You can offer the same operational polish and investor transparency as the big, established players, setting your firm up for real, sustainable growth.

Every fund manager, especially if you're just starting out, is going to run into accounting hurdles that create risk and uncertainty. These aren't just minor speed bumps. They're complex problems that can warp your fund's performance numbers, rattle investor confidence, and even attract unwanted regulatory scrutiny if you get them wrong.

Getting through these challenges is what separates an amateur operation from an institutional-grade one. It all comes down to having clear policies, solid processes, and the right tech to make sure your reporting is accurate, consistent, and can hold up under pressure. Let's dig into some of the most common issues you’ll face and talk about real, battle-tested ways to solve them.

One of the biggest headaches for any fund dealing in private equity, venture capital, or real estate is nailing down what these assets are actually worth. Unlike a public stock, there’s no ticker symbol to check for the latest price. And just guessing? That's not a strategy.

The real solution is to create and stick to a formal valuation policy. Think of this document as your official rulebook. It lays out, in no uncertain terms, how you will determine the fair value for different assets at the end of each reporting period.

Your policy needs to cover a few key things:

A strong valuation policy isn't just for your internal files. It’s a powerful tool for building credibility with LPs and auditors, proving you have a thoughtful and disciplined process.

Derivatives like options, futures, and swaps can be fantastic tools for managing risk or juicing returns. But their accounting can be a nightmare. The rules under US GAAP and IFRS are incredibly specific, and one tiny misstep can blow a hole in your financial statements.

The key here is specialized knowledge and automation. You simply can't account for a complex swap the same way you do a basic stock purchase. This usually means leaning on a fund administrator or accounting software that has derivatives expertise baked right in. These systems are built to handle the tricky requirements for marking instruments to market and correctly booking gains and losses. Don’t try to be a hero with a spreadsheet—the risk of a costly error is just too high.

Investing globally opens up a world of opportunity, but it also means dealing with foreign exchange (FX) risk. Currency swings can dramatically impact your returns, and accounting for them correctly is non-negotiable. You have to translate foreign asset values back into your fund's base currency and track all the gains or losses from those FX movements.

The most effective way to tackle this is with an integrated accounting system that handles multiple currencies without breaking a sweat. Manually tracking exchange rates and crunching the conversion numbers is an operational disaster waiting to happen. A modern platform automates this whole process by:

By turning this into a system, you lock in accuracy and free up countless hours. It's worth exploring modern fund administration software to see just how accessible this kind of power has become. You can review a transparent breakdown of Fundpilot pricing to get a feel for how these solutions can fit into an emerging manager's budget.

Even after you've got the basics down, you'll find that putting investment accounting into practice brings up a lot of specific questions. Here are a few of the most common ones we hear from emerging managers, with some straightforward answers to help you navigate the details.

It’s easy to get these two mixed up, but the distinction is pretty simple. Think of investment accounting as a single, focused task, while fund accounting is the whole show.

Investment accounting zooms in on the assets inside your portfolio. Its only job is to value those investments correctly, track the income they kick off (like dividends and interest), and report any gains or losses. It answers one question: "What are our specific investments worth and how are they performing?"

Fund accounting is the big picture. It takes all the data from investment accounting and puts it into the context of the entire fund. This means it also has to manage investor capital (subscriptions and redemptions), pay all the fund's bills, and—most importantly—calculate the fund's total Net Asset Value (NAV). Fund accounting answers the broader question: "What’s the total value of our fund, and what is each investor's slice of the pie worth?"

In short, investment accounting is a crucial ingredient in the much larger recipe of fund accounting. You simply can't get fund accounting right without solid investment accounting.

Fair value accounting is the bedrock of transparent fund management. It gives you, your team, and your investors the most accurate snapshot of what your fund is worth right now. Unlike just sticking with an asset's original purchase price (which can become irrelevant almost overnight), the fair value method tells you what that asset would fetch in the market today.

This is a huge deal for a few key reasons:

Relying on historical cost would paint a distorted picture, masking the fund's true performance and value. That's a recipe for misleading investors and making poor decisions.

Technology, especially purpose-built software, has completely changed the game. It automates the tedious, error-prone tasks that used to eat up countless hours for fund managers. Gone are the days of manually punching numbers into spreadsheets, a process that’s just begging for mistakes.

For instance, a good platform can pull trade data directly from your brokers, completely cutting out manual entry. It can automatically apply the right accounting rules for each asset and grab real-time market data to value your positions without anyone lifting a finger. This automation flows all the way through to generating investor reports and financial statements that are compliant with standards like GAAP or IFRS.

The difference is night and day. This kind of automation boosts accuracy, frees up your time for making better decisions, and lets your fund grow without drowning in back-office work. It transforms accounting from a backward-looking chore into a forward-looking strategic advantage.

Ready to graduate from spreadsheets and run your fund like a pro? Fundpilot gives emerging managers institutional-grade reporting, automated fund administration, and a seamless investor portal. Discover how Fundpilot can help you scale your fund.