Partner with a private equity fund administrator to enhance efficiency, ensure compliance, and drive superior investment outcomes. Learn more today!

At its core, a private equity fund administrator is a specialized third-party firm that takes on the heavy lifting of a fund's back-office operations. They handle the complex financial, accounting, and compliance tasks that are essential but incredibly time-consuming.

Think of them as the operational engine of the fund, allowing the investment team to pour all their energy into what they do best: sourcing deals, growing portfolio companies, and generating returns.

Imagine a private equity fund as a world-class orchestra. The General Partners (GPs) are the star performers, dazzling the audience with their skill in finding and nurturing valuable assets. Their talent is the reason investors, or Limited Partners (LPs), buy tickets to the show.

But behind every great performance, there's a conductor ensuring everything runs like clockwork. Who makes sure the sheet music is in order, the timing is perfect, and every section works in harmony?

That's the fund administrator. They are the conductor, seamlessly coordinating dozens of critical, behind-the-scenes activities. Without them, the star soloists would be stuck tuning their own instruments and arranging chairs, and the performance would inevitably suffer. The administrator's job is to absorb the immense operational burden that comes with running a modern investment fund.

Not too long ago, many firms tried to juggle these administrative tasks internally. But as funds grew larger, regulations became more complex, and investors demanded greater transparency, the in-house model started to break down. The sheer weight of the administrative work began to distract from the fund's primary mission: generating outstanding returns.

This reality has made outsourcing to a fund administrator the new industry standard. A recent survey from PEI Group and RSM US LLP confirms this shift, showing that finance leaders are strategically handing off key functions. They are turning over critical areas like fund accounting, tax, compliance, and even IT to specialized partners. You can explore the future of private equity fund administration to see how firms are adapting.

This isn't just about offloading work. It’s a strategic move to tap into deep expertise, boost efficiency, and build a rock-solid foundation of investor trust.

A fund administrator transforms the complicated back-office processes into seamless operations. They are the essential partner that ensures the fund's operational, financial, and regulatory components work in perfect harmony, providing a stable foundation for growth.

To better understand their scope, let's break down the core functions an administrator handles. The table below summarizes the key areas where they provide value.

| Function Area | Key Responsibilities | Impact on the Fund |

|---|---|---|

| Fund Accounting & Reporting | Managing the general ledger, calculating Net Asset Value (NAV), preparing financial statements, and handling capital account allocations. | Ensures accurate, timely, and compliant financial reporting, which is the bedrock of investor trust and regulatory adherence. |

| Investor Services | Onboarding new investors (KYC/AML), processing capital calls and distributions, managing investor inquiries, and generating LP reports. | Creates a professional and responsive experience for investors, enhancing the GP's reputation and simplifying capital management. |

| Treasury & Cash Management | Opening bank accounts, managing cash flows, processing payments for fund expenses, and reconciling accounts. | Safeguards fund assets, optimizes liquidity, and ensures all financial transactions are executed efficiently and securely. |

| Regulatory & Tax Compliance | Assisting with regulatory filings (e.g., Form PF, AIFMD), coordinating with auditors, and preparing tax documents (like K-1s). | Mitigates compliance risks, navigates complex regulatory landscapes, and ensures the fund meets all its legal and tax obligations. |

As you can see, their responsibilities are both broad and deep, touching every operational aspect of the fund's lifecycle.

The partnership with an administrator provides the structural integrity every private equity fund needs to succeed. Their involvement frees up the investment team while ensuring the entire operation runs with institutional-grade rigor—a non-negotiable in today's high-stakes investment world.

In short, the value of a private equity fund administrator is clear:

Ultimately, a fund administrator is the operational backbone that supports the entire investment lifecycle from launch to liquidation.

To really get what a private equity fund administrator brings to the table, we need to look under the hood. It’s about more than just checking boxes; it’s about managing the day-to-day operations that keep the entire fund running smoothly, ensuring accuracy, compliance, and—most importantly—investor confidence.

Think of it this way: the General Partner (GP) is the driver of a high-performance race car, focused on navigating the track and winning the race. The administrator is the expert pit crew—the team meticulously managing the engine, fuel, and tires. Their work behind the scenes is what makes peak performance possible.

The absolute bedrock of fund administration is fund accounting. This is so much more than basic bookkeeping. We’re talking about maintaining the fund’s official book of record, managing the general ledger, and tracking every single dollar with painstaking precision.

A huge piece of this is calculating the Net Asset Value (NAV). The NAV is the fund's per-share market value, and it’s the single most critical metric for investors and for measuring performance. An administrator calculates this regularly (usually quarterly) by valuing all assets, subtracting liabilities, and dividing by the number of shares. This gets especially tricky in private equity, where valuing a private company isn't as simple as looking up a stock price.

On top of that, the administrator is responsible for preparing comprehensive financial statements—the balance sheet, income statement, and statement of cash flows. These aren’t just internal reports; they are prepared to audit standards, giving everyone from the internal team to outside stakeholders a clear and accurate financial snapshot.

A fund is nothing without its Limited Partners (LPs), and the relationship with them is paramount. A fund administrator acts as the professional and efficient intermediary, managing this critical relationship. This function is a cornerstone for building and maintaining LP trust.

This bucket of services includes a lot:

A core function of the administrator is to provide systems that aggregate, analyze, and report key investment metrics. This gives LPs the detailed insight and transparency they expect from modern investment structures, directly strengthening the GP-LP relationship.

By seamlessly managing all these interactions, the administrator frees up the GP from a massive administrative headache and presents a polished, institutional-grade experience to the fund’s investors. To explore this further, check out our complete guide to private equity fund administration.

Navigating the dense web of financial regulations is a full-time job in itself, and it’s one where a single misstep can be incredibly costly. The fund administrator acts as an essential line of defense, ensuring the fund stays on the right side of all relevant laws and rules.

Here’s what that looks like in practice:

Finally, administrators handle treasury services. They manage the fund's bank accounts, process payments for fund expenses, and oversee all cash movements. This protects the fund's capital and optimizes liquidity for both investments and operations. Together, these core services create a complete support system that allows a fund to operate with integrity and focus.

For any growing private equity firm, there comes a crossroads: do we handle fund administration ourselves, or do we outsource it? On the surface, keeping it in-house seems to offer more control. But from my experience, that path often leads to a major operational drag, pulling your best people away from what actually makes money—finding great deals and managing your portfolio.

Choosing to partner with a private equity fund administrator isn't just about saving a few dollars. It's a strategic move that can seriously accelerate your growth. It gives you immediate access to an institutional-quality back office without the massive upfront cost and months of effort it would take to build it from scratch.

Picture this: a PE firm just closed its second fund, doubling its assets under management. It’s a huge win, but the operational complexity has just exploded. The small back-office team is now drowning in new NAV calculations, endless investor emails, and a maze of compliance work. This is the exact moment outsourcing goes from a "nice-to-have" to a "need-to-have."

The real problem with the in-house model is the sheer scope of expertise you need. It’s not enough to hire an accountant. You need a full team that understands PE-specific accounting, knows the ins and outs of regulatory filings, can navigate complex tax laws, and is savvy with investor relations software. Finding, hiring, and keeping that kind of talent is a huge, ongoing distraction from your firm's real mission.

When you outsource, you're essentially plugging into a team of specialists whose entire world revolves around fund administration. This brings a few powerful advantages to the table.

Outsourcing frees up your most valuable asset—your team's time and brainpower—to focus on high-value activities. Instead of chasing down K-1s or reconciling bank statements, your partners can pour their energy into sourcing the next big deal or working with portfolio companies.

Let’s go back to that growing PE firm. Instead of trying to hire three new operations people, they decide to partner with a fund administrator. The change is almost immediate. Within a few weeks, their investor reporting is running through a professional portal, capital calls are being handled flawlessly, and their financials are ready for the auditors.

The firm's partners are no longer bogged down in operational details. They can focus 100% on deploying capital and delivering the returns they promised their LPs. The administrator provides the scalable back-office engine that powers their growth, letting them punch above their weight and compete with much larger funds without the crippling overhead.

This isn't just a one-off story; it reflects a major shift in the industry. Investors and regulators are demanding more transparency and faster reporting than ever before. This pressure is pushing more and more fund managers to outsource, helping them reduce operational risk and become far more efficient.

Ultimately, the argument for outsourcing is pretty compelling. It takes fund administration from a potential headache and liability and turns it into a strategic asset. By partnering with an external private equity fund administrator, you build a tough, scalable operational foundation that directly helps you achieve your main goal: generating superior returns. To get a deeper dive on this crucial function, check out our guide on what is fund administration for essential insights you need.

Picking a fund administrator is one of the most critical choices a General Partner will ever make. This isn't just about outsourcing a task; you're bringing on a long-term partner who will be woven into the very fabric of your firm's operations. Get it right, and you can boost growth and solidify investor trust. Get it wrong, and you’re looking at serious operational headaches and potential damage to your reputation.

Making the right choice demands more than just a quick look at a sales deck. It requires a proper, structured evaluation. You need to dig deep and compare potential partners against a clear set of criteria that really matter to your fund's immediate needs and future goals.

In today's market, an administrator's technology is everything. Clunky, manual processes are a non-starter. You need a partner whose tech platform delivers efficiency, top-notch security, and the kind of smooth digital experience that modern investors have come to expect.

When you're kicking the tires on their platform, ask some direct questions:

A great private equity fund administrator will have a powerful, secure, and intuitive platform. It should give your LPs easy, on-demand access to their documents and performance data, while also providing your own team with the tools needed to manage the fund effectively.

A partner with a modern tech stack isn't just a service provider—they are a core piece of your firm's infrastructure. Their technology should make your whole operation more accurate and less risky, freeing up your team to focus on what they do best: creating value.

Let's be clear: not all administrators are created equal. Private equity is a different beast, with its own unique accounting, reporting, and regulatory hurdles. A firm that primarily deals with venture capital or hedge funds might not fully grasp the specifics of PE, like complex fee structures, carried interest waterfalls, and the nuances of valuing private assets.

Your due diligence has to confirm they actually have experience in your world. Look for a proven history of working with funds similar to yours in size, strategy, and complexity. Don't be afraid to ask for case studies or anonymized examples of how they’ve handled challenges you expect to face. This is the only way to ensure they won't be learning the ropes at your expense.

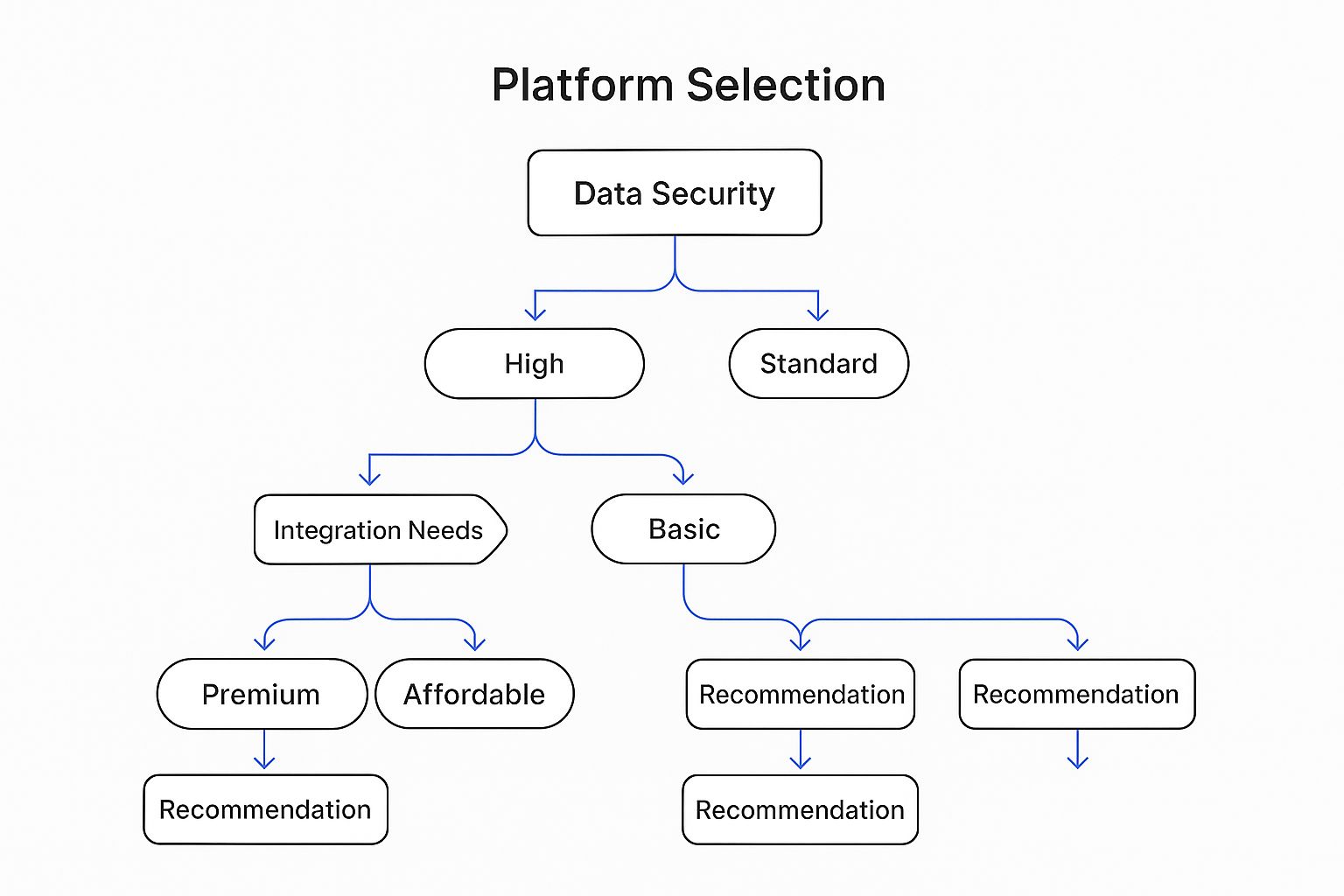

The decision tree below offers a simplified way to think through the selection process, showing how things like security, integration, and cost all play a part in finding the right fit.

As this guide illustrates, the best partner sits at the intersection of your firm’s specific technical requirements and what your budget allows.

Your fund is designed to grow, and your administrator needs to be able to grow right alongside you. A partner who is perfect for your $20 million fund might buckle under the pressure when you’re raising a $100 million successor fund. You have to investigate their ability to handle more complexity, more investors, and more transactions without letting service quality slip.

This brings us to the all-important element of service culture. When something urgent comes up—and it will—you need a responsive, knowledgeable person to talk to, not a faceless support ticket.

To get a real feel for their service, focus on these points during your evaluation:

Choosing a fund administrator requires a thoughtful approach. The checklist below can help you structure your evaluation and make a well-informed decision.

| Evaluation Criteria | Key Questions to Ask | Importance (High/Medium/Low) |

|---|---|---|

| PE-Specific Expertise | How many PE funds do you service? Can you describe your experience with our fund strategy (e.g., buyout, growth equity)? | High |

| Technology Platform | Can we have a full demo of the investor portal and GP dashboard? How do you ensure data security and privacy? | High |

| Scalability | What is the largest fund size you currently administer? How does your pricing and service model adapt as we grow? | High |

| Client Service Model | Will we have a dedicated point of contact? What are your documented SLAs for critical and non-critical requests? | High |

| Reporting Capabilities | Can you provide sample reporting packages (capital account statements, financial statements)? Are reports customizable? | Medium |

| Reputation & References | Can you provide 2-3 references from funds similar to ours? What is your client retention rate? | Medium |

| Pricing & Fees | What is your fee structure (basis points, flat fee, etc.)? Are there any hidden or out-of-scope fees we should know about? | Medium |

Ultimately, picking the right private equity fund administrator is about finding the perfect blend of technology, expertise, and people. By using a framework like this, you can look past the surface-level price comparisons and find a true partner who will safeguard your firm's operational integrity and contribute to your long-term success.

Let’s be clear: modern fund administration runs on technology, not spreadsheets. Today, a private equity fund administrator is defined as much by its software and systems as by its people. The days of slogging through manual data entry and waiting on paper reports are long gone. The industry now demands a level of speed, accuracy, and transparency that only powerful technology can deliver.

Think of it like swapping a flip phone for the latest smartphone. Sure, both can make calls, but the smartphone opens up a universe of new capabilities—instant data access, powerful apps, and seamless communication. A tech-forward administrator brings that same level of advancement to your fund’s back office.

Choosing a partner with a modern tech stack isn't just a nice-to-have; it's non-negotiable. It’s the only way to achieve real operational efficiency, ensure rock-solid security, and give today's investors the digital-first experience they expect.

The biggest game-changer technology brings to the table is its ability to automate repetitive, high-volume tasks. This is where artificial intelligence and machine learning are making a huge difference, transforming once-clunky processes into smooth, efficient workflows.

Take something like calculating a fund’s Net Asset Value (NAV). This used to be a painstakingly manual chore, wide open to human error. Now, advanced platforms can automatically pull data from various sources, apply the right valuation rules, and run complex calculations in a tiny fraction of the time. This doesn't just speed things up; it makes the final number substantially more accurate.

Perhaps the most visible leap forward is the investor portal. Any credible private equity fund administrator now offers a secure, cloud-based portal as a standard feature. It completely replaces messy email chains and mailed documents with a single, central hub for all investor-related information.

Investor portals do more than just share documents; they provide on-demand transparency. This ability for LPs to access real-time performance data and key reports is absolutely crucial for building and maintaining their trust.

A well-designed portal gives your Limited Partners 24/7 access to the information they need, when they need it. This digital-first approach not only looks professional but also meets the expectations of a new generation of investors who manage the rest of their financial lives online.

While efficiency gets a lot of attention, technology also plays a vital role in beefing up security and simplifying compliance. The best administrators invest heavily in cybersecurity to shield sensitive fund and investor data from the constant threat of attack.

This includes measures like:

By putting these technological tools to work, a fund administrator turns the back office from a potential cost center into a source of strategic advantage. This foundation of efficiency and security frees up General Partners to focus their energy on what really drives returns—making smart investment decisions.

The job of a private equity fund administrator isn't what it was five years ago, and it won't be the same five years from now. The entire market is in motion. If you're a General Partner, you have to look over the horizon to understand the forces shaping your firm's future. Picking an administrator isn't just about getting the books right today; it's about finding a partner who can keep you competitive tomorrow.

One of the biggest waves crashing over the industry is the focus on Environmental, Social, and Governance (ESG) criteria. High returns are no longer enough. Your investors want to see—with hard data—the real-world impact of their capital. This means your administrator needs to be able to track, measure, and report on complex ESG metrics, turning abstract goals into solid numbers that satisfy even the most demanding LPs. A great administrator helps you build this into your reporting from the very beginning.

At the same time, we're seeing the dawn of a digital asset revolution in private markets. Tokenization, the process of converting fund interests into digital tokens on a blockchain, is gaining serious traction. It promises to unlock liquidity and open the doors to a much wider group of investors. While it’s still early days, administrators are already building the technology needed to manage these digital assets, which requires a whole new playbook for tracking ownership and staying compliant.

This is all part of a larger trend: the "democratization" of private equity.

As private funds become accessible to more retail and high-net-worth individuals, the back-office workload explodes. An administrator must have scalable technology to handle a sudden influx of smaller investors, all of whom expect the same professional reporting and service as your institutional LPs.

These new investors also come with different expectations. They want fund structures that are easier to understand and offer more flexibility. Administrators are now front and center in creating and managing innovative vehicles, like interval and tender funds, that provide periodic liquidity options.

This operational pressure is only going to increase. Firms are sitting on huge piles of capital, and the private equity industry expects a surge of dealmaking in 2025 as the economic climate eases. This optimism, detailed in a comprehensive 2025 private equity outlook, points toward intense activity that will test the limits of every back office.

When you connect the dots, all these trends lead to one conclusion: the fund administrator is no longer just a back-office function. They are a strategic partner. They are your guide for navigating ESG demands, your expert on digital assets, and your operational backbone for scaling into new markets. Choosing a partner who not only sees these changes coming but is actively preparing for them is one of the most important decisions you'll make.

When you're deep in the world of fund operations, a lot of questions tend to pop up. Let's tackle some of the most common ones we hear about bringing a private equity fund administrator into the fold.

It’s an easy mistake to make, but they aren't the same thing. Think of a fund accountant as a specialist focused on a critical task: the numbers. They’re the ones in the trenches, calculating NAVs and preparing the core financial statements.

A private equity fund administrator, on the other hand, is the general contractor for your entire fund's back office. They manage the whole ecosystem. This includes the accounting, yes, but also investor communications, compliance monitoring, treasury services, and acting as the main point of contact for auditors and tax advisors. One role is a piece of the puzzle; the other manages the whole board.

There's no single price tag. Administrator fees usually come in one of two flavors: a small percentage of the total capital committed to the fund (measured in basis points) or a simple flat fee per year.

Several things will move the needle on the final cost:

The single most important thing here is getting a fee schedule that’s crystal clear. You need to know exactly what’s included in the base fee and what might pop up as an extra charge, like initial setup or custom reporting. No surprises.

This one’s easy: as early as possible. The absolute best time to bring on a private equity fund administrator is during your fund formation process—long before you’ve even thought about closing that first deal.

Getting an administrator involved from day one means all your systems, bank accounts, and compliance frameworks are set up correctly from the get-go. This isn't just about convenience; it’s about preventing expensive, time-consuming messes later on. It builds a rock-solid foundation for your launch and sets you up to scale smoothly.

Ready to move beyond spreadsheets and establish institutional-grade operations for your fund? Fundpilot provides the technology and support to streamline reporting, automate administration, and build investor confidence. See how we can help you scale.