Unlock the secrets of the restricted stock units tax rate. Learn how RSUs are taxed, when you owe, and how to build a smart financial strategy for your equity.

One of the biggest misconceptions about restricted stock units is that there's a special restricted stock units tax rate. There isn't. Instead, your RSUs are simply taxed as ordinary income when they vest.

Think of it this way: the value of your shares is treated just like a cash bonus. It gets added to your total income for the year and is taxed at your regular federal and state income tax rates.

Let's clear up the confusion. When your company first grants you RSUs, it's really just a promise of future shares. On your grant date, you don't actually own anything yet, so you owe zero tax. It's like being told you'll get a bonus next year—you don't pay tax on it until the money hits your bank account.

The real action happens at vesting. This is the moment you gain actual ownership of the shares, and it's the most critical event for tax purposes. The instant your RSUs vest, the government sees it as income you've just received.

Calculating your taxable income from vesting is straightforward. You just multiply the number of shares that vested by the stock's Fair Market Value (FMV) on that specific day. So, if 100 shares vest and the stock price is $50, you've just recognized $5,000 in taxable income.

This $5,000 gets added right onto your W-2 for the year, lumped in with your salary and any other compensation. This is why the tax rate for your RSUs is directly linked to your personal income tax bracket. The more you earn in total, the higher the tax rate you'll pay on that RSU income.

Key Takeaway: The taxable event is vesting, not the initial grant. The market value on your vesting date—not grant date—determines your immediate tax liability.

Because RSU income is treated like supplemental wages, your employer is required to withhold taxes on it. For federal taxes in the U.S., there's a mandatory flat withholding rate of 22% on supplemental income up to $1 million. If your vested shares are worth more than that in a single year, any amount over $1 million is withheld at 37%. You can explore more about how RSU income is taxed as a guide for your financial planning.

Companies typically handle this by doing a "sell-to-cover," where they automatically sell just enough of your vested shares to cover the required tax withholding. But here’s the critical part: that 22% withholding is often just a starting point. If your total income for the year (salary + RSU value) pushes you into a higher tax bracket, the 22% won't be enough, and you could be left with a surprise tax bill come April.

To make this even clearer, let's break down the tax implications at each stage of the RSU lifecycle. This table simplifies when you owe taxes and when you don't.

| Event | Taxable Income | Tax Type |

|---|---|---|

| Grant Date | $0 | No tax is due when you are granted RSUs. |

| Vesting Date | Full market value of vested shares | Treated as Ordinary Income (like your salary). |

| Holding Shares | $0 (unless you receive dividends) | No tax is due for simply holding the shares after they vest. |

| Selling Shares | The gain or loss since the vesting date | Treated as Capital Gains (short-term or long-term). |

As you can see, the two key moments for tax purposes are when the shares vest and when you eventually sell them. Understanding the difference between ordinary income and capital gains is fundamental to managing your RSUs effectively.

The single most important day for your RSUs is vesting day. This isn't just a corporate milestone; it's the moment the promise of stock from your employer becomes actual shares you own. More importantly, it's the exact point when the IRS takes notice and your tax clock officially starts.

Think of it like this: on your grant date, your company hands you a locked treasure chest. You have it, but you can't access what's inside. Vesting is the day the key finally turns, the lock clicks open, and the shares are truly yours. It’s this transfer of ownership that the government considers a taxable event.

Figuring out your taxable income at vesting is refreshingly straightforward. There's no complex formula, just a simple calculation based on the stock's value on that specific day.

The Formula: Number of Vested Shares × Fair Market Value (FMV) on Vesting Date = Taxable Ordinary Income

The final number is treated just like a cash bonus. It gets added to your W-2 wages and other earnings, and you'll pay your regular ordinary income tax rates on it.

Let's look at a quick example. Say 100 of your RSUs vest on a day when your company's stock is trading at $50 per share.

That $5,000 is now considered part of your total income for the year, no different than if your employer had handed you a $5,000 check.

Your company's vesting schedule determines when and how often these taxable events pop up. You’ll find this schedule detailed in your grant agreement, and it usually follows one of two common patterns.

Knowing your schedule is absolutely critical for planning. A huge cliff vest could easily bump you into a higher tax bracket for the year, leading to a surprisingly large tax bill. Graded vesting, on the other hand, makes the tax hit much more predictable and manageable.

Financial professionals, including exempt reporting advisers who manage funds, often build entire strategies around these predictable vesting events. You can explore a key compliance guide for exempt reporting advisers to get a sense of how the pros handle this. Understanding your schedule lets you see what’s coming and prepare, so you’re not caught off guard when the tax bill arrives.

One of the first things that catches people off guard about RSUs is how the taxes are actually paid. When your shares vest, the IRS views that value as supplemental income, and your employer is legally required to withhold taxes—much like they do with your regular salary. But since they can't just send shares to the IRS, they need a way to come up with the cash.

This is where a process called sell-to-cover comes in. It’s the most common approach companies use. Your employer will automatically sell just enough of your newly vested shares to pay for the estimated taxes. That cash goes straight to the government, and the remaining shares land in your brokerage account.

So, how much do they withhold? For federal taxes, the IRS mandates a flat rate for supplemental income like RSU vests. For the first $1 million of this type of income in a single year, that rate is a standard 22%. If your total supplemental income for the year crosses that $1 million threshold, the rate jumps to 37%.

This automated process seems straightforward, but it's a bit of a double-edged sword. While convenient, it often creates a significant tax shortfall for many employees down the road.

The Withholding Gap: That mandatory 22% federal withholding is just an estimate. It's a one-size-fits-all number. If your actual tax bracket is higher, you'll be on the hook for the difference when you file your taxes.

Here’s the heart of the issue: your restricted stock units tax rate isn't a flat 22%. Your vested RSU income gets added on top of your regular salary and any other earnings for the year. Your final tax bill is then calculated based on your marginal tax bracket, which could be much higher.

For many professionals, especially in tech or executive roles, a sizable RSU vest can easily bump their total income into the 32%, 35%, or even the top 37% federal tax bracket. When this happens, the initial 22% withheld at vesting simply isn't enough to cover the real tax liability. This creates what's known as the "withholding gap."

Let's walk through a quick example to see this gap in action:

Looking at the 2024 tax brackets for a single filer, a total income of $250,000 pushes this person deep into the 35% marginal tax bracket. Even though not all of that $100,000 is taxed at the highest rate, the effective tax rate on that extra income is far greater than 22%. The result? A surprise tax bill that could easily be $10,000 or more.

It's important to remember this isn't an error on your employer's part; they are just following the standard federal rules. It falls on you to see this potential shortfall coming and plan ahead to avoid a nasty financial surprise when tax season rolls around. Proactively managing this requires a solid grasp of cash flow, a core concept in financial management. If you're looking to deepen your understanding, our guide on what is fund administration is a great place to start.

Theory is one thing, but seeing the numbers play out in a real-world scenario is where it all clicks. Let's walk through the entire RSU lifecycle with a fictional employee, Alex, to turn abstract tax rules into a concrete, easy-to-understand process.

We’ll follow Alex’s shares from the initial grant, through the first vesting milestone, and finally to a sale more than a year later.

Alex joins a public tech company and receives a grant for 1,600 RSUs as part of the compensation package. On the day of the grant, the company's stock is trading at $125 per share. The grant has a pretty standard four-year graded vesting schedule with a one-year cliff.

On grant day, absolutely nothing happens from a tax perspective. Zero. Alex doesn't own the shares yet, so there’s no income to report and no tax bill to worry about. Think of the grant as simply a promise from the company.

A year goes by, and Alex hits the one-year cliff. As per the schedule, 25% of the total grant vests, which means 400 shares (1,600 x 0.25) are now officially theirs. On this vesting day, the stock price has climbed to a Fair Market Value (FMV) of $150 per share.

This is the moment the tax clock starts ticking. The total value of these newly vested shares is now considered ordinary income for Alex.

This $60,000 gets added to Alex's W-2 for the year, just as if it were a cash bonus. To handle the immediate tax liability, most companies use a "sell-to-cover" transaction. The company's broker automatically sells just enough shares to cover the estimated taxes. Let's assume a combined federal and state withholding rate of 35%.

After this automatic sale, Alex is left with 260 shares (400 - 140) sitting in their brokerage account. The $21,000 in tax money has been sent to the government on Alex's behalf.

Crucial Point: The cost basis for Alex's remaining 260 shares is set at $150 per share—the price on the day they vested and were taxed as income. This number is the starting point for calculating any future capital gains.

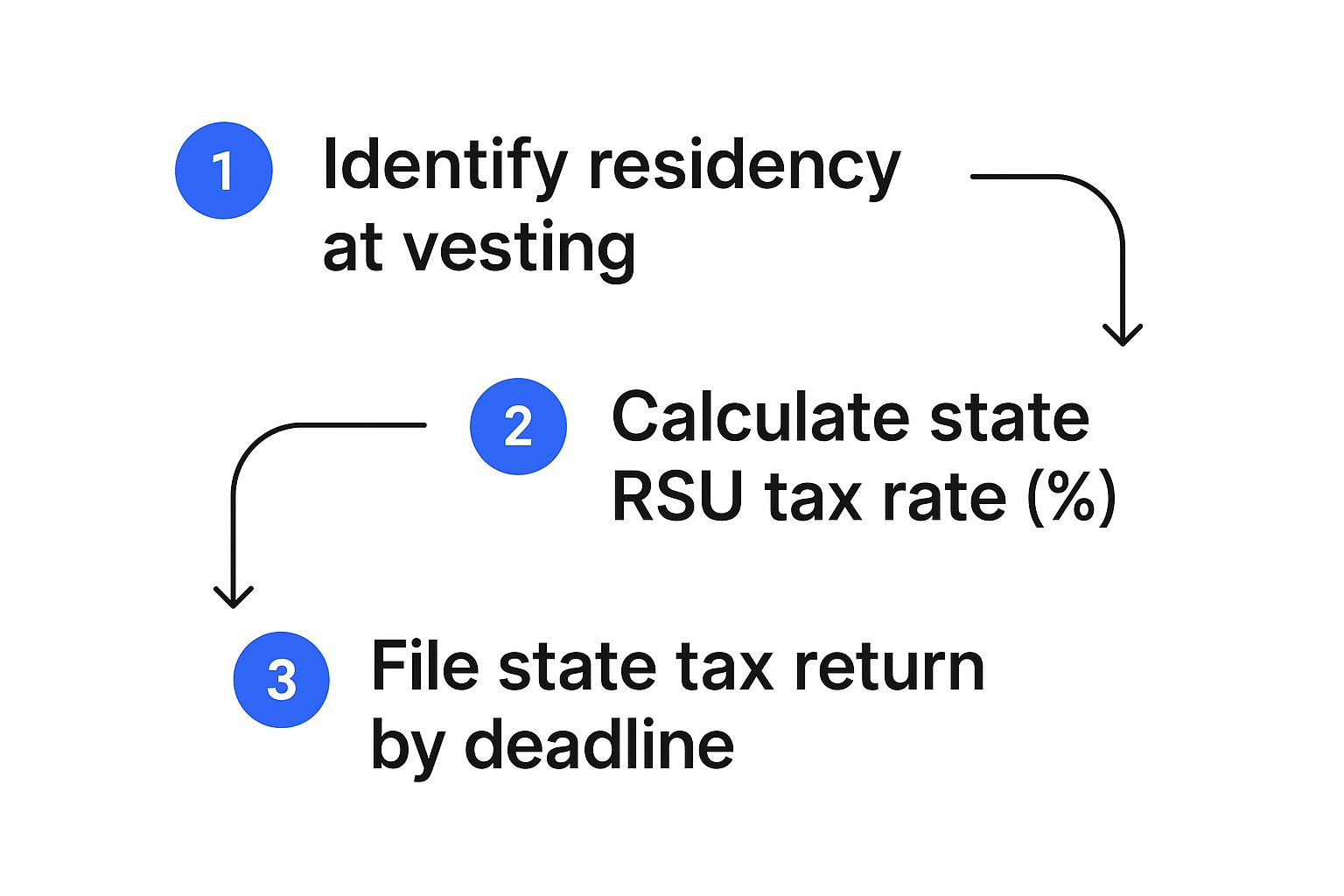

This visual gives a simple overview of how state taxes fit into the picture alongside federal obligations.

The key takeaway here is that your physical location when the RSUs vest determines which state gets to tax that income—a critical detail for anyone who moves while their shares are vesting.

Instead of selling immediately, Alex decides to hold the remaining 260 shares, hoping the stock will appreciate. Fast forward 18 months. The company has done well, and the stock is now trading at $200 per share. Alex decides it's a good time to sell all 260 shares.

Because Alex held the shares for more than one year after they vested, any profit from the sale qualifies for long-term capital gains treatment, which comes with a much friendlier tax rate than ordinary income.

Here's how the capital gains math works:

Alex has a $13,000 long-term capital gain. If we assume Alex is in the 15% long-term capital gains bracket, the tax owed on this sale is straightforward:

By holding the shares for over a year, Alex saved a significant chunk of money. If they had sold within a year of vesting, that $13,000 gain would have been taxed at their higher ordinary income rate, not the preferential 15% long-term rate.

To make this even clearer, the table below consolidates Alex's entire RSU tax journey into a simple, step-by-step summary.

| Stage | Calculation Detail | Resulting Value | Tax Consequence |

|---|---|---|---|

| Grant | 1,600 RSUs granted at $125/share | $200,000 (notional value) | $0 - No tax due at grant. |

| Vesting | 400 shares vest at $150/share | $60,000 | Taxed as ordinary income. |

| Tax Withholding | $60,000 income x 35% rate | $21,000 | Withheld via "sell-to-cover" (140 shares). |

| Holding Period | 260 shares held for 18 months | N/A | Qualifies for long-term capital gains rates. |

| Sale | 260 shares sold at $200/share | $52,000 | Proceeds from selling the stock. |

| Capital Gain | $52,000 proceeds - $39,000 cost basis | $13,000 | Taxed as a long-term capital gain. |

| Final Tax on Sale | $13,000 gain x 15% LTCG rate | $1,950 | The final tax bill for the stock sale. |

This breakdown shows how each step has a distinct tax implication, from the initial income event at vesting to the capital gains event at the final sale. Understanding this flow is the key to making smart decisions about your own RSUs.

Alright, now that you understand how the restricted stock units tax rate works, it's time to take control. Just letting your employer's default "sell-to-cover" process run on autopilot is a common mistake, and it can leave you with a surprisingly large tax bill in April. A little proactive planning can help you manage this liability and ensure your RSUs align with your bigger financial picture.

The main culprit, as we’ve discussed, is the withholding gap. The standard 22% federal withholding on your vested RSUs often isn't enough, especially if that extra income bumps you into a higher tax bracket. The good news is you have two primary ways to bridge this gap and avoid that dreaded tax-time surprise.

The most straightforward way to handle a potential tax shortfall is to simply pay the extra tax you'll owe during the year, not all at once when you file. This strategy keeps you on the right side of the IRS by avoiding underpayment penalties.

You can tackle this in a couple of ways:

Both methods get you to the same place. They ensure you’re paying enough tax throughout the year to cover your entire bill, turning a potential crisis into a planned, manageable expense.

Beyond just covering the taxes, you face a critical investment decision the moment those shares officially become yours. What you do next has major implications for both your future tax bill and your personal wealth.

The Big Question: Do you sell the RSU shares immediately, or do you hold on to them, hoping for future growth?

There's no single "right" answer here. The best move depends entirely on your personal financial situation, your tolerance for risk, and how you feel about diversification. Let's walk through the pros and cons of each path.

Option A: Sell Immediately at Vest

This is the cleanest and, for many people, the smartest strategy. It involves selling all your shares (after the automatic sell-to-cover withholding) as soon as they hit your account.

Option B: Hold for the Long Term

This approach means you're betting on the company. You keep the shares with the belief that their value will climb over time. If you hold them for more than a year before selling, any profit is taxed at the much friendlier long-term capital gains rates.

Ultimately, this choice is a personal one. For those whose shares are from qualified small businesses, the tax rules can get even more interesting. You can learn more by checking out your guide to QSBS tax treatment for a deeper dive into that specific area. The key is to make sure your RSU strategy is a deliberate part of a well-thought-out financial plan. That's how you turn equity compensation into lasting wealth.

https://www.youtube.com/embed/-3iW-tm0T80

Once you start digging into RSUs, you quickly realize that a few key questions pop up over and over again. Let's walk through the most common ones I hear from employees, so you can get clear, straightforward answers and feel confident about how your equity works.

We'll tackle these head-on.

This is a big one, and the answer is usually pretty simple: if you leave your job before your RSUs vest, you lose them. It doesn't matter if you resign or are let go—the unvested shares are forfeited.

Think of vesting as your employer's way of ensuring you stick around. Since the shares aren't legally yours until they vest, leaving the company means they go back into the company's equity pool. No shares ever hit your account, so there's no tax event to worry about.

It's always a good idea to read your grant agreement, though. In rare cases, like a company acquisition, there might be a clause that accelerates your vesting. But you should treat that as the exception, not the rule.

Getting this number right is absolutely critical for your future taxes. Your cost basis is simply the Fair Market Value (FMV) of the stock on the day your shares vest.

This is the value you already paid ordinary income tax on. So, if your shares vested when the stock was trading at $50, your cost basis for each share is $50.

When you eventually sell those shares, you'll only pay capital gains tax on the profit above that $50 starting point.

Here's a costly mistake I see all the time: assuming the cost basis is $0. This rookie error means you get double-taxed. You'd be paying capital gains tax on the entire value of the shares, even on the part that was already taxed as regular income. Always double-check that your brokerage account reflects the correct cost basis from your vest date.

The short answer is no. A Section 83(b) election is not an option for Restricted Stock Units, and it’s a key difference between RSUs and Restricted Stock Awards (RSAs).

Here’s why: an 83(b) election lets you pay tax on restricted stock when it’s granted, not when it vests. That’s only possible with RSAs because you receive actual shares of stock on day one (they’re just subject to forfeiture).

With RSUs, you don't get shares at grant—you only get a promise of future shares. Since no property has actually been transferred to you, there's nothing to tax yet. For RSUs, the taxable event is always, and only, the vesting date.

Are you an emerging fund manager tired of wrestling with manual spreadsheets for reporting and operations? Fundpilot empowers you to deliver institutional-grade quarterly LP reports, automate fund administration, and maintain audit-ready records, all from a single, streamlined platform. Stop spending your time on manual back-office tasks and start focusing on what matters—sourcing deals and raising capital. See how over 500 funds are scaling faster and improving LP retention by scheduling your demo.