Discover how investor portal software streamlines communication and boosts transparency for fund managers. Learn to select the best platform for your needs.

If you've ever tried managing dozens of investor relationships using a messy combination of emails, spreadsheets, and Dropbox folders, you know the pain. It's chaotic. Investor portal software cuts through that chaos by creating a single, secure digital space for everything and everyone, turning a manual mess into a professional, polished system.

Think of an investor portal as your fund's private, branded command center. For you, it’s a place to manage everything. For your investors, it’s a transparent, on-demand dashboard where they can find exactly what they need, whenever they need it.

This kind of software centralizes crucial documents, automates performance reporting, and makes communication a breeze. Instead of spending hours manually emailing quarterly updates or K-1s one by one, the platform handles the entire process. This ensures every limited partner (LP) gets the right information at the right time, every time.

For modern fund managers, this technology isn't just a "nice-to-have"—it's an essential part of the toolkit. By creating a secure, central hub for all communications and documentation, you build a powerful foundation of trust and transparency. Investors no longer have to dig through their inbox for a capital call notice or the original PPM; it’s all organized and accessible 24/7. Frankly, this level of professionalism is what investors now expect.

The move to digital-first investor relations is more than just a passing trend; it's a fundamental shift in how the industry operates. The demand for these tools is exploding, driven by a sharper focus on regulatory compliance and the need for crystal-clear communication.

In fact, the global market for related investor relations software is expected to climb from USD 206.8 million in 2025 to a staggering USD 651.2 million by 2034. That kind of growth tells you just how critical these platforms are for staying competitive.

The image below breaks down the core pillars of investor relations—all of which are streamlined and enhanced by a dedicated portal.

As you can see, it's all about the intersection of finance, communication, and compliance. An investor portal is designed to bring these three functions together seamlessly.

At its heart, an investor portal is so much more than a digital filing cabinet. It's an active tool for building relationships and driving operational efficiency, which has a direct impact on your fund's ability to grow.

A great investor portal turns investor relations from a reactive, administrative headache into a proactive, strategic advantage. It frees you up to focus on what you do best: sourcing deals and generating returns.

This is a game-changer for emerging managers. A well-designed portal lets a small team deliver an institutional-quality experience, leveling the playing field and helping them compete with larger, more established firms. It creates a standardized, repeatable system for:

By systemizing these critical tasks, the software gives you back your most valuable asset—time—while drastically reducing the risk of costly human error. If you're looking for more ways to sharpen your fund's operations, check out some other articles on our blog: https://www.fundpilot.app/blog.

Not all investor portals are built the same. While plenty of platforms offer basic tools, the real difference between a glorified document folder and a strategic asset comes down to the quality of its core features. Knowing what to look for is the first step in picking the right investor portal software for your fund.

Think of it like this: anyone can build a shed, but a secure, climate-controlled vault requires specialized engineering. The best portals are engineered to solve the specific, high-stakes problems fund managers face every day, turning complex manual processes into simple, automated workflows. It should act as the central nervous system for your investor relations, not just a digital storage closet.

Let's break down the must-have features that separate a generic tool from a true game-changer.

A top-tier investor portal isn't just a collection of features; it's an integrated system where each component works together to make your life easier and your investors happier. The table below outlines the essential functions you should expect from any serious platform.

| Feature | Primary Function | Key Benefit |

|---|---|---|

| Secure Document Management | Acts as a fortified digital vault for storing and distributing sensitive documents like LPAs, K-1s, and quarterly reports. | Provides bank-grade security, granular access controls, and a full audit trail, ensuring compliance and peace of mind. |

| Performance Dashboards | Presents key investment metrics (IRR, MOIC, DPI) in a clear, visual, and easily digestible format for investors. | Reduces inbound questions and builds trust by giving LPs self-service access to their performance data 24/7. |

| Automated Reporting | Automates the creation and distribution of financial reports, capital account statements, and other regular investor updates. | Saves countless hours of manual work, eliminates human error, and ensures timely, professional communication. |

| Streamlined Subscriptions | Digitizes the entire investor onboarding process, from filling out subscription documents to e-signatures and KYC/AML checks. | Drastically speeds up the closing process, reduces administrative errors, and creates a seamless first impression for new investors. |

| Centralized Communication | Creates a single, secure channel for all investor communications, including capital calls, distribution notices, and market updates. | Establishes an official, auditable record of all messages, eliminating lost emails and ensuring everyone stays informed. |

These features are the building blocks of a powerful investor relations strategy. When they work in harmony, they create an experience that feels professional, transparent, and effortless for both you and your LPs.

First and foremost, a portal has to be a fortress for your sensitive information. This is about much more than just a folder in the cloud. We're talking about granular control and effortless organization for every critical document.

This is your secure hub for distributing things like:

A high-quality system provides bank-grade encryption and lets you set role-based access controls, so investors only see their own documents. It also gives you a full audit trail, letting you know exactly who accessed what and when—a crucial layer for compliance and security.

Manually compiling reports is one of the biggest time-drains for any fund manager. A great investor portal takes this entire process off your plate, transforming raw data into clear, compelling performance stories for your LPs. This isn't about dumping data; it's about storytelling with numbers.

Investors should be able to log in and immediately see how their investment is doing. The portal should display key metrics in an intuitive, visual dashboard, making it easy for them to grasp their returns at a glance. Look for platforms that track metrics like IRR, MOIC, and DPI and can update them in near real-time.

A well-designed dashboard answers your investors' most common questions before they even think to ask them. It builds confidence by proactively offering transparency and clarity, solidifying your reputation as a professional and trustworthy manager.

This self-service model cuts down on the constant stream of emails asking for performance updates, freeing up your team to focus on what really matters: sourcing deals and managing the portfolio.

The onboarding process is an investor's first real taste of how your fund operates. It sets the tone for the entire relationship. A clunky, paper-based subscription process is slow, frustrating, and looks unprofessional. Modern investor portals digitize this entire workflow.

This feature turns onboarding into a smooth, efficient engine. Potential investors can complete their subscription documents online, use e-signatures, and securely upload necessary KYC/AML information. The platform guides them through each step, making sure nothing gets missed. This doesn't just speed up your closing process; it dramatically cuts down on administrative mistakes.

Finally, your portal needs to be the single source of truth for all investor communications. Trying to manage everything through scattered email chains is a recipe for disaster—messages get missed, and confusion reigns. A centralized hub ensures every announcement, from a capital call notice to a distribution alert, is logged and delivered securely.

This creates an official, auditable record of every touchpoint. Investors have one dedicated place to find important updates, and you can rest easy knowing every message was delivered through a secure, reliable channel. It puts an end to the "I never got the email" excuse and provides a polished, organized way to keep your LPs in the loop.

Bringing an investor portal into your firm isn't just about tidying up your digital files; it's a core business decision that pays dividends in trust, efficiency, and growth. It fundamentally changes how you operate. Think of it as the difference between navigating a new city with a crumpled paper map versus using a real-time GPS. Both might get you to your destination, but one is faster, more accurate, and inspires a whole lot more confidence.

This shift from scattered, manual processes to a single, secure platform delivers real, tangible value across your entire fund. It turns your back office from an administrative headache into a genuine competitive advantage.

Before you have a portal, transparency often feels like an accident. Investors are left digging through old emails for a performance update or chasing you for a K-1. This reactive song-and-dance creates friction and can slowly chip away at their confidence. It makes them wonder if your back office is as buttoned-up as your investment strategy.

Once you implement a dedicated investor portal software, that whole dynamic flips. Investors get on-demand, self-service access to their portfolio data, key documents, and all communications in one secure, professionally branded place. This proactive transparency builds immediate trust.

Providing a clear, accessible, and secure portal shows a deep commitment to professionalism and good governance. It tells investors you value their partnership and are serious about providing an institutional-quality experience, no matter the size of your fund.

This level of access isn't a luxury anymore; it’s the bare minimum. Sophisticated LPs are used to seamless digital experiences in every other part of their lives, and they now expect the same from their fund managers. A good portal meets that expectation head-on.

For many emerging managers, the daily grind is a constant battle against manual tasks. So many hours are lost cobbling together reports, tracking down e-signatures for sub docs, or sending out individual K-1s. This administrative quicksand doesn't just waste time—it pulls you and your team away from what actually matters: sourcing deals and managing investments.

An investor portal automates these soul-crushing workflows.

This newfound efficiency has a powerful compounding effect. By liberating your team from admin work, you create the bandwidth to focus on generating returns and raising that next fund. The global investor reporting software market, valued at USD 1.2 billion in 2023 and projected to hit USD 3.8 billion by 2032, shows just how essential this shift has become. You can find more details on these investor reporting market trends and growth projections.

Let's be honest: operating without a central system is risky. Sensitive investor data ends up in personal inboxes, tracking happens on messy spreadsheets, and there's no clear audit trail for who saw what, when. This creates serious compliance gaps and leaves your fund exposed.

A proper investor portal is built from the ground up with security and compliance in mind. It creates a single, auditable source of truth for every investor interaction.

Features like bank-grade encryption, two-factor authentication, and precise access controls ensure sensitive information is always locked down. Better yet, the built-in audit trails give you a complete, time-stamped record of every action—who viewed a report, when a notice was delivered, and who acknowledged it. This creates an ironclad record that’s invaluable during an audit or LP due diligence, cementing your firm’s credibility.

Picking the right investor portal software is a big deal. Let’s be honest, it’s a high-stakes decision. This platform becomes the digital front door to your fund and the very engine of your investor relations. If you get it wrong, you’re looking at frustrating workarounds, costs that seem to appear out of nowhere, and a clumsy experience for your limited partners.

To get this right, you need a clear framework for making the decision. This isn't about finding the platform with the most bells and whistles; it’s about finding the one that truly fits your fund's specific needs, your current stage, and where you plan to go. Let's break down the key things to look at so you can ask the hard questions and choose a real partner, not just another vendor.

One of the classic mistakes I see managers make is picking software that solves today's problems but creates much bigger ones down the road. You’re building your fund for growth, and your tech needs to be able to run at the same pace. What feels great for a $50M AUM fund can easily crack under the pressure of a $500M AUM portfolio.

So, when you're looking at scalability, get specific:

Choosing a scalable platform means you won't have to face a miserable and costly migration in just a couple of years. It’s an investment in a foundation that can actually support your ambition.

Your investor portal can't be an island. It has to talk seamlessly with the other critical tools you use every day, like your accounting software (think QuickBooks or Xero) and your CRM. If it doesn't, you’re just signing your team up for more manual data entry, which completely defeats the purpose of the software.

Picture this: your fund administrator finalizes the quarter-end numbers. A well-integrated system can automatically pull that data into the portal and generate investor statements. A disconnected one means you’re back to manually exporting and importing spreadsheets—a process that’s slow, boring, and a breeding ground for errors.

A truly effective investor portal acts as a central hub, not another isolated silo. Its ability to connect with your existing tech stack is a direct measure of its power to create real operational efficiency.

Before you sign anything, get a crystal-clear picture of a vendor’s integration capabilities. Ask for specific examples of systems they connect with and what that integration actually looks like in practice.

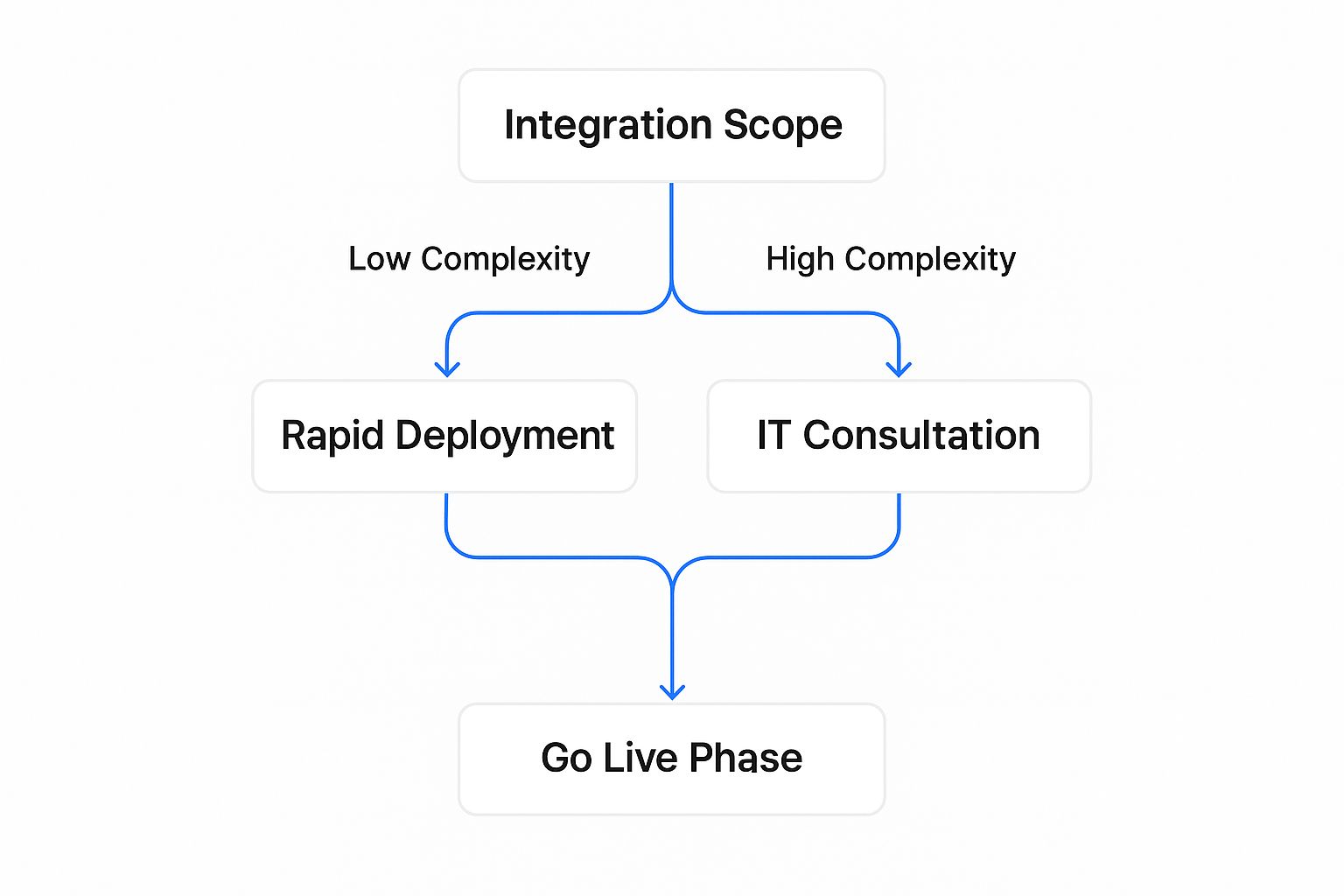

The chart below shows how the complexity of what you need to connect can affect your setup timeline.

As you can see, simple setups can get up and running fast. But if you're dealing with more complex or legacy systems, you'll likely need to plan for a more involved IT process.

In our industry, data security is simply non-negotiable. You are the steward of your investors' most sensitive financial and personal information. A breach isn’t just an IT problem; it could be catastrophic for your reputation and your business. Vague promises about "top-notch security" just don't cut it.

You need to see concrete proof of their security posture. Look for things like:

Don't be shy about asking a potential vendor for their security documentation. Any company that takes security seriously will be more than happy to provide it.

Investor portal software pricing can be confusing, and it's all too easy to get blindsided by hidden fees. A low introductory price can quickly inflate as you add more investors, need more features, or have to pay for support. You have to understand the total cost of ownership, not just the price on the proposal.

To help you get organized, here’s a checklist you can use when talking to potential vendors.

| Evaluation Criteria | Key Questions to Ask | Why It Matters |

|---|---|---|

| Scalability | What are the AUM/LP limits? What happens to my pricing when I exceed them? | Ensures the platform grows with your fund, preventing costly and disruptive platform changes in the future. |

| Integration | Does it integrate with my specific accounting/CRM software? What's the process? | Avoids manual data entry, reduces human error, and creates a single source of truth for your operations. |

| Security | Are you SOC 2 compliant? Can I see your security documentation? | Protects sensitive investor data, safeguards your firm's reputation, and meets regulatory requirements. |

| Pricing | Is pricing all-inclusive? What are the fees for implementation, support, or data migration? | Provides a clear understanding of the total cost of ownership and prevents unexpected budget overruns. |

| User Experience | Can I see a live demo for both my team (admin) and an investor (LP)? | A clunky, hard-to-use portal will lead to low adoption and more support calls from frustrated LPs. |

Make sure to get clear answers on every aspect of the cost. Ask directly about one-time fees for implementation, data migration, and training, as well as any ongoing costs for customer support. A transparent partner will give you a clear, all-in quote. For a good example of what clear pricing looks like, you can see how different investor portal pricing models are structured to compare approaches.

By digging into these four pillars—scalability, integration, security, and pricing—you can confidently choose the right investor portal software that doesn't just fix your immediate headaches but becomes a true strategic asset for years to come.

A list of features on a product website is one thing. Seeing how they solve real, painful problems is something else entirely. For an emerging fund manager, the right investor portal software isn't just another subscription—it's your operational backbone during the most critical moments of your fund's life. It lets you punch above your weight, executing complex tasks with the polish and precision of a much larger firm.

Let’s get out of the abstract and into the weeds. Here are a few common scenarios where this technology truly makes a difference, turning potential chaos into calm control.

The capital raise is an all-out sprint. It’s a high-stakes, high-stress period with a million moving parts—from sharing sensitive documents to tracking commitments and getting sub-docs signed. Trying to juggle this with email and spreadsheets is asking for trouble. It’s slow, insecure, and doesn't exactly scream "institutional-grade."

Now, imagine this instead: you've identified your first round of potential LPs. Instead of attaching your Private Placement Memorandum (PPM) to a mass email or using a clunky, generic data room, you invite them into a secure, branded portal.

Here's how the software completely changes the game:

The result? You close capital faster and with far fewer headaches. More importantly, you build trust and confidence with your LPs from the very first interaction.

For most fund teams, quarterly reporting is a recurring nightmare. It’s a mad dash to pull together performance data, generate individual statements for every investor, and then distribute it all securely without a single error. This manual grind can easily eat up weeks, pulling you away from what you should be doing: managing the portfolio.

Let's re-imagine the end of the quarter with an investor portal. Your fund administrator finalizes the NAV and performance data. Instead of them exporting it to a spreadsheet for you to wrestle with, that data flows directly into your portal.

With just a few clicks, the system generates personalized quarterly reports and capital account statements for every single LP. A task that used to take 40+ hours of painstaking manual work is now done in less than an hour.

This isn’t just a time-saver. It’s about delivering a professional, reliable experience every time. Your investors get their reports on schedule, and they can log into their dashboard anytime to see their performance metrics. This proactive communication cuts down on one-off questions and reinforces your firm's credibility.

Executing a capital call demands absolute precision. You have to notify every LP of the correct amount, track every dollar that comes in, and keep a perfect record of the entire process. One missed email or a typo in a spreadsheet can create major administrative and even financial problems.

With investor portal software, the whole process becomes standardized and nearly foolproof.

This structured workflow creates a clear, auditable trail for the entire event. It guarantees accuracy, gives investors total transparency, and dramatically reduces the risk and administrative weight of managing capital movements.

Alright, even after seeing all the features and benefits, you probably still have some practical questions. It's one thing to see what a platform can do, and another to understand what it really takes to get it running for your fund. Let's dig into the common questions I hear from managers when they get down to the brass tacks.

There's no single answer here—pricing can be all over the map and almost always depends on the size of your fund. Most software providers use a few standard models: a simple flat monthly fee, a tiered system based on your assets under management (AUM), or a charge for each investor on the platform. A smaller, emerging fund might just pay a straightforward subscription, while a larger, more established fund will find that the cost grows with their AUM.

But here’s a pro tip: never just look at the advertised price. You absolutely have to ask for a full breakdown of all potential costs.

The only way to avoid a nasty surprise six months from now is to get a detailed quote that spells out the total cost of ownership.

Security is everything. This is a complete non-negotiable, and any vendor worth their salt will treat it as their number one priority. Don't settle for vague promises about "state-of-the-art security." You need to see the proof.

An investor portal’s security isn't just a feature—it's the very foundation of trust with your LPs. A single data breach could destroy your reputation. Think of robust security as a mission-critical requirement, not just a nice-to-have.

Look for specific, verifiable security standards. This means things like bank-grade encryption (AES-256 is the gold standard) for data both in storage and when it's being sent. It also means mandatory two-factor authentication (2FA) for everyone and, critically, SOC 2 compliance. A SOC 2 report is an independent audit that proves the provider has serious controls in place. If you want to get into the details, you can always review the legal and privacy policies of a provider to see their commitments in black and white.

The timeline to get a portal live can be anything from a couple of days to several weeks. If you're a new fund with a clean, simple list of investors, you could be up and running surprisingly fast—maybe even onboarding LPs within the week.

On the other hand, complex setups take more time. If you're bringing over years of historical performance data from messy spreadsheets or need to integrate with a custom-built accounting system, expect the process to be more involved. A good vendor will be upfront about this and give you a clear, realistic timeline right from the start.

Ready to see how an institutional-grade investor portal can transform your fund's operations? Fundpilot provides a secure, scalable platform designed specifically for emerging managers. Schedule your personalized demo today to discover how you can automate reporting, streamline communications, and build lasting investor trust.