Learn how to start an investment corporation with our step-by-step guide. Tips, legal info, and strategies to kickstart your investment business today!

Before you ever think about filing legal paperwork or raising your first dollar, you need a rock-solid foundation. This is where you move from a good idea to a viable business. It's about meticulously defining your investment philosophy, carving out your specific market niche, and translating it all into a concrete business plan. This groundwork isn't just a formality—it guides every single decision you'll make down the road.

The most successful investment firms I've seen were built on a bedrock of obsessive planning long before they officially existed. This is the stage that separates a professional enterprise from a hobby. It's where you get brutally honest about your strategy.

Your very first job is to hammer out a clear and compelling investment philosophy. Think of this as your firm’s true north—the core beliefs that will guide every single investment choice. It answers the most critical question: How, exactly, will you make money for your investors?

An investment philosophy isn't some fluffy mission statement you stick on a website. It’s a disciplined framework that dictates your every move: the assets you’ll consider, your appetite for risk, and how long you plan to hold investments. When the market gets choppy—and it will—a strong philosophy keeps you from making emotional decisions.

For example, your firm might adopt one of these classic approaches:

A well-defined philosophy is your filter. It stops you from chasing a hot trend that has nothing to do with your core strategy. It’s the "why" behind every deal, and it's essential for explaining your value to potential investors.

With your philosophy locked in, it's time to get specific about your market niche. Trying to be a generalist is a fast track to mediocrity. You can't be an expert in everything. Success in this business comes from carving out a space where you can build deep expertise and a real competitive edge.

Specialization makes you far more effective. For instance, instead of just saying you invest in "tech," you might focus specifically on B2B SaaS companies with $1M to $5M in annual recurring revenue. Instead of "real estate," you could specialize in acquiring and improving multi-family apartment buildings in secondary cities in the Midwest. This focus sharpens everything from finding deals to performing due diligence.

Your business plan is the roadmap that connects your big-picture philosophy to day-to-day reality. This document isn’t just for showing to potential backers; it’s your internal guide for navigating the first 3-5 years.

A solid business plan for an investment firm has to include a few non-negotiable elements:

Ultimately, this foundational stage is all about asking—and answering—the tough questions before you're responsible for other people's money. It builds the discipline and strategic focus you need to create an investment firm that lasts. This is the work that gives investors the confidence to write that first check.

Picking the right legal entity for your new investment corporation is more than just paperwork. It’s a foundational decision that will shape nearly every aspect of your firm’s future, from personal liability and tax obligations to your ability to attract serious capital. Honestly, this is one of the first and most critical forks in the road you'll face.

Get this choice wrong, and you could be looking at a costly restructuring down the line or, even worse, a tax setup that cripples your growth before you even get started. The three most common paths are the C Corporation, the S Corporation, and the Limited Liability Company (LLC). Each one offers a different mix of protection, flexibility, and administrative headache.

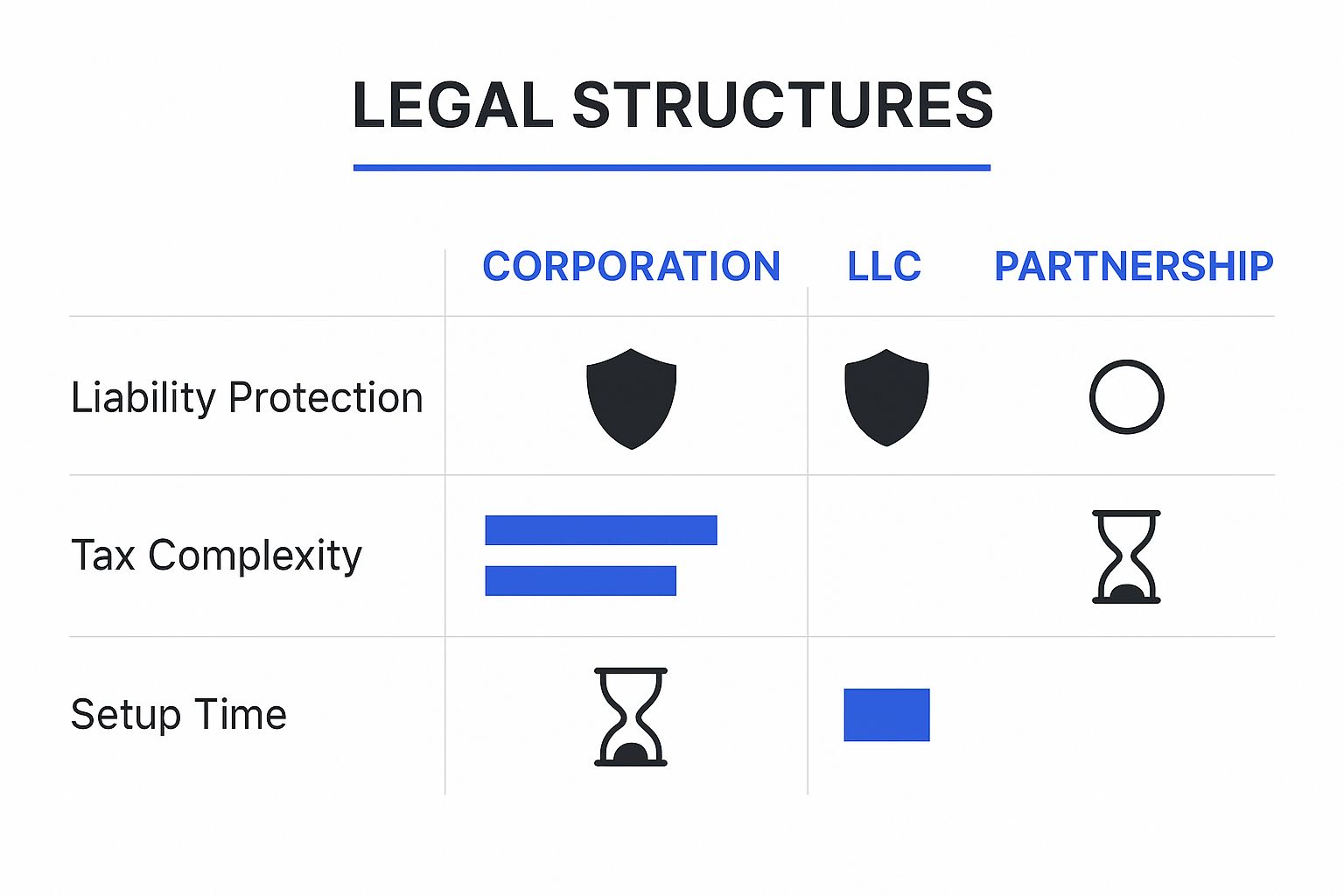

This visual gives a quick rundown of the core differences in liability protection, tax complexity, and how long it takes to get each one set up.

As you can see, corporations provide that ironclad liability shield but bring more complex tax rules. LLCs, on the other hand, often strike a better balance for new firms.

Let's break down these options side-by-side to make the decision clearer. The table below compares the key features of C Corps, S Corps, and LLCs, focusing on what matters most to an investment firm: liability, taxation, and appeal to investors.

| Feature | C Corporation | S Corporation | Limited Liability Company (LLC) |

|---|---|---|---|

| Liability | Strongest liability protection. Shields personal assets from business debts and lawsuits. | Same strong liability protection as a C Corp. | Strong liability protection, similar to a corporation. |

| Taxation | Subject to "double taxation" (taxed at corporate level and again at shareholder level on dividends). | "Pass-through" taxation. Profits/losses pass to shareholders' personal returns, avoiding corporate tax. | "Pass-through" taxation by default. Offers flexibility to be taxed as a corporation if desired. |

| Ownership | No restrictions on number or type of shareholders. Can have multiple classes of stock. | Limited to 100 shareholders, who must be U.S. citizens/residents. Only one class of stock. | No restrictions on number or type of members. Flexible profit distribution. |

| Best for | Firms planning to raise venture capital, go public, or attract institutional investors. | Small, closely-held firms that don't plan on seeking complex outside investment. | New firms, partnerships, and funds seeking operational flexibility and tax simplicity. |

Ultimately, the right choice depends entirely on your vision for the company. A C Corp is built for scale and traditional venture funding, while an LLC offers unparalleled flexibility for smaller, more dynamic teams. The S Corp fits a very specific niche but is often too restrictive for a growing investment business.

Think of the C Corporation as the go-to vehicle for ambitious firms with their eyes on the big leagues. If your roadmap includes raising significant venture capital or an eventual IPO, the C Corp is almost always the right call.

Why? It’s simple: venture capitalists and institutional investors are built to work with this structure. They understand its clean lines and can easily purchase preferred stock with specific rights. The corporation pays its own taxes, which, while leading to the infamous "double taxation," is actually a feature for big investors. They prefer a clean separation and don't want corporate profits and losses flowing through to their personal tax returns.

For many new investment firms, especially those launched by a small group of partners, the Limited Liability Company (LLC) is the perfect middle ground. It’s a more modern and adaptable structure that gives you the liability protection of a corporation but with the tax perks and operational ease of a partnership.

The biggest draw is "pass-through" taxation. An LLC's profits and losses are passed directly to its members’ personal tax returns, neatly sidestepping the double taxation issue. Beyond that, LLCs offer incredible flexibility in how you distribute profits. For instance, if one partner sources a deal and another manages it, your operating agreement can be written to give them different profit shares based on their unique contributions—something much more difficult with a rigid corporate stock structure.

The S Corporation is a bit of a hybrid. It’s a standard corporation that files a special election with the IRS to be taxed like a partnership, offering pass-through taxation similar to an LLC. You get the corporate liability shield without the double tax hit.

But here’s the catch. S Corps come with very strict rules that make them a poor fit for most growing investment firms:

That last point—the one-class-of-stock rule—is often the dealbreaker. It prevents you from offering sophisticated investors different types of equity with varied rights and preferences. You can dive deeper into these tradeoffs in our complete guide on how to start an investment firm from the ground up.

Knowing these nuances is crucial, especially when you think about where your firm fits in the global capital markets. For example, recent data shows U.S. direct investment abroad just hit $6.83 trillion, with a lot of that money flowing into European manufacturing. If your strategy involves partnering with international players in booming sectors like computers and electronics, a C Corp might be better equipped for that. These global trends are important data points when choosing a structure that will actually support your strategy. You can see more about these capital flows in the Bureau of Economic Analysis's latest report.

Alright, you've picked your corporate structure. Now it's time to shift from planning to action. This is the stage where your investment corporation becomes a real, legal entity, and it’s a process where every detail counts. Trust me, a misstep here can create expensive delays or, even worse, land you in regulatory hot water later on.

First up is the formal business registration. This means filing your formation documents with the Secretary of State in your chosen state. If you went with a corporation, you'll file the Articles of Incorporation; for an LLC, it's the Articles of Organization. This filing is what officially gives your company life.

At the same time, you'll need an Employer Identification Number (EIN) from the IRS. It's essentially a Social Security number for your business. You can't do much without it—opening corporate bank and brokerage accounts, hiring people, and filing taxes all require an EIN. The good news is the application is free and pretty straightforward to complete online.

For an investment firm, getting your EIN and state registration is just the start. The real challenge is navigating the dense world of securities regulations. Because you’re managing other people’s money, you’re squarely on the radar of federal and state authorities.

The main regulators you'll deal with are the U.S. Securities and Exchange Commission (SEC) and your state's securities administrator. Where you register mostly comes down to your Assets Under Management (AUM).

But AUM isn't the whole story. The kind of investors you work with (like retail versus accredited) and how your investment offerings are structured also play a big part in determining your regulatory path.

Crucial Insight: Don't ever assume you can fly under the radar. The Investment Company Act of 1940 is a beast of a law governing investment funds. Accidentally violating its rules can have brutal consequences, including making your client contracts unenforceable. Getting to know this law isn't just a good idea—it's essential.

Compliance isn't a one-and-done task you can just check off a list. It needs to be part of your firm’s DNA from the very beginning. A solid compliance program is your single best defense against regulatory trouble and shows investors you’re serious about operating by the book.

Your first practical step is to appoint a Chief Compliance Officer (CCO). In a new firm, one of the founders usually takes on this role. The CCO is in charge of creating, implementing, and enforcing all the firm's compliance policies.

Next, you need to create a detailed Compliance Manual. Think of this as your company’s rulebook. It should cover everything from your code of ethics and personal trading policies to your marketing rules and record-keeping procedures. It’s a living document that you'll have to update as your business grows and regulations evolve.

Finally, some firms might find they qualify for a lighter regulatory load through specific exemptions. For instance, managers of certain private funds can often operate as Exempt Reporting Advisers (ERAs). This path has fewer reporting hoops to jump through but still demands strict adherence to anti-fraud rules and other key regulations. To really dig into this option, our key compliance guide for Exempt Reporting Advisers breaks down all the requirements and responsibilities.

Putting these pillars in place—proper registration, a dedicated CCO, and a thorough manual—is non-negotiable. They are the guardrails that will protect your firm, your investors, and your own reputation. This groundwork is what ensures your investment corporation is built to last.

With the legal paperwork out of the way, you can get down to the real business: making money. This is the moment your investment corporation stops being a file in a cabinet and starts acting like a living, breathing enterprise. Turning your big-picture philosophy into a concrete portfolio strategy is a discipline. It demands foresight and a solid framework for every single decision you make.

Your strategy is more than just a vague mission statement. It’s the blueprint for building and managing your portfolio. You're not just trying to pick winners; you're assembling a collection of assets that delivers on the promises you made to your investors. Whether you're a deep-value investor hunting for overlooked gems or an aggressive growth fund chasing the next big thing in tech, your approach has to be crystal clear, repeatable, and easy to defend.

First things first: you need to define your sandbox. To turn your strategy into something you can actually use, you have to establish a set of strict, non-negotiable investment criteria. This is your best defense against "deal creep"—that dangerous temptation to chase a shiny object that falls outside your expertise. Think of these criteria as a filter, saving you from wasting time on prospects that don't truly fit your model.

A private equity firm specializing in manufacturing buyouts, for example, might lay down these ground rules:

Rules like these force you to stay focused. They stop your team from spending weeks analyzing a software company or a real estate deal, no matter how promising it looks on the surface. Get these criteria down on paper, share them with everyone, and make them a foundational part of your operations manual.

Once a potential deal makes it past your initial screen, the real work begins. Rigorous due diligence is where you go line by line to verify every claim, uncover every risk, and kick every tire before a single dollar is deployed. This is where most deals die, and frankly, that’s a good thing.

Thorough due diligence is a multi-front investigation that goes far beyond the P&L statement.

An investment firm lives and dies by the quality of its due diligence. It's the painstaking, unglamorous work that protects your investors' capital. A shortcut here is a direct path to a bad investment.

Building a portfolio is an art. It's not just about collecting great individual assets; it’s about how they fit and work together. Diversification is a core tenet, but it's more nuanced than just owning a bunch of different things. For an investment corporation, it means intentionally constructing a portfolio that is balanced to hit your specific risk and return targets.

Just look at the current private equity market for a sense of how fast things can move. Global deal value recently jumped 22% year-over-year to $1.75 trillion, with exit activity also on the rise. We're seeing a massive influx of venture capital into hot sectors like AI and machine learning—a sector that saw a 50% spike and now accounts for 35.7% of all venture money. Keeping an eye on trends like these is crucial. Insights from resources like the latest global investor survey from Adams Street Partners can help a new firm see where momentum is building and structure its portfolio accordingly.

Finally, risk management can't be an afterthought—it has to be baked into your strategy from day one. This means setting hard limits on how much capital you'll put into a single asset, a single industry, or even a single country. It also means stress-testing your portfolio to see how it would hold up in a recession, during a sudden interest rate spike, or in other ugly scenarios. A solid risk management framework is what ensures your portfolio can not only produce great returns but also survive the market's inevitable storms.

Alright, you've jumped through the legal hoops and your investment corporation officially exists. Now for the hard part: turning that legal shell into a real, functioning business. This is where your business plan gets tested against reality. You'll need to tackle two crucial tasks at once—raising money and building the operational framework to manage it. How you handle this phase will set the tone for everything that follows.

Raising capital isn't just about asking for money; it's about telling a convincing story backed by a rock-solid plan. Your internal business plan is your guide, but your pitch deck and Private Placement Memorandum (PPM) are the documents that will actually get investors to write checks.

Think of the PPM as the ultimate disclosure document. It's a formal, legal breakdown of everything an accredited investor needs to know before committing capital. It covers your strategy, the risks involved, and the specific terms of the offering. This isn't a marketing piece—it’s a critical tool for transparency that protects both you and your investors.

Most new firms start their fundraising journey close to home. Your first checks will likely come from your immediate network—the "friends and family" round. These early backers are often investing in you as much as your investment thesis. Once you have some initial traction, you can start reaching out to angel investors and family offices, which are generally more approachable for new managers than large institutional players.

When you're in the room, your primary job is to inspire confidence. You need to clearly and passionately explain your unique investment angle, highlight your team's experience, and define the market opportunity you're targeting. Expect a grilling. Be ready to defend your due diligence process, your risk management plans, and your exact path to generating returns.

I’ve seen countless pitches fail because the founder focused too heavily on the potential upside. Seasoned investors are looking deeper. They’re evaluating your discipline and your process just as much as your ideas. They need to see that you've built a professional, repeatable system for making and managing investments.

Once investors are on board, you formalize their commitment with a signed subscription agreement. From there, you'll begin issuing capital calls to bring in the funds needed for operations and your initial investments. Managing this flow of capital is fundamental to maintaining trust. If this is new territory for you, take the time to get familiar with the mechanics by understanding the capital call definition.

While you’re out raising money, you also have to be building the engine of your firm in the background. Your operational infrastructure is what allows you to actually deploy capital, track performance, and report back to your limited partners. Don't make the classic mistake of treating this as an afterthought.

Here's what you need to get in place right away:

A disciplined investment strategy is always stronger when it's informed by history. Long-term data, like the kind found in the UBS Global Investment Returns Yearbook which analyzes 125 years of data across 35 markets, is invaluable. It shows how diversification and a deep understanding of market cycles can help build more resilient portfolios. Use this kind of historical perspective to design strategies built on proven risk-reward principles that can withstand volatility.

The last piece of the puzzle is your team. In the beginning, this might just be the founders and maybe a part-time administrator. What's important is that every role is clearly defined—from who handles deal sourcing and due diligence to who manages compliance and investor relations. A well-oiled operational machine frees you up to focus on the one thing that matters most: executing your investment strategy and delivering returns.

Even with the best-laid plans, starting an investment firm always brings up a handful of persistent, tricky questions. It's completely normal. Tackling these common uncertainties head-on is one of the smartest things you can do to avoid major headaches later.

Think of these as the real-world issues that can quietly derail a new firm. Getting clear, practical answers now will save you a ton of time, money, and stress down the road.

This is the big one, and the honest answer is: it really depends on your specific strategy and which regulations you'll fall under. There's no single magic number. Your capital needs are a direct reflection of your ambitions and the rules of the game.

For instance, if you're aiming to become a Registered Investment Adviser (RIA) with the SEC, you're often looking at a high bar for Assets Under Management (AUM). You might need commitments for $25 million or more before you can even register.

But if you're registering at the state level or operating under an exemption, the financial picture shifts. The focus turns to your operational runway—the cash you need to keep the lights on. This typically breaks down into:

Legally? Yes, you can. It's possible to be the sole owner of a C-corp or form a single-member LLC. But from a practical standpoint—and this is critical—going it alone is an incredibly tough climb.

Founder's Insight: Think about all the hats you'd have to wear. A successful firm demands expertise in deal sourcing, due diligence, portfolio management, compliance, investor relations, and fundraising. It's almost impossible for one person to be a true expert in all of these areas, and both investors and regulators know it.

A solo founder can be a major red flag for sophisticated investors. They want to see a team with complementary skills. It shows depth, spreads the workload, and provides a clear succession plan if something happens to you. A strong founding team simply inspires more confidence than a one-person show ever will.

Compliance isn't a one-and-done task you check off during setup. It's a continuous process that needs to be woven into the very fabric of your daily operations. Once you're up and running, these duties are constant and non-negotiable.

Here’s a snapshot of what you'll be managing:

On top of all that, you have to constantly watch for conflicts of interest and ensure every piece of marketing material is fair, balanced, and not misleading. This is exactly why most firms either hire a dedicated Chief Compliance Officer (CCO) or outsource this critical function to a specialist firm.

This is a point of frequent confusion, but the distinction comes down to their core purpose.

An investment corporation is an active business. Its main job is to manage a portfolio of securities—stocks, bonds, private equity—to generate returns for its investors. It’s in the business of investing.

A holding company, on the other hand, is usually a passive entity. Its primary function is simply to own a controlling stake in other companies, known as its subsidiaries. The goal isn’t active trading but long-term control and strategic oversight. Its income comes from the profits and dividends of the companies it owns, not from short-term portfolio gains.

Ready to move beyond spreadsheets and build an institutional-grade operation? Fundpilot empowers emerging managers to automate fund administration, deliver professional LP reports, and streamline compliance. See how over 500 funds are scaling faster by booking a demo at Fundpilot.