Learn how to set up a venture capital firm with this practical guide. We cover your investment thesis, legal structure, fundraising, and team building.

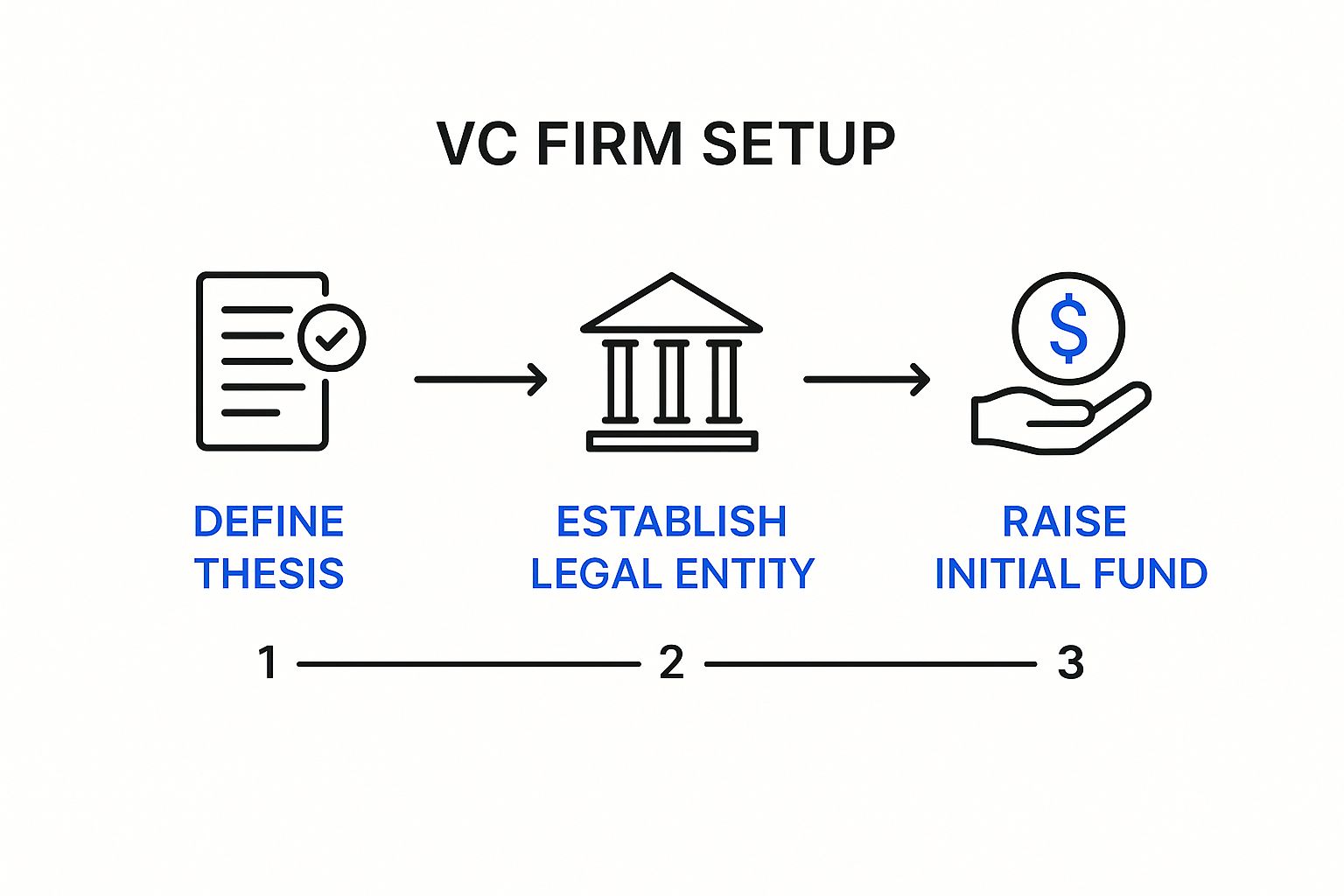

Starting a venture capital firm is a massive undertaking that really boils down to three core pillars: crafting a unique investment thesis, setting up the right legal structure, and convincing Limited Partners (LPs) to back you. This initial groundwork defines everything—from your focus on SaaS or fintech to the entire operational playbook for how you'll invest.

Before you even think about raising a single dollar or looking at a deal, you have to build a rock-solid foundation. This is where your big idea gets hammered into a real, actionable plan. The absolute cornerstone of that plan is your investment thesis. Think of it as your firm's constitution—it clearly states what you invest in, why you're the right person to do it, and how you plan to make money for your investors.

In today's venture landscape, a vague thesis like "investing in great founders" is a non-starter. You need to be specific. Your thesis is your North Star for making decisions, but it's also your primary marketing tool for attracting both capital and top-tier founders.

You need to have sharp, clear answers to a few critical questions:

For example, a strong thesis sounds something like this: "We're a $25M seed-stage fund backing B2B fintech startups in the Midwest led by second-time founders. Our team's experience building and selling a payments company gives us a unique network and a playbook for helping our portfolio scale." See the difference? It's specific, credible, and tells a compelling story.

The timeline below gives you a bird's-eye view of the entire setup process, and it all starts with nailing down that thesis.

As you can see, a powerful thesis isn't just a nice-to-have; it's the mandatory first step before you can even begin thinking about the legal and fundraising grind.

Your investment thesis isn't just a document; it's the blueprint for your entire firm. It directly influences your legal structure, the kind of LPs you'll target, and the team you need to build around you.

A well-defined thesis is your best filter. It gives you the conviction to say "no" to the shiny objects and focus your energy only on the deals that fit your strategy perfectly. That kind of discipline is how you build a great reputation and a top-quartile track record.

This initial stage is all about strategy and pressure-testing your ideas. Talk to potential LPs. Run it by trusted advisors. Pitch it to founders. The feedback you get here is invaluable for refining your focus. Get this foundation right, because everything else—fund formation, fundraising, and making that first great investment—depends on it.

To give you a clearer sense of the road ahead, here’s a breakdown of the typical milestones and timelines you can expect when launching your firm.

This table summarizes the core phases and estimated timelines for getting a new venture capital fund off the ground.

| Phase | Key Activities | Estimated Timeline |

|---|---|---|

| Phase 1: Foundation & Thesis | Define investment thesis, market map, and firm strategy. | 1–3 Months |

| Phase 2: Pre-Marketing & Legal | Engage legal counsel, draft preliminary fund documents (PPM, LPA). | 2–4 Months |

| Phase 3: Active Fundraising | Pitch to LPs, hold first close, begin collecting capital. | 6–12 Months |

| Phase 4: Operations & First Close | Finalize legal docs, set up bank accounts, launch fund operations. | Contingent on Fundraising |

| Phase 5: Deployment & Management | Source deals, conduct due diligence, make first investments. | Ongoing after First Close |

Remember, these timelines are just estimates. The fundraising phase, in particular, can vary wildly depending on your network, track record, and the overall market climate. But having a clear map of the journey is the first step toward reaching your destination.

Once you've honed your investment thesis, it's time to build the actual structure that will house your new venture capital firm. This is far more than just paperwork; it’s the skeleton of your entire operation. This framework dictates how you raise capital, invest in companies, and ultimately, deliver returns to your investors. Getting this right from day one is non-negotiable.

The go-to structure in the venture world, for good reason, is the Limited Partnership. This model creates a clean separation between you, the fund manager, and your investors. You'll operate as the General Partner (GP), with your investors acting as Limited Partners (LPs).

This setup is the industry standard because it works. It shields your LPs from liability beyond their committed capital—a huge selling point. At the same time, it gives you, the GP, the clear authority to manage the fund's day-to-day business, from sourcing deals to signing checks.

Let me be blunt: this is one of the worst places to try and cut costs. Hiring a generalist lawyer to save a few bucks is a rookie mistake. You absolutely need a law firm with deep, specific experience in fund formation. Think of them as your guide through the labyrinth of securities laws and complex documentation.

An experienced fund formation attorney does much more than just draft documents. They're a strategic partner. They'll advise you on market-standard terms, help you get ahead of potential LP concerns, and ensure you're squared away with all the regulatory bodies. The price tag for setting up a VC fund can run anywhere from $30,000 to over $200,000, but consider it an insurance policy against catastrophic and expensive mistakes down the road. A top-tier legal foundation sends a clear signal to LPs that you’re a serious, professional operator.

Your legal team will quarterback the creation of several crucial documents that serve as the contract between you and your investors. It’s essential you understand what’s in them. Two documents, in particular, are the bedrock of your fund.

Limited Partnership Agreement (LPA): This is the bible for your fund. The LPA is the definitive legal agreement that lays out all the rules of the road—from the fund's lifespan and investment period to the economic splits and the specific rights of both the GP and LPs. It's a dense read, but it’s the ultimate rulebook.

Private Placement Memorandum (PPM): Think of the PPM as your fund's business plan and official disclosure document. It’s where you lay out your investment thesis, the bios of your team, all the potential risks, and the fund's terms. It’s a cornerstone of your fundraising pitch.

Getting these documents right requires real expertise. For a more detailed look into these critical legal components, check out our comprehensive guide on the legal aspects of fund management.

Your LPA and PPM aren't just legal formalities; they are trust-building tools. Clear, fair, and standard terms show potential LPs that you're a credible steward for their capital. Any ambiguity or off-market terms will be a major red flag for sophisticated investors.

The financial terms of your fund have to be competitive enough to attract investors but sustainable enough to let you build a real business. The industry-standard model is known as "2 and 20," and it has two main parts.

Management Fee: This is the annual fee, typically 1.5% to 2.5% of the total fund size, that the GP collects to cover the firm’s operating expenses. We're talking salaries, rent, travel, and the software needed to run a modern firm. For a $20M fund, a 2% management fee works out to $400,000 a year to keep the lights on.

Carried Interest ("Carry"): This is your slice of the profits, almost always 20%. It's the primary economic incentive that drives you to generate outstanding returns. Crucially, carry is only paid after your LPs have gotten all of their initial investment back, which keeps everyone’s interests aligned.

Of course, these terms aren't set in stone. As a first-time manager, you might need to offer slightly more LP-friendly terms to get those first commitments. This could mean a lower management fee or adding a "hurdle rate"—a minimum return threshold LPs must hit before you start earning your carry. It's all about finding that sweet spot: a structure that lets you build a lasting firm while fairly rewarding your investors for backing your vision.

With your legal and financial plumbing in place, the real work begins: raising the capital. This is where your carefully constructed investment thesis collides with market reality. Your success now boils down to one thing—convincing Limited Partners (LPs) that your fund isn't just a compelling idea, but the smartest place for them to put their money.

The pitch deck is your primary weapon, but a common trap is creating a dry document choked with data. The best pitch decks tell a story. They weave a clear narrative about a huge market opportunity, your team’s unique insight into it, and a believable strategy to capitalize on it.

Before you even think about opening PowerPoint, you need to nail down your core message. Put yourself in an LP's shoes—they see hundreds of these pitches. What makes yours memorable? Your story needs to be sharp, credible, and stick in their mind long after the meeting ends.

This is all about turning your thesis into a powerful narrative. For instance, don't just say you're investing in B2B SaaS. Explain why now. Maybe you've spotted a new wave of AI automation that legacy players are sleeping on, and your team's background gives you an inside track with the founders building it.

A great pitch doesn't just present facts; it builds conviction. It leaves an LP feeling that passing on your fund would be a massive missed opportunity.

Think of your pitch deck as your ambassador; it often gets to LPs before you do. It has to look professional, get to the point quickly, and be genuinely persuasive. While the exact structure can shift, a winning deck for a first-time fund needs to hit these key points:

For more hands-on guidance on building out your strategy and materials, you can find some fantastic resources for emerging managers over at the Fundpilot blog.

Fundraising is sales. Period. It demands the same discipline, organization, and relentless follow-up. Don't just spray and pray with emails; a structured, thoughtful approach will save you months and dramatically improve your odds.

Start by building a hyper-targeted list of potential LPs. This isn't a numbers game. Research every single one to understand their investment history and typical check size. Your best bet is to find LPs who have backed first-time managers before or have a public interest in your specific sector.

You also have to be acutely aware of the market environment. The venture world has been on a rollercoaster. Global VC funding hit an incredible $643 billion in 2021 before macroeconomic headwinds slammed the brakes, causing it to fall back to $214 billion by 2023. This climate makes LPs extra cautious. They want to see a clear path to profitability and strong capital discipline.

Navigating this means being ready for intense due diligence. LPs will pick apart your track record, challenge your assumptions, and call your references. Be prepared, be transparent, and treat every interaction as a chance to build a relationship—even a "no" on Fund I could be a "yes" on Fund II. Your reputation is the only asset that truly matters in the long run.

A venture capital firm is the ultimate bet on people, and that starts with the team you build around your own table. When you're pitching Limited Partners, your founding team is your single most important asset. They aren't just buying into your investment thesis; they're betting on your team's collective ability to actually pull it off.

This is about more than just finding co-founders with impressive resumes. You're building a partnership that needs to weather market cycles, high-stakes negotiations, and incredibly tough decisions. That requires a rare mix of complementary skills, a deeply shared vision, and genuine, hard-earned trust.

When you're sketching out your firm's structure, think about the core functions essential for success. You can't be an expert in everything. Most successful emerging manager teams are a blend of investment acumen and operational savvy.

General Partners (GPs): These are the leaders, the final decision-makers. They're on the hook for raising the fund, defining the investment strategy, and giving the green light on deals. A powerful GP duo often pairs someone with a deep finance or investing background with a partner who’s been in the trenches as a founder or operator.

Principals or Associates: Think of this group as the engine room for your deal flow. They’re the ones sourcing new opportunities, running the initial diligence, building financial models, and fostering relationships with founders. They are your future partners in training.

Venture Partners: This role is more flexible and often part-time. Venture Partners are typically seasoned execs or successful founders who bring a specialized network or deep domain expertise to the table. They’ll help you source and diligence deals in their specific niche but aren't bogged down in the firm's day-to-day management.

The best teams tell a compelling story. An ex-founder who built and sold a fintech company teaming up with a seasoned investor who has managed institutional money? That’s a narrative that gives LPs confidence in both your deal flow and your process.

Beyond your core operating team, a thoughtfully constructed advisory board can give a first-time fund a massive credibility boost. These aren’t just logos to slap on a website; they are strategic assets who can open doors that would otherwise remain shut.

An effective advisory board is made up of industry veterans and respected founders who are genuinely engaged. They can offer invaluable guidance on your investment thesis, make warm introductions to potential LPs and portfolio companies, and act as a critical sounding board when you're facing a tough call. Choosing the right advisors shows LPs you have the humility to seek counsel and the network to attract top-tier talent.

Finally, you need to structure compensation so that everyone is pulling in the same direction for the long haul. The primary way to do this is with carried interest, or "carry."

By giving every key member of your team a piece of the fund's profits, you create a powerful incentive for the entire group to succeed together. This allocation needs to reflect each person's contribution, from the GPs who take on the most risk to the principals who are vital for execution. Being transparent about these structures from day one is absolutely crucial for building a cohesive and motivated team.

If you’re navigating the complexities of team structure and fund operations, it can be incredibly helpful to connect with experts in fund administration who have seen what works—and what doesn't—across hundreds of emerging funds.

Once your legal docs are signed and you're out talking to LPs, your focus has to shift to the inside game: building the engine that will actually run your firm. A venture firm is a complex beast, and trying to manage it with a mess of spreadsheets and manual reminders is a surefire way to drop the ball on a great deal or, worse, frustrate the very people who trusted you with their capital.

Building a solid operational engine from day one is how you professionalize your firm and create a foundation that won't crack as you start to scale. This isn't just about software—it's about defining the process for everything you do. How do you find and track new companies? How do you manage your relationships with founders? And crucially, how do you report back to your LPs? Get this right, and you'll be able to move with the speed and confidence that great deals demand.

The modern VC firm simply can't function without a curated set of tools built for the unique workflow of an investor. The whole point is to create a single source of truth for the data that matters most: your network, your pipeline, and the performance of your portfolio companies.

At a bare minimum, your tech stack needs to cover these three core areas:

Think of these tools as a force multiplier for your team. They handle the administrative grind so you can spend your time on what actually creates value—finding and backing the next generation of incredible companies.

Your operational infrastructure sends a powerful signal to LPs. A firm that uses institutional-grade tools for reporting and administration demonstrates a level of professionalism and foresight that builds immense confidence, especially for a first-time fund.

Let’s be clear: when you operate a venture fund, you are a fiduciary. That's a legal term with real teeth, meaning you are bound by law and ethics to act in the best interests of your investors. This responsibility comes with a whole host of regulatory requirements, mostly coming from the Securities and Exchange Commission (SEC).

Your lawyers will handle the nitty-gritty, but you have to understand the playing field. Most emerging VC firms register as an Exempt Reporting Adviser (ERA), which has a lighter reporting load than a full-blown Registered Investment Adviser (RIA). But "lighter" doesn't mean "non-existent." You'll still have to file a Form ADV with the SEC every year and follow very strict anti-fraud rules.

Compliance isn't something you set up once and forget about. It's an ongoing process. We're talking about everything from keeping meticulous records in case of an audit to having crystal-clear policies on how you handle potential conflicts of interest. Skimping on this can bring serious penalties and do lasting damage to your reputation.

Fund administration is the back-office plumbing that keeps everything flowing. It’s the unglamorous but absolutely essential work of managing your investors' capital.

This is the nuts and bolts of:

Don't underestimate the scale of this work. In 2023 alone, the 3,417 VC firms in the U.S. were sitting on a record $311.6 billion in "dry powder"—capital just waiting to be called and put to work. As you can see in the latest yearbook from the National Venture Capital Association, managing these huge sums requires absolute precision. Building a seamless operational engine isn't a nice-to-have anymore; it's what it takes to even compete.

Alright, you’ve built the machine. You’ve raised the capital. Now it’s time to actually do the job. This is where your investment thesis gets put through the wringer, and where reputations are made or broken.

Making sharp investments and then rolling up your sleeves to help those companies win is the entire point. It's the only way you'll build the kind of track record that has LPs lining up for your next fund. This final phase covers everything from hunting down standout deals to engineering a successful exit—and all the hard work in between.

Great deals don’t just fall into your lap. If you're only looking at the inbound pitches everyone else is seeing, you're already behind. You have to go out and find the real gems before they hit the market.

This means building a genuine network, not just collecting contacts. Forget passively attending demo days. Instead, build real relationships with angel investors, niche corporate lawyers, and early-stage founders who are in the trenches. They’ll become your eyes and ears.

A powerful sourcing engine is usually a mix of a few key things:

Once you have a promising company in the pipeline, the real detective work begins. Sure, you have to run the numbers and check the market size, but top-tier diligence goes so much deeper than the financials. You're trying to uncover the intangibles that make or break a startup.

Your mission is to stress-test the founder’s assumptions. Don't just read the pitch deck—go talk to their customers. Are they just happy, or are they true fanatics? Conduct backdoor reference checks on the founding team to get a real sense of their grit, leadership style, and how they handle pressure.

True diligence isn't about finding reasons to say no. It’s about building the conviction needed to say yes and then knowing exactly where you need to help that company once you’ve invested.

This qualitative deep dive—getting a feel for team dynamics, founder resilience, and market timing—is what separates the good investors from the great ones.

The term sheet is the blueprint for your partnership with a founder. It’s a critical document, and while your primary job is to protect your fund's capital, a lopsided, founder-unfriendly term sheet can kill the relationship before it even starts.

Aim for a balanced deal. The key points of negotiation usually boil down to:

The goal is to structure a deal that provides downside protection for your LPs while keeping the founding team fired up and focused on building a massive business.

The moment your wire transfer clears is when the real work truly begins. The best VCs are active partners, not just names on a cap table. The support you provide becomes a core part of your firm's brand—it's why the best founders will choose your term sheet over a competitor's.

Meaningful, hands-on support usually falls into a few key buckets:

This is the stuff that builds legendary firms. This hands-on, value-add work is what drives the outsized returns your LPs are counting on and completes the puzzle of building a venture capital firm that lasts.

If you're thinking about launching your own venture capital firm, you've probably got a million questions swirling around. It's a massive undertaking. Let's tackle some of the most common ones I hear from aspiring fund managers to give you some clarity and a solid footing.

This is the big one, isn't it? While there’s no single answer, most first-time, micro-VC funds target somewhere between $10 million and $50 million.

Honestly, the "right" number comes down to your investment thesis. If your plan is to write $250,000 checks into pre-seed startups, your capital needs are worlds apart from a Series A fund that needs to lead $3 million rounds. You have to work backward from your strategy.

And don't forget your GP commitment. This is your own cash you're putting into the fund. LPs need to see you have real skin in the game, and the industry standard is 1-3% of the total fund size. So, for a $20 million fund, you and your partners better be ready to cough up between $200,000 and $600,000.

Getting this straight is non-negotiable. The roles are completely different, with unique responsibilities and, crucially, different levels of liability.

General Partners (GPs): You. The managers. You're the ones running the show—sourcing deals, doing the diligence, making investment decisions, and working with your portfolio companies. The GP is the engine of the firm.

Limited Partners (LPs): The investors. LPs provide the vast majority of the capital. They're your endowments, family offices, and wealthy individuals who are entrusting their money to you. Critically, their liability is limited to their investment amount. They aren't on the hook for anything beyond that.

Here’s a simple way to think about it: The GPs are the pilots flying the plane. The LPs are the passengers who bought a ticket. The pilots are in complete control, but they have a fiduciary duty—a deep responsibility—to get their passengers to the destination safely and profitably.

Brace yourself. This is a marathon, not a sprint. For a first-time manager, fundraising is a grueling process that will test your resolve. From the moment you start building your deck to your first close, you're realistically looking at 12 to 24 months.

This isn't just about a few meetings. It's an all-out campaign. You'll spend months refining your pitch, building a pipeline of potential LPs, and taking hundreds of meetings—most of which will go nowhere. The LPs who do get interested will put you and your strategy under a microscope. Building that level of trust and conviction simply takes time. Patience and persistence aren't just virtues here; they're requirements.

Ready to graduate from spreadsheets and build a back office that inspires confidence? Fundpilot gives emerging managers the institutional-grade tools they need for professional LP reporting, streamlined fund administration, and audit-ready compliance. We help you focus on what you do best—finding and funding the next great companies. See how we can help you scale by visiting Fundpilot.