Learn how to reduce operational costs efficiently with expert tips on automation, tech upgrades, and process improvements. Start saving today!

If you're managing a fund, figuring out how to reduce operational costs isn't just a box-ticking exercise anymore. It’s a core strategy for staying competitive and profitable. The most effective way I've seen this done is by combining a few key moves: rooting out operational waste, smartly automating what you can, and upgrading your tech stack. Get this right, and you build a resilient, cost-effective operation that’s ready for growth.

In the fund management world we live in, the pressure is always on. We need to deliver great returns while investors expect more transparency and faster communication than ever before. The old way of cutting costs—like a sudden budget freeze—just doesn't cut it. These reactive measures are blunt instruments that often hurt morale and stall growth without fixing the underlying problems.

The real profit killers are the subtle, day-to-day operational frictions. Think about it: how many hours does your team sink into manual reconciliations every single month? What about the compliance risks lurking in all those disconnected spreadsheets? These aren't just small annoyances; they are significant financial leaks that add up fast.

This is where a proactive mindset becomes crucial. It’s about moving beyond simply slashing budgets and instead building a lean, agile operational model from the ground up. You know you’ve achieved true efficiency when your processes and technology are so well-aligned that your team is free to focus on what really matters: sourcing deals, nurturing investor relationships, and performing deep strategic analysis.

The goal is to transform your operations from a cost center into a strategic asset. By optimizing workflows and embracing modern tools, you create a scalable foundation that can support fund growth without a proportional increase in overhead.

This kind of strategic shift isn't a single project; it's a combination of smart moves. The most successful firms I've seen integrate quick operational wins with long-term structural investments. This might involve applying Lean principles to eliminate wasted steps, setting up digital workflows to automate repetitive tasks, and swapping out clunky legacy systems for more modern, scalable solutions.

To get a handle on where you can make the most significant impact, you need to conduct an honest assessment of how time and resources are really being spent across your firm. This exercise often reveals a handful of critical areas ripe for improvement.

We've compiled a quick summary of these focus areas below. This table breaks down the common challenges fund managers face and the strategic solutions that can lead to major cost savings.

| Operational Area | Primary Challenge | Strategic Solution |

|---|---|---|

| Manual Data Entry & Reconciliation | High time consumption, prone to human error, and creates compliance risks. | Implement automated data capture and reconciliation tools to reduce manual touchpoints. |

| Investor Reporting & Communications | Slow, labor-intensive process, often leading to inconsistent investor experiences. | Adopt a centralized investor portal for automated, secure, and on-demand reporting. |

| Compliance & Regulatory Filings | Complex, ever-changing requirements managed across disparate systems. | Use a unified platform with built-in compliance workflows and automated audit trails. |

| Legacy Technology & Data Silos | Outdated systems that don't integrate, causing workflow bottlenecks and poor data access. | Modernize the tech stack with a cloud-based, all-in-one fund management solution. |

By zeroing in on these specific operational areas, you're not just cutting costs—you're making your entire firm more robust and efficient.

Making these changes doesn't just lower your expense line. It boosts accuracy, speeds up reporting cycles, and seriously enhances the experience for your investors. For a more detailed look at these concepts, take a look at our complete guide on operational efficiency improvement for fund managers.

If you want to meaningfully cut operational costs, you first have to get an honest look at where your time and money are actually going. I see it all the time—fund managers know they're bogged down by admin work, but they can't put their finger on the exact cause. It's time to move past gut feelings and conduct a practical operational audit to see where the real inefficiencies lie.

Start by sketching out your core workflows. This doesn't have to be some overly complicated diagram. Just trace the path of key processes from beginning to end. Think about the entire lifecycle of an investment, from sourcing a deal to the final exit and reporting. Where are the bottlenecks? Where is your team constantly switching between systems or, worse, re-keying the same data into multiple spreadsheets?

Those friction points are exactly where you should focus your efforts.

For most emerging funds, the waste is hiding in plain sight, tangled up in day-to-day tasks. The hours spent reconciling investor data or the administrative headache of manually preparing and sending out updates are prime examples. These aren't just time-sucks; they open the door to human error, which can be far more expensive to clean up later.

In my experience, the usual suspects include:

This is where smart automation comes into play, as it’s central to modern operational efficiency.

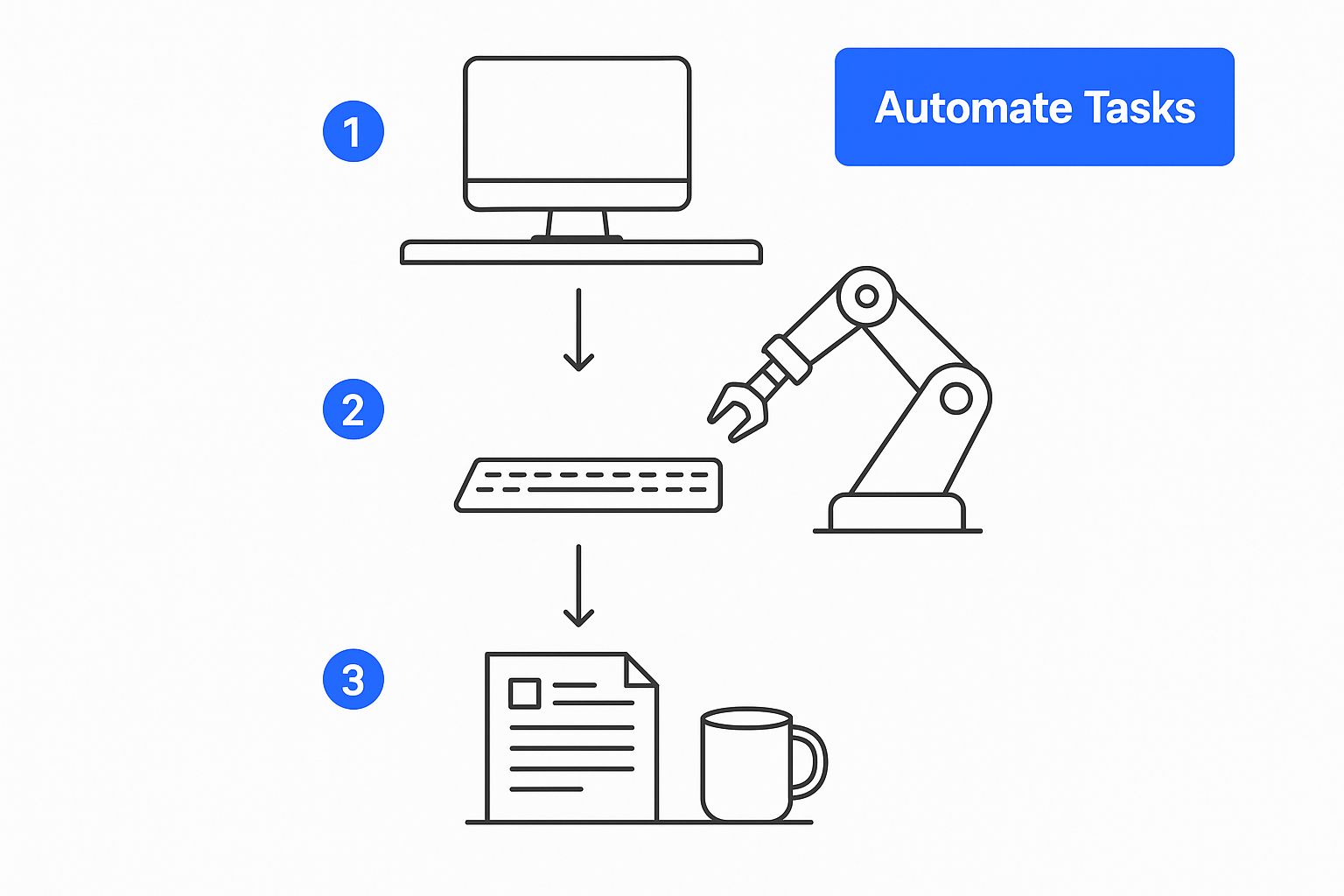

As the image shows, a big part of reducing operational drag is simply letting technology handle the repetitive keyboard work. This frees up your sharpest minds for what really matters.

As the image shows, a big part of reducing operational drag is simply letting technology handle the repetitive keyboard work. This frees up your sharpest minds for what really matters.

Once you’ve mapped out the workflows, the next step is to put some real numbers behind them. You don't need to get out a stopwatch for every little thing, but you should estimate the hours and resources tied to each stage. For example, if your team is burning 15 hours a month manually reconciling data for investor reports, you’ve just quantified a major operational drain.

The goal here is to build a data-backed case for change. It’s much more powerful to say, "We're spending X hours and Y dollars on this manual process," because it makes it incredibly clear which problems to tackle first for the biggest impact.

This detailed review is the foundation for any real cost-saving initiative. A great way to get started is by building a simple but effective audit framework. To help you out, you can learn how to build a better internal audit checklist template that’s tailored to your fund’s unique operations. Using a structured checklist helps you systematically find inefficiencies instead of just guessing.

By turning that vague feeling of being "too busy" into a concrete list of bottlenecks, you can be strategic about where modern tools like Fundpilot can deliver the highest return. This focused approach is what makes your cost-cutting efforts both successful and sustainable.

Alright, you’ve done the hard work of mapping your workflows and finding the snags. Now comes the powerful part: bringing in automation to slash those operational costs and really prime your fund for growth.

Let’s be clear—this isn’t about robots taking over. It's about giving your sharp, talented team the freedom to stop wrestling with tedious tasks and start focusing on what truly matters: strategic thinking and building rock-solid investor relationships.

For smaller or emerging funds, the right automation is a game-changer. It's like adding a superpower to your lean team without blowing up the payroll. We've seen firms take tasks that once ate up days of manual work and shrink them down to just a few minutes. The impact on labor costs and the risk of costly human error is immediate.

If there's one classic time-drain, it's investor onboarding. I can't count the number of managers I've spoken to who are bogged down by manually processing subscription documents. It’s a messy cycle of back-and-forth emails, chasing down missing signatures, and tediously re-typing data. This isn't just slow; it's a frustrating first impression for your LPs.

Now, picture this with a smart, automated workflow. Using a platform like Fundpilot, you can set up a secure, white-labeled digital portal. Investors log in, fill out their sub-docs online, and the system guides them through it. No more guesswork. It ensures every required field is completed and captures digital signatures, giving you a perfect data set from day one.

Switching to a digital-first approach pays off in several ways:

The outcome? A huge drop in the administrative hours you burn during a fundraise. All that time can now be spent securing capital, not chasing paper.

Capital calls and distributions are another area where manual processes can really hurt. The old way involves wrestling with complex spreadsheets, drafting individual notice letters, and then manually tracking every payment that comes in. It’s a minefield of potential mistakes.

A single mistake in a capital call calculation can seriously damage an investor relationship you've spent years building. Automation is your best defense, ensuring accuracy and consistency every single time.

This is where modern fund administration platforms really shine. The entire workflow becomes automated. Need to make a capital call? A few clicks can set it in motion for the whole fund. The system handles all the tricky pro-rata math, generates personalized notices for each LP, and delivers them through the secure investor portal.

The same goes for distributions. The platform manages the waterfall calculations and produces all the necessary documentation, leaving a clean, auditable record of every single transaction. What was once a high-stress, error-prone headache becomes a controlled, routine event.

Firms that make this shift consistently tell us they see a massive reduction in time spent on fund administration. That time saved translates directly to your bottom line and frees up your best people for more valuable, strategic initiatives.

If you're still running your fund on legacy, on-premise systems, you're likely bleeding money without even realizing it. These old-school setups are a major source of hidden operational costs. They create frustrating data silos, demand constant (and expensive) maintenance, and lock your team into rigid, inefficient workflows. Making a real, long-term dent in your operational costs means building a strong case for a modern, cloud-based technology stack.

The financial upside of ditching on-premise servers is both immediate and significant. Right away, you get to stop buying expensive hardware and slash your IT overhead. You also gain the agility of a scalable, pay-as-you-go model, which means you’re no longer paying for server capacity you aren’t even using.

But the savings go far beyond just hardware. The true advantage of a modern tech stack is its ability to create a single, reliable source of information for your entire firm.

When everyone—from your back office to your investor relations team—is working from the same unified platform, the expensive mistakes and delays caused by fragmented data simply vanish.

Think about your team getting ready for a due diligence request. Instead of frantically trying to reconcile data from five different spreadsheets and a disconnected CRM, they can log into one clean, centralized system. This is precisely where a modern platform like Fundpilot proves its worth. With all portfolio data, investor communications, and compliance documents in one place, everyone is finally on the same page.

This cohesive approach creates a positive ripple effect across your entire operation. A perfect example is managing complex fund structures. Rather than wrestling with error-prone spreadsheets that breed confusion and risk, a unified system brings clarity and control to the process. For anyone dealing with these intricate investment vehicles, our guide on fund to fund accounting shows just how much modern tools can simplify things.

This move toward a unified, cloud-based environment has only been sped up by recent market shifts. The widespread adoption of hybrid and remote work has made secure, accessible cloud platforms a necessity, not a luxury. Firms that have embraced this model have seen major overhead reductions in areas like office rent and utilities. A key piece of this puzzle is cloud computing, which eliminates the need for on-site servers and all the costs that come with them. You can find more insights on how these cost-cutting strategies are reshaping business at OneC1.com.

By adopting a unified, cloud-based system, you're not just buying software; you're investing in a more resilient and scalable operational model. You reduce risk, enhance team productivity, and build a foundation that can support growth without a linear increase in headcount.

Sustainable savings aren't born from a single project or a frantic, end-of-quarter budget slash. I've seen too many firms try that, and it rarely works for long. Real, lasting success in cutting operational costs comes from a deep cultural shift. It’s about weaving a mindset of financial stewardship and continuous improvement into the very fabric of your firm.

This means everyone, from the back office to investor relations, needs to understand how their work impacts the bottom line. Instead of reacting to financial pressure with painful, often morale-killing cuts, a proactive culture constantly seeks out small, incremental gains. This approach turns cost management from a dreaded chore into an ongoing, strategic discipline. You're not just managing expenses; you're actively building a more resilient business that can thrive in any market without sacrificing its growth ambitions.

While looking inward at your own processes is critical, sometimes the biggest savings are hiding in plain sight, just beyond your immediate view. This is where bringing in specialized services can be a game-changer. External experts, armed with sophisticated AI and data analytics, can often spot inefficiencies that an internal team, caught up in the day-to-day grind, might easily miss.

This isn't just a fringe concept—it's a fast-growing strategy for firms that are serious about their financial health. The global market for these cost reduction services is expected to nearly double, jumping from $123.6 million in 2025 to $242.4 million by 2032. You can read more about this trend toward specialized cost optimization at Coherent Market Insights. This boom highlights a major strategic pivot: businesses are finally moving away from reactive budget cuts and toward proactive, data-informed financial management.

So, how do you make this cultural change stick? It all starts with empowering your team and giving them the right tools for the job. When you bring in a platform like Fundpilot, you're doing more than just automating a few tasks. You’re handing your team the data and visibility they need to make smarter financial decisions, day in and day out.

Proactive cost management is a marathon, not a sprint. It’s built on a foundation of consistent, daily actions that prioritize efficiency, not on occasional, disruptive cuts that harm morale and stall progress.

This approach ensures your firm is always operating at its leanest and most effective. A few key areas are perfect for integrating this culture:

By adopting this forward-looking discipline, you create a more profitable, more resilient firm—one that's ready to seize opportunities without being dragged down by operational friction. This cultural change is the ultimate answer to the question of how to reduce operational costs for good.

When you're looking to cut down on operational costs, it’s natural to have a lot of questions. Most fund managers I talk to know they need to get leaner, but they aren't always sure where to start. Let's tackle some of the most common things that come up and give you some practical answers to get you moving in the right direction.

Before you do anything else, you have to do an honest operational audit. Seriously. You can't fix a problem you can't see clearly. It's tempting to jump straight to a new tool, but without understanding your real bottlenecks, you're just guessing.

Start with one core process—let's say investor onboarding or your quarterly reporting cycle. Get granular. Map out every single manual step, every time someone has to switch between systems, and every hour that gets burned. This exercise transforms that vague feeling of being "swamped" into a hard list of your biggest time and money sinks. Once you have that, you know exactly where to focus for the biggest return.

Automation isn't about replacing your team; it's about freeing them from the soul-crushing, repetitive tasks that invite errors and kill productivity. It lets your sharpest people focus on what really matters—finding great deals and keeping investors happy.

Here's what that looks like in the real world:

I hear this a lot, and it makes sense on the surface. But this is a classic "spend money to make money" scenario—or in this case, to save it. A smart investment in the right technology isn't just another line item on your expense report. It’s a direct attack on your biggest hidden costs: wasted payroll hours and expensive human errors.

Think of it this way: paying your team to manually copy-paste data between spreadsheets isn't a one-time cost. It's a recurring tax on your efficiency, and it compounds over time. Investing in a platform that eliminates that task for good pays a permanent operational dividend. That initial investment pays for itself by preventing much larger, ongoing expenses down the line.

This is a fantastic and crucial question. The great news is that you no longer need a seven-figure budget for custom software and an in-house server room. The rise of cloud-based, software-as-a-service (SaaS) platforms has completely changed the game.

Platforms like Fundpilot operate on a subscription model, which converts what would have been a massive capital expense into a predictable, manageable operating expense. This gives smaller and emerging funds access to the same institutional-grade tools that the giants use, effectively leveling the playing field. You can start with what you need now and scale your plan as your AUM grows, ensuring you're only ever paying for what you're actually using.

Ready to stop wasting resources on manual processes and start building a more profitable, scalable fund? Fundpilot provides the automated fund administration, professional LP reporting, and centralized data management you need to dramatically reduce operational costs. Book a demo today and see how you can upgrade your operations.