Learn how to invest in venture capital with our expert tips. Discover deal sourcing, due diligence, and key strategies to grow your investments.

Investing in venture capital means you’re funding startups and early-stage companies—the ones with the potential to become household names. You can do this through venture capital funds, angel syndicates, or by making direct investments. The end game is always a significant return when the company exits, either through an acquisition or an IPO. Getting a feel for this ecosystem is the absolute first step before you even think about writing a check.

Before you dive in, you need to understand the high-stakes world of venture capital. This isn't like buying blue-chip stocks on the NYSE. It's a long-term game played with illiquid assets, and success hinges on your ability to spot and back the next wave of disruptive companies. It demands patience, a healthy appetite for risk, and a real understanding of the landscape.

A startup's life is usually tracked by its funding stages. Each stage signals a different level of maturity, which in turn means a different level of risk for an investor like you. The earliest rounds are where the real risk lies, but they also hold the potential for those legendary, outsized returns.

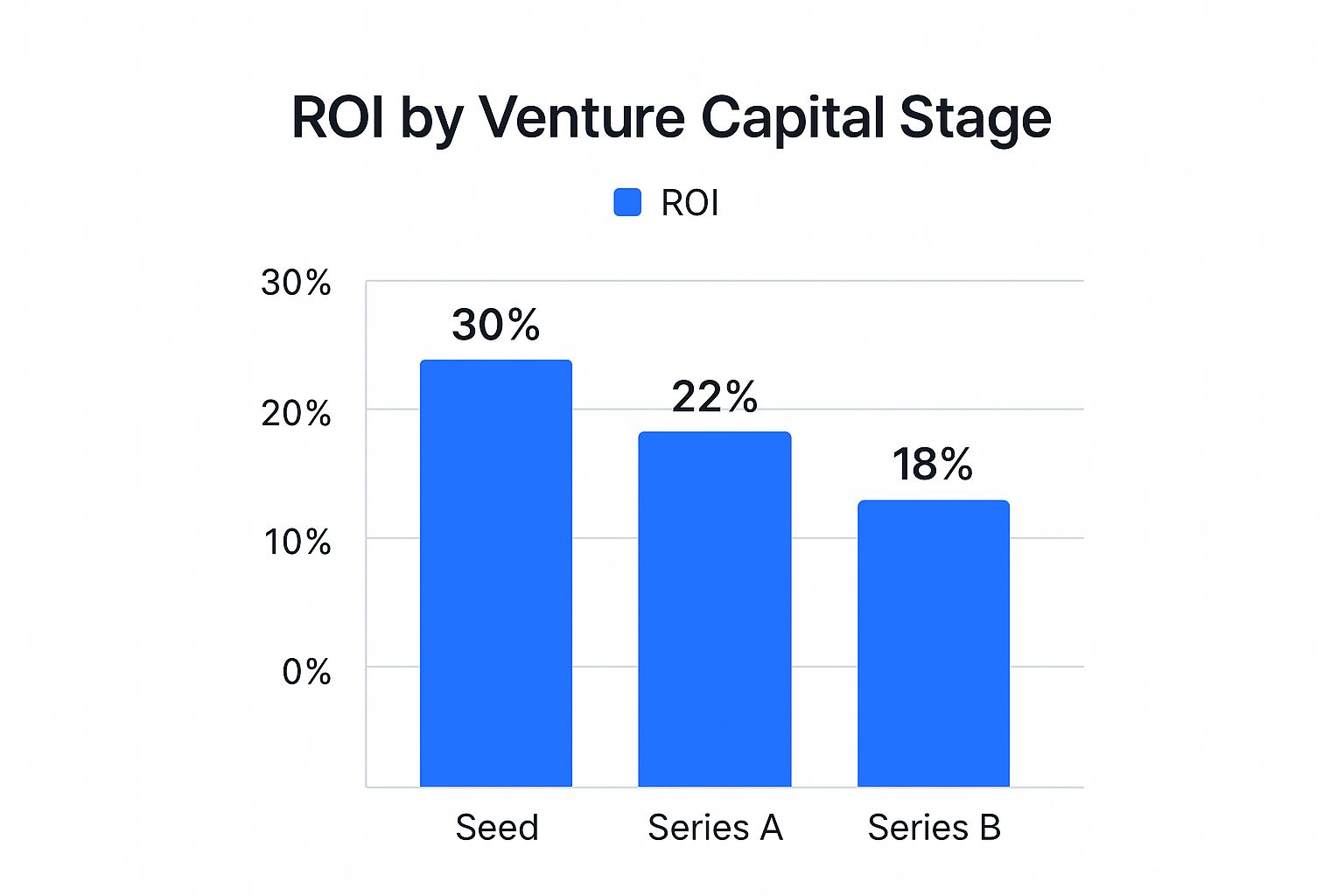

The image below gives you a great visual of how potential returns shift across these early funding stages.

As you can see, the biggest potential ROI is packed into those very first stages. It's the classic high-risk, high-reward nature of seed investing in a nutshell.

How you invest is just as critical as who you invest in. Your approach will determine your level of control, how much capital you need to commit, and how hands-on you'll be. There are a few well-trodden paths, and each has its own pros and cons.

Let's break down the most common ways to get into the venture capital game.

| Investment Method | Typical Capital Outlay | Level of Involvement | Risk Profile | Access to Deals |

|---|---|---|---|---|

| Direct Angel Investing | $25k - $100k+ per deal | High (active advising) | Concentrated (high) | Depends on personal network |

| Angel Syndicates | $5k - $50k per deal | Low to medium | Diversified but still high | Curated by lead investor |

| Venture Capital Fund (LP) | $250k+ over fund life | Very low (passive) | Highly diversified | Broad, fund-managed portfolio |

Each route offers a unique balance of risk and reward. Being a direct angel investor gives you the most control—you write checks straight to startups and often use your experience to help them grow. But it's also a ton of work, from sourcing deals to doing deep diligence.

Joining an angel syndicate is a great middle ground. You get to co-invest alongside an experienced lead who does the heavy lifting, letting you spread smaller amounts of capital across more deals. Finally, becoming a Limited Partner (LP) in a traditional VC fund is the most hands-off option. You commit capital and let the professional General Partners (GPs) handle everything. You get instant diversification, but you give up control over individual investment decisions.

The key is to match your investment approach with your personal financial goals, risk tolerance, and the amount of time you can realistically dedicate. There is no single "best" way; there is only the best way for you.

The VC market doesn't exist in a vacuum; it’s constantly shifting with the broader economy. For instance, global venture capital investment is projected to hit around $400 billion in 2025, which shows a massive amount of capital is still flowing into this space.

However, the story isn't just about the money. Deal volume has been tightening, dropping to 7,551 deals in Q1 2025. This tells us that investors are being more selective. In today's economic climate, they're placing bigger bets on fewer, more promising companies. You can dig into more venture capital statistics on Konvoy.vc to get a better handle on these trends.

Finding the next big thing in venture capital isn't about getting lucky. It’s about building a disciplined system for finding and vetting deals. Your deal flow—the constant stream of investment opportunities—is the absolute lifeblood of your success as an investor. Without a steady flow of high-quality opportunities, even the most brilliant analysis is worthless.

The truth is, the best deals are almost never publicly advertised. They surface through trusted relationships and proactive digging. This is where your network becomes your single most valuable asset. The goal isn't just to know people; it's to become a respected, value-add investor in a specific niche people want to bring deals to.

The first real step is creating a machine that consistently uncovers promising companies. This means blending old-school networking with modern digital platforms to cast a wide, but very strategic, net.

Your network is your first and best filter. Get serious about connecting with other investors, experienced founders, and true industry experts. I’ve found that attending smaller, niche industry events yields far better results than massive, generic tech conferences. Focus on building real relationships, not just collecting business cards. It's in those genuine conversations that insights—and eventually, deals—are shared.

Here are a few practical ways to get the ball rolling:

Platforms like AngelList have become essential tools for discovering deals and even joining syndicates.

These sites act as a curated marketplace, letting you review pitch decks, connect directly with founders, and pool capital with seasoned investors leading the charge.

Once deals start hitting your inbox, you need a quick and effective way to sort the signal from the noise. Not every company deserves hours of your time. A simple, initial screening process is key to focusing your energy where it matters most.

For that first glance, I always zero in on three things: the team, the market, and the product—in that order. Are these the right founders to tackle this specific problem? Is the market big enough for venture-scale returns? Is there something uniquely compelling about what they've built?

A strong founding team in a massive market with a "good enough" product will almost always outperform a mediocre team in a small market with a perfect product. Bet on people and markets first.

The market itself is signaling where to look. In Q1 2025, for instance, global venture investment shot up to a 10-quarter high of $126.3 billion. Much of that energy was funneled into hot sectors like generative AI. In fact, software and AI startups snagged about 45% of all VC funding in the first half of 2025, which tells you exactly where investors are placing their biggest bets. You can get more context on this trend from the analysis of the bifurcating venture capital market on alterdomus.com.

When an opportunity first lands on your desk, fight the urge to jump straight into the financial model. Start with high-level questions that let you quickly decide if it's worth a deeper look.

Here’s a mental checklist I run through for every initial screen:

Answering these questions first will help you build a disciplined process, ensuring your most valuable asset—your time—is spent on the opportunities with true breakout potential.

Finding a promising startup is one thing; truly understanding it is another. Sourcing the deal is often the easiest part of the whole process. Now comes the real work: due diligence. This is the deep, investigative dive that separates a flashy pitch from a fundamentally sound business.

Think of yourself as an investigative journalist. Your job is to uncover the full story—the good, the bad, and the ugly—behind the founder's narrative. Skipping steps here is the fastest way to see your capital vanish.

The first place I always look is the numbers. A startup's financial statements are a direct reflection of its operational health, its traction in the market, and its long-term viability. You have to get past the shiny top-line revenue figures and dig into the mechanics of how the business actually works.

There are a few metrics I consider non-negotiable for any early-stage company:

These numbers will tell you if the business model has legs or if it's just an expensive hobby that will need endless cash infusions to survive.

No company exists in a bubble. A brilliant product can be crushed if a well-funded competitor can swoop in, copy it, and outspend them on marketing. Your task is to get a realistic picture of the competitive terrain and pinpoint the startup's moat—its unique, defensible advantage.

A moat isn't just a clever feature. It’s a structural barrier that’s tough for others to overcome. This could be patented technology, a powerful network effect (like a social media platform), or exclusive deals that lock out the competition.

A classic rookie mistake is believing a founder who says, "we don't have any competitors." Every business has competition, even if it’s an indirect one or just the status quo. The real question is, what gives this specific team the right to win?

When you're looking at a tech company, you have to kick the tires on the technology itself. You don’t need to be a coder, but you need to ask the right questions to gauge the product's quality and scalability. And if you’re out of your depth, bring in a technical expert. It’s money well spent.

Here's what I'm looking to understand:

After all, a great idea is only as good as its execution.

Spreadsheets and code reviews are essential, but the ultimate truth comes from the people who use the product every day. This is where you confirm product-market fit, which is just a fancy way of saying the company has built something a lot of people desperately want.

I have a personal rule: I insist on speaking with three to five of their customers, and always without the founder listening in. I ask open-ended questions to get a feel for their genuine experience.

You can learn a lot by listening to the language they use.

| Signal of Weak Product-Market Fit | Signal of Strong Product-Market Fit |

|---|---|

| "It's a nice-to-have tool for us." | "We couldn't do our jobs without it." |

| "We got a big discount to try it out." | "It's expensive, but it pays for itself." |

| "It works okay, but the support is slow." | "The team is incredibly responsive." |

You’re listening for raw, unprompted enthusiasm. When a customer tells you the product is a "must-have" or that it has completely changed how their team works, you know you’re onto something. That kind of qualitative feedback is often a better predictor of success than any financial model you could build.

So, you've spent weeks, maybe months, digging into a company. The due diligence is done, and you're convinced this is a winner. Now for the hard part: hammering out the deal. This is where the term sheet comes in—a non-binding agreement that lays out the blueprint for the investment.

Think of it as the pre-nup for your relationship with the startup. It defines everything from your potential payout to how much say you'll have in big decisions. It can feel like you’re wading through a swamp of legalese, but every single clause in that document has a real-world impact on your money and your rights. Getting this right is non-negotiable.

A term sheet can be a dense document, but the good news is that most of the negotiating firepower is concentrated in a few key areas. Founders and investors spill the most ink on these clauses because they directly shape the economics and governance of the entire deal.

If you focus your energy here, you can protect your capital and ensure the structure is fair. These are the big ones:

Understanding how these three levers work together is the real key to seeing the true shape of a deal.

Of all the economic terms, liquidation preference is arguably the one you need to understand most deeply. It sets the pecking order for payouts when an exit happens. Let's say a startup sells for less than its last valuation—this clause ensures investors get their money back before founders and employees see a single dollar.

Liquidation preferences come in two main flavors, and the difference between them is massive for your bottom line.

A single word—"participating"—can completely rewrite the financial outcome for everyone at the table. I always recommend modeling a few different exit scenarios (a home run, a base hit, and a strikeout) to see exactly how the term sheet's structure will affect your actual cash-on-cash return.

The table below breaks down the most critical components you'll encounter in a term sheet. Familiarize yourself with these, as they'll be the focal point of any negotiation.

| Term | What It Means | Why It Matters to You |

|---|---|---|

| Valuation (Pre- & Post-Money) | The company's worth before and after your investment. | Determines your ownership percentage. A high valuation means you buy a smaller slice of the company. |

| Liquidation Preference | The order of payout in a sale or liquidation. | Protects your initial capital. A 1x non-participating preference is standard. |

| Anti-Dilution | Protects your stake if the company raises money at a lower valuation later on. | Prevents your investment from being unfairly devalued in a "down round." |

| Board Seats | The right to appoint a member to the company's board of directors. | Gives you a direct voice in the company's strategic direction and governance. |

| Pro-Rata Rights | The right to invest in future funding rounds to maintain your ownership percentage. | Allows you to double down on your winners and avoid being diluted out of a great company. |

| Protective Provisions | Veto rights on major company decisions (e.g., selling the company). | Gives you control over critical actions that could affect the value of your investment. |

Getting a handle on these terms is the first step. They form the foundation of the deal and are your primary tools for structuring an investment that aligns with your risk tolerance and return expectations.

Not every early-stage deal starts with a hard valuation. In the very beginning, when a startup might be little more than a brilliant idea on a napkin, pricing the company is more art than science. That's why many seed deals are done using other investment vehicles.

These instruments let investors get capital into a company quickly, pushing the difficult valuation conversation down the road.

The two you'll see most often are:

For anyone investing at the seed stage, these tools are indispensable. They offer a faster, simpler way to back a promising team while deferring the valuation debate until the company has more data and a clearer path forward. This kind of flexibility is a core part of being an effective early-stage investor.

Cutting the check is just the start of the relationship. The real work—and where the real value is created—begins the moment you're on the cap table. This is where you shift from being an evaluator to a genuine partner. Active portfolio management isn't just a buzzword; it's the hands-on process of helping your companies survive the early days and thrive long enough to reach a successful exit.

This doesn't mean you should be micromanaging founders. Far from it. The goal is to become their most trusted advisor and resource, the first person they call when they hit a roadblock or need a critical connection. Your network and your experience are often just as valuable, if not more so, than the capital you invested.

The best investors know their job is to support, not to steer the ship. You’re there to help founders see around corners, connect the dots, and sidestep the common mistakes that sink so many startups.

Here are a few high-impact ways I’ve seen this play out:

By actively helping your portfolio companies, you're not just improving their odds of success. You're also building a reputation as an investor who truly adds value, which in turn brings you better deals in the future.

To offer help where it's actually needed, you need a clear view of how the company is doing. This isn’t about hassling founders for daily updates. It’s about agreeing on a handful of key performance indicators (KPIs) that truly signal the health of the business. Think metrics like Monthly Recurring Revenue (MRR), customer churn rate, and user engagement figures.

A huge part of the post-investment journey is deciding when to double down. Participating in a follow-on round is one of the most critical decisions you'll make. The core of venture capital returns often comes from concentrating your capital in your biggest winners. When a company is hitting its milestones and showing real traction, you have to be ready to invest more to maintain or even increase your ownership stake.

"A classic rookie mistake is spreading follow-on capital too thin, like peanut butter. Your biggest returns will almost certainly come from a tiny fraction of your portfolio. You have to reserve enough capital to go big on those breakout companies as they scale."

Let's be clear: venture capital is an illiquid game. Your money is locked up for years. The only way you see a return is through a liquidity event, more commonly known as an exit. Thinking about the endgame shouldn't be an afterthought; it should be part of the conversation from the very beginning.

The broader market climate has a huge impact on exit opportunities. For example, recent analysis shows a trend toward capital concentration in fewer, larger deals. In Q2 2025, a staggering 30% of all global VC funding was poured into just 16 mega-rounds. The U.S. continues to dominate, attracting 64% of that total funding. You can dig into these global venture capital trends on Bain.com. This kind of environment can produce incredibly well-funded companies that become prime acquisition targets for incumbents.

For any startup, there are really only three paths to liquidity:

Understanding these different pathways from day one helps you align your expectations with the founders' long-term vision and gives you a realistic framework for what a successful return might actually look like.

Even with a solid grasp of the mechanics, people new to venture capital always have those nagging practical questions. It’s an opaque world, and bridging the gap between theory and what actually happens on the ground is everything. Let's tackle some of the most common questions I hear all the time.

We'll cover everything from the basic "how much do I need?" to the tougher stuff, like what to do when an investment goes to zero. This is where the rubber really meets the road.

This is always the first question, and the honest answer is: it depends entirely on how you plan to play the game.

If you’re going in as a direct angel investor, you’ll need the most cash per deal. You should be prepared to write a check for at least $25,000 for a single startup, and that's just the starting point.

A much more approachable path for most people is joining an angel syndicate. Platforms like these let you invest alongside a seasoned lead investor, which dramatically lowers the barrier to entry. Minimums can be as low as $5,000 a pop, which allows you to spread your capital across several different companies—a crucial strategy for managing risk in this asset class.

The most important rule isn't about the size of your first check. It's about having the dry powder for follow-on investments. You should set aside at least as much capital as your initial investment for the future funding rounds of your most promising companies. That's often where the real money is made.

Everyone hears about the legendary "100x" returns, but let's be clear: those are lottery tickets. They are the exception, not the rule. Venture capital follows a brutal power-law curve, which means a tiny handful of your investments will drive the lion's share of your total profit. Most of your investments will fail.

A well-constructed, diversified early-stage portfolio should aim for a net return of 3-5x over a typical 10-year fund lifecycle. In industry terms, that translates to an Internal Rate of Return (IRR) of 20-30%. But remember, this is just an average. The key is building a portfolio with enough shots on goal—I recommend at least 10-20 companies—to give yourself a statistical chance of backing one or two of those breakout winners that can return the entire fund and then some.

Failure isn't just a possibility in venture capital; it's a certainty. A huge chunk of startups, particularly at the pre-seed and seed stages, simply won't make it. The first and most important step is to accept this before you write your first check.

When a portfolio company is clearly on the ropes, your job is to be a supportive but realistic partner. Sometimes the best help you can offer is advice on how to wind things down gracefully. Financially, a failed investment is a write-off. You record the loss, and if you’re an accredited investor, you can often use that loss to offset capital gains from your winners. The cardinal sin is throwing good money after bad trying to "save" a company that's already sunk.

Historically, the VC world has been a closed shop, open only to accredited investors—people who meet specific income or net worth requirements set by regulators. This was put in place to shield everyday investors from the extreme risks involved.

That said, things are starting to open up a bit. Equity crowdfunding platforms have created a pathway for non-accredited investors to back startups, though with much smaller check sizes. These deals are just as risky, but they do offer more people a chance to get involved in the innovation economy. Just make sure you carefully check the specific rules and platform requirements in your country before jumping in.

Ready to move beyond spreadsheets and manage your fund like a top-tier firm? Fundpilot provides the institutional-grade tools you need for reporting, administration, and investor communications, helping you focus on what matters most: finding the next great company. Learn more and see how we can help you scale at https://www.fundpilot.app.