Learn how to change LLC ownership with our simple guide. Find out the necessary steps to update your LLC ownership today!

Transferring ownership of your LLC might sound like a major legal headache, but when you break it down, it's a manageable process. At its core, it's about officially changing who owns what piece of the company. This always involves updating your Operating Agreement, getting the green light from all members, and then making sure the state knows about the change.

Think of it this way: ownership isn't some abstract concept. It's defined by membership interests—the LLC equivalent of shares in a corporation. A transfer could mean anything from one partner buying out another completely to bringing a new investor into the fold.

Before you start drafting documents, it's essential to understand the mechanics behind an LLC ownership change. Your company's ownership structure isn't set in stone; it's designed to be flexible, as long as you follow the right procedures. The single most important document you'll work with is your LLC's Operating Agreement. It's the playbook for how your business runs, including how ownership can change hands.

Each member's stake in the company—their percentage of profits, losses, and voting power—is determined by their membership interests. So, changing ownership is really just a matter of re-slicing the pie and formally documenting who gets which slice.

The process always begins with your members and that all-important Operating Agreement. If you were thorough when you set up your LLC, your agreement likely has clauses that spell out exactly how to handle a transfer. Look for terms like "buy-sell provisions" or a "right of first refusal." These rules dictate who is eligible to buy in, how the value of a membership interest is calculated, and what steps are needed to get approval.

What if your agreement is silent on the matter? In that case, you'll have to follow your state's default rules. Nearly every state requires unanimous consent from all existing members to approve an ownership transfer. This makes open communication and getting everyone to agree absolutely critical.

Key Takeaway: An ownership transfer is far more than a casual handshake. It's a formal legal procedure that redefines control and financial stakes in your business. Documenting every step isn't just good practice—it's what makes the transfer legally binding and protects everyone involved from future disputes.

You're not alone in navigating this. Many entrepreneurs find themselves in this exact position. Data from the National Association of Small Business Owners (NASBO) shows that roughly 30% of small business owners expect to transfer ownership in the next five years. You can dig into the full business ownership transfer statistics to see just how common this is across different sectors.

The "why" behind the transfer often shapes the "how." For instance, selling your entire stake because you're retiring is a very different process from bringing on a new partner to help fund expansion. Knowing your specific scenario will make the necessary steps much clearer.

Here’s a quick look at the most frequent ways ownership changes hands.

| Transfer Method | Description | Common Scenario |

|---|---|---|

| Complete Buyout | An existing member or an outside buyer acquires 100% of the membership interests from the current owners. | The sale of the business to a third party, or when a founder retires and is bought out by the remaining partner(s). |

| Partial Sale / Buy-In | A member sells a portion of their interest, or a new member invests capital in exchange for an ownership stake. | Bringing on a key employee as a partner, securing new investment, or one partner reducing their involvement. |

| Gifting or Inheritance | Ownership is transferred without a sale, typically to a family member or heir through an estate plan. | A founder passing the business down to their children or a member's interest transferring to their spouse upon death. |

Each of these paths requires careful attention to legal and financial details. Getting it right from the start is the best way to prevent messy complications down the road.

When it's time to change who owns a piece of your LLC, your first move shouldn't be to call a lawyer or check state websites. It’s to pull out your Operating Agreement. This document isn't just boilerplate paperwork; it's the custom-written rulebook for your company. It dictates exactly how you handle major events, especially bringing in new owners or letting existing ones out.

A solid agreement is your roadmap, built by the members, for the members. It's the first and last word on the subject. So, before you get tangled up in official filings, you absolutely have to know what your own internal rules say.

Your initial task is simple: read the agreement. You're hunting for the specific clauses that control how membership interests can be transferred. Getting this right from the start can save you from a world of headaches and legal disputes down the line.

Here’s what you need to look for:

Let's say your partner gets a great offer for their 30% stake from someone you've never met. If your agreement has a Right of First Refusal, you and the other owners get the first crack at buying that stake at that price. It's a vital tool to keep you from ending up in business with a total stranger.

Don't forget: The Operating Agreement is a private, internal document, but when it comes to an ownership transfer, it can be more powerful than any state filing. If you ignore its rules, the entire sale could be declared invalid.

Knowing these provisions inside and out is crucial. These principles aren't unique to LLCs; a well-structured agreement is fundamental to any partnership. For a deeper dive into crafting these essential documents, especially in more complex investment structures, check out our guide to partnership agreements. The lesson is always the same: get the rules clear upfront to avoid chaos later.

So, what happens if you dig out the Operating Agreement and it's completely silent on transfers? Or, even more nerve-wracking, what if you realize you never actually made one? It happens more often than you'd think, especially with companies that got off the ground in a hurry.

If you find yourself in this boat, you're now at the mercy of your state’s default LLC laws. In most states, the default rule requires unanimous consent from all other members to bring a new member into the fold. This means every single owner, even someone with a tiny 1% stake, has veto power over the transfer.

When your agreement is silent, the first thing to do is get all the members together. The goal is to reach a clear consensus and get it in writing. This usually means drafting a formal resolution or consent form that everyone signs, explicitly approving the transfer.

If you have no agreement at all, the process is similar but carries more risk. You still need that unanimous consent required by state law. But this is also a golden opportunity to fix the original mistake. Before you do anything else, draft and sign a proper Operating Agreement. This puts clear rules in place for the future, professionalizes your operations, and protects everyone involved from ambiguity.

Changing who owns your LLC is rarely a solo act. It's a collective decision that hinges on clear communication and, critically, documented consent from your fellow members. This is where things can get messy. I've seen handshake deals go sideways more times than I can count, leaving everyone exposed.

Your operating agreement is your rulebook here. It should spell out exactly what kind of vote you need to approve a new member or shift ownership stakes. It might be a simple majority, a supermajority (say, 75%), or, as is often the case, unanimous consent. If your agreement is silent on this, don't guess—your state's law likely defaults to requiring every single member to agree.

To make it official, you’ll want to hold a formal vote and document the results in your meeting minutes. An even better, more ironclad method is to pass around a written consent resolution for every member to sign. This creates a crystal-clear paper trail, proving everyone was on board and understood the terms.

Think of a buy-sell agreement as a "business prenup" for your LLC. This is often a section baked right into your operating agreement, but it can also be a separate, standalone document. Its entire purpose is to map out the terms of a member's exit long before anyone is even thinking about leaving.

This agreement is a lifesaver. It provides a pre-approved roadmap for handling events that could otherwise send your company into a tailspin. A solid buy-sell provision tackles the hard questions before they turn into heated, emotional fights.

What kind of events are we talking about?

Without these rules, you could suddenly find yourself in business with a former partner’s heir or ex-spouse—people who might have zero interest or expertise in what you do. The buy-sell prevents this nightmare scenario by giving the LLC or the remaining members the first right to buy back the departing member's share.

One of the most crucial parts of a buy-sell agreement is defining how a member's interest will be valued. Getting the price wrong is a surefire way to end up in court and destroy relationships. Your agreement must be specific about the valuation method.

For example, you could agree on a fixed price you review and update each year. Or, you might use a formula based on a multiple of profits. Another common approach is to require a formal appraisal from a neutral, third-party expert when a triggering event happens.

Transferring membership interests in an LLC often necessitates a professional business valuation to ensure fairness, legal compliance, and transparency. Conducting a detailed company appraisal is crucial because it sets a rational price, helps navigate tax implications, and reassures investors. You can learn more about how a proper company valuation smooths LLC ownership transfers on eqvista.com.

This predetermined method takes the emotion and guesswork out of the picture. Imagine two founders of a successful tech firm. One is ready to retire. Their buy-sell agreement states the company's value is four times the average annual profit from the last three years. The math is clear, the process is objective, and it prevents a bitter fight over what the company is "really" worth.

Ultimately, a well-crafted buy-sell agreement delivers the stability you need to navigate one of the toughest parts of changing LLC ownership. It protects the business, honors the exiting member's contribution, and ensures a fair process for everyone, securing the company's future long after the names on the ownership line have changed.

Once everyone's on board and you have the necessary approvals, it's time to make it official. This is where you move from handshake agreements to legally binding documents. Getting this part right is absolutely critical—it creates the paper trail that proves the transfer happened correctly.

Think of it as a three-pronged approach. You'll need a solid purchase agreement between the buyer and seller, you'll likely have to notify the state, and finally, you'll need to update your own internal company records. Each piece is a vital part of the puzzle.

The absolute cornerstone of this entire process is the Membership Interest Purchase Agreement. This is a private contract that spells out every single detail of the transaction between the selling member and the buyer. This buyer could be anyone—an existing member, the LLC itself buying back a stake, or a brand new person joining the company.

This document needs to be airtight, leaving no room for confusion down the road. It’s the single source of truth for the sale.

Here's what must be included:

For instance, say a member is selling their 25% stake for $100,000. The agreement might state the buyer pays $50,000 at closing, with the other $50,000 paid in two equal installments over the following six months. That kind of detail prevents major headaches later.

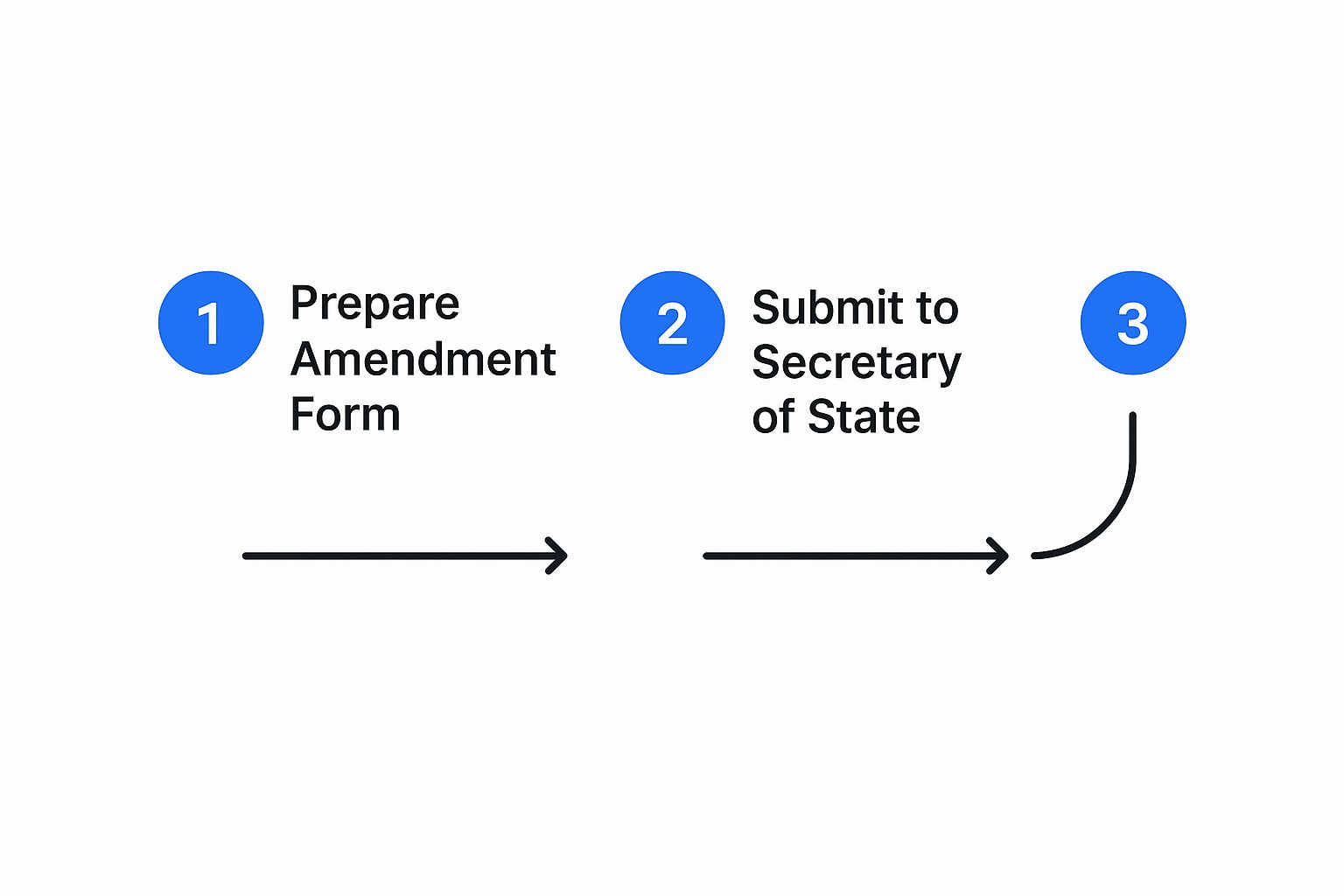

While the purchase agreement is a private matter, you usually have to let the state know what’s happened. This is typically done by filing an Amendment to the Articles of Organization with whatever state agency handles business filings, often the Secretary of State.

Now, not every ownership change requires a public filing—it really depends on your state's specific rules. Always check first.

A change that takes an LLC from multiple members to a single member (or the other way around) almost always requires an amendment. That’s because fundamental details listed in your original Articles, like management or tax structure, have now changed.

Filing this isn't rocket science, but it has to be precise. The process generally follows a clear workflow.

As the guide shows, you'll prepare the state's official form, submit it with the required fee, and wait for confirmation. This is what updates the public record.

You can typically find these forms right on your Secretary of State's website. You'll just need to fill in your LLC's name and file number and explain what’s changing. When ownership shuffles get complex, managing all the legal filings can feel like a full-time job. To learn about tools designed to ease this administrative load, check out the resources on Fundpilot's legal solutions page.

The final, and equally important, step is to get your own house in order. Your internal records must perfectly mirror the new ownership structure. This is all about good governance and preventing future disputes among the owners.

Here’s your internal checklist:

Imagine a 50/50 two-member LLC brings on a third partner who buys a 20% stake from the company. The Operating Agreement would need an addendum stating the new split is now 40%, 40%, and 20%. New certificates would be issued to all three members showing these percentages. This level of internal detail creates an unshakeable record of who owns what.

Once the legal papers are signed, it's tempting to think the hard work is over. But an ownership transfer isn't truly complete until you've handled the administrative side. This is where many business owners drop the ball, and it can lead to some serious headaches—think compliance issues, financial penalties, or even problems that call the new ownership into question.

This final leg of the process is all about communication. You have to get the word out to government agencies, financial partners, and anyone else with a stake in your business's financial health. It's essentially about updating your LLC's "status" across the board to reflect the new reality.

Your first stop should always be the Internal Revenue Service. An ownership change creates ripples that can significantly affect the taxes for both the buyer and the seller. In some cases, it can even change how the IRS classifies your business.

For the seller, any profit from the sale is typically treated as a capital gain. The final tax bill depends on the sale price, their original investment (their "basis"), and how long they owned their piece of the LLC. The buyer, on the other hand, is focused on establishing their new cost basis, which will be a critical number if they ever sell their own stake down the road.

Critical Question: Do you need a new Employer Identification Number (EIN)? This is a common point of confusion. The answer depends entirely on how the ownership structure changes. If a multi-member LLC becomes a single-member LLC (or vice versa), the IRS sees this as a fundamental shift in its tax structure, and you will need a new EIN. But if you're just shifting ownership percentages among existing members, you can almost always keep the EIN you have.

It's also common to see LLC ownership percentages shift for reasons other than a full buyout, like when a member invests more capital or a new partner joins. The process for this is dictated by your state's laws and, more importantly, your operating agreement. If your agreement has solid buy-sell provisions, making the change is usually straightforward. If not, you’re looking at formal amendments and fresh state filings.

Beyond the IRS, a whole series of notifications needs to go out. Overlooking this step can create operational chaos—imagine payments bouncing or a crucial insurance policy getting canceled because the right people weren't informed. This is a key part of the diligence that keeps the company in good standing.

In fact, thorough communication is a cornerstone of any major business transaction. If you're navigating other complex deals, our team has put together a complete guide to the due diligence process that you might find helpful.

Here's a quick checklist of who you need to contact as soon as the ownership change is official:

Even when you think you've checked all the boxes, changing who owns a piece of your LLC can get tricky. I’ve seen countless business owners get bogged down in the details, wondering about everything from transferring a stake to their kids to what this all means for their next tax return. Let's tackle some of the questions that pop up most often.

Absolutely. Bringing family into the business is a time-honored tradition, and the process for transferring ownership is fundamentally the same. Your operating agreement is still your guide here—in fact, it might even have specific clauses that make intra-family transfers a bit simpler.

But don't let the casual nature of family fool you into cutting corners. Even if you're gifting the ownership interest or selling it for a dollar, you absolutely need to formalize the deal. That means drafting a proper Membership Interest Purchase Agreement to serve as a clean record of the transaction. From there, amend your operating agreement to show the new ownership structure and issue new membership certificates.

A Word of Caution from Experience: Proper documentation is your best friend. A solid paper trail proves the transfer was legitimate and intentional. This can be a lifesaver if family dynamics sour down the road or another member decides to question the deal years later.

And one last thing: always, always talk to a tax professional before you pull the trigger. Gifting an ownership stake versus selling it creates very different tax situations for both you and the family member taking it on.

This is precisely why a well-thought-out operating agreement with a solid buy-sell provision isn't just a "nice-to-have"—it's a necessity. It’s your pre-negotiated roadmap for handling the worst-case scenarios. If you have clauses covering death or disability, they will tell you exactly what to do next.

Typically, the agreement will require the LLC or the other members to buy out the departing member's share. It should also spell out exactly how that share will be valued, which takes the emotion and guesswork out of an already difficult situation.

Without a buy-sell provision? You’re looking at a much messier path. The deceased member’s ownership would likely get passed on to their heirs through their estate. Suddenly, you could find yourself in business with a spouse or child who has zero interest or experience in the company. This can lead to gridlock and serious conflict. You'd be forced to negotiate a buyout directly with the estate, a process that can easily become contentious and legally tangled.

While the state won't send the legal police after you for not hiring a lawyer, doing this on your own is a huge risk. I highly recommend getting professional legal counsel. Transferring LLC ownership is a major financial and legal event with lasting effects.

A good business attorney is worth their weight in gold for a few key reasons:

Think of legal fees as an investment in peace of mind. The upfront cost is almost always a tiny fraction of what you’d spend on litigation, tax penalties, or the chaos caused by a botched transfer. A DIY job can leave you exposed in ways you never even imagined.

This question trips a lot of people up, but the answer really hinges on how the ownership structure changes. Your Employer Identification Number (EIN) is directly linked to how the IRS classifies your business for tax purposes.

Here's how it generally breaks down:

| Ownership Change Scenario | Do I Need a New EIN? | The Reason Why |

|---|---|---|

| A multi-member LLC becomes a single-member LLC. | Yes | Your tax status shifts from a partnership to a disregarded entity. |

| A single-member LLC adds a new member. | Yes | Your tax status shifts from a disregarded entity to a partnership. |

| A multi-member LLC just shuffles ownership percentages. | Usually No | The LLC is still a partnership in the eyes of the IRS, so the original EIN stays. |

| The LLC is bought outright by another corporation. | Yes | This is a fundamental structural change that demands a new tax identity. |

When you're not 100% sure, the best move is to check the official IRS guidelines or just call your tax advisor. They can give you a definitive answer based on your specific situation and keep you in the clear.

Juggling complex ownership structures, keeping investors in the loop, and staying compliant is a heavy lift, especially when your fund is growing. Fundpilot empowers emerging managers to ditch the chaotic spreadsheets and operate with the efficiency of an established institution. Our platform automates LP reporting, capital calls, and distributions, all wrapped in a white-labeled investor portal that builds confidence and trust.

Discover how Fundpilot can streamline your fund's operations today.