Learn how do you start an investment fund with our expert guide. Discover key steps to legal setup, raising capital, and building a successful fund.

Everything starts with the idea. Before you even think about raising a dollar or hiring a lawyer, your investment fund needs a clear, defensible reason to exist. This is your investment thesis, and it's the bedrock of your entire operation. It's your answer to the simple, brutal question every potential investor will ask: "Why you?"

Think of your thesis as the strategic DNA of your fund. It’s more than just a goal; it's the compelling story that explains what you do, how you do it, and why you’re uniquely qualified to win. A vague plan like "we'll invest in good tech companies" is a non-starter. A powerful thesis is sharp, specific, and immediately signals your edge.

This core identity dictates every decision you'll make down the line—from your legal structure and operational setup to the LPs you target for fundraising. Get this right, and everything else falls into place more easily. Get it wrong, and you’ll be fighting an uphill battle from day one.

So, what’s your fund’s reason for being? What market inefficiency have you spotted that others have missed? Your unique angle might be rooted in deep industry expertise, a proprietary network that gives you access to off-market deals, or a unique analytical model.

Maybe you’re focused on early-stage B2B SaaS companies in the Midwest, a region often overlooked by coastal VCs. Or perhaps your team has operational experience turning around distressed commercial real estate assets.

Specificity is your best friend here. It shows LPs you have a real plan, not just a vague ambition. Your angle needs to clearly answer:

Once you’ve nailed down your angle, you need to articulate the "how." This is where you translate your big idea into a disciplined, repeatable process. Investors need to see that you’re not just relying on gut feelings; you have a system for executing your thesis over the entire life of the fund.

Your investment thesis is the story you tell, but your strategy is the evidence that proves the story is believable. It turns a vision into a process that investors can actually underwrite.

Before you go too far, you need to lay out all the fundamental components of your fund. This table summarizes the core building blocks you'll need to define.

| Component | Key Considerations | Example |

|---|---|---|

| Asset Class | What will you invest in? Public equity, venture capital, real estate, private credit? | Focusing exclusively on pre-seed B2B software companies. |

| Geographic Focus | Where will you invest? A specific country, region, or globally? | Concentrating on the Southeastern United States to leverage local networks. |

| Fund Size | How much capital do you need to execute your strategy effectively? | Targeting a $25M fund to make 15-20 investments of $500k each. |

| Team | Who are the key partners? What unique skills and track records do they bring? | Two founding partners: one with a background in software engineering, the other in M&A. |

Defining these elements creates a solid, coherent framework that will guide all your future decisions and communications with potential investors.

A massive part of developing your strategy is also grounding it in reality. This means digging into historical market data to validate your assumptions. For instance, the UBS Global Investment Returns Yearbook 2025 offers 125 years of data, providing incredible context on long-term returns and diversification.

This kind of research does two things: it helps you pressure-test your own ideas and it shows LPs you’ve done your homework. By demonstrating a sophisticated understanding of market cycles, you prove you’re building a fund that can last, not just one designed to ride the latest wave.

So, you’ve hammered out your investment thesis—the "what" and the "why." Now comes the "how." This is where your brilliant strategy gets translated into a formal, legally sound entity, and it's a phase you absolutely cannot afford to get wrong.

Think of it as building the ship that will carry your investments, protect both you and your limited partners (LPs), and keep you squarely within the bounds of the law. Cutting corners here isn't just risky; a shaky legal foundation can sink your fund before it ever leaves the harbor.

This process means choosing the right legal vehicle, drafting the foundational documents that will govern every move you make, and untangling a complex web of securities regulations. Let's be clear: for most emerging managers, this is not a DIY project. You need experienced legal counsel who specializes in fund formation to navigate the maze.

For most private funds in the U.S., the go-to structure is the Limited Partnership (LP). In this classic model, you, the manager, are the General Partner (GP). You call the shots, but you also carry unlimited liability. Your investors come in as Limited Partners, contributing the capital with their liability capped at the amount they invest.

Another solid option is the Limited Liability Company (LLC). LLCs can offer a bit more flexibility in how the fund is managed and provide liability protection for everyone involved.

Here’s a quick rundown of how they stack up:

| Feature | Limited Partnership (LP) | Limited Liability Company (LLC) |

|---|---|---|

| Management | The General Partner (GP) runs the show. LPs are passive. | Can be member-managed or manager-managed, offering more options. |

| Liability | The GP has unlimited liability; LPs have limited liability. | All members have limited liability, protecting personal assets. |

| Investor Appeal | The gold standard for institutional investors. It's familiar and trusted. | Often a great fit for funds with a smaller, more tight-knit investor group. |

| Complexity | A standardized and well-trodden path, but can be rigid. | The operating agreement is highly customizable but can be more complex to draft. |

Which one is right for you? It really boils down to your fund’s strategy, who you’re raising money from, and your long-term vision. Venture capital and private equity funds chasing institutional checks almost always go the LP route. A real estate fund with a handful of active investors, on the other hand, might find an LLC to be the perfect fit.

Once you've picked a structure, you have to face the regulatory environment, which in the United States is dominated by the Securities and Exchange Commission (SEC). Dropping the ball on compliance can lead to crippling penalties, so you have to know the rules of the road.

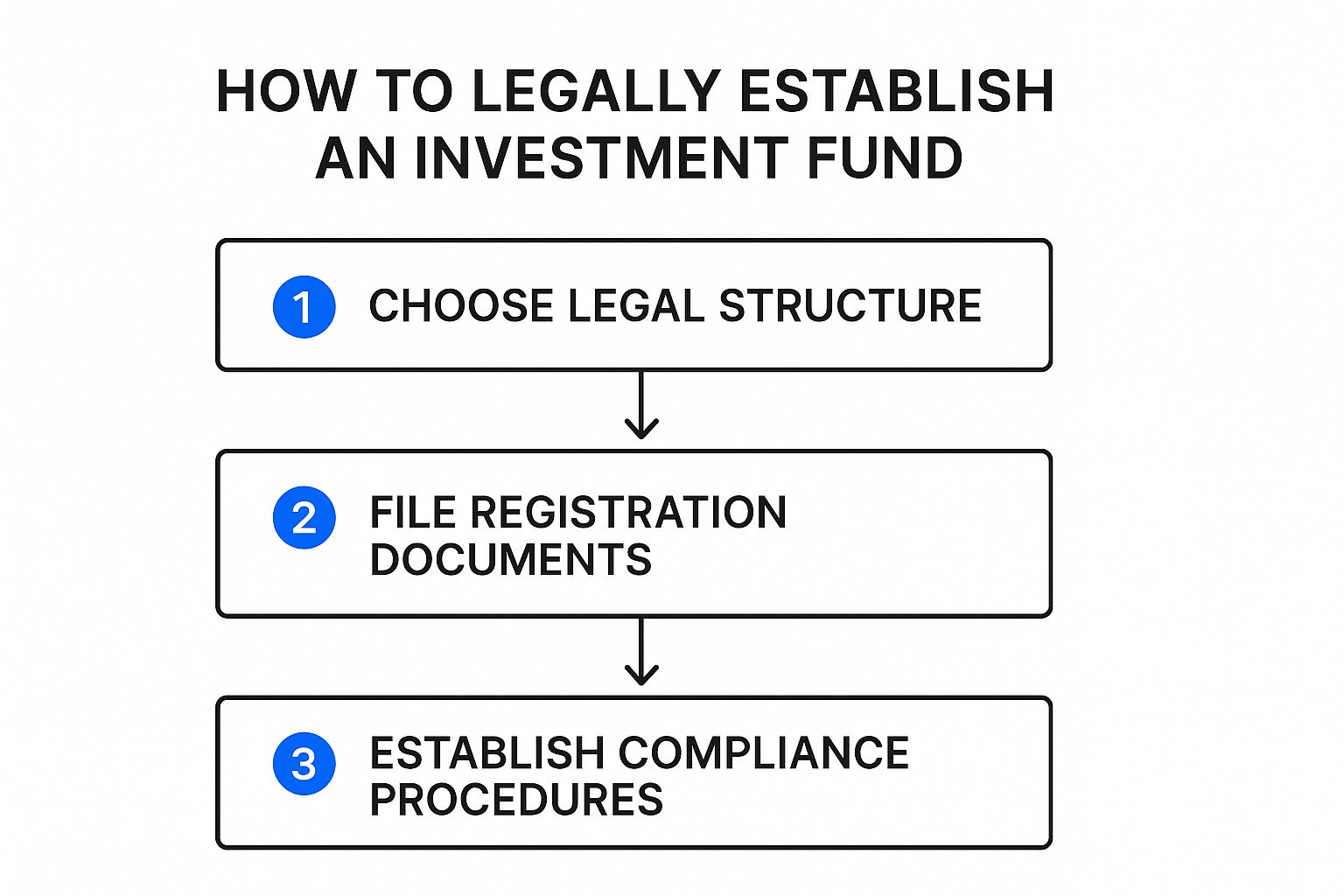

This is a simplified look at the legal setup flow.

As you can see, choosing a structure, filing the paperwork, and getting your compliance in order are foundational, sequential steps.

The good news is that most new private funds don't have to go through the incredibly expensive and time-consuming process of a full SEC registration. Instead, they rely on specific exemptions, most of which are found under Regulation D of the Securities Act of 1933.

It’s also worth watching how the fund landscape itself is evolving. Just look at the explosion in Exchange-Traded Funds (ETFs). With over 757 new ETFs launched in 2024 alone, it shows a clear trend toward more accessible fund vehicles that can sometimes have a lighter regulatory touch than traditional active funds.

Your legal team will be busy drafting a few critical documents that serve as the legal backbone of your fund. These aren't just boilerplate paperwork; they are the contracts that define your relationship with every single investor.

Private Placement Memorandum (PPM): This is your fund's official business plan and disclosure document, all in one. It lays out your investment strategy, all the potential risks, the fee structure, and the terms of the deal. It gives LPs everything they need to make an informed decision.

Limited Partnership Agreement (LPA): This is the core governing contract between you (the GP) and your LPs. It details the rights and responsibilities of everyone involved, from capital calls and distributions to voting rights and governance.

Subscription Agreement: This is the document an investor actually signs to commit capital. It officially binds them to the terms laid out in the LPA and the PPM.

Getting this legal framework right is non-negotiable. It’s the foundation of the trust and security your investors demand. For a deeper dive into your responsibilities, it's worth taking the time to learn more about mastering the SEC's private fund rules in our detailed guide.

A world-class investment strategy and a bulletproof legal structure are a great start, but they’re only half the story. I've seen brilliant ideas get completely bogged down by clumsy, inefficient, or non-compliant operations. This is where you build the engine of your fund—the network of providers and internal systems that handle the day-to-day mechanics.

Getting this right frees you up to focus on what you actually do best: generating returns.

More than just administrative work, your operational backbone is what creates institutional credibility. Your first LPs are betting on your investment acumen, of course. But they’re also underwriting your ability to run a professional organization. A solid operational setup sends a clear signal that you take their capital, and your responsibilities, seriously.

No emerging manager can do it all alone. Trust me, trying to handle complex functions like fund accounting or asset custody in-house is a surefire recipe for distraction and disaster. You’ll need to rely on a team of specialized third-party partners who will become the core of your fund's infrastructure.

Here are the key players you'll need on your team:

When you're choosing these partners, don't just shop on price. You need to consider their reputation, their specific experience with funds of your size and strategy, and the quality of their technology. Finding a provider that can grow with you is invaluable.

While you'll outsource the heavy lifting, you still need to manage your internal processes like a pro. This means establishing repeatable, compliant, and efficient workflows for everything from sourcing deals to communicating with investors.

For many emerging managers, the right technology is the key to punching above their weight. Modern platforms can automate tasks that once required a full-time back-office team.

Don’t try to reinvent the wheel. The path for how you start an investment fund has been well-traveled. Adopt institutional best practices for your operations from day one, even if you’re a team of two. Your future self—and your LPs—will thank you.

Think about your core internal needs and the software that can support them:

The right tools truly make all the difference. For instance, selecting the right platform is critical for managing your fund's financial health. To learn more about this crucial component, you can check out this helpful guide to fund administration software and see how it can fit into your operational stack.

Building this operational backbone correctly from the start prevents costly mistakes, satisfies due diligence from discerning investors, and builds a scalable foundation for future growth.

Once you’ve wrestled with strategy, legal structures, and operational plans, you arrive at the main event: raising the capital. Let’s be clear, this isn't a sales pitch. It’s about building conviction and forging long-term partnerships. You're asking Limited Partners (LPs) to trust you with their money for years, so your approach has to be as buttoned-up as your investment thesis.

Success here boils down to telling a compelling story backed by hard evidence. You have to clearly articulate your edge, the market opportunity you’ve spotted, and why your team is the only one that can seize it. All that foundational work you did? This is where it comes together in a narrative that gets people to write checks.

Think of your pitch deck as your fund’s resume and manifesto rolled into one. It’s not just a slideshow; it's a meticulously crafted argument for why your fund deserves to exist and why an LP should bet on you. It needs to be sharp, concise, and persuasive, guiding a potential investor through your entire vision.

A great deck doesn’t just present facts; it anticipates the tough questions and answers them before they're even asked. Keep it visually clean and easy to scan. Every single slide needs to earn its spot.

Here are the absolute must-haves:

The global market for private capital hit an incredible €13.2 trillion in 2024. Your deck has to instantly prove why your tiny corner of that universe is the most interesting place to be.

Not all money is good money. The secret to efficient fundraising is focusing your energy on the right Limited Partners—the ones whose investment mandates, risk appetite, and check size actually line up with your fund. Spraying and praying with your deck is a rookie mistake that will quickly tarnish your reputation.

Instead, get surgical. Build a targeted list of potential LPs. Your ideal investor might be:

Your fundraising process is your first real test as a fiduciary. How you communicate, handle tough questions, and maintain transparency sets the tone for your entire relationship with your LPs. This isn’t about getting a 'yes'—it's about earning trust.

Once you have your target list, work your network for warm introductions. A referral from a trusted contact is worth a hundred cold emails. Treat every interaction as a chance to build a relationship, not just deliver a pitch.

Getting a meeting is just the start. If an LP shows real interest, they’ll kick off a thorough due diligence process. Prepare for a multi-stage deep-dive where they will pick apart every aspect of your fund, from your personal track record to the fine print in your legal docs. Expect them to grill you on your strategy, operational plumbing, and financial models.

They will demand access to your data room, so have it ready and organized. It should be populated with all your core documents: the PPM, LPA, subscription agreement, and details on your service providers. They'll also be running reference checks on you and your team behind the scenes. The key here is to be organized, responsive, and radically transparent. Any hesitation or fuzziness is a major red flag.

Landing those first few commitments is always the hardest part. Once you get an "anchor" LP on board, their commitment provides social proof and creates momentum that makes it much easier to bring others across the finish line. Fundraising is a marathon, not a sprint. It takes persistence, a thick skin, and an unshakable belief in what you’re building.

Once the capital is in the bank, the real work begins. Your focus has to pivot immediately from fundraising to execution. Every promise you made in your pitch deck now needs to become a reality through disciplined action—sourcing deals, running rigorous due diligence, and deploying capital precisely in line with your investment thesis.

At the same time, your relationship with your Limited Partners (LPs) fundamentally changes. They're no longer just prospects on a list; they are your partners who have placed their trust—and their capital—in your hands. Building on that trust with transparent, professional communication is every bit as critical as the returns you generate. It's what keeps investors happy and sets you up to raise your next fund successfully.

Your day-to-day life is now consumed by the investment lifecycle. Think of it as a constant loop: identifying opportunities, evaluating them intensely, making the investment, and then actively managing it. This is a demanding cycle that requires a systematic process but also the street smarts to adapt when markets inevitably shift.

At the heart of it all is a non-negotiable commitment to risk control. Implementing proven risk management techniques isn’t just a box-ticking exercise; it’s essential for protecting capital and ensuring your fund is built to last. This is about more than just avoiding bad deals. It's about deliberately building a portfolio that can weather storms while still capturing the upside you promised.

Your core activities will boil down to three key areas:

Your LPs are your partners, not just a source of cash. Proactive and utterly transparent communication is the bedrock of a healthy, long-term relationship. In the world of fund management, silence is rarely golden—it breeds uncertainty and quickly erodes confidence. You need to establish a predictable, professional communication rhythm from day one.

It's worth noting that broader market trends signal what investors expect. Low-cost index funds and ETFs now account for about 25% of open-ended fund assets under management worldwide. This trend highlights a massive shift toward transparency and accessibility that all fund managers, regardless of strategy, need to respect.

The quality of your LP reporting is a direct reflection of the quality of your fund management. A clear, insightful report builds confidence, while a confusing or delayed one raises immediate red flags.

Your reports shouldn't just be a data dump. They need to tell the story of the quarter—what went well, what challenges you faced, and how you’re navigating the market to protect and grow their capital.

Having a structured schedule shows your investors that you respect their time and their capital. It also prevents the awkward situation where the only time they hear from you is when you need something, like a capital call.

Here is a look at a typical, effective communication rhythm you can adapt for your own fund.

| Frequency | Communication Type | Purpose |

|---|---|---|

| Quarterly | LP Report & Letter | Provides detailed updates on portfolio company performance, fund financials (NAV, IRR), and market commentary. |

| Annually | Annual Meeting | A formal opportunity to present the year-in-review, discuss strategy, and facilitate Q&A with all LPs. |

| Annually | Audited Financials & K-1s | Delivers the independently verified financial statements for the fund and necessary tax documents for LPs. |

| As Needed | Capital Calls / Distributions | Formal notices to LPs to fund their commitments for new investments or to distribute proceeds from exits. |

Managing this entire lifecycle, from the initial investment to the final report, is where you prove your mettle as a fund manager. By mastering both the art of investing and the science of investor relations, you’re not just building one successful fund—you’re building the foundation for a lasting franchise.

If you're gearing up to launch your own fund, your head is probably swimming with questions. That's completely normal. The path is complex, but getting a handle on the big questions now is the best way to avoid painful—and expensive—surprises down the road.

Let's dive into the real-world issues you'll be facing, moving beyond theory to the practical realities of getting a fund off the ground.

There’s no magic number here; it all boils down to your strategy. But for most first-time venture capital or private equity funds, you’ll want to target a first close of at least $5 million to $10 million. Anything less, and potential LPs might not see you as a viable, long-term player.

Remember, that initial capital isn't just for deploying into deals. A huge chunk of it has to cover your operational runway for the first few years. We’re talking about hefty legal bills, ongoing fund administration, annual audits, and maybe even a salary or two. Before you even think about your pitch deck, you need a rock-solid budget that maps out every single setup and operational cost.

One of the most common traps for new managers is getting so wrapped up in the genius of their investment strategy that they completely underestimate the operational side. The legal and regulatory setup is a beast—it's time-consuming, expensive, and unforgiving. Neglecting this foundation is a surefire way to face massive delays and unexpected costs that can kill a fund before it even starts.

Another classic error is a fuzzy investment thesis or, even worse, "style drift." That’s when you start making investments outside your stated strategy because a shiny object caught your eye. It’s one of the fastest ways to destroy investor trust.

And finally, don't go silent on your Limited Partners (LPs). Bad communication is a fund-killer. Keeping your investors in the dark, especially when things aren't going perfectly, will torpedo your reputation and make it nearly impossible to raise your next fund.

While a clear, attributable track record is the gold standard for raising capital, not having one isn't necessarily a dealbreaker. This is especially true for smaller, niche, or first-time funds. If you're wondering how to start an investment fund without that formal history, the key is to build overwhelming credibility in other ways.

When you don't have a formal track record, your personal credibility becomes your most valuable currency. Deep expertise in a specific domain, a powerful network, and a truly compelling thesis can often speak louder than a spreadsheet of past returns.

Here’s how you can build that kind of credibility from scratch:

Your ability to prove you have a real, sustainable edge can absolutely overcome the lack of a traditional fund management resume.

The compensation structure in the fund world is famously known as the "2 and 20" model. It’s designed to cover your costs while heavily incentivizing you to generate great returns for your investors.

It breaks down into two parts:

The "2" is the Management Fee: This is an annual fee, typically 2% of the fund's total assets under management (AUM). This isn't your take-home pay; it’s what keeps the lights on. It covers the day-to-day operational costs of running the fund—salaries, rent, software, legal, travel, you name it.

The "20" is the Performance Fee: This is the real prize. Known as "carried interest," it’s your 20% share of the fund's profits. But here's the critical part: you typically don't see a dime of it until your investors get all their initial capital back, plus a "preferred return" (often around 8%). This hurdle ensures you only win big when your LPs win big.

Getting these questions answered is a huge first step. As you grow, the complexity of managing operations, reporting, and investor relations will only increase. Fundpilot is built for emerging managers who need to move beyond messy spreadsheets and implement institutional-grade systems for everything from LP reporting to automated fund administration. Learn how Fundpilot can help you build a professional, scalable foundation for your fund.