Discover the top 12 investment accounting software solutions of 2025. Our detailed review helps you find the right platform for your fund's needs.

For emerging fund managers and their back-office teams, the limitations of spreadsheets become painfully clear as portfolios scale. Manual data entry, complex waterfall calculations, and the constant risk of formula errors can quickly turn fund administration into a high-stakes, time-consuming challenge. This manual approach not only creates operational bottlenecks but also compromises the accuracy needed for investor reporting and regulatory compliance. The right investment accounting software is no longer a luxury; it's a foundational tool for operational efficiency, transparency, and growth.

This guide is built to help you navigate the crowded market and identify the ideal platform for your specific needs, whether you're managing a $10M venture fund or a $100M real estate portfolio. We move beyond generic marketing claims to provide a detailed, practical analysis of the top 12 solutions available today. You will find an in-depth look at each platform's core functionalities, ideal user profiles, and crucial implementation considerations.

Inside this comprehensive resource, you will discover:

Each review includes screenshots for a visual preview and direct links to get started, ensuring you have all the information needed to make a confident, informed decision. Let's find the software that will replace your spreadsheets and empower your fund's back office.

Fundpilot positions itself as a powerful, all-in-one investment accounting software designed to bridge the operational gap for emerging fund managers. It’s built to elevate funds managing between $10 million and $100 million from reliance on manual spreadsheets to a sophisticated, institutional-grade platform. The core value proposition is enabling smaller funds to project the operational maturity and transparency of much larger entities, thereby building investor trust and accelerating growth.

This platform excels at automating and professionalizing the entire fund administration lifecycle. It replaces disjointed workflows with a unified system that handles everything from capital calls and distributions to maintaining a complete, audit-ready compliance trail. This comprehensive approach significantly reduces the administrative burden and the need for expensive back-office hires, allowing fund managers to redirect their focus toward high-value activities like deal sourcing and capital raising.

Fundpilot’s standout feature is its institutional-quality reporting capability. The platform generates detailed quarterly LP reports complete with in-depth portfolio analysis, performance benchmarking, and insightful market commentary. This allows emerging managers to deliver communications that rival those from top-tier firms, enhancing LP engagement and retention.

Another significant advantage is the white-labeled investor portal. This secure, branded hub provides LPs with real-time access to performance data, capital account statements, and important documents. For investor relations teams, this self-service model streamlines communication and strengthens transparency, a critical factor in securing follow-on commitments.

Practical Application: A venture capital fund transitioning from its first to its second fund can use Fundpilot to automate capital calls for new commitments while providing existing LPs with a professional portal to track performance. The built-in due diligence packages also help the fund present a polished, audit-ready profile to attract larger institutional investors for Fund II.

Fundpilot integrates crucial functions that are often siloed in other systems. The built-in deal pipeline management and performance analytics tools empower investment teams to make faster, data-driven decisions. By connecting with major brokerages and being trusted by over 500 funds, the platform demonstrates proven scalability and reliability. The onboarding process is demo-driven, ensuring a clear understanding of the platform's capabilities before commitment.

Website: https://www.fundpilot.app

For deeper insights into fund operations and investor relations strategies, you can learn more on the Fundpilot blog.

FIS Investment Accounting Manager is an enterprise-grade, cloud-based platform designed for asset managers and fund administrators who require a scalable and robust investment accounting software solution. Its core strength lies in its ability to handle a wide array of complex, global investment strategies and diverse asset classes, from standard equities and fixed income to more complex derivatives.

The platform distinguishes itself through its modular, SaaS-based architecture. This allows firms to integrate the solution into their existing tech stack, automating data flows between core systems and the accounting ledger. This high degree of automation is crucial for reducing manual reconciliation efforts, minimizing operational risk, and accelerating the production of financial reports for NAV calculation and investor communications. For operations teams, this means shifting focus from data entry to high-value analysis and exception management.

| Pros | Cons |

|---|---|

| Exceptional Asset Coverage: Supports complex and diverse investment strategies. | Opaque Pricing: Pricing is not publicly available and requires direct consultation. |

| High Scalability: Cloud-based nature supports significant growth in AUM and complexity. | Steep Learning Curve: The platform's power and complexity may require dedicated training for new users. |

| Enhanced Data Integrity: Automation reduces the risk of manual errors, ensuring accurate reporting. | Enterprise Focus: May be overly complex for very small or simple fund structures. |

FIS Investment Accounting Manager is best suited for established or rapidly growing asset managers, hedge funds, and fund administrators who manage diverse, multi-asset class portfolios. Its comprehensive feature set and scalability make it a strong contender for firms that have outgrown simpler solutions and require institutional-grade investment accounting software with robust automation and reporting capabilities.

Website: https://www.fisglobal.com/products/fis-investment-accounting-manager

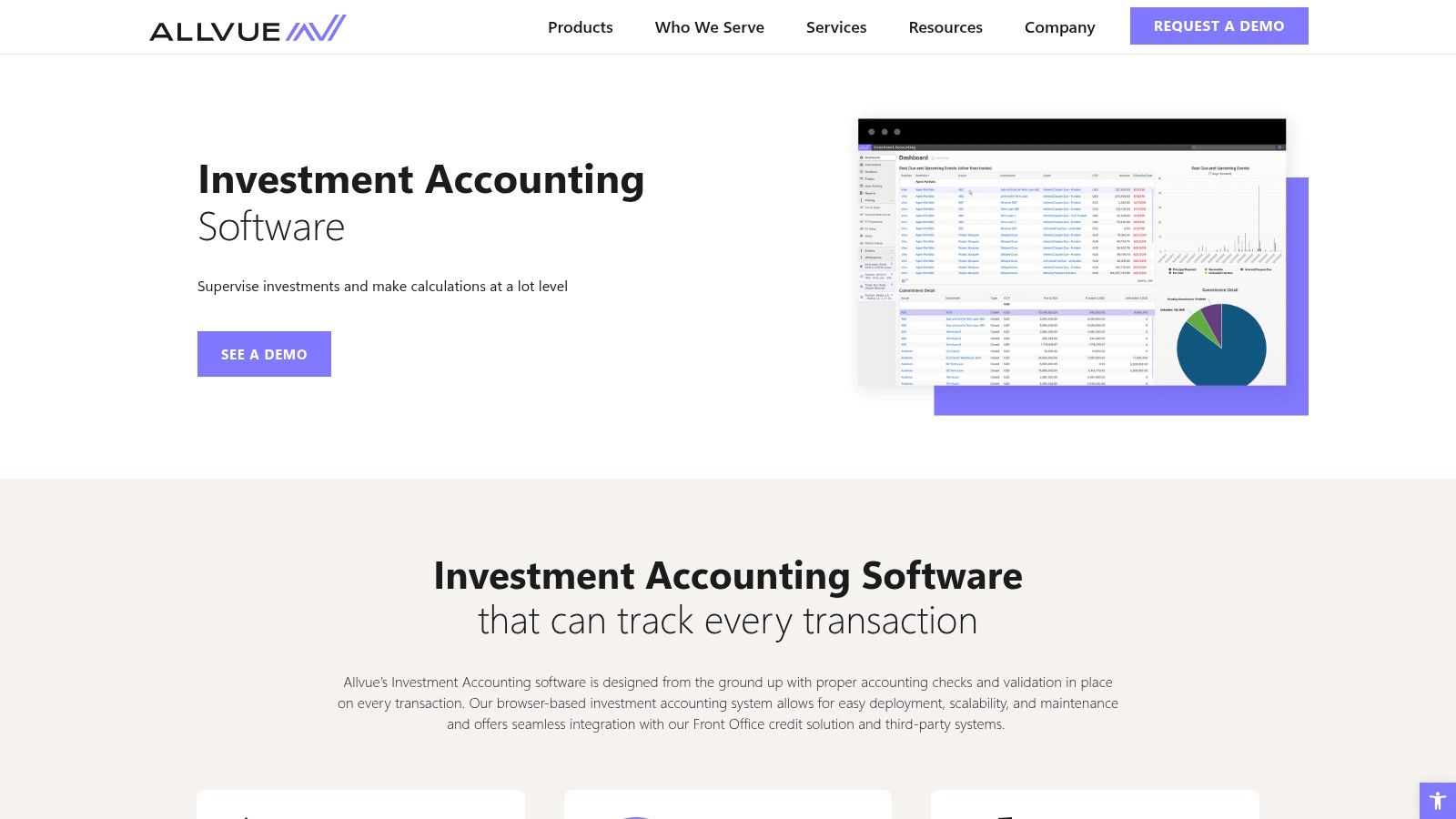

Allvue Systems offers a browser-based, integrated suite designed for private capital and credit fund managers who need a unified solution across the front, middle, and back office. Its platform excels at connecting portfolio management, trade order management, and fund accounting into a single, cohesive workflow. This integration is key to eliminating data silos and providing a consistent view of fund performance and operations from deal sourcing to investor reporting.

The system distinguishes itself with its strong focus on credit strategies and its ability to handle complex waterfall calculations automatically. For fund administrators, this means a significant reduction in time spent on manual, error-prone spreadsheets for carried interest and management fees. The platform’s open architecture facilitates seamless integration with third-party systems, creating a flexible and automated environment that supports both credit and equity portfolio accounting within the same solution.

| Pros | Cons |

|---|---|

| Supports Both Credit and Equity: Versatile enough for hybrid funds, eliminating the need for separate systems. | Customized Pricing: Pricing is not public and can be a significant investment, potentially better suited for established firms. |

| Dynamic Historical Insights: Provides robust reporting and analytics for performance tracking and investor queries. | Implementation Requires Resources: The comprehensive nature of the platform may require a dedicated project team for a successful rollout. |

| Open Architecture: Offers strong integration capabilities, enhancing data flow and automation. | Focus on Private Capital: May be less suited for funds focused purely on public markets or liquid securities. |

Allvue Systems is best suited for private equity, private credit, and hybrid fund managers who require a deeply integrated investment accounting software solution that bridges the gap between front-office activities and back-office administration. Its specialized features for waterfall calculations and multi-asset class support make it a strong choice for firms looking to automate complex processes and gain a unified view of their entire investment lifecycle.

Website: https://www.allvuesystems.com/solutions/investment-accounting/

MRI Software delivers a specialized investment accounting solution designed for the complexities of real estate investment management. It is particularly adept at handling intricate ownership structures, making it a go-to platform for firms managing funds, joint ventures, and Real Estate Investment Trusts (REITs). The software excels at automating complex financial consolidations, eliminations, and allocations across multiple legal entities.

What sets MRI apart is its deep focus on providing investor-to-asset transparency. The platform gives fund managers the ability to trace performance from the consolidated fund level down to an individual property or asset. This granular view is invaluable for investor relations teams that need to generate secure, configurable, and transparent reports. By automating these time-consuming processes, MRI frees up finance teams to focus on strategic analysis rather than manual data reconciliation.

| Pros | Cons |

|---|---|

| Specialized for Real Estate: Purpose-built to handle the unique accounting needs of property investment. | Opaque Pricing: Pricing details are not publicly disclosed and require a direct sales consultation. |

| Reduces Manual Errors: Automation of consolidations and allocations saves significant time and improves accuracy. | May Require Training: The platform's depth and real estate-specific features may require dedicated training for optimal use. |

| Ensures Auditability: Strong drill-down features provide a clear audit trail, simplifying compliance. | Niche Focus: Less suitable for funds that do not have a significant real estate allocation. |

MRI Software is best suited for real estate fund managers, developers, and REITs that need a robust investment accounting software to manage complex ownership structures and automate financial consolidations. Its powerful reporting and auditability make it an excellent choice for firms where investor transparency and regulatory compliance are top priorities. It's particularly valuable for operations and finance teams looking to move away from error-prone spreadsheets for their consolidation and reporting workflows.

Website: https://www.mrisoftware.com/products/real-estate-investment-software/investment-accounting/

Gravity Software offers a unique approach by integrating its investment management module directly into a comprehensive multi-entity accounting system. Built on the Microsoft Power Platform (Dynamics 365), it's designed for organizations like private equity firms, family offices, and real estate groups that manage complex ownership structures and need to consolidate financials across multiple subsidiaries. Its primary advantage is providing a single, unified platform for both operational accounting and investment tracking.

This tight integration eliminates the need for separate systems, reducing data silos and manual reconciliation between investment ledgers and the general ledger. For a family office managing direct investments alongside operating businesses, this means all financial data resides in one place. This unified view simplifies multi-entity consolidation, inter-company transactions, and provides a holistic financial picture for stakeholders, which is a key differentiator from standalone investment accounting software.

| Pros | Cons |

|---|---|

| Unified Financial Platform: Combines core accounting and investment tracking, eliminating data silos. | Pricing Not Public: Requires a direct consultation to obtain pricing information. |

| High Customizability: Built on Microsoft Power Platform, allowing for extensive customization. | Requires Customization: May need specific configuration to meet highly specialized fund requirements. |

| Strong Multi-Entity Features: Excels at managing complex legal structures with multiple subsidiaries. | Niche Focus: Less suited for funds needing a standalone, dedicated investment accounting system. |

Gravity Software is best for private equity firms, family offices, and holding companies that require a robust multi-entity general ledger with fully integrated investment management capabilities. It's an excellent fit for organizations that have outgrown basic accounting software like QuickBooks and need a scalable solution that can handle both their operational businesses and their investment portfolios within a single, cohesive ecosystem.

Website: https://www.gogravity.com/product/financials/investment-management

Vantage Portfolio Accounting™ is a specialized platform designed for the unique demands of alternative investment managers, including fund-of-funds, private equity, and advisory firms. Its primary value proposition is delivering a unified, up-to-the-minute view of portfolio data, covering everything from transactions and valuations to performance and risk analytics across both private and public asset classes.

The software stands out by blending robust back-office accounting functionality with a user-friendly interface and highly flexible reporting. Vantage enables teams to move beyond static spreadsheets by offering seamless integration options via Excel or Web APIs, allowing for automated data flows. This ensures that the accounting book of record (ABOR) is always current, which is critical for firms that need to provide timely and accurate data to limited partners and stakeholders. For smaller to mid-sized firms, this provides an institutional-grade tool without the overhead of larger enterprise systems.

| Pros | Cons |

|---|---|

| Robust Operational Support: Strong features for core accounting and back-office tasks. | Pricing Not Specified: Cost details are unavailable without a direct sales consultation. |

| Flexible Reporting Capabilities: Highly customizable reports meet diverse stakeholder needs. | Integration Efforts Required: May require some IT resources to set up API or Excel integrations. |

| User-Friendly Interface: An intuitive design makes it more accessible than many complex systems. | Niche Focus: Best suited for alternative investments, may be less ideal for purely public equity funds. |

Vantage Software is best suited for emerging to mid-sized fund managers, particularly those in the alternative investment space like fund-of-funds and private equity. It serves as an excellent piece of investment accounting software for firms that need professional reporting and robust operational support but prefer a more accessible and user-friendly platform. It is a strong choice for those looking to upgrade from spreadsheets to a dedicated, automated solution.

Website: https://vantage-software.com/portfolio-accounting/

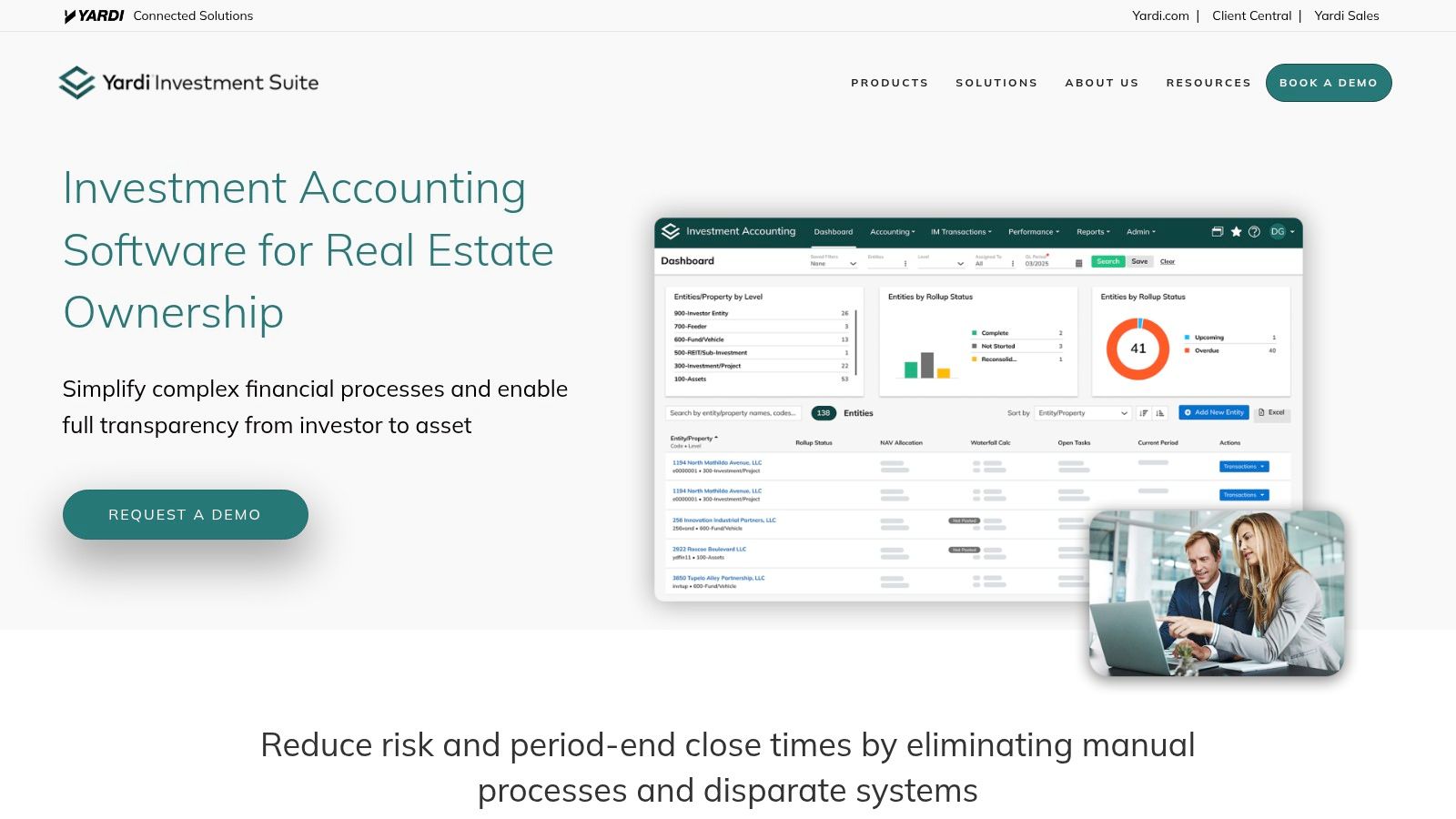

Yardi Investment Management is a specialized platform designed specifically for the complex world of real estate investment. It provides an end-to-end solution that automates intricate financial processes, from managing diverse ownership structures to delivering detailed financial reports, ultimately aiming to reduce risk and enhance investor satisfaction through transparent, timely data.

The platform’s key differentiator is its deep integration within the broader Yardi ecosystem, which includes property management and leasing solutions. This creates a single source of truth for real estate funds, linking operational property data directly to the investment accounting ledger. For fund managers, this eliminates data silos and manual reconciliations between property-level and fund-level financials, significantly accelerating period-end close times and improving accuracy.

| Pros | Cons |

|---|---|

| Specialized for Real Estate: Purpose-built to handle the unique accounting needs of real estate investments. | Niche Focus: Less suitable for funds that do not have a primary focus on real estate assets. |

| Comprehensive Integration: The tight integration with the Yardi ecosystem is a major efficiency driver. | Opaque Pricing: Pricing is not publicly disclosed and requires a direct sales consultation. |

| Reduced Close Times: Automation significantly shortens the time needed for period-end financial closing. | Potential Complexity: The extensive feature set may be overly complex for smaller firms or simple portfolios. |

Yardi Investment Management is the ideal investment accounting software for real estate private equity firms, REITs, and fund managers specializing in property assets. Its strength lies in managing the entire investment lifecycle, from acquisition to disposition. Firms already using other Yardi products will find its integrated approach particularly powerful for achieving operational efficiency and providing superior transparency to investors.

Website: https://www.yardiinvestmentsuite.com/investment-accounting-software/

RealPage Investment Accounting provides a specialized solution tailored for the unique complexities of real estate investment management. It is engineered to help firms maximize portfolio returns by offering robust tools for managing costs, partnership structures, and financial reporting across diverse real estate assets. The platform focuses on unifying property-level data with investment-level accounting, providing a single source of truth for sponsors and LPs.

What sets RealPage apart is its deep integration into the real estate operational ecosystem. By connecting directly with property management systems, it automates the flow of key metrics into the investment ledger. This eliminates manual data entry, simplifies complex consolidations, and allows fund managers to track and measure profit center performance in near real-time. For firms managing multiple properties and investment vehicles, this direct data pipeline is critical for accurate and timely decision-making.

| Pros | Cons |

|---|---|

| Real Estate Specialization: Purpose-built for the nuances of real estate investment. | Opaque Pricing: Pricing details are not publicly listed and require direct inquiry. |

| Enhances Operational Efficiency: Automates data flow from property to portfolio level. | Potential Learning Curve: The specialized nature may require training for users new to the platform. |

| Real-Time Data Integration: Provides timely metrics for proactive portfolio management. | Niche Focus: Less suitable for funds that are not primarily focused on real estate assets. |

RealPage Investment Accounting is the ideal investment accounting software for real estate investment firms, private equity real estate funds, and family offices with significant real estate holdings. It is particularly valuable for organizations that manage a diverse portfolio of properties and require a unified platform to handle everything from property-level operations to complex partnership accounting and investor reporting.

Website: https://www.realpage.com/real-estate-investment-accounting-software/

CQ, also known as CapQ, is an AI-powered fundraising platform designed to simplify the complexities of alternative investments for fund managers. While not a traditional accounting ledger, its strength lies in leveraging predictive analytics and automation to streamline the front-end of the investment lifecycle, from capital raising to investor relations, which are critical precursors to the accounting function.

The platform distinguishes itself by integrating seamlessly with popular ERP and general accounting systems. This allows operations teams to synchronize asset data, eliminate redundant manual entries, and reduce the risk of accounting errors. For firms where fixed assets represent a substantial portion of their portfolio's value, this tool is indispensable for maintaining an accurate book of record and generating audit-ready reports. Its focus on compliance helps mitigate risk associated with tax and regulatory reporting requirements.

| Pros | Cons |

|---|---|

| User-Friendly Interface: Generally considered easy to navigate, simplifying asset tracking. | Outdated UI Elements: Some users find the interface can feel dated compared to modern SaaS platforms. |

| Reduces Accounting Errors: Automation and integration significantly minimize the risk of manual data entry mistakes. | Niche Focus: It is not a complete investment accounting software for managing financial instruments like stocks or bonds. |

| Strong Compliance Tools: Excels at supporting complex tax and regulatory requirements for fixed assets. | Potential Learning Curve: New users may need time to master the more advanced features and reporting functions. |

Sage Fixed Assets is best suited for real estate funds, private equity firms with a focus on infrastructure or equipment-heavy industries, and family offices with significant physical asset holdings. It is an ideal supplementary tool for any organization that requires specialized, in-depth fixed-asset management to complement their core investment accounting software. It is particularly valuable for finance teams looking to automate depreciation, ensure tax compliance, and maintain an accurate asset ledger.

Website: https://www.sage.com/en-us/products/sage-fixed-assets/

Eze Investor Accounting, a core component of the broader Eze Investment Suite, is a specialized platform tailored for alternative investment managers who require precision in their back-office fund administration. It excels in handling the nuanced requirements of hedge funds, funds of funds, and private equity firms, particularly around complex fee structures and investor-level allocations. The system is designed to automate and streamline critical fund accounting processes from end to end.

What sets Eze Investor Accounting apart is its dedicated focus on automating the calculation and allocation of intricate management and performance fees, a common pain point for alternative funds. By providing a clear, auditable trail for these calculations, it significantly reduces the risk of errors and enhances transparency for limited partners. This automation empowers operations teams to move away from manual spreadsheet-based workflows, improving efficiency and allowing them to focus on strategic growth initiatives rather than administrative burdens.

| Pros | Cons |

|---|---|

| Specialized for Alternatives: Expertly handles complex fee and allocation structures unique to hedge funds. | High-End Pricing: The cost structure may place it out of reach for very small or emerging managers. |

| Operational Efficiency: High degree of automation reduces manual work and mitigates operational risk. | Requires Training: Maximizing the platform's robust functionality often requires dedicated user training. |

| Intuitive Interface: Designed with a modern, user-friendly interface that simplifies complex tasks. | Part of a Larger Suite: Best utilized within the Eze ecosystem; standalone integration can be complex. |

Eze Investor Accounting is an ideal investment accounting software for established hedge funds, private equity firms, and fund administrators managing complex partnership accounting and fee structures. It is best suited for firms looking to graduate from manual processes to a sophisticated, automated system that supports investor transparency, operational scalability, and regulatory compliance.

Website: https://www.ezesoft.com/solutions/investment-operations/investor-accounting-servicing

For firms with highly specialized workflows or unique operational requirements, an off-the-shelf solution may not suffice. ScienceSoft offers a different approach: building custom investment accounting software tailored precisely to a client's needs. This service is designed for investment firms that require full control over their technology stack and need to automate complex, proprietary processes that standard platforms cannot handle.

The core value proposition is complete customization. Instead of adapting your operations to a vendor's software, ScienceSoft builds the software around your operations. This allows for seamless integration with existing legacy systems, CRMs, and data providers, creating a truly unified ecosystem. The development process focuses on automating portfolio operations, supporting diverse investment types and accounting standards (like GAAP or IFRS), and implementing features like multi-currency bookkeeping and sophisticated tax lot accounting methods.

| Pros | Cons |

|---|---|

| Fully Customizable: The software is built to your exact specifications and business logic. | Significant Upfront Cost: Development costs range from $200,000 to over $600,000. |

| Perfect Integration: Designed to integrate flawlessly with your existing technology stack. | Long Development Timeline: Typical projects take between 7 and 13 months to complete. |

| Enhanced Efficiency: Automates unique workflows, maximizing accounting accuracy and efficiency. | Requires Internal Resources: Your team must be actively involved in the design and testing phases. |

ScienceSoft's custom development service is best for established asset managers, private equity firms, or family offices with complex, non-standard operational needs and the capital to invest in a bespoke solution. It is the ideal choice for firms that have found off-the-shelf investment accounting software too restrictive and require a platform that provides a distinct competitive advantage through perfectly tailored technology.

Website: https://www.scnsoft.com/services/software-development/investment-accounting

| Platform | Core Features ✨ | User Experience ★ | Value Proposition 💰 | Target Audience 👥 | Unique Selling Points 🏆 |

|---|---|---|---|---|---|

| 🏆 Fundpilot | Institutional-grade reporting, automated fund admin | ★★★★☆ | Transparent pricing, scalable solutions | Emerging fund managers $10M-$100M | White-labeled portal, integrated compliance & pipeline |

| FIS Investment Accounting | Automated accounting, diverse strategy support | ★★★★☆ | Cloud-based scalability | Asset managers, fund admins | Highly automated, accurate & timely reporting |

| Allvue Systems | Carried interest automation, fund book integration | ★★★★ | Custom pricing, supports credit & equity | Mid to large funds | Open architecture, dynamic historic insights |

| MRI Software | Automates consolidations, secure reporting | ★★★★ | Not public | Funds, REITs | Audit-ready drill-down reporting |

| Gravity Software | Multi-entity accounting, real-time multi-currency | ★★★★ | Not disclose | PE, family offices, real estate | Built on MS Power Platform, scalable |

| Vantage Software | Flexible reporting, private/public investments | ★★★★ | Not specified | Alternative funds, advisors | User-friendly, API integrations |

| Yardi Investment Management | Real estate focused, automates complex structures | ★★★★ | Not disclosed | Real estate funds | Integrates Yardi ecosystem, reduces close times |

| RealPage Investment Accounting | Portfolio returns focus, multi-asset support | ★★★★ | Requires inquiry | Real estate funds | Real-time metrics integration |

| CQ (CapQ) | AI-powered fundraising, investor profiles | ★★★★ | Custom pricing | Alternative investment firms | AI-driven memos, collaboration data rooms |

| Sage Fixed Assets | Asset tracking, depreciation, tax compliance | ★★★ | Not openly detailed | General accounting users | Integration with ERP, compliance support |

| Eze Investor Accounting | Complex fees, tax processing, investor reporting | ★★★★ | Custom pricing | Hedge funds, PE, wealth mgmt | Focus on operational efficiency and growth |

| ScienceSoft Custom Solutions | Multi-type support, automation, multi-currency | ★★★★ | $200K-$600K+, long dev time | Firms needing tailored software | Fully customizable & integrable |

Navigating the landscape of investment accounting software can feel like charting a complex financial instrument itself. The market offers a diverse array of solutions, from enterprise-grade monoliths like FIS Investment Accounting Manager and Allvue Systems to more specialized, niche players such as CQ (CapQ) and MRI for real estate. Our deep dive into these twelve distinct platforms has hopefully illuminated the path forward, demonstrating that the "best" software is not a one-size-fits-all designation but a highly contextual choice.

The core takeaway is this: the right platform is the one that aligns most precisely with your fund's unique operational DNA. An emerging venture capital fund with a $20M AUM has fundamentally different needs than a seasoned real estate investment trust managing billions. The former requires agility, ease of use, and cost-effectiveness, while the latter demands robust compliance frameworks, multi-currency support, and extensive integration capabilities.

As you transition from evaluation to decision, it's crucial to distill your findings into a clear, actionable checklist. Revisit the core pain points that initiated this search. Are you drowning in manual spreadsheet work? Struggling with LP reporting deadlines? Facing an upcoming audit with dread? Let these challenges guide your priorities.

Consider the following critical factors as you finalize your choice:

Ultimately, software is a tool wielded by your team. The most successful implementations occur when there is a strong cultural fit between your team's technical aptitude and the platform's user experience. Involve your operations, compliance, and investor relations teams in the final demo stages. Their hands-on feedback is invaluable for gauging daily usability and identifying potential workflow friction.

Selecting the right investment accounting software is a strategic decision that reverberates throughout your organization. It enhances operational efficiency, strengthens investor trust through timely and accurate reporting, and solidifies your compliance posture. By moving beyond manual processes and embracing a purpose-built solution, you are not just buying software; you are investing in a scalable, transparent, and resilient foundation for your firm's future success. Take your time, conduct thorough due diligence, and choose the partner that will empower your growth for years to come.

Ready to see how a modern, intuitive platform can transform your fund's back office? Fundpilot was designed specifically for emerging and established fund managers who need powerful investment accounting software without the enterprise-level complexity. Schedule a demo today to discover how you can automate your fund administration and deliver exceptional investor experiences.